How To Claim Your Retirement Savings

Normally, getting at your money can be difficult, and the rules are often imposed by the plan design rather than regulations.

For instance, regulations allow you to access the money without a bonus penalty by:

- Getting a hardship withdrawal before age 59 ½.

- Waiting until age 59 ½.

- Leaving your employer in the year you turn age 55 or after.

While most plans do have loan provisions, many dont allow hardship withdrawals, and some plans require that a person be terminated before accessing their money, even if they are 59 ½ or older.

Due to COVID-19, the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, made it easier to get at your money up to $100,000 in loans or distributions, if the plan allowed it. These withdrawals had to be taken before the end of 2020. If you took a hardship loan in 2020, you could avoid paying the 10 percent penalty on the money, as well as take the option to repay the loan tax-free over the next three years.

Unless youre really in a bind, Brewer advises against taking a distribution or a loan. Theres no replacing time in the market, she points out, and consistent saving over time is one of the best ways to build wealth for the future.

Think About How Much You’ll Need In Retirement

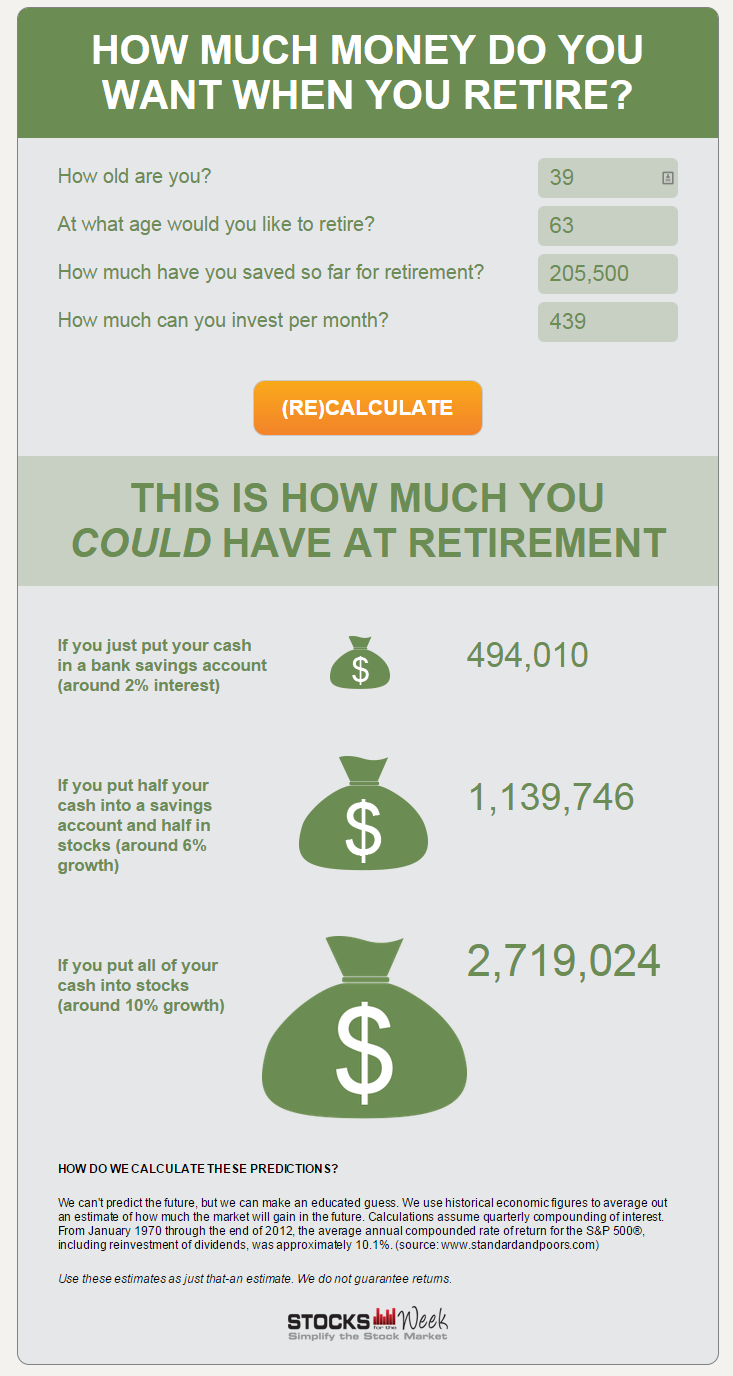

Contributing the maximum to your 401 requires a lot of money especially as an ongoing, year-after-year commitment. It may or may not be enough to fund your retirement, or it could be even more than you need. Your 401 contribution amount should be guided by your retirement savings goal.

How much money you’ll need in retirement depends on when you plan to retire, how much of your current income youd like to replace and how much you want to rely on Social Security.

Most experts recommend saving 10% to 15% of your income, but our suggestion is to get a more detailed goal from a retirement calculator.

If you need to start at a lower contribution and work your way up, that’s fine. Aim to contribute at least enough to grab the match, then bump up the percent you contribute by 1% or 2% each year.

Simple 401 Limits In 2022

Employers offering a SIMPLE 401 allow employees to save up to $14,500 in 2022, which is up by $1,000 from 2021. Those age 50 and older may contribute another $3,000 for a total of $17,000.

Employers can contribute dollar-for-dollar up to 3% of a workers pay or contribute a flat 2% of compensation regardless of the employees own contributions. Employer 401 contributions are subject to an employee compensation cap of $305,000 for 2022.

You May Like: How To Calculate Max 401k Contribution

Why Should You Offer A 401 Employer Match

Offering a 401 employer match as part of your employee retirement plan has three primary benefits for your company:

- Better recruiting. Not all companies offer a 401 employer match, so doing so can help your business stand out to top job candidates. Offering better benefits correlates with hiring better candidates.

- Stronger employee morale and retention. Just as offering 401 contribution matching can draw better recruits to your business, this benefit can also improve employee morale and retention at your company.

- Employer tax benefits. There are tax savings that businesses can take advantage of by offering 401 employer matching. Tax laws allow employers to claim their matching contributions as tax deductions.

Key takeaway: Offering a 401 employer match program can attract stronger new hires, reduce taxable business income, and boost employee morale and retention.

How Much Can I Contribute

Each year the IRS determines the maximum amount you can contribute to tax-deferred savings plans like the TSP. This is known as the IRS elective deferral limit. Participants should use this calculator to determine the specific dollar amount to be deducted each pay period in order to maximize your contributions and to ensure that you do not miss out on Agency or Service Matching Contributions if you are entitled to them.

What information do you need to use this calculator?

- Your most recent Leave and Earnings statement or payslip.

- The number of salary payments you have left for the year.

- Yes

- No

- Explain this

Participants turning age 50 or older are eligible for catch-up contributions. Well take that into account when calculating how much you can contribute.

Start

Read Also: How Much Can You Contribute 401k

How Much Do Companies Typically Match

More commonly, companies follow a formula to determine their matching contribution. A 50% match means that for every dollar an employee puts in, the employer adds 50 cents. A 100% match means the employer puts in a dollar for every dollar the employee contributes. On average, companies donate an extra 4.3% of a persons pay into their retirement accounts as a bonus.

A 2019 Vanguard study identified the most common 401 match scenarios:

- About 71% of companies choose: 50% match, up to 6% of the employees pay

- Another 21% of companies prefer: 100% match on the first 3%, 50% match on the next 2%

- 6% of companies selected: A single or multi-tiered formula, capped at a certain amount

- 2% of companies opted for: A variable formula based on age, tenure, and other variables.

Is Offering A 401 Employer Match Mandatory

Although offering a 401 employer match for your employees’ retirement plans may benefit your business, there are no laws requiring employer matching. However, if you do offer a 401 employer match contribution program, you are legally required to conduct nondiscrimination testing to ensure your program equally benefits all of your employees. These IRS-created tests, known as the Actual Deferral Percentage and Actual Contribution Percentage tests, ensure that your company’s most highly paid employees benefit as much from tax-deferred contributions as your other employees.

Key takeaway: Employers are not required to offer a 401 employee match, but those that do must regularly test for compliance with nondiscrimination standards that ensure employees of all incomes benefit equally from tax-deferred contributions.

Also Check: How To Borrow From 401k

Contribution Limits For 2021 And 2022

When most people think of 401 contribution limits, they are thinking of the elective deferral limit, which is $19,500 in 2021 and $20,500 for 2022. This is the maximum amount you are allowed to voluntarily defer to your 401 for the year. Adults 50 and older are also allowed $6,500 in catch-up contributions, which are additional elective deferrals, in 2021 and 2022. This brings the maximum amount they can contribute to their 401s to $26,000 in 2021 or $27,000 in 2022.

The IRS also imposes a limit on all 401 contributions made during the year. In 2021, it rises to $58,000 and $64,500, respectively. In 2022, it rises to $61,000 and $67,500, respectively. This includes all your personal contributions and any money your employer contributes to your 401 on your behalf.

Highly paid employees have some additional limitations to keep in mind. Companies can elect to stop a participants salary deferrals once that person has earned $290,000 in 2021 or $305,000 in 2022, and companies use only that first amount to calculate employer matching contributions.

For example, say your company matches up to 6% of your salary and you earn $300,000 in 2021. Six percent of $300,000 is $18,000 however, your company can only match you up to 6% of $290,000, the maximum employee compensation limit for 2021. So rather than up to $18,000, youd get up to $17,400 as an employer match.

Heres a useful reference chart to help you remember these important limits and thresholds:

|

Type of Contribution |

|---|

What Happens If You Over Contribute To Your 401k

If the excess contribution is returned to you, any earnings included in the amount returned to you should be added to your taxable income on your tax return for that year. Excess contributions are taxed at 6% per year for each year the excess amounts remain in the IRA. Any income earned on the excess contribution.

Dont Miss: Should I Contribute To Roth Or Traditional 401k

Don’t Miss: How Do I Find Previous 401k Accounts

What Happens If You Exceed The 401 Contribution Limit

If you go over the maximum 401 contribution for a given tax year, this is called an “excess contribution.” Excess contributions are subject to double-taxation if you do not disburse them by April 15 of the year following the tax year in question. If you discover you made an excess contribution, reach out to your plan administrator immediately to correct the issue.

Your Employer’s Contribution Limit

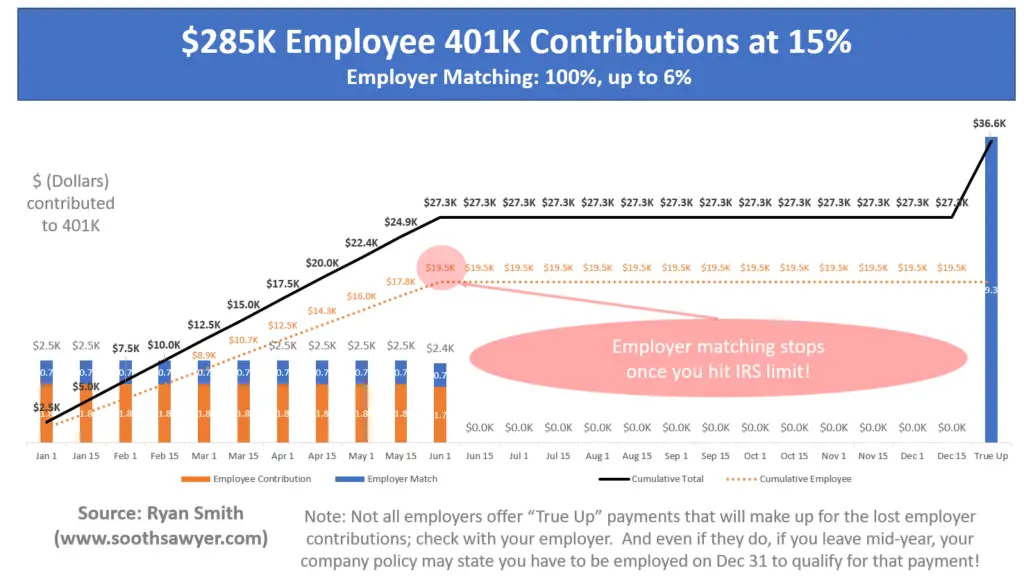

Some employers may have a set limit for the percentage you can contribute toward your 401 each paycheck and, depending on how much you get paid, maxing out your employer’s limit may still not be enough for you to max out the federal contribution limit.

For example, a company may allow employees to contribute up to 50% of their paycheck to their 401 account . Or, they may allow up to a 20% contribution per paycheck. It depends on your company, so be sure to double check.

If you’re maxing out your employer’s contribution limit but you still worry that it’s not enough to help you reach your retirement goals, you can also contribute your post-tax income to a Roth IRA account.

A Roth IRA is another type of retirement account but with slightly different rules s which differ from a Roth IRA). You must open the account on your own is). And instead of contributing pre-tax dollars that you’re taxed on when you make withdrawals in retirement, you contribute after-tax dollars and won’t pay taxes on withdrawals later on.

Also, the contribution limits for an IRA are different from that of a 401 you can contribute up to $6,000 per year to a Roth IRA if you’re under age 50, and $7,000 per year if you’re age 50 or older.

Also Check: Is It Better To Contribute To 401k Or Roth 401k

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

How Does Employer 401 Matching Work

An employer 401 contribution match is one of the best perks going. An employer match is literally free money and with our good friend compound returns coming in clutch, it can make a serious difference in how much money youll have when you retire. Its kind of like being given magic beans without having to sell the cow.

Even better: This is no fairy tale. In fact, employer matches are pretty common. More than three-quarters of employers with fewer than 1,000 401 plan participants offer a match and that percentage only goes up the bigger the company and the plan.

If your employer offers a 401 match, heres what you need to know.

Recommended Reading: How To Transfer 401k To Another Job

The Contribution Limit For 2022

Pretty much all retirement accounts ‘s, IRA’s, 403’s, etc.) have specific contribution limits that change almost every year due to cost of living adjustments. A lower contribution limit can feel like there’s a little less leg work to be done to max out the account.

According to the IRS, you can contribute up to $20,500 to your 401 for 2022. By comparison, the contribution limit for 2021 was $19,500. This number only accounts for the amount you defer from your paycheck your employer matching contributions don’t count toward this limit.

Some companies provide a dollar-for-dollar match on your 401 contributions, up to a certain percentage of your total salary, usually between 3% and 7% . So let’s say you contribute 7% of every paycheck to your 401, which works out to be $200 per paycheck. If your company matches your contributions dollar-for-dollar up to 7%, that means your employer is giving you an additional $200 per paycheck into your 401. If you get paid twice per month, that works out to be a total 401 contribution of $800 per month, or $9,600 per year.

In this scenario, you can still contribute beyond 7% of your paycheck, but anything beyond 7% will not be matched by your employer. You’ll need to double check with your HR department if you aren’t sure how much of a match your company provides.

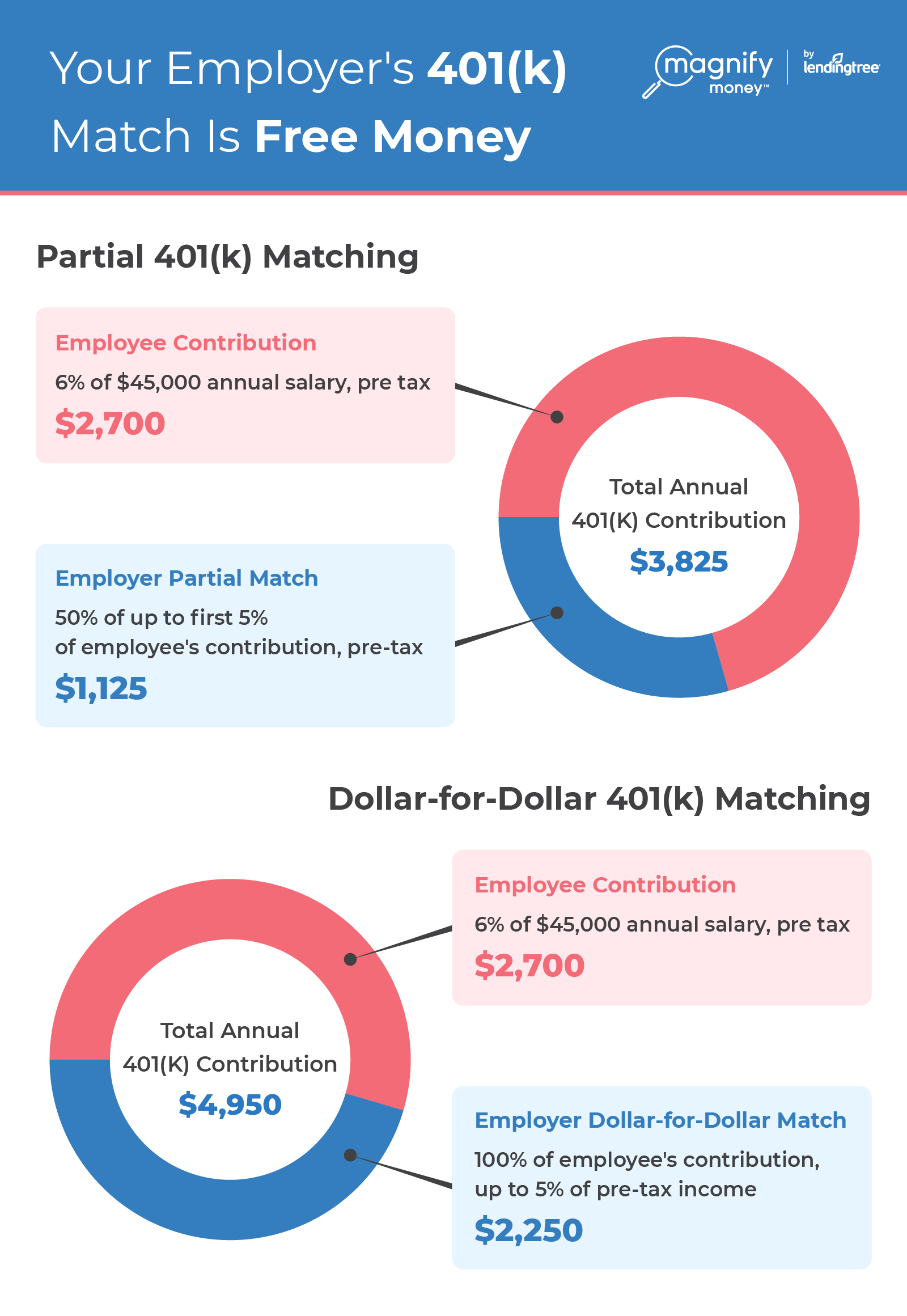

What Is A Partial 401 Match

With a partial 401 match, an employers contribution is a fraction of an employees contribution, and the employers total contribution is capped as a percentage of the employees salary. According to Jean Young, a senior research associate with Vanguard Investment Strategy Group, partial matching is the most commonly used matching formula in Vanguard 401 plans.

Matching structures vary by plan, said Young. In fact, we keep records on over 150 unique match formulas. But the most commonly offered match is $0.50 on the dollar, on the first 6% of pay. About one in five Vanguard plans provided this exact matching formula in 2018.

Lets say you earn $40,000 per year and contribute $2,400 to your 4016% of your salary. If your employer offers to match $0.50 of each dollar you contribute up to 6% of your pay, they would add $1,200 each year to your 401 account, boosting your total annual contributions to $3,600.

Recommended Reading: Why Is Roth Ira Better Than 401k

What Happens If I Exceed My 401 Limit By Mistake

If you contribute too much to your 401 and notice your mistake before the tax filing deadline, you can probably correct it with your employer. Youll need to notify your plan administrator. Theyll return the excess money to you, and youll get a new W-2 and pay taxes on your new total taxable wages.

If you dont catch the mistake before tax day, you may have to pay taxes twice on the amount you contributed over the limit. Thats because the excess contribution cant be deducted from your taxes in the year it was made, and because the IRS will still count that money as taxable when its distributed too.

About the author:Arielle O’Shea is a NerdWallet authority on retirement and investing, with appearances on the “Today” Show, “NBC Nightly News” and other national media. Read more

What Is Your Employer Match

The exact match amount varies from employer to employer, so you will need to ask human resources or your boss about the plan details to be sure your contributions meet the level of the maximum employer match.

Generally speaking, the average matching contribution is 4.3% of an employees pay. Nearly three-quarters of employers prefer to match 50 cents on the dollar, up to 6% of employee pay. About one-quarter of employers elect to match dollar-to-dollar, up to a maximum of 3% employee pay.

You want to be sure youre contributing at least enough to earn all of the matching dollars your employer offers. After all, this is FREE money.

Read Also: How Do I Find Out My 401k Balance

Effect Of 401 Contribution Limits On Income Tax

Contributions to the 401 retirement plan are deducted from gross income before taxation. This means that the payroll deferrals to the 401 account are not taxed until after retirement. The tax will be applied when employees withdraw their earnings after retirement, when they are likely in a lower tax bracket than they were during employment.

However, the contribution limits prevent high-salaried employees and employers from minimizing their tax burden by contributing a large proportion of their earnings to the 401 retirement plan.

Engage Employees And Encourage Them To Save With A 401 Match This Year

The employer match is an excellent incentive tool to encourage employees to participate in your small business 401 plan. Matching not only helps employees create better financial security, but allows you and higher-paid executives the opportunity to max out your retirement savings as well.

Ubiquity is a leading provider of 401 plans geared specifically to small businesses. We are happy to help you set up an easy and affordable small business retirement plan with matching and educate your workforce so they understand what a great and valuable benefit youre offering. Contact us to learn more.

Recommended Reading: What Will My 401k Be Worth

What Is The Best Possible 401 Employer Match

Employers rarely match 100% of employee contributions. Even if they do, there is a limit mandated by the IRS. For 2020, employees can contribute up to $19,500 to their 401 accounts. Employers can contribute up to $37,500 to reach a combined employee/employer total of $57,000. Employees over 50 can add $6,500 in catch-up contributions as well. So that would represent the best possible match an extra $37,500 put toward your retirement.

Compensation Limit For Contributions

Remember that annual contributions to all of your accounts maintained by one employer – this includes elective deferrals, employee contributions, employer matching and discretionary contributions and allocations of forfeitures, to your accounts, but not including catch-up contributions – may not exceed the lesser of 100% of your compensation or $61,000 for 2022 . This limit increases to $67,500 for 2022 $64,500 for 2021 $63,500 for 2020 if you include catch-up contributions. In addition, the amount of your compensation that can be taken into account when determining employer and employee contributions is limited to $305,000 for 2022 $290,000 in 2021 .

Don’t Miss: Can You Rollover Your 401k Into A Roth Ira