How Do I Complete A Rollover

Roth Ira Rollover Rules From 401k

As a reminder, you must generally be separated from your employer to roll your 401k into a Roth IRA. However, some employers do permit an in-service rollover, where you can do the rollover while still employed. Its permitted by the IRS, but not all employers participate.

Before January 1, 2008, you werent able to roll your 401 into a Roth IRA directly at all. If you wanted to do so you had to complete a two-step process.

However, the law changed shortly after and this option became available. Still, just because the law has made this option available doesnt mean you can definitely roll your old 401 into a Roth IRA no matter what. Unfortunately, it all depends on your plan administrator.

For example, recently I had two clients who intended to roll their old retirement plans into a Roth IRA.

One client had an old military retirement plan- Thrift Savings Plan and the other had an old state retirement plan. After helping each of them complete the required paperwork, I came across an interesting discovery.

The TSP rollover paperwork had a box you could mark if you wanted to roll over the plan into a Roth IRA . However, the state retirement plan did not give that option.

The only option was to open a traditional IRA to accept the rollover and then immediately convert it to a Roth IRA. That certainly seemed like a hassle at the time, and it definitely was.

Also Check: How Long Will My 401k Last Me In Retirement

Should You Do A Reverse Rollover

Now that you understand how an IRA to 401k reverse rollover works, and how to do it, should you consider it for your situation? Well, if youre planning to do a backdoor Roth IRA conversion, or youre looking to retire early, it could make a lot of sense to do it.

However, the process can be complicated, and over 30% of employer-sponsored 401k plans dont even allow you to do it. However, the IRS has issued guidelines making the process more forgiving for 401k providers, and as such, more and more are allowing them.

The biggest takeaway here is to always check with your 401k provider before you start the process. You dont want to go down this path only to realize you cant do it.

Have you considered doing an IRA to 401k reverse rollover? If youve done it, what was your experience?

Recommended Reading: How To Get Money From 401k After Retirement

What If I Have Employer Stock In My Employer

You can choose to roll company stock into an IRA or a taxable brokerage account. If you decide to roll the stock to an IRA, its full value will be taxed as income at your regular rate if you move the stock to a taxable brokerage account, you might be able to save money by paying capital gains taxes on the difference between the stocks value and the price you paid for it. There are tax benefits to each, so consult your tax advisor and ask about the net unrealized appreciation strategy.

Where Should You Partially Rollover Your 401 To

The three primary characteristics of an ideal partial rollover are:

- Its deliberate. Remember, you always have the option to leave your entire 401 in place or roll over the entire thing. Make sure theres a good reason to do only a partial rollover, like the Rule of 55 or if you have some unique investment in your 401 that you dont want to move. The last thing you need in a retirement plan is unnecessary complexity.

- Youre moving money to a low- or no-cost provider. If youre moving any amount of money to any new firm, its always important to know exactly how much youre paying and the exact services you receive in return. Most online IRA providers dont charge to open an account or to invest money.

- You picked a new provider with a wide investment menu. One of the biggest criticisms of many company plans is that they offer too few investments at too great a cost. Make sure that the company you choose to hold your new IRA offers a wide range of investment options and one that wont restrict your choices.

Recommended Reading: Can I Rollover My 401k Into My Spouse’s Ira

Keeping Your Current 401 Plan

First off: Whatever you do, dont take the cash out. This means cashing out your 401 and depositing that amount into your checking account and using it toward other expenses. This is a bad idea. If you do, youll get hit with a penalty from the IRS, and the money will count as income that increases your federal taxes for the year. Although it may be tempting, try other options instead.

One of the easiest things you can do instead is simply leave your current 401 balance where it is, even though you wont be able to make any additional contributions.

This option might be right for someone who is happy with the fees and performance of their current 401 plan and who doesnt have another retirement account to move the balance to.

But this option may not be the best because in a decade or two, you may have a handful of 401 plans sitting with previous employers, making them easy to lose track of and difficult to manage.

Also, not every employer allows you to keep your 401 open after you leave. Some might have a minimum balance requirement or require that you rehome your retirement funds into a new account with the same investment manager.

The Ins And Outs Of Opening And Contributing To A Roth Ira

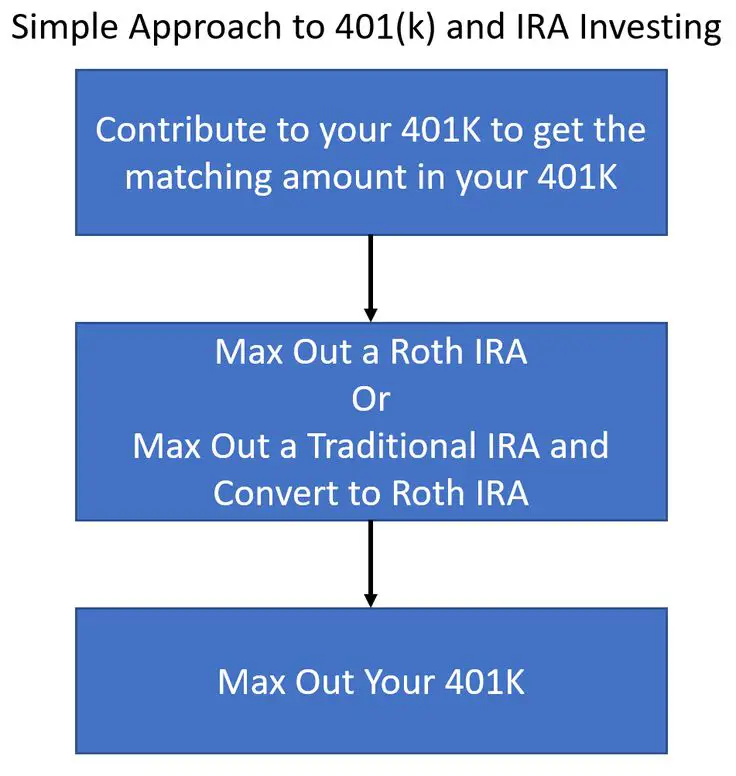

The easy answer to your second question is again, yes, you can potentially contribute to a Roth IRA even if you contribute the yearly maximum to a 401. In fact, it’s an ideal retirement savings scenario to contribute the maximum to both. And it’s something I highly recommend if you can afford it.

For 2022, you can contribute up to $20,500 to a 401 with a $6,500 catch up if you’re 50 or over. You can contribute up to $6,000 to a Roth IRA with a $1,000 catch up . Together, that’s a sizeable savings.

So on the surface, it would appear you’re good to go. However, although there are no income limits for contributing to a Roth 401, there are yearly income limits for contributing to a Roth IRA, and that could throw a wrench in your plan. For 2022, if your adjusted gross income is $144,000 or over for single filers you wont be eligible to make a Roth IRA contribution.

Also Check: How Do I Get My 401k Money From Walmart

Transfer Funds From Your Old Qrp

Contact the plan administrator of the QRP you are rolling , and request a direct rollover distribution payable to Wells Fargo. Make sure to:

- Ask to roll over the funds directly to Wells Fargo for benefit of your name.

- Reference both your name and the account number of the new IRA you set up or your existing IRA.

They will either send the funds directly to Wells Fargo, or you will receive a check in the mail made payable to your IRA to deposit into your Wells Fargo IRA.

Transfers To Simple Iras

Previously, a SIMPLE IRA could only accept transfers from another SIMPLE IRA plan. A new law in 2015 now allows a SIMPLE IRA to also accept transfers from traditional and SEP IRAs, as well as from employer-sponsored retirement plans, such as a 401, 403, or 457 plan. However, the following restrictions apply:

- SIMPLE IRAs may not accept rollovers from Roth IRAs or designated Roth accounts of employer-sponsored plans.

- The change applies only to rollovers made after the two-year period beginning on the date the participant first participated in their employers SIMPLE IRA plan.

- The new law only applies to transfers to SIMPLE IRAs made after December 18, 2015, the date of enactment.

- The one-per-year limitation that applies to IRA-to-IRA rollovers also applies to rollovers from a traditional IRA, SIMPLE IRA, or SEP IRA into a SIMPLE IRA.

Don’t Miss: How To Transfer 401k Balance To New Employer

Advantages Of Payroll Deduction Iras

Once your employer has established a relationship with your desired payroll deduction IRA provider, youll need to sign a document authorizing your company to transfer money from each paycheck into your IRA. To determine a contribution amount, consider retirement saving guidelines like putting away 15% of your paycheck for retirement. If you cant afford that amount now, you can start smallerlike $100 each month. Just make sure you arent contributing more than $6,000 a year .

Video advice: 401k VS Roth IRA

Can You Transfer A 401 To An Ira While Youre Still Employed

Written by John Rothans

Thousands of Americans wonder the same thing: Can I transfer my 401 to an IRA if Im still with my current employer? Yes, theres a good chance you can.

While most people think about transferring their 401 after they leave a job, its actually something you might be able to do while youre still in that joband doing so could offer some attractive asset options. Learn when it makes sense to roll some of your 401 into an IRA while still employed, along with the advantages.

Also Check: When Do You Have To Start Withdrawing From 401k

Why Roll Over Your 401 Into An Ira

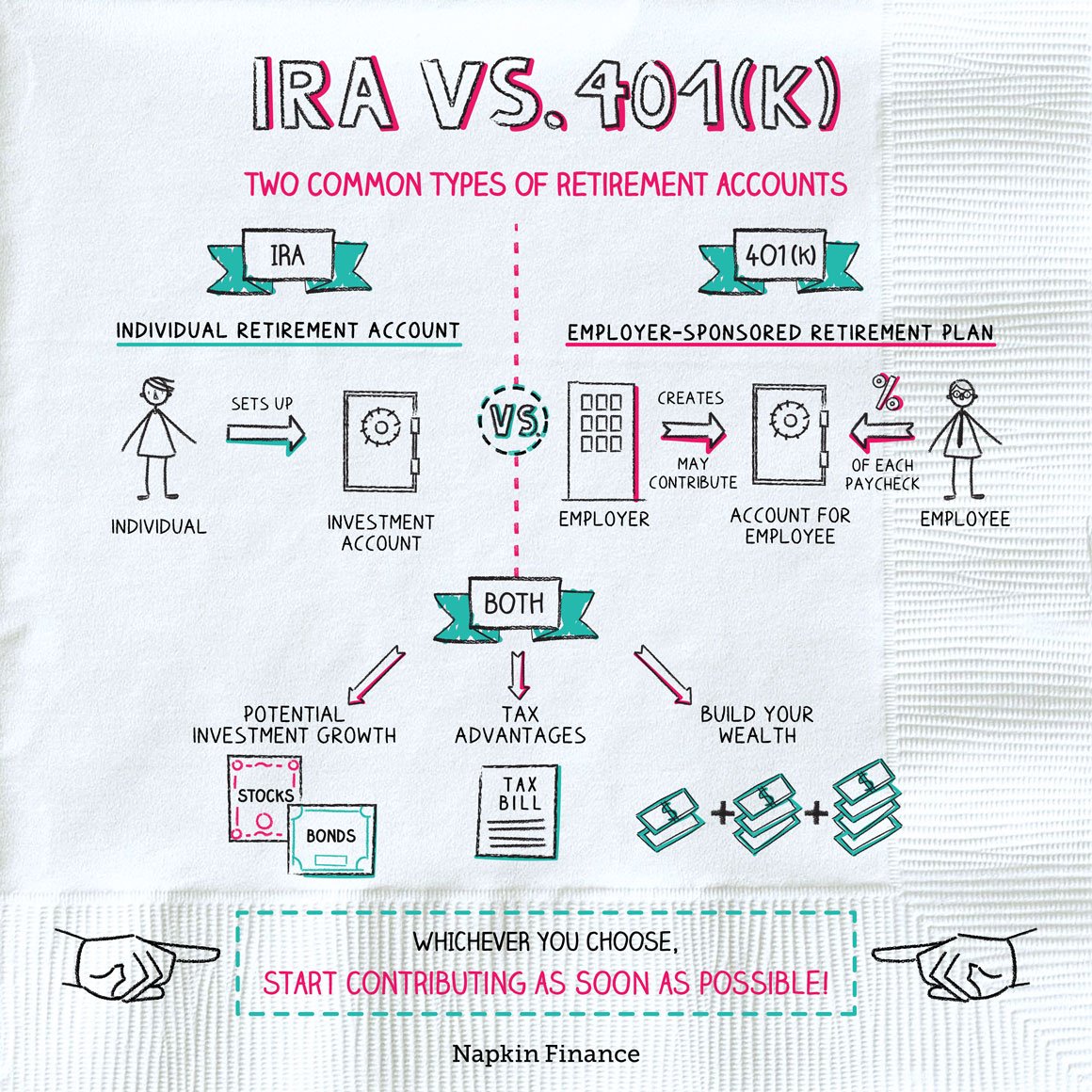

Moving your funds from a 401 to an IRA offers various benefits that you are unlikely to find in a 401 plan. While 401 are limited to a few investment choices like stocks and bonds, IRAs have a wider pool of investments ranging from EFTs, REITs, Certificates of Deposits, stocks, and bonds. This can help you create a diversified portfolio and have multiple income streams.

Also, IRA tends to be less expensive than 401 plans. Due to the limited investment choices in 401, you will have to incur higher costs in administrative fees, fund expense ratios, and management fees, which can reduce your overall return. While IRAs are not free of fees, the higher number of investment choices means you can pick investments with the lowest fees and exercise more control over how you invest.

Tags

How Much Money Do I Need To Open A Vanguard Ira

At Vanguard, you can open an account with a $0 balance. But there are a few minimums to keep in mind as you begin to invest.

- Vanguard ETFs: You only need enough money to cover the price of 1 share, which can generally range from $50 to a few hundred dollars.

- Vanguard mutual funds: Some Vanguard mutual funds have a $1,000 minimum . Most of our other Vanguard mutual funds have a $3,000 minimum.

Recommended Reading: How Do I Get My 401k From A Previous Employer

Disadvantages Of An Ira Rollover

A rollover is not for everyone. A few cons to rolling over your accounts include:

- . You may have credit and bankruptcy protections by leaving funds in a 401k as protection from creditors vary by state under IRA rules.

- Loan options are not available. The funds may be less accessible. You may be able to get a loan from an employer-sponsored 401k account, but never from an IRA.

- Minimum distribution requirements. You can generally withdraw funds without a 10% early withdrawal penalty from a 401k if you leave your employer at age 55 or older. With an IRA you generally have to wait until you are age 59 1/2 to withdraw funds in order to avoid a 10% early withdrawal penalty. The Internal Revenue Service offers more information on tax scenarios as well as a rollover chart.

- More fees. You may be responsible for higher account fees as compared to a 401k which has access to lower-cost institutional investment funds because of group buying power.

- Tax rules on withdrawals. You may be eligible for favorable tax treatment on withdrawals if your 401K is invested in company stock.

Neither State Farm nor its agents provide tax or legal advice.

Start a Quote

Pick The Financial Services Company You Will Work With

Pick one firm that will serve as the custodian for your retirement account. If you manage your own investments, you might pick Vanguard, Fidelity, or Charles Schwab. If you work with a financial advisor, they will have a brokerage firm or custodian they use and will open the account you need there.

Some people mistakenly think they need to spread their money across multiple companies to be diversified. That is not true. You can open an account at one company and inside that account, spread your money across multiple types of investments.

Using a well-established custodian helps you protect your accounts from numerous types of fraud, and having your money with one firm makes managing your retirement money and retirement distributions much easier.

You May Like: How To Rollover 401k When Changing Jobs

Can You Move A 401k To An Ira Without Penalty

A 401 and an IRA are retirement accounts that offer tax benefits. However, they do not work the same way. While a 401 is employer-sponsored, an IRA isnt. Therefore, when you get another job, you must think of what to do with your employer-sponsored account.

Usually, four options are available. First, you can rollover your funds into an IRA. Second, transfer it to the new employers plan . Third, withdraw your money and pay the corresponding taxes. Lastly, if your former employer agrees, leave it with them.

If you choose the roll-over option, you should be extremely careful to avoid costly mistakes. This article explains how you can rollover your 401 to an individual retirement account without being penalized. You will also see some reasons why several people are choosing to roll over.

How to Roll Over Funds to an IRA from a 401 without Penalty

The first method of moving funds from an employer-sponsored account to an IRA is through a direct rollover. This method is simple and less risky. It involves moving funds directly from your previous plan manager to the one that will handle your IRA.

The second method involves receiving a check so you can go to the bank and receive your money in person. However, your previous employer will collect 20 percent of the total amount for taxes. So by the time you want to deposit the money in an IRA, you have to make up the rest.

Why You Should Roll Over from a 401 to an IRA

Inheritance Tax Issues

More Investment Options

Are There Tax Implications Of Ira Rollovers

Depending on how you move your money, there might be tax implications. If you move your money into an account with the same tax treatment as your old account, there shouldnt be issues as long as you deposit any checks you receive from your 401 into a tax-advantaged retirement account within 60 days. However, if you move a traditional 401 into a Roth IRA, you could end up with a tax bill. Check with a tax professional to find out how you may be affected.

You May Like: How Do I Pull Money From My 401k

Disadvantages Of Rolling An Ira Over Into A 401

As with every investment decision, there are also some potential drawbacks to moving your IRA assets into a 401:

Limited investment options. One of the advantages of an IRA is that you can invest in nearly everything. But 401 accounts, in contrast, are often much more limited. Some company 401 accounts only allow you to invest in a few mutual funds, for instance, or encourage you to invest in company stock.

In certain circumstances, it can be easier to access IRA funds than those held in a 401. Though IRAs dont allow you to take out emergency loans, there are some loopholes that allow early distributions without penalty for higher education expenses and a first-time home purchase .

Low-cost investment advice. If your 401 plan doesnt come with investment advice and you want help with that, many IRAs offer help with investment selectionas long as you dont mind working with a robo-advisor. A financial advisor can also help you manage investments in a 401, of course, but this could be of limited use considering the small, curated investment selection that’s typical of a 401.

Tax Consequences Of The One

Beginning in 2015, if you receive a distribution from an IRA of previously untaxed amounts:

- you must include the amounts in gross income if you made an IRA-to-IRA rollover in the preceding 12 months , and

- you may be subject to the 10% early withdrawal tax on the amounts you include in gross income.

Additionally, if you pay the distributed amounts into another IRA, the amounts may be:

- taxed at 6% per year as long as they remain in the IRA.

Recommended Reading: How To Claim 401k From Previous Employer