Can You Rollover A Pension Into A 401k

Traditional retirement days are coming to an end because companies are still turning to 401 s for occupational retirement plans. Some members of todays workforce, mainly generation X and older, were lucky to be enrolled in blue-chip retirement plans before they were offered. Can you rollover a pension into a 401k?

Option : Transfer The Money From Your Old 401 Plan Into Your New Employers Plan

Moving your old 401 into your new employers qualified retirement plan is also an option when you change jobs. The new plan may have lower fees or investment options that better support your financial goals. Rolling over your old 401 into your new companys plan can also make it easier to track your retirement savings, since youll have everything in one place. Its worthwhile to talk with an Ameriprise advisor who will compare the investments and features of both plans.

Some things to think about if youre considering rolling over a 401 into a new employers plan:

Read Also: How Can I Use My 401k To Buy A House

Nc 401 And Nc 457 Transfer Benefit

Teachers and State Employee System Members, and Local Government Employee System Members have the option to transfer their NC 401 or NC 457 funds to the NC Retirement System to receive an additional monthly benefit. Transfers are optional and are a one-time, irrevocable election.

To estimate your monthly benefit from account funds you transfer, use the Transfer Benefit Estimator found in your personal ORBIT account.

To apply to transfer all or a part of your NC 401 or NC 457 funds complete Form 319401k for the NC 401 or Form 319457 for the NC 457, which can be found in ORBIT.

If you have questions about how to apply for the Transfer Benefit or want to check the status of your application, call the NC Retirement Systems at 814-4590.

Check the SECU Suitability Tool

The State Employees Credit Union provides a tool to help you determine if the NC 401 and NC 457 Transfer Benefit is right for you.

Don’t Miss: What Happens To A 401k When You Leave A Company

Can You Have More Than One Ira

You are allowed to have as many IRAs as you want to. Many people open multiple IRAs to get access to more investment options. For example, you might want both a traditional brokerage IRA for stocks and a self-directed IRA for real estate.

When you do a rollover, the IRS lets you do multiple rollovers for direct transfers. If you do a 60-day rollover, you have to make a single deposit into a single IRA. You can then move money between IRAs if you want to.

Check with your pension plan for any rules they may have on doing multiple rollovers.

Government Employees Still Get Pensions

Still, defined benefit plans are available to most government employees, whether they work at the federal, state, or municipal level. While it may be comforting to assume your retirement needs will be fully met by a government pension, that’s not a good idea.

Many state and municipal employee pension plans are facing substantial shortfalls to cover future obligations. That means your pension might not be as ironclad as you once thought. Even government employees should be making additional plans to save for retirement.

Also Check: What Is The Most You Can Put Into A 401k

Make Sure You Don’t Make Mistakes Rolling Over Your Workplace Pension

Traditional pensions used to be much more common, but recently, they’ve largely given way to defined contribution plans like 401s. Nevertheless, the rules for rolling over pension plan balances are equally important to both in order to make sure that you don’t create a huge amount of unnecessary tax liability. Here, we’ll cover more about the pension rollover rules and the options you have in dealing with your workplace pension plan. That way, you can figure out which one makes the most sense for you from a financial and tax perspective.

What the pension rollover rules sayIRS Publication 575 defines the pension rollover rules that workers have to follow when they decide to roll over their pension balances. The rules apply to qualified retirement plans, which include not only traditional pensions but also 401 plans and similar retirement accounts.

The most important general rule is that if you take a lump-sum distribution from a retirement plan, then you can roll it over into another qualified retirement plan or a traditional IRA and defer any taxable income. Normally, a lump-sum distribution from a pension would be taxable in the year in which you take the distribution. By rolling it over, you can avoid that tax, and the rules for whichever type of account you use to roll the money into will apply going forward.

Rolling over a pension can be a smart way to minimize tax. Just make sure you follow the pension rollover rules to get the full tax benefits that you deserve.

Working Because I Want To

The other category of retirees that tend to favor the IRA rollover option is the Im working because I want to category. It has becoming more common for individuals to retire from their primary career and want to still work doing something else for two or three days a week just to keep their mind fresh. If the income from your part-time employment and your social security are enough to meet your expenses, having a fixed pension payment may just create more taxable income for you when you dont necessarily need it. Rolling over your pension plan to an IRA allows you to defer the receipt of that income until at least age 70½. That is the age that distributions are required from IRA accounts.

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

Most pre-retirement payments you receive from a retirement plan or IRA can be rolled over by depositing the payment in another retirement plan or IRA within 60 days. You can also have your financial institution or plan directly transfer the payment to another plan or IRA.

The Rollover Chart PDF summarizes allowable rollover transactions.

Don’t Miss: What Is A 401k Profit Sharing Plan

Traditional Pension Plans: A Blast From The Past

Pensions are terrific if youre lucky enough to still have one. Until the 1970s, most workers had defined-benefit pensions. They were originally designed to encourage employees to stay with one company for the long haul. The employee was rewarded for loyalty, and the company benefited from having a stable, experienced workforce.

As the name implies, these plans provide a fixed payment during retirementfor as long as you live. Of course, if you’d rather have a single payment, you can elect a lump-sum distribution. You can even choose a combination of these two options.

Either way, your benefits are based on metrics, such as your age, earnings history, and years of service. Your employer funds the pension and takes on the investment risk. They also bear the longevity risk. That’s the risk that plan participants will live longerand collect more moneythan the company expected.

These days, defined benefit plans are still fairly common in the public sector . But they’ve largely disappeared from the private workforce, where defined contribution plans now rule.

Defined Benefit Pension Rollover To An Ira: Is It Possible

The short answer to this question is yes or more accurately, usually. Some states have switched from defined benefit pensions to 401 plans for their public school teachers and do not allow a pension rollover to an IRA. However, for most people this type of pension rollover is possible and often encouraged by their employer, particularly if they are closing out their defined benefit plan.

Two conditions must be met for you to roll over your pension to an IRA. The first is that the pension plan you are currently under must be a qualified employee plan that conforms to Internal Revenue Service rules. If your contributions to the plan have been tax-deferred, then the chance is good that it is. The second condition is that you must be leaving the company, through either retirement or other circumstance, or your company must be closing its pension plan. To be safe, contact your plan administrator before you initiate any transfer of funds.

Don’t Miss: Can You Take Money Out Of 401k

Should I Transfer My Pension Savings

Nest is backed by the government and our great service and value for money is recognised with our Defaqto 5 Star rating. Before you transfer, its worth making sure your money is going to a similarly high-quality scheme.

Once youve found a new pension provider, run through our 4-point transfer checklist to make sure youre getting a good deal.

Four things to ask before you transfer your pot

Want to see how Nest delivers? See how you can benefit from the UKs largest workplace pension scheme.

If youre still unsure, think about taking independent financial advice or contacting an independent organisation such as MoneyHelper.

Open An Individual Retirement Account

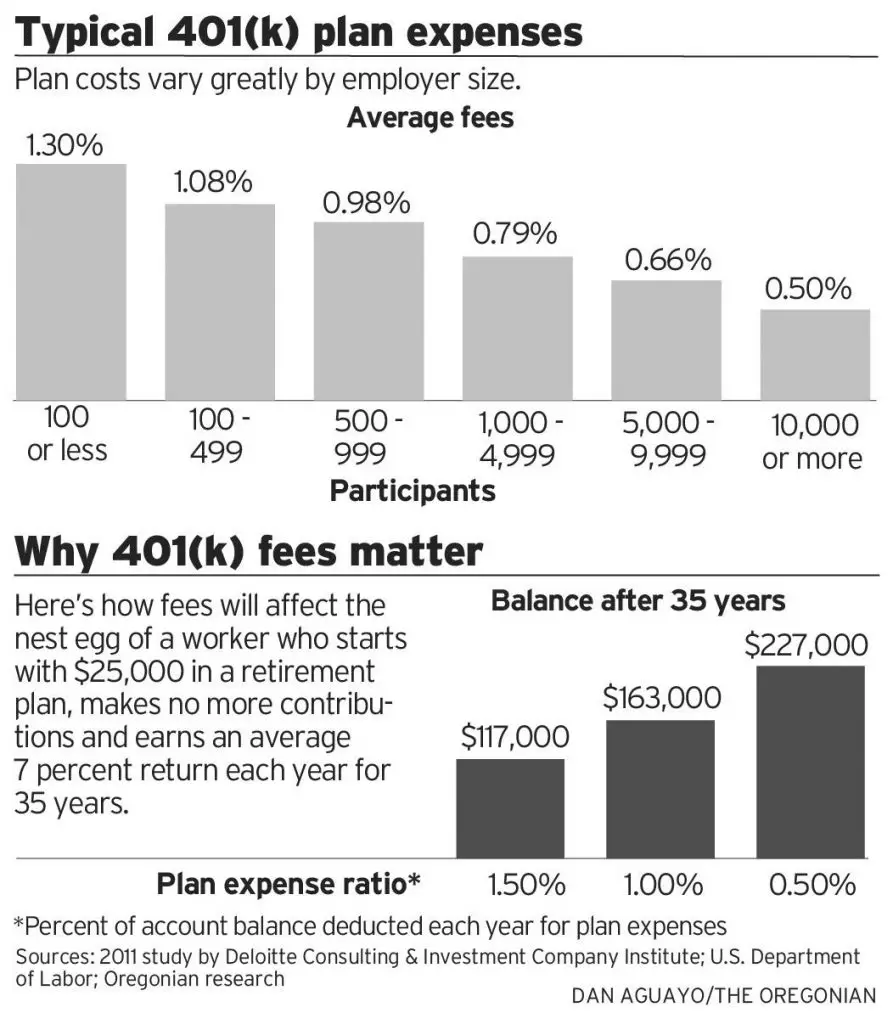

If you reach the annual contribution limit for your 401 or you dont like the investment offerings in your employer plan, you can continue saving by opening a traditional or Roth IRA. With an IRA, you can save another $6,000 per year for retirement , giving you some extra cushion to build up your retirement paycheck.

Recommended Reading: How To Find A 401k From Previous Employer

How Long Does The Process Take

The process to transfer out can take 15 weeks or more depending on a number of things, like how responsive your new pension provider is once they have your forms. See our transfer out timeline for more information.

For transfer requests received on and after 30 November 2021, we are required by law to check that the transfer out application satisfies requirements set out in new legislation. For certain transfers out of USS we must obtain further information/evidence from you before we are able to able to proceed with a transfer request, and in other cases we may request further information/evidence from you before we are able to proceed with a transfer request. This could add to the processing time but is in place to help protect you from pension scams. For further information regarding the new requirements please refer to Dealing with transfer requests on The Pensions Regulator website.

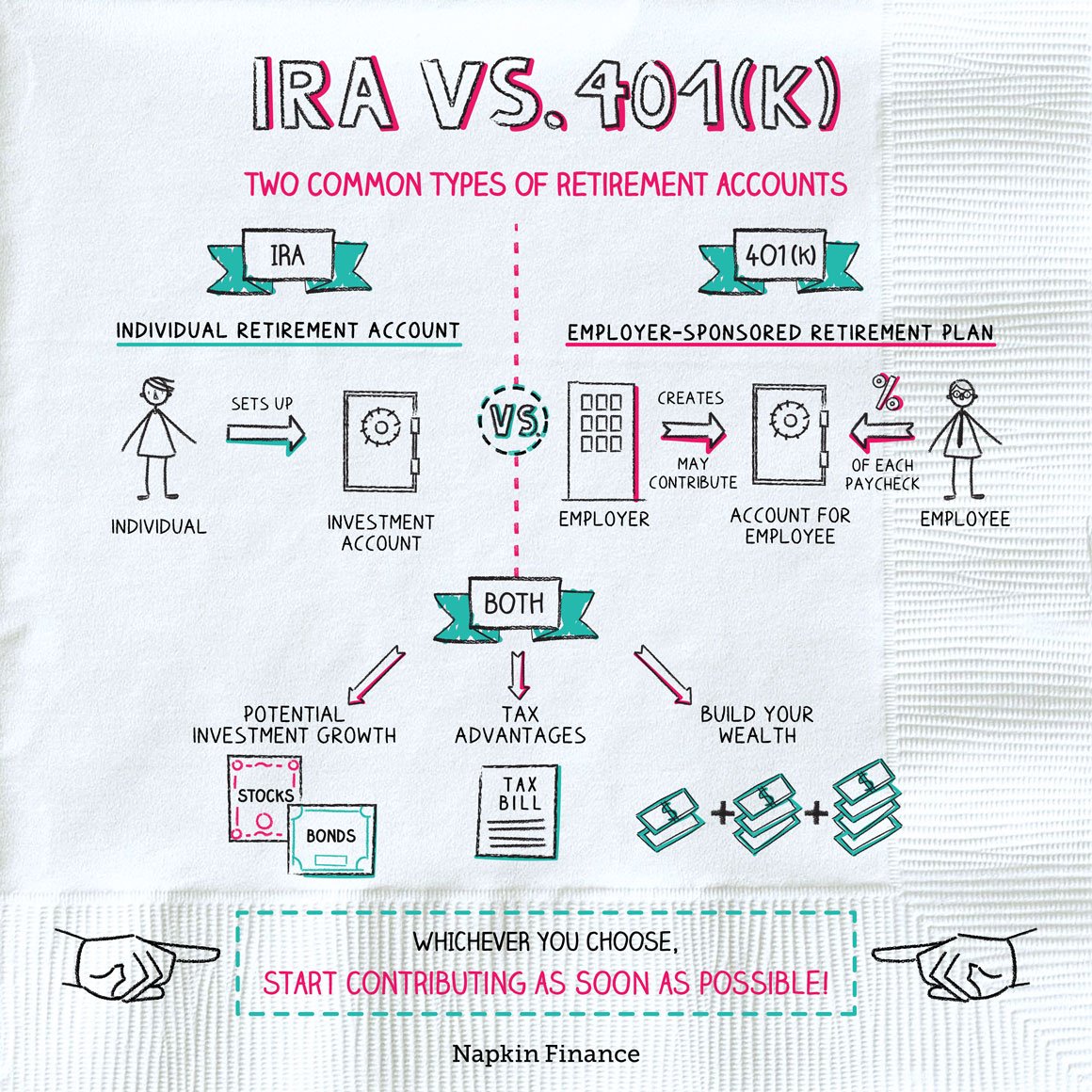

How Do 401s And Iras Work

A 401 is an employer-sponsored retirement savings plan that allows employees to save pre-tax money from their paychecks, often with a partial match from their employers. Money deposited into 401 accounts is not taxed until it is withdrawn. It gets its name from the section of the tax code that covers it.

An IRA is an individual retirement account in which the saver directly deposits pre-tax funds. Often, individuals who leave companies where they had 401 plans will roll the funds into IRAs.

Regardless of whether you own a 401k or an IRA, once a distribution is taken, it is taxable as ordinary income. Additionally, if you are withdrawing money prior to the age of 59 and a half, then the IRS levies an additional 10% penalty tax. The same rules of taxation apply when you roll a 401 plan or an IRA into an annuity.

Recommended Reading: How To Maximize Your 401k

Can I Transfer Uk Pension To A Us 401k 401k Vs Uk Pension Explained

Article Summary

The governments of the United Kingdom and the United States have both established legislation encouraging their citizens to save for retirement. The government offers tax benefits to funds that are invested in a certain pension account.

We continue to receive questions about whether or not it is possible to transfer a UK pension plan to a 401 or another qualifying US pension plan due to the tax differences between the two nations, and vice versa. In this article, we will explain it thoroughly.In the meanwhile, you can enjoy a video discussing the same topic explained by our CEO and Independent Financial Advisor, Dominic James Murray.

Rolling Over Your Pension

Retirement is easy as long as you stay in the same company throughout your working life. But the average person will change jobs at least several times during his working life. The exact number is difficult to trace, but it is not uncommon for someone to change jobs a dozen or more times between the ages of 18 and 48.

Don’t Miss: Can I Borrow Against My Fidelity 401k

Can I Transfer Uk Pension To My 401k In The Us

Is it possible to transfer UK pension to the US? This is a question often asked by the estimated 750,000 British expats now resident in the US, or maybe you are one of the many thousands of US citizens who have previously worked in the UK and built up some form of UK Pension benefits.

If you’ll be residing in America for the long term, then naturally you’ll want to look at a transfer of your UK pension into a 401k or IRA in the US.

Should You Roll Over Your 401

To start, its worth knowing that you dont have to make a 401-to-IRA rollover, even if you do leave your job. You have the option of leaving the money youve invested in the plan at your old company. You cant keep contributing to it, but it will stay invested and if your investments go up, youll continue to see your account grow. This is called an orphan account.

Do you like the way your money is invested currently? If so, you may want to consider keeping your money in the existing plan. If you currently arent working but anticipate taking a new job soon, you could leave your money at your old plan temporarily and put it into your new companys plan once you have access to it.

For those who dont think theyll end up in another 401 plan but still want to save more for retirement, it might make sense to do a 401-to-IRA rollover. Remember, even though you still have your account at your old companys 401, you wont have the ability to make more contributions.

Read Also: Can I Have 2 401k Plans

Recommended Reading: Can I Borrow From My Solo 401k

Let The Pension Transfer Specialist Help You

Cameron James Expat Financial Planning is one of the few companies in the industry to hold both an FCA and an SEC licence. We truly understand the UK perspective, primarily on pension transfers, as well as the US perspective. Our financial advisors are fully licensed and qualified to perform the pension transfer in both countries.

There may be financial advisors in the US who have done more than us in terms of working strictly on US 401Ks and rollovers. They will not, however, be able to look after everything for you so that you understand both the UK and US sides of the spectrum.

Many concerns, such as your equity, withdrawal, or tax benefit, can only be understood by an IFA company that is qualified in both countries. So, thats when working with a cross-border financial advisor emerges.

Cameron James Expat Financial Planning is the preferred independent financial advisory service for International SIPP transfers. With over 10 years experience in transferring pensions, Cameron James is now servicing clients in 26 countries.

We have the qualifications and technical knowledge required to help you transfer to an International SIPP both as an expat and US resident. Our mission is to bring regulated and transparent advice to our clients. As such, our clients fully understand how much their advice will cost in advance, with no hidden fees.

Other Transfer Services

Employee Contributions Your Consent Is Not Required

401 plans can provide for either voluntary or mandatory contributions by employees, and this decision is made by the employer as part of the plan. The employer can also determine whether the contributions are made on a pretax or after-tax basis.

Once again, employer contributions to a 401 plan are mandatory, regardless of whether or not employee contributions are required.

If employee contributions are mandatory, then they will be made on a pretax basis . If they are voluntary, they are usually after-tax. Those contributions can represent up to 25% of the employees total compensation. Any contributions to a 401 plan made by the employee are immediately vested .

The employer contributions are typically made using either a fixed dollar amount, a percentage of your compensation, or a match of the employees contributions.

Employer contributions are subject to vesting. That means you will have to work for the employer for a certain minimum number of years before you will have full ownership of those contributions.

The vesting schedule can be based either on cliff vesting, which provides for full vesting after a certain number of years, or graded vesting, which provides for incremental vesting over several years.

Even if you dont make contributions to the plan as an employee, the employer is still required to make contributions on your behalf.

Don’t Miss: How Do Employer Contributions To 401k Work

Transferring Service Between Systems

Any credit you may have in the following retirement systems may be counted along with your credit in your current system in order to determine your eligibility for a reduced or unreduced retirement benefit:

- Teachers’ and State Employees’

- Local Governmental Employees’

- Consolidated Judicial

However, only your creditable service in your current system is used in computing the amount of your benefit in that system. Creditable service in any other system is used to compute benefits from that system.

In addition, any service credit you have in the UNC Optional Retirement Program may be added to your creditable service in TSERS in order to determine eligibility for benefits from TSERS.