Fidelity Institutional Asset Management Verify Your Identity

https://fps.fidelity.com/ftgw/Fps/Fidelity/FIISCust/ResetPIN/Init

Fidelity Institutional Asset Management. FIDELITY INSTITUTIONAL ASSET MANAGEMENT ® This is a secure transaction. Verify Your Identity. Let’s confirm some basic information about your account. Username. Submit. Cancel. Verify Your Identity. Let’s confirm some basic information about your account. ZIP Code. Submit. Cancel.

Status: Online

Paul Mccartney Marketing Campaign

Fidelity has experimented with marketing techniques directed to the baby boomer demographic, releasing Never Stop Doing What You Love, a compilation of songs by Paul McCartney. McCartney became the firm’s spokesman in 2005 in a campaign entitled “This Is Paul”. On the day of the disc’s release, company employees were treated to a special recorded message by Paul himself informing them that “Fidelity and have a lot in common” and urging them to “never stop doing what you love”.

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

Recommended Reading: How Much Can I Take From 401k For Home Purchase

Recommended Reading: Who Is Eligible For Solo 401k

You Are Viewing This Page As An Investor

Advisors, switch views to see more relevant content.

TFSA basics

Regardless of what youre saving for, a TFSA is a great way to reach any financial goal.

RRSPs 101

You can reduce tax on your current income when you save for the future. Here are six RRSP tips.

For you and your goals

Over 1.5 million

To business leaders around the world

Over 25,000

Commissions, fees and expenses may be associated with investment funds. Read a funds prospectus or offering memorandum and speak to an advisor before investing. Funds are not guaranteed, their values change frequently and investors may experience a gain or loss. Past performance may not be repeated.

Read our privacy policy. By using or logging in to this website, you consent to the use of cookies as described in our privacy policy.

This site is for persons in Canada only. Mutual funds and ETFs sponsored by Fidelity Investments Canada ULC are only qualified for sale in the provinces and territories of Canada.

88747-v202076

You can use the search box above to compare up to 4 additional funds.

Please contact Fidelity Client Relations for assistance.

How Long Do I Have To Deposit The Check

You should deposit the check you get right away. Even if the check is made out to your IRA provider , you should try to do it within 60 days of receiving it.

Get a prepaid envelope sent directly to your door with a tracking number! Start a rollover with Capitalize and well send you a prepaid priority mail envelope with detailed instructions to make sure your rollover is transferred successfully. Get started

Don’t Miss: Why Is A 401k Good

Rolling Over Into An Ira

Well handle the entire process for you online, for free!

- Well help you choose an IRA provider if you dont already have one

- Customer support available if you have questions along the way

- We get paid by the IRA provider if you open an account so our service comes at no cost to you!

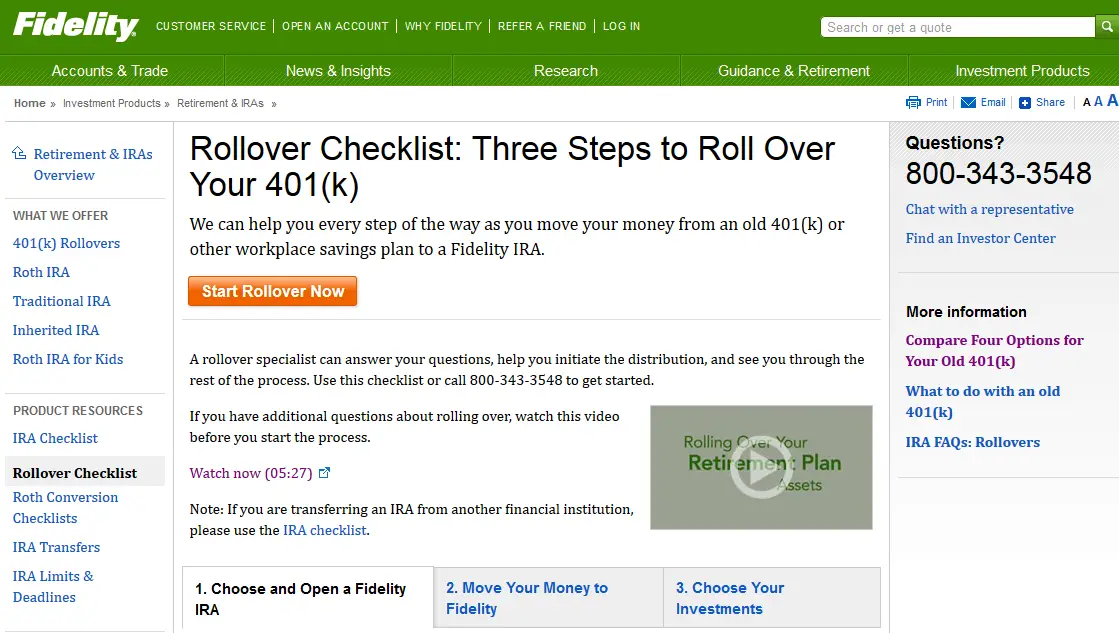

Weve laid out a step-by-step guide to help you roll over your old Fidelity 401 in five key steps:

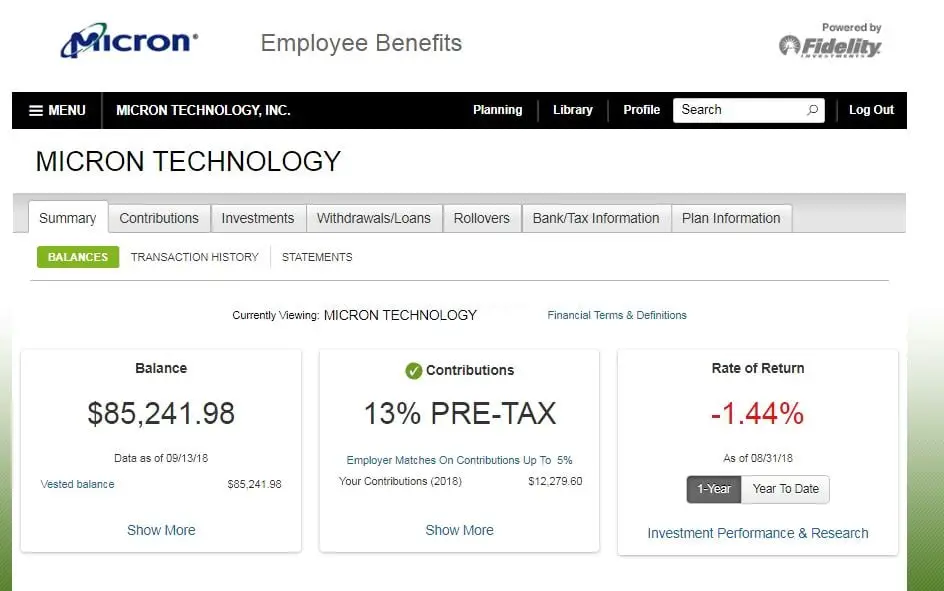

What Are Average Fidelity 401 Fees

We have evaluated the fees of a few Fidelity plans over the years as part of our 401 fee comparison service. Below are the averages we found for these plans.

|

Average Fidelity 401 Fees |

|

|

All-In Fees |

0.71% |

While their per-capita admin fee was below the $422.30 average in our 2018 401 fee study, that number can easily grow much higher due to the way these fees are charged.

In our experience, about 70% of admin fees charged by Fidelity are paid by revenue sharing hidden 401 fees that lower the investment returns of plan participants. Not only are plan sponsors or participants often unaware that theyre paying them, but theyre always charged as a percentage of plan assets. That means plan participants will automatically pay Fidelity higher and higher administration fees for the same level of service as their account grows. Thats not fair!

When you factor in compound interest, these growing fees can make a huge dent in your retirement savings. As such, you want to do everything in your power to avoid paying them.

If youre currently using Fidelity for your 401, your first step to avoiding these fees is to find out whether or not youre paying them. Well show you how to do that next.

Dont Miss: How Much Can You Contribute 401k

Don’t Miss: How Do I Get A 401k Plan

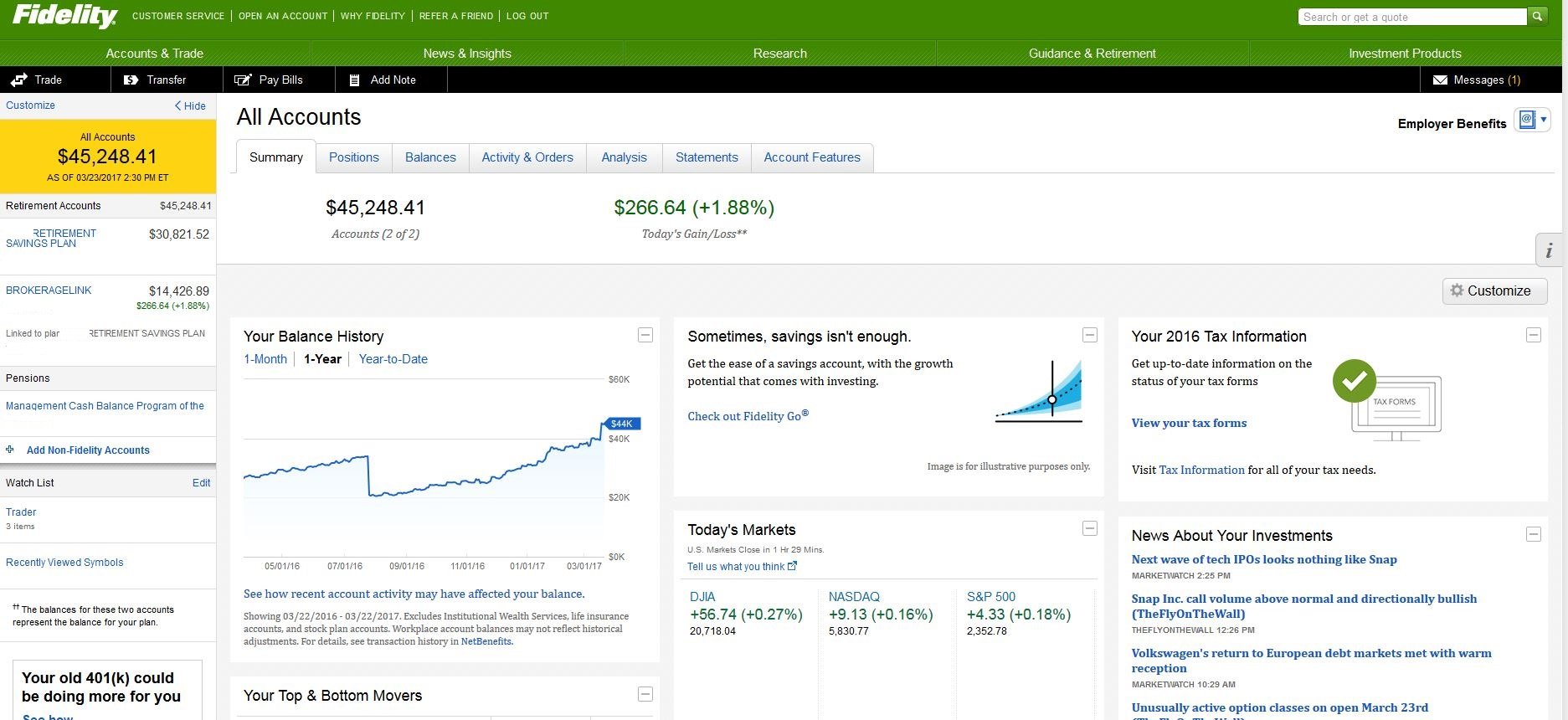

Timing Of The Brokerage Account Setup

After submitting the Fidelity brokerage forms to Fidelity Investments, between 5-7 business days , you should receive an email from Fidelity Investments that their system has updated your email address. This indicates the application is in processing.

When you start receiving emails from Fidelity, you can check if the account has been fully setup without having to wait on the Fidelity Welcome Letter in the mail which includes your new account number. Please try to log in using one of the following methods:

- If you have an existing Fidelity login , you should see the new Non-Prototype account appear under your portfolio with an account number that starts with the letter Z.

- If you do not have an existing Fidelity login, you can try to register to Fidelity.com at the following link: You will need to create a username and password.

The Workplace Investing Service Centre Offers These Services:

- Account balance

- Find information on your investment options

- Fund prices

- Past investment performance

- Provide fund investment objectives

- Provide literature such as factsheets and further detail on the investment options available in your Plan

Our complaints procedureFidelity’s representatives have a thorough understanding of the Rules of your Plan and are there to help resolve any queries you may have.

We take all complaints extremely seriously and do our best to resolve them satisfactorily and as quickly as we can. Find out how we handle complaints.

Also Check: What Type Of Plan Is A 401k

Username & Password Help Fidelity Investor

https://fidelityinvestor.investorplace.com/fidelity-investor/customer-service/username-password/

How do I create a personalized Username & Password? My Username or Password isnt working. I forgot my Username and/or Password. How do I change my personalized Username and/or Password? If I already have a working personalized Username & Password from another InvestorPlace.com subscription, do I need to create a new one for Fidelity Investor?

Status: Online

Climate Change And Sea Level Rise

The City of Boston has developed a climate action plan covering carbon reduction in buildings, transportation, and energy use. Mayor Thomas Menino commissioned the city’s first Climate Action Plan in 2007, with an update released in 2011. Since then, Mayor has built upon these plans with further updates released in 2014 and 2019. As a coastal city built largely on , is of major concern to the city government. The latest version of the climate action plan anticipates between two and seven feet of sea-level rise in Boston by the end of the century. A separate initiative, Resilient Boston Harbor, lays out neighborhood-specific recommendations for coastal resilience.

Boston has teams in plus , and, as of , has won 39 championships in these leagues. It is one of eight cities to have won championships in all four major American sports leagues. It has been suggested that Boston is the new “TitleTown, USA”, as the city’s professional sports teams have won twelve championships since 2001: Patriots , Red Sox , Celtics , and Bruins . This love of sports made Boston the ‘s choice to to hold the , but the city cited financial concerns when it withdrew its bid on July 27, 2015.

Boston has teams as well, such as the ‘s . Established in 2017, they were the first team to complete a perfect stage with 0 losses.

Also Check: What Are The Advantages Of A 401k

Peak Cold War Years And Civil Rights

After World War II, the United States and the competed for power, influence, and prestige during what became known as the , driven by an ideological divide between and . They dominated the military affairs of Europe, with the U.S. and its allies on one side and the Soviet Union and its allies on the other. The U.S. developed a policy of towards the expansion of communist influence. While the U.S. and Soviet Union engaged in and developed powerful nuclear arsenals, the two countries avoided direct military conflict.

The United States often opposed movements that it viewed as Soviet-sponsored and occasionally pursued direct action for against left-wing governments, occasionally supporting authoritarian right-wing regimes. American troops fought communist and forces in the of 19501953. The Soviet Union’s 1957 launch of the and its 1961 launch of the initiated a “” in which the United States became the first nation to in 1969. The United States became increasingly involved in the , introducing combat forces in 1965.

What Type Of Ira Should I Open

During the process of opening your new account, you may get asked which type of IRA youd like to open. You might see the following options: Rollover IRA, Traditional IRA, or Roth IRA. Heres how to pick the right one:

- If you had a Traditional 401 pick a Rollover IRA or, if thats not available, Traditional IRA or, if thats not available, just IRA. The only exception would be if youre considering a Roth conversion, but this is an advanced tax planning strategy that most people dont need to worry about.

- If you had a Roth 401 pick a Roth IRA. Youll need to match the Roth 401 to a Roth IRA for tax reasons.

- If your 401 has mixed assets youll need to open two IRAs, one Roth and one Traditional to for their respective assets.

Read Also: How To Move 401k From One Company To Another

How Many Lost 401ks And Other Retirement Accounts Are Forgotten

Think lost and forgotten retirement accounts amount to chump change? Although no one keeps data on how much retirement money gets lost or forgotten, in an interview with Bloomberg, Terry Dunne of Millennium Trust Co., made an educated guess based on government and industry data that more than 900,000 workers lose track of 401k-style, defined-contribution plans each year.

That figure doesnt include pensions. According to the Pension Benefit Guaranty Corporation, an independent agency of the U.S. government tasked with protecting pension benefits in private-sector defined benefit plans, there are more than 38,000 people in the U.S. who havent claimed pension benefits they are owed. Those unclaimed pensions total over $300 million dollars, with one individual being owed almost $1 million dollars!

Could that money belong to you?

Compare Fidelity Financial Services To

Companies are selected automatically by the algorithm. A company’s rating is calculated using a mathematical algorithm that evaluates the information in your profile. The algorithm parameters are: user’s rating, number of resolved issues, number of company’s responses etc. The algorithm is subject to change in future.

Read Also: Where To Put 401k After Retirement

How Does Fidelity Make Money With No Fees

Fidelitymake moneyfundsfeefundfundHere’s how to avoid 401 fees and penalties:

Fidelity Investments’s Best Toll

This is Fidelity Investments’s best phone number, the real-time current wait on hold and tools for skipping right through those phone lines to get right to a Fidelity Investments agent. This phone number is Fidelity Investments’s Best Phone Number because 13,248 customers like you used this contact information over the last 18 months and gave us feedback. Common problems addressed by the customer care unit that answers calls to 800-544-6666 include Tax Documents, Account access, Speak to an agent, Hacked account and other customer service issues. Rather than trying to call Fidelity Investments first, consider describing your issue first from that we may be able to recommend an optimal way to contact them via phone or web. In total, Fidelity Investments has 3 phone numbers. It’s not always clear what is the best way to talk to Fidelity Investments representatives, so we started compiling this information built from suggestions from the customer community. Please keep sharing your experiences so we can continue to improve this free resource.

Read Also: How Can I Save For Retirement Without 401k

Log In To Fidelity Netbenefits

https://login.fidelity.com/ftgw/Fidelity/NBPart/Login/Init

If you use your SSN to log in, please create a personalized username for added security. Use the Need Help links to the right to change your login information. For outside the U.S. employees, your Participant Number is your Username and if you created a PIN previously, it is now considered your Password.

Status: Online

Contact The Workplace Investing Service Centre:

Phone

In the UK: 0800 3 68 68 68 Outside the UK: 1737 838 585. Lines are open Monday to Friday, 8am to 6pm .

Please be aware that we’re unable to discuss account information by email. We aim to respond to emails within 2 working day.

Should you wish to discuss account specific information please have your telephone PIN or password to hand when calling.

You May Like: Can I Open A Roth 401k On My Own

What Is Fidelity 401k

3.9/5

Simply so, what is a 401k plan and how does it work?

A 401k is a qualified retirement plan that allows eligible employees of a company to save and invest for their own retirement on a tax deferred basis. Only an employer is allowed to sponsor a 401k for their employees.

Beside above, does fidelity have a 401k? Fidelity’s 401 plans for small businesses through Fidelity Workplace Services can help you offer competitive benefits to your employees.

One may also ask, what are Fidelity 401k Fees?

For instance, Fidelity Investments is America’s biggest provider of 401s. A typical advisory fee for a Fidelity portfolio account starts at 1.7% and decreases from there by as much as half, depending on how much you put in.

How do I withdraw money from my Fidelity 401k?

Your 401k is your money, and making a withdrawal is as simple as contacting Fidelity to let them know you want it. The easiest way is to simply visit Fidelity’s website and request a check there. However, you can also reach out via phone if you prefer: Call 800-343-3543 with any questions about the process.

Dol Gravely Concerned About Fidelity 401k Bitcoin Announcement

The Department of Labor responded quickly to Fidelity Investments announcement on April 26 that it would offer participants the ability to allocate a portion of their retirement investment to bitcoin.

We are not talking about millionaires and billionaires that have a ton of other assets to draw down.

Acting EBS Assistant Secretary Ali Khawar

We have grave concerns with what Fidelity has done, Ali Khawar, acting assistant secretary of the Employee Benefits Security Administration , told The Wall Street Journal soon after the news broke.

He added there is a lot of hype around You have to get in now because you will be left behind otherwiseFor the average American, the need for retirement savings in their old age is significant. We are not talking about millionaires and billionaires that have a ton of other assets to draw down.

Khawar indicated he and the EBSA staff would speak with Fidelity about the departments concerns, many of which were highlighted in the DOLs compliance assistance guidance for 401k plan fiduciaries considering plan investments in cryptocurrencies.

The Labor Department said it was worried about the prudence of a fiduciarys decision to expose a 401k plans participants to direct investments in cryptocurrencies, or other products whose value is tied to cryptocurrencies.

According to a recent Fidelity digital assets study, 30% of U.S. institutional investors surveyed would prefer to buy an investment product containing digital assets.

Read Also: How Much Can Be Put Into A 401k Per Year

Revolution And The Siege Of Boston

The weather continuing boisterous the next day and night, giving the enemy time to improve their works, to bring up their cannon, and to put themselves in such a state of defence, that I could promise myself little success in attacking them under all the disadvantages I had to encounter.

,in a letter to , about the British army’s decision to leave Boston, dated March 21, 1776.

Many of the crucial events of the occurred in or near Boston. Boston’s penchant for mob action along with the colonists’ growing lack of faith in either or fostered a revolutionary spirit in the city. When the British parliament passed the in 1765, a Boston mob ravaged the homes of , the official tasked with enforcing the Act, and , then the Lieutenant Governor of Massachusetts. The British sent two regiments to Boston in 1768 in an attempt to quell the angry colonists. This did not sit well with the colonists. In 1770, during the , British troops shot into a crowd that had started to violently harass them. The colonists compelled the British to withdraw their troops. The event was widely publicized and fueled a revolutionary movement in America.