Which Option Is Better For You

If your 401 or 403 retirement plan accepts both traditional and Roth contributions, you have two ways to save for your retirement. Both offer federal income tax advantages.

Traditional accounts provide a tax break now. Traditional contributions are not taxed at the time of investment. Instead, taxes are paid on withdrawals, including any earnings. Getting a tax break at the time of investment will leave more money in your pocket now money that you can invest, save or spend.

Roth accounts provide a tax advantage later. Roth contributions are made with money thats already been taxed, so you wont have to pay taxes on qualified withdrawals, including earnings.

Enter your personal information to compare the results of traditional before-tax savings and Roth after-tax savings. You can click each for help.

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses and summary prospectuses, which can be obtained from a financial professional and should be read carefully before investing.

Future tax rates may change. The analyzer applies tax rates to all taxable income. When estimating your future tax rate, you should consider whether the amount of taxable distributions might push you into a higher tax bracket.

- STAY CONNECTED:

Also Check: How Do I Find My 401k Account Number

Variables To Consider And Not

To many, what matters most is getting a ballpark figure of how much money they will have when they hit their 60s a simple and matter-of-fact figure in dollars!

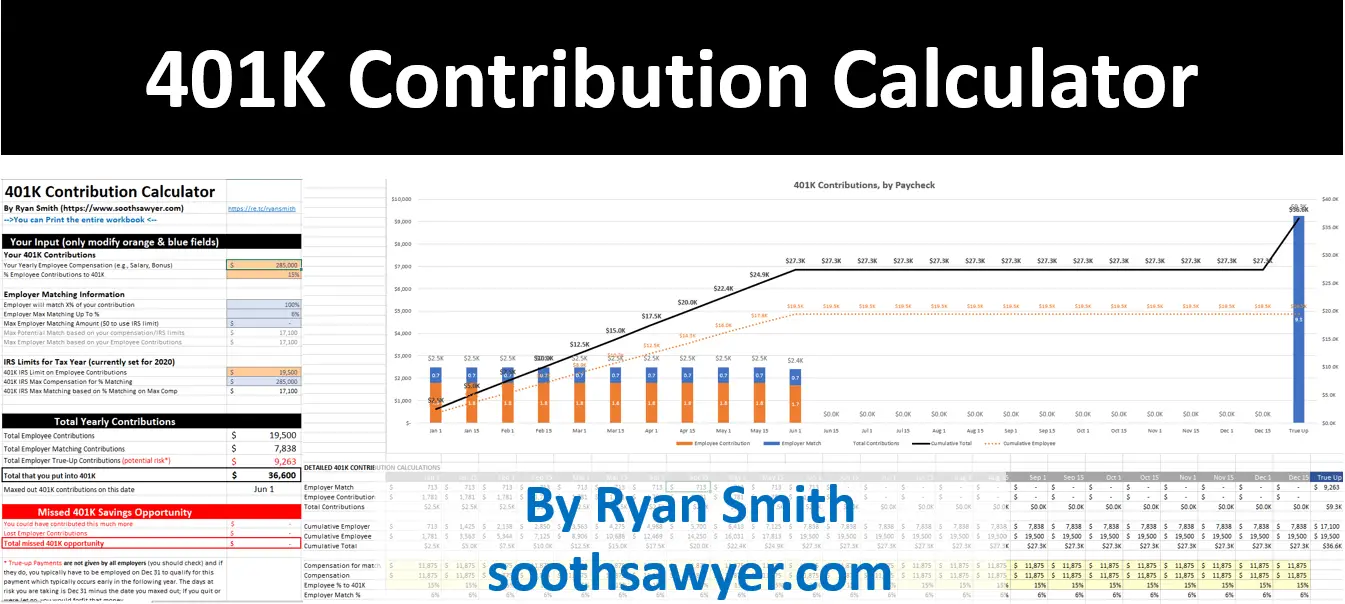

While there are only four input variables in this calculator, it’s important to consider how you arrive at each variable. For example, when figuring out your total monthly contributions, include:

- Your average monthly contributions.

- Your employer’s average monthly contributions sometimes called a match.

- Any catch-up contributions in order to reach your desired future goal.

- Limitations due to being a highly-compensated employee.

Only focus on the variables presented in this calculator. Never go into the details of something that is completely out of your control like inflation, salary growth, changes in federal law, or changes in employment policies.

This 401k contribution calculator helps streamline the process of figuring out how much you should contribute toward your 401k to meet your future goal. It simulates that if you contribute X that you’ll end up with Y in a future date, without unnecessary complication.

Simply take a few moments to run a couple of scenarios and figure out how much you should be contributing toward your 401k preparing now will result in a more rewarding retirement later.

Solo 401k Calculator For S Corp

- Pay yourself a reasonable wage on a W2. S-Corp owners are required to pay a reasonable wage that is subject to employment tax. Make sure you and your accountant agree on the wage first.

- Make your employee deferral of $19,000 via payroll deductions. Remember that the deferral is elective and is the lower of compensation or the $19,000.

- Consider how much profit sharing you want to contribute. Remember that profit sharing is elective as well. You can take your gross compensation at 25%. But your combined contributions cant exceed $56,000 for 2019 and $57,000 for 2020.

- Many accounts are opened at the large players like Vanguard, Fidelity, and Schwab. But you may be able to self-direct the funds and be your own custodian.

- Fund your account before the deadline. Dont forget to contribute the profit sharing contributions up to the date you file your taxes including extensions.

You May Like: Is Solar Power Cost Effective

Don’t Miss: Can You Take Money From 401k Without Penalty

A 401 Is A Defined Contribution Plan

Unlike a defined benefit plan , also known as a pension plan, which is based on formulas for determining retirement withdrawals, defined contribution plans allow their participants to choose from a variety of investment options. DCPs, 401s in particular, have been gaining in popularity as compared to DBPs. Today, the 401 defined contribution pension plan is the most popular private-market retirement plan. The shift in the choice between DBPs and DCP can be attributed to a number of reasons, one of which is the projected length of time a person is likely to stay with a company. In the past, it was more common for a person to stay with a company for several decades, which made DBPs ideal since deriving the most value out of a DBP required a person to stay with their company for 25 years or more. However, this is no longer the case today, as the workforce turnover rate is much higher. DCPs are highly mobile in comparison to DBPs, and their values do not drop when a person switches companies. When an employee with a 401 plan changes employers, they generally have the option to:

Who Qualifies For Roth 401

Roth 401 is available to any employee who is eligible to contribute to a traditional account, a Roth account, or both. This option is only available through employers that offer Roth 401. There are no income restrictions to be eligible.

What are the benefits of a Roth 401?

With a Roth account, you have already paid income tax on your contributions. You will not have to pay taxes on those again. In addition, you will not pay taxes on the growth of a Roth account as long as you follow the Qualified Distribution rules.

With a traditional account, you will pay income taxes not only on your contributions into the account but also on the growth. These

taxes are paid when you withdraw the money, at the tax bracket you are in the year of withdrawal. So while you do get to lower your taxable income now, you may end up paying higher taxes on the withdrawals later.

Don’t Miss: How Can You Get A 401k

How Much Will Safe Harbor Contributions Cost

It may seem counterintuitive, but the 3% non-elective contributions can be cheaper than the 4% match at a certain point. The overall participation and savings rate will influence the total cost of the plan.

To calculate how much a safe harbor matching contribution will cost, run this formula:

# employees x % employees participating x $ average salary x % safe harbor contribution = $$

Lets consider a few different scenarios for an employer with 50 employees whose average salary is $40,000.

- Basic 4% Match, 60% participation rate: The employer contribution will cost $48,000 a year.

- 3% Nonelective contribution for all employees: The employer pays $60,000 a year.

- Basic 4% Match, 100% participation rate: With everybody saving, your 4% match costs $80,000.

Choosing which safe harbor contributions to make is a personal decision based on the unique factors of your business. Contact Ubiquity, a low-cost, flat-fee 401 administrator, to explore your options.

Read Also: Can I Pull Out My 401k

Can You Put Money In Both A Roth Ira And A Traditional Ira

While you dont pay taxes on your traditional IRA contributions, but are responsible for paying taxes on withdrawals in retirement, the opposite is true with the Roth IRA. All the money you deposit into the Roth IRA is tax-free, but your account will be tax-free and you will not have to pay tax on withdrawals.

Also Check: Can I Roll My Roth 401k Into A Roth Ira

What Is An Employer 401 Match

Some companies will also chip in to your 401. This is free money, and, as any financial advisor will tell you, free money is good. Suppose, for example, your employer matched every dollar you contributed with 50 cents, up to 5 percent of your salary. If you make $50,000 and save 5 percent, or $2,500, your employer would pitch in $1,250. Even if you earned nothing on your investments, your employer match would mean a 50 percent gain on your contributions a level that would make hedge-fund managers green with envy.

You are leaving AARP.org and going to the website of our trusted provider. The providers terms, conditions and policies apply. Please return to AARP.org to learn more about other benefits.

Your email address is now confirmed.

You’ll start receiving the latest news, benefits, events, and programs related to AARP’s mission to empower people to choose how they live as they age.

You can also manage your communication preferences by updating your account at anytime. You will be asked to register or log in.

Whats The 401k Contribution Deadline

What is the 401k contribution deadline? The 401k contribution deadline does land at the very end of the calendar year on December 31, 2021.

However, the IRS will allow you to contribute to your IRA account right up to the tax filing deadline of the coming year that is to say, April 15, 2022 of this next year.

Don’t Miss: How To Close 401k Fidelity

Plan Compensation For A Self

To calculate your plan compensation, you reduce your net earnings from self-employment by:

- the deductible portion of your SE tax from your Form 1040 return, Schedule 1, on the line for deductible part of self-employment tax, and

- the amount of your own retirement plan contribution from your Form 1040 return, Schedule 1, on the line for self-employed SEP, SIMPLE, and qualified plans.

You use your plan compensation to calculate the amount of your own contribution/deduction. Note that your plan compensation and the amount of your own plan contribution/deduction depend on each other to compute one, you need the other . One way to do this is to use a reduced plan contribution rate. You can use the Table and Worksheets for the Self-Employed to find the reduced plan contribution rate to calculate the plan contribution and deduction for yourself.

Read Also: How To Transfer 401k From Fidelity To Vanguard

What Are Catch Up Contributions

To help bridge the gap between what they may not have saved early on in life, catch-up contributions allow people to contribute extra as they near retirement. Acatch-up contributionis a contribution to a retirement savings plan that exceeds the annual limit. To be eligible to make a catch-up contribution, investors must be age 50 or older. They can start making catch-up contributions in the calendar year they turn 50, even if its before their 50th birthday.

The 2022 annual limit for a 401 plan is $20,500, but workers 50 and up can make an annual catch-up contribution of $6,500, bringing their overall limit to $27,000.

Recommended Reading: How To Open Individual 401k Account

Is Solo 401 Tax Deductible Solo 401 Tax Advantages

The nice thing about a solo 401 is you get to pick your tax advantage: You can opt for the traditional 401, under which contributions reduce your income in the year they are made. In that case, distributions in retirement will be taxed as ordinary income. The alternative is the Roth solo 401, which offers no initial tax break but allows you to take distributions in retirement tax-free.

In general, a Roth is a better option if you expect your income to be higher in retirement. If you think your income will go down in retirement, opt for the tax break today with a traditional 401.

Because of these tax perks, the IRS has pretty strict rules about when you can tap the money you put into either type of account: With few exceptions, youll pay taxes and penalties on any distributions before age 59 ½.

February 24, 2020 by Editorial Team

The Solo 401k is the most powerful retirement account on the planet when it comes to contributions. This can add up to huge tax savings for you if you own your own business. When you run your own retirement account, you need access to the best tools. Fortunately, all Solo 401k account holders with Nabers Group have access to our contribution calculator. Lets walk through how to use the calculator, determine how much you can contribute to a Solo 401k plan.

You May Like: How To Wire In Solar Panel To Home

Should You Switch To A Roth 401k Age

Thanks to the budget deal with Congress, Roth retirement account enthusiasts now have the option to convert their traditional 401K into a Roth 401K at any age. Ironically, this was part of the reduced cost recovery.

Spousal Ira,What is Spousal Ira?Generally, you will need income to participate in a traditional IRA or Roth. Mess in Convenient Quinney Travel Pet Joskes partner has an income of 6 6,000, which the IRA earned in 2020 for the Convenient Quinnie Travel Pass. The limit of competition title is 7,000 if the title of the competition is at the end of 50 years or more.Literal Meanings of Spousal IraSpousal:Meanin

You May Like: What Happens To Your 401k When You Leave A Company

You May Like: Can I Combine 401k Accounts

Overall Limit On Contributions

Total annual contributions to all of your accounts in plans maintained by one employer are limited. The limit applies to the total of:

- elective deferrals

The annual additions paid to a participants account cannot exceed the lesser of:

However, an employers deduction for contributions to a defined contribution plan cannot be more than 25% of the compensation paid during the year to eligible employees participating in the plan .

There are separate, smaller limits for SIMPLE 401 plans.

Example 1: In 2020, Greg, 46, is employed by an employer with a 401 plan, and he also works as an independent contractor for an unrelated business and sets up a solo 401. Greg contributes the maximum amount to his employers 401 plan for 2020, $19,500. He would also like to contribute the maximum amount to his solo 401 plan. He is not able to make further elective deferrals to his solo 401 plan because he has already contributed his personal maximum, $19,500. He would also like to contribute the maximum amount to his solo 401 plan.

Not A Math Whiz No Worries

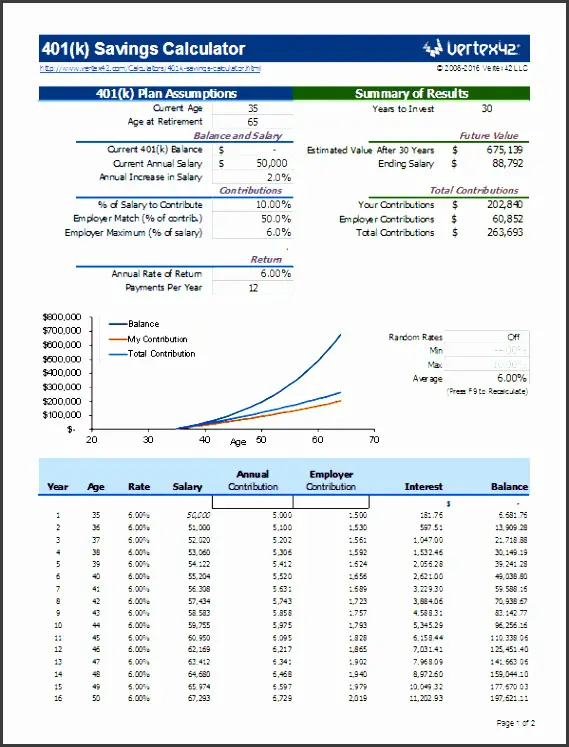

You can find out how much your 401k will grow without the help of a financial wizard. Simply provide the required inputs variables and quickly calculator what your 401k will grow to in the future.

Play around with the actuals and the extras to model various what if scenarios to reach your financial goals. This Simple 401k Calculator can be your best tool for creating a secure retirement. The following step-by-step procedure will show you how

Calculating the compound interest growth and future value of your monthly contributions is as simple as entering your beginning balance, the combined contributions , an estimate of your return on investment, and the number of years until retirement.

Related: 5 Financial Planning Mistakes That Cost You Big-Time Explained in 5 Free Video Lessons

Read Also: How To Invest My Fidelity 401k

Simple 401k Calculator Terms & Definitions

- 401k a tax-qualified, defined-contribution pension account as defined in subsection 401 of the Internal Revenue Taxation Code.

- Inflation the rate at which the general level of prices for goods and services is rising, and, subsequently, purchasing power is falling.

- Federal Contribution Limit a specified amount set by the Federal government as to the maximum contribution a person can put into, in this case, their 401k account.

- Catchup Contribution an option given to employees who have reached the age of 50 to put additional contributions into their 401k account this might also be considered to be simply raising your contribution up, not exceeding the maximum contribution limit, in order to better reach a goal.

- Employer Contribution the amount employers pay as a match to the contribution of their employees to their 401k account.

- Compound Interest when interest is added to the principal of a loan or deposit, so that interest earns interest on a recurring basis.

How Aggressive Should I Be

The more aggressive your portfolio allocations, the higher the potential returns but investments can drastically peak and valley over short periods of time. The closer you are to retirement, the less aggressive you want to be with your assets. Over time, you may want to reduce the percentage of stocks in your plan in favor of bonds, cash, and other investments that are more stable over the short term.

Also Check: How Much Can A Business Owner Contribute To A 401k

You Are Relatively Young And Earn A Lower Income Now But Expect To Earn A Much Higher Income And Expect To Be In A Higher Tax Bracket In The Future

If you expect your income to increase dramatically over your career, you may find contributing to the Roth feature today to be very advantageous, as you are in a lower tax bracket now than you will be in the future. Also, if you are many years from retirement, you could choose a Roth 401k as your best option as you expect your retirement plan to grow tax-free to a significant nest egg that can be withdrawn tax-free, more than compensating for the taxes paid when young and lower paid.

How A 401 Match Works

Employees usually contribute a percentage of their salaries to their 401s, and most employers who offer matching also contribute a percentage of employees income. Some companies offer dollar-for-dollar matches, whereby the employer contributes $1 for every $1 the employee contributes to their 401, but more common are partial matching percentages. This means the company matches a portion of what the employee contributes, such as $0.50 for every $1 the employee puts into their 401.

Regardless of the matching structure, your employer will likely cap your match at a certain percentage of your income. For example, your employer may pay $0.50 for every $1 you contribute up to 6% of your salary. So if you make $50,000 per year, 6% of your salary is $3,000. If you contribute that much to your 401, your employer contributes half the amount $1,500 of free money as a match. If the company offered a dollar-for-dollar match instead of a partial match, it would give you $3,000 for the year. Youre free to contribute more than $3,000 if you want to, but you wont get any additional match from your company.

Every company has its own matching methodology and vesting schedule, so talk to your employer if youre not sure how your 401 match works.

You May Like: What Is The Maximum I Can Contribute To My 401k