Always Roll Over Into One Spot

Regardless of how much, or how little, you make its always best to keep your 401 in one place. There are two options: roll over your old 401 into your new employers 401 plan or roll your 401 into an individual IRA account.

Rolling over a 401 to a new employer is fairly straightforward you simply call the 401 provider at your old company and request the rollover yourself or your current employer plan can do it for you.

The other option, which is rolling over a 401 into an IRA, is also a popular choice. This move gives you more control over your assets in the long run. There are generally lower fees and more investment options. However, there could be tax consequences, depending on how you do it.

A 401 rollover to a traditional IRA account does not cause a taxable event, and your money will still remain tax-deferred. Often, your old 401 provider will mail you a check for the full amount of your 401 assets. Its very important that as soon as you receive these funds you forward them along to your IRA provider.

See: Take These 7 Key Steps Today to Retire a Millionaire

Gaurav Sharma, CEO and co-founder of retirement rollover platform Capitalize says, Once youve got that check, dont dilly-dally. Just forward it on to your IRA provider. If you dont know where, quickly check online. If you dont forward the check on within 60 days then the IRS can deem you to have withdrawn the 401 money permanently which could lead to you paying taxes and penalties.

Can You Rollover Your Tsp To Another Investment

Thrift Savings Plans, or TSPs, are retirement accounts available to service members who leave the military.

The veterans can also place their retirement funds in Individual Retirement Accounts, which provide some key advantages. As a result, we will explain how to rollover TSP earnings into an IRA a Roth or traditional IRA.

How Many 401k Rollovers Per Year

The IRS imposes certain restrictions on the number of times you can rollover 401s and IRAs. Find out how many times you can rollover 401 per year.

If you are looking for greater flexibility with your retirement money, you could consider rolling over your 401. The IRS allows 401 participants to move the retirement money from one retirement account to another. You can rollover your 401 funds to a new 401 or an IRA. However, 401 rollovers are subject to certain restrictions that participants must observe.

There is no limit on the number of 401 rollovers you can do. You can rollover a 401 to another 401 or IRA multiple times per year without breaking the once-per-year IRS rollover rules. The once-per-year IRS rule only applies to the 60-day IRA rollovers. You can only rollover the 60-day IRA rollover once per year, but there is no limit on direct trustee-to-trustee IRA rollovers.

Don’t Miss: Can You Rollover A 401k Before Leaving Your Job

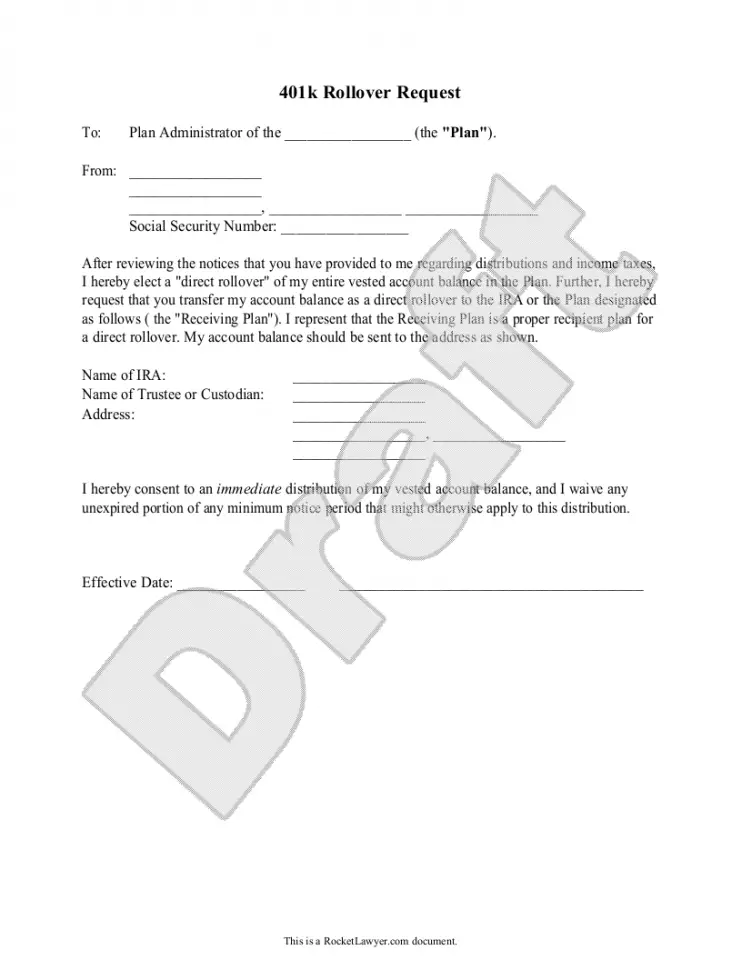

Ask Your 401 Plan For A Direct Rollover Or Remember The 60

These two words direct rollover are important: They mean the 401 plan cuts a check directly to your new IRA account, not to you personally.

Here are the basic instructions:

Contact your former employers plan administrator, complete a few forms, and ask it to send a check or wire for your account balance to your new account provider.

The new account provider gives you instructions for how the check or wire should be made out, what information to include and where it should be sent. You can opt for an indirect 401 rollover instead, which essentially means you withdraw the money and give it to the IRA provider yourself, but that can create tax complexities. We generally recommend a direct rollover.

If you do an indirect rollover, the plan administrator may withhold 20% from your check to pay taxes on your distribution. To get that money back, you must deposit into your IRA the complete account balance including whatever was withheld for taxes within 60 days of the date you received the distribution. .)

For example, say your total 401 account balance was $20,000 and your former employer sends you a check for $16,000 . Assuming youre not planning to go the Roth route, youd need to come up with $4,000 so that you can deposit the full $20,000 into your IRA.

At tax time, the IRS will see you rolled over the entire retirement account and will refund you the amount that was withheld in taxes.

How Long Do I Have To Rollover My 401 From A Previous Employer

When leaving a job many ask, âHow long do I have to rollover my 401?â Usually, your previous employer will rollover a 401 for you. If you receive a check youâll have 60 days to roll it over to avoid penalties.

Leaving a job can be a stressful time. Tying up loose ends and preparing for your next venture can cause certain things to fall through the cracks. Namely, forgetting to bring your 401 with you. There are a few things to remember when you go to rollover your 401 from a previous employer.

If your previous employer disburses your 401 funds to you, you have 60 days to rollover those funds into an eligible retirement account. Take too long, and youâll be subject to early withdrawal penalty taxes.

However, there are alternatives to your previous employer cashing out your 401 when you leave that can make the process much easier.

Recommended Reading: How Much In 401k To Retire

Transferring Your 401 To Your Bank Account

You can also skip the IRA and just transfer your 401 savings to a bank account. For example, you might prefer to move funds directly to a checking or savings account with your bank or credit union. Thats typically an option when you stop working, but be aware that moving money to your checking or savings account may be considered a taxable distribution. As a result, you could owe income taxes, additional penalty taxes, and other complications could arise.

IRA first? If you need to spend all of the money soon, transferring from your 401 to a bank account could make sense. But theres another option: Move the funds to an IRA, and then transfer only what you need to your bank account. The transfer to an IRA is generally not a taxable event, and banks often offer IRAs, although the investment options may be limited. If you only need to spend a portion of your savings, you can leave the rest of your retirement money in the IRA, and you only pay taxes on the amount you distribute .

Again, moving funds directly to a checking or savings account typically means you pay 20% mandatory tax withholding. That might be more than you need or want. Most IRAs, even if theyre not at your bank, allow you to establish an electronic link and transfer funds to your bank easily.

Recommended Reading: How To Rollover My Fidelity 401k

Pros And Cons Of Rollover Tsp

TSP rollovers provide complete investment control, multiple investment options, portability, and professional money management.

Pros: No administrative fee, no creditors protection, no RMD until you retire from your federal job.

Cons: Higher costs and expenses, transferring an old 401 or IRA into TSP, typically higher fees and expenses.

The governments equivalent of the 401 plans that we see in the private sector. Choosing whether to transfer the money to an IRA or Individual Retirement Account is one of the most significant decisions facing TSP owners.

Related Article: The Complete Guide to Investments and Financial Planning for Veterans

Also Check: Can I Have A 401k Without A Job

Does Roth Count Toward 401k Limit

Rollover does not count towards limits. If you have money in other eligible retirement accounts, such as a traditional IRA, 401, 403, or even another Roth IRA, you can transfer money into the Roth IRA. These renewals do not count as a premium and therefore do not reduce the amount that you can pay annually.

Recommended Reading: How To Manage 401k In Retirement

Rolling Your Old 401 Over To A New Employer

To keep your money in one place, you may want to transfer assets from your old 401 to your new employers 401 plan. Doing this will make it easier to see how your assets are performing and make it easier to communicate with your employer about your retirement account.

To roll over from one 401 to another, contact the plan administrator at your old job and ask them if they can do a direct rollover. These two words “direct rollover” are important: They mean the 401 plan cuts a check directly to your new 401 account, not to you personally.

Generally, there aren’t any tax penalties associated with a 401 rollover, as long as the money goes straight from the old account to the new account.

Although this route may help you stay organized with fewer accounts to keep track of, make sure your new 401 has investment options that are right for you and that you aren’t incurring higher account fees.

Also Check: How Do I Access My Wells Fargo 401k

Can I Convert 401k To Roth 401k

Not every company allows employees to convert an existing 401 balance to a Roth 401. If you can’t convert, consider making your future 401 contributions to a Roth account rather than a traditional one. You are allowed to have both types. As mentioned, you’ll owe income tax on the amount you convert.

Deemed Distribution Vs Loan Offset

If you leave your job and you have an outstanding 401 balance, the unpaid plan loan could trigger two types of distributions i.e. deemed distribution and plan loan offsets. A deemed distribution occurs when the 401 loan requirements are not met or upon default by the participant. Deemed distributions are not considered to be actual distributions from the retirement plan, and hence are not eligible for rollover to a new 401. However, the unpaid loan considered to be a deemed distribution creates a taxable event, and you will owe taxes in addition to an early withdrawal penalty if you are below 59 ½. Some 401 plans may allow participants to pay off the missed payments even after the unpaid 401 becomes a deemed distribution.

A plan offset occurs when the plan administrator reduces a participantâs 401 money to pay off an unpaid 401 loan. An offset is made when a 401 participant misses several loan payments, and the 401 loan is considered to be in default. It could also occur when a participant requests a distribution and they have an unpaid loan. The participant must be qualified to take a distribution for the unpaid loan to be considered a loan offset. The loan offset amount is subject to income taxes, and a 10% penalty tax if you are below 59 ½.

Don’t Miss: How Do You Take A Loan Out Of Your 401k

Move Money To New Employers 401

Although theres no penalty for keeping your plan with your old employer, you do lose some perks. Money left in the former companys plan cannot be used as the basis for loans. More importantly, investors may easily lose track of investments left in previous plans. I have counseled employees who have two, three, or even four 401 accounts accumulated at jobs going back 20 years or longer, Ford said. These folks have little or no idea how well their investments are doing.

For accounts between $1,000 and $5,000, your company is required to roll the money into an IRA on your behalf if it forces you out of the plan.

If you have at least $5,000 in your account, most companies allow you to roll it over. But accounts of less than $5,000 can be rolled out of the plan by the company if a former employee does not respond to a notification letter within 30 days.

For amounts under $1,000, federal regulations now allow companies to send you a check, triggering federal taxes and state taxes if applicable, and a 10% early withdrawal penalty if you are under age 59½. In either scenario, taxes and a potential penalty can be avoided if you roll over the funds into another retirement plan within 60 days.

Rolling Over To A New 401

The first step in transferring an old 401 to a new employer’s qualified retirement plan is to speak with the new plan sponsor, custodian, or human resources manager who assists employees with enrolling in the 401 plan. Because not every employer-sponsored plan accepts transfers from an outside 401, it is imperative for a new employee to ask if the option is available from the new employer. If the plan does not accept 401 transfers, the employee needs to select one of the three other options for the 401 account balance.

If the new employer plan accepts 401 transfers from other companies, there is often a substantial amount of paperwork that must be completed by the employee. The paperwork is provided by the new plan sponsor or human resources contact and requires the name, date of birth, address, Social Security number, and other employee identifying information.

In addition, the 401 transfer form must provide details of the old employer plan, including total amount to be transferred, investment selections held in the account, date contributions started and stopped, and contribution type, such as pre-tax or Roth. A new plan sponsor may also require an employee to establish new investment instructions for the account being transferred on the form. Once the transfer form is complete, it can be returned to the plan sponsor for processing.

A transfer from one 401 to another is a tax-free transaction, and no early withdrawal penalties are assessed.

Also Check: How To Roll Over Old 401k

How Does The Nerdwallet 401k Calculator Work

401 Calculator 401 Calculator NerdWallet calculates your 401 balance in retirement, considering your contributions, applicable employer dollar amounts, expected retirement age, and investment growth. New to 401s? Learn the basics from your 401 guide.

Roth ira vs brokerage accountWhat is the difference between an IRA and a brokerage account? The securities account is managed like a savings account with a bank. However, your brokerage money can grow faster because it is invested in financial assets. Consequently, the brokerage account is more focused on growth. An IRA can also be called a minor escrow or escrow account.What do banks offer Roth IRA?Roth Bank IRAs generally

Also Check: What Happens To Your 401k When You Die

Can You Roll A 401k Into A 403b

Companies cannot offer both a 401k and 403b plan to its employees, because 401k plans are only offered by for-profit employers, while 403b plans can only be offered by non-profits. However, if you change employers from a for-profit company to a non-profit, you might want to take your retirement savings account with you. The Internal Revenue Service permits moving money from a 401k plan into a 403b plan.

Read Also: Can You Use 401k To Pay Off Student Loans

Option : Leave Your Money Where It Is

Usually, if your 401 has more than $5,000 in it, most employers will allow you to leave your money where it is. If youve been happy with your investment options and the plan has low fees, this might be a tempting offer. Before you decide, compare your old plan with any retirement plans offered at your new job or with an IRA of your own.

Your new employer-sponsored plan might have more limitations on it than your previous plan or other available options. Maybe there are fewer investment choices/options. Maybe it doesnt have an employer match or higher management fees. So youll want to look closely.

Also consider how often you tend to stay at jobs. If you change jobs every few years, you could end up with a trail of 401 plans at all the different places youve worked. Consolidating might be easier in the long run.

Will I Pay Taxes When Rolling Over A Former Employer

Generally, there are no tax implications if you move your savings directly from your employer-sponsored plan into an IRA of the same tax type to a Roth IRA).

If you choose to convert some or all of your pretax retirement plan savings directly to a Roth IRA, the conversion would be subject to ordinary income tax.

Don’t Miss: Can I Use My 401k To Pay Student Loans

Challenges Of Saving With A 401 If You Change Jobs Often

A 401 is a retirement savings and investing plan that many private employers offer to their employees. Employee contributions are typically withdrawn automatically from employee paycheckspretaxand invested.

Not counting your employer match, if available, you can contribute up to $20,500 this year to your 401 and make an additional catch-up contribution of $6,500 if the plan permits and you’re over 50.

As a nest egg for retirement, you probably don’t want to just leave that money behind when changing jobs. Deciding what to do with your 401 can be challenging, however, and you may face a few barriers.

When Not To Transfer To An Ira

You now know some of the benefits of moving your 401 to an IRA. But control over your money isnt the only thing that matters, and you may have other priorities. Its impossible to list every potential pitfall, but here are just a few examples of when I suggest that clients might want to leave funds with their employer.

Between age 55 and 59.5

When youre at least 55 years oldbut not yet 59 1/2 years oldyou might want to leave at least some of your money in the 401 plan. 401s allow you to pull money out without penalty after age 55 . IRAs, on the other hand, require that you wait until age 59 ½ to avoid an early-withdrawal penalty of 10% on certain distributions. There are always exceptions and workarounds, but those are the basic rules. If you intend to spend your 401 savings between the ages of 55 and 59 1/2, keep this in mind before making a transfer.

Some Government Workers

If you worked for a federal, state, or local government, be sure to explore your options. Those with 457 plans can potentially avoid the early-withdrawal penalty thats commonly associated with 401 and similar plans. Plus, some public safety workers can avoid early withdrawal penalties from a retirement planincluding the TSPas early as age 50.

Roth Conversions

RMD While Working

Stable Value Offerings

Fees and Expenses

NUA Opportunities

You May Like: How Do I Protect My 401k In A Divorce