You Lose Thousands In Potential Growth

Even if youre not deterred by tax penalties, think twice before you sabotage your long-term retirement savings goals. When you withdraw money early, youll miss out on potential future savings growth because you wont gain the perks of compound interest. Compounding is the snowball effect resulting from your savings generating more earnings not only on your principal investment but also on your accrued interest.

Also, if you make a 401k early withdrawal while the market is down, youre doing yourself a disservice because youll be leaving thousands on the table. Its unlikely youll fully recover the lost years of compound interest you would have benefited from. You might need to get creative with a passive income stream to help support you later in life.

Plan To Replace About 80% Of Income

When you stop working, aim to replace about 80% of pre-retirement earnings from all income sources combined, such as 401s and IRAs, Social Security, and pensions.

You can anticipate spending less because youll no longer be paying payroll taxes or making 401 contributions. You may also spend less on things like gas and clothing because youre no longer working. The actual amount youll need in order to replace your working income depends on how frugal or luxurious you want your retirement to be.

Borrowing Money From My 401k

It may seem like an easy way to get out of debt to borrow from your retirement accounts for DIY debt consolidation, but you can only borrow $50,000 or half the vested balance in your account, if its less than $50,000. You wont face a tax penalty for doing so, like you would with an out-right withdrawal, but youll still have to pay the money back.

And unlike a home equity loan where payments can be drawn out over a 10-to-30-year period, most 401k loans need to be paid back on a shorter time table like five years. This can take a huge chunk out of your paycheck, causing you even further financial distress. Borrowing money from your 401k also limits the ability of your invested dollars to grow.

Paying off some of your debt with a 401k loan could help improve your debt-to-income ratio, a calculation lenders make to determine how much debt you can handle. If youre almost able to qualify for a consolidation or home equity loan, but your DTI ratio is too high, a small loan from your retirement account, amortized over 5 years at a low interest rate may make the difference.

Recommended Reading: How To Take Money Out Of Your 401k Fidelity

Withdrawing Money Early From Your 401

The method and process of withdrawing money from your 401 will depend on your employer, and which type of withdrawal you choose. As noted above, the decision to remove funds early from a retirement plan should not be made lightly, as it can come with financial penalties attached. However, should you wish to proceed, the process is as follows.

Step 1: Check with your human resources department to see if the option to withdraw funds early is available. Not every employer allows you to cash in a 401 before retirement. If they do, be sure to check the fine print contained in plan documents to determine what type of withdrawals are available, and which you are eligible for.

Step 2: Contact your 401 plan provider and request that they send you the information and paperwork needed to cash out your plan, which should be promptly completed. Select providers may be able to facilitate these requests online or via phone as well.

Step 3: Obtain any necessary signatures from plan administrators or HR representatives at your former employer affirming that you have filed the necessary paperwork, executed the option to cash in your 401 early, and are authorized to proceed with doing so. Note that depending on the size of the company, this may take some time, and you may need to follow up directly with corporate representatives or plan administrators at regular intervals.

K Withdrawal Rules: How To Avoid Penalties

401k plans, IRAs and other tax-advantaged retirement savings accounts are common ways to save for retirement, and millions of Americans pour money into them every year. Its generally wise to avoid withdrawing money from your 401k, as there are often hefty penalties and taxes to consider for early withdrawals.

Sometimes, however, unplanned circumstances force people to withdraw funds from their 401k early. So if you find yourself in a place where you need to tap your retirement funds early, here are some rules to be aware of and some options to consider.

Also Check: What Is A Safe Harbor 401k Plan

Dmitriy Fomichenko President Sense Financial

If you want to roll over the money into another retirement plan, say an IRA for example, you have to check with your plan administrator about “in-service distribution”. If your plan allows that, you can roll the money out. If it doesn’t, you cannot do a rollover until you stop working for the employer. Withdrawing from a 401k early before retirement age, whether if you are still with the same employer or not, is possible but a penalty tax will apply on top of your regular income tax rates.

How Much Are You Penalized For A 401k Early Withdrawal

On the surface, withdrawing funds from your 401k might not seem like a bad option under extenuating circumstances, but you could face penalties. Young adults are especially prone to early withdrawals because they figure they have plenty of time to replace lost funds.

If youre not experiencing a significant hardship, 401k early withdrawal probably isnt the right choice for you. Ultimately, you could lose a substantial portion of your retirement savings if you choose to withdraw your 401k early to use the money to make other risky financial moves. Below, lets delve further into the penalties that usually apply when you withdraw early.

You May Like: Where To Move 401k Money

Understanding Early Withdrawal From A 401

Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. It really should be a last resort.

Not every employer allows early 401 withdrawals, so the first thing you need to do is check with your human resources department to see if the option is available to you.

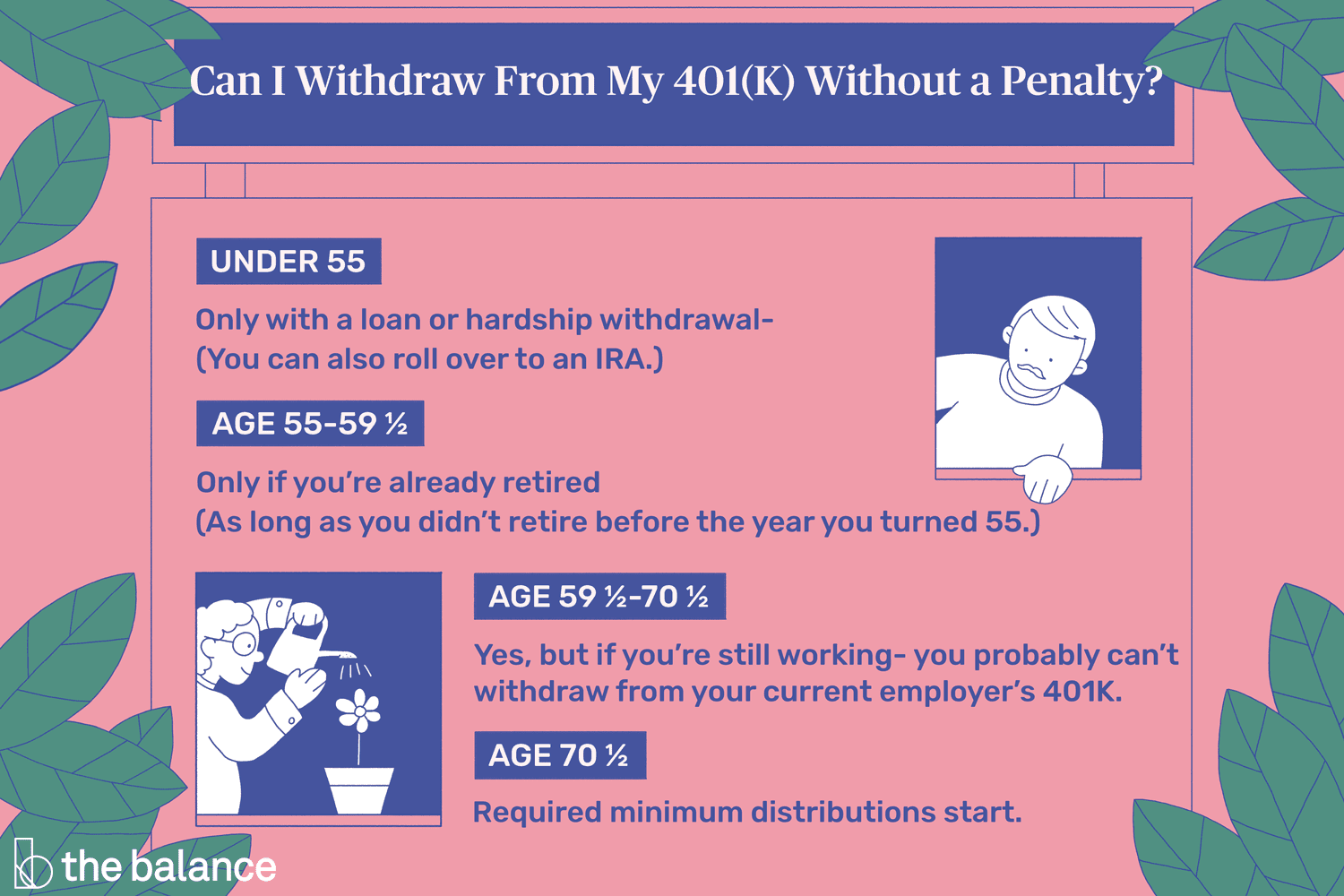

As of 2021, if you are under the age of 59½, a withdrawal from a 401 is subject to a 10% early withdrawal penalty. You will also be required to pay regular income taxes on the withdrawn funds.

For a $10,000 withdrawal, when all taxes and penalties are paid, you will only receive approximately $6,300.

Withdrawals After Age 59 1/2

Age 59 1/2 is the magic number when it comes to avoiding the penalties associated with early 401 withdrawals. You can take penalty-free withdrawals from 401 assets that have been rolled over into a traditional IRA when you’ve reached this age. You can also take a penalty-free withdrawal if your funds are still in the 401 plan, and you’ve retired.

You can take a withdrawal penalty-free if you’re still working after you reach age 59 1/2, but the rules change a bit. Check with the plan administrator about its specific rules if you’re still working at the company with which you have your 401 assets.

Your plan might offer an “in-service” withdrawal that allows you to access your 401 assets penalty-free, but not all plans offer this option. And remember, the withdrawal will still be subject to income taxes, even if it’s not penalized.

Also Check: How To Take My Money Out Of 401k

How Can I Withdraw Money From My 401k Without Penalty

Here are the ways to get free withdrawals from your IRA or 401

- No medical payments.

- The first of the health insurance.

- Death.

- If you owe the IRS.

- Home buyers for the first time.

- Higher education costs.

- For entry purposes.

What qualifies as a hardship withdrawal for 401k?

Eligibility for Retirement Difficulty Certain medical expenses. Home purchase expenses for a main residence. Up to 12 months of schooling and expenses. Expenses to prevent them from being foreclosed on or expelled.

When can you withdraw from 401k tax free?

Stashing pre-tax cash on your 401 also allows you to grow it tax-free until you pick it up. There is no limit to the number of withdrawals you can make. After you turn 59, you can withdraw your money without having to pay an early retirement penalty.

Can Robs Be Used In Llc

Because ROBS is based on the sale of Qualified Employer Securities , the company you form or acquire must be a C corporation with the ability to sell shares. QES cannot be issued by other company types such as an LLC, LLP, S Corporation, or Sole Proprietorship.

Recommended Reading: How Much In 401k To Retire

How To Cash Out A 401 After Quitting

You may follow this type of action plan for your 401 when you quit your job:

If your new employer offers a 401 plan, check your eligibility and enroll yourself.

Once enrolled, get the funds and investments in your old account directly transferred to your new account. You can opt for a direct administrator-to-administrator transfer through simple documentation to avoid potential taxes and penalties.

Instead of direct transfer, you can also cash out your old account and deposit the proceeds in your new account within 60 days of cashing out. That way, you dont have to pay income tax on the amount of the withdrawal .

You must start taking 401 distributions after you turn 70 ½ years old and you are not working anymore. However, unlike traditional plans, in a new retirement plan with your current employer, you cannot be forced to take the required minimum distributions even after you reach the age of 70 ½.

If your new employer does not have a 401 plan or you do not like the plan your new employer has, you may roll over your old 401 account to an IRA. The rollover process is like the process of rolling over to a new account. You can either get it done directly through your plan administrator or take out the proceedings and deposit them in your IRA within 60 days.

What Are The Penalty

The IRS permits withdrawals without a penalty for certain specific uses, including to cover college tuition and to pay the down payment on a first home. It terms these “exceptions,” but they also are exemptions from the penalty it imposes on most early withdrawals.

It also allows hardship withdrawals to cover an immediate and pressing need.

There is currently one more permissible hardship withdrawal, and that is for costs directly related to the COVID-19 pandemic.

You’ll still owe regular income taxes on the money withdrawn but you won’t get slapped with the 10% early withdrawal penalty.

Don’t Miss: Can I Rollover My 401k Into My Spouse’s Ira

What Are The Consequences Of Taking A Hardship Distribution

Whether youre a Millennial or Baby Boomer, a hardship withdrawal could have a significant impact on your retirement outcome. As a Baby Boomer, your years of catching up will be shorter. In some cases, you may never entirely catch up to where you once were prior to the withdrawal. It could also mean you may need to postpone your retirement until you are financially more stable, dramatically setting you back on your retirement goals.

As a Millennial, things arent quite as bleak. While a hardship disbursement will certainly set you back, you will have many more years in the workplace to make up the difference. However, they are still costly in the short term when you pay taxes, and participants that are not 59 ½ or older may be subject to a 10 percent penalty tax.

Heres the bottom line: the decision to take a hardship distribution is truly a personal one and is often surrounded by extenuating circumstances. Because of the impact on funds for retirement, hardship distributions should be your absolute last resort for withdrawing funds from your 401 retirement fund.

Can I Take Money Out Of My 401k

Asked by: Dion Casper

Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. … As of 2021, if you are under the age of 59½, a withdrawal from a 401 is subject to a 10% early withdrawal penalty. You will also be required to pay normal income taxes on the withdrawn funds.

Read Also: What To Do With 401k When You Switch Jobs

Can You Take Money Out Of Your 401k Without Being Penalized

The CARES Act allows individuals to withdraw up to $ 100,000 from a 401k or IRA account without penalty. Early withdrawals are added to the participants taxable income and taxed at ordinary income tax rates.

Can you withdraw from 401k without being taxed?

Withdrawals of contributions and earnings are not taxed until the distribution is deemed qualified by the IRS: The account is held for five years or more and the distribution is: Cause of disability or death. At the age of 59½ or later

How Can I Reduce The Tax On My 401k Withdrawal

Important Points to Remember Converting to a Roth IRA or Roth 401 is one of the simplest methods to reduce the amount of taxes you have to pay on 401 withdrawals . Some strategies enable you to save money on taxes while simultaneously requiring you to withdraw more money from your 401 than you need.

Read Also: How Often Can I Change My 401k Investments Fidelity

Risks Of A 401 Early Withdrawal

While the 10% early withdrawal penalty is the clearest pitfall of accessing your account early, there are other issues you may face because of your pre-retirement disbursement. According to Stiger, the greatest of these issues is the hit to your compounding returns:

You lose the opportunity to benefit from tax-deferred or tax-exempt compounding, says Stiger. When you withdraw funds early, you miss out on the power of compounding, which is when your earnings accumulate to generate even more earnings over time.

Of course, the loss of compounding is a long-term effect that you may not feel until you get closer to retirement. A more immediate risk may be your current tax burden since your distribution will likely be considered part of your taxable income.

If your distribution bumps you into a higher tax bracket, that means you will not only be paying more for the distribution itself, but taxes on your regular income will also be affected. Consulting with your certified public accountant or tax preparer can help you figure out how much to take without pushing you into a higher tax bracket.

The easiest way to avoid these risks is to resist the temptation to take an early 401 withdrawal in the first place. If you absolutely must take an early distribution, make sure you withdraw no more than you absolutely need, and make a plan to replenish your account over time. This can help you minimize the loss of your compound returns over time.

If You Get Terminated From Your Job You Have The Option Of Cashing Out Your 401 However This Is Probably Not The Smartest Move

Image source: Andrew Magill.

If you get terminated from your job, you have the ability to cash out the money in your 401 even if you haven’t reached 59 1/2 years of age. This includes any money you’ve contributed and any vested contributions from your employer — plus any investment profits your account has generated. However, you may face a 10% early withdrawal penalty from the IRS for cashing out early, so this might not be the best option. Here’s what you need to know to make an informed decision about your 401 after you’re no longer with your employer.

How to cash out and the implications of doing soThe procedure for cashing out is usually rather simple. All you need to do is contact your plan’s administrator and complete the necessary distribution paperwork. However, there are a few things you need to keep in mind, especially regarding the tax implications of cashing out.

Unless your 401 is of the Roth variety, all of the money you withdraw will be treated as taxable income, no matter how old you are or the reason for the withdrawal. So, even if you are older than 59 1/2, it’s important to consider how cashing out will affect your tax status for the year. If you have a large 401 balance, cashing out could easily catapult you into a higher tax bracket. Your plan provider will be required to withhold 20% of the amount you cash out for taxes , and will also file a form 1099-R to document the distribution.

Read Also: How To Pull Out Of Your 401k

Benefits Of Taking Money Out Of Your 401 Earlier

Your 401 is likely a centerpiece of your retirement income plan. Taking distributions sooner than a typical retirement age around 65, like in your early 60s, can have benefits.

It can make an early retirement possible. Depending on your financial situation, you may have the financial freedom to step out of the workforce by the time youâre 60. Itâs your nest egg, and youâve worked hard to build it by making regular contributions during your working years. 401 distributions, along with other sources of retirement income, can set the stage for this new phase of your financial life.

It can help you delay taking Social Security. You canât begin claiming Social Security until age 62. Still, generally, it can be beneficial to delay taking Social Security. Thatâs because your monthly benefit will increase every year that you wait until age 70. Since Social Security pays guaranteed income that will last for as long as you live, a larger monthly benefit could pay off over time.