Do 401 Contribution Limits Include The Employer Match

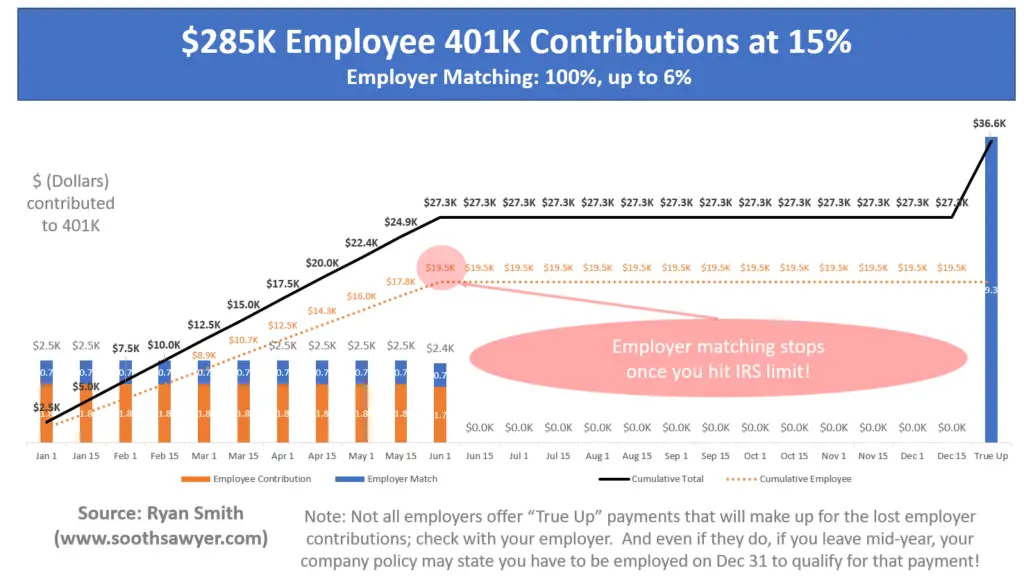

Employees are allowed to contribute a maximum of $19,500 to their 401 in 2020, or $26,000 if youre over 50 years of age. The good news is employer contributions do not count towards the $19,500 limit. Instead, employer matching contributions are subject to the lesser known $57,000 limit on all contributions made to a 401 account .

Your 401 can receive no more than $57,000 in contributions in a single year, whether those contributions are made by you or by your employer. That limit is three times the contribution limit for employees, so your employer would need to offer a 200% 401 employer match on all contributions you make for you to reach the limit.

The $57,000 limit mostly affects small business owners and the self-employed who pay themselves and make retirement contributions as both the employee and the employer. Most people who work for regular companies will never have to worry about the $57,000 overall limit.

How To Calculate Using A 401 Contribution Calculator

One needs to follow the below steps in order to calculate the maturity amount for the 401 Contribution account.

Step #1 Determine the initial balance of the account, if any, and also, there will be a fixed periodical amount that will be invested in the 401 Contribution, which would be maximum to $19,000 per year.

Step #2 Figure out the rate of interest that would be earned on the 401 Contribution.

Step #3 Now, determine the duration which is left from current age till the age of retirement.

Step #4 Divide the rate of interest by the number of periods the interest or the 401 Contribution income is paid. For example, if the rate paid is 9% and it compounds annually, then the rate of interest would be 9%/1, which is 9.00%.

Step #5 Determine whether the contributions are made at the start of the period or at the end of the period.

Step #6 Figure out whether an employer is also contributing to match with the individuals contribution, and that figure plus value arrived in step 1 will be the total contribution in the 401 Contribution account.

Step #7 Now use the formula accordingly that was discussed above for calculating the maturity amount of the 401 Contribution, which is made at regular intervals.

Step #8 The resultant figure will be the maturity amount that would include the 401 Contribution income plus the amount contributed.

How Much Can I Contribute

Another good reason to take advantage of a 401 match is that it allows you to exceed the annual 401 maximum contribution limits set by the IRS. For 2020 and 2021, you can contribute up to $19,500 of pretax income to a 401. If you are 50 or older, you can contribute another $6,500 in what are called catch-up contributions.

When including employer contributions, the maximum amount you can contribute in 2020 is the lesser of $57,000 for participants 49 or younger or 100% of the participants compensation. In 2021, the limit is $58,000 for participants 49 or younger .

You May Like: Can I Sign Up For 401k Anytime

Don’t Miss: Can You Withdraw Your 401k If You Quit Your Job

Contribute Up To The Employer Match

You have enough saved up to cover your expenses. You emergency fund is there in case you need it. Now youre starting to think about 401 contributions. Where do you you start?

The first thing you should figure out is if you have an employer matching program with your 401. With an employer match, your employer will match your 401 contributions up to a certain percentage of your gross salary. Say your employer offers 100% match on the first 5% you contribute. That means if you contribute 5% of your gross salary to your 401, your employer will contribute an amount equal to 5% of your gross salary. The total contribution to your 401 would then equal 10% of your gross salary.

An employer match allows you to increase your contribution, and you should always take advantage of matching programs. Unfortunately, many people pass up free money by not contributing up to their employer match.

Definition Of A 401 Account

A 401 is an employer-sponsored retirement plan that allows you to relegate a percentage of your paycheck into future retirement savings.

There are several benefits to a 401 account:

First of all, it forces you to save money for the future by keeping a portion separate from the rest of your paycheck people are less likely to put money aside for future savings regularly if they have it available to spend.

Second, money is taken out of your paycheck with pre-tax dollars taxes are not paid on your 401 funds until you withdraw money out. Since the funds provide a rate of return over time, pre-tax dollars will grow more quickly. Third, your employer typically matches your contributions to your 401 up to a certain percentage, causing your money to grow more quickly.

Finally, you can control how the money in your 401 gets invested the plans for a 401 typically involve a mix of stocks, bonds and money market funds. You can choose to make your plan more aggressive or conservative, depending on your risk tolerance.

Don’t Miss: Can You Transfer Money From 401k To Roth Ira

How To Calculate 401k Contribution

Let’s be honest – sometimes the best 401k contribution calculator is the one that is easy to use and doesn’t require us to even know what the 401k contribution formula is in the first place! But if you want to know the exact formula for calculating 401k contribution then please check out the “Formula” box above.

Using The Calculator To Estimate Your Future Earnings

With this 401 contribution calculator, you can estimate what you will have saved in your fund when you plan to retire. To use the calculator, enter several parameters into the available fields:

- Salary

- Estimated percent rate of return

- Years until you plan to retire

After entering these parameters into the fields, click on the Calculate button. The calculator will take these parameters and tell you how much you will have in the fund at the time of your retirement.

If you find the total amount to be unacceptable, then you can go back by pressing the Back button on the calculator and revise your figures. Play with the parameters to help you determine how to save more for retirement. For example, you have these options to modify and see how they affect your totals:

- Increasing your 401 percentage contribution

- Increasing your employers percentage contribution, if your employer will match a higher amount

- Increasing the number of years until you retire

- Determine how a different rate of return than expected would affect retirement savings

If, after using the calculator, you find that changing contribution percentages and years until retirement do not give you a significant enough retirement savings, then you may want to consider looking for a different position that offers you a higher salary, allowing you to save more for the future.

Recommended Reading: How Do I Find My 401k

What Is A 401

A 401 is a retirement plan offered by some employers. These plans allow you to contribute directly from your paycheck, so theyre an easy and effective way to save and invest for retirement. There are two main types of 401s:

-

A traditional 401: This is the most common type of 401. Your contributions are made pre-tax, and they and your investment earnings grow tax-deferred. Youll be taxed on distributions in retirement.

-

A Roth 401: About half of employers who offer a 401 offer this variation. Your contributions are made after taxes, but distributions in retirement are not taxed as income. That means your investment earnings grow federally tax-free.

How Much To Contribute To 401k

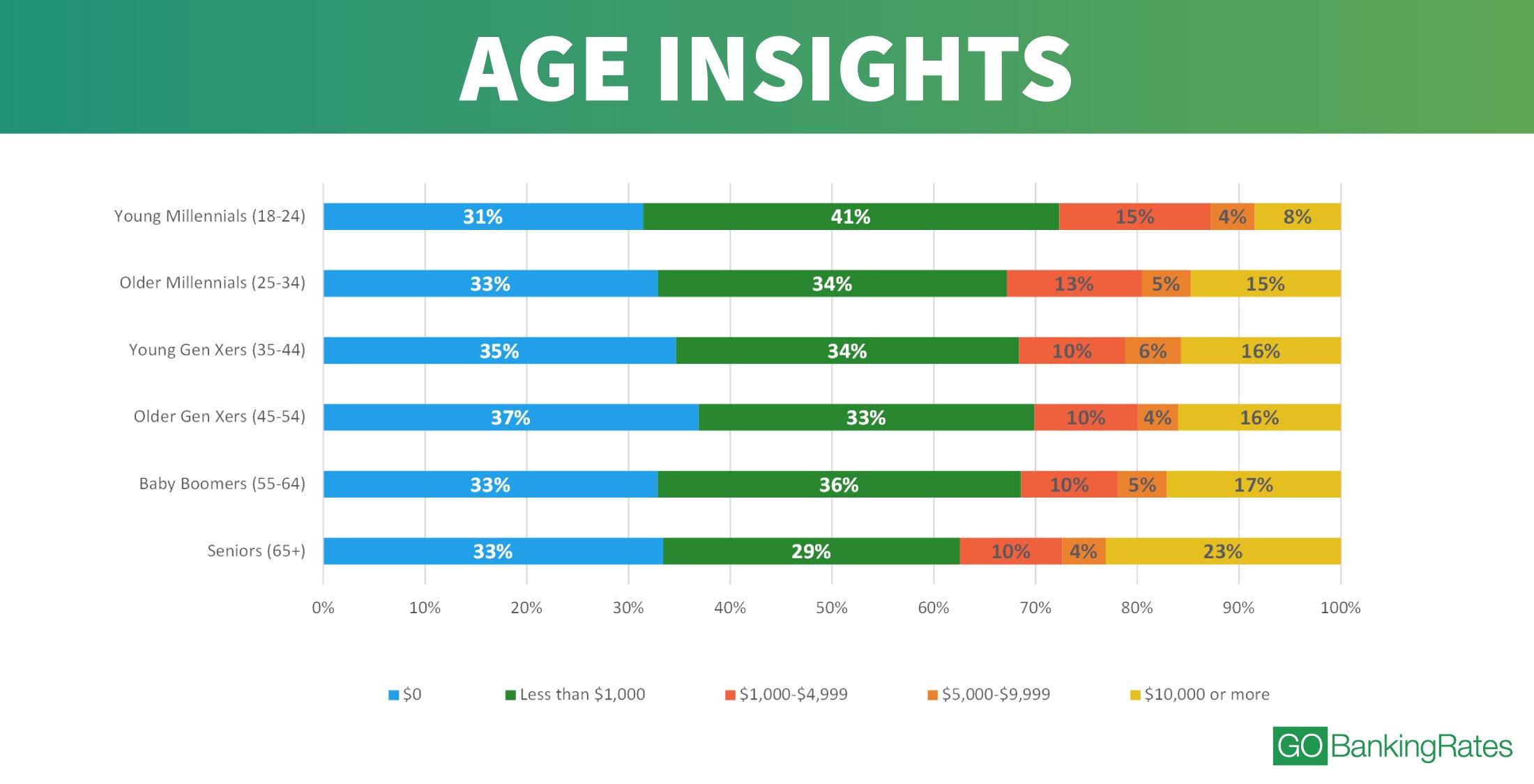

As for many other big questions – the answer is: “it depends“. It depends on your age, financial situation, lifestyle, health, priorities, and so on. You need to consider how much money you’ll need, when you’ll start saving, when are you planning to retire, for how many years of retirement you’ll need money , and how much you earn.

That being said, finance experts generally advise contributing enough to get the maximal matching contribution. For example, if your employer offers a matching contribution with a 4% limit, you should probably transfer at least 4% because it’s “free money” from your employer.

Hopefully, this 401k withdrawal calculator can help you make the right decision. It’ll help you check how your future pension changes depending on your monthly 401k contributions.

Don’t Miss: Can I Move My 401k To An Ira

Using This Simple 401 Calculator

Our 401 Growth Calculator is a simple and easy way to estimate the long-term growth of your 401 retirement account by the time you want to retire. Knowing how much your current 401 account may accumulate in the future can help you determine if you should adjust your annual 401 contributions to help reach your retirement goals. After answering a brief series of questions, you will get your results, including your estimated accumulated plan balance at retirement, total out-of-pocket costs, and a summary table and bar graph illustrating your retirement plan accumulation over time.

How Much Should You Contribute To Your 401

Most retirement experts recommend you contribute 10% to 15% of your income toward your 401 each year. The most you can contribute in 2019 is $19,000, and those age 50 or older can contribute an extra $6,000. In 2020, you can contribute a maximum of $19,500. Those age 50 or older will be able to contribute an additional $6,500. However, you can use our 401 calculator to figure out how much you can expect to earn based on any contribution amount you choose.

You May Like: Can I Roll Over A 403b To A 401k

Solo 401k Contribution Calculator

Self-employed individuals and businesses employing only the owner, partners and spouses have several options for tax-advantaged savings: a Solo 401 plan, a SEP IRA, a SIMPLE IRA, or a Profit Sharing plan. Each option has distinct features and amounts that can be contributed to the plan each year. Use the Solo 401 Contribution Comparison to estimate the potential contribution that can be made to a Solo 401 plan, compared to Profit Sharing, SIMPLE, or SEP plan.

Disclaimer: Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

Ready to take control of your financial future?

Start where you are. Use what you have. Invest in what you want.

Whats A Typical Employer Match To A 401

Ever wondered how employers calculate matched contributions? In 2018, Vanguard administered more than 150 distinct match formulas . With 71% of plans using it, the most popular formula is the single-tier formula, such as $0.50 per dollar on up to 6% of pay. Under this single-tier formula, an employee making $60,000 per year could get up to $1,800 in employer-matched contributions.

Here are the most common employer matching formulas per the Vanguard survey:

| Match Type | |

|---|---|

| Variable formula, based on age, tenure or similar vehicles | 2% |

There are literally hundreds of matching formulas out there, so contact your 401 plan administrator regarding the rules and specifics of the matching formula used by your employer.

-

The most common matching formula among Vanguard plan holders was $0.50 per dollar on the first 6% of pay.

-

The second most popular formula for employer matching contributions is $1.00 per dollar on the first 3% of pay and $0.50 on the next 2% of pay. Under this multi-tier formula, the same worker in our previous example would receive up to $2,400 in matching contributions.

Dont Miss: How Much Can You Put In Your 401k A Year

Don’t Miss: What Is The Max I Can Put In My 401k

How Much Will Your 401 Be Worth

We all have ideas for how wed like to spend our retirement. Whether you hope to travel the world, buy an RV, or just spend more time with your family, the choices you make today will dictate the options available to you when you retire.

Fortunately, you dont have to fly blind. Use Ubiquitys 401 calculator to get a clear picture of how your savings will stack up when you retire and how much you should be saving now to realize your goals.

How Much Should I Put Into My 401 Out Of Each Paycheck

Aiming to put at least 15% of each paycheck into your 401 as long as you can still comfortably afford your living expenses is an excellent start on your way to saving for retirement. It’s suggested that if you can’t meet this amount, aim for the minimum amount to where your employer will match your 401 investment.

Read Also: Does Fidelity Offer Self Directed 401k

Retirement Isnt Freebut Your 401 Match Is

Many of us herald this time of year as the arrival of summer, the end of the school year and seemingly longer days with more sunlight. Yet June is also a great time to check in with your employer-sponsored retirement plan.

Are you leaving free money on the table? In addition to offering the potential for free money through a match, employer-sponsored retirement plans can give you significant tax advantages.

Here are four steps to get the most out of your retirement savings.

Read Also: Should I Open A 401k

Understand The Value Of An Employer Match

A 401 or similar employer-sponsored retirement plan can be a powerful resource for building a secure retirementand an employer match can add a substantial amount to your nest egg. Lets assume you are 30 years old, make $40,000 and contribute 3 percent of your salary$1,200to your 401. And, for the sake of this example, lets assume you continue to make the same salary and the same contribution each year until you are 65. After 35 years, you will have contributed $42,000 to your 401.

Now lets assume you get a match from your employer. One of the most common matches is a dollar-for-dollar match up to 3 percent of the employees salary. Taking full advantage of the match literally doubles your savings, even assuming no increase in the value of your investments: Instead of having set aside $42,000 by the time you retire, you will have set aside $84,000, with $42,000 in free contributions. Look at it this way: its a no-cost way for you to increase your contributions by 100 percent.

In reality though, the impact will be even bigger than that. Thats because when you invest money its value compounds. Check out The Time Is Now: The True Value of Time for Young Investors to learn how taking full advantage of a match early in your career can add up.

Read Also: How To Find Old 401k Money

How Much Could Your 401 Grow If You Stop Contributing

Now lets examine what happens to your 401 when you stop contributing and your employer does not make any matching contributions either. Using most of the same parameters as before, lets use our 401 Growth Calculator to see how much your 401 will be worth if you stop contributing at age 30, after you have already accumulated $10,000 in your account:

- You are 30 years old right now.

- You have 37 years until you retire.

- You make $50,000/year and expect a 3% annual salary increase.

- Your current 401 balance is $10,000.

- You get paid biweekly.

- You expect your annual before-tax rate of return on your 401 to be 5%.

- Your employer match is 100% up to a maximum of 4%.

- Your current before-tax 401 plan contribution is now 0% per year.

What happens to your previous 401 balance of $795,517? It plummets to $63,485 $732,032 less than before. When you stop contributing to your 401 and have no employer matching contributions, your total 401 balance in year 37 is 92% less. Procrastinating with your retirement savings and your 401 contributions means you have to work much harder and save even more to catch up to where you need to be in order to reach your retirement goals. Learn more about the cost of waiting to save for your retirement.

Total 401 Employer And Employee Annual Contribution Limits

| 2021 | ||

|---|---|---|

|

Total with Catch-Up Contributions for those 50 or Older |

$64,500 |

$67,500 |

Vanguard data from 2018 show that among 401 plans the firm administered, 95% of employers provided matching or non-matching contributions to their employees. Approximately 85% of employers provided a 401 match to their employees. Approximately 10% of employers provided non-matching 401 contributions, with no requirement that employees also contribute.

While the annual limits for individual contributions are cumulative across 401 plans, employer contribution limits are per plan. If you were to participate in multiple 401 plans in one calendar year , each of your employers could max out their contributions.

Recommended Reading: How Do I Roll A 401k Into An Ira

Variables To Consider And Not

To many, what matters most is getting a ballpark figure of how much money they will have when they hit their 60s â a simple and matter-of-fact figure in dollars!

While there are only four input variables in this calculator, it’s important to consider how you arrive at each variable. For example, when figuring out your total monthly contributions, include:

- Your average monthly contributions.

- Your employer’s average monthly contributions â sometimes called a match.

- Any catch-up contributions in order to reach your desired future goal.

- Limitations due to being a highly-compensated employee.

Only focus on the variables presented in this calculator. Never go into the details of something that is completely out of your control like inflation, salary growth, changes in federal law, or changes in employment policies.

This 401k contribution calculator helps streamline the process of figuring out how much you should contribute toward your 401k to meet your future goal. It simulates that if you contribute X that you’ll end up with Y in a future date, without unnecessary complication.

Simply take a few moments to run a couple of scenarios and figure out how much you should be contributing toward your 401k â preparing now will result in a more rewarding retirement later.