A Qdro To Cash Out A 401k

The concept of using a non-divorce QDRO is not made up. Estate lawyers have trademarked a different term for a happily married QDRO.

Briefly, a QDRO is a state specific document usually used to separate qualified assets in a divorce. There is no mention of divorce in IRS language, however, and real estate investors are using it to cash out 401k plans penalty free.

Cash Out Of Your Plan Permanently

Some respected CPAs and real estate investors advocate against having a 401. Robert Kiyosaki once wrote, the 401 has robbed Americans for over 40 years now,and proclaims, I would never invest in a 401.

Kiyosaki believes more money can be made when people build a real estate portfolio outside a tax-deferred plan. Inside a plan, your tax liability continues to increase with no advantage of depreciation. You are also subject to the changing laws. He outlines his theory in his recent book Who Stole My Pension?

You do have the option of taking your money out of the 401 entirely and investing in real estate with after-tax dollars. Getting rid of your 401 can be an aggressive move because if your investment does not work out, you also now have no retirement. You are also subject to a 10% penalty on top of paying taxes on all the money if you take it out before age 59.5.

You will want to do a cost analysis and speak to professionals before taking action on saying goodbye to your retirement plan. That said, you are growing all your money with pre-tax dollars in retirement plans. At some point, you are going to have to pay up, unless you have a Roth IRA or Roth 401.

Invest In Syndication Deals

Syndication deals are another form of partnering in deals and are often passive, so you dont need to do any heavy lifting. The opportunity to use qualified self-directed funds makes it very easy to grow a retirement account, keep a solid position in real estate, and reap potentially high returns. Syndications are large deals that are put together with multi-family, mobile home parks, and storage units. Depending upon the offer to participate, you may need to be an accredited investor. The sponsor who is organizing the investment will let you know the minimums and requirements. All of the proceeds and returns need to stay inside the plan.

Taking advantage of your retirement funds through self-directed plans can be a game-changer in growing your portfolio as long as you weigh out all the variables, run the numbers, and ensure your documents allow it.

Statistics show that most Americans these days are not saving enough to retire. While a large part of the problem may be that people cant afford to save, those who can dont always know how to maximize the returns on their savings by investing that money in real estate.

Read Also: Can I Buy An Annuity With My 401k

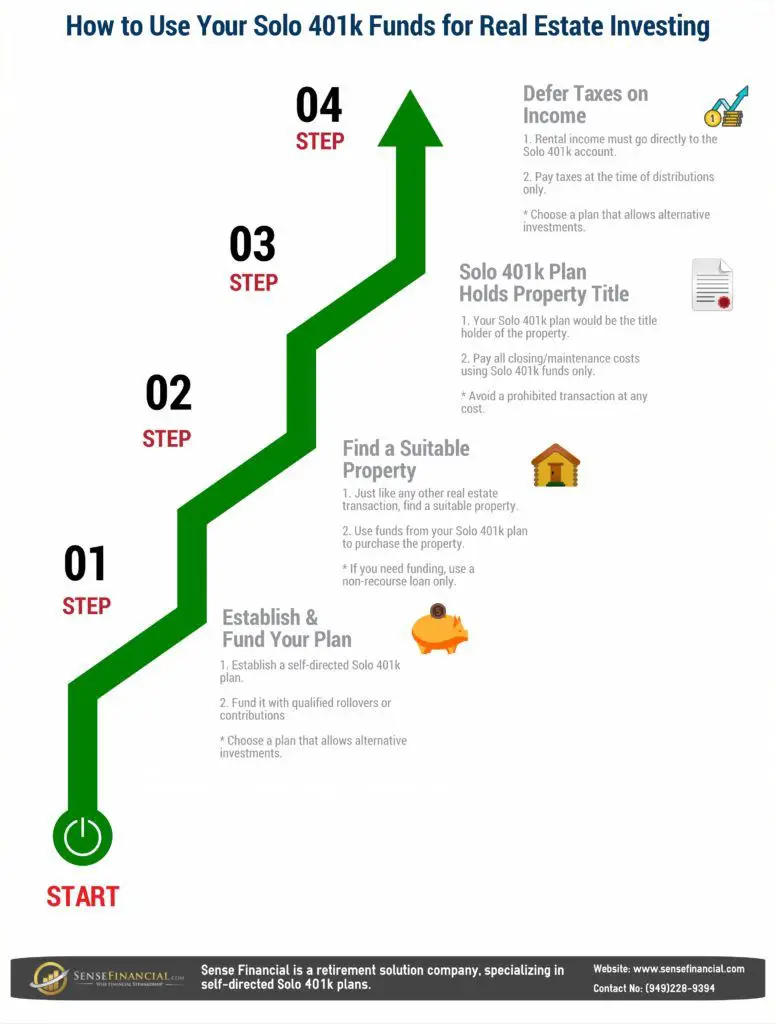

Funding Your Solo 401

You cannot rollover your assets into a solo 401 from a current employer. You must be retired, have left the employer, or be eligible under IRS guidelines. You have several options when it comes to funding your solo 401:

- In-kind transfer: Non-cash assets are moved from the employer-backed 401 account to a solo account and not taxable.

- Cash transfer: Cash assets are moved from the employer 401 to the individual account. Partial or full investment may be processed and not taxable.

- In-kind direct rollover: Assets from an IRA are transferred to a solo 401 account, and theres no need for the liquidation of assets. This action must be reported for tax reasons and is not subject to tax withholding.

- 60-day cash rollover: This is the quickest way to fund your solo 401 from an IRA, but you have a 60-day period to deposit the check to avoid taxes and a 10% penalty for early distribution.

- Annual cash contribution: This is an option for self-employed individuals. Your solo 401 can be funded with annual cash contributions by your business tax return date. However, keep in mind that cash contributions have an annual limit. This number depends on your age and salary.

What You Should Know About Solo 401k Retirement Plans

- Annual contributions: $60,000 for 2017 .

- Roth contributions: Make Roth contributions of up to $24,000 in 2017, irrespective of your income threshold.

- Dates to remember: Establish your Solo 401k plan before December 31 of the year for which contributions are to be made. You can make elective contributions up to December 31 whereas, profit-sharing contributions could be made up to the regular tax-filing deadline plus extension.

- Participant loan: The IRS allows every eligible plan participant to borrow up to $50,000 or 50% of the account balance.

- UBIT exemption: You receive UBIT exemption when purchasing real estate with non-recourse financing.

- Diversification: With a self-directed Solo 401k, you can invest in real estate, mortgage notes, tax liens, tax deeds, precious metals, private equity, and the traditional stock and bond investments.

Related: How to purchase rural land with your self-directed Solo 401k plan?

Recommended Reading: What’s My 401k Balance

K Loan: Pros And Cons

The first way to borrow from your 401k is to take out a loan. As the name suggests, some of this method involves borrowing the money temporarily and then paying it back with interest over time. We’ve listed the pros and cons of choosing to take out a loan so you can get a better idea of how this process works.

What Is An Ira

An IRA is a type of account set up at a bank, brokerage firm, mutual fund company, insurance company or other types of financial institution. Regardless of where the account is held, the purpose is the same: it is a place to hold assets to be used during retirement. IRAs can be used to invest in many types of assets . Some IRAs can be self-directed, allowing you to choose how to invest, ranging from investing in CDs, government bonds, mutual funds, stocks, even investment property .

There are many kinds of IRAs, but the two most common are Traditional IRAs and Roth IRAs. They differ based on the tax rules that regulate each type of IRA account, and specifically, how and when the account holder gets a tax break.

Don’t Miss: Can You Roll Over Your 401k To A Roth Ira

What Is A 401 Rollover

A 401 rollover is when you transfer money out of your retirement account into a different account. Its important to know that you dont necessarily have to do this immediately. Once you withdraw funds out of your 401, the IRS gives you 60 days to deposit it into another retirement account. However, you can only do this once every 12 months.

Employees often find the need to roll over their 401 to a personal individual retirement account when they leave a job or retire. However, others might choose to use this as a strategy to invest in real estate.

Flow Of Rent Deposits Question:

Can my tenants deposit the rent payments into my business bank account and then I will deposit the funds into my solo 401k bank account?

ANSWER:

Since the property is owned by the solo 401k plan, the funds must flow directly to the solo 401k bank account not first to your self-employed business or personal bank account.

Read Also: How To Claim Your 401k

For Mutual Fund Investors: Qtrade*

At a flat rate of $8.75 per trade, Qtrade* charges a higher commission on stocks and ETFs than Questrade, but it eliminates commissions on mutual funds, which might be a savvy trade-off for those looking to invest in their RRSPs this way. Theres a $25 administration fee billed quarterly, but if you establish recurring deposits or hold a minimum of $25,000, you can get a waiver. Qtrade* enjoys a reputation for offering stellar customer service and great investment tools for seasoned investors and helpful educational guides for newbies.

A note-worthy perk: When new and existing clients open a new Qtrade account and deposit/transfer at least $15,000 in assets , they can earn up to $2,000 cash back.

- Account fees: $25 per quarter

- Commissions: $0 when buying/selling mutual funds $8.75 per trade for most equities

What Is The Difference Between An Ira And 401k

As outlined above, the key differences between an IRA and 401k are as follows:

- Anyone who falls within the income criteria can set up an IRA, whereas a 401k must be established by an employer.

- There are no income limits for investing in a 401k.

- Individuals can only invest up to $6,000 in an IRA each year vs. up to $19,000 in a 401k.

- Money can be withdrawn from an IRA at any time, whereas a person must have reached a distribution event before they can access their 401k savings.

- Investment selection may be more limited when investing in a 401k vs. an IRA.

Don’t Miss: How To Check How Much Money Is In My 401k

House Hacking With Your 401k

Good news! You can! Despite what I said above, you can still use your 401k to house hack. Just not directly.

How?

You can give yourself a loan from your 401k for the lesser of $50,000 or 50% of your 401ks balance. This can help with your down payment on a house hack.

You will be paying your solo 401k interest of approximately 4.0%. This is certainly not the best use of your 401k money, but if you do not care much about the balance of your 401k and are looking to invest in real estate to achieve early financial freedom, this may make sense.

So, rather than going ahead and liquidating the 401k, use it to your advantage. The net proceeds you would get when taking it out and when taking a loan against it are almost equivalent. Still, by taking a loan against it, you are not getting penalized and your 401k is still growing tax-free.

Warning! Before making the loan request, be sure to talk to your lender. Taking a loan out against your 401k does reduce the amount of your reserves and therefore may impact your ability to get financing.

Pros And Cons Of Property In An Ira

We’ve mentioned so many hassles and drawbacks, you might be wondering at this point if there is any point to putting property in an IRA. Historically, real estate has been a good long-term investment as property values rise over time, and long-term appreciation goes hand-in-hand with the long-term investment horizon of a retirement account. In the short term, any income the property generates is tax-sheltered within the IRA. Finally, as a hard asset, real estate helps diversify a portfolio otherwise invested in equities and other securitiesnot the worst idea in the world.

-

Real estate helps diversify a portfolio, often moving counter to financial markets.

-

Real estate has historically appreciated over time, ideal for an IRA’s long-term investment horizon.

-

Real estate can provide a steady income stream from rents, and any rental income you collect grows tax-free within the IRA.

-

You can buy, sell, flip, and accumulate properties.

-

You need to set up a self-directed IRA with a custodian.

-

You cant claim deductions for property taxes, mortgage interest, depreciation, and other property-related expenses.

-

All expenses, repairs, and maintenance costs must be paid with IRA funds, and you must pay others to do them and manage the property.

-

You and your relatives cant live in or run a business out of the property.

Don’t Miss: How Much Will My 401k Pay Me Per Month

Cash Out Current 401k Assets To Invest In Real Estate

It is true! QDROs are one of the exceptions where you are able to use to get at your money without a penalty. If you want to invest in after-tax real estate from your current employers 401k, use a QDRO and cash out to your spouses bank account. Of course, ordinary taxes are due when cashing out, but as the funds were accessed via a QDRO, there is no 10% penalty.

Qualified Retirement Plans For Real Estate Investment

The real estate market can provide high returns.

Sometimes these returns can be higher returns than the returns you would get if you just invested in the stock market buying mutual funds, stocks, or other traditional securities.

Real estate can also add diversification to your investing portfolio and help increase the money in your retirement accounts.

If you want to buy real estate as an investment and hold it in a qualified retirement plan, you can use the following accounts:

- Self Directed IRA

- Solo 401k

Holding real estate in a qualified plan requires the observance of rules that govern the holding of real estate in the plan in order to avoid:

- prohibited transactions

- treatment of capital gains

Don’t Miss: Can You Take Out Your 401k To Buy A House

Using A 401 Withdrawal To Buy A House

401 withdrawals are generallynot recommended as a means to buy a house because theyresubject to steep fees and penalties that dont apply to 401 loans.

If you take a 401 withdrawalbefore age 59½, youll have to pay:

- A 10% early withdrawal penaltyon the funds removed

- Incometax on the amount withdrawn

For example, say you withdraw$20,000 from your 401 to cover your down payment and closing costs.

- Youll be charged a $2,000 earlywithdrawal penalty

- Andyoull have to pay income tax on the $20K, which likely comes out to around$4,000-$6,000

Thats up to $8,000gone from your retirement savings, on top of the initial withdrawal.

The standard rules for 401withdrawals are as follows:

- Most 401 plans allow withdrawals only in cases of financial hardship

- However, using the money to buy a primary residence often qualifies as a hardship withdrawal

- You can withdraw only the money required to cover your immediate need

- The money does not have to be repaid

Since the IRS considers 401 withdrawals income,withdrawing 401 money could bump some home buyers into a higher tax bracket.This could add even more to the cost of the early withdrawal.

Coronavirus update:

The CARES Act provision allowingfor tax-free withdrawals from a 401 expired on Dec. 31, 2020. The IRSsnormal 10% penalty is being enforced on hardship withdrawals in 2021.

The Best Of Both Worlds

In the analysis above, we assume your 401k is handled by a financial advisor and is diversified amongst a plethora of mutual funds, index funds, bonds, stocks, etc. that garner a return of 7%. The analysis suggests that despite the tax-deferred earnings, there is a high probability that you can attain a better annual return on a liquidated 401k by investing it yourself.

Fortunately, there is a way for you to invest in these same high-yielding assets with your 401k without taking the penalty. Rather than having your 401k held with a financial advisor and being diversified amongst asset classes that return ~7% annually, you can move it to a self-directed IRA or a solo 401k to manage yourself.

With these self-directed accounts, you can invest in almost anything. Even real estate.

Notice how I said almost anything. The one limiting factor is that you cannot get a conventional recourse loan with your 401k. That means that the low-down payment, owner-occupied loans are not available.

In other words, you CANNOT house hack with your 401k or self directed IRA. This is for investment property only so most lenders will require at least 15% down and sufficient cash flow.

But Crraaaiiiigg, I WANNA HOUSE HACK.

You May Like: How To Rollover My 401k To New Employer

Financing Through A Solo 401k

With regards to getting financing through a Solo 401K, there are certain rules that the lender must abide by. The loan must be non-recourse, meaning that the only recourse for the lender is foreclosure on the property. The lender cannot take a guaranty from you personally.

The classification of a loan as non-recourse may lead your lender to change the terms of the loan from its non-retirement account loans, so you should make sure to let the lender know that the borrower will be a retirement account, and let them explain their policies with regards to this.

At Rehab Financial Group, LP, we adjust the loan to value for these loans, but the rest of the process remains substantially the same.

If you are seriously thinking about investing in real estate through a self-directed retirement vehicle, it is worth the expense to speak with your accountant, to make sure that you are following the rules, and to discuss any potential issues you may have.

Depending on how the retirement plan is structured, you want to make sure to avoid losing the tax protections for retirement accounts and/or exposing yourself to liability for unrelated business tax income.

BACK TO REAL ESTATE BUSINESS STRATEGY

Sign up for RFGs Mailing List for Flipping Info and Updates

The Difference Between An Ira And 401k

Briefly, most 401ks are set up for individuals through their employment. For self-employed people, the IRA is the best vehicle to create tax sheltered retirement investments. One of the biggest differences is the tax deductible amount that can be contributed each year into each type of plan. With the 401k, there is no income level phase out, but the IRA contribution has some limitations based on the individuals income.

Also Check: How Do I Get My 401k From Walmart

Cash Out A 401k For Real Estate Investors

Have you thought about cashing out a 401k to invest in real estate?

Real Estate Investors invest in real assets rather than retirement accounts. Investors with significant qualified retirement accounts discuss cashing out a 401k prior to the age of 59 ½. This means a 10% penalty in addition to the ordinary income taxes.

Cashing out of 401k plans while still actively employed is difficult and expensive. Lets discuss a possible option to access a current 401k plan without paying the penalty.