Can I Switch My Roth 401k To A Traditional 401k Plan

You cannot convert a Roth IRA to a traditional IRA, as the Roth is not a conversion, but rather a replacement for the existing Roth 401. Since Roth is after-tax money, it is not possible or allowed to convert it into pre-tax money.

Roth meaning Rosa makes sense to you?The sooner you start a Roth IRA, the better, but when youre going to receive a Roth IRA can still make sense In any case A Roth IRA is an individual retirement account that allows fixed distributions or withdrawals to be free under certain conditions.Why is Ross better than the Irish Republican army?If you are not eligible for a deduction, the best option to contribute to a Roth IRA is if you are eligible for assis

Dont Miss: How To Collect Your 401k From Previous Employer

Best Places For Employee Benefits

SmartAssets interactive map highlights the counties across the country that are best for employee benefits. Zoom between states and the national map to see data points for each region, or look specifically at one of four factors driving our analysis: unemployment rate, percentage of residents contributing to retirement accounts, cost of living and percentage of the population with health insurance.

Can I Roll Over Distributions From A Designated Roth Account To Another Employer’s Designated Roth Account Or Into A Roth Ira

Yes. However, because a distribution from a designated Roth account consists of both pre-tax money and basis , it must be rolled over into a designated Roth account in another plan through a direct rollover. If the distribution is made directly to you and then rolled over within 60 days, the basis portion cannot be rolled over to another designated Roth account, but can be rolled over into a Roth IRA.

If only a portion of the distribution is rolled over, the rolled over portion is treated as consisting first of the amount of the distribution that is includible in gross income. Alternatively, you may roll over the taxable portion of the distribution to another plans designated Roth account within 60 days of receipt. However, your period of participation under the distributing plan is not carried over to the recipient plan for purposes of measuring the 5-taxable-year period under the recipient plan.

The IRS may waive the 60-day rollover requirement in certain situations if you missed the deadline because of circumstances beyond your control. See FAQs: Waivers of the 60-Day Rollover Requirement.

Don’t Miss: Why Cant I Take Money Out Of My 401k

Details Of Roth Ira Contributions

The Roth IRA has contribution limits, which are $6,000 for 2022 and $6,500 for 2023. If youâre age 50 or older, you can contribute an additional $1,000 as a catch-up contribution. Contributions, not earnings, can be withdrawn tax-free at any time.

Itâs worth noting that an investor can have both a Roth and a traditional IRA and contribute to both, but the contribution limits apply across all IRAs. For example, suppose an investor contributes $4,000 to a Roth IRA. In that case, that same investor could contribute $2,000 to their traditional IRA in that same year . If that taxpayer is age 50 or older, they could contribute an additional $1,000.

Can My Employer Match My Designated Roth Contributions Must My Employer Allocate The Matching Contributions To A Designated Roth Account

Yes, your employer can make matching contributions on your designated Roth contributions. However, your employer can only allocate your designated Roth contributions to your designated Roth account. Your employer must allocate any contributions to match designated Roth contributions into a pre-tax account, just like matching contributions on traditional, pre-tax elective contributions.

You May Like: Can You Rollover A 401k To An Annuity

What Is A Designated Roth Contribution

A designated Roth contribution is a type of elective deferral that employees can make to their 401, 403 or governmental 457 retirement plan.

With a designated Roth contribution, the employee irrevocably designates the deferral as an after-tax contribution that the employer must deposit into a designated Roth account. The employer includes the amount of the designated Roth contribution in the employees gross income at the time the employee would have otherwise received the amount in cash if the employee had not made the election. It is subject to all applicable wage-withholding requirements.

The law does not allow designated Roth contributions in SARSEP or SIMPLE IRA plans.

Retirement Plans Faqs On Designated Roth Accounts

A designated Roth account is a separate account in a 401, 403 or governmental 457 plan that holds designated Roth contributions. The amount contributed to a designated Roth account is includible in gross income in the year of the contribution, but eligible distributions from the account are generally tax-free. The employer must separately account for all contributions, gains and losses to this designated Roth account until this account balance is completely distributed.

These FAQs provide general information and should not be cited as legal authority.

Recommended Reading: How Do I Convert A 401k To A Roth Ira

Could You Invest Just 2 Percent More

Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Even 2 percent more from your pay could make a big difference. Enter information about your current situation, your current and proposed new contribution rate, anticipated pay increases and how long the money might be invested, as well as your own assumptions about the growth rate of your investments, and see the difference for yourself*. For additional information, see How to use the Contribution Calculator.

*This calculator is intended to serve as an educational tool, not investment advice. It enables you to enter hypothetical data. The variables you choose are not meant to reflect the performance of any security or current economic conditions. The examples are intended for illustrative purposes only and are not a prediction of investment results.

Calculations are based on the values entered into the calculator and do not take into account any limits imposed by IRS or plan rules. Also, the calculations assume a steady rate of contribution for the number of years invested that is entered.

Dont Miss: How To Retrieve 401k Money

When Must I Be Able To Elect To Make Designated Roth Contributions

You must have an effective opportunity to make an election to make designated Roth contributions at least once during each plan year. The plan must state the rules governing the frequency of the elections. These rules must apply in the same manner to both pre-tax elective contributions and designated Roth contributions. You must make a valid designated Roth election, under your plans rules, before you can place any money in a designated Roth account.

Also Check: How Much Can You Contribute To 401k

Roth 401 Withdrawal Rules

There are three types of withdrawals from a Roth 401: qualified distributions, hardship distributions and non-qualified distributions. Each type has its own rules, pros and cons.

You can start making qualified distributions from a Roth 401 once youve satisfied two conditions: Youre age 59 ½ or older and youve met the five-year rule. This rule states that you must have made your first contribution to the account at least five years before making your first withdrawal. Note that if you retire and roll your Roth 401 balance into a Roth IRA that has been open for more than five years, the five-year requirement is met.

For example, if you started contributing to a Roth 401 at age 58, you would have to wait until you were 63 to begin making qualified distributions.

There are a few other conditions that allow you to withdraw money from your Roth 401 due to hardship, depending on the rules of your plan. These include:

- To pay for medical expenses that exceed 10% of your adjusted gross income.

- You become permanently disabled.

- If youre a member of a military reserve called to active duty.

- If you leave your employer at age 55 or older.

- A Qualified Domestic Retirement Order issued as part of a divorce or court-approved separation.

Additionally, if you die, the full amount in your Roth 401 can be distributed to your named beneficiaries without penalty.

Withdrawals And The Cares Act

The passage of the Coronavirus Aid, Relief, and Economic Security Act in March 2020 allowed for the withdrawal of up to $100,000 from Roth or traditional IRAs without having to pay the 10% early withdrawal fee.

This hardship withdrawal was allowed for those economically affected by the COVID-19 pandemic. The account holder has three years to pay taxes owed on withdrawals vs. having to pay them in the current year. In addition, the withdrawals can be repaid and no taxes owed. The repayment amount doesnât count toward the contribution limit.

Dont Miss: Where Can I Rollover My 401k To An Ira

Recommended Reading: How Do I Cash Out My 401k After Being Fired

Can You Contribute To Both A Roth 401 And A Traditional 401

You can deposit into either the Roth 401 or the traditional 401, as long as your accrued contributions do not exceed the annual contribution limit of 401. Deciding whether it makes sense to save on taxes now or later is an important consideration when choosing between Roth or a traditional 401 plan.

Traditional ira vs roth iraWhat are the advantages and disadvantages of a Roth IRA? Here are the main advantages and disadvantages of accounts and how they differ from traditional IRAs. Withdrawals from a Roth IRA are tax-free if the account has been open for at least five years and you are 59½ or older. In contrast, withdrawals from a traditional IRA are tax-deductible.How do you calculate a Roth IRA?Divide the b

Roth Ira Income Limits 2022 And 2023

The Roth IRA income limit refers to the amount of money you can earn in income before the Roth IRA maximum annual contribution begins to phase down. At some incomes, the ability to contribute to a Roth IRA is eliminated completely.

|

Filing status |

|

|---|---|

|

2022 and 2023: $10,000 or more. |

No contribution allowed. |

You May Like: How To Create A Self Directed 401k

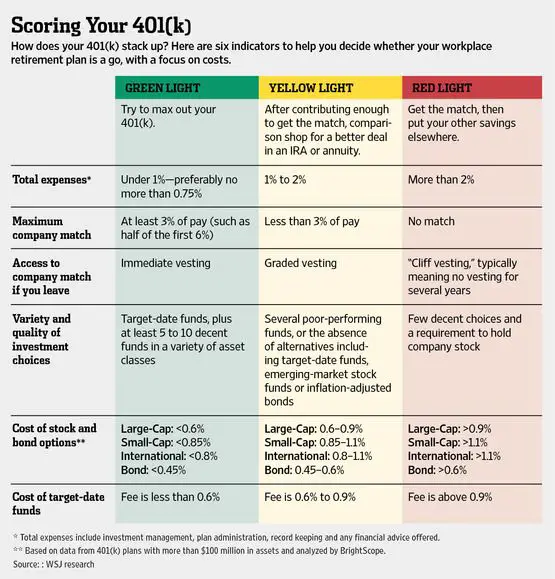

General Pros And Cons Of A 401

Pros

Cons

- Few investment optionsGenerally speaking, 401s have few investment options because they normally originate from employers, they are limited to what is offered through employers’ 401 plans, as compared to a typical, taxable brokerage account.

- High feesCompared to other forms of retirement savings, 401 plans charge higher fees, sometimes as a percentage of funds. This is mainly due to administration costs. Plan participants have little or no control over this, except to choose low-cost index funds or exchange-traded funds to compensate.

- Illiquid 401 funds can only be withdrawn without penalty in rare cases before 59 ½. This includes all contributions and any earnings over time.

- Vesting periodsEmployers may utilize vesting periods, meaning that employer contributions don’t fully belong to employees until after a set point in time. For instance, if an employee were to part ways with their employer and a 401 plan that they were 50% vested in, they can only take half of the value of the assets contributed by their employer.

- Waiting periodsSome employers don’t allow participation in their 401s until after a waiting period is over, usually to reduce employee turnover. 6 month waiting periods are fairly common, while a one-year waiting period is the longest waiting period permitted by law.

How Are These Numbers Calculated

This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

When you make a pre-tax contribution to your retirement savings account, you add the amount of the contribution to your account, but your take home pay is reduced by less than the amount of your contribution. That represents an increase in your take home pay compared to what would happen if you contributed the same amount to a taxable account.

In the following boxes, you’ll need to enter or select:

- Annual Gross Salary Total annual salary before any deductions

- Pay Period How frequently you are paid by your employer

- Federal Income Tax Rate Choose from the dropdown list. Note that the tax calculations are based on your overall tax rate.

- State/Local Tax Rate Percentage to estimate your combined state and local income tax rate this entry is optional.

- Contribution Rate Percentage of your salary you’re currently contributing to your plan account. If you contribute a portion of your salary on a dollar deferral basis, you can convert your dollar deferral portion to a percentage for purposes of this calculator.

Additional Savings Opportunity

Fidelity does not provide legal or tax advice, and the information provided above is general in nature and should not be considered legal or tax advice. Consult with an attorney or tax professional regarding your specific legal or tax situation.

Pretax contributions are subject to the annual IRS dollar limit.

Recommended Reading: How To View My 401k

How Does A Profit

A profit-sharing plan is a retirement plan funded entirely by your employer. If you have a 401 with employee contributions, it is not a profit-sharing plan.

Employers set up profit-sharing plans to decide how much money they want to give each employee. Sometimes, businesses do not give any money for some years. But when they give money, the company has to plan how the money will be divided among the employees.

The most common way businesses determine how to share profits is by using the comp-to-comp method.

- This calculation starts by figuring out the total amount of all employee compensation.

- Then, the company divides each employees annual salary by that total to find what percentage of the profit-sharing plan they are entitled to.

- Finally, that percentage is multiplied by the total amount of shared profits to find how much each employee gets.

Can I Borrow From My 401

This depends on your employer, but in most cases, you can borrow from a traditional or Roth 401. You cant borrow more than the lesser of $50,000 or 50 percent of your balance, and you must repay the loan within five years. The loan can be longer if its for the down payment on a home. You will owe interest on the loan .

The drawback: If you cant repay the loan, its considered an early withdrawal taxes and penalties will apply.

Read Also: Can I Contribute To Both 401k And Ira

Your Employer’s Contribution Limit

Some employers may have a set limit for the percentage you can contribute toward your 401 each paycheck and, depending on how much you get paid, maxing out your employer’s limit may still not be enough for you to max out the federal contribution limit.

For example, a company may allow employees to contribute up to 50% of their paycheck to their 401 account . Or, they may allow up to a 20% contribution per paycheck. It depends on your company, so be sure to double check.

If you’re maxing out your employer’s contribution limit but you still worry that it’s not enough to help you reach your retirement goals, you can also contribute your post-tax income to a Roth IRA account.

A Roth IRA is another type of retirement account but with slightly different rules s which differ from a Roth IRA). You must open the account on your own is). And instead of contributing pre-tax dollars that you’re taxed on when you make withdrawals in retirement, you contribute after-tax dollars and won’t pay taxes on withdrawals later on.

Also, the contribution limits for an IRA are different from that of a 401 you can contribute up to $6,000 per year to a Roth IRA if you’re under age 50, and $7,000 per year if you’re age 50 or older.

How Much Could Your 401 Grow If You Stop Contributing

Now lets examine what happens to your 401 when you stop contributing and your employer does not make any matching contributions either. Using most of the same parameters as before, lets use our 401 Growth Calculator to see how much your 401 will be worth if you stop contributing at age 30, after you have already accumulated $10,000 in your account:

- You are 30 years old right now.

- You have 37 years until you retire.

- You make $50,000/year and expect a 3% annual salary increase.

- Your current 401 balance is $10,000.

- You get paid biweekly.

- You expect your annual before-tax rate of return on your 401 to be 5%.

- Your employer match is 100% up to a maximum of 4%.

- Your current before-tax 401 plan contribution is now 0% per year.

What happens to your previous 401 balance of $795,517? It plummets to $63,485 $732,032 less than before. When you stop contributing to your 401 and have no employer matching contributions, your total 401 balance in year 37 is 92% less. Procrastinating with your retirement savings and your 401 contributions means you have to work much harder and save even more to catch up to where you need to be in order to reach your retirement goals. Learn more about the cost of waiting to save for your retirement.

Also Check: How Much Money To Put In 401k

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.