Can You Have A 401 And An Ira

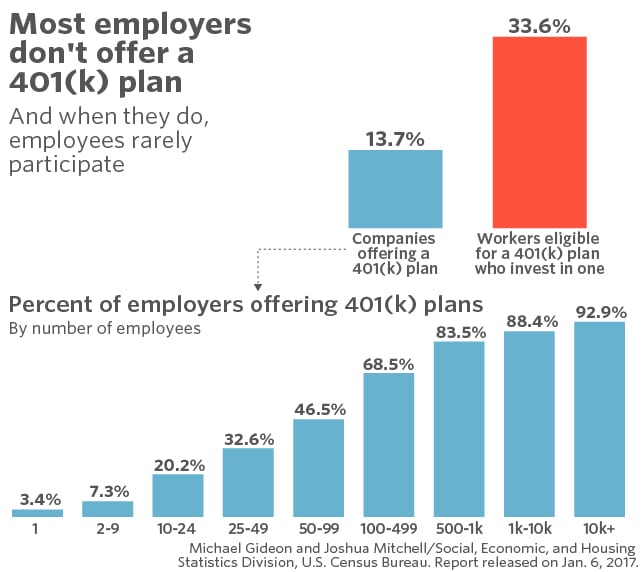

Save as much as you can, for as long as you can: Thats what nearly every financial professional encourages for retirement. So why dont more people contribute to a 401 and an individual retirement account at the same time? Awareness, says Jeremy Smalley, senior retirement education specialist at Principal®. Those two types of accounts can work together, and both have advantages.

If you didnt know before, now you do: Generally, you can contribute to a 401 if you have an IRAand contribute to an IRA if you have a 401. Heres why its a savings strategy to consider.

Tip:Brush up on how you can protect your retirement from market volatility.

Who Is Eligible For A Roth 401

If your employer offers it, youre eligible. Unlike a Roth IRA, a Roth 401 has no income limits. Thats a fantastic feature of the Roth option! No matter how much money you earn, you can contribute to a Roth 401.

If you dont have access to a Roth option at work, you can still take advantage of the Roth benefits by working with your investment professional to open a Roth IRA.

Can I Roll Over Distributions From A Designated Roth Account To Another Employer’s Designated Roth Account Or Into A Roth Ira

Yes. However, because a distribution from a designated Roth account consists of both pre-tax money and basis , it must be rolled over into a designated Roth account in another plan through a direct rollover. If the distribution is made directly to you and then rolled over within 60 days, the basis portion cannot be rolled over to another designated Roth account, but can be rolled over into a Roth IRA.

If only a portion of the distribution is rolled over, the rolled over portion is treated as consisting first of the amount of the distribution that is includible in gross income. Alternatively, you may roll over the taxable portion of the distribution to another plans designated Roth account within 60 days of receipt. However, your period of participation under the distributing plan is not carried over to the recipient plan for purposes of measuring the 5-taxable-year period under the recipient plan.

The IRS may waive the 60-day rollover requirement in certain situations if you missed the deadline because of circumstances beyond your control. See FAQs: Waivers of the 60-Day Rollover Requirement.

You May Like: How To Save Without 401k

Roth 401 Vs : How Are They Different

The biggest difference between a Roth 401 and a traditional 401 is how the money you put in is taxed. Taxes are already super confusing , so lets start with a simple definition, and then well dive into the details.

A Roth 401 is a post-tax retirement savings account. That means your contributions have already been taxed before they go into your Roth account.

On the other hand, a traditional 401 is a pretax savings account. When you invest in a traditional 401, your contributions go in before theyre taxed, which makes your taxable income lower.

Which Will Work Better For You

Fortunately, most people wont have to make a choice between a Roth IRA and a Roth 401. Thats because current law allows you to have both. That is, you can have a 401 plan with a Roth 401 provision and still fund a Roth IRA. You can do that as long as your income does not exceed the limits required for making a Roth IRA contribution.

Theres also a maximum combined limit for contributions to all retirement plans. For 2022, its $61,000, or $67,500 if youre 50 or older. The Roth 401, because it is part of a 401 plan in general, provides much higher contribution limits. This will enable you to save a very large amount of money. As well, you always have the choice to allocate some of your 401 contribution into a regular 401. That means that the portion contributed to the traditional 401 will be tax-deductible.

Still, the big advantage to also having the Roth IRA is the fact you can access many more investment options. That means you can make the best of the investment selections offered within your 401 plan, but still expand your investing activities through your Roth IRA based on your goals.

Finally, dont forget that having a Roth IRA means you will already have an account in place if you leave your employer and need an account to transfer your Roth 401 into. In addition, you could also do a Roth IRA conversion of the balance thats in your traditional 401 plan.

You May Like: Can You Take Money From 401k Without Penalty

Retirement Contribution Growth Over Time

| AGE |

| $6,439,708.09 |

Based on the above chart, you can see how 401 savings can really start adding up over time. The no growth end assumes a consistent maximum contribution at the 2022 limit of $20,500 after the first year contribution of $8,000 with zero company match and zero growth. The 8% growth column assumes a consistent maximum contribution of $20,500 plus an 8% annual rate of return with zero company match.

Can You Max Out Both A Roth 401k And Roth Ira

You can contribute a maximum of $19,500 in 2021 to a Roth 401âthe same amount as a traditional 401. Between the two, you can invest up to $25,500 in 2021 into a Roth 401 and Roth IRAâor even more, if you reach the 50-year threshold by the end of the year.

Does Roth 401k count towards Roth IRA limit?

Having a Roth 401 plan at work does not limit your ability to contribute to your personal Roth IRA. Depending on your income, you may have to fund a traditional IRA and then convert to a Roth IRA.

Can you max out two ROTH IRAs?

There is no limit to the number of IRAs you can have. You can even have multiples of the same type of IRA, meaning you can have multiple Roth IRAs, SEP IRAs, and traditional IRAs. you are free to split the money between IRA types in any given year, if you wish.

Recommended Reading: How Long Do I Have To Transfer My 401k

Can You Lose Money In A Roth 401 K

There are no tax consequences when you take money out of a Roth 401 when you’re 59½ and you have met the five-year rule. If you need $20,000, take out the $20,000, and no taxes are due. If you take a similar distribution from a traditional 401 plan, the money you withdraw is subject to ordinary income tax.

What Are The Similarities Between A Roth 401 And A Traditional 401

Now that we know the differences between a Roth 401 and a traditional 401, lets talk about how theyre similar.

The Roth 401 includes some of the best features of a 401, but thats where their similarities end.

Don’t Miss: What Should My 401k Contribution Be

Is A Roth Ira Ever A Bad Idea

A Roth IRA isnt necessarily a bad idea if you qualify for a suitable employer through your employers workplace retirement plan, but its not a great first choice. You can contribute up to $19,500 for a 401 in 2020 or $26,000 if you are 50 or older, compared to just $6,000 and $7,000, respectively, for a Roth IRA.

Is Roth IRA for poor people?

Only those fortunate enough to earn less than $140,000 per year as individuals or less than $208,000 for married couples can contribute the full amount of a Roth IRA for 2021. After earning more than $140,000 a year for singles and $208,000 for married couples, you cannot contribute. to a Roth IRA.

Who should not convert to a Roth IRA?

If you are less than five years away from retirement, it may not make sense to switch to a Roth IRA. Roth conversions will trigger taxes, so you must be willing and able to pay those taxes.

Prev Post

Trustee And Investment Selection

This is another area that usually favors Roth IRA plans. As a self-directed account, a Roth IRA can be held with the trustee of your choosing. That means you can decide on an investment platform for the account that meets your requirements for both fees and investment selection.

You can choose a platform that charges low fees, as well as one that offers the widest variety of potential investments. You can even open your Roth IRA with one of the best online brokerage firms.

But with a Roth 401, since its part of an employer-sponsored plan, you will likely have no choice in the matter. This is one of the biggest issues people have with employer-sponsored plans. The trustee selected by the employer may charge higher than normal fees.

They also commonly restrict your investment options. For example, while you might choose a trustee for a Roth IRA that has virtually unlimited investment options, the trustee for a Roth 401 may limit you to no more than a half a dozen investment choices.

Recommended Reading: Can I Check My 401k Online

Roth Ira Or Roth : Which Is Better

Determining which account will best suit your needs depends on your current and future financial situations, as well as your own specific goals.

High earners who want to make contributions to retirement accounts each year should consider a Roth 401, because they have no income caps. Additionally, individuals who want to make large contributions can put more than three times the amount in a Roth 401 as in a Roth IRA.

Those who want more flexibility with their funds, including no required distributions, might lean toward a Roth IRA. This would be especially helpful if you want to leave the account to an heir. But Roth 401 accounts can be rolled over into a Roth IRA later in life anyway.

Tips For Getting Retirement

- Consider working with a financial advisor to help you meet your retirement goals. Finding one who fits your needs doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Figure out how much you need to save to retire comfortably. An easy way to get ahead on saving for retirement is by taking advantage of employer 401 matching.

Also Check: Is It Good To Have A 401k

What Is The Biggest Advantage Of A Roth Ira

Roth IRAs offer several key benefits, including tax-free growth, tax-free withdrawals in retirement, and no minimum distribution required, but they also have their drawbacks. One major drawback: Roth IRA contributions are made on an after-tax basis, meaning there is no tax deduction in the year of contribution.

Are there any tax advantages to a Roth IRA?

There are many advantages to keeping your money in a Roth IRA. Roth IRAs offer tax-free growth on both contributions and income earned over the years. If you play by the rules, you will not pay taxes when you take the money.

What is the main advantage of a Roth IRA?

A Roth IRA is a retirement savings account that allows your money to grow tax-free. You fund Roth with after-tax dollars, meaning youve paid taxes on the money you put in. In return for no upfront tax deductions, your money grows and grows tax free, and when you withdraw in retirement, you pay no taxes.

Yes But The Tax Breaks You Receive May Be Limited By Your Income

The quick answer is yes, you can have both a 401 and an individual retirement account at the same time. Actually, it is quite common to have both types of accounts. These plans share similarities in that they offer the opportunity for tax-deferred savings or Roth IRA, tax-free earnings). However, depending on your individual situation, you may or may not be eligible for tax-advantaged contributions to both of them in any given tax year.

If you have a retirement plan at work, your tax deduction for a traditional IRA may be limitedor you may not be eligible for a deduction, depending on your modified adjusted gross income .

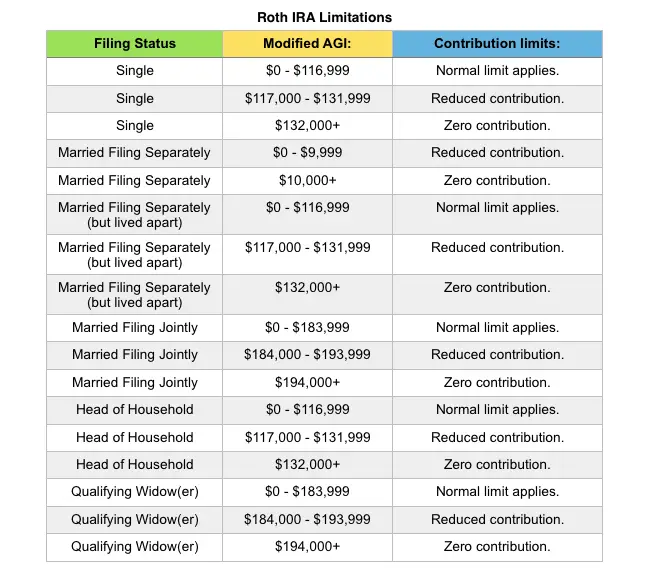

You can, however, still make nondeductible contributions. And if your income exceeds certain thresholds, you may not be eligible to contribute to a Roth IRA at all.

Don’t Miss: What Can You Do With Your 401k

Ira Benefits And Drawbacks

The investment choices for IRA accounts are vast. Unlike a 401 plan, where you’re likely to be limited to a single provider, you can buy stocks, bonds, mutual funds, ETFs, and other investments for your IRA at any provider you choose. That can make finding a low-cost, solid-performing option easy.

However, the amount of money you can contribute to an IRA is much lower than with 401s. For 2021 and 2022, the maximum allowable contribution to a traditional or Roth IRA is $6,000 a year, or $7,000 if you are age 50 or older. If you have both types of IRAs, the limit applies to all of your IRAs combined.

An added attraction of traditional IRAs is the potential tax-deductibility of your contributions. But, the deduction is only allowed if you meet the modified adjusted gross income requirements. Also, it is subject to phase out if you have a workplace retirement plan and make above a certain amount.

For single taxpayers covered by a workplace retirement plan, the phase-out range in 2022 is $68,000 to $78,000, up from $66,000 to $76,000 in 2021. For married couples filing jointly, if the spouse making the IRA contribution is covered by a workplace retirement plan, the phase-out range is $109,000 to $129,000 in 2022, up from $105,000 to $125,000 in 2021.

Having earned income is a requirement for contributing to an IRA, but a spousal IRA lets a working spouse contribute to an IRA for their nonworking spouse, making it possible for the couple to double their retirement savings.

How To Get Money Into A Roth Ira Even If You’re Not Eligible To Contribute

Savvy savers can still get money into a Roth IRA even if they’re not eligible to contribute to one directly. They can utilize the backdoor Roth IRA strategy.

This involves making a nondeductible contribution to a traditional IRA and converting those funds into a Roth IRA.

If you have other IRA accounts with pre-tax contributions in them, you’ll have to mind the pro rata rule. This makes the backdoor Roth strategy ineffective. You can get around the problem if your work 401 allows rollovers from an IRA. Roll over your pre-tax IRA funds into the 401 and then use the backdoor Roth conversion.

Read Also: What Do You Do With Your 401k When You Quit

Who Is Responsible For Keeping Track Of The Designated Roth Contributions And 5

The plan administrator is responsible for keeping track of the amount of designated Roth contributions made for each employee and the date of the first designated Roth contribution for calculating an employees 5-taxable-year period. In addition, the plan administrator of a plan directly rolling over a distribution would be required to provide the administrator of the plan accepting the eligible rollover distribution) with a statement indicating either the first year of the 5-taxable-year period for the employee and the portion of the distribution attributable to basis or that the distribution is a qualified distribution.

Ira Deduction Limits For 2022

If you save with both a 401 and a traditional IRA, you may also face some limits on your ability to deduct your contributions depending on your income. Contributions to a Roth are never deductible.

For instance, if you are covered by a retirement plan at work:

- You can deduct up to the contribution limit, if youre single and your Modified Adjusted Gross Income is $68,000 or less for 2022. You can take a partial deduction if your income is between $68,000 and $78,000 in 2022. Theres no deduction for people who earn more than $78,000 in 2022.

- If youre married and filing jointly, you can deduct the full amount if your MAGI is $109,000 or less in 2022. You can take a partial deduction if your income is between $109,000 and $129,000 in 2022. Theres no deduction if you earn more than $129,000 in 2022.

Making pre-tax IRA contributions is a great way to save on taxes and invest for retirement. If your MAGI is above the threshold, your contribution would be considered nondeductible. There may be alternative and potentially better strategies to explore instead of making nondeductible contributions. Some other avenues to consider would be a Roth IRA and a taxable brokerage account.

Don’t Miss: Can 401k Be Transferred To Roth Ira

Is Income Tax Withholding Required On In

There is no income tax withholding required on an in-plan Roth direct rollover. However, if you receive a distribution from your plan, the plan must withhold 20% federal income tax on the untaxed amount even if you later roll over the distribution to a designated Roth account within 60 days. The IRS may waive the 60-day rollover requirement in certain situations if you missed the deadline because of circumstances beyond your control. See FAQs: Waivers of the 60-Day Rollover Requirement.