Withdraw From Your Ira

While using a 401 for a down payment may be costly at tax season, theres a good chance you might have better luck taking a distribution from an IRA instead. In this case, the rules around distributions depend on what kind of IRA you have. For example, if youre withdrawing from a Roth IRA, you can take a tax-free distribution at any time , provided that youve had the account for at least five years.

With a traditional IRA, however, the rules are a little bit different. Here, the tax scenario works similarly to a 401, where your distributions are taxed as ordinary income and youre typically taxed on early withdrawals. However, there is an exception for first-time homebuyers: They are allowed to borrow up to $10,000 to put towards their down payment without having to pay the extra 10% early distribution tax.

Can I Use My 401 To Buy A House

Disclosure: This post contains affiliate links, which means we receive a commission if you click a link and purchase something that we have recommended. Please check out our disclosure policy for more details.

For many would-be homeowners, the down payment is the biggest entry barrier to buying a house. While down payments can be as low as 3.5%, 20% is ideal if you want to secure a mortgage without monthly mortgage insurance fees.

If youre having trouble gathering funds for a down payment, you might find yourself considering using your 401 retirement fund as a convenient source of cash. While this is technically allowed, and could help you cover your down payment, it shouldnt be your first choice. There are some factors and drawbacks that you might want to consider before using your 401 to buy a house.

Well break down the pros and cons of making a 401 withdrawal for a home purchase, as well as some alternatives.

Taxes And Penalties For Withdrawals

Amounts withdrawn from your 401 plan and used toward the purchase of your home will be subject to income tax and a 10% early-distribution penalty .

Even though the distribution will be used towards the purchase of your first home, typically, the first-time homebuyer exception does not apply to distributions from qualified plans such as a 401. Furthermore, if the amount you receive is rollover eligible, your employer is required by law to withhold 20% of it for federal income tax.

Don’t Miss: What Can I Roll My 401k Into

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: Can I Borrow Against My 401k

Ask For Money From The Seller

Whether or not you decide to pull from your 401 for your home purchase, if you truly feel that youre unable to afford the upfront costs of buying a home, it may be a good idea to ask for money from the seller. In this scenario, the seller will pay for a portion of your closing costs upfront and raise the sale price of the home accordingly, which will allow you to pay for your closing cost overtime in the form of a slightly- higher mortgage payment.

While this may sound like a good deal, its important to note that its usually not recommended to go this route unless its absolutely necessary. Often, asking for a seller concession makes your offer appear weaker in the eyes of the seller and may make you less competitive in a hot market.

Be Careful Using 401 For A Down Payment

The biggest challenge most buyers face when purchasing a home? Coming up with that big down payment. Even if your mortgage lender only requires a down payment of 5 percent, that still comes out to $10,000 for a modestly priced home of $200,000. Many buyers simply don’t have that much cash lying around.

If you have a 401 plan at work, though, you might have a convenient source for down payment funds. You are allowed to borrow money from this retirement account for a down payment. You just have to pay back your loan — with interest — on time to avoid any penalties or taxes.

But does doing this make financial sense? That depends upon how badly you want the home, how close you are to retirement and how certain you are that you can pay back the loan on time.

Heather McRae, senior loan officer with Chicago Financial Services in Chicago, said that a 401 loan has helped several of her clients gather the funds they need for down payments. She considers it a smart financial move for borrowers who know they can handle the payback schedule.

“If you don’t have the money for a down payment and you don’t have family members who are kind enough to gift you the down payment, you’re kind of out of luck,” McRae said. “The 401 loan is often the best option for these buyers. If you haven’t saved the money for a down payment and you’ve fallen in love with a property, the 401 can make the purchase work.”

Don’t Miss: Can I Rollover My 401k Into My Spouse’s Ira

Is It Worth Taking A 401 Withdrawal To Buy A House

Taking a 401 withdrawal for a house can be a costly way to fund your home purchase. Youll pay income taxes on the distribution most likely at a higher rate than you would when withdrawing funds during your retirement years. And unless youre 59½ or older, youll pay an additional 10% penalty on the withdrawal.

Besides the immediate costs, using your 401 for a house down payment has long-term consequences. Youll be removing money from your nest egg money that may be harder to replace later on. And youll be unplugging a chunk of your money from future growth.

| Note: Withdrawing money from your 401 for a house down payment and other purchase costs qualifies as a hardship distribution as long as its for your primary residence. But the withdrawal will still be subject to income tax and, if youre under 59 ½, the 10% early withdrawal penalty. |

Down Payment And Closing Cost Assistance

What if you dont have a 3% down payment? After all, 3% of $300,000 is $9,000 thats still a lot of money.

If you need help making your down payment, there are other places to turn before your 401. For example:

- Look for down payment assistance programs in your area.DPA programs are available in every state. They offer grants and low-interest loans to help home buyers cover their down payment and closing costs. If you need help buying a house, DPA should be the first place you turn

- Look for mortgage lenders that offer down payment or closing cost help. Some lenders have special programs that offer credits to cover part of your down payment and/or closing costs. Find a few examples in our list of the best lenders for first time home buyers

- Ask a relative or family friend for help. Some home loans allow you to cover your entire down payment and closing costs using gifted money, although this must be properly documented. Make sure your real estate agent and loan officer know if you plan to use gifted funds

Most of these programs are specifically designed for first-time, lower-income, or lower-credit home buyers. So if youre having trouble saving for a down payment for any of these reasons, theres a good chance you could qualify.

Also Check: Is 401k Divided In Divorce

A Note About The Cares Act

Signed into law on March 27, 2020, the $2 trillion dollar Coronavirus Aid, Relief and Economic Security Act emergency stimulus bill was drafted to help those affected by the coronavirus pandemic. Under the act, 401 account owners can make a hardship withdrawal of up to $100,000 without paying the 10% penalty. The bill also grants the account holder 3 years to pay the income tax, rather than it being due within that same year.

Alternatives To Borrowing From Your 401

Before you borrow from a 401 to buy a home, consider whether there are other options available. For example:

- Down payment assistance programs: Down payment assistance programs are designed to help eligible buyers with down payment and closing costs. Some programs offer grants to qualified buyers that don’t have to be repaid. Others offer matching savings programs, similar to a 401, that match every dollar you save towards your down payment, up to a certain amount.

- Down payment gifts: If you have family members who want to support your efforts to buy a home, consider asking them to gift money for a down payment. The amount of money that can be gifted and the amount you have to put towards the down payment out of your own funds may vary based on the type of mortgage. The most important thing to remember with down payment gifts is that they must be thoroughly documented. Otherwise, the lender might not allow you to use those funds for your down payment.

- IRA withdrawal: If you have an IRA, you can withdraw up to $10,000 from your account towards a down payment on a home without incurring the 10% early-withdrawal penalty. Be aware that if you’re withdrawing from a traditional IRA, you’ll still owe income tax on the amount you withdraw.

Read Also: How Can You Get A 401k

Are You A First

Unless you are a person with a disability or you are helping a related person with a disability buy or build a qualifying home, you have to be a first-time home buyer to withdraw funds from your RRSP to buy or build a qualifying home.

You are considered a first-time home buyer if, in the four-year period, you did not occupy a home that you or your current spouse or common-law partner owned.

Also Check: Can You Convert A 401k Into A Roth Ira

The Cons To Using Your 401 To Buy A Home

Tapping your retirement plan to buy a home creates problems. Heres how.

Diminishing your retirement savings not only hurts you with the initial drop in its balance but for its future growth.

For instance, you take out $50,000 from your account to buy a home. If your 401 is earning 7% annually, in 25 years your $50,000 will be worth$271,372. You lose that gain!

You are better off leaving the $50,000 in your 401 plan unless the equity in your new home can equal or better the $50,000 left in your 401k for 25 years.

You May Like: How To Select 401k Investments

Other Down Payment Funding Options

Taking money from your 401 either in loan or withdrawal form is not the only way to come up with money that you can use for a down payment on a house. Here are some other options that are available:

If you’re a first-time homebuyer, you can get an FHA loan to finance your home purchase. With an FHA loan, you will not have to put down 1020%. Instead, you can put a minimum of 3.5% down as long as your credit score is above 580.

- Gift From Friends or Family

If you have a generous friend or family member who is willing to help you out with a down payment, then this is a good option. Most lenders will allow gifts to be used for a down payment. However, the amount of gift money that can be used for the down payment may vary depending on the type of loan and the lender. Be sure to ask your lender what their policies are before you try to use a gift as a down payment.

One party that you are not allowed to get a gift from for a down payment is the seller. As Sullivan at HUD explains, “We have long prohibited that the sources of payment be the seller. It is critically important that there be separation between buyer and seller in the transaction. There was a time, for a while, when the FHA would insure mortgages where the buyer of the home was contributing a down payment that was financed by the seller. We found those loans to be incredibly risky and defaulted at a much greater rate. And so, we prohibited that practice.”

- IRA Withdrawals

- Assistance Programs

About the Author

Accessing And Repaying 401 Funds

Funds can be obtained, as you may expect, from a loan. Its often called a 401 loan, and when you take one out, you will have to repay it with interest no surprise there. The interest rate is typically set up as a formula, such as “prime rate plus one or two percentage points. The prime rate is published daily, and it is based on surveys of 30 banks’ lending rates.

More often than not your loan term will be a maximum of five years, and your payment will be taken directly from your payroll.

Don’t Miss: How To Get Money Out Of 401k Without Penalty

The $10000 Exclusion From Traditional Ira’s

Typically if you withdraw money out of your Traditional IRA prior to age 59 you have to pay ordinary income tax and a 10% early withdrawal penalty on the distribution. There are a few exceptions and one of them is the “first time homebuyer” exception. If you are purchasing your first house, you are allowed to withdrawal up to $10,000 from your Traditional IRA and avoid the 10% early withdrawal penalty. You will still have to pay ordinary income tax on the withdrawal but you will avoid the early withdrawal penalty. The $10,000 limit is an individual limit so if you and your spouse both have a traditional IRA, you could potentially withdrawal up to $20,000 penalty free.

How Do You Qualify For A Hardship Withdrawal

The IRS wont charge you a 10% penalty if you need to cover medical expenses. If you dont have medical insurance or sufficient cover, the IRS will allow you to withdraw without penalty.

The unemployed can withdraw some money to pay for medical insurance or bills, but only if you have lost your job rather than resigned. You also need to have been claiming unemployment benefits for 12 weeks continuously.

Even without meeting these hardship reasons, you could still withdraw without penalty. If you have no other way of paying higher education bills for yourself or a dependent, you could claim, for example.

Also Check: How To Take A Loan From 401k

Also Check: What Will My 401k Be Worth

What Is The Difference Between A 401 Loan And A 401 Withdrawal

When you withdraw money from your 401, you have to pay income taxes on the amount you withdraw and you may also have to pay a 10% early withdrawal penalty if you are not at least 59½ years of age. Unlike a 401 loan, you do not have to repay a 401 withdrawal, which can make this type of funding sound good to first-time homebuyers. Remember, though, the money you withdraw will no longer be there for you at retirement.

If your 401 is the only funding source you have, then you might consider buying your home using a 401 loan instead of a 401 withdrawal. Before considering this option, however, remember to check to see if your 401 plan allows for a loan. These often allow you to borrow up to half the value of your vested balance, and repay yourself, with interest. While most 401 loans require repayment within 5 years, for some first-time homebuyers, that period may be extended.

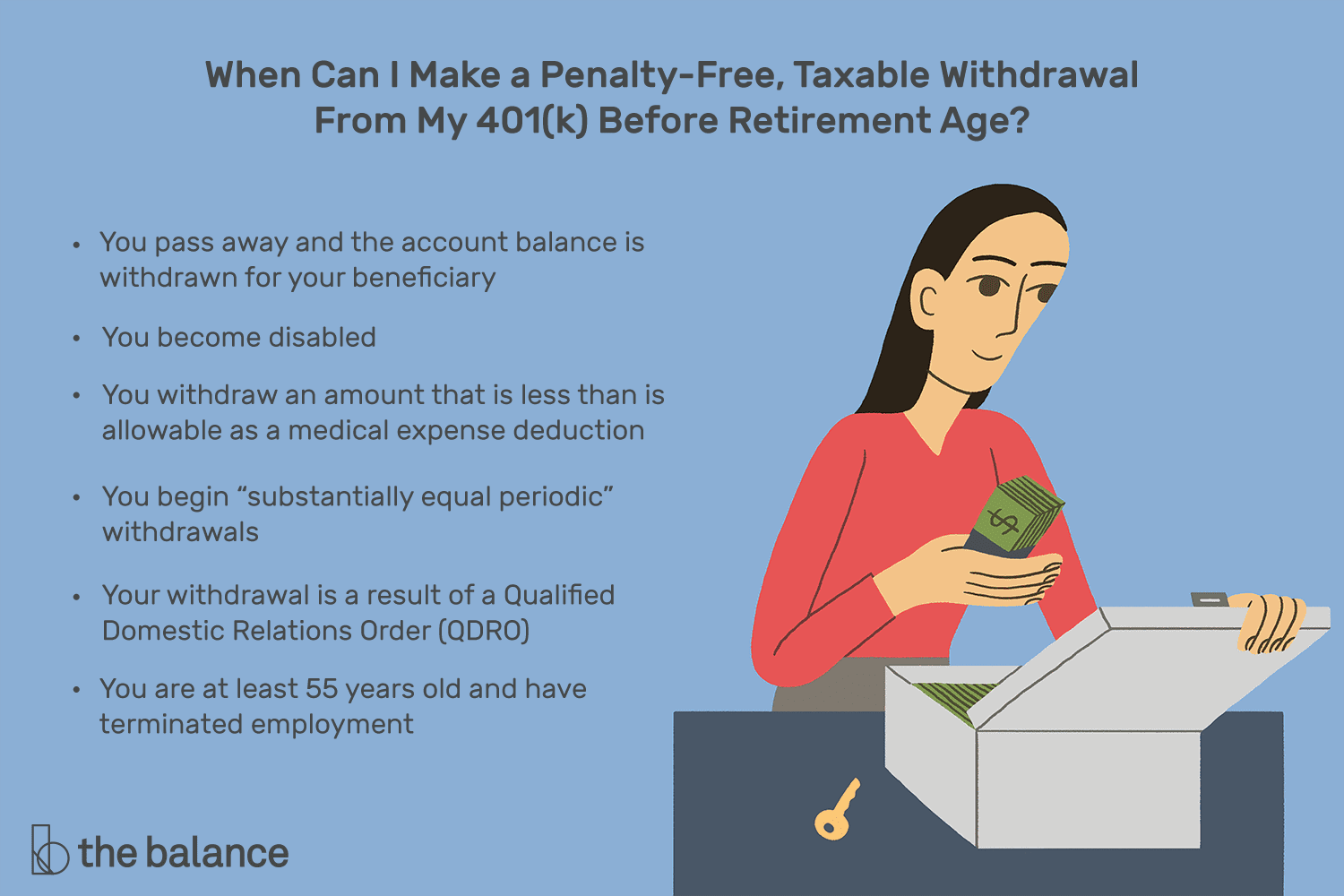

What Are Some Other Circumstantial Exemptions

Leaving your job after youve turned 55 is one way you can make withdrawals from your 401 without penalties, including buying a second home. Public safety officers and state and federal government workers are eligible to receive distributions beginning at age 50. See IRC Section 72.

Keep in mind early distribution penalties are issued based on your withdrawal age at that given time. Withdrawals or distributions are always reported by your plan administrator or custodian to the IRS regardless of your age.

You May Like: When Can You Pull Money From 401k