What Can Employers Do To Save More In 2022

Employers who personally want to save more in a small business retirement plan and perhaps reward some of the top employees in their ranks may consider adding a Safe Harbor provision and employer contributions to the retirement plan. By bringing up the combined total of the non-HCE group, HCEs will be able to contribute more to their plans.

How Much Should You Contribute

Ideally, you’d take advantage of the IRS maximum contribution limit to your account year after year. But if that’s not possible financially, start by contributing enough to max out your employer contribution. If you’re not sure what that is, check with your company’s benefits administrator. They can walk you through the matching contribution policy and direct you on how to set up contributions.

“Contribute the maximum your household budget will allow, up to the maximum annual contributions allowed by the IRS,” says Daniel Milan, managing partner at Cornerstone Financial Services. “At the very least, if your company offers a match, you should contribute at least the percentage required to get the maximum match, as that is free money you’re leaving on the table if you don’t.”

Pay attention, though. Your company may change its matching policy from time to time, so make sure to check in annually with your plan administrator. You’ll want to take full advantage of any employer contributions as long as it’s financially possible.

What Percent Should I Contribute To A 401

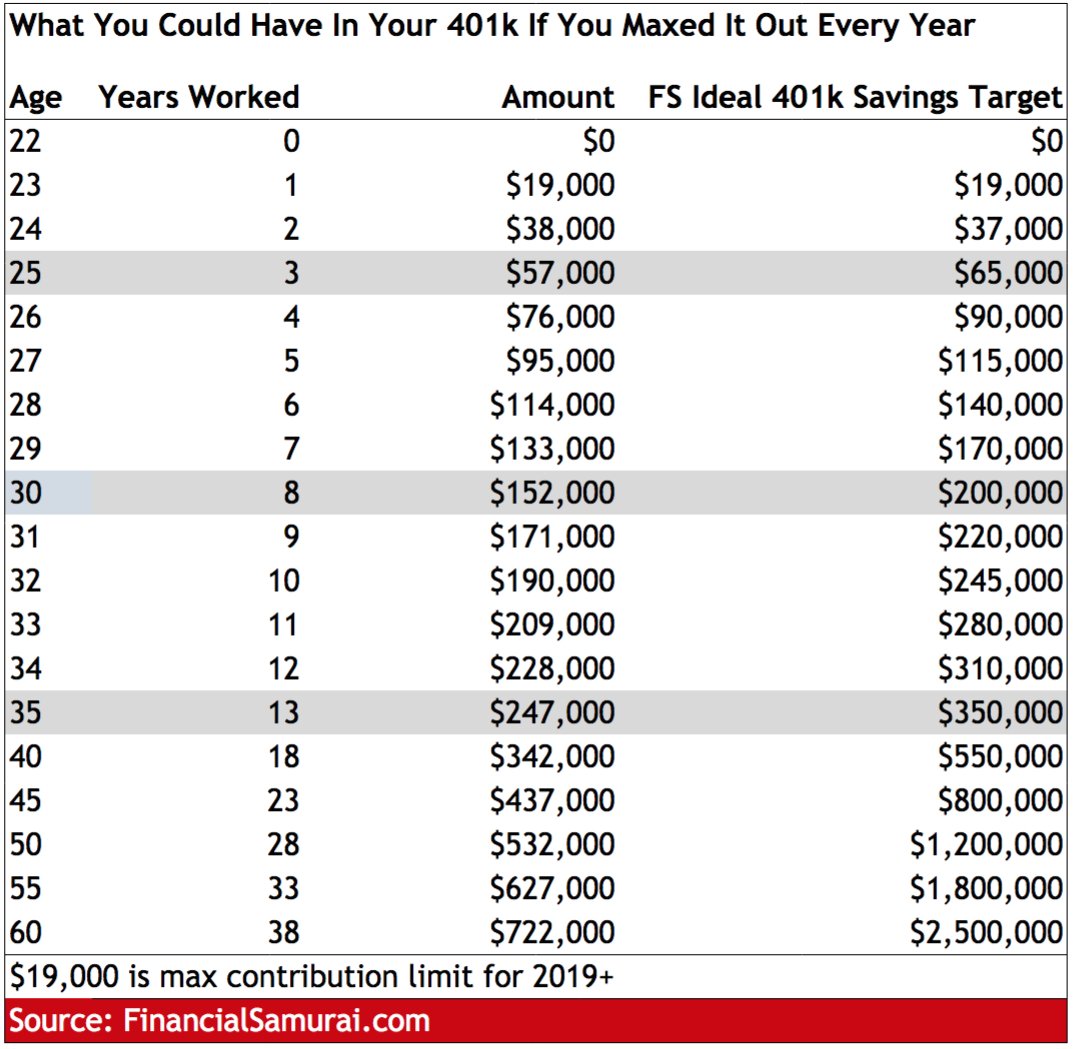

Brewer suggests that your contributions should be based on a percentage of your income, depending on your age. She recommends that you stash away between 10 percent and 15 percent of your gross income if youre in your 20s and 30s, or if you started saving during those years. If youre behind in retirement savings in your 40s and 50s, Brewer encourages you to set aside between 15 percent and 25 percent of your income.

If youre not saving anything for retirement right now and want to get started, start with at least 3 percent to get going, Brewer says. Increase your contribution by at least 2 percent each year and do a larger increase in years where you get a big raise until you hit your target savings percentage.

Recommended Reading: How To Set Up Self Employed 401k

How To Avoid The Mistake:

- Work with your plan administrator to ensure that the administrator has sufficient payroll information to verify that the deferral limitations of IRC Section 402 were satisfied.

- Establish procedures to ensure that, based on the participant election forms , participants won’t exceed the IRC Section 402 limit.

- Have checks and balances in place to alert you and your plan administrator when the limit is exceeded to take timely corrective action.

Highlights Of Changes For 2022

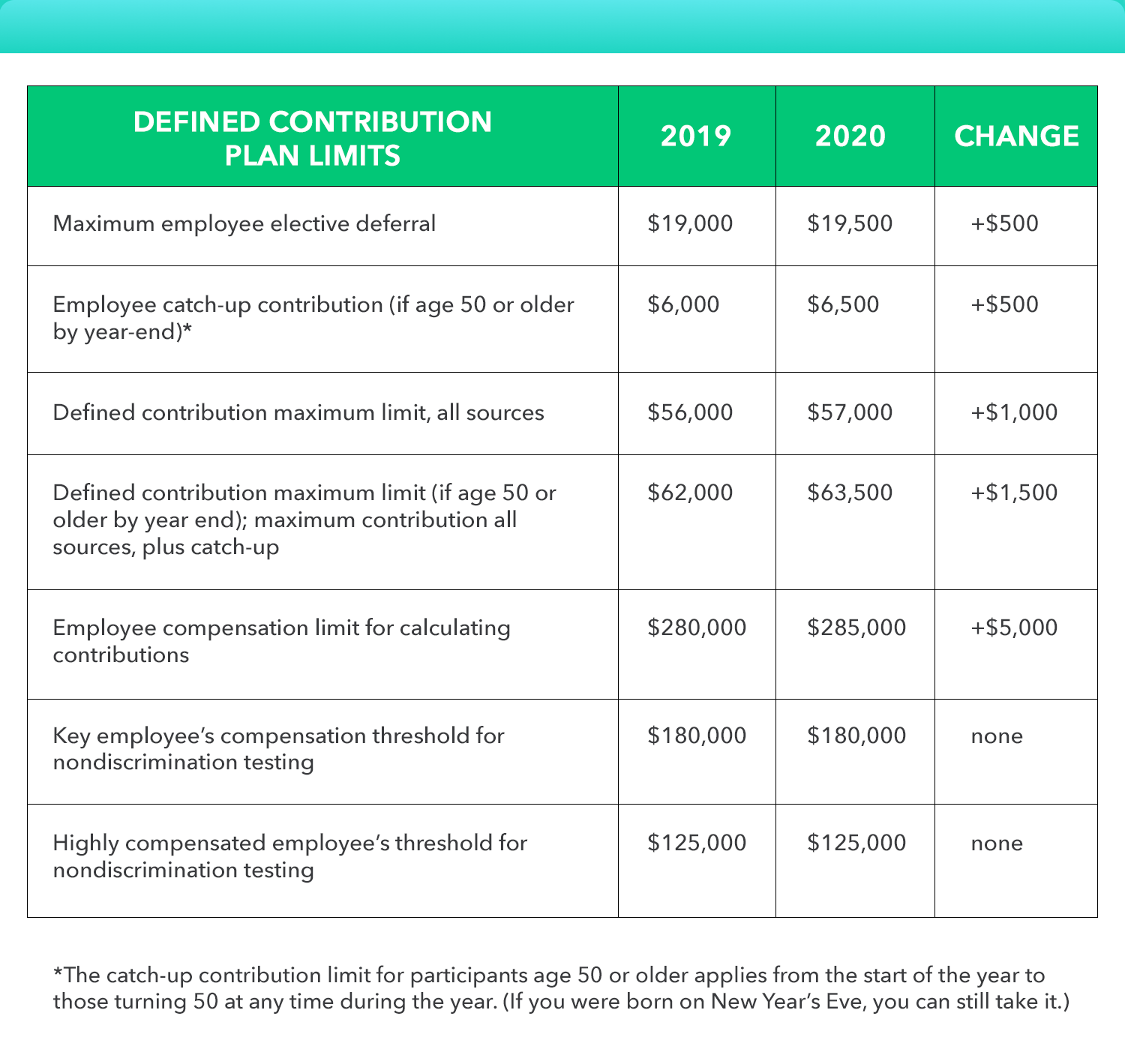

The contribution limit for employees who participate in 401, 403, most 457 plans, and the federal government’s Thrift Savings Plan is increased to $20,500, up from $19,500.

The income ranges for determining eligibility to make deductible contributions to traditional Individual Retirement Arrangements , to contribute to Roth IRAs, and to claim the Saver’s Credit all increased for 2022.

Taxpayers can deduct contributions to a traditional IRA if they meet certain conditions. If during the year either the taxpayer or the taxpayer’s spouse was covered by a retirement plan at work, the deduction may be reduced, or phased out, until it is eliminated, depending on filing status and income. Here are the phase-out ranges for 2022:

- For single taxpayers covered by a workplace retirement plan, the phase-out range is increased to $68,000 to $78,000, up from $66,000 to $76,000.

- For married couples filing jointly, if the spouse making the IRA contribution is covered by a workplace retirement plan, the phase-out range is increased to $109,000 to $129,000, up from $105,000 to $125,000.

- For an IRA contributor who is not covered by a workplace retirement plan and is married to someone who is covered, the phase-out range is increased to $204,000 to $214,000, up from $198,000 to $208,000.

- For a married individual filing a separate return who is covered by a workplace retirement plan, the phase-out range is not subject to an annual cost-of-living adjustment and remains $0 to $10,000.

Also Check: How To Manage 401k In Retirement

How To Fix The Mistake:

IRC Section 72 imposes a 10% additional tax for distributions that don’t meet an exception, such as death, disability or attainment of age 59 ½, among others. To avoid this additional tax, correct excess deferrals no later than April 15 of the following year. If you don’t correct by April 15, you may still correct this mistake under EPCRS however, it won’t relieve any Section 72 tax resulting from the mistake.

Under Revenue Procedure 2021-30, Appendix A, section .04, the permitted correction method is to distribute the excess deferral to the employee and to report the amount as taxable both in the year of deferral and in the year distributed. These amounts are reported on Forms 1099-R. In the case of amounts designated as Roth contributions, the excess deferral will already have been reported in income in the year of deferral. However, the amount will be reported as taxable in the year distributed.

Example:

Employer X maintains a 401 plan that has 21 participants and plan assets of $715,000. For calendar year 2020, Ann deferred $20,000 to the plan. None of the elective deferrals were designated as Roth contributions. Ann is under age 50 and isn’t eligible to make catch-up contributions. Ann has excess deferrals of $500 because $19,500 is the 402 maximum amount permitted for 2020. Employer X didn’t discover this mistake until after April 15, 2021. On November 1, 2021, X distributed the excess deferral to Ann.

Whats The Maximum Contribution For A 401 And Iras In 2020

- Contributions to a traditional IRA may be tax-deductible meaning you might be able to lower your taxable income and, in turn, reduce your tax bill.

- Roth IRAs, funded with after-tax dollars, grow tax-free & you pay zero taxes when you make withdrawals in retirement.

- Contributions to a traditional IRA may be tax-deductible meaning you might be able to lower your taxable income and, in turn, reduce your tax bill.

- Roth IRAs, funded with after-tax dollars, grow tax-free & you pay zero taxes when you make withdrawals in retirement.

The journey to retirement is anything but a straight and narrow path. As pensions gradually become a thing of the past , many workers are looking for ways to grow their money ahead of retirement.

There are multiple ways to save for your golden years, like investing in a regular brokerage account to build your nest egg over the long term. But taking advantage of tax-friendly investment accounts is what puts real muscle behind your efforts.

There are, of course, contribution limits. Heres how much you can kick into an Individual Retirement Account and a 401 in 2020.

Also Check: Can You Transfer 401k To Another 401 K

How Do I Know That All Of My Contributions Are Accounted For

The Canada Revenue Agency and Revenu Québec provide Service Canada with details on your earnings and the contributions you have made. Service Canada then keeps a record using a Statement of Contributions. You can check this statement for accuracy and contact us if you disagree with any of the figures.

You do not contribute while you are receiving a CPP Disability benefit, or during periods when you have no earnings or when your earnings are below the $3,500 minimum amount.

Can Employees Enroll In A 401 Employer Match Plan As Soon As They Are Hired

Employers are able to define their own specifications regarding when employees are eligible for 401 enrollment. Some companies choose to allow for registration immediately, while others require a certain amount of time to pass, such as the probation period, six months of employment and so on. Employers should make these regulations clear during the hiring process, so employees arent surprised if they need to wait.

Also Check: Can You Roll Your 401k Into An Ira

How Much Should You Save For Retirement

To start, invest 15% of your gross income into retirement savings accounts like a Roth 401 and Roth IRA. Spread your money evenly across four types of mutual fundsgrowth and income, growth, aggressive growth, and internationalinside of those retirement accounts.

And listen, we know youre eager to start saving money for your retirement future . . . but if youre still getting out of debt or need to get a solid emergency fund in place, now is not the time to save for retirement. Your income is your number one wealth-building tool, and you cant take full advantage of it if its tied up in credit card or student loan payments.

So lets say youre out of debt with a fully funded emergency fund and you have an annual salary of $75,000. That means your goal is to save $11,250 each year for retirement. Where do you start? Lets walk through it step-by-step.

What Are The Tax Benefits To The Employer For Offering A 401 Matching Plan

Employers can use the contributions to employee 401 accounts as tax deductions on their federal corporate income tax returns. These contributions may also be exempt from state and payroll taxes. As a result, the employer keeps their employees happy, sees reduced turnover and benefits financially with tax deductions.

Read Also: How Do I See How Much Is In My 401k

Key Employee Contribution Limits That Remain Unchanged

The limit on annual contributions to an IRA remains unchanged at $6,000. The IRA catch-up contribution limit for individuals aged 50 and over is not subject to an annual cost-of-living adjustment and remains $1,000.

The catch-up contribution limit for employees aged 50 and over who participate in 401, 403, most 457 plans, and the federal government’s Thrift Savings Plan remains unchanged at $6,500. Therefore, participants in 401, 403, most 457 plans, and the federal government’s Thrift Savings Plan who are 50 and older can contribute up to $27,000, starting in 2022. The catch-up contribution limit for employees aged 50 and over who participate in SIMPLE plans remains unchanged at $3,000.

Details on these and other retirement-related cost-of-living adjustments for 2022 are in Notice 2021-61PDF, available on IRS.gov.

When You Can Withdraw Money From A 401

You generally must be at least 59 1/2 to withdraw money from your 401 without owing a 10% penalty. The early-withdrawal penalty doesn’t apply, though, if you are age 55 or older in the year you leave your employer.

Depending on the plan sponsor, you may be allowed to borrow up to 50% of your vested account balance or $50,000, whichever is less, but unless the money is used to buy a primary residence, you will generally need to repay the loan within five years, making payments at least quarterly. If you miss a payment, the remaining balance is treated as a distribution, with taxes and penalties for early withdrawals applying.

Also Check: How To Use 401k Money To Start A Business

Contribution Limits In 2021 And 2022

For 2022, the 401 limit for employee salary deferrals is $20,500, which is above the 401 2021 limit of $19,500. Employer matches dont count toward this limit and can be quite generous.

However, the total contribution limit, which includes employer contributions , has increased to $61,000 in 2022, up from $58,000 in 2021.

On top of these amounts, workers aged 50 and older can add up to $6,500 more annually as a catch-up contribution.

The 401 contribution limits also apply to other so-called defined contribution plans, including:

- 403 plans, available to education and non-profit workers.

- Most 457 plans used by state and local government employees.

- The federal governments Thrift Savings Plan.

| 401 plan limits | ||

|---|---|---|

| Maximum salary deferral for workers | $19,500 | |

| Catch-up contributions for workers 50 and older | $6,500 | |

| Total contribution limit, plus catch-up contribution | $64,500 | |

| Compensation limit for figuring contributions | $290,000 | |

| Compensation threshold for key employee nondiscrimination testing | $185,000 | |

| Threshold for highly compensated employee nondiscrimination testing | $130,000 | +$5,000 |

How Much You And Your Employer Can Contribute For You In 2022

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

If your employer offers a 401 plan, it can be one of the easiest and most effective ways to save for your retirement. But while a major advantage of 401 plans is that they let you put a portion of your pay automatically into your account, there are some limits on how much you can contribute.

Each year, usually in October or November, the Internal Revenue Service reviews and sometimes adjusts the maximum contribution limits for 401 plans, individual retirement accounts , and other retirement savings vehicles. In November 2021, the IRS made updates for 2022.

Recommended Reading: What Happens To My 401k When I Change Jobs

Your 2022 Guide To Employer Match And 401 Contribution Limits

Offering a matching 401 plan to your team is a great way to attract high-quality employees to your company. An employer-matched 401 can also help reduce employee churn as individuals recognize the financial significance of this benefit.

Many companies now opt for a 401 employer match program, rather than the traditional pension plan. Employer-matched 401 contributions allow for tax deductions for the employer. For this reason, there are 401 matching limits for how much employers can contribute to their employees 401 savings plans.

Learn more about what a 401 plan is, how employer matching works and the max 401 contribution company match limits over the past few years, including 2022 limits.

What Is A 401 Retirement Savings Plan

A 401 is a retirement savings plan some employers offer their team as a financial benefit for working at the company. The U.S. government established the 401 to incentivize workers to save for their retirement.

Employees volunteer to have a certain amount deducted from their paychecks each pay period to go toward their 401 savings accounts. While employees usually choose how much theyd like to deduct from their paycheck, they often have a limit on how much theyre allowed to contribute.

Employers can offer one of two plans: a traditional 401 plan or a Roth 401 plan. For traditional plans, 401 withdrawals are taxed at the employees current income tax rate. Roth 401 withdrawals arent taxable if the 401 account is five years old or older and the employee is over 59 years old. There are specific regulations to follow regarding how much and how often an employee can withdraw these funds for their 401.

Many employers use 401s as an employee benefit for working at the company and as an incentive to keep long-term employees. Some employers require employees to work at a company for a certain amount of time before they can start depositing their paycheck money toward a 401.

Employees can choose the specific types of investments from a selection their employer offers. Some of these investment types may include stock and bond mutual funds, target-date funds, guaranteed investment contracts or the employers company stock.

Recommended Reading: Can A Self Employed Person Open A 401k

Profit Sharing Contribution Question:

Yes, provided you each spouse separately has the necessary net self-employment income to satisfy said contribution amounts, as solo 401k contributions are based on each participants separate net self-employment income. For example, if the self-employed business is an LLC that is taxed as as sole proprietorship, both spouses will need to file a separate Schedule C and their solo 401k contributions will be based on their respective Schedule C net self-employment income figure, so line 31 of the Schedule C.

Don’t Forget The Match

Of course, every person’s answer to this question depends on individual retirement goals, existing resources, lifestyle, and family decisions, but a common rule of thumb is to set aside at least 10% of your gross earnings as a start.

In any case, if your company offers a 401 matching contribution, you should put in at least enough to get the maximum amount. A typical match might be 3% of salary or 50% of the first 6% of the employee contribution.

It’s free money, so be sure to check if your plan has a match and contribute at least enough to get all of it. You can always ramp up or scale back your contribution later.

“There is no ideal contribution to a 401 plan unless there is a company match. You should always take full advantage of a company match because it is essentially free money that the company gives you,” notes Arie Korving, a financial advisor with Koving & Company in Suffolk, Va.

Many plans require a 6% deferral to get the full match, and many savers stop there. That may be enough for those who expect to have other resources, but for most, it probably won’t be.

If you start early enough, given the time your money has to grow, 10% may add up to a very nice nest egg, especially as your salary increases over time.

You May Like: Where To Check 401k Balance

Annuities In Your Plan

Although companies have been permitted to include annuities in their 401 plans, the Secure Act aimed to eliminate companies’ fear of legal liability if the annuity provider were to fail or otherwise not meet its obligations.

Now, insurance companies, asset managers and employers are moving toward making these guaranteed lifetime income options more broadly available through 401 plans and similar workplace plans.

However, uptake by plan sponsors has been slow. Part of the problem is workers not understanding annuities, as well as aversion to the idea of handing over their retirement savings in one lump sum.

“But people also say they are interested in a guaranteed source of income in retirement,” Copeland said. “So, that makes it tough.”