Provisions For Changing Jobs

Most 401 plans permit the employee who terminates employment the options of receiving the 401 balance in a lump sum or to receive periodic payments or to roll over the proceeds to an IRA or other employer-sponsored retirement plan. Additionally, some 401 plans permit the terminated employee to retain their 401 balance in their former employer’s plan. Amounts that are retained in a former employer’s 401 plan or transferred to another employer’s plan or IRA postpone the taxation until amounts are subsequently distributed from the plan or IRA the money was rolled into.

When receiving funds from a 401 with the intention to roll the amount to an IRA:

- The rollover must be completed in 60 days.

- Employers must withhold 20% of the proceeds as a withholding tax. It is up to the participant to make up this 20%, or it will be treated as a distribution. The money withheld will be used as a credit against any income tax liability.

- Neither the 60-day rule nor the 20% withholding apply to amounts directly transferred to an IRA or other qualified plan.

Alternatives To An Employer 401 Match

Deferred annuities can offer premium bonuses on contributions that mimic an employers 401 match with no annual limits.

For example, an annuity may offer up to an 11% bonus on all contributions for the first seven years of the annuity. The 11 percent premium bonus mimics the employers match, and the employee has no annual contribution limits.

Unlike a 401, employees can open a deferred annuity without an employer.

How 401 Plan Contribution Limits Work

The 401 plan is a long-term savings plan designed to help people build their retirement savings. The IRS labels a 401 as a qualified retirement plan, which means it has certain tax benefits for the employee, the employer, or both.

The tax advantage for employees is that their contributions are deducted from gross income, not net income. That means less take-home pay, which lowers the employees taxes, and the money goes into an investment account on an ongoing basis.

For some 401 plans, employers can match some percentage of their employees contributions, but its strictly voluntary. The average 401 match ranges from 3% to 7% of the employees gross salary.

Also Check: How To Check How Much Money Is In My 401k

K Contribution Limits Ira And Roth Limits And More

Inflation crept up over the past year, and there is talk that tax rates might be rising too. The good news is that in 2022 you will be able to put more money away in your 401k to help you stay ahead. That’s right, the IRS released the contribution and tax-deferral limits for 401k plans, IRAs, and other retirement accounts for 2022. Changes are based on cost of living and with costs rising, there are some notable changes for those saving in 401k accounts.

401k employee contribution limits increase in 2022 to $20,500 from $19,500 in 2021. Like 2021, those over 50 years of age can make additional catch-up contributions of $6,500 per year to their 401k accounts. Most 401ks allow Roth 401k contributions. Employees may choose to put some, none, or all contributions into the Roth 401k or tax-deferred option. Do know that all employer match or contribution must be provided on tax deferred basis. Separately, IRA limits remain the same as last year.

The Total Amount You Can Defer Into a 401k is Increased to $61,000Another 401k area of import that changed is the amount you can contribute and receive in total to your 401k account. If you receive company matching contributions or profit sharing, the all-in tax-deferral limit has been increased from $58,000 to $61,000 for 2022 with those over 50 years able to put in $67,500 with the catch-up. Here is a summary of the 2022 401k limits as compared to 2021:

| 401 Limits for 2022 |

|---|

| Yes, via a loan | No |

Whats The 401k Contribution Deadline

What is the 401k contribution deadline? The 401k contribution deadline does land at the very end of the calendar year on December 31, 2021.

However, the IRS will allow you to contribute to your IRA account right up to the tax filing deadline of the coming year that is to say, April 15, 2022 of this next year.

Recommended Reading: How Do I Check My 401k For Walmart

Key Takeaways: 401k Plans In 2022

Whether youre just starting out or youve already saved some money in your 401k, you should take note of the 401k contribution limits that apply to taxpayers in 2022. Use these tips to guide your savings strategy and help you reach your retirement savings goals.

Save more, spend smarter, and make your money go further

Can I Have A 401 And An Ira

Yes. IRAs make a great supplement to retirement savings in addition to a 401 if youre contributing enough to receive a full match from your employer, or youre planning on maxing out your 401. If you dont receive a match on your 401 or it has narrow investment options or high fees, it may be a good idea to invest primarily in an IRA. The annual contribution limit for an IRA in 2021 and 2022 is $6,000, or $7,000 if youre 50 or older.

» Ready to try an IRA? Check out our list of the best IRA accounts

Read Also: Can I Open A 401k By Myself

How To Claim Your Retirement Savings

Normally, getting at your money can be difficult, and the rules are often imposed by the plan design rather than regulations.

For instance, regulations allow you to access the money without a bonus penalty by:

- Getting a hardship withdrawal before age 59 ½.

- Waiting until age 59 ½.

- Leaving your employer in the year you turn age 55 or after.

While most plans do have loan provisions, many dont allow hardship withdrawals, and some plans require that a person be terminated before accessing their money, even if they are 59 ½ or older.

Due to COVID-19, the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, made it easier to get at your money up to $100,000 in loans or distributions, if the plan allowed it. These withdrawals had to be taken before the end of 2020. If you took a hardship loan in 2020, you could avoid paying the 10 percent penalty on the money, as well as take the option to repay the loan tax-free over the next three years.

Unless youre really in a bind, Brewer advises against taking a distribution or a loan. Theres no replacing time in the market, she points out, and consistent saving over time is one of the best ways to build wealth for the future.

What Is A 401

A 401 is a retirement plan offered by some employers. These plans allow you to contribute directly from your paycheck, so theyre an easy and effective way to save and invest for retirement. There are two main types of 401s:

-

A traditional 401: This is the most common type of 401. Your contributions are made pre-tax, and they and your investment earnings grow tax-deferred. Youll be taxed on distributions in retirement.

-

A Roth 401: About half of employers who offer a 401 offer this variation. Your contributions are made after taxes, but distributions in retirement are not taxed as income. That means your investment earnings grow federally tax-free.

You May Like: Can I Use My 401k To Buy A Second Home

Knowing These Rules Can Save You A Lot Of Trouble With The Irs

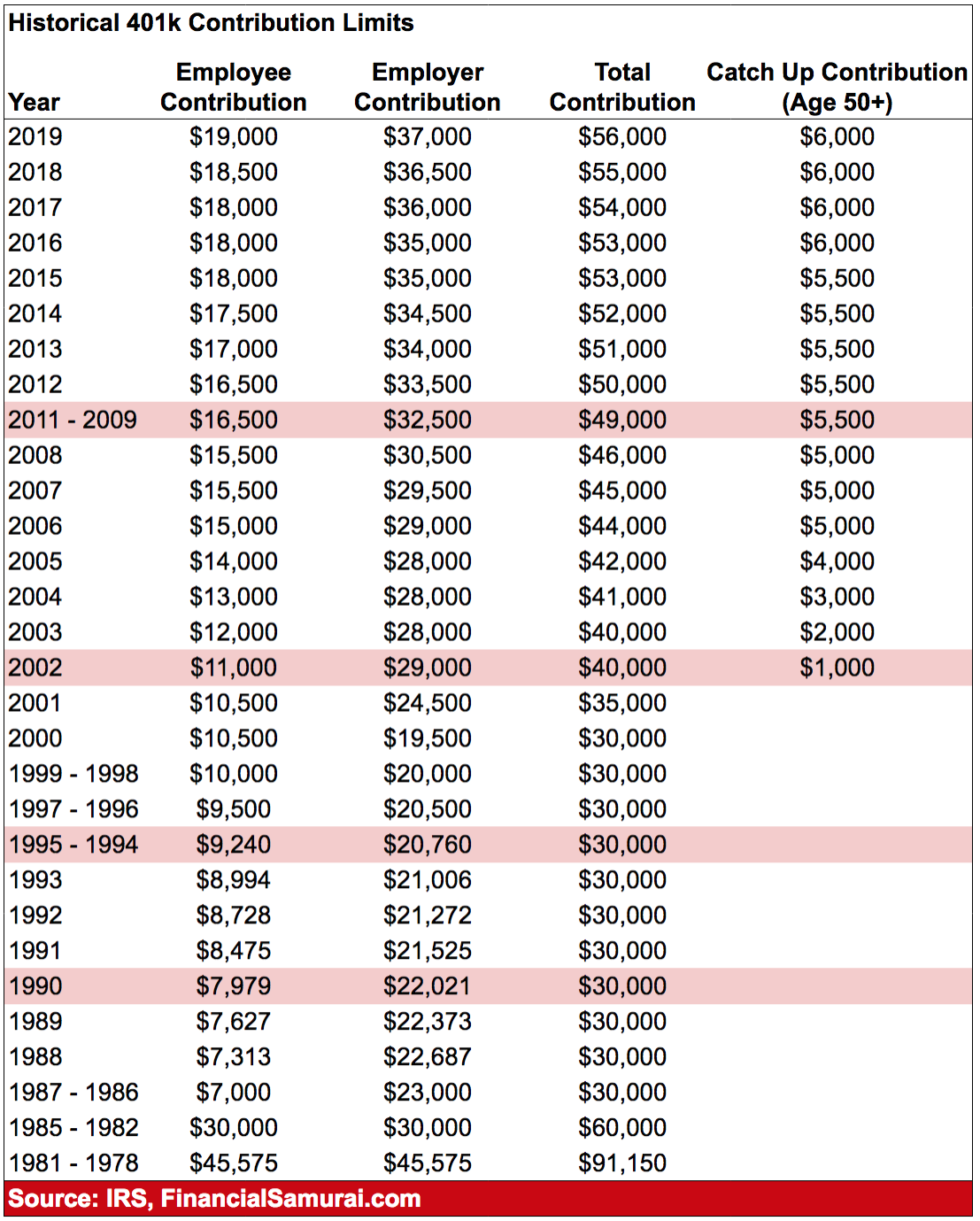

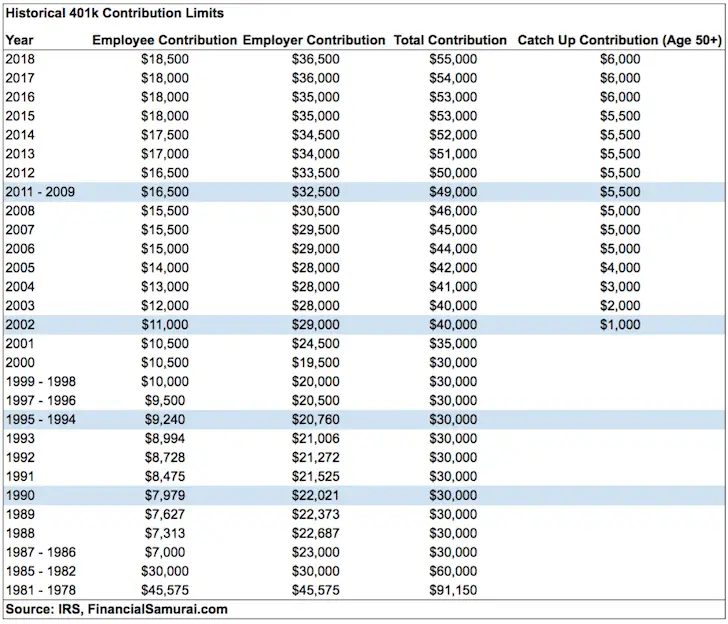

A 401 is a tax-advantaged retirement account, so the government sets limits on how much you can contribute every year. But it also understands that inflation makes retirement more expensive over time, so it reevaluates its limits every year and sometimes raises them. Here’s an overview of all of the contribution limits the government imposes on 401s in 2020 and 2021.

Sit Back And Celebrate

Implementing these pretax savings tips helps you reach your other savings goals above and beyond maxing out your 401 or other retirement contributions for the year. And while these ideas to save may not exactly seem like an indulgent splurge, finding new ways to invest in your future may be the best way to celebrate how well you’ve done in your workplace retirement plan.

Read Also: How Much Can You Put In 401k

Two Annual Limits Apply To Contributions:

How To Maximize Your 401 Retirement Savings

A workplace 401 account can be a powerful tool to help build your retirement savings. To maximize your 401 benefits, follow these tips:

1. Set your contribution level to take full advantage of your employers 401 match. If your company matches a certain percentage of your contributions, set your contribution level to take maximum advantage of the match. Otherwise, youre leaving money on the table.

2. Start contributing to your 401 immediately.

3. Take advantage of target-date funds. If youre overwhelmed by the investment options offered by your 401 plan, choose a target-date fund aligned with your anticipated year of retirement. Target date funds are optimized for your retirement timeline, making them great options for beginners or more hands-off investors.

4. Increase your 401 contribution percentage regularly. Each year, increase your 401 contribution rate by at least one additional percentage point. Gradual small increases have a minor impact on your take-home pay and a major impact on your retirement nest egg over time. In addition, if you receive any raises or bonuses, dedicate at least a portion of them to your savings.

Recommended Reading: Can A 401k Be Transferred To A Roth Ira

Max Out 401k Employer Contributions

Your employer may offer matching contributions, and if so, there are typically rules you will need to follow to take advantage of their match. An employer may require a minimum contribution from you before theyll match it, or they might match only up to a certain amount. They might even stipulate a combination of those two requirements. Each company will have its own rules for matching contributions, so review your companys policy for specifics.

For example, suppose your employer will match your contribution up to 3%. So, if you contribute 3% to your 401, your employer will contribute 3% as well. Therefore, instead of only saving 3% of your salary, youre now saving 6%. With the employer match, your contribution just doubled.

Since saving for retirement is one of the best investments you can make, its wise to take advantage of your employers match. Every penny helps when saving for retirement, and you dont want to miss out on this free money from your employer.

If youre not already maxing out the matching contribution, you can speak with your employer to increase your contribution amount.

How Much Should I Be Saving In My 401k In 2022

Theres not a universal standard for how much you should invest in your 401k each year, or even how much you should have saved by the time you retire. The answer for you, ultimately depends on your cost of living, career, and what age you want to retire.

Use our retirement savings calculator to check your progress.

However, there are some guidelines for how much you should have in your 401k that can help you figure out if youre on the right track toward enjoying your golden years.

- youve had a little time to figure out your career path and hopefully youve been able to save up some money in your 401k, too. At this stage, you should aim to have about a years salary saved in your planso if you make $50,000 per year, youd ideally want to have about $50,000 saved up for retirement.

- youve likely seen some advancement in your career, and your annual income may have seen a boost as well. By age 40 you might strive for about three years worth of salary saved in your 401k.

- youre inching closer and closer toward enjoying your retirement. At this stage, you should consider having about five years worth of salary saved.

What were saying is: dont panic if you havent saved as much as you planned onor if you havent saved anything at all. Its never too late to change your habits and improve your financial health.

Also Check: What Is 401a Vs 401k

Traditional Vs Roth 401

Some employers offer both a traditional 401 and a Roth 401. With a traditional 401 plan, you can defer paying income tax on the amount you contribute. In other words, if you earn $80,000 a year and contribute the maximum $20,500, your taxable earnings for the 2022 tax year would be $59,500.

With a Roth 401 plan, you dont get an upfront tax break, but when its time to withdraw that money in retirement, you wont owe any tax on it. All your accumulated contributions and earnings come out tax free.

Investing in both types of plans provides you with tax diversification, which can come in handy during retirement.

If you have access to both a Roth and a traditional 401 plan, you can contribute to both, as long as your total contribution to both as an employee doesnt exceed $20,500.

In addition to the Roth and traditional 401, some employers also offer an after-tax plan, allowing you to save up to the total annual limit of $61,000. With this account you can put away money after-tax and it can grow tax-deferred in your 401 account until withdrawal, at which point any withdrawn earnings become taxable.

Phathom Pharmaceuticals Announces New Data At Acg 2021 Annual Scientific Meeting

For people who have to consider what they can afford to contribute, the best advice is to regularly check up on their 401 status. Every quarter or so consider how much you are dedicating to your retirement account, compare it to the cap and check to see if you can budget for a little bit more. As you get older, work harder to increase those contributions, and perhaps even consider signing up for an automatic increase plan if your employer offers one.

The standard advice is to try and contribute between 15% to 20% of each paycheck to your retirement account. For many people, this is an enormous amount of money, but it is possible. The median American makes approximately $59,000. This means finding of $9,000 in the budget . It wont be easy, which is why you should make it an active part of your budgeting process. If you treat your 401 like a fire-and-forget, it will be easy to miss opportunities to put more money in.

Read Also: Can 401k Be Transferred To Another Company

Don’t Miss: Can I Have A 401k Without An Employer

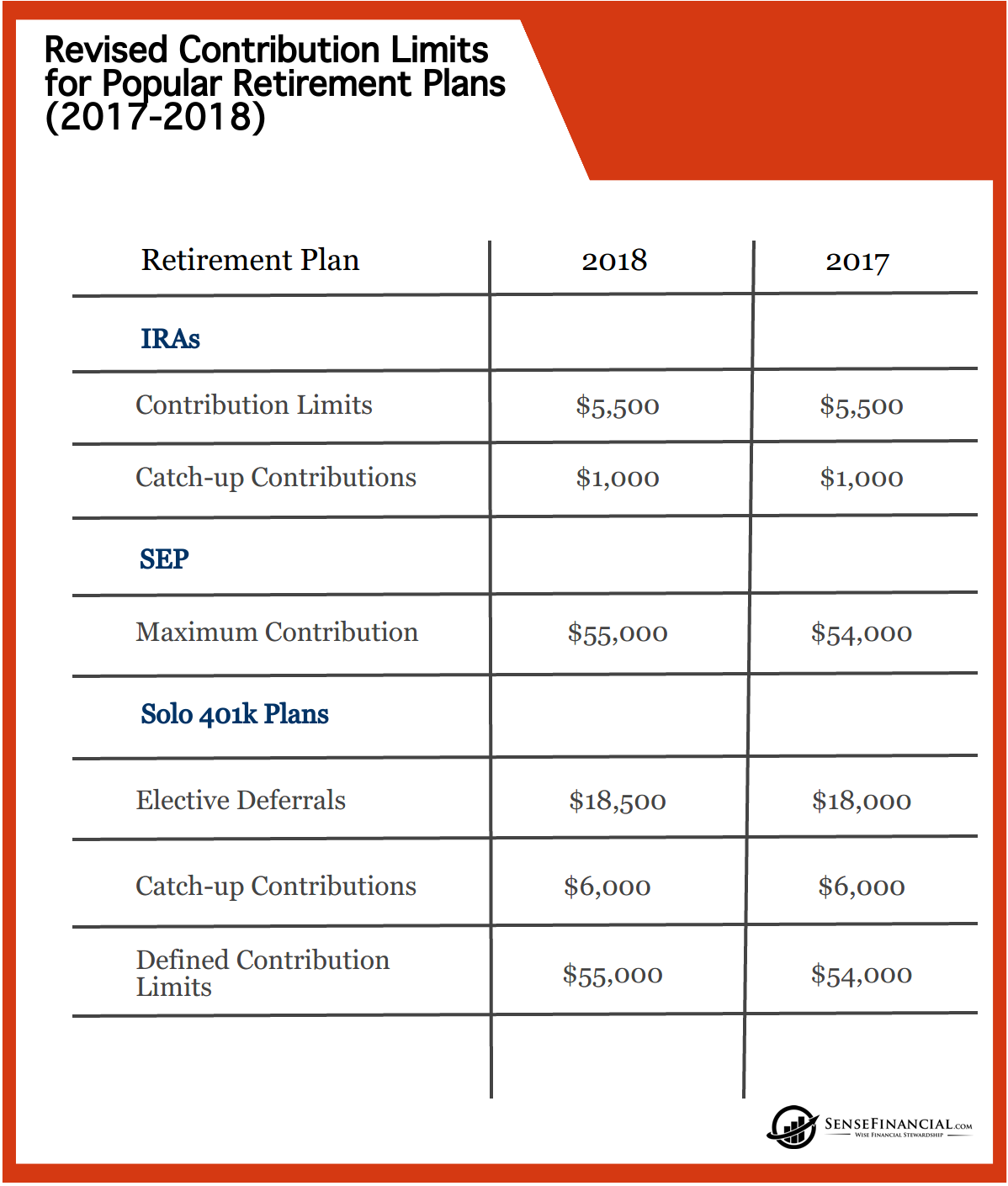

Contribution Limits For 2021

Contributing to your 401 is a great way to prepare for retirement, allowing for tax-deferred growth and, in some cases, employer matching contributions. If you really want to boost your savings, you might even contribute the maximum to the account. For 2021, the 401 annual contribution limit will remain unchanged from 2020 at $19,500. For employees over 50, there are also catch-up contributions. The limits for these will also remain unchanged from 2020 at $6,500. Note that the IRS also has rules surrounding 401 employer matching. Many taxpayers work with a financial advisor to maximize their retirement strategy. Lets take a look at the contribution limits and rules for 2021.

Also Check: Does Borrowing From 401k Affect Credit Score

Perks For Older Investors

If you happen to be at least 50 years old, youre entitled to make catch-up contributions by adding an additional $6,500 for a total contribution of $27,000 in 2022. The total maximum that can be tucked away in your 401 plan, including employer contributions and allocations of forfeiture, is $67,500 in 2022, or $6,500 more than the $61,000 maximum for everyone else. Forfeitures come from an account in which company contributions accumulate from departing employees who werent vested in the plan.

You May Like: Can They Take Your 401k If You File Chapter 7

Are There Separate Limits For Roth 401s

No. Roth 401s have the same contribution limit as regular 401s. For 2022, that limit is $20,500. You can contribute to both a traditional 401 and a Roth 401 account in the same year, as long as your total contributions dont exceed that amount. If youre choosing between the two, learn about the differences between a Roth and traditional 401.

|

no account fees to open a Fidelity retail IRA |

||

Account minimum |

||

|

when you invest in a new Merrill Edge® Self-Directed account. |

Promotioncareer counseling plus loan discounts with qualifying deposit |

PromotionGet $100 when you open a new, eligible Fidelity account with $50 or more. Use code FIDELITY100. Limited time offer. Terms apply. |

How Much You Can Afford To Contribute

Despite contribution limits, often times employees will contribute what they can afford to set aside for retirement. Financial experts generally recommend that everyone contribute 10% of their paycheck to a 401, but this may not be doable for all. Plus, often times we think about other ways we’ll need to use that money now.

Your life expenses can play a role in how much of your paycheck you feel comfortable contributing to your 401. If you tend to have high monthly costs or someone who relies on your financial support, you may feel like contributing a higher percentage to your 401 may mean having less in your paycheck to meet your monthly expenses.

If attempting to max out your 401 means putting yourself in a financially stressful situation, it’s okay to just contribute what you feel comfortable with.

In this case, a good rule of thumb that still has a profound positive impact on your retirement savings is to contribute just enough to receive the full employer match. So if your employer will match up to 7% of your contributions, only contribute 7% so you can take full advantage of that extra money. Your employer match is essentially “free money” so you don’t want to leave any sitting on the table.

You May Like: How Much Can You Put In 401k A Year