Tips For Choosing The Type Of Ira That’s Right For You

There are two types of IRAs: a traditional tax-deductible IRA and a Roth IRA. For 2022, the annual contribution limit for both is $6,000 with a $1,000 catch-up if you’re age 50-plus.

However each IRA does have an income ceiling that will determine whether one or the other is right for you.

- Traditional tax-deductible IRAFor someone who doesn’t have a 401 or similar plan, a traditional IRA is fully tax-deductible. Upfront tax deductibility plus tax-deferred growth of earnings are two of the pluses of this type of IRA. However, if you participate in an employer sponsored retirement plan such as a 401, tax deductibility is phased out at certain income levels based on your Modified Adjusted Gross Income . For tax-year 2022, the levels are $68,000-$78,000 for single filers, $109,000-$129,000 for married filing jointly.

- Roth IRAWith a Roth IRA, you don’t get any upfront tax deduction, but you do get tax-free growth plus tax-free withdrawals at age 59½ as long as you’ve held the account for five years. And there’s no restriction if you participate in an employer plan. However, there are income phase-out limits based on your MAGI that determine whether you’re eligible to open and how much you can contribute to a Roth. In 2022, the limits are $129,000-$144,000 for single filers, $204,000-$214,000 for married filing jointly.

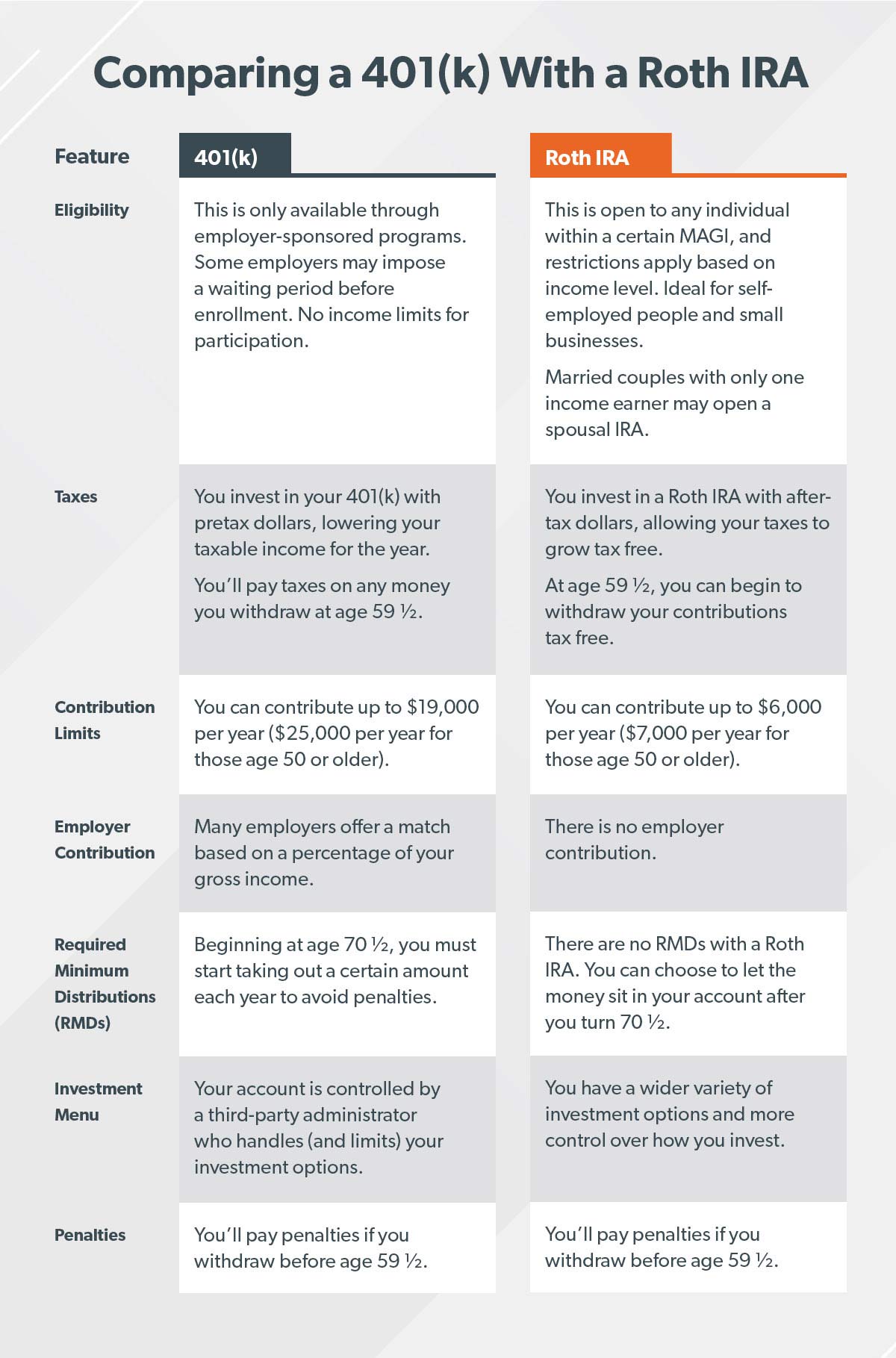

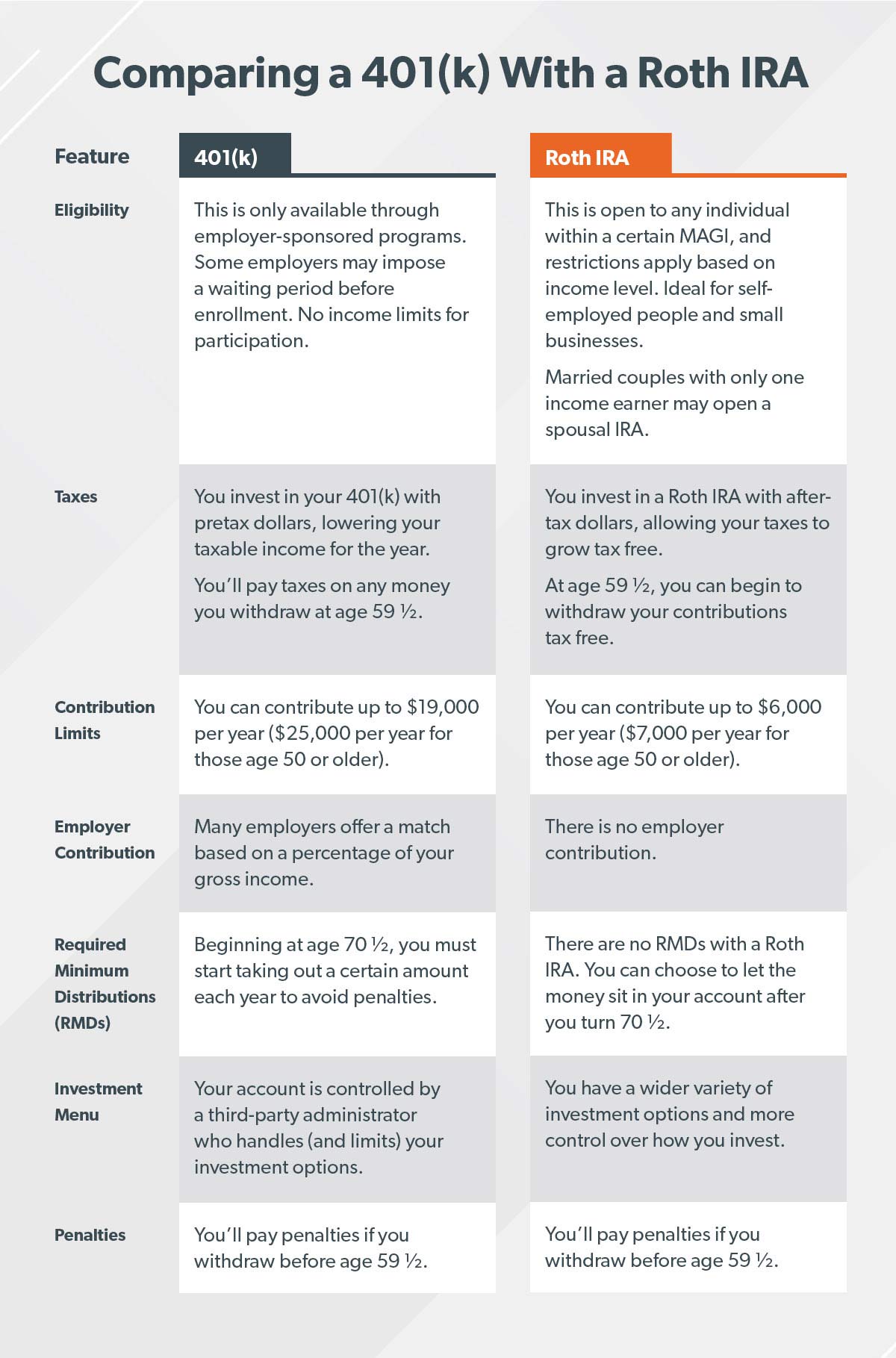

Which Is Better For Taxes A Roth Ira Or 401

Weve talked briefly about the different tax implications of a 401 and Roth IRA, but lets dive a bit further into them here. As we mentioned, a 401 and a Roth IRA have different tax advantages.

In most cases, 401 contributions are made pre-tax, meaning they reduce your taxable income and, therefore, your tax burden in the current year. The money grows tax-deferred while its in your account, and youll pay taxes on your 401 withdrawals at your ordinary income tax rate at retirement.

A Roth IRA, on the other hand, allows you to make your contributions after taxes. While theres no tax advantage in the current year, your money grows tax-free in the account and you can withdraw both your contributions and earnings tax-free during retirement.

So which tax advantage is better? Traditional 401 contributions are generally more beneficial for taxpayers with a high income today who expect to have a lower income during retirement. In other words, you can get a tax break today if your tax rate is high, and then defer those taxes until youre in a lower tax rate. And vice versa.

A Roth IRA is better for taxpayers who expect to be in a higher tax bracket during retirement. You can pay the taxes today while your tax rate is lower, and then enjoy tax-free withdrawals while your tax rate is higher during retirement.

What Is The Difference Between An Ira And A 401 Plan

Every day, the need to save money for the future seems to get more important. Most individuals have some money set aside for a rainy day, but not everyone has considered saving for retirement. When it comes to retirement savings plans, two of the most popular options are IRA and 401 plans. IRA stands for Individual Retirement Account, and it differs from the 401-retirement savings plan. At a glance, both offer tax-deferred growth of your investment and allow you to make contributions with pretax dollars. However, they also have a few key differences:

You May Like: How To Receive 401k Cash Out

What Is The Difference Between A 401 And An Ira

The terms 401 and individual retirement account are bandied about quite a bit when discussing retirement planning, but what are the actual differences between the two? The main distinction is that a 401 — named for the section of the tax code that discusses it — is an employer-based plan, while an IRA is an individual plan, but there are other differences as well.

Both 401s and IRAs are retirement savings plans that allow you put away money for retirement. You may begin taking distributions from these plans at age 59 ½. There are two main types of IRAs: Roth and traditional. With a traditional IRA, you don’t pay taxes when you make contributions because the taxes are paid only when you withdraw the money, whereas with a Roth IRA, you pay the taxes up front and any gains accumulate tax-free. In addition, with a traditional IRA and 401, you are required to start taking minimum distributions at age 72 , but with a Roth IRA there is no requirement to take minimum distributions.

Local Elder Law Attorneys in Your City

Participation

In order to have a 401, you must work for an employer that offers this type of plan as part of its benefit package. Because it is a benefit, your employer may limit which employees may join the plan. Contributions are usually made through deductions from your paycheck.

Contributions

Investments

Loans

Beneficiaries

With an IRA, you can designate whomever you want to be your beneficiary without needing spousal consent.

Withdrawing Funds From Your Ira

The good news about withdrawing funds from an IRA is that the process is simple, as you just need to contact your brokerage firm and fill out the corresponding paperwork. The bad news is that, if you are withdrawing before you reach the minimum age of 59½, there are penalties in the form of additional fees. Withdrawing prior to the age of 59½ will cost you an additional 10% on the funds that you are taking out. Keep in mind that, with an IRA, you will also have to claim the withdrawal as taxable income. For traditional IRAs, you must also start taking minimum deductions once you reach 72 or 70½ if you turned 70½ before Jan. 1, 2020.

Don’t Miss: Why Cant I Withdraw My 401k

Whats The Difference Between An Ira And 401

These days, few people have access to defined benefit plans like the pensions that may have guaranteed your grandparents a certain payout from retirement through the rest of their lives.

Instead, most retirement plans are of the defined contribution variety, meaning you contribute a certain amount each month, quarter or year, with the payout you receive during retirement based on the market value of the account.

IRAs and 401s are among the most common defined contribution plans, and both offer tax-advantaged retirement savings. However, there are a few key differences between these types of plans. The good news is that you dont have to choose one over the other. For the health of your retirement you can and should, if possible contribute to both a 401 and an IRA.

Whats The Difference Between Ira Vs 401

An IRA and a 401 are very similar except that an IRA is generally set up and operated by an individual account holder while a 401 is usually offered through an employer and run by a third-party firm.

A 401 also has a higher maximum amount that can be contributed each year and employers may also offer some form of a matching program as a benefit. Typically, 401s offer less freedom for the individual investor but both accounts are easy to set up, offer traditional and Roth options, and have similar rules for when money can be withdrawn.

| IRA accounts | |

|---|---|

| No matching programs Lower annual contribution max | Less flexibility |

Recommended Reading: When Can You Rollover A 401k Into An Ira

The 13 States Offering Direct Payments To Parents Worth Up To $1000

Meanwhile, there is no matching under an IRA since its not an employer-sponsored plan.

IRAs also come with stricter contribution limits per year. The most individuals under 50 can contribute to their IRAs per year is $6,000, whereas the maximum is $19,500 for 401ks.

Knowing that now, it must seem like a 401k is a drastically better plan. Yet an IRA does beat a 401k plan in a couple of areas.

Logan Murray, financial planner and tax preparer at Pocket Project, notes that IRAs hold an advantage over 401ks when it comes to fees and the ability to trade in the entire public investment universe.

The plan may have very limited, or very expensive options which would make the IRA more appealing, he said.

401s typically have fees for using the account, whereas IRAs do not.

For example, you may only get to choose from 20 investments under a 401k.

Typically, there arent restrictions to where you can invest under an IRA. And under an IRA, you can pick any brokerage that you want.

Can You Have Both A 401 And Ira

Yes. This is a great strategy, especially if you have enough income to max out your annual 401 contribution limit. Depending on your age, you can put another $6,000-$7,000 in an IRA.1

Another strategy is to invest enough to meet your employers contribution match, then direct whatever else you can to an IRA.

It’s important to note that, depending on your income, you may not be eligible for IRA tax benefits if you have access to a 401 or other employer-provided retirement account. Tax benefits of traditional IRAs phase out if your individual income is over $68,000 . Roth IRA benefits phase out if individual income is over $129,000 .2

You May Like: What’s The Most I Can Contribute To My 401k

Is A Roth Or Traditional Ira Better

With a Roth IRA, contributions are not tax-deductible, but qualified withdrawals in retirement are tax-free . Traditional IRA contributions are tax-deductible, so you could save money at tax time for the year you contribute. But you will owe income taxes on withdrawals in retirementincluding on all that growth. In general, youre better off with a traditional IRA if you expect to be in a lower tax bracket when you retire than you are now. If you think you will be in the same tax bracket or higher when you retire, a Roth may be the better choice because youll get your tax bill out of the way at your current, lower tax rate.

When Your Income Is Too High

Above certain income levels, you cant deduct a traditional IRA contribution or even contribute to a Roth IRA. How much income is that? Thats a complicated question that is best answered by our IRA calculator.

It can tell you what IRA plans you can use. If you can no longer fund a Roth, or youre not getting full deductions from your traditional IRA, it might be worth throwing your full savings power behind your 401.

Read Also: Can You Rollover A 401k Into A Roth Ira

What Is An Individual Retirement Account

An individual retirement account is a tax-advantaged investment portfolio that individuals use to save money for retirement. IRAs are set up by you rather than an employer, making it a great option for entrepreneurs or for people who have employers that dont provide a work-sponsored retirement plan.

Anyone can create an IRA with the help of banks, brokerages and investment firms. To be eligible for an IRA, you must have some form of taxable compensation. Besides retirement, people use IRAs to save for other large expenses, such as their childs college tuition.

How Much Can I Contribute To A 401 And Simple Ira

In 2021, the contribution limit for traditional 401 plans is $19,500, with an additional catch-up contribution of $6,500 for plan participants who are age 50 and older.

The contribution limit for SIMPLE IRA plans is $13,500 for 2021. Participants who are age 50 and older may make catch-up contributions up to $3,000, if the plan permits it. If an employee participates in any other employer retirement plan during the year, the total amount of contributions that they can make to all plans is limited to $19,500.

Don’t Miss: How To Find 401k Account Number

Employer Matching Contributions To A 401

Many employers provide a matching contribution for some or all of an employees 401 contribution, incentivizing employees to participate in the plan. Matching contributions are considered to be traditional 401 deposits, even if the employee contributes to a Roth 401.

For example, some employers may match 50 percent of an employees contributions up to eight percent of salary each year. If the employee contributed eight percent, the employer would add another four percent, and the employee would effectively enjoy a total of 12 percent saved. But if the employee contributed 10 percent, the employer would still add a maximum of four percent.

Employers offer different matching amounts, and some employers may offer no match at all.

Many employers require matching contributions to vest over time. For example, if the employer requires three years of vesting, employees must remain with the company at least three years before any matching funds become fully theirs. However, once the employee has surpassed the vesting period, any subsequent matching funds immediately become theirs.

Matching funds may partially vest, depending on the employees length of service. For example, with a three-year vesting schedule, an employee who stays two full years may be able to keep two-thirds of any matching funds. But the rules depend on the details in the employers plan.

Key Differences Between Ira And 401

Both an IRA and 401 may be a great place to save and invest your money for retirement. While both share a lot of similarities, there are a few key differences that may influence where you want to put your money.

AccessibilityIf your employer does not sponsor a 401, then this may not even be an option for you. On the other hand, IRAs are available to anyone with earned income.

Contribution LimitsIRAs have much smaller contribution limits than 401s. As of 2022, you may only contribute up to $6,000 per year to an IRA, and up to $20,500 per year to a 401.

Investment OptionsIRAs provide much more investment options than 401s. With an IRA, you can invest in stocks, bonds, mutual funds, and ETFs, and you can choose where you want to open your account. On the other hand, with a 401, depending on your employers plan, you are likely limited to small selection of mutual funds.

Early Withdrawal PenaltiesWith both an IRA and 401, you may make penalty-free withdrawals starting at age 59 ½. However, if you make early withdrawals before 59 ½ , you may be subject to certain penalties. If you make early withdrawals from a 401, you will face a 10% penalty fee in addition to any applicable income taxes on the amount. With an IRA, there are certain cases where you are exempt from the 10% penalty fee . With a Roth IRA, you may make penalty-free withdrawals at any time for any reason, as long as youve held the account for at least 5 years and withdraw no more than your contributed amount .

You May Like: Can You Invest 401k In Bitcoin

Overview Of An Ira Vs 401k:

You probably know fundamentally that saving for retirement is one of the single best things you can do financially. You dont want to rely on social security, you dont want to run out of money, you dont want to be a financial burden to your children, and you want to enjoy your golden years. All great reasons to have a retirement plan! So which retirement plan is best for you?

Both IRAs and 401Ks have tax benefits and are among the most common defined contribution plans. The good news is that you dont have to choose one over the other. To maximize your retirement savings, you can and should, if possible, contribute to both an IRA and 401k.

The key to note is that a 401k, named for the section of the tax code that discusses it, is an employer-based plan and an IRA is an individual retirement plan. Got it?

First up lets look at how a 401K and IRA are alike.

You Have Other Choices

If you are self-employed or a small-business owner, your options may not be limited to SIMPLE IRA vs. 401. There are a variety of retirement plans at your disposal.

» MORE: Learn the basics of IRAs

For example, if you run a business with no employees, a solo 401 is worth considering. As the employer and employee, youre allowed to contribute a total of up to $61,000 in 2022.

A also has a high contribution limit for business owners and self-employed individuals, though there is no catch-up contribution for savers 50 or older. The drawbacks: Like the SIMPLE IRA, a SEP requires employers to contribute to eligible employee accounts, and no Roth version is allowed.

You May Like: How To Self Manage Your 401k

You Can Afford To Contribute More Than You Can To An Ira

If you are under 50, you can only put $6,000 in an IRA, but up to $20,500 in a 401. After you turn 50, you can add an additional $1,000 to an IRA, but $6,500 more to your 401.

If $6,000 feels like a reach on its own, you may not want to contribute to a 401. But if a higher amount seems possible for you, it may be worth going for that 401 account.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Read Also: What To Do With 401k When You Retire