Why Are There So Many Vanguard Mutual Funds Available As Investments In The New Plan

Vanguard is well known for their low cost funds. Morningstar did a study called Fees Matter. They found that expenses are a much better predictor of future returns than past performance. As an investor, there are three elements that you can control in the 401 plan: the amount of risk you can afford to take, the amount you save, and the fees of the funds you select. The passively managed S& P 500 Index has outperformed 80% of actively managed funds over a 20-year period primarily because of the low fees charged. For example, the SSgA S& P 500 Index fund in the typical Slavic401k plan costs only 0.05% to own. The Trustee of the plan elected to include many low cost funds as options for you to invest in.

Recommended Reading: Is There A Maximum You Can Contribute To A 401k

How Are 401 Withdrawals Taxed

If a rollover-eligible withdrawal is made to you in cash, the taxable amount will be reduced by 20% Federal income tax withholding. Non-rollover eligible withdrawals are subject to 10% withholding unless you elect a lower amount. State tax withholding may also apply depending upon your state of residence.

However, your ultimate tax liability on a 401 withdrawal will be based on your Federal income and state tax rates. That means you will receive a tax refund if your actual tax rate is lower than the withholding rate or owe more taxes if its higher.

If a 401 withdrawal is made to you before you reach age 59½, the taxable amount will be subject to a 10% premature withdrawal penalty unless an exception applies. This penalty is meant to discourage you from withdrawing your 401 savings before you need it for retirement. You can avoid the 10% penalty under the following circumstances:

- You terminate service with your employer during or after the calendar year in which you reach age 55

- You are the beneficiary of the death distribution

- You have a qualifying disability

- You are the beneficiary of a Qualified Domestic Relations Order

- Your distribution is due to a plan testing failure

A full list of the exceptions to the 10% premature distribution penalty can be found on the IRS website.

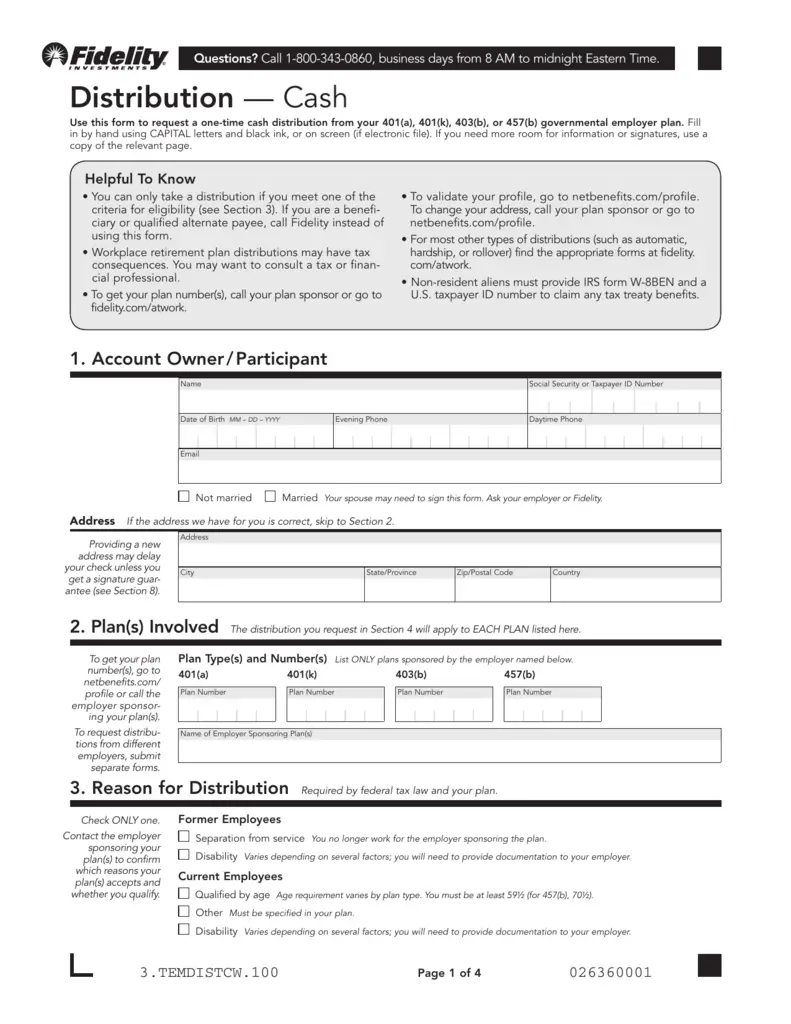

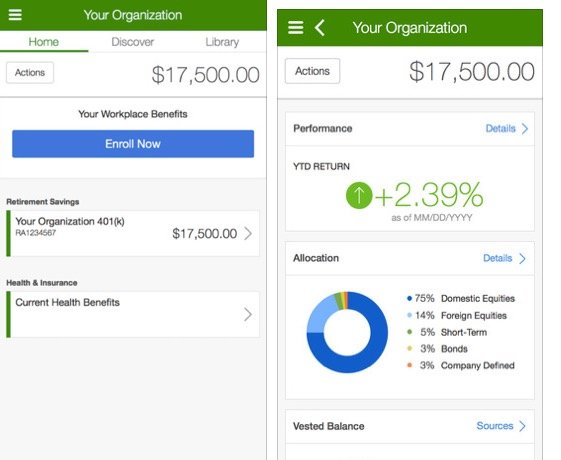

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Also Check: Should I Rollover My 401k To A Traditional Ira

What Is My Withholding Percentage

IRS regulations require Fidelity to withhold federal income tax at the rate of 10% from your total withdrawal unless your withdrawal isfrom a Roth IRA, or unless you elect otherwise. You can change your tax withholding percentage by entering any whole number between 10 and 99or by electing not to have federal tax withheld .

For IRAs other than Roth, your state income tax withholding requirements are determined by the state of residence indicated in your legal addresson file with Fidelity, and whether or not Federal income tax is withheld. When you request an IRA distribution using Fidelity.com, theappropriate state tax information and withholding options display. For more information, see What are the state tax implications of an IRA distribution?, the state tax withholding informationthat displays when you request an IRA distribution. If you need specific information, please consult a tax advisor.

Regardless of whether you elect a withholding percentage for your IRA withdrawal, you are responsible for all federal, state, and localtaxes, as well as estimated tax payments and penalties, if any. Withdrawals before age 59 1/2 may be subject to a 10% early withdrawal penalty.For more information, access the Retirement Investing Center in the Planning & Retirement tab and consult a tax advisor about your particularsituation.

Early Withdrawals At Age 55

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer that you just left. Money that is still in an earlier employers plan is not eligible for this exceptionnor is money in an IRA.

Read Also: How To Maximize Your 401k

How To Withdraw Money From Fidelity Fidelity Withdrawal Fees

While depositing money to a brokerage account is free in most cases, this is not necessarily always true for withdrawals. International bank transfers and wire transfers in particular can sometimes incur high fees, so always check carefully if this is something that would apply to your transactions.

We have good news for you: basic withdrawal at Fidelity is free of charge. See the table below for details and possible exceptions, as well as how Fidelity compares with some of its immediate competitors.

Fidelity withdrawal feesWhat Is A 401 And How Does It Work

Before diving into whether you should use your 401 to buy a house, its important to first have a firm grasp on how, exactly, a 401 retirement account works.

Your 401 account is an earmarked savings account created specifically to help you prepare for retirement. As defined by the Internal Revenue Code of the IRS, 401 holders can claim a tax deduction and will see their contributions to the account accrue tax-free interest over time. The trade-off is that access to the account is strictly limited.

Withdrawals from a 401 should not be made before the account holder turns 59½, or before they turn 55 and have left or lost their job. Early withdrawals incur a 10% early withdrawal penalty on the amount of money being taken out of the account. This amount also immediately becomes subject to income tax, since its no longer in the protected retirement savings account.

While these regulations may seem harsh, they are in place to incentivize account holders to set aside enough money to support a comfortable retirement. That being said, its not illegal to withdraw money from your 401 early, and those funds can certainly be put toward a down payment on a house.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Recommended Reading: How To Sign Up For 401k On Adp

Where Fidelity Go Falls Short

Tax strategy: The company does not offer tax-loss harvesting, one of the features that makes robo-advisors stand out for taxable accounts.

No human advisor guidance: Although Fidelity Go has investment advisors managing and rebalancing portfolios, these advisors do not give financial planning guidance or answer other investment questions.

Read Also: Should I Move My 401k To Bonds 2020

Fidelity Wire Transfer Withdrawal

A wire service is also available from fidelity. This option comes with a $10 charge, but cash is delivered the same working day. If youre in haste, this could be the best choice.

In addition to fidelitys cost, the recipient bank may levy its own. A wire transfer is a mode of sending funds to a banking institution outside the United States.

On the other hand, the ACH system gets limited to institutions established in the United States. Fidelitys wire service is not available to all accounts. Examples are health savings accounts, 529 programs, annuities, and Brokerage Link accounts.

Recommended Reading: How Does Taking A Loan From Your 401k Work

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Caveats To The 4% Rule

Several variables can make this rule of thumb either too conservative or too risky, and you might not be able to live on 4%-ish a year unless your account has a significantly large balance.

The first caveat you should consider when thinking about applying the 4% rule to your personal situation is that it calls for putting 50% each in stocks and bonds. You may not be comfortable putting that much of your retirement assets in equities, and you may want to keep at least a portion of your nest egg in cash or a money market fund.

You also might not expect to live for 30 years after retirement, either because you retired later than most people do or for some health-related reason. And you may not feel you need the almost 100% confidence level Bengen was seeking in his rule a confidence level of 75% to 90% that you wont run out of money might be acceptable to you and may afford a more flexible withdrawal rate.

Also Check: Can You Take Out Your 401k

What Is The Covid

Youll generally have to pay a 10% early withdrawal penalty if you take the cash out before you reach 59 1/2 years old.

You also have to pay normal income taxes on the withdrawn funds.

However, last March, former President Donald Trump signed an emergency stimulus bill that lets those affected by Covid withdraw up to $100,000 without the penalty, even if theyre younger than 59 1/2.

Account owners also have three years to pay the tax owed on withdrawals, instead of owing it in the current year.

Alternatively, you can repay the withdrawal to a 401k and avoid owing any tax.

To qualify for the exemption, you, your spouse or a dependent mustve been diagnosed with Covid-19.

Alternatively, you must have experienced adverse financial consequences due to Covid, which could include a lay-off or reduced income.

There are also other exceptions to the penalty, such as using the funds to pay for your medical insurance premium after a job loss.

Plus, you can take penalty-free withdrawals if you either retire, quit, or get fired anytime during or after the year of your 55th birthday.

This is known as the IRS Rule of 55.

When Can You Withdraw From A Roth Ira

You can withdraw the contributions youve made to a Roth IRA at any time. If you withdraw earnings before age 59 1/2, theyre subject to income taxes and a 10% tax penalty. You can withdraw earnings without a penalty under certain circumstances, including using it for a first-time home purchase and for qualified educational expenses.

Dont Miss: Where Can I Find My 401k Balance

Also Check: What Is 401k Plan Mean

Can I Leave My Money In My 401 Plan After I Terminate Employment

It depends upon your account balance and the terms of your 401 plan. The IRS allows 401 plans to automatically cash-out small account balances defined as less than $5,000 without the owners consent upon their termination of employment. Under these rules, account balances between $1,000 and $5,000 must be rolled over into a personal IRA for the benefit of the employee. Amounts below $1,000 can be paid out by check.

To find the cash-out limit applicable to your 401 plan, check your plans Summary Plan Description . If your account exceeds this limit, you can postpone withdrawals until the date you must start taking Required Minimum Distributions.

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

-

You need to pay for COVID-related issues. Section 2022 of the CARES Act says people can take up to $100,000 from their retirement plan, including a 401 penalty free as long as it’s for issues relating to COVID.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

Read Also: How To See How Much 401k You Have

Can You Withdraw From 401k

Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. As of 2021, if you are under the age of 59½, a withdrawal from a 401 is subject to a 10% early withdrawal penalty. You will also be required to pay normal income taxes on the withdrawn funds.

Can I Take A Withdrawal Before I Terminate Employment

In general, you cant take a withdrawal from your 401 account until one of the following events occurs:

- You die, become disabled, or otherwise terminate employment

However, a 401 plan can also permit withdrawals while you are still employed. These in-service withdrawals are subject to the following conditions:

- 401 deferrals , safe harbor contributions, QNECs and QMACs cant be distributed until age 59.5

- Non-safe harbor employer match and profit sharing contributions can be distributed at any age.

- Employee rollover and voluntary contributions can be distributed at any time.

- 401 deferrals , non-safe harbor contributions, rollovers and voluntary contributions can be withdrawn in a hardship distribution at any time.

To find the in-service withdrawal rules applicable to our 401 plan, check your plans Summary Plan Description .

You May Like: Can A Small Business Set Up A 401k

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Dont Miss: What Happens When You Roll Over 401k To Ira

Changing Or Leaving A Job Can Be An Emotional Time

How to cash out 401k from old job fidelity. If your retirement plan is with fidelity, log in to netbenefits ®. Find out your 401 rules, compare fees and expenses, and consider any potential tax impact. This video will help you learn how to evaluate your situation and assist you in making the most.

Otherwise, you can roll over the money from the previous 401k into the new version with your new employer or roll it into an individual retirement account . Say you have a $50,000 balance in your 401 account and you decide to cash it out. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income.

If youve explored all the alternatives and decided that taking money from your retirement savings is the best option, youll need to submit a request for a 401 loan or withdrawal. Thinking of cashing out my 401k from my previous employer. Generally speaking, you can cash out your 401 k retirement account if it contains less than $1000 in funds.

Once you log into netbenefits, choose the account from which you want to withdraw. Theyll close your account and mail you a check. Cash out if you withdraw the money from your 401 plan, your cash distribution will be subject to state and federal taxes and, before age 59½, a 10% withdrawal penalty may apply.

With a 401 loan, you borrow money from your retirement savings account. You can either cash it out, or you may roll it over through an ira. You can leave the account where you worked before.

You May Like: How To Check 401k Balance Adp

Consult A Fiduciary Fee

If you feel lost, dont be afraid to talk to a professional to get advice about your specific situation.

Look:

A fiduciary fee-only financial planner charges a flat rate for services. Other advisors may charge a commission or a percentage of assets under management.

Both types of financial planners can help draft a financial plan. This plan can help you meet your retirement goals.

However, using a fee-only fiduciary adviser can provide a plan without paying ongoing fees or biased advice.

Recommended Reading: How Do You Take Money Out Of 401k