How Do I Avoid Taxes On Social Security And Retirement Income

Here’s how to reduce or avoid taxes on your Social Security benefit:

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

Loan Or 401 Withdrawal

While similar, a 401 loan and 401 withdrawal aren’t interchangeable and have a few key differences. While you can use either to access up to $100,000 of your retirement funds penalty- and tax-free as part of the Consolidated Appropriations Act, they each have their own rules.

As part of a 401 withdrawal:

- Repayment isn’t required.

- There’s no withdrawal penalty.

- Distribution will be taxed as income, but you can pay it back within three years and claim a refund.

As part of a 401 loan:

- You must repay the loan within a specified time frame .

- The loan amount isn’t taxed initially, and there’s no penalty. If you can’t pay it back within the specified time frame, the outstanding balance is taxed and you’ll also be assessed a 10 percent early withdrawal penalty, if you are under age 59 1/2.

- If you leave your job, you have until mid-October of the following year to offset the outstanding loan amount. Otherwise, you could owe 401 early withdrawal taxes and penalties.

Work with your plan sponsor to learn more about the pros and cons of a 401 withdrawal vs. 401 loan.

Don’t Miss: Can You Move Money From Your 401k To An Ira

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

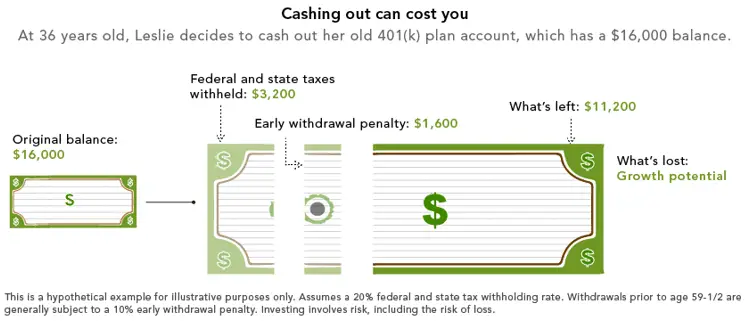

Cashing Out A : What A 401 Early Withdrawal Really Costs

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Contributing to a 401 can be a Hotel California kind of experience: Its easy to get your money in, but its hard to get your money out. That is, unless youre at least 59½ years old thats when the door swings wide open for a 401 withdrawal. But try cashing out a 401 with an early withdrawal before that magical age and you could pay a steep price if you dont proceed with caution.

Read Also: Can You Contribute To 401k And Roth Ira

Early Withdrawal // 11 Ways To Cash Out Without Penalty

If you are in financial need, it might seem extremely tempting to simply withdraw some money from your 401, IRA, or other retirement account to cover the need. However, that withdrawal generally comes with a heavy penalty of 10% of the withdrawal amount. Retirement accounts are intended to be used for retirement, so the IRS imposes this penalty to discourage you from withdrawing money from your retirement savings. But what if you are in a true financial hardship? When can you withdraw from your 401 without this penalty? In some cases, you might be able to take some cash from your 401 without a penalty. Here is everything you need to know about early withdrawals from your 401 plus some ways that you can cash out without a penalty.

Do You Have To Pay Taxes On 401k After 60

A withdrawal you make from a 401 after you retire is officially known as a distribution. While you’ve deferred taxes until now, these distributions are now taxed as regular income. That means you will pay the regular income tax rates on your distributions. You pay taxes only on the money you withdraw.

Don’t Miss: How To Start 401k On Your Own

What Is The Penalty For Withdrawing From A 401

When a 401 account holder withdraws money from a 401 before age 59½, the IRS may charge a 10% penalty in addition to the ordinary income taxes assessed on the amount.

Unqualified withdrawals from a 401 are considered taxable income. Then, the 10% penalty is assessed on top of that. This could result in a hefty penalty.

Is It A Good Idea To Use The Rule Of 55

Just because you can take distributions from your 401 or 403 early doesn’t mean you should. Depending on your financial situation, it might be better to let your money continue to grow. Holding off withdrawals could help you better position yourself for a financially sound future. If you’re tempted to withdraw retirement funds before you’re eligible, instead consider finding another job, drawing from your savings or using other sources of income until you need to tap into your retirement savings.

If you decide to begin withdrawing funds from your 401 early, the long-term value of your portfolio will likely decrease. It’s essential that you time your withdrawals carefully and take into account how much they would cost you in taxes. To create a strategy that makes sense in your situation, consider working with a financial advisor or a retirement planner.

Also Check: Should I Pay Someone To Manage My 401k

Is A 401 Withdrawal Without Penalty Possible

There are some exceptions to the 401 early withdrawal penalty rule. For example, an exception may be made in the event that a participant has a qualifying event such as a disability or medical expenses, and must use 401 assets to make payments under a qualified domestic relations order, has separated from service during or after the year they reached age 55, or that a distribution is made to a beneficiary after the death of the account owner.

Additionally, it may be possible to avoid the 401 withdrawal penalty through a method known as the Substantially Equal Periodic Payment rule. These are also called 72 distributions.

To do this, the account owner must agree to withdraw money according to a specific schedule as defined by the IRS. The participant must do this for at least five years or until they have reached age 59½.

Under the 72 distribution, a participant will systematically withdraw the total balance of their 401. While this is technically an option in some instances, it does mean taking money away from retirement. Consider this while making your ultimate decision.

Can I Take A Withdrawal Before I Terminate Employment

In general, you cant take a withdrawal from your 401 account until one of the following events occurs:

- You die, become disabled, or otherwise terminate employment

However, a 401 plan can also permit withdrawals while you are still employed. These in-service withdrawals are subject to the following conditions:

- 401 deferrals , safe harbor contributions, QNECs and QMACs cant be distributed until age 59.5

- Non-safe harbor employer match and profit sharing contributions can be distributed at any age.

- Employee rollover and voluntary contributions can be distributed at any time.

- 401 deferrals , non-safe harbor contributions, rollovers and voluntary contributions can be withdrawn in a hardship distribution at any time.

To find the in-service withdrawal rules applicable to our 401 plan, check your plans Summary Plan Description .

Don’t Miss: What Is The Maximum Employer 401k Contribution For 2020

High Unreimbursed Medical Expenses

This particular exception is similar to the hardship distributions mentioned earlier, and these medical bills might qualify you under either category. You should know that a hardship withdrawal for medical bills will not entitle you to a waiver of the 10% penalty in all cases. To qualify for a penalty-free withdrawal, the amount of the bills must be greater than 7.5% of your adjusted gross income . You must also take the distribution in the same year in which the bills were incurred. You cannot take money for estimated future bills either. The bills must be currently due for services already provided.

Also note the requirement that the bills be unreimbursed. If your insurance covers part of the bills or will reimburse you for the payments, then you cannot use money from your 401 to pay them. Likewise, the bills must be for you, your spouse, or a qualified dependent. You cannot use the money to pay bills for a parent, sibling, or any other family member. The limit to the amount of money you can withdraw for medical bills was recently removed, so you are allowed to withdraw as much as is needed to cover all the expenses.

How Do I Avoid Taxes On My 401k Withdrawal

Here’s how to minimize 401 and IRA withdrawal taxes in retirement:

Also Check: What Age Can You Collect 401k

Ira Rollover Bridge Loan

There is one final way to borrow from your 401k or IRA on a short-term basis. You can roll it over into a different IRA. You are allowed to do this once in a 12-month period. When you roll an account over, the money is not due into the new retirement account for 60 days. During that period, you can do whatever you want with the cash. However, if its not safely deposited in an IRA when time is up, the IRS will consider it an early distribution. You will be subject to penalties in the full amount. This is a risky move and is not generally recommended. However, if you want an interest-free bridge loan and are sure you can pay it back, its an option.

How To Make An Early Withdrawal From A 401

When you have determined your eligibility and the type of withdrawal you want to make, you will need to fill out the necessary paperwork and provide the requested documents. The paperwork and documents will vary depending on your employer and the reason for the withdrawal, but when all the paperwork has been submitted, you will receive a check for the requested funds, hopefully without having to pay the 10% penalty.

Read Also: Can I Cash Out An Old 401k

Consult With A Tax Professional

Speak with both the 401 plan administrator and a tax professional to make certain that you understand your total tax obligations. I have seen many people who thought they had accounted for all taxes owed, only to find out that they owed a lot more, once the return was prepared. For instance, a large 401withdrawal can raise the total income for the year to the point where the taxpayer falls into a higher income tax bracket. When that happens, the amount that the taxpayer was having withheld from his or her regular paychecks may prove to be insufficient to cover the tax obligation at the new, higher tax rate.

Even worse, if a person files an incorrect return, understating the taxes owed, it may take years for the IRS to catch the error. Once the IRS does correct the error, it is the taxpayer who will owe the taxes plus years of interest and penalties.

I hope this information helps you Find. Learn & Save.

Best,

Youll Face A Hefty Tax Bill

On top of the 10% penalty, youâll owe taxes on the amount you withdraw from your 401.

Your plan administrator is required to withhold 20% of your withdrawal for taxes. However, depending on your income bracket, this may not cover your entire tax obligation.

If youâre unable to come with the rest when you file taxes, you may be left with more costly options to pay the remaining taxes.

Don’t Miss: Is Fidelity A 401k Plan Administrator

Employers Have Options Under Latest Law

Although the Consolidated Appropriations Act temporarily relaxes rules for eligible individuals to access their retirement funds, businesses don’t necessarily have to include these provisions in their plan provisions. Businesses that had to layoff workers due to business slowdowns also have more time to restore their workforce to at least 80 percent to avoid partial plan termination rules relating to their retirement plan. The partial retirement plan termination rule would be relaxed during a plan year that includes the period between March 13, 2020, and March 31, 2021, deferring assessments until March 2021.

Take An Early Withdrawal

Perhaps youre met with an unplanned expense or an investment opportunity outside of your retirement plan. Whatever the reason for needing the money, withdrawing from your 401 before age 59½ is an option, but consider it a last resort. Thats because early withdrawals incur a 10% penalty on top of normal income taxes.

While an early withdrawal will cost you an extra 10%, it will also diminish your 401s future returns. Consider the consequences of a 30-year-old withdrawing just $5,000 from his 401. Had the money been left in the account, it alone would have been worth over $33,000 by the time he turns 60. By withdrawing it early, the investor would forfeit the compound interest the money would accumulate in the years that follow.

Don’t Miss: Can You Roll 401k Into Another 401k

Purchasing Your First Home

You can use money from your 401 to buy a house. But you will pay a 10% penalty.

You can take money from your IRA without a penalty. You do not have to be a first-time home buyer, but you cannot buy another house if youve owned a home in the last two years. You can take more than one withdrawal for a home, but there is a $10,000 limit over a lifetime.

What Are The Penalty

The IRS permits withdrawals without a penalty for certain specific uses, including to cover college tuition and to pay the down payment on a first home. It terms these “exceptions,” but they also are exemptions from the penalty it imposes on most early withdrawals.

It also allows hardship withdrawals to cover an immediate and pressing need.

There is currently one more permissible hardship withdrawal, and that is for costs directly related to the COVID-19 pandemic.

You’ll still owe regular income taxes on the money withdrawn but you won’t get slapped with the 10% early withdrawal penalty.

Read Also: Should I Roll Over 401k From Previous Employer

How To Make A Penalty

Well, if you want to make a 401k withdrawal before retirement you should be aware of possible taxation and even penalties. Luckily for you, there are some kinds of emergencies that allow making penalty-free early withdrawals.

Make sure you understand the difference between taxes and penalties since the first ones are paid almost in all cases. Traditional 401 withdrawals are usually taxed due to ordinary interest rates.

As a rule, a person can make use of money from a retirement account without paying penalties and taxes if the account has been opened for more than 5 years. (provided it is written down in the employers plan.

But how can a person make a penalty-free withdrawal from a 401? Lets focus on these exceptions.