You Might Want A Roth Account

If your 401 plan doesnt provide a Roth 401 option, you might choose to roll your retirement savings into a Roth IRA. Advantages of a 401-to-Roth IRA rollover include:

Avoiding Roth IRA income restrictions. Even if your annual income is above the thresholds for Roth IRA contributions, youre still allowed to roll your 401 savings into a Roth IRA. This move is commonly referred to as a backdoor Roth IRA conversion, and it can grant you the benefits of tax-free withdrawals in retirement.

No required minimum distributions . With a 401or even a traditional IRAyoure subject to RMDs, or the mandated annual withdrawals from your retirement savings once you reach age 72. Roth IRAs are free of RMDs, providing you with more control over your retirement savings.

Tax-free withdrawals in retirement. When you roll over a traditional 401 into a Roth IRA, youll probably end up paying some taxes on the amount youre converting. But these taxes may be less than what youd pay if you took regular withdrawals from a traditional 401 in retirement.

Access to additional death benefits. Because there are no lifetime distribution requirements, you can pass down your Roth IRA to your heirsalthough beneficiaries need to draw down the account within 10 years.

Henderson cautions that you must be aware of the immediate tax consequences when you roll your money from a 401 to a Roth account, however.

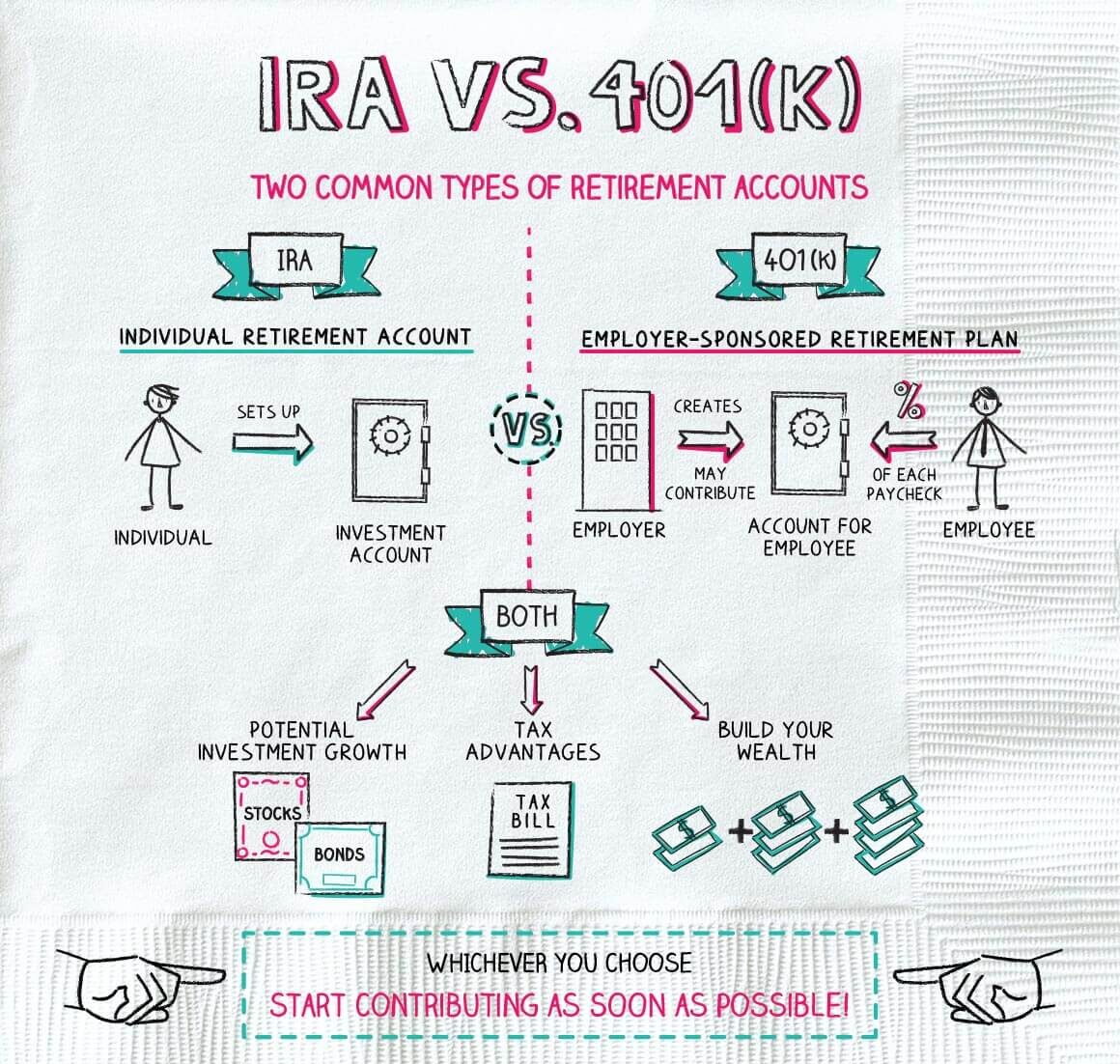

Decide On The Type Of Ira

When youre ready to roll over your 401, your first step is to choose between a Roth and a traditional IRA. Both are good retirement options, but they have some differences you should be aware of that will be critical to your retirement planning.

The biggest difference between a Roth and traditional IRA is that a Roth IRA allows you to take advantage of tax benefits in the future, whereas a traditional IRA allows you to take advantage of tax benefits today. Heres why:

- Contributions to a Roth IRA are made with after-tax dollars. This means youve already paid taxes on that money right now and your distributions in retirement will be tax-free.

- Contributions to a traditional IRA are made with pre-tax dollars. As a result, contributions to a traditional IRA can be deducted from your taxable income in the year theyre made. But when it comes time to take distributions in retirement, you will have to pay tax on that money.

If you feel your tax bracket will be higher when youre ready to retire, a Roth IRA might be the better option. The inverse is true for a traditional IRA.

The type of IRA you choose also has implications for right now. If you roll your 401 into a Roth IRA, you will have to pay taxes on that money. If you want to roll over your 401 without incurring taxes right now, a traditional IRA might be a better option. Alternatively, if you have a Roth 401, you can roll it into a Roth IRA without incurring taxes.

Direct Rollover Vs Indirect Rollover: Whats The Difference

Okay, once you decide to roll money from one account to another, you have two options on how to do the transfer: a direct rollover or an indirect rollover. Spoiler alert: You always want to do the direct transfer. Heres why.

With a direct rollover, the money in one retirement accountan old 401 you had in a previous job, for exampleis transferred directly to another retirement account, like an IRA. That way, the owner of the account never touches the money, and you wont have to pay any taxes or penalties on the cash being transferred. Once its done, its done!

Indirect rollovers, on the other hand, are a bit more complicatedand needlessly risky. In an indirect rollover, instead of the money going straight into your new account, the cash goes to you first. Heres the problem with that: You have only 60 days to deposit the funds into a new retirement plan. If not, then youll get hit with taxes and penalties.

See why the direct rollover is the only way to go? Theres just no reason to take a chance on an indirect rollover that leaves you open to heavy taxes and penalties. Thats just dumb with a capital D!

About the author

Ramsey Solutions

Read Also: Should I Do 401k Or Roth Ira

Pro: More Investment Options

One of the main benefits of an IRA is the wider investment selection that is available to investors. You can invest in stocks, bonds, commodities, REITs, etc. This allows you to diversify your portfolio in a way that increases your chances of earning a return on your investments even in unfavorable economic conditions.

In contrast, a 401 limits participants to a few hand-picked investments such as mutual funds and stocks, hence limiting their ability to invest in high-risk high-return assets.

Best Rollover Ira Providers For 2022

Are you switching jobs and thinking about transferring your retirement funds? This post helps you consider your options before opening a rollover IRA.

In the past, job-hopping was a bit of a taboo. But times have changed, and most millennials arent afraid to change jobsor even careers when it makes sense. In fact, some millennials are now even taking mini-retirements in their 20s or 30s to achieve greater work-life balance and shift their focus.

Wherever life takes you, your retirement plan should follow. If you have a 401 through an employer, its easy to transfer your money into another account when you switch jobs. This process is called a 401 rollover. It might sound complicated, but keep reading and youll learn its really not that difficult at all.

In This Article

Here are some of the top online brokers to look into when considering a new account.

Recommended Reading: How To Withdraw From Fidelity 401k

Why Should You Invest In An Ira

A traditional IRA offers big advantages over a brokerage account, thanks to special tax treatment.

In a brokerage account, the capital gains you realize when you sell at a profit and dividends earned by your investments are taxable based on your current income levels.

With a traditional IRA, you experience none of these tax consequences. Instead, you only pay regular income taxes on withdrawals from the IRA. This huge advantage helps your retirement funds grow much faster over time.

Saving Tips For Retirement

- Need help planning for retirement? Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Take advantage of any 401 match that your employer offers. Be sure to contribute enough to your 401 to qualify for the matching funds. See if youre on track to save enough for retirement by using SmartAssets 401 calculator.

Don’t Miss: How To Access My Walmart 401k

Option : Roll It Into Your New 401

If your new employer offers a 401, you can possibly roll your old account into the new one. You may be required to be with the company for a certain amount of time before youre eligible to participate in their plan.

You can choose to do a Direct Rollover, whereby the administrator of your old plan transfers your account balance directly into the new plan. This only requires some paperwork.

Or, you can choose an Indirect Rollover. With this option, 20% of your account balance is withheld by the IRS as federal income tax in addition to any applicable state taxes. The balance of your old account is given to you as a check to deposit into your new 401 within 60 days. There is one catch, though. Youll need to deposit the entire amount of your old account into your new account, even the amount withheld for taxes. That means using personal cash to cover the difference and waiting until tax season to be reimbursed by the government.

Dave Anthony President And Portfolio Manager

@DaveAnthony09/28/15 This answer was first published on 09/28/15. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

ROTH–ROTH–ROTH. Look, if you have any substantial amount of money saved up , then you need to convert your monies over to tax free accounts while you still can.

Our country is $19 trillion in debt—Baby Boomers are retiring at 10,000/day and are putting an enormous strain on Social security and Medicare plans. The government has already passed the legislation to come ofter those “affluent” boomers–those that make over $44k/year in retirement, and they will be the ones paying for these out of control programs. You’ll be one of them as well unless you strategically allocate your money into the five accounts that don’t count toward SS taxation and Medicare surcharge penalties.

Both of these programs are means based, if you follow the old-school train of though and defer, defer, defer your retirement income into all IRA/401 plans, you’ll be in for a world of hurt once you hit 70 1/2 and are required to take distributions.This will cause a triple whammy of ordinary income tax, Social security tax, and probably Medicare penalty premium tax. OUCH!

Pay taxes now, at some of the lowest rates in a long time, and go tax free.

Also Check: What’s The Maximum Contribution To A 401k

Option : Cash Out Your 401

Lets get this out of the waythis is the worst thing you can do with your old 401.

If you withdraw the money from your 401 plan and take a direct cash distribution, youll have to pay any state and federal income taxes you owe on every last penny. And if youre under 59 1/2 years old, you can go ahead and add another 10% early withdrawal penalty to your tab.

But the worst part is youre robbing yourself of the chance to continue earning tax-free or tax-deferred growth on your investments for years, maybe decades. Its just a bad idea all around, folks.

Pros Of Rolling Over 401 To Ira

Once you leave your former employerâs workplace, you no longer get an employer match on your 401 contribution nor are you required to continue making contributions to your former employerâs retirement plan. This is why rolling over your funds to IRA is the best bet to grow your retirement savings.

Here are some reasons why you should rollover your 401 savings to an IRA:

Read Also: Is It Better To Contribute To 401k Or Roth 401k

Rolling Over Your Old 401 To A New Employer

Many companies offer 401 plans, so people often end up having multiple 401s over their years in the workforce. If youd rather keep your funds in a single 401 or dont want to open an IRA, you might have the option of transferring assets from your old 401 to your new one at your current job. If not, youll need to keep an eye on how each is performing individually.

The process for this is as simple as talking to both your current and past plan providers to make sure they will both accept a transfer of assets. While the providers can offer more specific instructions, youll likely use one of the methods above to complete the rollover.

Note that not all plan providers will accept employees past 401 funds as a rollover. This is because they may not be willing to add more assets to the plan, which could overwhelm it.

Investment Options And Flexibility

Most 401s offer a relatively limited menu of core options. The investment options are determined by your employer and the type of plan it offers. If your plan includes a specific investment that isnt available through an IRA and is integral to your investment strategy, that may be a reason for you to stay put.

With an IRA, the world is your oyster, says Lobel. There are thousands of low-cost ETFs and mutual funds from which to choose. Thats in addition to individual stocks, CDs, and other investment vehicles.

Lobel cautions that for some people, more choice can be overwhelming. But with a bit of research, you can find the right investments to match your goals and give you the diversification thats key to investment success.

Read Also: How Do You Split A 401k In A Divorce

Benefits From An Ira Rollover

There are some situations where you are allowed to withdraw funds from an IRA before age 59½ without penalty â although youâll still trigger normal income tax. In this case, a rollover from a qualified plan can be beneficial.

Goldco: Best Gold Ira Company Overall

This privately held Gold IRA company Goldco focuses on wealth and asset protection. Your assets can be moved from a tax-advantaged retirement plan, such as an IRA, 401, or 403, to a precious metals IRA with the help of this company. Additionally, Goldco provides direct sales of gold and silver coins to customers.

Experts are urging Americans to pick up a free gold investing guide before its too late:

You can fund your gold individual retirement accounts with a variety of coins if you decide to invest in one. Goldco collaborates with mints to find premium coins suitable for gold IRAs, such as:

- Gold American Eagle Gold coins

- Gold Maple Leaf coins

Is goldco legit?

Goldco is a privately held business with a focus on wealth and asset protection. By converting an IRA, 401, 403, or another comparable retirement account to a gold and silver IRA, it helps its clients in protecting their retirement savings.

Additionally, Goldco has both an A+ rating from the Better Business Bureau and a Triple-A rating from Business Consumer Alliance. These are based on positive feedback from clients regarding reliability and moral business conduct.

> Visit Goldco.

GOLD-BACKED IRA

Goldco will make sure you adhere to IRS guidelines when buying a gold IRA or precious metal IRAs. If you want, you can open an IRA account that is backed by gold, silver, platinum, and palladium.

Silver-Backed IRA

Customer Support

You May Like: How To Withdraw Your 401k From Fidelity

Delay Required Mandatory Distributions

Workers with traditional IRAs and 401s both face the same reality when it comes to taking mandatory distributions. The IRS requires that you begin taking distributions by April 1 of the year following your 72nd birthday. However, you may delay taking RMDs from your 401 if youre still working and own less than 5% of the company that sponsors the plan.

A Special Note About Indirect Rollovers

If you opt for an indirect rollover as a way to get a short-term loan before you deposit your money in a new account, there are some important factors to be aware of. Any distribution paid to you is subject to a mandatory withholding of 20%, regardless if you intend to roll it over. This 20% withholding is used to prepay the tax youll owe if you dont roll over your distribution and keep the check for yourself.

To have the 401 distribution be tax-free, you must roll over the check amount and the 20% that was withheld into your IRA account within 60 days. If you do this, you may receive most of the 20% that was withheld back in a refund when you file your taxes, as it wont be needed to pay the tax on the 401 withdrawal.

Lets walk through this all with an example. Say you elect to have the distribution paid to you with the intention of depositing it into an IRA yourself. If your 401 distribution is $5,000, you would receive a check for $4,000 . However, for the distribution to be tax-free, you must put all $5,000 into your IRA. That means youll have to come up with the $1,000 that was withheld. When it comes time to file your tax return, you should receive that $1,000 back, as it wasnt needed to pay the tax on the withdrawal.

Recommended Reading: What Happens To Your 401k If You Quit Your Job

Pick An Ira Account Type

There are two main types of IRAs that you can transfer 401 funds to: a traditional IRA or a Roth IRA. As we mention above, most people roll over their money into an account that has the same tax benefits as the one theyre transferring from.

For instance, lets say you have a traditional 401 account that allows you to contribute money and deduct it from your taxable income, all while staving off income taxes until you withdraw in retirement. In order to maintain this tax-deferred status, youll need to roll your 401 asset over into a traditional IRA. You still have the option of rolling over to a Roth IRA, though thatll mean youll pay taxes on that money for the current year.

On the flip side, those with a Roth 401 gain the perk of tax-free growth since the money they contribute has already had taxes paid on it. Because of this, the IRS does not allow Roth 401 account holders to roll funds over to anything but a Roth IRA or another Roth 401.

Only you can choose which type of IRA is best for your situation. If you can figure out whether your tax rate is higher now than it will be in retirement, then that should lead you in the right direction. You could also speak with a financial advisor if you have further questions.