Retirement Benefits Are Important To Job Seekers

said retirement benefits are important inaccepting a job.

said retirement benefits are important instaying with a job.

Retirement Benefits, Workplace Culture Crucial to Job Seekers,National Association of Plan Advisors , July 2019.

What are some of the potential benefits to your employees?

Convenience

Contributions are automatically deducted from participating employees’ paychecks each pay period, so they don’t have to budget separately for setting money aside.

Savings

The earlier employees start saving, the more time theyll have for their retirement accounts to grow. And any matching contributions you offer give them an opportunity to take advantage of free moneyproviding even more incentive to maximize their contributions.

Tax advantages

Employee pre-tax contributions are deducted from paychecks before income taxes, reducing taxable income. Taxes are also deferred on any investment earnings until the money is withdrawn in retirement.

Flexibility

Employees can request to take a loan from their 401 plan balance and select a loan repayment schedule that suits them within plan terms. You can also choose to have the plan allow for hardship withdrawals.

Financial wellness

Simply Retirement by Principal® 401 plan participants will have access to a comprehensive financial wellness platform that provides tools and resources to employees to better manage their current and future financial well-being.

How much could your employees save for retirement?

Determine If You Want To Match Employee Contributions

Matching contributions are an additional kind of compensation for employees that can help them maximize their retirement savings. Moreover, Employees and employers can both benefit from matching contributions. Small business owners might use vesting schedules to further personalize their plan design to match their objectives.

What Are The Potential Tax Benefits Of A Solo 401

One of the potential benefits of a Solo 401 is the flexibility to choose when you want to deal with your tax obligation. In a Solo 401 plan all contributions you make as the “employer” will be tax-deductible to your business with any earnings growing tax-deferred until withdrawn. But for contributions you make as an “employee” you have more flexibility. Typically, your employee “deferral” contributions reduce your personal taxable income for the year and can grow tax-deferred, with distributions in retirement taxed as ordinary income. Or you can make some or all of your employee deferral contributions as a Roth Solo 401 plan contribution. These Roth Solo 401 employee contributions do not reduce your current taxable income, but your distributions in retirement are usually tax-free. Generally speaking, there are tax penalties for withdrawals from a Solo 401 before 59 1/2 so be sure to know the specifics of your plan.

You May Like: How To Direct Transfer 401k To 403b

Contribute Enough To Get Any Employer Match

Even the priciest 401 plan can have some redeeming qualities. Free money via an employer match is one of them. Contributing enough money to get the match is the bare minimum level of participation to shoot for. Beyond that, it depends on the quality of the plan.

A standard employer match is 50% or 100% of your contributions, up to a limit, often 3% to 6% of your salary. Note that matching contributions may be subject to a vesting period, which means that leaving the company before matching contributions are vested means leaving that money behind. Any money you contribute to the plan will always be yours to keep.

If your company retirement plan offers a suitable array of low-cost investment choices and has low administrative fees, maxing out contributions in a 401 makes sense. It also ensures you get the most value out of the perks of tax-free investment growth and, depending on the type of account or the Roth version), either upfront or back-end tax savings.

How To Set Up A 401 Contribution For Employees:

To set up a new employee quickly, go to Update Company Files, Company Information, select Default Payroll Information, and apply the same changes in steps 46.

Don’t Miss: How To Transfer 401k Accounts

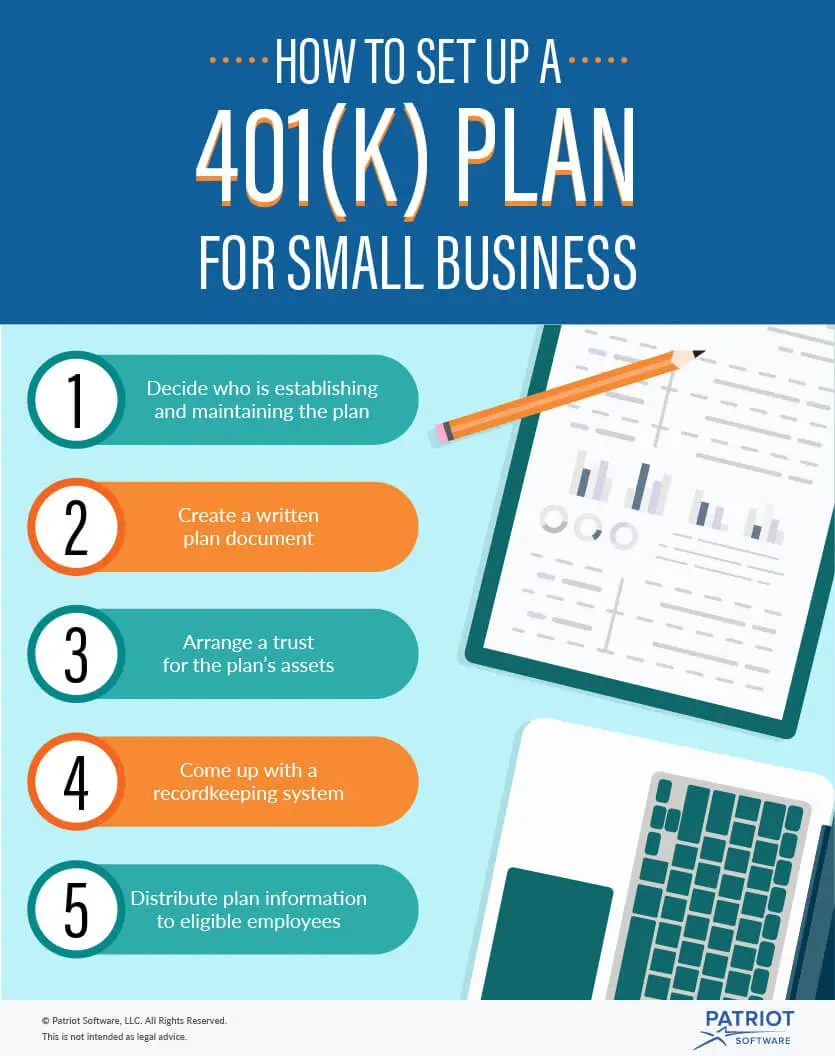

How To Set Up A 401 Plan

Now that you know the landscape, youre ready to set up a plan as an employer or self-employed individual. Whether youre establishing a plan for a large enterprise or or on your own the next steps are:

- If youre self employed, decide if you want a SoloK, SEP, or SIMPLE providers).

- Decide which plan provisions you want , Safe Harbor, matching, vesting schedules?).

- Choose a vendor .

- Complete the adoption agreement along with other agreements and submit to your vendor.

- Communicate and educate: Inform employees of the plans existence and features.

- Set up individual participant accounts.

- Fund the plan through payroll or any employer contributions.

- Review the plan regularly to ensure its meeting the needs of plan participants.

- Monitor and adjust the plan as regulations change and your needs evolve.

- Provide required information to participants on an ongoing basis.

After Establishing The Plan

Once your portfolio is in place, monitor its performance. Keep in mind that various sectors of the stock market do not always move in lockstep. For example, if your portfolio contains both large-cap and small-cap stocks, it is very likely that the small-cap portion of the portfolio will grow more quickly than the large-cap portion. If this occurs, it may be time to rebalance your portfolio by selling some of your small-cap holdings and reinvesting the proceeds in large-cap stocks.

While it may seem counter-intuitive to sell the best-performing asset in your portfolio and replace it with an asset that has not performed as well, keep in mind that your goal is to maintain your chosen asset allocation. When one portion of your portfolio grows more rapidly than another, your asset allocation is skewed toward the best performing asset. If nothing about your financial goals has changed, rebalancing to maintain your desired asset allocation is a sound investment strategy.

And keep your hands off it. Borrowing against 401 assets can be tempting if times get tight. However, doing this effectively nullifies the tax benefits of investing in a defined-benefit plan since you’ll have to repay the loan in after-tax dollars. On top of that, you will be assessed interest and possibly fees on the loan

Read Also: When Can You Pull Money From 401k

What’s So Great About 401 Accounts

A 401 is a popular type of employer-sponsored retirement plan that’s available to all employees 21 or older who have completed at least one year of service with the employer, usually defined as 1,000 work hours in a plan year. Some employers enable new employees to join right away, even if they haven’t met this criterion yet.

In 2021 you’re allowed to contribute up to $19,500 to a 401 or up to $26,000 if you’re 50 or older. In 2020, those amounts rise to $20,500 and $27,000. These limits are much higher than what you find with IRAs, and they enable you to set aside a fairly large sum annually.

Most 401s are tax deferred, so your contributions reduce your taxable income each year. You must pay taxes on your distributions in retirement, but you may be in a lower tax bracket by then, in which case you would save money. Some employers also offer Roth 401s. You pay taxes on contributions to these accounts now, but you’ll get tax-free withdrawals in retirement.

Some employers also match a portion of their employees’ 401 contributions, which can make the task of saving for retirement a little easier. Each company has its own rules about matching, so consult with your HR department to learn how yours works.

Fund Types Offered In 401s

Mutual funds are the most common investment options offered in 401 plans, though some are starting to offer exchange-traded funds . Both mutual funds and ETFs contain a basket of securities, such as equities. Mutual funds range from conservative to aggressive, with plenty of grades in between. Funds may be described as balanced, value, or moderate. All of the major financial firms use similar wording.

Read Also: Can I Keep My 401k If I Quit My Job

How Much Does It Cost To Set Up A 401 For A Small Business

Costs to set up a 401 plan will vary depending on the size of your business and the types of benefits you select. Initial setup fees can generally run anywhere from $500 to $3,000, depending on the chosen retirement service provider. Other costs to consider are fees associated with rolling assets over from another plan and initial consulting costs for investment advice.

If You’re An Employee

You can fund a Roth 401sometimes referred to as a designated Rothif your employer offers one as part of its retirement plan options. Not all employers do, but their numbers are growing, especially among large companies. If your employer matches your contributions, or some percentage of them, that money, unlike your own Roth 401 contributions, is considered a pretax contribution and is therefore taxable when you withdraw it.

Unlike Roth IRAs, which have income limits, you can open a Roth 401 regardless of how much money you earn. Another critical difference between the two Roths is that unless you are still working for the company through which you have the Roth, you must generally take required minimum distributions from your Roth 401 starting at age 72. Roth IRAs, on the other hand, have no RMDs during your lifetime.

Unlike Roth IRAs, Roth 401s are subject to required minimum distributions.

If you’d like to hedge your bets, you can have both a Roth 401 and a traditional one and split your contributions between them. The maximum total you can contribute to the two accounts is the same as if you had just one account: $19,500 plus another $6,500 in catch-up contribution if you’re 50 or older.

Also Check: Can I Cash Out My 401k After Leaving My Employer

Be Smart With Your 401

Opening a 401 is a smart step on the road to a comfortable retirement, but it’s not quite as simple as signing some papers and setting aside a percentage of your paycheck. You have to understand the rules, choose your investments wisely, and continue to maintain your plan for as long as you own it. If you do that, you can feel confident that you’re giving yourself the best shot at a secure retirement.

Choose A Plan For Your Employees

Once you’ve chosen a retirement services provider, it’s time to decide on a plan that fits both your business and your employees’ needs. Options available to employers regardless of size, including businesses with only one employee, include:

1. A traditional 401 plan, which is the most flexible option. Employers can make contributions for all participants, match employees’ deferrals, do both, or neither.

2. The safe harbor 401 plan, which has several variations and requires the company to make a mandatory contribution to the plan participants. The contributions benefit the company, the business owner, and highly compensated employees by giving them greater ability to maximize salary deferrals.

3. An automatic enrollment 401 plan, which allows you to automatically enroll employees and place deductions from their salaries in certain default investments, unless employees elect otherwise. This arrangement encourages workers to participate in the company 401 plan and increase their retirement savings, which also benefits business owners. Automatic enrollment plans may also contain a safe harbor provision.

Recommended Reading: How To Open A 401k Plan

What Are The Contribution Levels And Limits Of A Solo 401

To take full advantage of contributions to a Solo 401 plan you must understand your limits as an employee and employer, as well as contributions allowed on behalf of a spouse if applicable.

When contributing as the employee, you are allowed up to $19,500 or 100% of compensation in salary deferrals for tax years 2020 and 2021. If you are over 50, an additional $6,500 catch-up contribution is allowed for tax years 2020 and 2021. This is the type of contribution that can be made as pre-tax/tax-deferred or Roth deferral or a combination of both. Additionally, as the employer, you can make a profit-sharing contribution up to 25% of your compensation from the business up to $57,000 for tax year 2020 and $58,000 for tax year 2021. When adding the employee and employer contributions together for the year the maximum 2020 Solo 401 contribution limit is $57,000 and the maximum 2021 solo 401 contribution is $58,000. If you are age 50 and older and make catch-up contributions, the limit is increased by these catch-ups to be $63,500 for 2020 and $64,500 for 2021.

Compensation from your business can be a bit tricky. This is calculated as your business net profit minus half of your self-employment tax and the employer plan contributions you made for yourself plan). The limit on compensation that can be factored into your tax year contribution is $285,000 for 2020 and $290,000 for 2021.

What Is The Role Of The Employer In Administering 401k Plans

Under ERISA, plan fiduciaries, including the employer and any third parties who manage the plan and its assets, must act solely in the interest of the plan beneficiaries. Some of their responsibilities include:

- Managing the plan with the exclusive purpose of providing the plans retirement benefits to participants

- Ensuring that the investment menu offers a broad range of diversified investment alternatives

- Choosing and monitoring plan investment alternatives prudently

- Ensuring that the costs of plan administration and investment management are reasonable

- Filing reports, such as Form 5500 Annual Return/Report, with the federal government

These tasks should be taken seriously since fiduciaries can be held personally liable for plan losses or profits from improper use of plan assets that result from their actions.

Read Also: How To Pull Money From Your 401k

What Is A 401 Plan

A 401 plan is a type of IRS-approved retirement plan that allows employees to contribute pretax amounts to individual retirement accounts. Employers also can contribute to employee accounts, often by matching employee contributions, up to a certain percentage.

You can choose from several types of small-business 401 plans and other varieties of retirement plans. Get help from a retirement plan advisor to select the best one for your business.

What’s The Difference Between A Traditional 401k And A Roth Ira

The primary difference between a 401k and a Roth IRA is how the savings are taxed. Contributions to a 401k are made before tax deductions, whereas those to a Roth IRA are made after tax deductions. When employees retire, their income from a 401k savings plan is subject to taxes. Qualified withdrawals from a Roth IRA, on the other hand, are tax free.

Don’t Miss: When I Withdraw From My 401k

Start Your Own Retirement Plan

When youre an employee, you can only use a 401 plan if your employer establishes a plan and youre eligible to contribute. All too often, thats not the case. But you still have options.

Ask for a 401: Your employer might be willing to set up a 401 they just havent done it yet. Start the conversation by asking why there isnt one, why you want one, and that there are potential tax benefits for employers. Explain that valuable employees like yourself would be even more valuable with excellent benefits. Offer to do some of the legwork required to get the plan up and running. In some cases, especially with small organizations, your employer simply doesnt have time to set up a plan. Cost is another factor companies and small nonprofits might be hesitant to pay plan costs . If cost is the primary concern, discuss less-expensive options like SIMPLE plans. Only time will tell if itll actually happen, but it never hurts to ask.

IRAs: If you dont have a 401, you may still be able to save in an individual retirement account , and you might even receive tax benefits similar to a 401. Unfortunately, the IRS sets maximum annual limits much lower for IRAs. Still, something is better than nothing. Evaluate traditional IRAs for potential pre-tax saving, and Roth IRAs for possible tax-free withdrawals . Another drawback of IRAs ) is that you may need to qualify to make contributions or receive a deduction. Speak with a tax expert before you do anything.

Maintaining Your Businesss 401 Plan

Figuring out how to start a 401 for a small business is just the beginning. Keep in mind that there are some recurring employer responsibilities after starting a 401 for a small business.

Depending on the type of 401 you selected, you will need to conduct nondiscrimination testing, make employer contributions, report plan information, and keep up with fees.

Don’t Miss: Is A 401k A Defined Benefit Plan

How Do You Choose The Best Funds To Offer To Your Employees

The contributions you make to your 401 are invested in a portfolio made up of mutual funds, stocks, bonds, money market funds, savings accounts, and other investment options, as permitted by the plan.

Beneficial funds allow your employees to choose the types of investments they make. The fund choices are transparent, have a low fee, and follow well-researched investment approaches. Again, speak with a finance professional while you are researching options.

You Are Leaving The Wells Fargo Website

You are leaving wellsfargo.com and entering a website that Wells Fargo does not control. Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website.

When considering a 401 plan for employees, keep in mind this flexible plan offering provides the highest level of employee pre-tax or Roth contributions, a wide range of employer contribution options, and an optional loan provision.

You May Like: Where Can I Move My 401k Without Penalty