The Cons Of Target Date Funds

Target date fund ease of use may come with trade-offs. One intuitive consequence is indifference.

articipants who invest solely through target date fundsthe dominant default investment optionare significantly less likely to seek any form of advice throughout the age distribution, raising the possibility that reliance upon defaults crowds out advice seeking, per a recent working paper published in the National Bureau of Economic Research.

That is, savers get conditioned to believe that their needs are being met by the target date fund, and are unaware that despite the broad positives for target date funds, there are issues to consider as they get closer to retirement.

Some of these issues include:

Target Date Mutual Funds

A target date mutual fund is a fund in the hybrid category that automatically resets the asset mix of stocks, bonds and cash equivalents in its portfolio according to a selected time frame that is appropriate for a particular investor. In simpler terms, an investor can purchase a target date fund based on their anticipated retirement date and the fund will automatically become more conservative as the investor approaches retirement.

This is often times a suitable investment for the average investor or participant in a 401 plan that would not typically make allocation adjustments on their own. During the financial crisis of 2008 and 2009, many investors approaching retirement were overexposed to the stock market and lost half of their savings with no time to make it back before retirement. This is where the benefit of a well-managed target date fund would have been useful as investors who needed an allocation change as they approached retirement would have got it. Emphasis on the well-managed.

At year end 2013, there was approximately $595.5 billion dollars invested in target date mutual funds, up from approximately $111.9 billion in 2006 based on a study conducted by Morningstar. With so much money being placed in these funds, it is important to know how they work and what to look for when choosing the correct fund for your risk tolerance and time horizon.

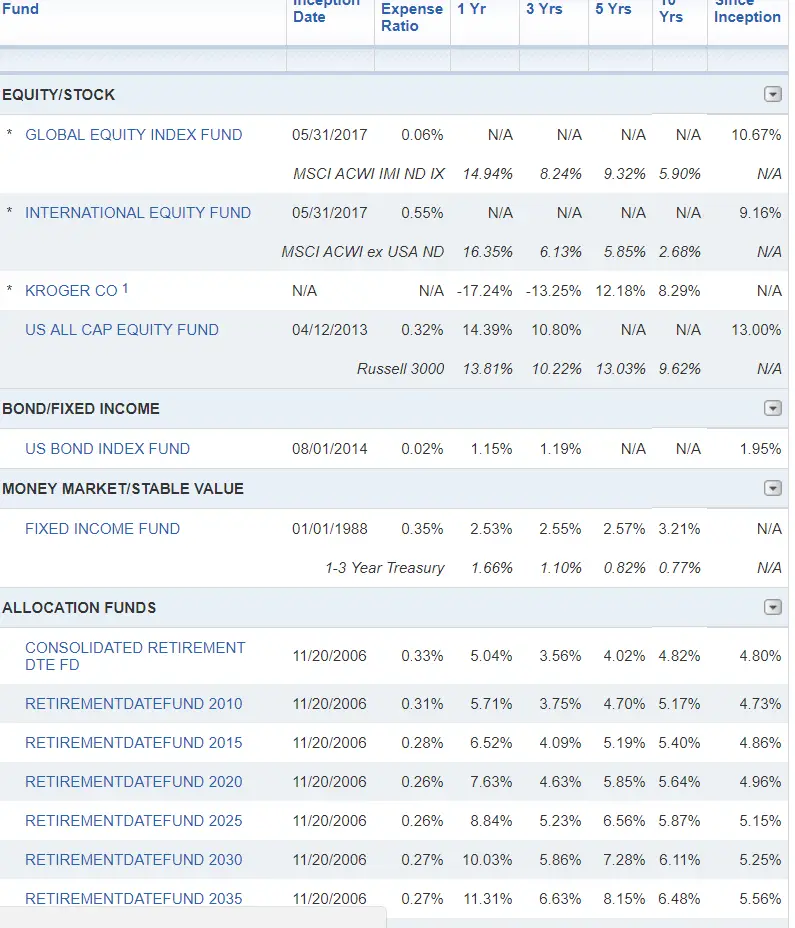

comparing target date fund performance

Companies That Will Help You Retire A Millionaire

According to the International Longevity Centre UK , you should save at least 11 percent of your income in order to retire comfortably. However, research shows that most Americans fall short of this goal, with just $5,000 tucked away for retirement.

Eric Roberge, a CFP and founder of Beyond Your Hammock, tells CNBC Make It that the biggest mistake most people make when saving for retirement is not taking advantage of their employer’s 401 match.

“If you have a 401 at work and you choose to open a Roth IRA, and your employer’s willing to give you 100 percent of the first 5 percent that you put in your 401, you’re missing out on free money,” he says.

To help you find a company that’ll set you on the road to a comfortable retirement, no matter your current salary, job search platform Glassdoor compiled a list of companies with strong 401 programs and substantial company matches.

Don’t Miss: What To Roll 401k Into

What Is A Target Date Fund

Investing is confusing. You know you need to own stocks, but which ones? How do you decide whether international equities are appropriate for you?

Then theres fixed income. Should you go with corporate bonds, or Treasurys? How should you divide up your portfolio among these different asset classes?

Young workers have to make investing decisions like these while scanning a menu of 401 fund options when they start their first jobs. Overwhelmed and unconfident, many spend less than an hour deciding on the fate of their retirement savings.

Related:The Best Target Date Funds

Target date funds make the decisions for you. The investor chooses a particular fund from a financial service firm that corresponds to when they think theyll retire. A 25-year-old in 2022, for instance, may pick a 2060 target date fund.

The investment company packs the target date fund with well-diversified mutual funds and exchange-traded funds that are aligned with the risk tolerance appropriate for the investors current age. More than 90% of that 2060 option, for instance, will be held in stocks.

Once you pick a target date fund, youre on whats known as a glide path, which is a term of art to describe how the funds asset mix changes over time.

As you get older, the target date fund will typically shed some of its stock positions in favor of bond holdings. For instance, a 2020 target date fund typically allocates between 40% and 50% in stocks.

What Is A Good 401k Match

If your employer has a 401 match, you may be wondering how the employerâs match compares to other employerâs 401 match.

A survey by the US Bureau of Labor Statistics reported that only 56% of companies provide a 401 plan for their employees, with about half of these companies providing a 401 match. 41% of the companies with a 401 match up to 6% of the employeeâs salary, while only 10% of the companies match 6% or more of the employeeâs salary. The survey also reported a median 401 match of 3% of the employeeâs salary.

If your employer’s 401 match is above the average and median match, it means you have a good 401 match than half of 401 participants.

Read Also: How To Transfer 401k From Fidelity To Vanguard

Target Date Funds Handle Rebalancing For You

As you age, your risk tolerance typically decreases. But its easy for retirement savers to go for years in a portfolio that doesnt suit their needs.

For instance, a strong bull market could leave you overweight stocks and underweight bonds. A target date fund, however, is structured to rebalance for you.

While the stocks make up 90% of the Vanguard Target Retirement 2060 Fund, theyre roughly 70% of the 2035 version. You could have ignored your retirement account for the first 25 years of your working life, and still be appropriately invested.

Match Of The Top 41 Employers

Find out how 401 match works and the 401 match of top employers such as Amazon, Google, Microsoft, CVS, and others.

A 401 plan provides a convenient way to build a nest egg for retirement. An attractive feature of 401 plans is the companyâs 401 match, which helps employees grow their savings with some free money from the employer. If your employer offers a 401 match, you should find out if you are eligible to receive the match and start collecting the benefit.

401 match of top employers averages 6% of the employeeâs eligible pay. A 2020 study by Vanguard reported that 71% of companies matched $50 cents for every $1 an employee contributed up to 6% of the eligible compensation. Only 21% of these companies match employee contributions dollar for dollar.

Don’t Miss: When Can I Take My 401k Out Without Penalty

Morgan Stanley 401k Match

Eligible employees can join the 401 plan immediately after the hire date. They can contribute 1% to 30% of their eligible pay to the plan.

Morgan Stanley offers dollar-for-dollar matching of the employee’s contribution up to 4% of the eligible pay. This means that employees get a match of $1 for every $1 they contribute to the plan up to 4% of their eligible pay. The match can be made in cash or company stock.

Employees are fully vested in their contributions, but vesting in matching contributions depends on the employee’s years of service. Employees hired on or after January 1, 2004, become 100% vested after completing three years of employment. Employees hired before January 1, 2004, have different vesting rules depending on the business units they serve.

Can You Lose Money In A 401

Its possible to lose money in a 401, depending on what youre invested in. The U.S. government does not protect the value of investments in market-based securities such as stocks and bonds. Investments in stock funds, for example, can fluctuate significantly depending on the overall market. But thats the trade-off for the potentially much higher returns available in stocks.

That said, if you invest in a stable value fund, the fund does not really fluctuate much, and your returns or yield are guaranteed by private insurance against loss. The tradeoff is that the returns to stable value funds are much lower, on average, than returns to stock and bond funds over long periods of time.

So its key to understand what youre invested in, and what the potential risks and rewards are.

Recommended Reading: How To Open A 401k Plan

The Pros Of Target Date Funds

Target date funds have exploded in popularity over the past decade.

About two-thirds of 401 plans offered target date funds in 2007, according to recent research by the Employee Benefit Research Institute and the Investment Company Institute. In 2019, this figure was almost 87%.

Just a quarter of retirement savers used a target date fund in 2007, compared to 60% just 12 years later.

A major reason for these gains is that in 2007, the Department of Labor allowed retirement plan sponsors to automatically enroll employees into target date funds upon becoming eligible for company benefits.

Should You Follow The Herd

Just because everybody is doing it doesnt necessarily mean its right for you. As financial advisors are quick to point out, financial situations differ by individual. Are you the right person to snub target-date funds and instead put together your own mix of stocks and bonds?

If your retirement funds are inside a 401, you wont have a lot of choices in most cases, so putting together your own actual mix of stocks and bonds might not be possible. However, you could pick other assets outside of target-date funds.

Read Also: What Is A Robs 401k

Is Your 401 Beneficiary Up To Date

Do you have the right beneficiary for your 401? This is a separate election from your life insurance and pension preretirement beneficiary elections. Your beneficiary elections for one benefit wonât carry over to another benefit.

Review your beneficiary elections whenever you experience a significant life event like retirement, marriage, divorce or the death of a previously elected beneficiary.

You can change your beneficiary anytime. Log in to your NetBenefits account at 401k.com or call Fidelity at 1-877-743-4015.

Determine Your Risk Tolerance First

The first questions an investment advisor will typically have for a client are: âWhat is your time horizon?â and âWhat is your risk tolerance?â. Since target date mutual funds allocate assets for a group of investors based on a date in the future, the only piece that is somewhat satisfied is time horizon. Just because a group of investors have the same time horizon does not mean they should be invested the same way. Fund managers cannot allocate funds in a way that satisfies both questions without knowing the risk tolerance for each individual investor. That means, the risk tolerance piece relies on you. Two 45 year old investors may be 20 years from retirement and have completely different portfolio allocations due to their risk tolerance. One may be more aggressive and tolerant of stock market fluctuations while the other may be conservative and less willing to risk their savings. Even though each investor has the same time horizon, the appropriate portfolio for each would vary greatly. It is important to know your risk tolerance and apply that knowledge to the appropriate target date fund.

You May Like: Can I Rollover Current Employer 401k To Ira

When Did Aon Hewitt Change To Alight

May 1, 2017May 1, 2017: outsourcing department sold to private equity firm Blackstone and rebranded as Alight Solutions.

Is Alight a good company for 401k?

This company is terrible. If your employer is planning to use Alight to administer 401k or HSA accounts, do yourself a favor and roll it over to Fidelity. If your employer is planning on having Alight administer health benefits, pray you never get sick.

When did Aon Hewitt change to alight?

Is alight Financial a fiduciary?

Alights Form ADV doesnt list any other regulatory violations. The firm is also fee-based, so advisors can earn commissions from selling financial products to clients. Despite this potential conflict of interest, the firm is a fiduciary and is legally obligated to act in the best interests of clients at all times.

Difference Between Target Date And Active Management

Although target date mutual funds are often referred to as âset it and forget itâ, there are a number of factors that must be taken into consideration. Most target date mutual funds are typically managed exclusively on time horizon. Fund managers traditionally do not make significant allocation adjustments to these types of funds based on changing market conditions which can leave investors exposed to big drops in the stock market as they approach retirement. Investors within 10 years to retirement should work closely with their investment advisor to make sure they have the right mix of stocks and bonds in their portfolio.

Read Also: When To Withdraw From 401k

Advantages Of Target Date Funds

Target date funds are great for investors who do not want to spend a lot of time managing their portfolios or making investment decisions. Some advantages to consider include:

- Professionally Managed Portfolio: A portfolio manager will both enroll you in the appropriate target date fund and manage your investments, optimizing your funds over time. This is a great choice for people who are not familiar with the market, or who do not have time to manage their own portfolios.

- Low Maintenance: Instead of choosing multiple investments for a portfolio, participants of a target date fund plan can rest easy knowing their money is working for them. Portfolio managers will enroll the participant in a target date fund that matches with their retirement goals. For example, if you are looking to retire in 2065, you will be enrolled in the target date 2065 fund.

- One-and-Done Approach: Many financial advisors recommend a target date fund being the only investment you have. The account is optimizing your investments for you, so if you have similar additional investments on the side, then they could skew your overall portfolio allocation. Before making changes, speak with a financial advisor about what makes the most sense in your retirement savings journey.

Goldman Sachs 401k Match

Goldman has an automatic enrollment feature for its 401 plan that allows employees to be enrolled into the plan immediately upon hire. Employees can contribute up to 50% of their eligible pay to the plan.

For an employee to qualify for the employerâs match, he/she must have completed 12 months of service. Goldman Sachs matches 100% of the employee’s 401 contributions each pay period up to 4% of the employeeâs base pay.

Matched contributions become fully vested immediately.

Recommended Reading: Can You Use 401k For Down Payment

Average 401k Match 2017

The average 401 match in 2017 was 4.5% of eligible employee compensation. A 2017 Vanguard Study titled âHow America Savesâ reported an increase in the average contributions to 4.7% up from 3.9% in 2015 and 3% during the financial crisis of 2007/08.

After the financial crisis, most companies reduced or suspended their 401 match when their earnings dropped. As revenue stabilized, employers increased their match to retain and attract the best talents, especially in competitive sectors. Most companies also introduced automatic enrollment for new hires as an inducement for employees to save for retirement.

Can I Use A Target

Yes. Most plan providers today offer access to target-date funds. However, for these to work properly be careful to only use a target-date fund for nearly all of your allocations. This is because if you allocate money to other investments it may defeat the purpose of the glide path provided in the target-date fund.

Read Also: Can I Transfer My Ira To My 401k

Want Professionals To Handle Your Investments

PG& E offers fee-based Professional Management through Edelman Financial Engines. And if youâre at least age 60 or five years from retirement, you have the option of enrolling in the Income+ service through Edelman Financial Engines. Both Professional Management and the Income+ service do all the investing for you.

Visit EdelmanFinancialEngines.com/forpge to see what Edelman Financial Engines can do for you.

Are you looking for a single investment strategy to achieving a balanced portfolio targeted to a planned retirement date?

- You decide what year you want to retire then pick a fund with a target date closest to your retirement date, in five-year intervals.

- Investment professionals make all the investment selections and asset allocation decisions based on the fundâs target retirement date.

- The investment mix in your Target Date Fund will adjust automatically to a more conservative mix as the fundâs target date approaches.

The Target Date Funds are the default investment for your contributions. If you donât provide instructions about how to invest your contributions, theyâll be automatically invested in the Target Date Fund with a target date closest to your 65th birthday.

Are you 65 or older? Your account will automatically be invested in the RSP Retirement Income Fund.

Wheres The Finish Line

Another problem with target-date funds is that they adjust the weightings based on your retirement year, when, in fact, your finish line is the day you die. Because of that, the fund might end up too conservative, leaving you with a lot of money lost in fees and not enough gains to retire in the way you would like.

You May Like: What Happens To My 401k From My Old Job

Do It For Me Need Help Managing Your Own Portfolio

Premixed Portfolios – Target Date Funds

Target Date funds provide a single, diversified investment option that automatically gets more conservative as you approach retirement age. All you need to do is select the target date fund thatâs closest to the year you plan on retiring.

Donât forget:

- They automatically rebalance as contributions are added or grow, so you always have a diversified portfolio.

Personalized Planning & Advice

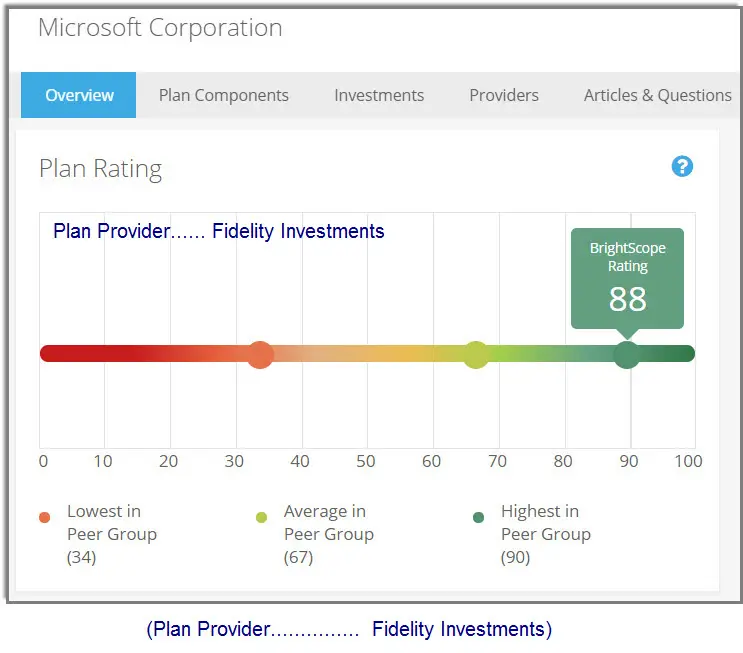

For a fee, Fidelityâs professional investment team will continuously monitor and rebalance your assets to a model portfolio based on your speciï¬c ï¬nancial situation. These professionals will track the changes in the market, as well as the funds in your plan.

Donât forget:

- You can opt in or out at any time by contacting a Fidelity Planning Consultant at .

- To learn more about Personalized Planning & Advice, including how to change your participation in this service, see the Investment Performance and Research section of NetBenefits.