Understanding The Different Investing Options

The average 401 plan provides about 19 different investment options to choose from. Unless the plan has a default investment option, your contributions could sit in your 401 as cash without being actually invested in anything.

If your contributions are automatically invested in a particular fund, you can always change what your money is invested in. If your 401 plan has an online portal, then you can research different funds and move your money as you please. If not, youâll have to contact your planâs custodian to facilitate moving your money to other investment options.

Your 401 planâs summary plan description will outline the default investment options, the other available investment options, and how to move your money to various funds. Some of the most common funds provided in 401 plans are target-date funds, mutual funds, index funds, and bond funds.

Is A 401 Worth It

Gordon Scott has been an active investor and technical analyst of securities, futures, forex, and penny stocks for 20+ years. He is a member of the Investopedia Financial Review Board and the co-author of Investing to Win. Gordon is a Chartered Market Technician . He is also a member of CMT Association.

You don’t have to master investing to allocate money in your 401 account in a way that meets your long-term goals. Here are three low-effort 401 allocation approaches and two additional strategies that might work if the first three options aren’t available or right for you.

How Much Should I Contribute To My 401

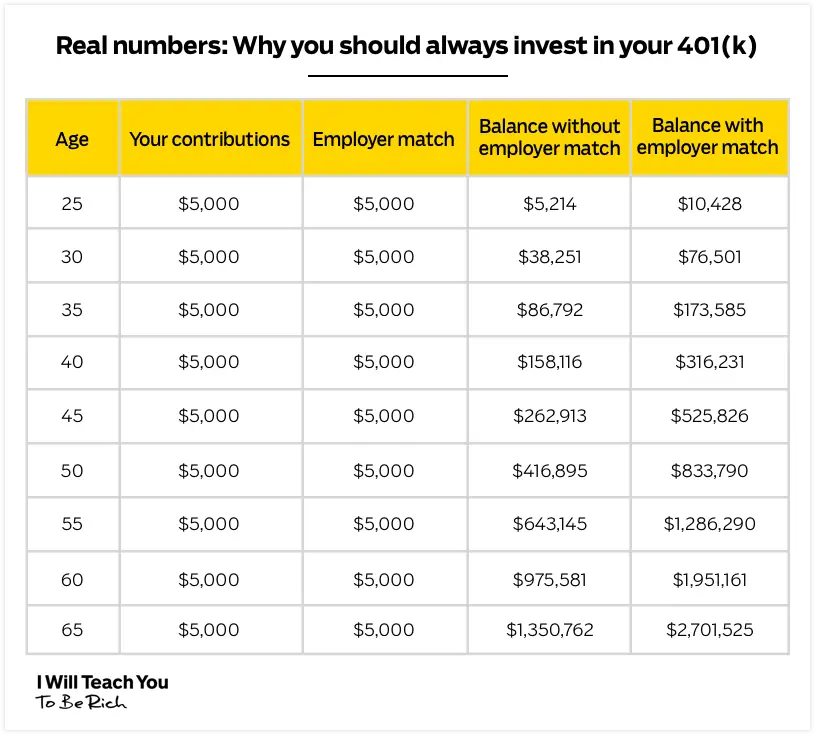

As long as you can afford to do so, it’s often advised that you contribute to your 401 to at least maximize your employer’s contribution. Often, the employer’s contribution maxes out at a defined percentage set by your company. If your company has a generous match, you may be limited by IRS contribution limits.

In addition to making sure you at least get your company’s match, consider contributing more if you have enough cash flow. Whatever you set aside will receive favorable tax treatment and has the potential to appreciate in value.

Don’t Miss: What Time Does Fidelity Update 401k Accounts

Mistake #: Underestimating The Cost And Length Of Retirement

Some crucial factors to take into account:

- Longevity: If you retire around age 65, you could spend a quarter century or more in retirement. Many advisors now urge clients to save enough to last 25 to 30 years.

- Inflation and taxes: Even with relatively mild inflation over the past 25 years, the cost of living has more than doubled. Also consider what taxes youll be paying on the money you distribute from your retirement account.

- Health care: Even with Medicare, you could have expenses for supplemental insurance, some prescription drugs, and nursing home care.

- Lifestyle sticker shock: People in retirement generally need at least 80 percent of their pre-retirement income.

How To Invest For Retirement At Age 60

Retiring early is a dream that many Americans have but most investors arent confident in how to invest in order to achieve that goal. While 65 is considered a normal or expected retirement age, lets take a look at what types of investments and things you should consider if youre planning to retire early by the age of 60. A financial advisor can help you discover how to invest for retirement regardless of your target age with a plan that meets your individual goals.

Also Check: How To Convert Your 401k To A Roth Ira

Two Key 401 Plan Fees

Finding the fees is one thing. Understanding them is another. The most firmly entrenched of the fees is the 12b-1 fee, named after the relevant section of the Investment Company Act of 1940. Generally filed under marketing and distribution expenses, 12b-1 fees are ostensibly earmarked for the intermediaries who sell 401 plans to your employer. These fees are capped at 0.75% of assets, while some funds impose a 0.25% shareholder services fee.

Note that 12b-1 fees charged by individual funds are separate from investment management fees, which are the cut the 401 provider takes for itself.

For example, Fidelity bills itself as the No. 1 recordkeeper of 401 plans in the United States. Businesses that use Fidelity report paying as little as 0.53% in fees, though some say expenses are well over 1%.

401 fees fall into two basic categories: those charged by the plan provider, and those charged by the mutual funds or ETFs in the account.

Are Retirement Savers Actually Changing Course

To answer this question, we looked at the behavior of 401 participants during the first half of 2022 from T. Rowe Prices recordkeeping data. Using collective and anonymized data, we analyzed their exchange activity and changes in their deferral rates during this volatile period.

In general, 401 participants have been staying the course. Based on our research, over 95% of 401 participants have not made any investment exchanges during the first half of 2022. But underlying that, there are some noticeable trends.

Apart from exchanges, 401 participants can also change their deferral rates in response to market conditions, but other factors may also be at work. For most of the first half of 2022, average deferral rates stayed relatively stable. More recently, though, the average has trended downward, suggesting that cutting back on contributions is one way workers may be coping with inflation at fourdecade highs. If high inflation persists and the downward trend in deferral rates is prolonged, then it could become problematic because retirement savings might fall.

Average Deferral Rate Has Remained Stable

Weekly average deferral rate during the first and second quarter of 2022

As of July 1, 2022.401 participants of plans with approximate assets> $25m. during the first half of 2022 from T. Rowe Prices record-keeping data.Source: T. Rowe Price.

Recommended Reading: How Do I Sign Up For 401k

Get An Automated Micro

Small savings add up quickly.

A wave of micro-investing apps have allowed users to invest spare money in small amounts in selected exchange-traded funds , which are securities that track a basket of stocks, bonds, commodities, or indexes like the S& P 500 index, for instance. You can often select a ready-made portfolio depending on your risk tolerance and invest as little as $5 each day.

Take Acorns as an example: It automatically invests a small amount of your money daily, weekly, or monthly. One of Acorns interesting features is rounding up your purchases to the nearest full dollar amount and makes the change available for you to invest.

Lets say you used a credit card to buy a cup of coffee for $2.75. You can choose to invest the 25 cents on the app, or Acorns will invest the change for you if you elect automatic-roundup investments. Its free to open an Acorns account. The app charges $1 per month if your balance is under $5,000, or 0.25 percent per year if your balance is $5,000 or more.

Weve reviewed four micro-investing apps. Read more about their features here.

Best for: People with cash sitting idle in their checking account. And those who have the best intention to save but struggle to get over the emotional barrier. The automated apps help you save spare money and potentially grow it through investing.

After Establishing The Plan

Once your portfolio is in place, monitor its performance. Keep in mind that various sectors of the stock market do not always move in lockstep. For example, if your portfolio contains both large-cap and small-cap stocks, it is very likely that the small-cap portion of the portfolio will grow more quickly than the large-cap portion. If this occurs, it may be time to rebalance your portfolio by selling some of your small-cap holdings and reinvesting the proceeds in large-cap stocks.

While it may seem counter-intuitive to sell the best-performing asset in your portfolio and replace it with an asset that has not performed as well, keep in mind that your goal is to maintain your chosen asset allocation. When one portion of your portfolio grows more rapidly than another, your asset allocation is skewed toward the best-performing asset. If nothing about your financial goals has changed, rebalancing to maintain your desired asset allocation is a sound investment strategy.

Borrowing against 401 assets can be tempting if times get tight. However, doing this effectively nullifies the tax benefits of investing in a defined-benefit plan since you’ll have to repay the loan in after-tax dollars. On top of that, you will be assessed interest and possibly fees on the loan. Plus, you will often not be able to make 401 contributions until the loan has been paid off.

Also Check: How To Access An Old 401k Account

Review Your Specific Situation

In a down market, its important to keep your eyes on the prize, the prize, in this case, being a comfortable retirement. Take a look at your goals, which will tell you how much money you will need to retire. If you dont know this already, its a good time to crunch some numbers and try to figure it out. Then you can adjust your strategy to make it more likely that you will achieve those goals.

Consider how much you have saved already and how much you will save between now and retirement. Then figure in your expected rate of return, which will depend on how your assets are invested. Finally, factor in what you expect to spend during retirement, and see if you need to make adjustments in order to get to where you want to be.

How Do I Invest In Stocks

Although the world of finance is filled with financial gurus who seem to complicate the ideas and concepts surrounding the stock market and how to invest, dont let it intimidate you. All it comes down to is putting your money in companies that are financially stable and monitoring them as necessary.

That being said, nothing beats being an educated investor, so before you start investing in stocks, lets get familiar with the concept of the stock market and how stocks work.

When you hear people discuss the stock market, they are most likely referring to what is known as the Dow Jones Industrial Average or the Standard& Poors 500 , which are the major indexes that show how the various companies that make up the stock market perform. However, as an investor, its essential to understand that the stock market is a place where regular people can buy and sell stocks, which, as we now know, are fractional pieces of the companies we buy ownership into.

Some of the terms to be familiar with include:

Although these are just a few of the terms youll come across in your journey on how to get into the stock market, you will find them helpful in gaining an overall understanding that will come in handy as you continue to learn.

You May Like: What Is A Roth Ira Vs 401k

Come To Terms With Risk

Some people think investing is too risky, but the risk is actually in holding cash. Thats right: Youll lose money if you dont invest your retirement savings.

Lets say you have $10,000. Uninvested, it could be worth less than half that in 30 years, factoring in inflation. But invest 401 money at a 7% return, and youll have over $75,000 by the time you retire and thats with no further contributions. calculator to do the math.)

Clearly youre better off putting your cash to work. But how?

The answer is a careful asset allocation, the process of deciding where your money will be invested. Asset allocation spreads out risk. Stocks often called equities are the riskiest way to invest bonds and other fixed-income investments are the least risky. Just as you wouldnt park your life savings in cash, you wouldnt bet it all on a spectacular return from a startup IPO.

Instead, you want a road map that allows for the appropriate amount of risk and keeps you pointed in the right long-term direction.

How Much Money Should You Invest

If youre still a long way from retirement and struggling with current issues, you might think your 401 isnt exactly a priority. However, the combination of employer match and tax benefits make the theme irresistible.

When youre starting out, your goal should be to make a minimum payment on your 401. That minimum should be the amount that qualifies for your employers full match. To get the full tax savings, you must contribute a maximum annual contribution.Lately, most employers contribute a little less than 50 cents for every dollar the employee puts in, or 6% of your salary. This is a 3% salary bonus. Plus, youre reducing your federal taxable income when you contribute to the plan.

As your retirement date approaches, you may also begin to accumulate a higher percentage of your income. Considering the time horizon isnt that far off, the dollar value is probably much larger than it was in your early years, even when we factor in inflation and income growth. For the year 2022, taxpayers can contribute up to $20,500 of their pre-tax income, while people over 50 can contribute an additional $6,500.

In addition to this, as you get closer to retirement, you can start reducing your marginal taxes by contributing to your companys 401 plan. When you retire, your taxes may drop, allowing you to withdraw your funds at a lower tax assessment percentage.

Don’t Miss: How To Move 401k Into Ira

Finding The Fees In 401s

Many workers dont. A TD Ameritrade survey found that just 27% of investors knew how much they paid in 401 fees, and 37% didnt realize they paid fees at all. Unfortunately, many never think to ask how much a 401 provider makes off the money you hand over to invest. Your provider takes a fee every month, and over time these fees can impact your returns. Some 95% of 401 plan participants pay fees.

These fees arent truly hidden. The U.S. Department of Labor requires 401 providers to disclose all fees in a prospectus that is given to you when you enroll in a plan, and which must be updated every year.

We know you devour these statements the minute they arrive. As the fees are no longer difficult to locate, it pays to pay attention to them. When you receive a 401 statement or prospectus, check for line items or categories such as Total Asset-Based Fees, Total Operating Expenses As a %, and Expense Ratios.

What Are The Risks Of Moving My 401 To Bonds

The risks of moving your 401 to bonds include:

- Missing out on gains: If the stock market goes up, you will miss out on the potential gains.

- Income risk: If interest rates go up, the income from your bonds will go down. This can be a problem if you are relying on that income to live on in retirement.

- Reinvestment risk: If you need to sell your bonds before they mature, you may get less than paid for them if interest rates have gone down.

Don’t Miss: How Much Can I Borrow Against My 401k

Things To Know Before Opening A 401 Brokerage Account

If you’re considering a 401 brokerage account, the first thing you must decide is what percentage of your retirement savings you’d like to put there. You can put all of it there if you’d like, but it may be better to leave part of it in a mutual fund chosen by your employer, just to be safe.

You should also note that some 401s only allow you to transfer funds to a brokerage account during a certain window each year. If this is the case for your plan, make a note of this time frame so you don’t miss it.

Next, look into the account maintenance fees and any other fees associated with the investment products you’re considering. Ideally, you can keep these at or below 1% of your assets. That means you’ll pay $1,000 or less per year for every $100,000 you have in the account. If you plan to employ a financial adviser to help manage or offer suggestions for your 401 brokerage account, don’t forget to factor in those fees as well.

If a 401 brokerage account isn’t a good fit for you, go with one of your employer’s investment selections instead. This is the safer bet if you don’t have the time or interest to learn more about investing. These are your retirement savings at stake, so you don’t want to take unnecessary risks.

The Motley Fool has a disclosure policy.

Pros And Cons Of 401 Brokerage Options

Expanded investment choices make this self-directed approach a double-edged sword for 401 investors.

| For more news you can use to help guide your financial life, visit our Insights page. |

Important legal information about the e-mail you will be sending.

Content for this page, unless otherwise indicated with a Fidelity pyramid logo, is selected and published by Fidelity Interactive Content Services LLC , a Fidelity company. All Web pages published by FICS will contain this legend.Fidelity Brokerage Services LLC Before investing, consider the funds investment objectives, risks, charges, and expenses. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. Read it carefully.

Also Check: Can You Take A Loan From 401k For Home Purchase

Read Also: How Much Tax On 401k Distribution

Contribute Enough To Max Out Your Match

Employers often match contributions you make to your own 401 plan. For example, your employer might match 50% of your contributions up to a maximum of 4% of your salary.

This is free money, but you can claim it only if you invest at least enough to max out your company’s matching funds. This is the only investment option that gives you a guaranteed 100% return on invested funds immediately with no risk, so it’s smart to always max out your match before investing in any other retirement accounts.