Option : Roll It Into An Ira

If your new employer doesnt offer a 401 or you dont like their option, you can roll your 401 into an IRA.

Rolling over accounts is easier than it sounds. You may need to open an IRA at a brokerage company and sign a few papers that allow the brokerage to transfer the money into your new account. This option will help keep your balance growing tax deferred and you can continue to make tax-deferred contributions.

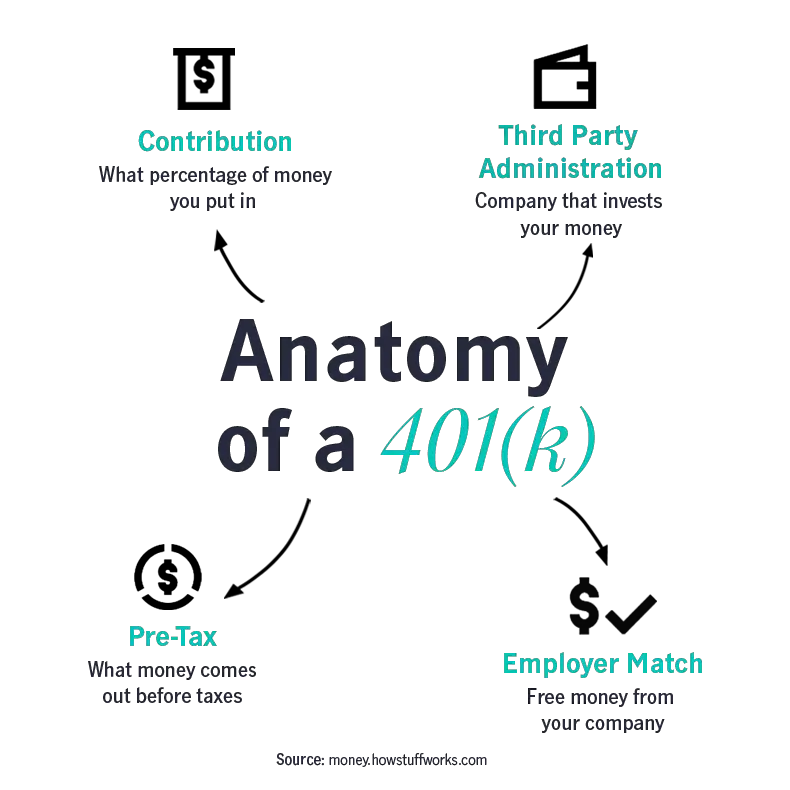

What Is A 401

Before we get into it, lets remember what a 401 account is. A 401 is a type of retirement account that allows an individual to start saving money for years in preparation for retirement. The investing account comes with several tax benefits, and you have the option of either getting a traditional account or a Roth account.

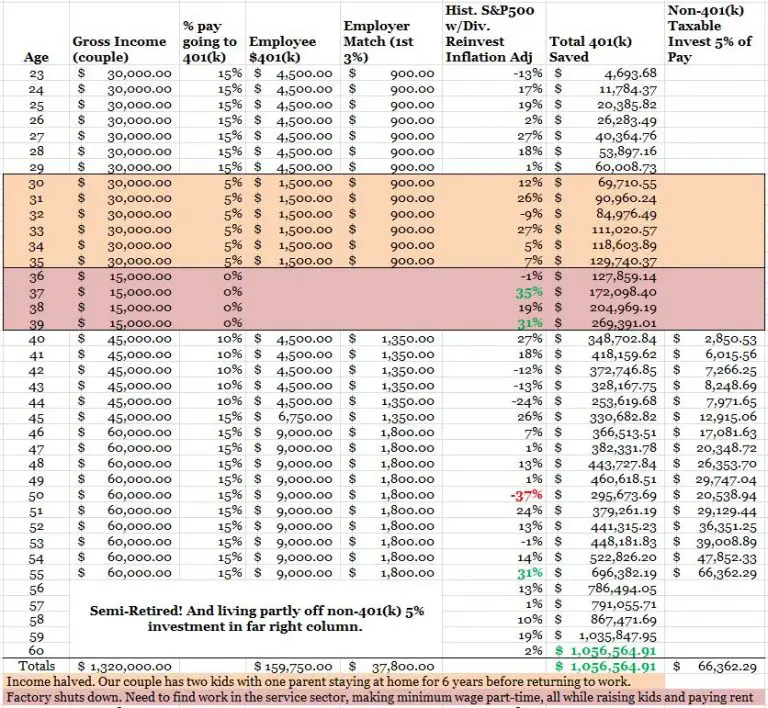

Employers offer this type of savings account in order to allow workers to save towards their retirement. You are able to contribute up to a certain amount every year, and it is possible to contribute to both a 401 account and an IRA in one year. The contributions you make to your savings account will be taken from your paycheck. Its also possible to have money put into the account by the employer on your behalf if you get a 401 employer match.

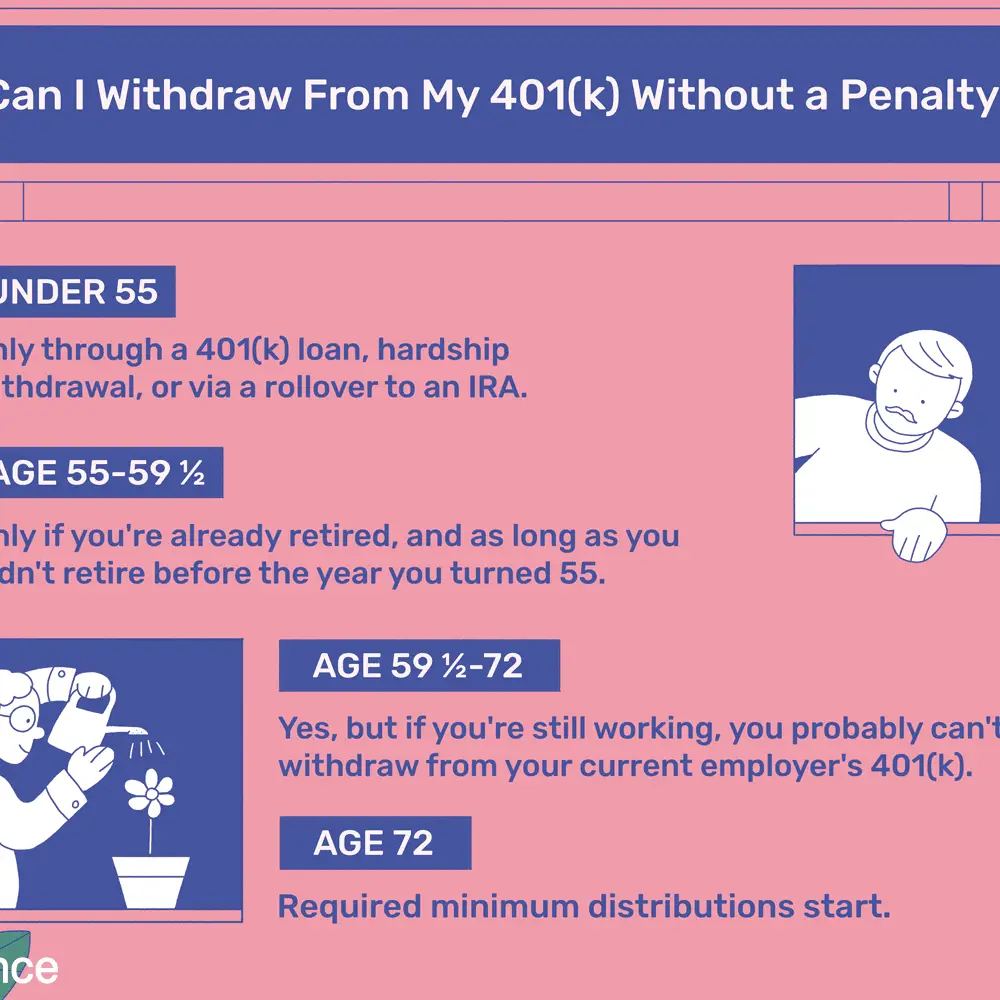

Usually, a 401 plan does not tax the investment earnings until you decide to withdraw the amount from your account. Usually, this happens after you retire, as youll not always be allowed to withdraw any amount from it before your retirement. When it comes to Roth 401 plans, though, withdrawals have no tax.

How Long Do You Have To Move Your 401 After Leaving Your Job

Theres no time limit on how long you can keep your 401 after leaving your job. You can leave it in your former employers plan, roll it into an IRA, or cash it out. Each option has different rules and consequences, so its important to understand your choices before making a decision.

If you leave your 401 in your former employers plan, youll still be able to access your account and make changes to your investment choices. However, you may have limited options for withdrawing your money and may be subject to higher fees.

Rolling your 401 into an IRA gives you more control over your account and typically lower fees. Youll also be able to access your money more easily. However, youll need to roll over the account within 60 days to avoid paying taxes and penalties.

Cashing out your 401 should be a last resort. Youll have to pay taxes on the money you withdraw, and you may also be hit with a 10% early withdrawal penalty if youre under age 59 1/2. Cashing out will leave you without the tax-deferred savings to help you reach your retirement goals.

Read Also: Is 401k Divided In Divorce

Leave It In Your Current 401 Plan

The pros: If your former employer allows it, you can leave your money where it is. Your savings have the potential for growth that is tax-deferred, youll pay no taxes until you start making withdrawals, and youll retain the right to roll over or withdraw the funds at any point in the future.

The cons: Youll no longer be able to contribute to the plan, and the plan provider may charge additional fees because youre no longer an employee. Managing multiple tax-deferred accounts can also prove complicated. The IRS mandates required minimum distributions annually from all such accounts beginning at age 72 . Fail to calculate the correct amount across multiple accounts, and the IRS will slap you with a 50% penalty on the shortfall.

Also Check: Should I Do Roth Or Traditional 401k

Plan Options When You Leave A Job

If you have an employer-sponsored 401, you will likely be faced with four options when you leave your job.

- Stay in the existing employers plan

- Move the money to a new employers plan

- Move the money to a self-directed retirement account

Before deciding, here are a few things to consider with each option.

Also Check: Can I Withdraw Money From 401k

Rolling Over Your 401k To An Ira

You can rollover your 401k to a new or existing IRA. Although there is a $6,000 contribution limit with IRAs, there is no limit on funds that are rolled over from a 401k.

Benefits

- Your IRA belongs to you and isnât connected to an employer. This helps you consolidate your retirement savings accounts throughout your career and retirement. Considering that Americans have lost track of more than $1 trillion to forgotten 401k plans, this can be really helpful, especially if you change jobs often.

- Youâre no longer subject to your former 401k planâs custodial and administrative fees.

- Compared to a 401k, youâll have much greater control over your investments and many more investment options with an IRA.

- You can withdraw money from an IRA penalty-free for first-time home purchases and college education.

- Beyond traditional IRAs, Roth IRAs have some additional benefits, including tax-free growth potential and withdrawals and no required minimum distributions.

Drawbacks

Can You Lose Your 401 If You Get Fired

There are two types of 401 contributions: Employers and employees contributions. You acquire full ownership of your employers contributions to your 401 after a certain period of time. This is called Vesting. If you are fired, you lose your right to any remaining unvested funds in your 401. You are always completely vested in your contributions and can not lose this portion of your 401.

You May Like: Can A Roth Ira Be Rolled Into A 401k

Will Cashing Out My 401k Affect My Credit Score

When you leave your job, it’s important to know if you can withdraw money from your 401k account.

If you are over 59 ½ years old, you may be able to withdraw the entire balance of your 401k without penalty. However, if you are under 59 ½ years old and have less than 5 years of service with your employer, any withdrawals will reduce the amount that is available for future contributions.

If you decide to cash out your 401k, make sure that you do not negatively affect your credit score. To avoid any negative effects on your credit score, consult with a credit counseling agency or financial advisor before making any decisions about withdrawing money from your 401k account.

Cashing Out Your 401 After Leaving A Job

LAST REVIEWED Feb 18 20219 MIN READ

Based on the amount of money in your 401 account, your employer may allow you to leave the account with them. However, you will not be able to contribute any more to your old account.

Leaving your account with the old employer may not be prudentespecially when you have access to more flexible Individual Retirement Account plans from most brokers. You may roll over your 401 account to your new employer or transfer the funds into an IRA. If you meet the age criteria, you may start taking distributions without having to pay any penalty for early withdrawal.

Don’t Miss: What Is 401k Self Directed Brokerage Account

You Have Less Than $1000 In Your 401

If you have less than $1000 in your 401, you may request to get a lump sum payment via check. Still, if you leave the funds behind without giving any instructions to the employer, the plan administrator may force cash-out in order to close the account.

Usually, active 401 accounts incur costs to maintain, and your employer may be unwilling to bear the cost since you will no longer contribute to the plan. The employer will send you a check within 3 to 10 days of leaving the job. Once the payment is made, you have 60 days to deposit the funds into an IRA to avoid paying taxes. If you donât deposit the funds into an IRA, the payment will be considered an early withdrawal and you will pay an income tax and early withdrawal penalty.

You Can Roll It Over To A New Employers Plan

If youre starting a new job, you can roll over your 401k money directly into your new employers retirement plan, in most cases. Thats something to ask about during the onboarding process. You should also ask if your new company will match any of your rollover. If youre lucky, youll get even more money out of your job change.

Don’t Miss: How To Find My Fidelity 401k Account Number

Option : Roll Over Your 401 To Your New Employer

The most common route people take is rolling over their 401 to their new employer. Typically, this is done through a direct transfer or having your employer automatically transfer your 401.

Alternatively, you may opt for your employer to mail you a check for you to manually deposit into your new 401. The 60-day rule applies again here: If the funds arent deposited into a new 401 after this time, youll pay income tax on the entire balance.

Before transferring your funds to a new 401 plan, make sure you understand your new plans rules, fees, and investment options. Look into your new companys 401 matching program, if there is one. Make sure youre making the most of your new 401 plan by knowing all your options and seeing if your new plan is better or worse than what was available at your previous employer.

How Do I Cash Out My 401 From An Old Job

If you have a 401 from a previous job, you may wonder how to cash it out. The process is actually relatively simple. You will need to contact the plan administrator and request a distribution form. Once you have completed the form, you must submit it to the plan administrator. They will then process your request and issue a check for the amount of your distribution. It is important to note that taxes and penalties may be associated with cashing out your 401.

You May Like: How To Create A Self Directed 401k

How Can I Avoid Paying Taxes On My 401k Withdrawal

Here’s how to minimize 401 and IRA withdrawal taxes in retirement:

Who Can Contribute To A 401k

Anyone with access to a 401k can contribute. If your employer sponsors a 401k plan and you meet their eligibility requirements, then you can enroll and contribute. Eligibility requirements vary by employer and are usually based on how long youâve worked for the employer. For example, many employers will allow employees to enroll in their 401k plan after 12 months of employment.

If you are self-employed and do not have any employees, you can also establish a solo 401k.

Don’t Miss: How Do I Open A 401k Account

Option : Keep Your 401 With Your Old Employer

Many are surprised to learn that in certain circumstances, you can leave your 401 with your old companys retirement plan. However, if you have less than $5,000 in retirement savings, your company may force you out by issuing you a check. If they issue you a check, its crucial that you transfer the funds into a new 401 within 60 days, or else youll have to pay income tax on the distributed balance.

Leaving your retirement savings with your old employer has its drawbacks. For example, you wont be able to make any more contributions to the account, and you may also not be able to take out a loan on your 401. Your old employer may also charge administration fees on the account now that youre no longer an active participant. Additionally, youre still locked in to the funds that plan offers, which may be limited and expensive. For these reasons, many people particularly those new to the workforce choose to roll over their 401 to their new employer.

Offer From The Motley Fool

The $16,728 Social Security bonus most retirees completely overlook: If you’re like most Americans, you’re a few years behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $16,728 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

The Motley Fool has a disclosure policy.

The Motley Fool is a USA TODAY content partner offering financial news, analysis and commentary designed to help people take control of their financial lives. Its content is produced independently of USA TODAY.

Don’t Miss: Who Do I Call About My 401k

Cashing Out A 401 After Leaving A Job

The IRS established the 401 as a tax-advantaged plan for employees, rather than the self-employed. This works fine most of the time, but in an era when people change jobs far more often than they used to it also has created some confusion. What do you do with this account, thats supposed to grow over decades, when you change employers? There are a few common options. A financial advisor can offer you valuable insight and guidance on handling tax-advantaged accounts.

Leave The Money In The Old 401k Account

Because of the turmoil around job changes, this has become the default option for many people, as weve discussed above. You dont have to worry about incurring withdrawal penalties or decide whether to take a lump sum distribution or annuity payments.

Pros: If the costs of the old plan are really low and the investment options are extremely good, this may be a viable option.

Cons: As weve discussed, you may be paying high fees, have restricted investment options, and lose early withdrawal options.

Also Check: How Do I Invest My 401k In Stocks

How Long Do You Have To Move Your 401 After Leaving A Job

If you leave your job, you have the right to move your 401 money to another 401 or IRA. Knowing how long you have to move your 401 after leaving a job can help plan your retirement savings better.

When switching jobs or quitting to start a business, it is easy to get lost in the excitement. As you plan your next move, you should remember your 401 plan where youâve been accumulating your retirement savings. By knowing what happens to your 401 and how long it takes to move your 401 after leaving a job, you can plan what to do with your retirement savings.

Generally, 401 plans are tied to employers, and once you leave your job, you will no longer contribute to the plan. However, the amount you contributed to your account is still your money, and you can choose what to do with it. How long you have to move your 401 depends on how much asset you have in the account: you have 60 days from the date of leaving your employer to move the 401 money into a preferred retirement plan if your 401 balance is below $5000. For large balances over $5000, you can leave the funds in your old 401 plan for as long as you want.

You May Lose Early Withdrawal Options

This is one of those risks you may not see until its too late. One of the many benefits of 401k plans is that they often allow employed participants an option to borrow funds or make early withdrawals. 401k plans usually provide a loan option where you can borrow from your own account without penalty or tax. But this option is only available to you if youre still employed. When you are still employed, you may be able to actually withdraw funds without penalty if youre at least 55. But once youve left employment, these options disappear.

You May Like: How Much Can You Borrow From 401k

You Could Withdraw The Money

Technically, youre allowed to withdraw your money from your old 401, but unless youre facing some really dire financial circumstances, we advise against it. Early withdrawal comes with big penalties from the IRS, on top of whatever taxes youd owe on the money. and you dont deposit it into another retirement account.) In all, you could end up paying as much as 50% of the balance in your account to pull from it. Yeah ouch.

You May Not Have The Best Investment Options

Even if the fees are reasonable, your orphaned 401k offers only limited investment options. By their very nature, 401ks cannot provide access to every investment option available in the market. Instead, someone at your old employer or someone in the insurance companys or brokers back office decided which investment funds you could use. Leaving your money in an old 401k is leaving your money to the whims of the least common denominator in that process.

Also Check: How To Close Out A 401k Early

I Still Have A 401k From My Last Job What Do I Do About That

As you move ahead from job to job, dont make the mistake of leaving a trail of old savings accounts behind you. Put your hard-earned savings to work for you by looking at all the options. If youve left a job and a 401k, here are the options available to you for those funds.

- Leave your balance

- Rollover to new 401 plan.

- Rollover to an IRA.

- Cash out your 401.

Rollover Over To An Ira

If you want to diversify your investments, you can transfer your savings to an IRA to enjoy more investment options. You can also find better-performing investments that pay higher returns than the investment options available in a 401.

If you have other old 401 plans with former employers, you can do a direct rollover to your IRA to make it easier to manage your retirement savings in a single account. A direct rollover helps you avoid paying taxes and penalties on the distribution.

Read Also: How Can I Take Money From My 401k