How Long Does It Take To Get Money Out Of My 401k

May 3, 2011 It usually takes a week or two to get money out of your 401, although it can take much longer. The countdown begins when you request payment and ends when you actually receive the money in the form of a check or wire transfer.

Principal 401k phone number What is your 401k plan based on your retirement count?Your 401 is qualified retirement plan Although your donation has been reported in field 12 code D in format W2. You dont need to report them again in TurboTax. If youre going to bring up another issue, youll only answer yes to this question, such as BT IRA or Roth IRA. June 4, 2019 at 11:51 a

Recommended Reading: How Much Do You Have To Withdraw From 401k

People May Have Different Reasons For Withdrawing Funds Early From A 401k

- Financial Hardship: People sometimes withdraw funds early due to financial hardship . Example include: medical care, expenses related to the purchase of a home, tuition, and funeral expenses

- Discretionary Spending: People may withdraw funds from a 401K because they prefer to have the money now rather than save it for retirement. In general, we do not recommend this strategy

- Early Retirement: Some people retire earlier than the standard retirement age. In this case, it is understandable why they may want to access funds early since they are no longer working

Youll Halt Compound Interest In Its Tracks

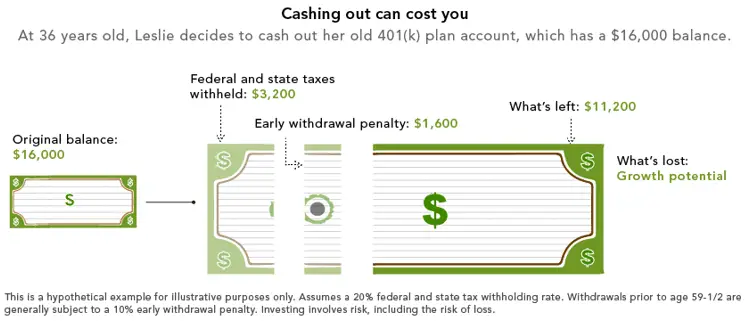

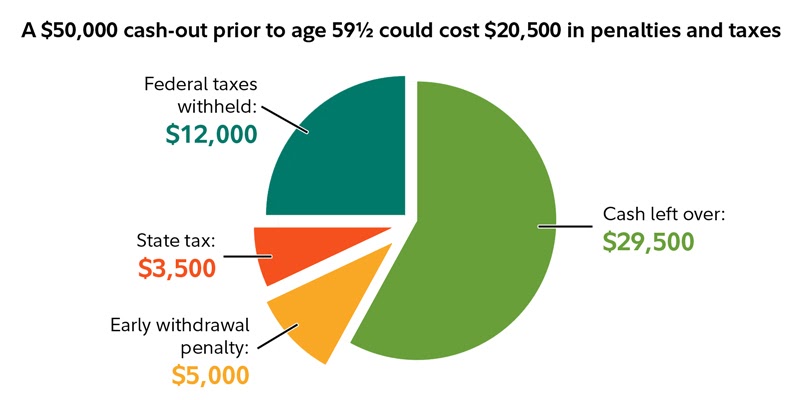

Compound interest is another way of saying interest on interest it results in exponential account growth over time. By cashing out your 401 early, youll be giving up somewhere around 30% of your balance to taxes and penalties. This will substantially reduce your asset base and limit the degree to which your account can grow via compound interest into the future.

Don’t Miss: How Do I Take My Money Out Of My 401k

Withdrawal Penalty Before Age 59

If you’re under age 59½, you may have to pay an additional 10% when you file your tax return. If you are still working when you are 59 ½, you can take money out of your 401.

You can take money from your 401 account if you are age 59½ or older. You will not have a penalty. Twenty percent is withheld for federal income taxes. You can also roll money from your 401 to IRA or other qualified plan. Funds that are rolled over are not subject to tax at that time.

How To Avoid An Early Withdrawal Penalty

You can avoid the 401 early withdrawal penalty by waiting until you are 59 ½ to take distributions from your plan. The IRS also lists various situations which could exempt you from the 10% tax, such as taking an early distribution due to a qualifying disability or reducing excess contributions. Make sure to review the exemptions list to see if your situation qualifies.

Another way to avoid the 10% early withdrawal tax is to opt for a loan against your 401 account. Your loan amount won’t be taxed as a distribution as long as:

- You borrow 50% or less of your vested balance up to $50,000.

- The loan is repaid within five years .

- Your payments are substantially level.

- Payments are made at least quarterly over the life of the loan.

While 401 loans can be a good alternative, not all plan providers offer them so you’ll have to check to see if it’s an option for you.

You May Like: How To Locate 401k Account

Can You Make An Early Withdrawal From Your 401 Plan

Yes, you can make an early withdrawal but just because you can, it doesnt mean that you should. Cashing out from your 401 plan early can come with several financial consequences such as loss of interest growth or penalties. This is why its not recommended to cash out the 401 until you are at least 59 years old.

How Taking A 401 Distribution Affects Your Retirement

Time in the market and compounding interest are critical factors when it comes to your retirement savings. While investment returns will vary, in general more money in the market means more at retirement, while anything you withdraw now is that much less youll have for your golden years. Plus, taking money out means missing any potential gains your investments would have seen along the way, even if you reinvest the money down the road.

Thats why its important to carefully assess your situation if youre experiencing a true emergency and your retirement is your only financial source, consider limiting the amount you take out to only what you need. If youre certain that you can pay yourself back, theres also less of a risk in going this route. But if you can go without touching your nest egg, over time you may be able to reap the rewards of compound interest and avoid any potential losses.

Read Also: How Do I Offer 401k To My Employees

Also Check: Can I Roll Over 401k Into Ira

Who Is Eligible For Coronavirus

If you, your spouse or a dependent have been diagnosed with COVID-19, you qualify for the above benefits. However, eligibility for coronavirus-related distributions extends well beyond those who have been diagnosed.

According to an IRS notice issued on June 19, qualified individuals include anyone who has encountered “adverse financial consequences” as a result of the individual, the individual’s spouse or a member of the individual’s household experiencing any of the following due to COVID-19:

-

Being quarantined, furloughed or laid off.

-

Having their hours at work cut.

-

Having a job offer rescinded or delayed or their income reduced.

-

Being unable to work because of a lack of child care.

-

Slashing operating hours or shutting down a business due to the outbreak.

This means that if your spouse experiences financial hardship, you may qualify for a coronavirus-related distribution from your retirement account, even if you’re still employed.

Cashing Out A 401 After Leaving A Job

The IRS established the 401 as a tax-advantaged plan for employees, rather than the self-employed. This works fine most of the time, but in an era when people change jobs far more often than they used to it also has created some confusion. What do you do with this account, thats supposed to grow over decades, when you change employers? There are a few common options. A financial advisor can offer you valuable insight and guidance on handling tax-advantaged accounts.

Also Check: What Is The Difference Between 401k And 403b

Build An Emergency Fund

This should be the foundation of your financial plan and experts recommend having about six months worth of expenses saved. You can park this money in a high-yield savings account to earn more interest than you would in a traditional checking account. An emergency fund should help you manage most of lifes curveballs.

There Are Some Situations In Which It Can Be Advisable To Take An Early 401k Withdrawal

- It may be beneficial to cash out a portion of your 401K if you have a loan that has very high interest. For example, taking an early distribution on your 401K be wise to pay down credit card or personal loan with a very high interest rate. In this case, you may be financially better off cashing out the 401K and paying the penalty than continuing to pay that interest. However, it is important to do the math to determine whether its better to cash out a portion of the 401K or not

Recommended Reading: How Much Will My 401k Be Worth When I Retire

Getting The Funds May Take Time

Generally, it takes several weeks to actually cash in your 401 plan. Some companies, usually small ones, can even limit the number of distributions you can take out. They might only allow it once per year or once per quarter. These rules come in the form of your 401 summary plan document, which you and your company must follow.

But that means you may wait a significant amount of time, which can be dangerous if youre facing a financial emergency.

Determine Whether You Qualify For A Hardship Withdrawal

The IRS defines a hardship as an immediate and heavy financial need. This is the type of withdrawal you should take if you qualify youll still have to pay income tax on the money, but you wont be charged the 10% early withdrawal penalty in many cases. Examples of financial hardship include the following:

- Rent or mortgage payment to prevent eviction or foreclosure

- Funeral expenses for the employee or employees spouse, dependents or beneficiaries

- Certain expenses to repair damage to the employees personal residence

Keep in mind that the IRS limits hardship withdrawals to the amount thats necessary to satisfy the need.

You May Like: Can You Invest Your 401k In Stocks

Alternatives To Withdrawing From 401

How can you access cash without withdrawing or borrowing from your 401? If you’re a homeowner with equity, you can consider a cash-out refinance, home equity loan, or home equity line of credit . All three of these options typically come with competitive interest rates because the financing is secured by your home.

Permanent life insurance policies with cash value components are another option. In this case, your death benefit serves as collateral for the loan. Once the loan balance is paid off, your death benefit is restored in full. Don’t have either? You can also look into personal loans from a wide variety of online lenders. The better your credit and income, the more competitive offerings you can access.

Consider All Of Your Financial Options

When you need cash in a crunch, ideally you have options: using money saved, dipping into emergency savings, getting a loan, or possibly as a last resort withdrawing money saved for retirement. Consider the relief available if youve been impacted by a FEMA declared disaster , and talk to your plan sponsor and/or retirement services provider before taking any next steps.

You May Like: What Is 401k In Usa

Recommended Reading: What To Do With A 401k After Leaving A Job

Should You Take A 401 Loan Or 401 Withdrawal

Some plans allow loans from 401 plans as an option to get access to the fund for virtually any purpose. Maybe you want to travel, pay your childs college tuition, put a down-payment on a new house, or cover the cost of a divorce. There are many personal reasons to consider a loan.

Generally, you can take up to 50% of the balance to a maximum of $50,000. The good news is that there is no age restriction, and there are no taxes due when you take out a loan. However, the loan must be repaid over a five-year period, with interest owed back to your account.

There is risk involved in taking out a loan. Some plans allow you to roll over a 401 when changing employers. However, in other cases, you may have to pay your outstanding loan balance in full within 60 days of leaving an employer otherwise, it will be considered a 401 withdrawal, taxed as ordinary income and subject to the 10% withdrawal penalty.

Compared to a loan, an early 401 withdrawal:

- Must have an option that allows for in-service withdrawals, which may be restricted by age or hardship.

- Will be taxed as ordinary income .

- Can be subject to a 10% penalty if youre under 59.5 .

- Will not require repayment loan).

Losing Your Job Or Changing Jobs

Picture this: Your boss calls you into his office. You close the door behind you. Then you hear those words no one wants to hear: Im sorry, but we have to let you go.

Just like that, you pack your desk and youre out of a joband, if you dont have a ton of cash saved up in your 401 when you leave, you might just want to take that money and run. But the truth is that even a small cash-out can have a huge impact on your retirement savings.

Lets take a look at Joe. At 25, hes been working for a couple of years and just landed a new job. He decides to cash out the $4,500 in his 401 to pay for his move and furnish his new place. After all, its only $4,500, right?

Turns out that its even less. First of all, Uncle Sam keeps about 25% for income taxes. Then Joe also gets penalized with a 10% early withdrawal fee, reducing his $4,500 to a mere $2,925.

Worse, Joe will miss out on the long-term benefits of compound growth. What if he had rolled his 401 into an IRA when he left his job like he should have? Joes account could have grown to over $200,000 during the next 40 years, and thats without adding another penny. Talk about a pricey mistake!

Read Also: Can You Take Out Your 401k To Buy A House

What Is An Early 401k Withdrawal Or Early 401k Distribution

An early withdrawal is a withdrawal that occurs before you are 59½

There may be penalties for withdrawing funds from a 401K early.

- The penalty is 10% of the distribution

- Lets say you have $100K in your 401K and you take an early distribution for $10K

- The penalty is 10% of $10K which is $1K

- If the 401K was a traditional 401K, then $10K will also be added to your income for the year and you will pay taxes on it, based on your taxable rate for ordinary income. If it was a Roth 401K, then $10K will not be added to your income

Withdrawal Taxes After Retirement

The account holder can cash out their savings without a penalty tax after retiring.

However, for a traditional 401 plan, the holder still must pay income tax on the money. The tax rate will depend on the federal tax bracket at the withdrawal time.

After retirement, the pensioner must watch out for the required minimum distribution, which is obligatory after 72 years. If they dont take the RMD, the IRS can penalize them by taking 50% of the amount that they didnt distribute.

Don’t Miss: How To Find My 401k Contributions

Penalties And Taxes On Cashing Out A 401k

When you complete a 401k cash out, you will need to pay an early withdrawal penalty and 401k taxes on your withdrawal. The 401k early withdrawal penalty is 10% of the amount that you withdraw. You will also be taxed at your normal income rate on the amount that you withdraw. Most plans will withhold 20% of the amount that you withdraw and send it to the IRS to help cover the costs and will send you a 1099-R form. If your tax rate is higher than 10%, then you will need to be prepared to pay additional money when you file your taxes. It is important to be prepared for this possibility.

Can Anybody Cash Out A 401 K Early

If you resign early, you might want to cash out your 401 k. However, you might face a financial penalty for doing so. If you haven’t reached retirement age, you can often expect to be charged 10% plus ordinary income tax on the amount in your 401 k for an early withdrawal. If you think you might want to take your 401 k money out of the IRA early, you should discuss this with your current employer.

Also Check: Can I Invest In 401k And Roth Ira

How Can I Pull Out My Money From My 401

Cashing out a 401 can be a tempting idea, especially if you are facing financial difficulties or need to raise money for a major purchase. But even though the money in the account belongs to you, it is subject to certain rules and restrictions due to the tax advantages it provides account owners. One of the rules related to cashing out a 401 relates to the employment status of the account owner. You are allowed to cash out a 401 while you are employed, but you cannot cash it out if you’re still employed at the company that sponsors the 401 that you wish to cash out.

TL DR

You can cash out a 401 while you are employed, but you cannot cash it out if you’re still employed at the company that sponsors the 401 that you wish to cash out.

The Costs Of Early 401k Withdrawals

Early withdrawals from an IRA or 401k account can be expensive.

Generally, if you take a distribution from an IRA or 401k before age 59 ½, you will likely owe:

- federal income tax

- 10% penalty on the amount that you withdraw

- relevant state income tax

Calculate It:401k Withdrawals Before Retirement

The 401k can be a boon to your retirement plan. It gives you flexibility to change jobs without losing your savings. But that all starts to fall apart if you use it like a bank account in the years preceding retirement. Your best bet is usually to consciously avoid tapping any retirement money until youve at least reached the age of 59 ½.

If youre not sure you should take a withdrawal, use this calculator to determine how much other people your age have saved.

You May Like: Do You Pay Taxes On 401k Rollover To Roth Ira

The 401 Withdrawal Rules For People Between 55 And 59

Most of the time, anyone who withdraws from their 401 before they reach 59 ½ will have to pay a 10% penalty as well as their regular income tax. However, you can withdraw your savings without a penalty at age 55 in some circumstances. You cannot be a current employee of the company that runs the 401, and you must have left that employer during or after the calendar year in which you turned 55. Many people call this the Rule of 55.

If youre between 55 and 59 ½ years old and you are considering a 401k withdrawal from an old employer, you should keep a few things in mind. For starters, doesnt matter why your employment stopped. Whether you quit, you were fired, or you were laid off, you can qualify for a penalty-free withdrawal. However, you need to meet the age requirement and your employment must end in the calendar year you turn 55 or later.

These rules for early 401 withdrawal only apply to assets in 401 plans maintained by former employers. The rules dont apply if youre still working for your employer. For example, an employee of Washington and Sons usually wont be able to make a penalty-free withdrawal before they turn 59 ½. However, the same employee can make a withdrawal from a former employers 401 account and avoid the penalty when he or she turns 55.