Fidelity Routing Number United States

Fidelity Routing Number is used for wire transfer transactions in your bank. Fidelity is not the usual brick-and-mortar bank. It focuses on brokerage accounts while functioning as a checking account too. Fidelity even has FDIC insurance for deposits, and it also offers interests with consumer-friendly policies. To boot, it yet has basic savings accounts. If you want a free cash account with little interest, this Fidelity will work for you. You can also get the routing numbers of similar banks in our complete Routing Numbers List.

Meanwhile, you can also wire money with Fidelity. Before you can do this, you need to have Fidelity direct deposit or direct debit routing numbers. Ensure that your Fidelity account is a checking account in the case of Automated Clearing House .

Ways Of Finding My Old 401ks Including Using Ssn

If youâve ever left a job and wondered âWhere is my 401?â, youâre not alone. Locating 401âs is complicated. Thus, billions of dollars are left behind each year. Beagle can help track down your money.

Contributing to an employer-sponsored 401 plan is a great way to build wealth for retirement especially if youâre receiving a match from your company. The problem is they are tied to an individual employer. We forget about them, leave that company, and one day we realize âOh yeah! Where is my 401?â

A 401 can be in a few different places. Most commonly it could be with your previous employers, an IRA they transferred your funds to after you left, or mailed to the address they had on file.

Believe it or not, Americans unknowingly abandoned $100 billion worth of unclaimed 401 accounts. According to a US Labor Department study, the average worker will have had about 12 different jobs before they turn 40. So itâs easy to see how we can lose track of so much 401 money.

To find your old 401s, you can contact your former employers, locate an old 401 statement, search unclaimed asset database in different states, query 401 providers using your social security number or better yet, get some help to find your 401 accounts from companies like Beagle.

Finding Old Retirement Accounts

You may want to start by contacting your former employers and the plan administrators, the companies that ran the retirement plan. Sometimes, youll find that your retirement account is still there and chugging along as is, hopefully growing in value over time. If you want, you may be able to leave it there, although update the company with your current contact information so it can let you know about any important changes.

However, its not always that easy. If your account had less than $5,000 in it when you left, the plan administrator can transfer the funds to an individual retirement account that was set up in your name. If it had less than $1,000, the company may have tried to send you a check for the amount to the address it had on file. You may also have trouble tracking down the account if the company went bankrupt or switched plan administrators, leaving it up to you to figure out who is holding onto the money now.

One thing is certainother companies dont get to keep your money. If a company cant figure out how to contact you, it has to turn unclaimed funds over to state agencies. You can start searching for your unclaimed funds in these databases:

Once you find your account or money, youll still need to decide what to do with it.

You May Like: Should I Take A 401k Loan To Pay Off Debt

Organize And Rebalance Your Accounts

Now that youve found your old 401k plans, its time for a review. After years of neglect, your forgotten retirement accounts may not be properly balanced. This means there may be too much emphasis on one type of investment, or not enough on another.

If you plan to keep the IRA or company plan open, you may want to consider diversification, so theres the right amount in stocks, bonds, U.S. investments or international exposure thats appropriate for your investment goals and risk tolerance.

Youll need to check each account individually at first. However, if you can list them all in one place, youll see how your combined investment diversification stands up. An online tracking service can continue to monitor your accounts, possibly flagging you if you need to consider rebalancing again.

Online tracking services cant do the rebalancing for you, youll have to go to each individual account to manage the rebalancing. And if the diversification seems off but its not time for you to rebalance, youll have to look at each individual account to determine which one may be out of balance the most.

Look For Contact Information

If you don’t know how to contact your former employer perhaps the company no longer exists or it was acquired or merged with another company see if you have any old 401 statements. These should have contact information to help put you in touch with the plan administrator.

If you don’t have an old 401 statement handy or yours doesn’t tell you what you need to know, visit the U.S. Department of Labor website and look up your employer. There you should find your old retirement account’s tax return, known as Form 5500. That will most likely have contact information for your 401’s plan administrator.

Recommended Reading: Where To Open A 401k

A Special Note For Pennsylvania Residents

If you live in Pennsylvania, you should start your search sooner rather than later.

In most states, lost or abandoned money, including checking and savings accounts, must be turned over to the states unclaimed property fund. Every state has unclaimed property programs that are meant to protect consumers by ensuring that money owed to them is returned to the consumer rather than remaining with financial institutions and other companies. Typically, retirement accounts have been excluded from unclaimed property laws.

However, Pennsylvania recently changed their laws to require that unclaimed IRAs and Roth IRAs be handed over to the states fund if the account has been dormant for three years or more.

If your account is liquidated and turned over to the state before the age of 59.5, you could only learn about the account when you receive a notice from the IRS saying you owe tax on a distribution!

Company 401k plans are excluded from the law unless theyve been converted to an IRA. If you know you have an account in Pennsylvania, be sure to log onto your account online periodically. You can also check the states website at patreasury.gov to see if you have any unclaimed property.

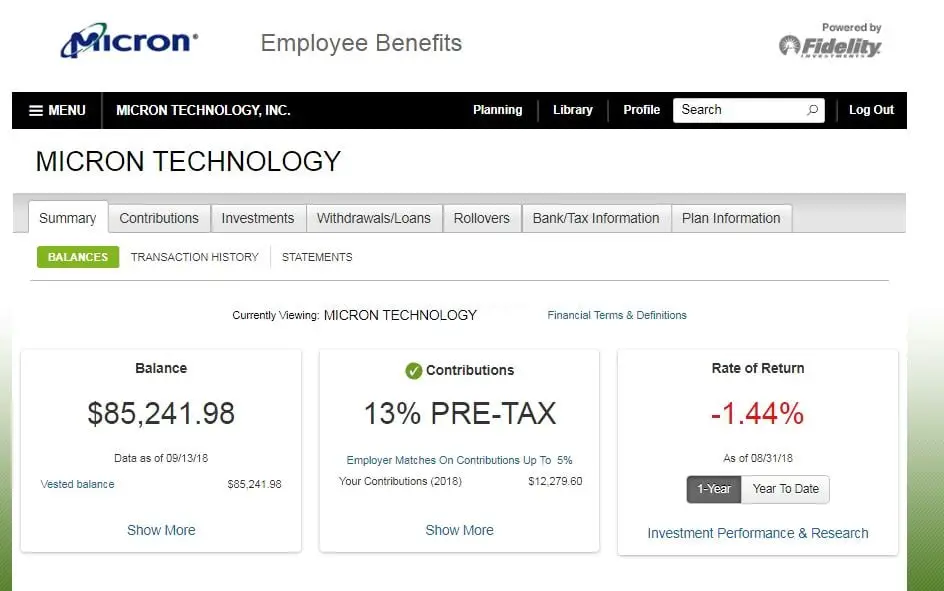

How To Use The Contribution Calculator

This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. The Growth Chart and Estimated Future Account Totals box will update each time you select the âCalculateâ or âRecalculateâ button.

Pre-filled amountsBased on our records, the following information may be pre-filled:

Salary

- Pay period. If the information is not available, the default pay period is weekly.

Contribution

- Your contribution rate. Note that we will use 8% as a default value if your contribution rate is not available or if your contribution is a dollar amount rather than a percentage.

Investment

Also Check: When Leaving A Company What To Do With 401k

Recommended Reading: Can I Transfer My Ira To My 401k

Search Unclaimed Assets Databases

If your search is still coming up empty, your former employer has folded or was bought by another company, youâre not out of luck yet.

It may take a little more effort and research but there are many national databases that can help you track down your old 401 accounts:

- The Department of Laborâs Abandoned Plan database can help you identify what happened to your old plan and the contact information of the current administrator

- The National Registry of Unclaimed Retirement Benefits allows you to do a free search for any unclaimed retirement money using just your Social Security number

- FreeERISA is another free resource to search for any old account information that has been filed with the federal government

- The Securities and Exchange Commissionâs website or your stateâs Secretary of State can provide more information on your previous employer

Where Has My 401 Gone

There are a few scenarios in which someone might lose track of their 401.

If you did a bit of job-hopping early in your career, you may have moved on and forgotten about your 401 plan. Or perhaps your company merged with another, but your 401 plan didnt transfer over. In other cases, you may have automatically enrolled in your companys 401 plan without realizing it.

You know all the paperwork from human resources you ignored? The information youre looking for probably was in there.

Regardless of why you lost track of a 401 plan, the good news is that whatever contributions you made no matter how long ago that may have been are yours to keep and always will be. Heres what you need to know to track down your old 401 and make it work in your favor again.

Don’t Miss: How To Maximize Your 401k

Find Old 401 And Pension Accounts

Sites like Unclaimed.org help people and businesses find unclaimed property. Unclaimed.org is run by the National Association of Unclaimed Property Administrators.

You can conduct a free search using an official state program and find any old 401 and pension plans that youve paid into and forgotten.

It is worth being cautious here, though. Official state programs will help you find and claim your pension and retirement funds for free. The National Association of Unclaimed Property Administrators can direct you to those state programs.

Professional hunters can also track down any funds for you in return for a fee, but you dont really need them. The information is available for nothing, and it wont take more than a few minutes to scan your states official program to discover whether youve got any hidden money.

If you start fishing emails out of your spam folder telling you that youve got several million dollars sitting in an account in Africa somewhere, give that a miss. Thats not yours, and you arent getting it.

How To Find Old 401 And Pension Accounts

The challenge will be finding that money and claiming it. If youve worked a dozen jobs and are now in your fifties and looking forward to retirement, theres a good chance youll struggle to remember everywhere you worked. But how do you find old 401 and Pension Accounts?

You might remember carrying bags in a hotel one summer but you might also struggle to remember the name of the hotel or when exactly you were there.

The good news is that you dont have to try to remember every place youve ever worked and that might have given you pension payments.

Also Check: How Much To Put In 401k

If You Are Under 59 1/2

Making a withdrawal from your Fidelity 401k prior to age 60 should always be a last resort. Not only will you pay tax penalties in many cases, but youre also robbing yourself of the tremendous benefits of compound interest. This is why its so important to maintain an emergency fund to cover any short-term money needs without costing yourself extra by making a 401k early withdrawal.

However, life has a way of throwing you curveballs that might leave you with few to no other options. If you really are in a financial emergency, you can make a withdrawal in essentially the same way as a normal withdrawal. The form is filled out differently, but you can find it on Fidelitys website and request a single check or multiple scheduled payments.

If you jump the gun, though, and start making withdrawals prior to the age of 59 1/2, youve essentially broken your pact with the government to invest that money toward retirement. As such, youll pay tax penalties that can greatly reduce your nest egg before it gets to you. A 401k early withdrawal means a tax penalty of 10 percent on your withdrawal, which is on top of the normal income tax assessed on the money. If youre already earning a normal salary, your early withdrawal could easily push you into a higher tax bracket and still come with that additional penalty, making it a very pricey withdrawal.

Use Resources To Discover Unclaimed Assets

Once you use these resources to locate your funds, you can use the following resources to get access to your unclaimed assets.

You May Like: Can I Use My Fidelity 401k To Buy A House

What Is A 401

A 401 is an employer-sponsored retirement plan enabling workers to save money in a tax-deferred way. Often employers will match contributions up to a percentage of salary. Its just like any other retirement plan in the sense that youre trying to save money and reduce taxes as you do it. Like an IRA, you will pay taxes once you start taking withdrawals in retirement.

If you opted for it when you were hired, every paycheck a percentage of your salary is taken out and put into a 401 retirement account. Your employer may add some more money, maybe even the same amount, on top of that. That money is usually invested, and has been accumulating. How much is in there?

There are different types of 401s. A Roth 401 operates much in the same fashion as a Roth IRA. While still employer-sponsored, it uses after-tax income to fund itself, so you pay the taxes now, and not later in retirement. While one can deliberate the merits of which to use, the general consensus is that a Roth format is useful if one believes they will be in an higher tax bracket later in life when withdrawing from their retirement accounts.

Conversely, a traditional 401 advocate might argue that the ability to put more money into an account in the beginning and through time, allows the saver to make the most of compound interest.

Read more about how a 401 works in this article from TheStreet.

You’ve Found Your Old 401s Now What

Once you’ve located your old 401s, you have a few options. Some come with penalties, some require taxes to be paid, and some don’t require either.

You have the option to cash out all of the funds in your old 401s. However, the IRS will charge you a 10% early withdrawal penalty. In very few cases, can this penalty be waived, so it’s best to leave it saved until you’re at least 59½.

Secondly, you can rollover your old 401s into your current employer-sponsored plan. This comes with no penalty or taxes. Because you are rolling it over into another retirement account, you won’t incur any additional costs in doing so.

Lastly, you can consolidate your 401s into an IRA. Like a 401, an IRA is a retirement account, so it’s free from any penalties and taxes. These are held outside of your employer’s 401 plan, but they’re easy to set up and come with many more investment options.

Also Check: Should I Transfer 401k From Previous Employer

Option : Leave It Where It Is

You don’t have to move the money out of your old 401 if you don’t want to. You won’t ever lose the funds provided you don’t lose track of your old account again. But this option is usually the least desirable.

For one, it’s more difficult to manage your retirement savings when they’re spread out over many accounts. You also get stuck paying whatever your old 401’s fees were, and these can be higher than what you’d pay if you moved your money to an individual retirement account, for example.

But if you like your plan’s investment options and the fees aren’t too high, you could consider leaving your old 401 funds where they are. Just make careful note of how to access them again so you don’t forget.

What You Can Do Next

To keep track of your retirement accounts, you first must know where they all are. Once you gather all your old accounts in one place and make sure they are properly balanced, its about sticking to the same investment principlesensuring your money is in diversified, low-cost fundsthat you would follow for your current company retirement plan.

For Compliance Use Only:1020356-00003-00

Also Check: Can I Contribute To A Roth Ira And A 401k

Roll Over The Old 401 Account Into An Ira

This will likely be the best option for most people because the IRA is attached to you instead of your employer, making it less likely that youll lose track of the account again. An IRA also comes with a much wider selection of investments than most 401 plans. Youll be able to choose from individual stocks as well as mutual funds, ETFs and more.

If you dont already have an IRA, youll need to set up an account before you roll over your 401. The process is fairly straightforward and you can open an IRA through most online brokers.

Make Sure You Actually Contributed

Before you go through the hassle and process of calling the HR department at your old employer, or searching through databases, its a good idea to verify that you contributed to the plan.

If you are unsure if you contributed to a 401 plan, you can check your previous year tax return and old W-2. Any contribution will be in Box 12 of the W-2.

ERISA, or the Employee Retirement Income Security Act of 1974, sets minimum standards for retirement plans, and protects retirement savings from abuse or mismanagement.

Among other things, employees are required to make annual reports

Don’t Miss: Where Is My Fidelity 401k Account Number