Dont Cash Out Your 401 Early

Another lesson: Whatever you do, dont cash out your 401 savings. If you leave your job, you are allowed to spend your 401 funds if you pay taxes on the amount, including a 10% penalty tax assessed on most withdrawals made before age 59 ½. You may be tempted to take the cash and spend it on a vacation before you start your next job, but thats not a very good idea.

Roll over that retirement money, sign up for the retirement plan with your new employer and take a nice and affordable staycation instead. Your retired self will be very grateful to your working self for making a small sacrifice that could have a big impact down the line.

Perks For Older Investors

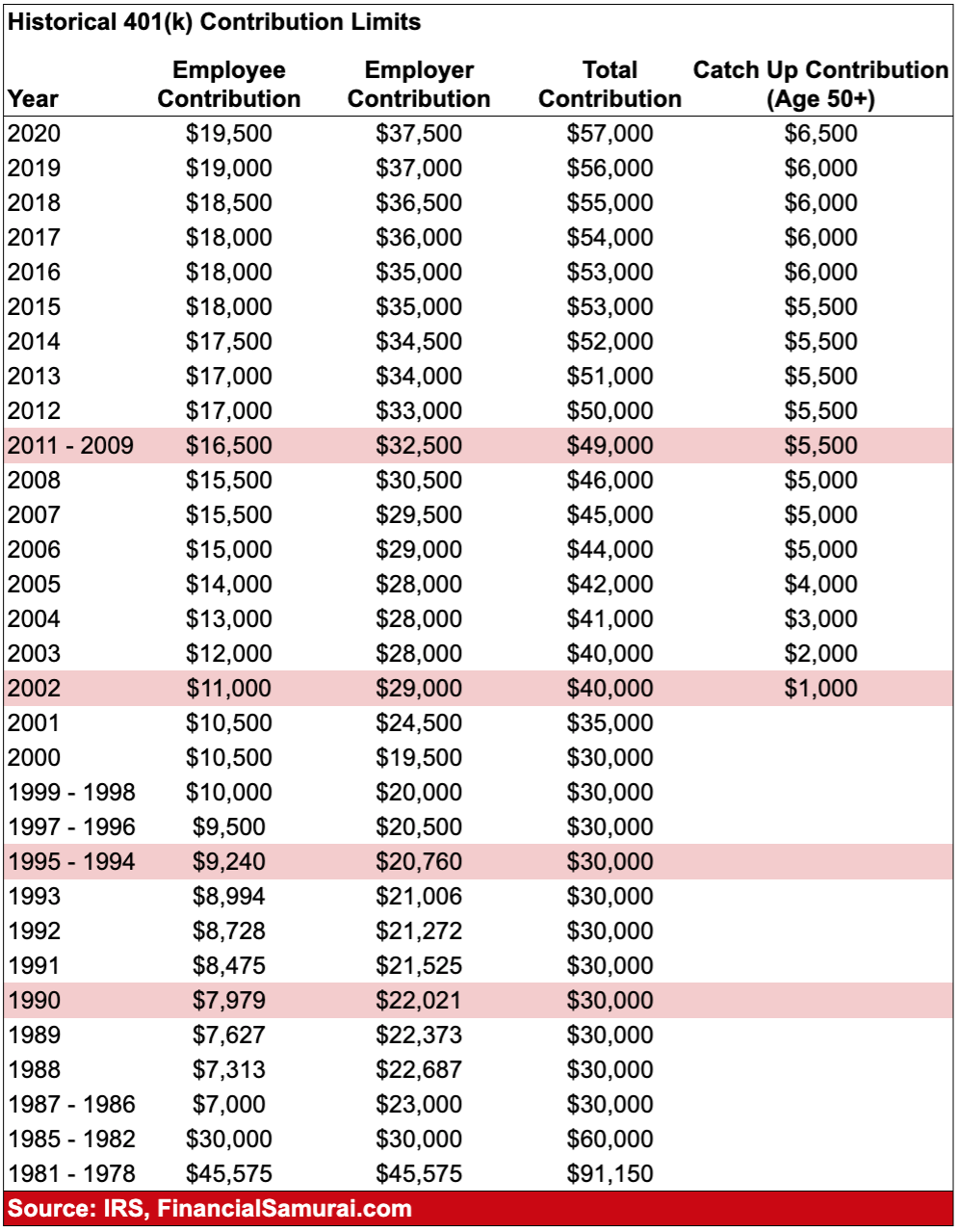

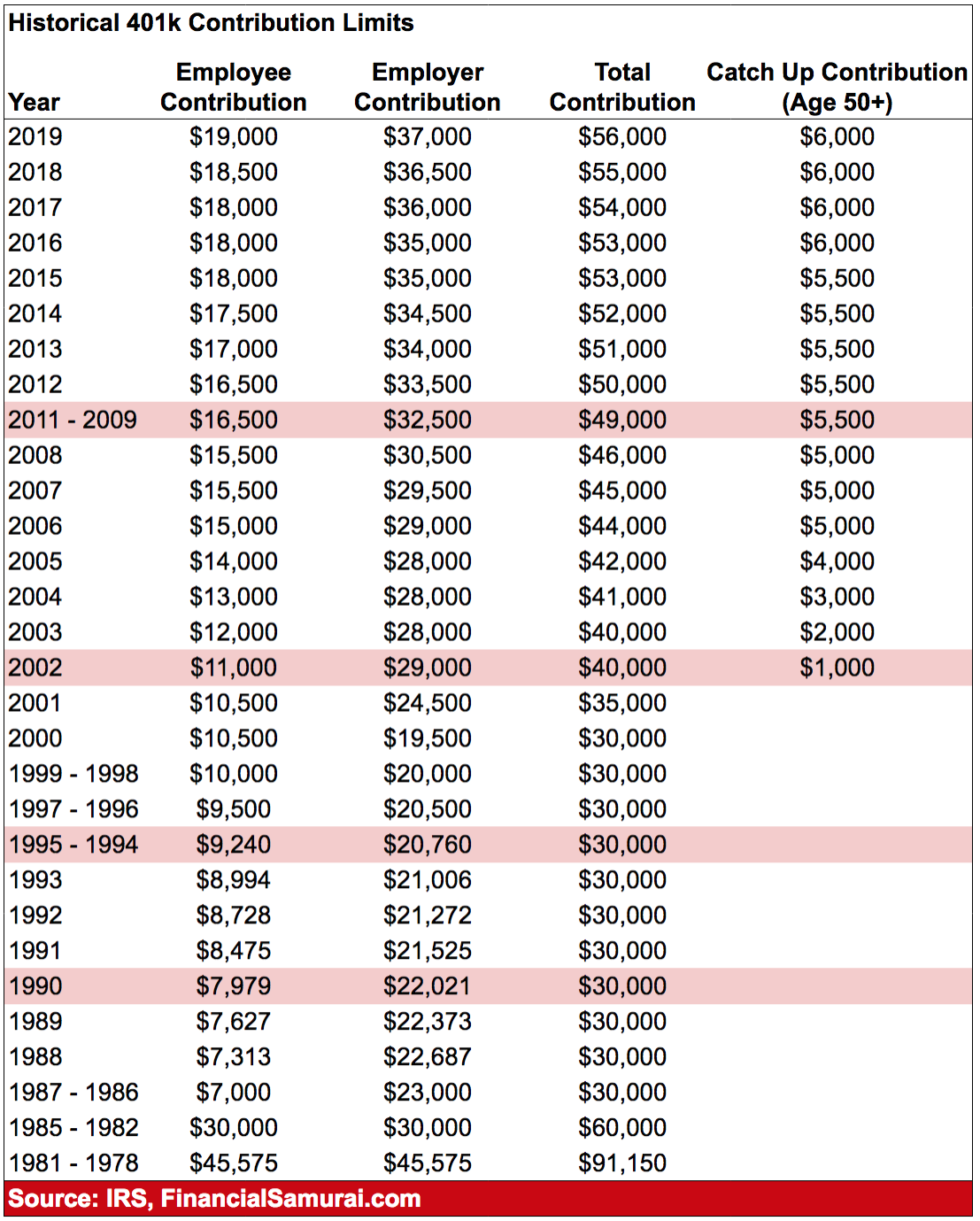

If you happen to be at least 50 years old, youre entitled to make catch-up contributions by adding an additional $6,500 for a total contribution of $27,000 in 2022. The total maximum that can be tucked away in your 401 plan, including employer contributions and allocations of forfeiture, is $67,500 in 2022, or $6,500 more than the $61,000 maximum for everyone else. Forfeitures come from an account in which company contributions accumulate from departing employees who werent vested in the plan.

How Much Money Is Too Much For A Roth

Contributions to Roth IRAs are limited and can be phased out, depending on how much income you earn and your tax-filing status. This may interest you : Taxes in Retirement and Roth IRA Conversions: What to Know. For those who propose taxes as a single, contributions cannot be made to Roth if your income exceeds $ 139,000 in 2020 and more than $ 140,000 in 2021.

What income is too high for Roth?

In 2021, if you make more than $ 140,000 filing alone or $ 208,000 filing together as a married couple, you are prevented from contributing to a Roth IRA.

Do I make too much money for a Roth IRA?

So you have too much money to qualify for a Roth individual retirement account. If your adjusted gross income exceeds $ 131,000 or $ 193,000 , you cannot contribute to a Roth IRA directly. To get around this, you finance a traditional IRA, and then convert the money into a Roth.

How much should you put into a Roth IRA?

The IRS, in 2021, closes the maximum amount that you can contribute to a traditional IRA or Roth IRA $ 6,000. Seen the other way, its $ 500 a month you can donate throughout the year. If you are age 50 or older, the IRS allows you to contribute up to $ 7,000 annually .

You May Like: Can I Transfer My Roth Ira To My 401k

How Much Should I Have In My 401k

Laurie BlankSome of the links included in this article are from our advertisers. Read our Advertiser Disclosure.

If youre wondering how much money you should have in your 401k, your wait is over. Retirement savings is much of the talk in todays personal finance world.

You want to make sure youre saving enough to meet your retirement goals. Otherwise, you may have to find ways to save more or possibly delay retiring.

While each person has a different financial situation, these insights can improve your retirement plan.

In This Article

Traditional 401s Vs Roth 401s

A 401 works best for someone who anticipates being in a lower income tax bracketat retirement than theyre in now. For example, someone currently in the 32% or 35% tax bracket may be able to retire in the 24% bracket.

Employers have been increasing tax diversification in their retirement plans by adding Roth 401s. These accounts combine features of Roth IRAs and 401s. Contributions go into a Roth 401 after you have paid taxes on the money. You can withdraw contributions and earnings tax- and penalty-free if youre at least age 59 1/2 and have owned the account for five years or more. Youll also be required to take minimum distributions from a Roth 401 once you turn age 72. However, you might be able to avoid RMDs if you can move the money from a Roth 401 into a Roth IRA, which isnt subject to required minimum distributions.

and a Roth 401, the total amount of money you can contribute to both accounts cant exceed the annual limit for your age, either $20,500 or $27,000 for 2022. If you do exceed it, the IRS might hit you with a 6% excessive-contribution penalty.)

Also Check: How To Transfer 401k Without Penalty

Using Ubiquitys 401 Calculator

The Ubiquity 401 calculator paints a picture of what your retirement savings will look like when youre ready to stop working. Start by entering your age, household income, and any current savings.

Enter the amount you currently save towards your 401 each month, the amount you expect to spend each month when you retire, and the age you plan to retire. Then, Ubiquitys 401 calculator will show you what to expect, and if there is a deficit. Unlike other 401 calculators, you might find online, the Ubiquity 401 calculator also accounts for hidden fees associated with your retirement savings that you may not be aware of.

You will see:

- The monthly income you can expect to need when you retire

- The amount you will actually receive from your retirement based on your current savings and monthly contributions

- How close you are to achieving your retirement goalswhether youre on the right track, ahead of the game, or need to beef up your savings

Understanding Your Investment Account Options

Now that youve made the right choice in deciding to save for retirement, make sure you are investing that money wisely.

The lineup of retirement accounts is a giant bowl of alphabet soup: 401s, 403s, 457s, I.R.A.s, Roth I.R.A.s, Solo 401s and all the rest. They came into existence over the decades for specific reasons, designed to help people who couldnt get all the benefits of the other accounts. But the result is a system that leaves many confused.

The first thing you need to know is that your account options will depend in large part on where and how you work.

You May Like: How To Transfer 401k To Another Job

How To Build A Retirement Portfolio

You dont have to be rich to save money. You can start saving early in your life by putting aside small amounts of cash each month. If you want to make sure that youre on track, then you should look into setting up an automatic savings plan. This way, you wont need to worry about forgetting to put any extra money away.

Once youve saved enough for retirement, you can decide whether youd like to invest in stocks or bonds. Stocks are riskier than bonds, but they tend to grow faster and offer higher returns. On the other hand, bonds pay interest every year, and you get paid regardless of what happens with the stock market.

If you prefer, you could also consider investing in mutual funds. Mutual funds allow you to combine different investments together so that you can earn better returns.

There are many ways to create a successful investment strategy. But one thing is certain: youll need to work hard to achieve your goals.

Your Employer’s Contribution Limit

Some employers may have a set limit for the percentage you can contribute toward your 401 each paycheck and, depending on how much you get paid, maxing out your employer’s limit may still not be enough for you to max out the federal contribution limit.

For example, a company may allow employees to contribute up to 50% of their paycheck to their 401 account . Or, they may allow up to a 20% contribution per paycheck. It depends on your company, so be sure to double check.

If you’re maxing out your employer’s contribution limit but you still worry that it’s not enough to help you reach your retirement goals, you can also contribute your post-tax income to a Roth IRA account.

A Roth IRA is another type of retirement account but with slightly different rules s which differ from a Roth IRA). You must open the account on your own is). And instead of contributing pre-tax dollars that you’re taxed on when you make withdrawals in retirement, you contribute after-tax dollars and won’t pay taxes on withdrawals later on.

Also, the contribution limits for an IRA are different from that of a 401 you can contribute up to $6,000 per year to a Roth IRA if you’re under age 50, and $7,000 per year if you’re age 50 or older.

You May Like: How Much Can We Contribute To 401k

Learn From Your 401 Balance

Although learning about the average 401 balance by age might help you understand where you stand compared to others, it wont help you analyze your retirement situation altogether. Since everyone has different finances, lifestyles, and unexpected emergencies, its important not to use 401 balance by age as your only benchmark.

Instead, you can use it as a way to motivate yourself to start making better financial decisions and contribute more each year. A good way to benchmark your savings is by using a retirement calculator that will give you more information on how much you will have saved by a certain age and how much you should be saving monthly to achieve your retirement goals. Bottom line: Saving early can set you up to be more prosperous later in life.

How Much Money Should You Have In Your 401k

At IWT, we talk about 401ks a lot.

And, thats with good reason. If you want to be rich, the 401k is one of the most powerful investment tools at your disposal, especially for retirement planning. It is also one of the most misunderstood money-maximizing vehicles, starting with how much you should have in your 401k.

That is a solid question, but it doesnt have a simple answer. To answer that burning question How much should I have in my 401k? we need more details. How much to invest in 401k investments will depend on your age and a few other considerations.

Lets start at the beginning.

Also Check: Should I Transfer My 401k To A Roth Ira

Contributions: How Much Is Enough

Please fill out all required fields

Email addresses provided will be used only to let the recipient know who sent the web content. The information will not be used for any other purpose by Securian Financial.

Thank you for sharing

Your message has been sent.

When you land your first full-time job, chances are your employer will offer you the chance to contribute to a 401. Should you participate? And, if so, how much should you contribute?

If youre lucky enough to work for a company that offers a 401, most financial experts will recommend that you participate in the plan and that you do so as soon as possible. Heres why.

What Is The 401k Savings Potential By Age

The following chart depicts 401k savings potential by age, based on several assumptions. These numbers can seem high to many people, especially if you are older and started your retirement savings when the contribution limit was much lower. It can still be used as a guide for your target total retirement savings amounts, including your IRA, Roth IRA, and after-tax savings. While its designed for one person, it can also be used as a guide for a married couple if one spouse decides to no longer work.

The assumptions we used for this chart include:

- The numbers are more forward-looking vs. backward, since the average 401k contribution limits were lower in the past.

- You start full-time employment at age 22 at a company that provides a 401k, without a company match.

- You contribute $8,000 to your 401k after the first year, then from the second year onward, you contribute the maximum annual amount of $20,500.

- The No Growth column shows what you could potentially have in your 401k after so many years of a constant $20,500-per-year contribution and no growth.

- The 8% Growth* column shows what you could potentially have in your 401k after so many years of a constant $20,500-per year contribution compounded over the next 43 years.

- The difference between the two columns emphasizes the power of growth, compounding over time. By starting early and enjoying a historically average return on 401k, at age 65, an individual could turn $869,000 of contributions into over $6.4M dollars.

Recommended Reading: How Much Can You Put Into A 401k Per Year

How Much Will Your 401 Be Worth

We all have ideas for how wed like to spend our retirement. Whether you hope to travel the world, buy an RV, or just spend more time with your family, the choices you make today will dictate the options available to you when you retire.

Fortunately, you dont have to fly blind. Use Ubiquitys 401 calculator to get a clear picture of how your savings will stack up when you retire and how much you should be saving now to realize your goals.

If Youre In Debt Focus On High

If your employer matches 401 contributions, put in enough to get that match, even if youre in debt.

Next, if youre in credit card debt, stop. Put your extra money towards paying that off before making additional retirement contributions. Focus first on getting out of credit card debt and then come back.

Got student loans? Follow the above schedule anyway. Unless your private loans have double-digit interest rates, I dont recommend repaying student loans early.

Also Check: How To Take A Loan Against Your 401k

Common Mistakes People Make In Retirement Planning

Retirement is an important part of life, but it can be difficult to plan ahead. If you want to avoid making any costly mistakes when it comes to your finances, then you should take a look at the article below. This guide will help you understand how to save money so that you can have enough money to retire comfortably.

One of the most common mistakes that people make is to spend more than they earn. You shouldnt spend more than you can afford to pay back, and you need to set aside as much money each month as possible.

Another mistake that people often make is to focus on the short term. When youre thinking about saving for retirement, you need to think long-term. After all, youll likely live longer than you did before. So, you need to start saving now in order to ensure that you can enjoy a comfortable retirement.

If you dont think about your financial situation, you could end up living with less money than you expected. This is why you need to do some research into the best ways of managing your finances.

Overall Limit On Contributions

Total annual contributions to all of your accounts in plans maintained by one employer are limited. The limit applies to the total of:

- elective deferrals

The annual additions paid to a participants account cannot exceed the lesser of:

However, an employers deduction for contributions to a defined contribution plan cannot be more than 25% of the compensation paid during the year to eligible employees participating in the plan .

There are separate, smaller limits for SIMPLE 401 plans.

Example 1: In 2020, Greg, 46, is employed by an employer with a 401 plan, and he also works as an independent contractor for an unrelated business and sets up a solo 401. Greg contributes the maximum amount to his employers 401 plan for 2020, $19,500. He would also like to contribute the maximum amount to his solo 401 plan. He is not able to make further elective deferrals to his solo 401 plan because he has already contributed his personal maximum, $19,500. He would also like to contribute the maximum amount to his solo 401 plan.

You May Like: How To Roll Roth 401k To Roth Ira

How Much Should You Contribute To Your 401

Most retirement experts recommend you contribute 10% to 15% of your income toward your 401 each year. The most you can contribute in 2021 is $19,500 or $26,000 if you are 50 or older. In 2022, the maximum contribution limit for individuals is $20,500 or $27,000 if you are 50 or older. For both years, those those age 50 and older can contribute an extra amount of $6,500. Consider working with a financial advisor to determine the best contribution rate.

What Happens If You Contribute Too Much To Your 401

If your 401 contributions exceed the limits above, you may end up being taxed twice on your excess contributions: once as part of your taxable income for the year that you contribute and a second time when you withdraw from your plan. Earnings still grow tax-deferred until you withdraw them.

If you realize you contributed too much to your 401, notify your HR department or payroll department and plan administrator right away. During a normal year, you have until your tax filing deadlineusually April 15to fix the problem and get the money paid back to you.

Excess deferrals to a 401 plan will have to be withdrawn and returned to you. Your human resources or payroll department will have to adjust your W-2 to include the excess deferrals as part of your taxable income. If the excess deferrals had any earnings, you will receive another tax form that you must file the following tax year.

Read Also: How Much Should I Have In My 401k At 60

Recommended Reading: How Does Retirement Work With 401k

Why Should I Use One

Matching dollars, for one thing. Over 90% of employers that offer a 401 plan also kick in a company match, which means as you contribute, your employer will, too. Commonly, that match will be worth 50% to 100% of your contributions, up to a limit that typically falls between 3% and 6% of your annual salary. If your employer offers up this free money, a good rule of thumb is to do everything you can to contribute enough to take advantage of it.

The other huge benefit of the 401 is that it allows you to put a lot of money away for retirement in a tax-advantaged way. The annual 401k contribution limit is $20,500 for tax year 2022, with an extra $6,500 allowed as a catch-up contribution every year for participants age 50 or older.