Best Fidelity Funds For Your 401k: Low

Manager: Joel TillinghastExpenses: 0.82%

Still inimitable, still head and shoulders above even the best crop of giants you can find in the space, lead manager Joel Tillinghast is about as far a cry from leveraged stocks as you can get.

Fidelity Low-Priced Stock invests in low-priced stocks, which for his purpose are stocks $35 or less. While that sounds like a gimmick, its the secret to this funds genius, and was Joels brainchild, making him of one of the best managers of any generation. It can lead to a small-/mid-cap tilt, but it also can lean toward even mega-caps in ultra-bear markets .

FLPSX began trading in December 1989 and has a market value of over $30 billion. The fund is heavily weighted toward consumer discretionary , with ample weight given to information technology and financials . Top holdings for now are UnitedHealth Group Inc. , Seagate Technology PLC and Next plc. Its noteworthy that of the funds weve discussed so far, FLPSX is the only one with more than 5% of the fund currently in cash .

Joel is a stock pickers stock picker if hes around the water cooler, other managers are keen to hear what he has to say. While unsung by the media, he is a manager that compares with Peter Lynch, his mentor while Joel was learning the trade. His stealth advantage: Hes always been a global investor.

Charles Schwab Solo 401k

Schwab is another discount brokerage that offers a prototype solo 401k plan for free. Since Schwab is continually working to improve their image in the low-cost brokerage space, I was interested to see what they offered.

I was disappointed to learn that Schwab only offers traditional 401k contributions – they do not have a Roth option on their plan. They also do not offer loans under their plan.

It appears that you can rollover a 401k into your Schwab solo 401k, but you cannot do an IRA rollover.

Schwab does offer a lot of investing options, including Vanguard mutual funds and commission free ETFs.

There are no fees to open the solo 401k, and there are no yearly maintenance fees. Inside the 401k, traditional Schwab pricing applies – $0 per stock trade, with $0 on Schwab funds and ETFs.

Learn more about Charles Schwab in our Charles Schwab Review.

Charles Schwab: Best For Investors Who Want Low To No Fees On Various Trades

| Fund fees | 0.04% to 1% annually |

Charles Schwab offers a full-service 401 plan customized to your company with zero dollar trading fee, making it an excellent option for a low-fee provider and 401 owners wanting to trade stocks or bonds in their accounts. You also have the option to add investment advisory services to an existing 401.

Because Charles Schwab has a broker-dealer and banking subsidiary, it can provide a full range of financial services. It also offers proprietary mutual funds and ETFs to plan participants and other investment options.

The company offers individual and business 401 plans, SEP and SIMPLE IRAs, personally designed benefit plans, and company retirement accounts. It has a plan for your company, regardless of how many employees you have.

You can call a toll-free number to start the process or stop by one of 360 Charles Schwab branches across the United States.

Read Also: What To Do With 401k When You Leave A Company

Compare Other Advisors Online

Investment advice, services, and costs vary widely among online brokerages, and its important to find the right combination of features and fees for you. Your best online broker depends on what type of investor you are:

- Very active trader desiring efficient execution and low commissions

- Small investor looking for affordable fees and no minimum balances

- DIY investor desiring abundant research resources

- Mobile investor wanting a great interface

At MoneyRates, its easy to compare and choose among the best online brokers.

Contributing To Your Mit 401 Account

You contribute to your 401 account through deductions from your MIT paycheck. You can contribute pre-tax dollars, Roth post-tax dollars, or a combination of both. You may change your contribution preferences any time through Fidelity NetBenefits.

Your contributions are sent to Fidelity Investments at the end of each pay period. You may contribute as little as 1% and as much as 95% of your salary after amounts for Social Security and Medicare taxes and health and dental insurance have been subtracted. You may start, stop, or change your deferral or investment elections at any time.

Federal law limits the amount of your pay each year that may be recognized for determining your allowable contribution. In 2021, MIT can consider only the first $290,000 of pay for calculating your allowable contributions. This means that if your annual compensation exceeds $290,000, MIT Payroll will take 401 deductions from your pay until your pay for the year reaches $290,000, or one of the other 401 program limits has been reached .

Contribution limits

What MIT contributes to your 401 Plan

- MIT matches your 401 contributions dollar-for-dollar up to the first 5% of your MIT pay .

- MIT only contributes a match during months in which you have made a contribution

- The MIT match is provided pre-tax, and therefore is fully taxable when you withdraw your matching contributions from the plan, along with associated investment earnings.

When contributions are invested in your 401 account

Recommended Reading: How To Take Money From Your 401k

What Does A Fidelity 401 Cost

Because we are independent 401 advisors, we have the opportunity to speak with a number of organizations that use Fidelity as a 401 recordkeeper, and have observed a variety of overall fees on the platform. Some companies pay as little as 0.53%, while others pay over 1% of assets. This huge difference for similarly-sized small business plans is meaningful, given the impact fee reductions can have on your employees’ savings at retirement. See the table below for real data on what similar plan sponsors pay for their Fidelity 401, and find out where in the spectrum your business falls.

- Fidelity 401 Fee Data

The following chart contains information about fees paid by Fidelity clients. We collected this information as part of a fee benchmarking analysis we conducted to help plan sponsors understand what they were currently paying. This is an interesting range of costs, in that companies may be generally of a similar size, yet that may pay a meaningful difference in asset based costs. We believe that a well managed small business Fidelity 401 should cost well below 0.75% in total fees, and want to talk to you if you are currently paying more.

# of Employees $7,090,000 0.53%

Where Can I Find My Fidelity 401k Fees

Whether due to my own ineptitude, or through deliberate camouflaging on Fidelitys part, I could not for the life of me figure out what these additional fees were. The info that I sought is information that your 401 provider must supply youyet I could not locate and account for these mysterious fees. A few days after giving up on Fidelitys website, I happened to receive an email with Fidelitys annual prospectus disclosure and viola, a CTRL F later and I finally uncovered the fees that were eating up nearly one percent of my account on an annual basis. You can find this required disclosure information under the Plan Information and Documents tab on your account.

Assuming Im not the only one who sucks at navigating an unfamiliar financial services website, I wanted to spell out those fees in somewhat plain English. For those who dont have a 401k plan through Fidelity, this information should still prove somewhat valuable, as it allows you to compare the fees in your own plan to another provider. I had a next-to-impossible time finding my own 401k providers fees, never mind search for those of competing plans.

Now, lets take a look at the Fidelity 401k fees that Im paying.

Read Also: How To Find 401k From Old Jobs

Advantages Of Employee Retirement Plans

Anyone can set up a retirement plan for their small business, but there are significant advantages to using an independent provider. Here are just a few:

- Helps to attract and retain talent. The job market is competitive. According to a survey of 100 companies from , 16% of companies plan to reinstate or raise 401 contributions in 2022. A further 8% are weighing raising their contribution. Business owners can use a solid retirement plan as a tool for recruitment.

- Improves productivity. Your HR manager will be a lot more productive if everyones retirement benefits are handled centrally by a professional provider.

- Saves time for recordkeeping. Retirement plan providers have software that makes plan administration and recordkeeping totally seamless and largely automated.

- Reduces the pressure of compliance requirements. The professionals who work with retirement service companies are up to date on the regulations and familiar with current best practices.

Best For Real Estate: Rocket Dollar

Rocket Dollar

Rocket Dollar allows you to invest in anything you can pay for with a checkbook. That means you can invest in real estate and other non-traditional assets while enjoying the tax advantages of a solo 401 account.

-

Checkbook control allows you to invest in real estate and other alternatives

-

Support for 401 loans and Roth contributions

-

Option for upgraded account that includes free wire transfers, checks, tax form filing, and other features

-

Basic accounts require $15 monthly fee and $360 setup fee

-

Premium accounts require a $30 monthly fee and $600 setup fee

If you dont want the limitations of traditional financial markets, you may want to consider Rocket Dollar. Instead of stocks, ETFs, mutual funds, and bonds, Rocket Dollar accounts give you the control to buy any asset with your solo 401 that the IRS allows. That can include rental properties, fix-and-flip real estate, or land that you think will appreciate in value. You can invest outside of real estate as well, such as private investments in a startup or precious metals, however, Rocket Dollar’s flexibility makes it the solo 401 that’s best for real estate.

Also Check: How To Check Your 401k Balance

Fidelity Is Best For:

|

No base commission $0.65 per contract. |

|

|

Account fees |

None. |

|

Number of no-transaction-fee mutual funds |

More than 3,300 no-transaction-fee mutual funds. |

|

Tradable securities |

Stocks. Bonds. Mutual funds. ETFs. Fractional shares. Options. FOREX. |

|

Trading platform |

Fidelity.com and Active Trader Pro. Both free for all customers. |

|

Mobile app |

Available for iOS and Android advanced features. |

|

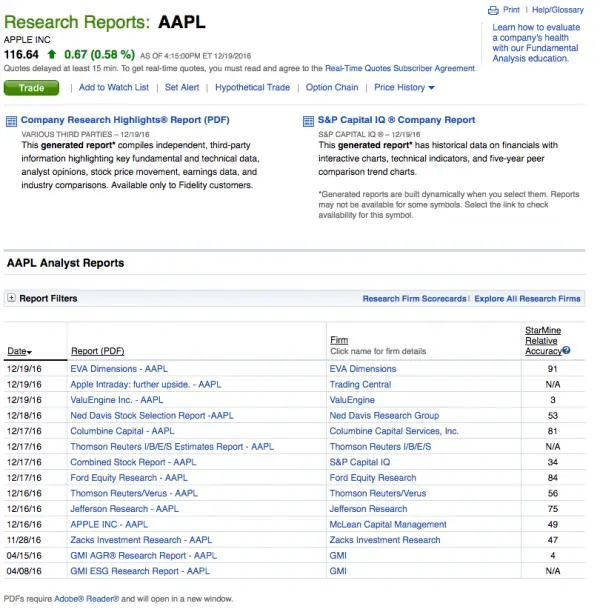

Research and data |

|

|

Customer support options |

Phone, email and live chat 24/7 more than 200 local branches. |

Will Fidelity Stop 401k Automatically

So, will Fidelity stop 401k contributions automatically? Yes. Fidelity will stop a 401k contribution immediately if it hits the limit set by the United States Internal Revenue Service .

What happens to my Fidelity 401k if I quit my job?

If you withdraw from your 401 before age 59½, the money will generally be subject to both ordinary income taxes and a potential 10% early withdrawal penalty. (An early withdrawal penalty doesnt apply if you stopped working for your former employer in or after the year you reached age 55, but are not yet age 59½.

What are the fees for a fidelity 401k plan?

Per Fidelity: The annual Plan level fee is 0.30% per year for the first $9,999,999.99 of the plan assets. This percentage does decrease slightly, down to 0.20%, depending on the amount invested in your companys plan.

Where do the fees in a 401k come from?

Reflecting mostly administrative and investment management costs, 401 fees spring from two sources: the plan provider and the individual funds within the plan. Although individual investors cant do much about plan provider fees, they can choose funds within the plan with lower expense ratios.

What do I need to know about my fidelity account?

In the following boxes, youll need to enter: Your annual gross salary. Your expected annual pay increases, if any. How frequently you are paid by your employer. The amount of your current contribution rate . The proposed new amount of your contribution rate.

Recommended Reading: How Much Can I Contribute To My 401k Plan

Comparing The Most Popular Solo 401k Options

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty.

Over 5 years ago I went on the hunt for the best solo 401k providers, did my research, and learned a whole lot. I’ve shared in the past the best options for saving for retirement with a side income, and I’ve leveraged a SEP IRA in the past.

Best Fidelity Funds For Your 401k: Select Health Care

Manager: Eddie YoonExpenses: 0.77%

Fidelity Select Health Care Portfolio invests in companies involved in numerous parts of the healthcare industry so thats pharmaceuticals, medical instruments, biotechs and hospitals, among others.

This nearly $10 billion funds top holdings include Actavis plc , Medtronic PLC , McKesson Corporation , Amgen, Inc. and Alexion Pharmaceuticals, Inc. . This also is a very international-heavy fund at 31.6% of FSPHXs investments.

I like Select Healthcare for reasons that follow this refrain: Healthcare provides necessary goods and services for huge, worldwide demographics that are aging and whose collective demand isnt slowing.

Eddie Yoon invests with an eye on the necessary demographic trends and stories of aging boomers needing a youth-inducing crutch, as well as on the emerging-market theme of new consumers demanding better healthcare.

Also Check: How To Find 401k From An Old Employer

Read Also: Is A Spouse Entitled To 401k In Divorce

What To Look For In A Solo 401k

Going through the process of shopping around for a solo 401k provider, I’ve learned a lot about what to look for. There are a lot of options and nuances that you should look for when shopping for a 401k. Many of the “free” providers offer simple generic plans , and if those don’t work for you, you can have a third party provider create a custom 401k plan for your business, which you can then take to a brokerage .

Whoa, that sounds confusing, and it can be. So let’s look at the major options that you need to consider when selecting a solo 401k provider.

- Does the 401k provider offer both Roth and Traditional contributions?

- Does the 401k provider offer after-tax contributions to do a mega backdoor Roth IRA.

- Does the 401k provider offer loans from the plan?

- What types of investment options are allowed in the plan ?

- Does the provider allow rollovers into the plan and rollovers out of the plan?

- The costs to maintain the plan

- The costs to invest within the plan

Based on your wants and needs, there are a lot of things to compare when shopping for a solo 401k provider. Let’s compare some of the main firms that offer solo 401ks.

Why Solo 401k Loan Not On Fidelity Statement Question:

Looking at my solo 401k brokerage account and Im confused on how the account is showing up. I wrote a check for the solo 401k participant loan proceeds , and it looks like the account is showing the actual balance has decreased. Is this just how Fidelity is accounting it or did this actually come from the balance as a withdrawal? Where can I see the actual loan balance/ information?

You May Like: How To Qualify For 401k

Observers Say That Advisers Delivering Financial Wellness Programs To 401 Plans Should Take Note

Fidelity Investments, the largest record keeper of defined-contribution plans, has upgraded its managed account service to encompass more holistic financial planning and advice for 401 investors. Observers say the move signals a trend thats likely to accelerate among other providers and that may concern retirement plan advisers who fear that Fidelity is competing with them on participant services.

Fidelitys new managed account offering Personalized Planning & Advice, which launched Tuesday helps plan participants set financial goals and priorities, like paying down student debt and establishing an emergency fund.

The program offers participants an asset allocation thats based on their financial plan and delivers follow-up correspondence, on at least a quarterly basis, to make sure participants are on track to meet their goals.

This approach differs from the previous iteration of Fidelitys managed account branded as Portfolio Advisory Service at Work, or PAS-W which factored more basic information, such as risk tolerance and investment preference, into an investors asset allocation without considering broader financial goals or providing regular check-ins.

Were really doubling down on the financial plan, said Sangeeta Moorjani, head of product, marketing and advice for Fidelitys Workplace Investing group.

A team of Fidelity representatives, registered with Finra Series 7 and/or 66 licenses, can help with the financial plan and quarterly reviews.