Adopt A Safe Harbor 401 Plan

If you adopt a Safe Harbor 401 plan, it will be deemed to pass these nondiscrimination tests, meaning the owner and other HCEs can contribute any amount up to the annual salary contribution limit, plus catch-up contributions if eligible, without worrying about the contribution rate of lower paid employees. Offering a Safe Harbor 401 plan may also help improve participation and savings rates for all employees.

Saving In A Personal Annuity

If you want an additional way to save for retirement outside of your employer plan, consider a personal annuityOpens dialog. A personal annuity, also called an after-tax annuity, can help you build additional retirement savings. It offers options that can provide a steady stream of income when you retire.4

Highlights Of Changes For 2020

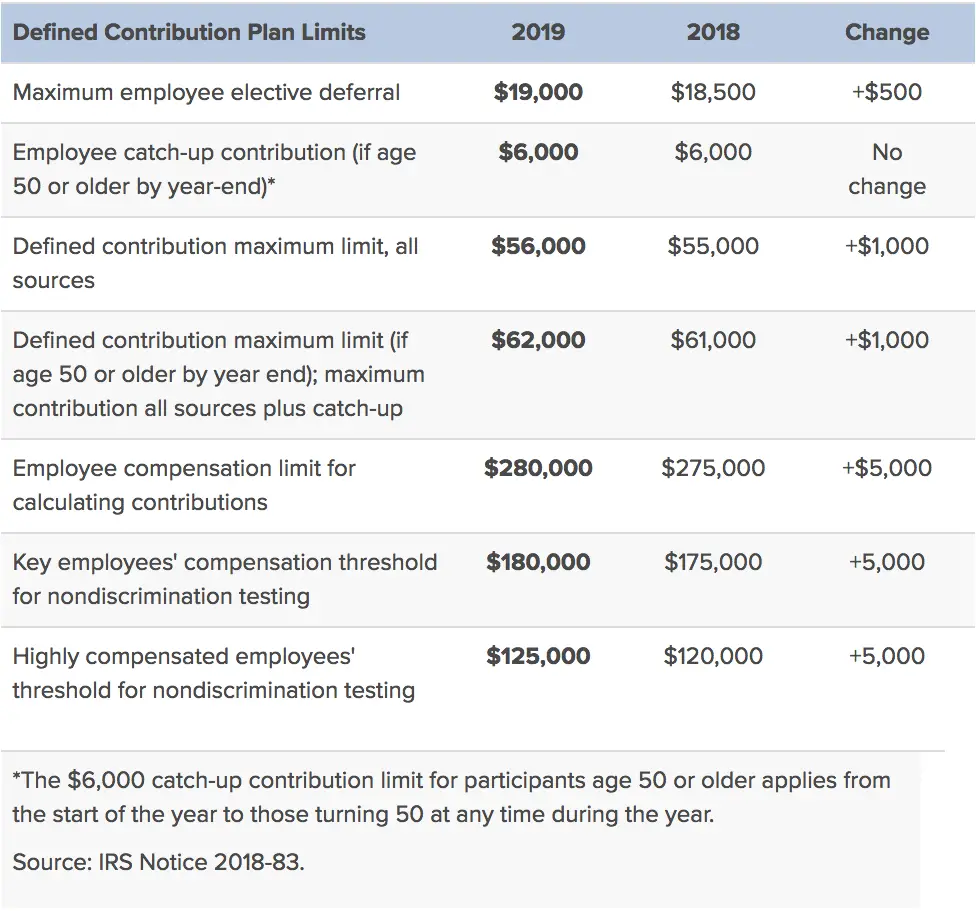

The contribution limit for employees who participate in 401, 403, most 457 plans, and the federal government’s Thrift Savings Plan is increased from $19,000 to $19,500.

The catch-up contribution limit for employees aged 50 and over who participate in these plans is increased from $6,000 to $6,500.

The limitation regarding SIMPLE retirement accounts for 2020 is increased to $13,500, up from $13,000 for 2019.

The income ranges for determining eligibility to make deductible contributions to traditional Individual Retirement Arrangements , to contribute to Roth IRAs and to claim the Saver’s Credit all increased for 2020.

Taxpayers can deduct contributions to a traditional IRA if they meet certain conditions. If during the year either the taxpayer or his or her spouse was covered by a retirement plan at work, the deduction may be reduced, or phased out, until it is eliminated, depending on filing status and income. Here are the phase-out ranges for 2020:

Also Check: Can You Borrow From Your 401k Twice

Solo 401 Establishment Deadline:

For 2021, in order to make employee contributions for 2021, the self-employed business owner had to establish the solo 401k plan by December 31, 2021. However, if the plan was established on January 1, 2022 or after by your business tax return due date including the business tax return extension, then you cam make employer profit sharing contributions for 2021 but cannot make employee contributions. For example, an employer operating the plan on a calendar-year basis had to complete the solo 401k plan documentation no later than .

For makin 2021 solo 401k plan contributions, the solo 401k has to be adopted by December 31, 2021 for self-employed businesses operating the plan on a calendar-year basis in order to preserve the right to make both employee and employer contributions in 2022 for 2021 by the business tax return including business tax return extensions. Otherwise, if the solo 401k plan is adopted on January 1, 2022 or after but by your business tax return due date including extensions, you will only be allowed to make employer contributions not employee contributions to the solo 401k plan. To learn more about the December 31, 2021 plan adoption/establishment deadline VISIT HERE.

Traditional 401s Vs Roth 401s

A 401 works best for someone who anticipates being in a lower income tax bracket in retirement compared with the one they’re in now. For example, someone currently in the 32% or 35% tax bracket may be able to retire in the 24% bracket.

Employers have been increasing tax diversification in their retirement plans by adding Roth 401s. These accounts combine features of Roth IRAs and 401s. Contributions go into a Roth 401 after you have paid taxes on the money. You can withdraw contributions and earnings tax- and penalty-free if you’re at least age 59 1/2 and have owned the account for five years or more. You’ll also be required to take minimum distributions from a Roth 401 once you turn age 72. However, you might be able to avoid RMDs if you can move the money from a Roth 401 into a Roth IRA, which has no required minimum distributions.

and a Roth 401, the total amount of money you can contribute to both accounts can’t exceed the annual limit for your age, either $20,500 or $27,000 for 2022. If you do exceed it, the IRS might hit you with a 6% excessive-contribution penalty.)

Recommended Reading: How To Cash Out 401k Without Penalty

Roth 401 Vs Traditional 401

Although the contribution limits are the same for traditional 401 plans and their Roth counterparts, a designated Roth 401 account is technically a separate account within your traditional 401 that allows for the contribution of after-tax dollars. The elected amount is deducted from your paycheck after income, Social Security, and other applicable taxes are assessed. The contribution doesn’t garner you a tax break in the year you make it.

The big advantage of a Roth 401 is that no income tax is due on these funds or their earnings when they’re withdrawn after you retire. A traditional 401 works in the opposite way. That is, savers make their contributions on a pretax basis and pay income tax on the amounts withdrawn when they retire. Neither of these 401 accounts imposes income limitations for participation.

When available, savers may use a combination of the Roth 401 and the traditional 401 to plan for retirement. Splitting your retirement contributions between both kinds of 401s, if you have the option, can help you ease your tax burden in retirement.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

You May Like: What To Roll 401k Into

Benefits Of Contributing To Your 401 Plan

401 account contributions provide a double tax advantage for taxpayers. Individuals are able to direct pre-tax funds from their paycheck into their 401, reducing the amount of their income subject to income taxes the following year. In addition, any earnings from 401 account contributions are also tax-exempt.

Individuals will need to pay income taxes on funds taken out of 401 accounts during retirement. However, many find their income is lower during retirement than it was while working, placing them in a lower tax bracket.

About The Authortrue Tamplin Bsc Cepf

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance , author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website, view his author profile on , or check out his speaker profile on the CFA Institute website.

Don’t Miss: Should I Roll Over 401k From Previous Employer

Common 401 Management Errors To Avoid

Cashing Out Too Soon

The worst thing you can do with an existing IRA is to withdraw funds before retirement. This is the final option for these savings, as they are difficult to replace later in your career. At all costs, you should avoid taking this path.

Investing Too Little to Get Maximum Matching Funds

The IRS has some of the most stringent requirements in terms of what you must do to qualify for their matching funds, but many firms have far more stringent standards. One typical error is not saving enough money, which lowers or eliminates your employers contribution amount.

Before you sign on, double-check the firms withdrawal criteria. This policy should be clearly stated in your strategy if it is not, ask for clarification. If you have made a mistake and do not realize it, act swiftly to correct it.

Taking 401 Loans

In a difficult job climate, it can be nearly as bad to take loans on your 401 as simply cashing it out and reinvesting elsewhere. The restrictions on what you are allowed to withdraw funds for can be exacting. In addition to the amount of principal removed from your account, there is an interest rate that you will be responsible for paying back.

Investing Too Aggressively

The majority of 401 plan losses in 2008 were caused by aggressive investing. When several plans fell at the same time, some investors focused on unsecured debt or junk bonds, which made them fall even more.

Rolling Over Into IRA Savings

Provisions For Changing Jobs

Most 401 plans permit the employee who terminates employment the options of receiving the 401 balance in a lump sum or to receive periodic payments or to roll over the proceeds to an IRA or other employer-sponsored retirement plan. Additionally, some 401 plans permit the terminated employee to retain their 401 balance in their former employer’s plan. Amounts that are retained in a former employer’s 401 plan or transferred to another employer’s plan or IRA postpone the taxation until amounts are subsequently distributed from the plan or IRA the money was rolled into.

When receiving funds from a 401 with the intention to roll the amount to an IRA:

- The rollover must be completed in 60 days.

- Employers must withhold 20% of the proceeds as a withholding tax. It is up to the participant to make up this 20%, or it will be treated as a distribution. The money withheld will be used as a credit against any income tax liability.

- Neither the 60-day rule nor the 20% withholding apply to amounts directly transferred to an IRA or other qualified plan.

You May Like: How To Transfer 401k Balance To New Employer

Solo 401 Contribution Limits For 2022

With a Solo 401, small business owners can contribute as both employees and employers. Maximizing your Solo 401 can lead to substantial tax savings. As a Los Angeles financial planner, many of my highest-earning clients save 50 cents on the dollar for their 401 contributions . Would you rather write a check to the IRS or your financial future?

For 2022, the maximum contribution to a regular 401 is $20,500. As a business owner, you can potentially take that up to $61,000 . Thanks to the additional catch-up contributions, that number increases by $6,500 if you are 50 or older. This brings the total Solo 401 contribution limit for 2022 up to a whopping $67,500 for some business owners.

Issues With 401 Plans

Despite the fact that 401 plans have become the de facto standard of retirement savings in the United States, there are still issues with 401 plans that investors at all income and participation levels should be aware of. Many employees are carefully considering and deciding what to do with their retirement investments following a substantial decline in many plans value for the first time in many years.

Given that the expected rate of saving is anticipated to drop during a lengthy recession, performance of 401 accounts and fund managers capacity to be suitably defensive or reactive may be hampered by changing circumstances. Knowledge is a powerful weapon.

Transferring 401 Earnings

It can be challenging to move your 401 plan to a new employer. Along with the complicated tax paperwork that needs to be organized and filed you will also have to coordinate actions with your former employers.

When changing jobs, it is always advisable to consider the financial situation and your options to see if your money would be better off staying where it is. Naturally, doing all of this requires time and effort from a lot of people who are not used to investing either in speculative financial matters. That is the main reason why so many people have their investments managed by professionals.

Hidden Costs

401 management fees have risen steadily since the early 2000s, as have several of the unpleasant problems with account transparency.

Common Transparency Issues

You May Like: How To Roll Ira Into 401k

Does Employer 401k Match Count Towards The Annual Limit

Do you want to take advantage of a max contribution to a 401k? Do you know if your employers 401k match counts towards the maximum limit? The answer is yes, but does it count as a contribution from the individual, or does it count as an employer contribution? These two factors can make a huge difference.

What Is A Good 401 Contribution

Your ideal 401 contribution depends on several factors. If your employer offers a match, your first priority should be to contribute enough to get the full match. From there, you may want to max out a tax-free retirement account such as a Roth IRA before you finish maxing out your 401. If you’re able to do all three of these, it can help you get the most out of your investments.

Don’t Miss: How Much Will My 401k Pay Me Per Month

Reading And Understanding The Summary Annual Report

The first thing you should do is discover exactly what is going on. You should have statements and contracts relating to the agreements you signed, as well as prior-year tax returns. To figure out where your money is going, use a computer program or a pen and paper.

As of 2009, the amount of information on your 401 report summary will be greater, including a more detailed account of the costs you pay to maintain it. Inquire about any line items that are unclear and double-check with your own research.

Request for Updated Materials

You may occasionally wait months for your fund reports to arrive. Even if you are charged an additional fee to receive a new statement, you are entitled to one. To make an informed decision about whether your fund sub-components are suitable candidates for weathering a bear market, you will need up-to-date information on your funds performance and diversification.

Investment funds can change rapidly, especially in a volatile market. Be sure your reports include historical data and some sort of standard to compare performance against that makes sense. This will help you understand how the fund is performing over time and make more informed decisions about investing.

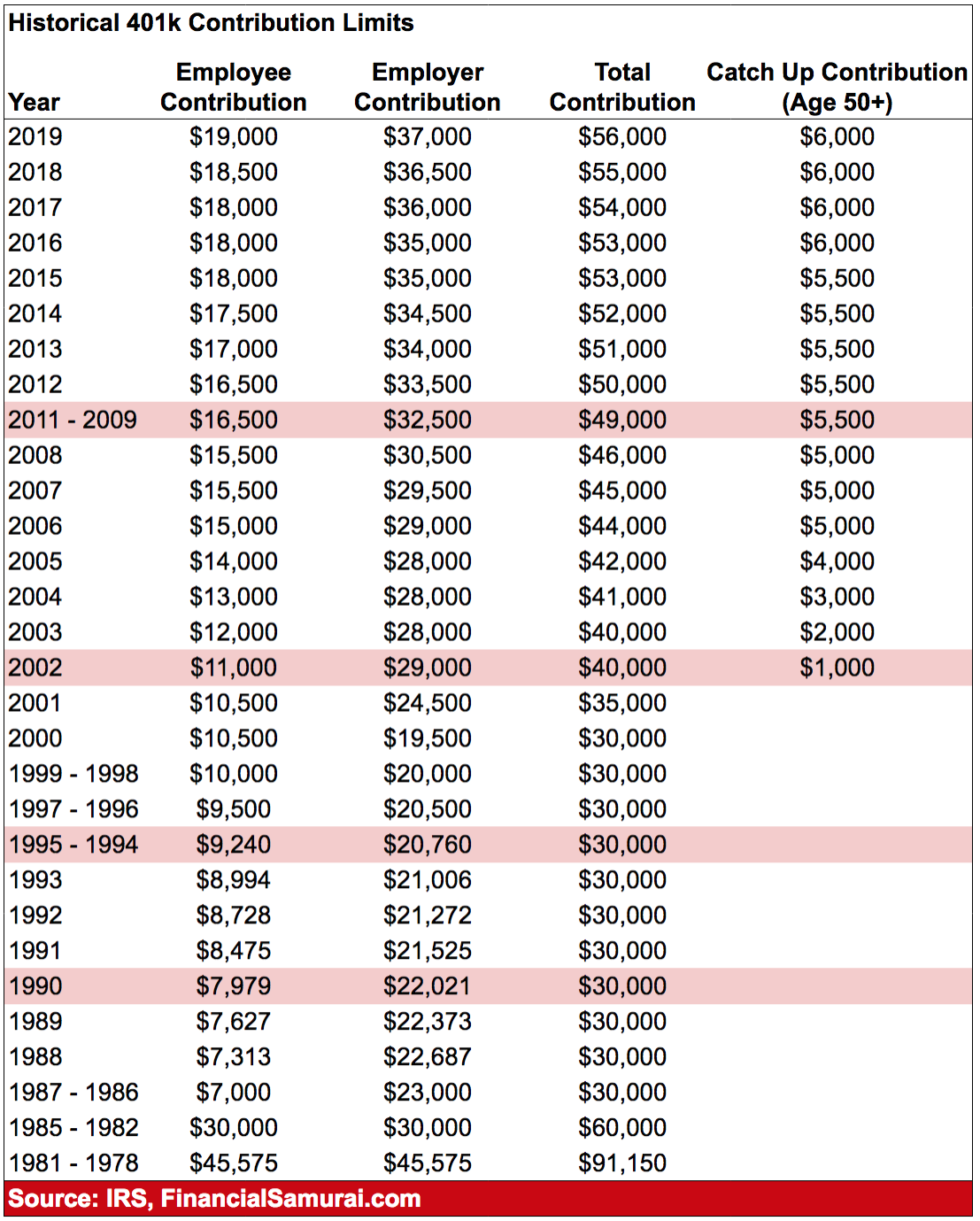

Historical Performance Analysis

Irs Announces 401 Limit Increases To $20500

IR-2021-216, November 4, 2021

WASHINGTON The Internal Revenue Service announced today that the amount individuals can contribute to their 401 plans in 2022 has increased to $20,500, up from $19,500 for 2021 and 2020. The IRS today also issued technical guidance regarding all of the costofliving adjustments affecting dollar limitations for pension plans and other retirement-related items for tax year 2022 in Notice 2021-61PDF, posted today on IRS.gov.

Read Also: Can I Transfer Part Of My 401k To An Ira

Total Annual 401 Contribution Limit For 2022

Employers 401 contributions do not count toward employees contribution limits.

Instead, employers contributions are capped by the total contribution limit. This is the sum of their contributions and that of their employees.

There have also been changes in the total annual 401 contribution limit since 2021. The following are the changes:

The information presented above only covers the traditional 401 and Roth 401 plans.

For SIMPLE 401 plans, the total annual contribution limit varies per company. This is because employers can either make a matching contribution of up to 3% of the income of the employees or make a non-elective contribution of up to 2% of the employees income.

Regardless of the plan type, the total annual contribution limit must not exceed 100% of employees annual compensation.

Traditional Vs Roth 401k Contribution Limits

Some employers offer both a traditional 401k and a Roth 401k, but whats the difference between each? Lets walk through the differences between both account types so you can decide which type works best for your needs.

- Roth 401k: A Roth 401k refers to an employer-sponsored savings plan that gives you in which you can invest after-tax dollars for retirement. The perk to investing in a Roth 401k: You pay taxes on your money ahead of time, which means that you wont pay any taxes on your contributions after you take withdrawals after you reach age 59 ½ as long as the account has been funded for at least five years. All of your accumulated contributions and earnings come out tax free.

- Traditional 401k: A traditional 401k refers to an employer-sponsored plan that gives you the option to defer paying income tax on the amount you contribute for retirement. For example, lets say you earn $50,000 and max out your retirement plan at $19,500. Assuming you have no other deductions, your taxable earnings will reduce from $50,000 to $30,500. .

Wondering whether you should invest in both? You might want to take a tax-diversified approach because it could allow you to invest in many types of assets and allow you to diversify your savings. You can contribute to both a Roth and a traditional 401k plan as long as your total contribution doesnt go over $19,500 in 2021 and $20,500 in 2022.

Don’t Miss: Should I Rollover 401k To New Employer

How Much Should I Be Saving In My 401k In 2022

Theres not a universal standard for how much you should invest in your 401k each year, or even how much you should have saved by the time you retire. The answer for you, ultimately depends on your cost of living, career, and what age you want to retire.

Use our retirement savings calculator to check your progress.

However, there are some guidelines for how much you should have in your 401k that can help you figure out if youre on the right track toward enjoying your golden years.

- youve had a little time to figure out your career path and hopefully youve been able to save up some money in your 401k, too. At this stage, you should aim to have about a years salary saved in your planso if you make $50,000 per year, youd ideally want to have about $50,000 saved up for retirement.

- youve likely seen some advancement in your career, and your annual income may have seen a boost as well. By age 40 you might strive for about three years worth of salary saved in your 401k.

- youre inching closer and closer toward enjoying your retirement. At this stage, you should consider having about five years worth of salary saved.

What were saying is: dont panic if you havent saved as much as you planned onor if you havent saved anything at all. Its never too late to change your habits and improve your financial health.