The Case For Not Cashing Out A 401 Early

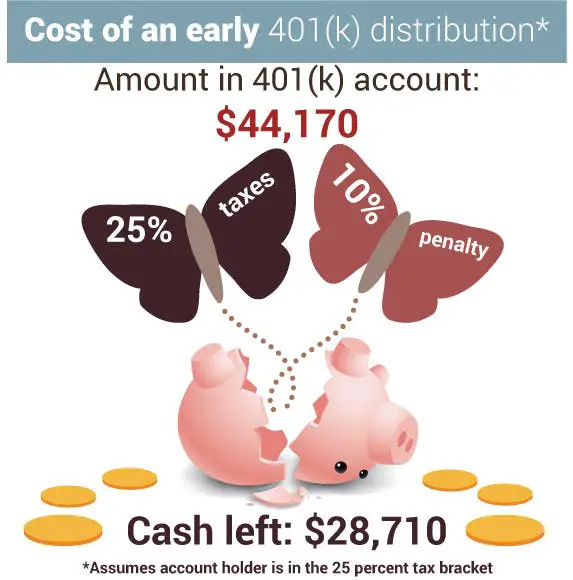

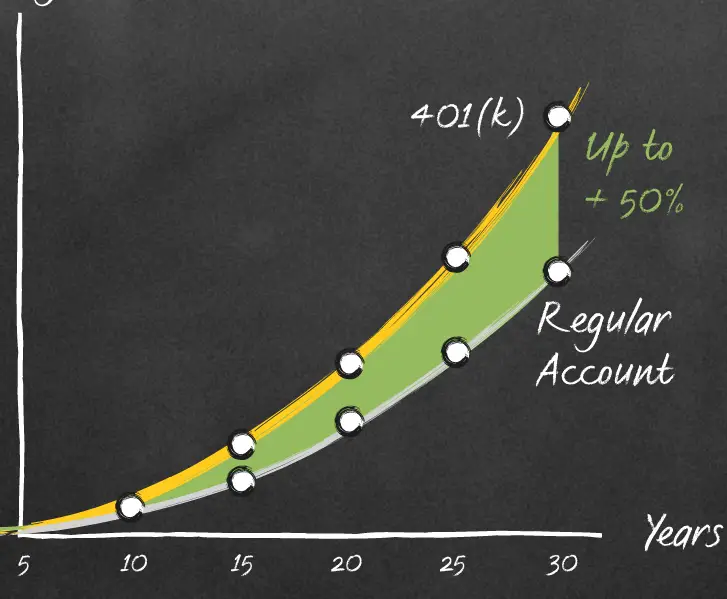

Keep in mind compound interest only works if you leave the money sitting. When you cash your retirement checks early, youre not only subtracting that sum from your future retirement, but youre also negating potential interest accrued over the years and losing almost 30 percent of your balance to taxes and fees.

It may be tempting to view your 401 as your own personal bank account, but it can be so much more if you have the willpower to let your money work harder for you.

Are you considering taking money out of your 401? Try our 401 calculator to see if this option is right for you.

How Do I Receive Money From Moneygram To My Bank Account

MoneyGram allows you to send money directly to a bank account or mobile wallet in select countries. To find out if you can send money to your receivers bank account or mobile wallet, start sending money or estimate fees from the homepage, and select Direct to Bank Account or Account Deposit as your receive option.

You May Like: How Do You Withdraw From 401k

Your Retirement Money Is Safe From Creditors

Did you know that money saved in a retirement account is safe from creditors? If you are sued by debt collectors or declare bankruptcy, your 401k and IRAs cannot be liquidated by creditors to satisfy bills you owe. If youre having problems managing your debt, its better to seek alternatives other than an early withdrawal, which will also come with a high penalty.

You May Like: Can You Move 401k To Ira While Still Working

Early Withdrawal Penalties Dont Always Apply

The 10% penalty doesnt apply on an early distribution if:

- The participant has died and their beneficiary is collecting the balance

- The participant has a significant disability

- The person is separated from service during or after the year that the participant turned 55 according to IRS Publication 575

- Is being made to a payee under a qualified domestic relations order sometimes called a QDRO

- The participant needs it for medical care

- The participant accidentally made an excess contribution or the employer accidentally made an excess contribution, and the contribution is withdrawn in the year it was made

- The participant needs it because of a natural disaster that the IRS has specifically indicated as qualified for an early penalty-free withdrawal

So How Much Do You Need To Retire Early

If you want to retire early, youll have to dedicate yourself to saving aggressively beginning at an early age. Although $1 million could potentially fund an early retirement at age 62, retiring with less money or at an even earlier age will be a stretch.

The amount you will need is heavily predicated on the type of lifestyle you want to lead, but you can use these numbers as a rough guidepost as to what you should be targeting. In a nutshell, youll likely need at least $1 million to retire early, and the earlier you want to stop working or the grander the lifestyle you want to lead the more you will have to bump that number higher.

Talk with your financial advisor as early in life as you can if you want to pursue a life of early retirement so you can develop a plan to reach your goals.

More From GOBankingRates

Recommended Reading: Who Can Open A 401k

What Is A 401 Early Withdrawal

First, lets recap: A 401 early withdrawal is any money you take out from your retirement account before youve reached federal retirement age, which is currently 59 ½. Youre generally charged a 10% penalty by the Internal Revenue Service on any withdrawals classified as earlyon top of any applicable income taxes.

If youre making an early withdrawal from a Roth 401, the penalty is usually just 10% of any investment growth withdrawncontributions are not part of the early withdrawal fee calculation for this type of account.

But the entire account balance counts for calculating the fee if youre making an early withdrawal from a traditional 401. These rules hold true for early distributions from a traditional IRA as well.

When Does A 401k Early Withdrawal Make Sense

In certain cases, it actually might be strategic to move forward with 401k early withdrawal. For example, it could be smart to cash out some of your 401k to pay off a loan with a high-interest rate, like 1820 percent. You might be better off using alternative methods to pay off debt such as acquiring a 401k loan rather than actually withdrawing the money.

Always weigh the cost of interest against tax penalties before making your decision. Some 401k plans do allow for penalty-free early withdrawals due to a layoff, major medical expenses, home-related costs, college tuition, and more. Regardless of your strategy to withdraw with the least penalties, your retirement savings are still taking a significant hit.

Also Check: Can You Contribute To 401k And Ira

Tapping Your 401 Early

If you need money but are trying to avoid high-interest credit cards or loans, an early withdrawal from your 401 plan is a possibility. However, before you consider this option, be forewarned that there are often tax consequences for doing so.

If you understand the impact it will have on your finances and would like to continue with an early withdrawal, there are two ways to go about it cashing out or taking a loan. But how do you know which is right for you? And what are the tax consequences you should be expecting?

Tips That Will Allow You To Retire Early

Some of this stuff may seem hard, but my father always said, Anything worth doing is going to seem hard at first.

Some of the things you may have heard before, but thats because they are 100% true.

Some of this you may want to pretend doesnt work, but I promise you it does.

1) The first tip is to INVEST EARLY. I have heard this time and time again, but have I put it into practice? Nope.

I dont even really know how to get started.

My husband, who is a confessed nerd, has said for YEARS that we need to invest in a Roth IRA, and this is something that Mia Pham agrees that you should totally do.

Just fill out the form and send it in.

Dont wait until you are older. The earlier you sign up for your Roth IRA, the more time it has to earn interest!

You will find there is magic in the compound interest that your Roth IRA earns.

Invest, Invest, Invest, and then up your contributions. You will eventually be earning money just for having money in your Roth IRA.

2) Mia says she was all set to buy a house when she learned of the FIRE movement.

Then, she got to thinking about the possibility of retiring early, and that big house didnt seem so important.

When we realized that stocks generally outperform real estate except for this pandemic rate we decided to buy a smaller house.

She got a smaller house, and INVESTED THAT MONEY that she would have spent on a larger house.

What does she invest in?

Mia suggests to live below your means. *Sad Face Emoji*

4) PLAN for your retirement.

Read Also: How Do I See How Much Is In My 401k

What Are The Pros And Cons Of Withdrawal Vs A 401 Loan

A withdrawal is a permanent hit to your retirement savings. By pulling out money early, youll miss out on the long-term growth that a larger sum of money in your 401 would have yielded.

Though you wont have to pay the money back, you will have to pay the income taxes due, along with a 10% penalty if the money does not meet the IRS rules for a hardship or an exception.

A loan against your 401 has to be paid back. If it is paid back in a timely manner, you at least wont lose much of that long-term growth in your retirement account.

What Is A Hardship Withdrawal

Another option in addition to the ones I describe below is taking a hardship withdrawal. According to the IRS, some retirement account types may allow you to make a withdrawal without the early withdrawal penalty but only if you have an immediate and heavy financial need. You will still pay taxes.

The hardship withdrawal is limited to the amount of money necessary for that hardship. So the hardship withdrawal is not a helpful early withdrawal penalty exception for a planned early retirement.

Heres a quick overview of different investment account types. There are some exceptions for each and rules for hardships, disabilities, and contribution limit rules. So check with a tax professional before making any major moves.

Read Also: How Do I Move My 401k To An Ira

You May Like: Can You Take Money From 401k Without Penalty

Avoiding 401 Withdrawal Penalties

To avoid having to make 401 withdrawals, investors should consider taking a loan from their 401. This avoids the 10% penalty and taxes that would be charged on a withdrawal. Another possible option is make sure your withdrawal meets one of the hardship withdrawal requirements.

Note that if you have a Roth 401 you can withdrawal contributions tax-free. Instead of tapping into your 401, you may also be able to use your individual retirement account to avoid the withdrawal penalty. IRAs also charge a 10% penalty on early withdrawals, but they can be avoided if the withdrawal is used for one of the following:

- Unreimbursed medical expenses

- To fulfil an IRS levy

- You’re called to active duty

How Do I Close My Merrill Lynch 401k Account

4.6/5closeMerrill Lynch accountcloseaccount

Also know, how do I close my Merrill Lynch account?

You should send a closure request to the broker by logging into the Merrill Edge site and using the internal messaging system. You could also call the broker at 1-877-653-4732 and speak with a live agent. If youre outside the United States, you should call 1-609-818-8900 instead.

Furthermore, how do I contact Merrill Lynch 401k? If you do not receive your User ID, or have any questions, please the Merrill Lynch Retirement and Benefits Contact Center at 1-866-820-1492 or 609-818-8894 .

Also know, how do I withdraw my 401k early from Merrill Lynch?

To start your withdrawal youll need a One Time Distribution form from Merrill Lynch. You must fill it out with your personal information, including your name, date of birth, phone number and Merrill Lynch retirement account number. This information must be accurate to avoid delays in getting your funds.

How long can an employer hold your 401k after termination?

If you get terminated from your job, you have the ability to cash out the money in your 401 even if you havent reached 59 1/2 years of age. This includes any money youve contributed and any vested contributions from your employer plus any investment profits your account has generated.

Read Also: What Happens To Your 401k When You Quit Your Job

How Long Will Your Money Last In Early Retirement

Although early retirement is a dream for many, there are two main obstacles that can get in the way. First, the earlier you retire, the less time you have to build up your savings. Second, and perhaps more importantly, the longer your retirement lasts, the more youre going to have to stretch out your savings.

Important: 7 Surprisingly Easy Ways To Reach Your Retirement Goals

Whereas someone retiring at 70 may only need 15-20 years of savings, an early retiree who stops working at 40 might need their nest egg to last a whopping 40-50 years, or perhaps even longer.

To paint these numbers in black and white, heres a look at how long varying amounts of savings will last if you retire at age 62, age 55 or age 40. This analysis assumes an annual investment return of 5% and yearly withdrawals starting at $54,132 the average annual income of a full-time earner as of Q2 2022 increasing by 3% per year to keep up with inflation. Lets examine the scenarios.

Can You Make An Early Withdrawal From Your 401 Plan

Yes, you can make an early withdrawal but just because you can, it doesnt mean that you should. Cashing out from your 401 plan early can come with several financial consequences such as loss of interest growth or penalties. This is why its not recommended to cash out the 401 until you are at least 59 years old.

Recommended Reading: Can I Set Up My Own 401k Plan

Benefits Of The Walmart Moneycard

The MoneyCard offers many of the benefits found on all Visa and MasterCard debit cards, including fraud protection. A free online bill-paying service is also included. You can send money orders, get paper checks, or set recurring monthly payments for bills such as for your auto insurance. These cards also allow you to send funds to friends or family anywhere in the United States.

You can also earn cash-back rewards by shopping at Walmart.com and via the Walmart app , Walmart fuel stations , and Walmart retail stores . The limit for cash-back rewards is $75 a year.

Alternatives To A 401 Early Withdrawal

As we mentioned, a 401 early withdrawal can be used in a financial emergency, but it shouldnt be your first choice. The good news is there are plenty of other options available to you.

There are several alternatives to an early withdrawal from retirement, however, most of them mean going into debt, Woodward said. The only difference is your credit will not be used in determining your eligibility for a 401 loan. Your credit will be used for credit cards , HELOCs, personal loans, and any other type of loan.

Your creditworthiness is a major factor when youre borrowing money. Some of the options below may only be available if you have good credit. In other cases, a poor credit score could make the loan cost-prohibitive.

Also Check: Do You Get Your 401k When You Quit

Alternatives To Withdrawing From 401

How can you access cash without withdrawing or borrowing from your 401? If you’re a homeowner with equity, you can consider a cash-out refinance, home equity loan or home equity line of credit . All three of these options typically come with competitive interest rates because the financing is secured by your home.

Permanent life insurance policies with cash value components are another option. In this case, your death benefit serves as collateral for the loan. Once the loan balance is paid off, your death benefit is restored in full.

Withdrawal Penalty Before Age 59

If you’re under age 59½, you may have to pay an additional 10% when you file your tax return. If you are still working when you are 59 ½, you can take money out of your 401.

You can take money from your 401 account if you are age 59½ or older. You will not have a penalty. Twenty percent is withheld for federal income taxes. You can also roll money from your 401 to IRA or other qualified plan. Funds that are rolled over are not subject to tax at that time.

Don’t Miss: What Is The 401k Retirement Plan

Wait To Withdraw Until Youre At Least 595 Years Old

If all goes according to plan, you wont need your retirement savings until you leave the workforce. By age 59.5 , you will be eligible to begin withdrawing money from your 401 without having to pay a penalty tax.

Youll simply need to contact your plan administrator or log into your account online and request a withdrawal. However, you will owe income taxes on the money , so a portion of each distribution should be designated to cover your tax liability. 401 withdrawals arent mandatory until April 1 of the year after you turn 72 , at which point you must take a required minimum distribution every year.

Benefits Of Saving For Early Retirement

To retire early, youll probably need to start saving early. The earlier you start saving, the harder your money can work for you and the more help youll get from the government and your employer.

First of all, your savings have more time to grow . The magic of compound interest kicks in any growth in your savings gets reinvested and then also starts to grow. The earlier you start saving, the more of an impact that can have.

Secondly, investing in your pension is a very tax-efficient way of saving money. Thats because it qualifies for tax relief. Your money goes straight into your pension pot, without any of it going to the government.

And finally, if youve got a workplace pension, your employer will also help. Depending on how much you save, theyll match some or all of your contributions. In effect they give you extra money, over and above your normal salary payments.

Of course, if youre self-employed, you wont get help from an employer. But you can still make the most of compound interest and government support by setting up and saving into a personal pension.

Also Check: What To Do With 401k When Laid Off

Determine If Your 401 Account Was Rolled Over To A Default Ira Or Missing Participant Ira

One possibility is your employer rolled the funds over into a Default IRA.

If your employer tried to contact you for instructions as to what to do with your account balance, and you fail to respond, you may be deemed a non-responsive participant.

If they are unable to locate you altogether, you may be deemed a Missing Participant.

In either scenario, if the plan is being terminated, your employer may have put the funds in a Missing Participant Auto Rollover IRA.

This is an IRA account set up on your behalf to preserve your retirement assets until they are claimed by you or your beneficiaries under Department of Labor regulations.

To qualify for a Missing Participant or Default IRA, the account balance must be greater than $100 but less than $5,000 unless the funds are coming from a terminated plan, then the $5,000 ceiling is waived.

Finding a Missing Participant IRA

If your money has been transferred to a Missing Participant IRA, you should be able to find it by searching the FreeERISA website.

This search is slightly more time consuming than the national registry. Registration is required to search the database, which contains 2.6 million ERISA form 5500s, covering 1.3 million plans and 1 million plan sponsors.

If you know your money has been transferred to one of these default accounts, you should get it out into a standard IRA account.

Typically, these accounts must be interest-bearing, bear a reasonable rate of return, and be FDIC insured.

Heres the bad part: