Considerations When Choosing A Plan

Before you select a retirement plan, think about the qualities that the plan should have to meet your needs. Here are some questions to ask about the plans you are considering:

What are the tax benefits? Some plans allow you to make larger contributions than other plans. Generally, the larger the contribution, the bigger the tax break.

What are the costs of the plan? Some plans require a lot of administrative work. For some, you will need to hire an actuary to calculate contributions. Some plans require you to make reports to the government. All of these things cost money and time only you can decide if the plan’s benefits outweigh the administrative costs.

Does the plan require you to make contributions every year? This is an important consideration if the income from your business varies from year to year. During leaner years, you may want the option of making a small contribution or no contribution at all. Not all plans will give you this flexibility.

What is the deadline for establishing the plan? Some types of plans must be established by December 31 of the year you want to make contributions. Others may be established as late as the extended due date of your income tax return.

Can I Have A Solo 401k Plan And Sep Ira

It is good practice not to have a SEP IRA and Solo 401k plan open at the same time. According to IRS Form 5305, any employer who establishes a SEP IRA using the form cannot have both a SEP IRA and Solo 401 Plan opened at the same time.

The main reason is that both plans have employer profit sharing options. However, if a bank or IRA custodian establishes the SEP IRA by using an individually drafted document other than IRS Form 5305, then an employer can have a SEP IRA and Solo 401k plan at the same time. However, this is quite uncommon.

What commonly occurs is that an employer will have a SEP IRA and make contributions to it and then open a Solo 401 plan. Then the employer will roll the SEP IRA contributions tax-free into the plan. The employer will then close the SEP IRA and only keep the Solo 401 plan.

Start Your Own Retirement Plan

When youre an employee, you can only use a 401 plan if your employer establishes a plan and youre eligible to contribute. All too often, thats not the case. But you still have options.

5 Ways to Save on Your Own

Ask for a 401: Your employer might be willing to set up a 401 they just havent done it yet. Start the conversation by asking why there isnt one, why you want one, and that there are potential tax benefits for employers. Explain that valuable employees like yourself would be even more valuable with excellent benefits. Offer to do some of the legwork required to get the plan up and running. In some cases, especially with small organizations, your employer simply doesnt have time to set up a plan. Cost is another factor companies and small nonprofits might be hesitant to pay plan costs . If cost is the primary concern, discuss less-expensive options like SIMPLE plans. Only time will tell if itll actually happen, but it never hurts to ask.

IRAs: If you dont have a 401, you may still be able to save in an individual retirement account , and you might even receive tax benefits similar to a 401. Unfortunately, the IRS sets maximum annual limits much lower for IRAs. Still, something is better than nothing. Evaluate traditional IRAs for potential pre-tax saving, and Roth IRAs for possible tax-free withdrawals . Another drawback of IRAs ) is that you may need to qualify to make contributions or receive a deduction. Speak with a tax expert before you do anything.

You May Like: How To Transfer 401k To Different Company

How Does The Money Grow In A Self

Bergman says thatdepending on the provider you choose to house your plan, you can invest in almost anything. However, if you select a financial institution to oversee your plan, you must invest in their products. Otherwise, opportunities remain limitless. Go the traditional route with stocks or mutual funds, or turn to alternative investments like real estate, gold or cryptocurrencies.

Do You Qualify For A Self

Are you a self-employed professional planning for your retirement? A self-employed 401 is an excellent plan to build out your retirement nest egg. Whether you are a freelancer, shop owner, or small business owner without employees, a solo 401 retirement plan can help you live your dream life when you retire. Here well discuss an overview of a self-employed 401, setting one up, how to withdraw from the account and other vital information.

Recommended Reading: How Much Do I Need To Contribute To My 401k

Administering A Solo 401 Plan

Once your Solo 401 plan exceeds $250,000 in assets at the end of the year, the IRS requires you file an annual Form 5500 EZ. Or if you ever terminate the plan, you must also file a Form 5500 EZ.

Unlike Traditional 401 plans, there are no compliance testing requirements to ensure Solo 401 plans do not favor highly compensated employees and are non-discriminatory, as long as you have no employees participating in the plan.

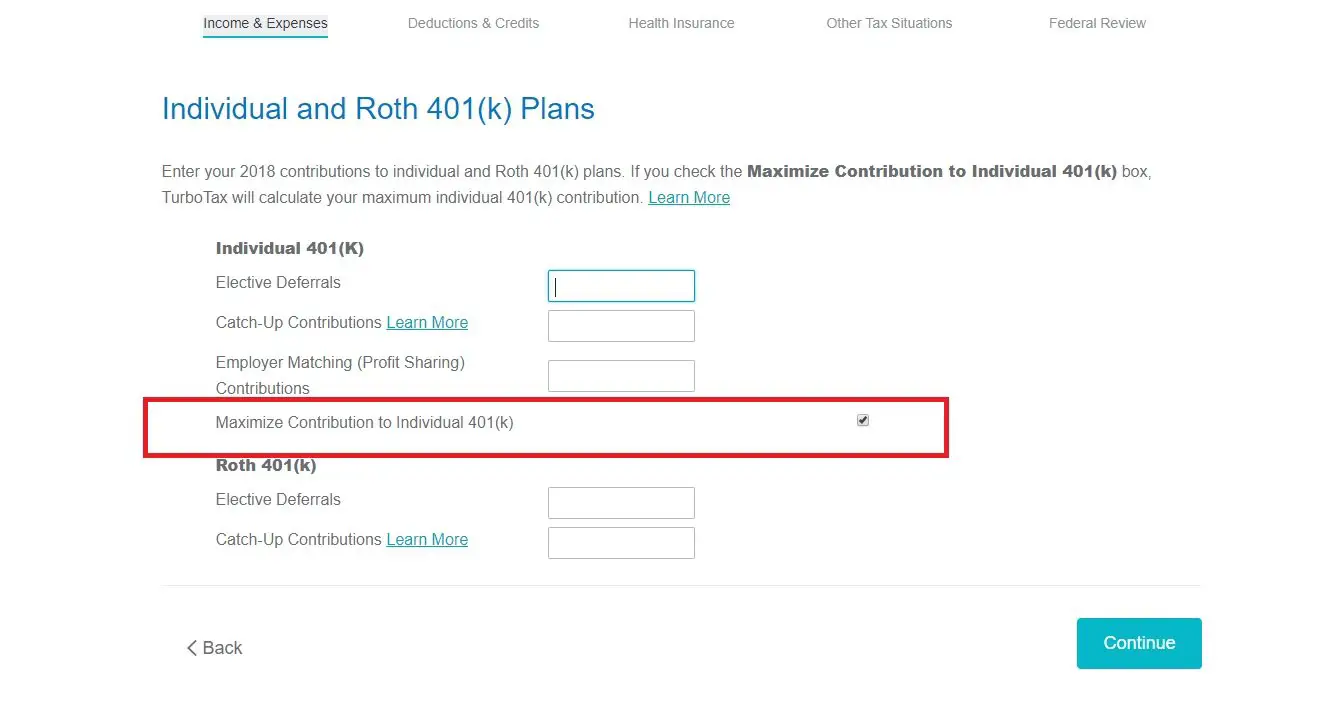

These plans can be called Self-Directed 401, Individual 401, Individual Roth 401, Self-Employed 401, Personal 401 or One-Participant 401 depending upon the vendor offering the plan services.

Important Plan Provision Changes: New plan loan provisions are no longer offered in the TD Ameritrade Individual 401 plan. All outstanding plan loans must be paid off by May 31, 2022 to continue to use the TD Ameritrade plan document. Roth 401 deferral contributions in the Individual 401 plan will no longer be accepted as of December 1, 2022.

Why Choose Roth Over A Traditional Ira

Like we talked about earlier, since you pay taxes on the money you put in your Roth IRA when you invest it, youll be able to use your savings in retirement tax-free. That means if you contribute the maximum amount each year, you could potentially have a nest egg worth almost $1.5 million after 30 years! Weve got your attention now, right? And you wont have to pay a penny in income taxes when you withdraw that money in retirement.

Its also important to remember that you have no idea what tax rates will be when you reach retirement, especially if you move up in tax brackets throughout your career .

With a Roth IRA, youre paying the current income taxes within your bracket as you contribute. So, when you finally settle down to enjoy that nest egg, you know exactly how much money is yours versus Uncle Sams.

Recommended Reading: What Is A 401k Annuity

Can My Llc Have A 401k

The federal tax law allows employees to participate in an employers 401k plan to take advantage of tax deferrals to contribute to retirement accounts. However, if you are an independent business member of a small business that operates as an LLC, the IRS allows you to set up a 401k plan for yourself.

Can single member LLC contribute to 401k?

If your LLC is a single-member entity, your maximum revenue share contribution can be up to 20% of your net compensation . The total contribution to your Solo 401k plan is the aggregate of your salary deferral and profit-sharing contribution.

Can an LLC have a 401k plan?

Can LLC owners contribute to a 401 ? Solo 401 plans are not limited to single proprietorships. Businesses that are structured as limited liability corporations , as well as partnerships, can also participate in these plans if they meet all of the requirements.

How Do You Set Up A Self

It is easy to set up a self-employed 401 plan with many 401 administrators. You can also open a solo 401 online. To set one up, you will need an Employer Identification Number , which you can get from the IRS. You also need to complete a plan adoption agreement and an account application. Self-employed 401s are easy to administer and attract low maintenance fees because they involve only one or two people.

Before choosing a plan administrator, it is important to compare their fees before you sign up. You may also want to choose an administrator that allows you to invest your retirement savings into a broad range of assets including mutual funds, ETFs, CDs, stocks, and bonds. Other features to look for include 24-hour multi-channel support, investment advisory, low fees, and positive customer reviews. Once youve completed the paperwork, and the plan becomes active, the only thing you have to do is to set contribution levels and choose investments.

Self-employed 401 plans have no annual minimum contribution requirements. In good years, you can make the maximum contributions and reduce your savings when the cash flow is low. But once you have up to $250,000 in the account, you must file IRS Form 5500-EZ to report the financial status of your solo retirement plan to the tax authorities.

You May Like: What Is A Simple 401k

The Drawbacks For The Self

While often the best choice if you qualify, there are a few things that make an individual Roth 401 slightly less than perfect:

- Establishing an individual Roth 401 plan can be a lot of initial paperwork.

- An individual Roth 401, unlike a Roth IRA, requires mandatory distributions once you reach age 72. However, you might be able to roll over your Individual Roth 401 assets to your Roth IRA once you’re no longer employed, effectively getting around this rule.

- Not all brokerage houses offer individual Roth 401 products.

- You can’t change your mind about Roth 401 contributions, rolling them over to your traditional 401 and taking the tax deduction later. Once it’s done it’s done. It’s a better deal in the long run, anyway.

Anyone who can take advantage of these tax shelters probably should. At the very minimum, it warrants a meeting with your qualified tax adviser to seriously discuss the topic. The consequences in terms of real-world dollars and cents are profound.

What If They Are Offered By The Same Business

However, if both plans are offered by the same business, then the individuals contributions to both plans, in total, are limited to the lesser of $57,000 or 25% of the net earnings from self-employment, excluding catch-up contributions from the $57,000 limit, and salary deferrals from the 25% limit.

If you have self-employment income from a side business in addition to W-2 income from employment, consider contributing to a SEP plan and a 401 plan, if available. Doing so will maximize your retirement savings. Contact one of our team members today for more information.

Reference: IRS Publication 560 and IRS.gov FAQs on retirement plans

Like This Article? Share With Your Networks

Don’t Miss: How To Withdraw Money From My Fidelity 401k

Can I Contribute To A Sep Ira And 401 Simultaneously

Question: If I have self-employment income from a separate business and also am employed by an employer that offers a 401 plan, can I participate in the 401 plan and still contribute to my SEP IRA?

Answer: Yes As long as the SEP IRA plan and the 401 plan are offered by separate companies. If you dont own the company that pays you a W-2, you can participate in both plans. Even if you participate in an employers retirement plan at a second job, you are allowed to set up an SEP plan if you have self-employment income through a business. You can learn more via the IRS Frequently Asked Questions for SEP plans. However, your contributions are still subject to some limitations.

How To Access Funds When You’re Unemployed

Under ordinary circumstances, getting fired or quitting presents a series of choices for individuals who have a 401. First, there’s the question of whether to keep the account with the former employer or transfer the funds to a rollover IRA. If handled correctly, this transfer is not considered a taxable event.

Rolling over a 401 into an IRA might make it easier to access the funds. Under certain circumstances, IRAs are not subject to the 10% early withdrawal penalty . Some penalty-free IRA withdrawals include paying for unreimbursed medical expenses, health insurance premiums while you’re unemployed, higher education expenses, or becoming permanently disabled.

You May Like: How To Enroll In 401k

Sole Proprietor / Independent Contractor:

In the case of a sole proprietor or independent contractor , you have earned income from performing personal services and report the income to the IRS on Schedule C, line 31, or Schedule F in the case of farmers and ranchers. Each of these schedules are attachments to IRS Form 1040. An owner of a sole proprietorship is the eligible participant under the employer solo 401k plan. The employer of these individuals is the sole proprietorship . See IRC 401 and IRC 401.

Other Benefits Of Solo 401s

The advantages of solo 401s arent limited to taxes. If your spouse works with you at your companyeven part-timethey may be able to invest in a solo 401 as well. As long as your husband or wife works for you at least part-time, they can contribute up to $19,500 a year to a solo 401 in 2021 , plus catch up contributions of $6,500 if theyre 50 or older.

You, as their employer, can then contribute up to 25% of their compensation, up to a total of $58,000 in 2021 or $61,000 in 2022. This allows couples to invest more than $100,000 in tax-advantaged retirement accounts.

Recommended Reading: Where To Check 401k Balance

Should I Buy Stocks In Roth Ira

Given the tax characteristics of the two types of IRAs, it is generally better to hold investments with the greatest growth potential, typically stocks, in Roth, while assets with more moderate returns, usually bonds, in traditional IRAs.

How many shares should I have in my Roth IRA? As a general rule, however, most investors hold 15 to 20 stocks at the very least in their portfolios.

Can I Contribute To A Roth Ira If I Am Self

Self -employed investors can use a Roth IRA to help fund part of their retirement. The only eligibility requirement to contribute to a Roth IRA is that you and / or your spouse have earned such salary income (vs.

How much can you contribute to an IRA if you are self-employed?

Contribute as much as 25% of your net income from self -employment , up to $ 61,000 for 2022 .

Can a self-employed person contribute to a SEP and a Roth IRA?

You can use self -employment income to fund SEP IRAs. If you maximize both, you can continue and open a Roth IRA for as long as you qualify. And if you make too much money to open a Roth IRA, keep in mind that SEP IRA contributions reduce your taxable income.

Don’t Miss: Can I Move My 401k To Gold

Do I Need A 401 Solo Plan

For sole proprietorship businesses, solo 401 plans are very effective ways to set aside and grow a large amount of money for retirement. If you’re a small business owner and don’t yet have a retirement plan set up, a solo 401 is an excellent way to save for retirement.

If you happen to need to hire employees at some time during your business’s lifetime, you’ll need to be sure to adjust the plan to include them equally or create criteria to define benefit-eligible employees and create retirement plans for them.

What Fees Are Associated With A Solo 401

Annual or maintenance fees for these plans, according to Allec, usually run between $20 and $200. Youll pay the least if your needs are simple you dont have any employees besides yourself, theres no rollover and youre OK with investing in a budget brokerage firms products. If you have more interesting investment appetites, another provider can accommodate those. These providers usually charge higher fees to maintain your plan, but you also have more flexibility with your investment and plan options.

Also Check: What Reasons Can You Withdraw From 401k Without Penalty

How Much Does It Cost To Open A Solo 401

There is no cost to open a 401 account but watch out for those fees later on. While you’re researching your options, check for account maintenance fees, transaction fees and commissions, mutual fund expense ratios, and sales loads.

A fractionally higher fee can mean a big hit to a retirement portfolio. If you make the right choices you can minimize the fees you pay.

Traditional Or Roth Ira

Best for: Those just starting out. If youre leaving a job to start a business, you can also roll your old 401 into an IRA.

IRA contribution limit: $6,000 in 2022 .

Tax advantage: Tax deduction on contributions to a traditional IRA no immediate deduction for Roth IRA, but withdrawals in retirement are tax-free.

Employee element: None. These are individual plans. If you have employees, they can set up and contribute to their own IRAs.

How to get started: You can open an IRA at an online brokerage in a few minutes. See NerdWallet’s picks for the best IRA providers for more details.

Read Also: Can I Withdraw 401k After Leaving Job

Both An Employee And Self

You can be an employee of a business and also be separately self-employed. In this case, you are still eligible to establish a Solo 401 for your own business, even if you may also be participating in a 401 or other retirement plan through your primary employment. In such cases, your ability to make employee contributions will be capped at the overall limit of $20,500 if you are under age 50 or $27,000 if you are 50 or older. Your business that sponsors the Solo 401 can make a profit sharing employer contribution up to the plan maximum, independent of the other employer plan, however.