Roth Ira Vs : What Are The Major Differences

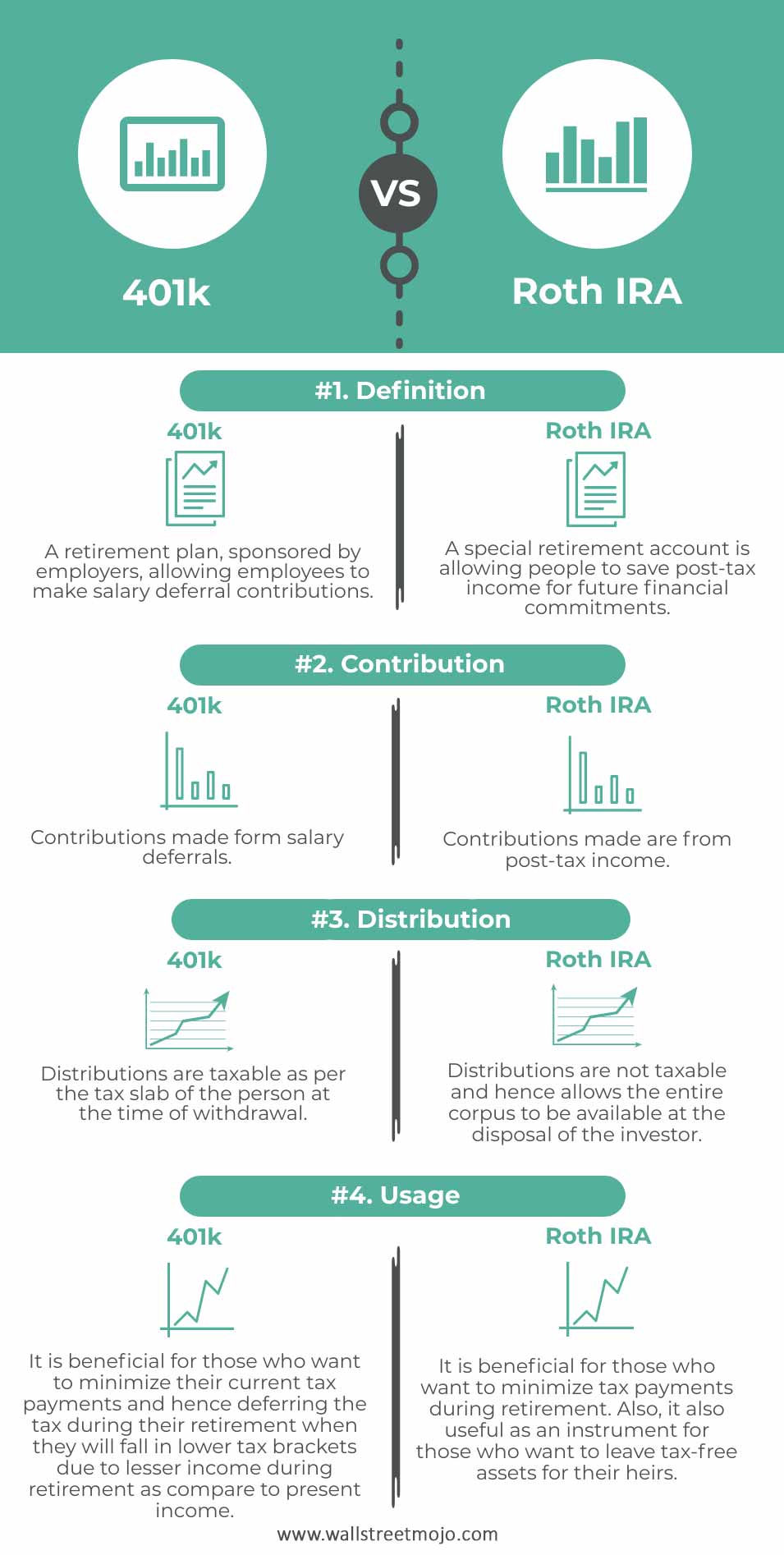

Okay, folks, does anybody else feel like theyve been drinking water from a firehose? That was a lot of information! Heres the tale of the tape showing how the Roth IRA and the 401 stack up against each other:

|

Feature |

|

|

Penalties for withdrawals before 59 1/2. |

Penalties for withdrawals before 59 1/2. |

Hedging Your Bets With Both

The good news is that when it comes to a traditional vs. a Roth 401, you don’t necessarily have to make an all-or-nothing choice. You may be able to have both, and decide year-by-year where you want to make your contributions.

If your employer’s plan allows it, you may even be able to split your contributions between the two types of accounts. In 2022, you can contribute a total of up to $20,500 to a 401. So, for example, depending on your plan rules, in 2022 you could decide to put $10,250 in your traditional 401 and $10,250 in your Rothenjoying the benefits of both.

How Much Should I Invest In A Roth 401

No matter what your income is, you should be investing 15% of your income into retirement savingsas long as youre debt-free and have a fully funded emergency fundenough to cover 36 months of expenses. Lets say you make $60,000 a year. That means you would invest $750 a month in your Roth 401. See? Investing for the future is easier than you thought!

If you have a Roth 401 at work with good mutual fund options, you can invest your entire 15% there. Boom, youre done! But if youre not happy with your 401s investment options, then invest up to the match and max out a Roth IRA on your own.

Also Check: How Much Can I Add To My 401k

What Are Roth 401 Contribution Limits

For 2022, the 401 contribution limit is $20,500. This contribution limit applies to all of your 401 contributions, whether theyre in a Roth or traditional 401. That means if youre contributing to both, the combined total of your contributions cant exceed that amount.6 And in case you were wondering, your employers contributions do not count toward the limit.

If youre 50 or above, you can also pitch in an extra $6,500 as a catch-up contributionwhich increases your contribution limit to $27,000.7

Top Questions About Roth Iras

Why should I open a Roth IRA?

Tax-free gains, ability to withdraw your contributions anytime, and choice of investments.

Where do I open a Roth IRA?

Most brokerages let you open them for a minimal fee, including E-Trade, Fidelity, TD Ameritrade and Vanguard. More on these below.

How do I open a Roth IRA?

Its surprising how easy it is to open a Roth IRA. Simply log onto the site where you want to open your IRA and follow the steps.

How do I contribute money to a Roth IRA?

Once youve opened your account you can deposit funds directly from a bank account. You can also set up automatic contributions on a recurring schedule.

What is the contribution limit for a Roth IRA?

As of 2018, the contribution limit is $5,500 if you are under 50 years old. You can add an extra $1,000 if you are 50 or older.

How do I decide what stocks, bonds or funds to pick?

With a Roth IRA, you can pick any investment choices, unlike your 401k, which has limited options that are provided by your employers retirement program.

Overwhelmed by choices? Index funds are one way to invest that require minimal effort on your end and keep costs low.

Roth IRA compounding example

Here is an example that shows compounding within a Roth IRA.

- A 29-year-old makes a $5,500 initial contribution

- Continues to make $458 monthly contribution

- Invests for 30 years

- Never withdraws money prior to 59½ years old

- Averages 8% annual return

10% return is over $1,000,000!

Don’t Miss: When Can I Draw From My 401k Without Penalty

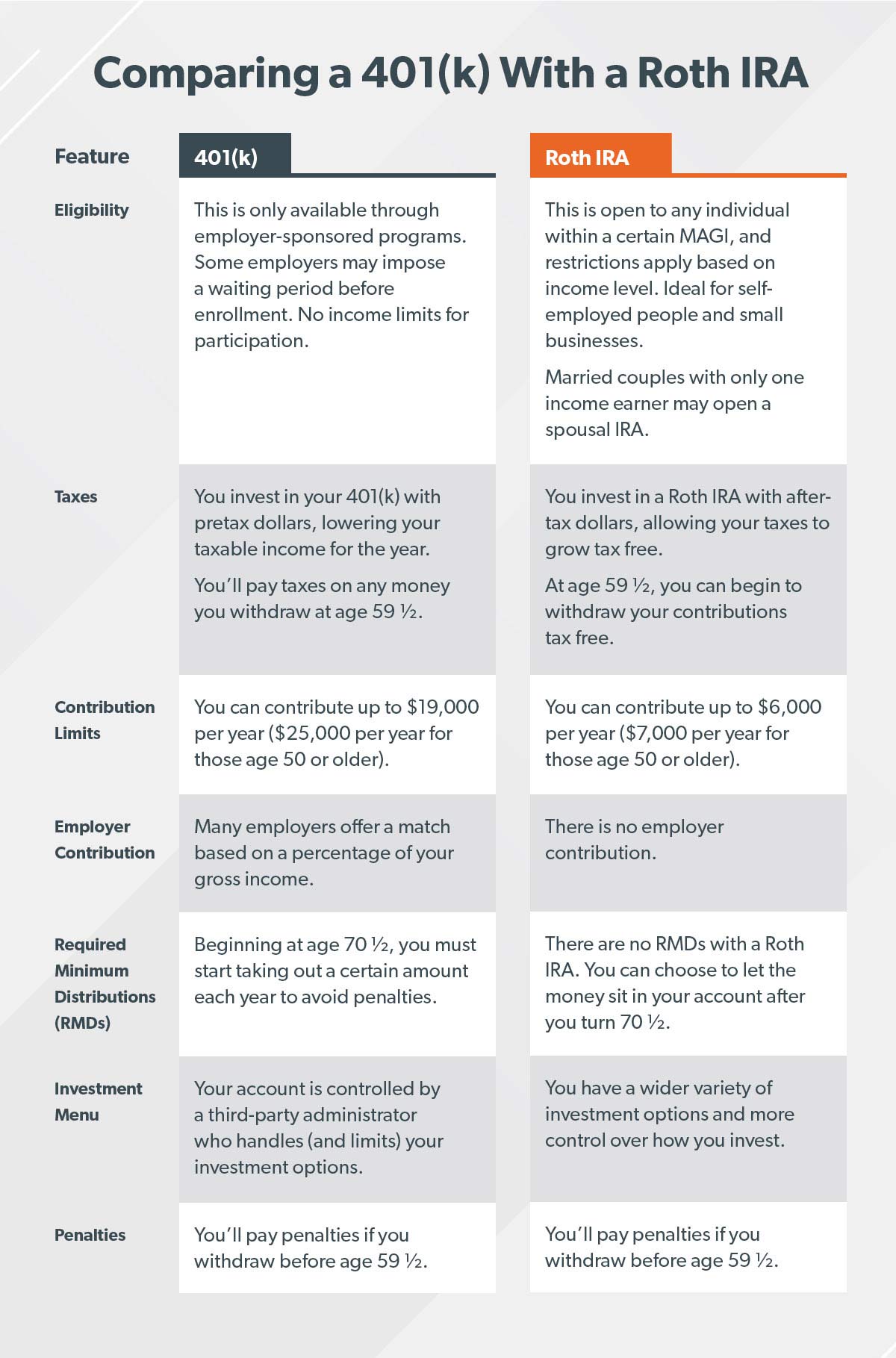

What Is A 401

A 401 is a retirement savings plan many employers offer as a way to encourage employees to save for retirement. Basically, you tell your employer how much you want to invest in your 401usually as a percentage of your salary or a specific amount each pay periodand that money is automatically taken out of your paycheck and put into retirement savings. Voila!

According to Ramsey SolutionsThe National Study of Millionaires, 8 out of 10 everyday millionaires built their wealth through their companys 401.If all those millionaires could use the boring, old 401 to get to millionaire status, so can you!

Should I Open A Roth Ira If I Have A Roth 401

If you have the funds to do so and your income allows Roth IRA contributions, you can grow your retirement savings faster by contributing to both! More money into retirement funds is a great idea, and often more money into Roth is an even better one. However, we do recommend you consult your fiduciary financial advisor to make sure your income limits arent in excess of the limits for a Roth IRA, and that contributions to a Roth IRA and Roth 401 fit within your financial plan and goals.

Don’t Miss: How To Get Your Money Out Of 401k

How To Contribute To A Roth Ira

A Roth IRA is a retirement savings account that is funded with money after taxes have been paid on earnings. This means that an individual can save money in the account and withdraw it tax-free during retirement.

Contributions to an IRA are subject to both minimum and maximum limits depending on the type of IRA, how much you make, and your age. The contribution limit for anyone over the age of 50 is $7,000 per year. Contributions below this amount are not allowed by law.

Roth IRAs can be opened by anyone who has earned income even if they dont make the contribution themselves as long as they meet certain requirements set by federal law .

What Is Best For You

If youre still wondering which retirement savings account is best for you, weve got you covered with these frequently asked questions and answers.

Should I take advantage of my companys 401k?

If your company offers a 401k with a company match, you may want to consider setting up your 401k and contribute the match amount if you can afford it. Why? Its free money that your employer is giving you for retirement, so you may as well take advantage of it.Just make sure you avoid the common investing mistake of counting your employers match towards your maximum contribution.

What if I have leftover funds to invest after the 401k match?

Once youve met your companys 401k match, you can start taking a look at IRA options to diversify your investment portfolio. Having multiple retirement savings accounts isnt for everyone, though. If the thought of having two is overwhelming, you can stick to the 401k and contribute more than your company match, although there are 401k contribution limits.

How do I decide which IRA to open?

If you do decide to diversify your investments, youll need to decide which IRA youd like to open. Remember that your Roth IRA will be after-tax dollars, so you wont pay any taxes when you withdraw your investment and gains in retirement.Since your traditional IRA functions more similarly to a 401k, you can reduce your taxable income today, but youll pay taxes on your investment and gains in the future.

Is it beneficial to have an IRA and a 401k?

Read Also: How To Buy A House With 401k

Disadvantages Of A 401k

1. Limited investment choices

With 401ks you can only invest your money into accounts within your employer-sponsored 401k plan. You cant start investing in specific stocks, index funds or other types of vehicles that arent included in the plan.

2. Hard to withdraw your money

If you try to withdraw your money before age 59 1/2, expect a 10% fee plus taxes! This is why its a great idea to have a Roth IRA and a 401k.

A Roth Conversion Will Trigger A Tax Bill But This Years Stock Market Volatility May Work In Your Favor

If youve been thinking about converting money from a traditional individual retirement account to a Roth IRA, this may be a prime time to bust a move.

Last Monday, the Dow Jones Industrial Averageplunged 876 points following a stomach-churning inflation report. The S& P 500 stepped into bear-market territory after dropping 3.9%, or 151.23 points. On top of that, the Federal Reserve raised interest rates by 75 basis points during Junes Federal Open Market Committee meeting.

The recent market moves may not be good for your portfolio, but it could be a potential win if you decide to do a Roth conversion. Here are a few items to consider before you shift funds from a traditional to a Roth IRA.

Recommended Reading: How To Get My 401k Money From Walmart

Also Check: How Much Does A 401k Cost A Small Business

Whats The Difference Between A Roth Ira And A 401

Both Roth IRAs and 401s are popular forms of retirement accounts. Each account offers generous tax advantages, making them valuable tools for building wealth over time. A Roth IRA is an account you open as an individual, but to invest in a 401 plan, youll need to work for a company that offers one.

Which Is Right For Me

One thing to keep in mind is that you can open both a 401 and an IRA.

If youre eligible for both, then its a good idea to take advantage of both Roth IRA and Roth 401, especially if your employer offers matching contributions.

Common advice is to contribute to your 401 to max out your employers match. After that, you can contribute to your IRA where you have more flexibility to choose what you invest in. If you max out your IRA and want to keep saving, you can then return to contributing to your 401.

Of course, if youre only eligible for one of the two accounts due to income limits or not working for an employer that offers a 401, you should take full advantage of it.

Don’t Miss: How To Contact Fidelity 401k

Which Is Best For You

This decision mainly comes down to how you want to put money into the account and how you want to take money out.

Lets start with today putting money in. If youd prefer to pay taxes now and get them out of the way, or you think your tax rate will be higher in retirement than it is now, choose a Roth 401.

Youre also giving yourself access to a more valuable pot of money in retirement: $100,000 in a Roth 401 is $100,000, while $100,000 in a traditional 401 is $100,000 less the taxes youll owe on each distribution.

In exchange, each Roth 401 contribution will reduce your paycheck by more than a traditional 401 contribution, since it’s made after taxes rather than before. If your primary goal is to reduce your taxable income now or to put off taxes until retirement because you think your tax rate will go down, you will do that with a traditional 401.

Just know that:

-

Youre kicking those taxes down the road, to a time when your income and tax rates are both relatively unknown and might be higher if you advance in your career and start earning more

-

If you want the after-tax value of your traditional 401 to equal what you could accumulate in a Roth 401, you need to invest the tax savings from each years traditional 401 contribution. For more on this, see our study on the Roth IRA advantage, which also applies here.

The Change Coming To 401s

There is broad support in Congress for the plan to require employers to automatically set up 401 accounts for eligible employees at a savings rate of 3% of their annual income. Each year, their savings rate would increase by 1% per year until it reaches 10%.

You can choose not to contribute or change the amount of contributions.

In March, the House almost unanimously passed the legislation, called Setting Every Community Up for Retirement Enhancement Act 2.0.

If the Senate and President Joe Biden agree to the proposal as expected, the SECURE 2.0 bill also would:

- Increase the after-tax catch-up contribution limit to $10,000 for workers ages 62 to 64.

- Allow employers to match the student loan payments you make with a deposit into your 401.

- Enable part-time workers to contribute to 401 plans.

- Raise the age when people must take required minimum distributions, or RMDs, from 72 to 75.

You May Like: What Is The Tax Rate On 401k After 65

Early Roth 401 Withdrawals:

If your employer allows for in-service withdrawals , you can access your contributions tax and penalty-free, since they are made with money that has already been taxed. If you take the earnings out though, you may have to pay income tax as well as a 10% penalty. The problem with taking money from a Roth 401 before you meet the qualified distribution rules is that early withdrawals are pro-rated and will be considered partially your contributions and partially your earnings. You cant choose to just take out earnings. It can get messy.

How To Spend A 401 Plan Efficiently In Retirement

Employees cant touch their 401 plans without a tax penalty until theyve reached the age of 59½ years. At that time, a 401 plan owner can roll over their retirement savings plans into a deferred annuity with a lifetime income rider. The annuity will then equally distribute a percentage of the retirement account for the rest of the retirees lifetime or married retirees lifetimes, even after the account has run out of money.

Recommended Reading: What Percentage Should I Be Putting In My 401k

Details About A Roth Ira

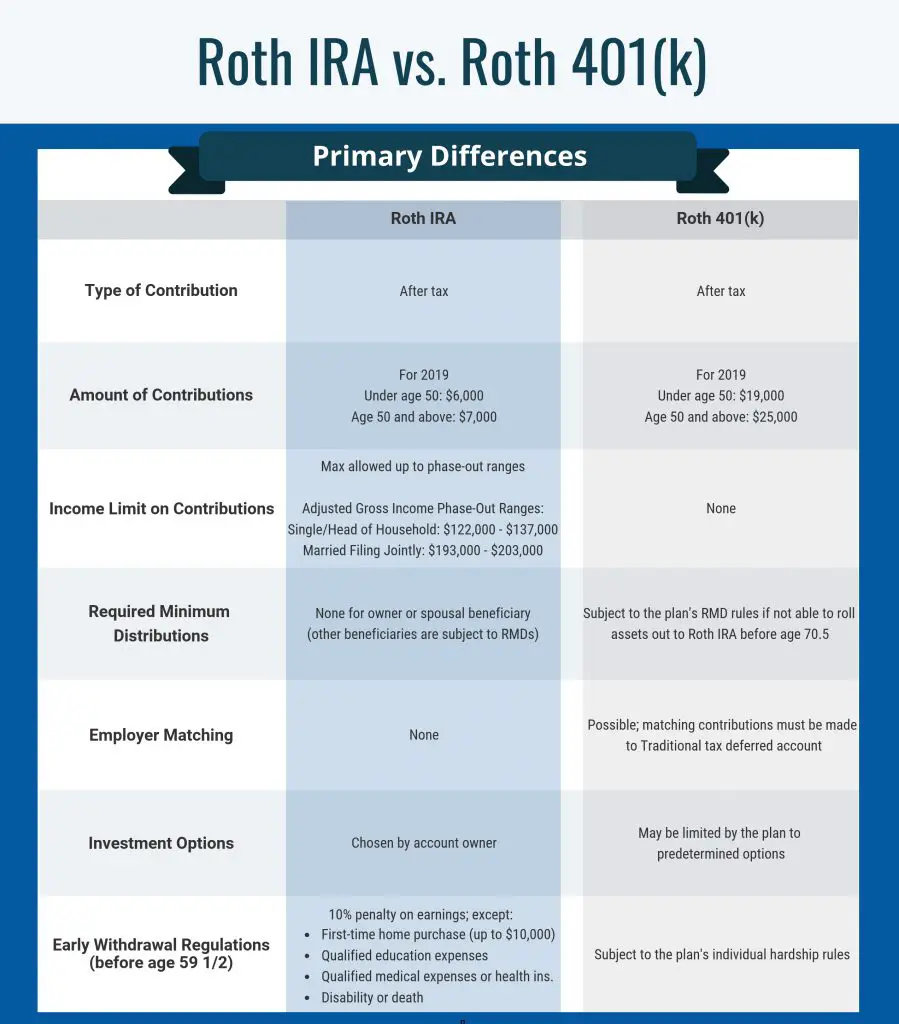

A Roth IRA can be opened by individuals independently oftheir jobs. However, there are some maximum income limits to open a Roth IRA.If you are single, your ability to make contributions to a Roth IRA begins tophase out once you earn $122,000 and is eliminated completely once you earn$137,000. If you are married, the phase-out for maximum contributions beginswhen you earn $193,000 and is eliminated when you earn a combined $203,000 ormore per year.

If you are younger than age 50, you can contribute amaximum of $6,000 per year to a RothIRA. You will be able to make an additional $1,000 per year incontributions if you are age 50 or older. The contributions that you make go inafter tax so that you will not have to pay taxes at the time of disbursement.

If you withdraw your earnings before you reach age 591/2, you will have to pay a 10 percent penalty. However, some types ofwithdrawals are exemptfrom the penalty. The following types of withdrawals will not incura Roth IRA early withdrawal penalty:

- Withdrawalsbecause of disability

- Death of theRoth IRA owner

- Used to payunreimbursed medical expenses that exceed 7.5 percent of the AGI of the RothIRA owner

- Used to payfor medical insurance for people who have been unemployed for longer than 12months

- Used topurchase a home as a first-time homebuyer

- Used to payqualified higher education expenses

- Used to payback taxes because of an IRS levy

The advantagesof a Roth IRA include the following:

What Do My Beneficiaries Receive When I Die

Both a Roth IRA and 401 will provide a straightforward death benefit that is the retirement plans account value in a lump sum.

Helpful tip: If you want to leave money to your beneficiaries, life insurance might be a better option for you. In some cases, you dont need to take a medical examination. Receive a free life insurance quote to find out if you can get affordable coverage. Coverage starts at $9.37 per month. Proceeds are tax-free too!

Recommended Reading: How To Rollover A 401k Into An Ira

How M1 Finance Works

M1 Financeis an investment platform that allows you to choose your own type of accountand your own investments. It does not charge any commissions or management feesand offers a combination of innovative expertise, accessibility, andpersonalization.

Theplatform is set up in such a way to make investing understandable for investorsat all levels. You can pick your own IRAs, roll over your 401 or choose aportfolio that has been created by experts for your risklevel.

Disadvantages Of A Roth Ira

The Roth IRA sounds pretty awesome, doesnt it? Unfortunately, the Roth IRA does have some limitations that you need to be aware of:

- Lower contribution limits. You can only invest up to $6,000 in a Roth IRA each year or $7,000 if youre age 50 or older.3 When you compare that with the contribution limits for a 401, you might be thinking, Thats it? Thats why 401s and Roth IRAs work better together.

- Income limits. As amazing as the Roth IRA is, theres a chance you might not even be eligible to put money into one. Gasp! If your modified adjusted gross income is higher than $144,000 as a single person or more than $214,000 as a married couple filing jointly, then you wont be able to contribute to a Roth IRA in 2022.4 But dont worry, the traditional IRA is still an optionits better than nothing!

- The five-year rule. This wont be an issue for most folks, but the five-year rule says you cant take money out of your Roth IRA until its been at least five years since you first contributed to the account. Youll get hit with taxes and penalties if you break that rule . And remember: Just like the 401, youll be penalized for taking money out of a Roth IRA before age 59 1/2 .

Recommended Reading: How To Calculate How Much To Contribute To 401k

How Much To Save

It makes sense to take full advantage of any employer matching contributions to a plan at work before putting money into an IRA. Save at least as much as the matching percentage if your employer matches your 401 contributions.

One good rule of thumb is to save 10% to 15% of pretax income. Consider maxing out a Roth IRA after you reach this point, or at least setting aside as much as you can into this type of account throughout the year. The tax benefits will pay off, particularly if you expect your income tax rate to rise over time.