Automatically Enrolling Employees Into The Plan Theres A Tax Credit For That

For years, companies that offered 401 plans did so on an opt-in basis. Vanguards How America Saves report finds that plan participation rate for these voluntary contribution plans hovers around 60%. But as the government woke up to the reality of having too many retirees with too little retirement income, it promoted 401 automatic enrollment, whereby an employee must actively opt out of the plan. Automatic enrollment plans have become quite popular as employees have been shown to embrace them, with low opt-out rates. In fact, Vanguard reports a 92% automatic enrollment plan participation rate, meaning more Americans are saving through employer-sponsored retirement plans today.

The most recent example of the governments support for automatic enrollment is the SECURE Act provision that gives employers whose plans have that feature an annual tax credit of up to $500/year for 3 years, for a total of $1,500. Remember, this credit is only for companies with fewer than 100 employees. However, it is available not just to brand new plans but also to existing plans that decide to add the automatic enrollment feature.

What Is A Partial 401 Match

With a partial 401 match, an employerâs contribution is a fraction of an employeeâs contribution, and the employerâs total contribution is capped as a percentage of the employeeâs salary. According to Jean Young, a senior research associate with Vanguard Investment Strategy Group, partial matching is the most commonly used matching formula in Vanguard 401 plans.

âMatching structures vary by plan,â said Young. âIn fact, we keep records on over 150 unique match formulas. But the most commonly offered match is $0.50 on the dollar, on the first 6% of pay. About one in five Vanguard plans provided this exact matching formula in 2018.â

Letâs say you earn $40,000 per year and contribute $2,400 to your 401â6% of your salary. If your employer offers to match $0.50 of each dollar you contribute up to 6% of your pay, they would add $1,200 each year to your 401 account, boosting your total annual contributions to $3,600.

How 401 Profit Sharing Helps Businesses Lower Taxes Maximizes Owner Savings And Rewards Employees

401 plans provide this pretty sweet, optional feature called profit sharing. Donât let the name fool you. It has nothing to do with whether your business earned a profit.

401 profit sharing enables employers to give employees including owners a discretionary contribution. The profit share contribution is typically 100% tax deductible for the firm, which can help the firm lower taxes versus other profit-sharing options the business may consider. So, if you do $100,000 in profit sharing, you likely just lowered your business tax bill by $100,000. The profit share also isnât subject to Social Security or Medicare withholdings.

For you and your employees, itâs bonus with tax benefits. You boost employees’ retirement accounts without increasing their taxable income. This could be worth more to employees literally and figuratively than a similar after-tax bonus.

Reward employees and lower taxes â you can see the appeal. Itâs a common practice for savvy businesses to execute during years they perform well, and less so in years the business may have weaker results. You can even profit share using a vesting schedule and use it as an employee retention tool too.

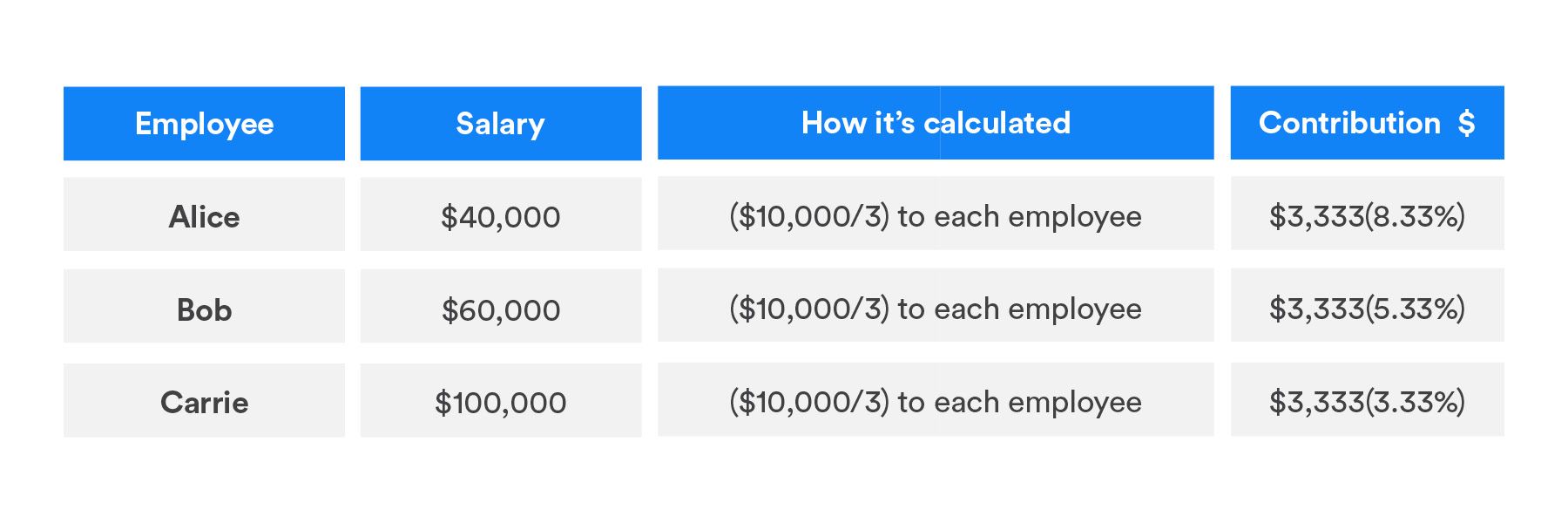

Profit sharing can be given on a whole dollar amount where everyone gets the same, a salary percentage, or on a social security integrated basis . There are also Advanced Profit Sharing options which can help you determine different amounts or percentages by employee groups.

EmployeeSalaryCalculationContribution

Read Also: How Much Should I Put In My 401k

Alternatives For Reducing Taxable Income

Aside from contributing to a traditional 401 account, there are other ways to reduce taxable income while putting money away for the future.

Traditional IRA:Traditional IRAs are one type of retirement plan that can lower taxable income. Individuals may be able to deduct their traditional IRA contributions on their individual federal income tax returns. The deduction is typically available in full if an individual doesnt have retirement plan coverage offered by their work. Their deduction may be limited if they or their spouse are offered a retirement plan at work and their income exceeds certain levels.

are a possible alternative investment account for individuals who are self-employed and dont have access to an employee sponsored 401. Taxpayers who are self-employed and contribute to an SEP IRA can qualify for tax deductions.

403 Plans: A 403 plan is a retirement plan that select employees may qualify for, such as employees of public schools and tax-exempt organizations, and certain ministers. Employees with 403 plans can contribute some of their salary to the plan, as can their employer. As with a traditional 401 plan, the participant doesnt need to pay income tax on any allowable contributions, earnings, or gains until they begin to withdraw from the plan.

Letter Ruling Letter Ruling 83

| Date: |

|---|

May 12, 1983

You inquire about the Massachusetts income tax treatment of contributions to a qualified trust described in Section 401 of the Internal Revenue Code which includes a “cash or deferred arrangement” described in Section 401 of the Code.

A “cash or deferred arrangement” is any arrangement which is part of a qualified profit-sharing or stock bonus plan and under which a covered employee may elect to have the employer make payments to a trust under the plan on his behalf, or to the employee directly in cash employee directed employer contributions are not distributable to plan participants or other beneficiaries earlier than upon retirement, death, disability, separation from service, hardship or attainment of age 59½ and which provides that an employee’s right to his accrued benefit derived from such employer contributions is nonforfeitable.

A qualified trust described in Section 401 is exempt from taxation. ). Under Section 402 of the Code amounts actually distributed or made available to any distributee from a qualified trust are taxable to him under Section 72 of the Code in the year so distributed or made available.

Employee compensation is subject to Massachusetts income tax withholding if it is taxable under Chapter 62, and it constitutes “wages” as defined in Section 3401 of the Code. . Amounts paid on behalf of an employee to a qualified trust are not wages. ).

Based on the foregoing it is ruled:

Very truly yours,

You May Like: How To Use Your 401k Money

Property Acquired Before 1991 Or From A Non

If you acquired property before 1991, you did not pay the GST/HST. Also, you do not generally pay the GST/HST when you acquire property from a non-registrant. As a result, you cannot claim an ITC under these circumstances. However, if you make this property available to your employee and the benefit is taxable for income tax purposes, you may still be considered to have collected the GST/HST on this benefit.

Example

You bought a passenger vehicle from a non-registrant and made it available to your employee throughout 2021. The passenger vehicle is used more than 90% in the commercial activities of your business. You report the value of the benefit, including the GST/HST and if applicable, the PST, on the employee’s T4 slip. For GST/HST purposes, you will be considered to have collected the GST/HST on this benefit even if you could not claim an ITC on the purchase of the passenger vehicle.

Examples for remitting GST/HST on employee benefits

The following examples will help you apply the rules for remitting the GST/HST on employee benefits.

Automobile benefit See examples in the section on Automobile benefits standby charges, operating expense benefit, and reimbursements.

HST considered to have been collected on the motor vehicle benefit = $5,100 × 14/114 = $626.32

Note

The calculation of the amount of GST/HST you are considered to have collected on the motor vehicle benefit differs from that of an amount calculated on an automobile benefit.

What Are 401 Matching Contributions

If your employer offers 401 matching contributions, that means they deposit money in your 401 account to match the contributions you make, up to a certain threshold. Depending on the terms of the 401 plan, an employer may choose to match your contributions dollar-for-dollar or offer a partial match. Some employers may also make non-matching 401 contributions.

Matching contributions arenât required by law, and not all employers offer them as part of their 401 plans. But according to Katie Taylor, vice president of thought leadership at Fidelity Investments, a 401 match can be a core employee benefit that helps an organization retain talent and build strong teams.

âAbout 85% of the employers we work with offer some sort of matching contribution,â said Taylor. âThe average employer contribution dollar amount into 401s in 2019 was $4,100, which equates to a little bit more than $1,000 per quarter.â

Some 401 plans vest employer contributions over the course of several years. This means you must remain at the company for a set period of time before you fully take ownership of your employerâs matching contributions. Employers use vesting to incentivize employees to remain at the company. When you complete the schedule, you are said to be âfully vested.â

Recommended Reading: How To Find Out Whats In My 401k

Cellular Phone And Internet Services

If you provide your employee with a cell phone that you own, to help carry out their employment duties, the fair market value of the cell phone or device is not a taxable benefit.

However, if you reimburse your employee for the cost of their own cell phone , the FMV of the cell phone or device is considered a taxable benefit to the employee. This is the case even if the employee used, lost, or damaged the cell phone or device while carrying out their employment duties.

If you pay for, or reimburse the cost of an employees cell phone service plan, or Internet service at home to help carry out their employment duties, the portion used for employment purposes is not a taxable benefit.

If part of the use of the cell phone or Internet service is personal, you have to include the value of the personal use in your employee’s income as a taxable benefit. The value of the benefit is based on the FMV of the service, minus any amounts your employee reimburses you. You can only use your cost to calculate the value of the benefit if it reflects the FMV.

For cellular phone service only, we do not consider your employee’s personal use of the cellular phone service to be a taxable benefit if all of the following apply:

- the plan’s cost is reasonable

- the plan is a basic plan with a fixed cost

- your employee’s personal use of the service does not result in charges that are more than the basic plan cost

Note

Your 2022 Guide To Employer Match And 401 Contribution Limits

Offering a matching 401 plan to your team is a great way to attract high-quality employees to your company. An employer-matched 401 can also help reduce employee churn as individuals recognize the financial significance of this benefit.

Many companies now opt for a 401 employer match program, rather than the traditional pension plan. Employer-matched 401 contributions allow for tax deductions for the employer. For this reason, there are 401 matching limits for how much employers can contribute to their employees 401 savings plans.

Learn more about what a 401 plan is, how employer matching works and the max 401 contribution company match limits over the past few years, including 2022 limits.

Don’t Miss: What Do I Need To Rollover My 401k

Do You Need To Deduct 401 Contributions On Your Tax Return

You do not need to deduct 401 contributions on your tax return. In fact, there is no way for you to deduct that money.

When employers report your earnings at the end of the year, they account for the fact that you made 401 contributions. To give you an example, lets say you have a salary of $50,000 and you contribute $5,000 into a 401 account. Only $45,000 of your salary is taxable income. Your employer will report that $45,000 on your W-2. So if you try to deduct the $5,000 when you file your taxes, you will be double-counting your contributions, which is incorrect.

Uniforms And Protective Clothing

Your employee does not receive a taxable benefit if either of the following conditions apply:

- you supply your employee with a distinctive uniform they have to wear while carrying out the employment duties

- you provide your employee with protective clothing designed to protect them from hazards associated with the employment

If you reimburse or pay an accountable advance to your employee to buy uniforms or protective clothing and require receipts to support the purchases, the reimbursement or accountable advance is not a taxable benefit if:

- the cost of the uniforms or protective clothing is reasonable

If you pay an allowance to your employee for the cost of protective clothing and did not require receipts to support the purchases, the allowance is not a taxable benefit if all of the following conditions apply:

- the employee used the allowance to buy protective clothing

- the amount of the allowance is reasonable

You may pay a laundry or dry cleaner to clean uniforms and protective clothing for your employee or you may pay a reasonable allowance to your employee . You may also reimburse the employee for these expenses when they present a receipt. If you do either of these, the amounts you pay are not taxable benefits for the employee.

Don’t Miss: How To Open A Solo 401k Account

The Tax Benefits Of Saving For Retirement In A Pre

Scott Spann is an investing and retirement expert for The Balance. He is a certified financial planner with over two decades experience. Scott currently is senior director of financial education at BrightPlan. Scott is also a published author and an adjunct professor at Maryville University, where he teaches personal finance.

The Balance / Katie Kerpel

Congress established 401 plans to encourage and help workers to save for retirement. Traditional 401 plans offer major tax benefits at the time you’re making contributions. You also accumulate the money to achieve financial independence later down the road in retirement.

How Does Employer Match Count Toward 401 Limits

Some employers offer a 401 employer matching plan, which means they match the amount of pay an employee contributes toward their 401. The amount an employer matches can vary, depending on the company and IRS limits. Some employers match a portion of the employees contribution, while others match the full amount.

You can make the same contribution for all employees, or it can vary according to much each employee makes and change annually based on their earnings. For example, if an employee receives a raise at the end of the year, their employer may also increase their match amount. The most popular matching plan employers use is matching up to 6% of their employees annual income.

You May Like: Should I Roll 401k To Ira

Reason No : Youre A High

If you are a high-income earner and you are already set to max out your 2021 pretax contributions , after-tax 401 contributions might make economic sense for you, too, because they enable you to put more money into your 401 plan. For example, those under age 50 can contribute up to $58,000 to a 401 in 2020, if their employer allows that. This figure would include pretax, Roth, after-tax and employer contributions. For individuals 50 or older, the limit is $64,500. Contributing after-tax to a 401 after you have maxed out your pretax contributions lets you benefit from additional tax deferral on earnings from dividends, capital gains and interest of your investments.

Some people may choose to convert those extra contributions into a Roth account later. Having both Roth and pretax assets can be helpful in retirement because it gives you more flexibility in generating income in a tax-efficient way, both in the near and long term. In fact, one of the hottest financial planning tactics these days is engaging in a year-by-year tax minimization process that looks at which buckets to withdraw from each year based on how each additional dollar will potentially be taxed. To take advantage of this approach, youll need both pretax and Roth accounts to withdraw from.

Keep in mind that the Tax Cuts and Jobs Act of 2017 reduced tax rates through 2025, which means it could be a good idea to pay taxes on at least some of your retirement savings now.

Is This Guide For You

Use this guide if you are an employer and you provide benefits or allowances to your employees, including individuals who hold an office, for items such as:

- automobiles or other motor vehicles

- board and lodging

- group term life insurance policies

- interest-free or low-interest loans

- transit passes

- tuition fees

If you or a person working for you is not sure of the workers employment status, either one of you can request a ruling to determine the status. If you are a business owner, you can use the “Request a CPP/EI ruling” service in My Business Account. If you are an individual, you can use the Request a CPP/EI ruling service in My Account for Individuals. You can also fill out and mail Form CPT1, Request for a CPP/EI Ruling Employee or Self-Employed? to the CPP/Rulings Division at the Tax Services Office in the province or territory of your residence or place of business. See the table found on Form CPT1 for the mailing addresses. For more information on employment status, see Guide RC4110, Employee or Self-Employed?

A benefit or allowance can be paid to your employee in cash or provided to your employee in a manner other than cash .

You may have to include the value of a benefit or allowance in an employee’s income, depending on the type of benefit or allowance and the reason you give it.

This guide explains your responsibilities and shows you how to calculate the value of taxable benefits or allowances.

Read Also: Does Mcdonald’s Offer 401k