Review Employer Matching Rules

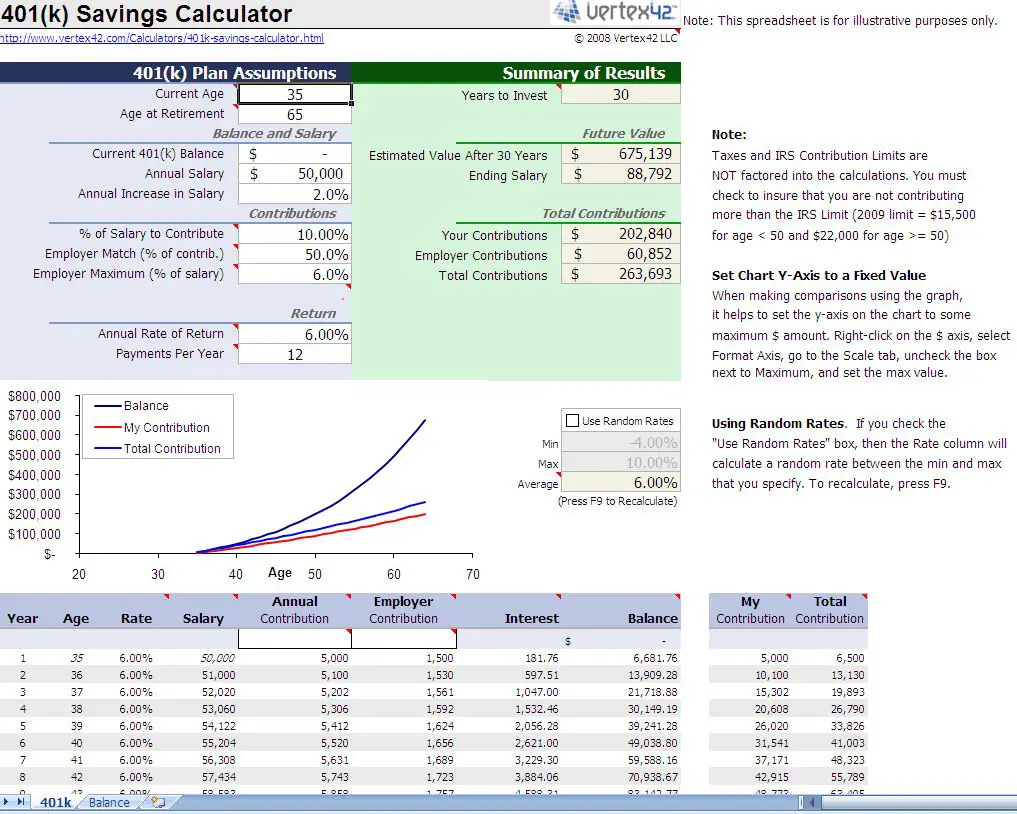

An employer match occurs when a company contributes to your 401 after you put your own money into your account. Companies may match 100% of your contributions up to 4% or your salary or use another system, such as contributing 50% of up to 6% of your salary. Vanguard data, however, shows the median 401 match is 4% of a workers salary.

Because requirements can differ, you need to know your individual companys rules for matching contributions. If you dont already know how this process works, find out as soon as you can in 2022. That way, youll have all year to claim as much of the free money available to you from your employer as possible and youll know exactly what you need to do in order to do that.

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

What Is A Defined Contribution Plan

A defined contribution plan is any retirement plan to which an employee or employer regularly contributes some amount. Often, the employee chooses to send a fixed percentage of monthly income to the account, and these contributions are automatically withdrawn, directly from her paycheck – no effort required. The money that doesn’t go to the employee’s take-home pay gradually accumulates, the balance earns interest from investments, and by the time retirement rolls around, its grown into a substantial nest egg for the retiree. Thats the idea.

In a defined contribution plan , there are no guarantees about the income youll receive in retirement. That doesnt mean such plans cant be just as effective, however, and employers often sweeten the deal by making contributions of their own, straight into your account.

Don’t Miss: How To Find Out If You Have 401k Money

How Much Do You Need For Retirement Savings

The exact amount varies depending on your goals, lifestyle, and needs. But as a rule of thumb, financial experts suggest saving 25 times your total annual expenses once you hit retirement. Its considered the safe amount, which will allow you to withdraw up to 4% of your retirement savings annually.

But in reality, many people are not able to save that much. According to the Federal Reserves 2019 Survey of Consumer Finances , the average retirement savings for all families was $255,130, while the median retirement savings for all families was only $65,000. In relation to this, the average annual household expenditure was $63,036 in 2019, according to the Bureau of Labor Statistics. It also showed a 3% increase from 2018, which will continue to increase over the years due to inflation.

Based on these figures, Americans are not saving enough to plan for a comfortable retirement. The average retirement savings is nowhere close to the ideal amount, which should be 25 times their total annual expenditures. Without ample retirement funds, many people will not be able to maintain their current standard of living once they stop working.

To assess if youre saving enough for retirement, see the age-to-savings guide below:

At What Age Do Most Americans Retire

65 is the common retirement age most people aim for. But according to the U.S. Census Bureaus American Community Survey in 2019, the average retirement age varied for different states.

- In Washington, D.C., people retired at an average age of 67.

- In Hawaii, South Dakota, and Massachusetts, people retired at an average age of 66.

- Those living in West Virginia and Alaska retired at an average age of 61.

Retiring a bit early, say the age of 61, is an option for those who have saved enough funds. And for residents of West Virginia and other similar states, the general low cost of living may help you reach your retirement goals earlier.

Meanwhile, residents in the following states had an average retirement age of 65:

- Vermont

- Virginia

While others try to retire at 65 or earlier, many Americans, particularly Gen Xers and baby boomers, plan to work through retirement. Based on a 2019 article by Business Insider, some of these people simply want to work even if they dont need the money, up until the age of 72. And because retiring early has its disadvantages, it makes sense for some people to keep working especially if theyre still in good health.

How Long People Live

Recommended Reading: Can I Move My 401k To A Roth Ira

Other Benefits Of A 401

Even for employers who do not offer any matching program, every employer with a 401 plan is responsible for administering the plan. That may seem like its no big deal, but it actually saves quite a bit of trouble for the employees. As an employee in a 401 plan, you dont have to worry about the complicated rules and regulations that need to be followed, or about making arrangements with the funds in which you invest your moneyyour employer takes care of all of that for you. Thats quite a bit of saved paperwork.

At the same time, employees who participate in a 401 maintain control over their money. While employers provide a list of possible investment choices, most commonly different sorts of mutual funds, employees have quite a bit of freedom to decide their own strategy. Whether you are willing to take on a little more risk with your investments, or if you would rather play it safe, theres probably an option for you.

How Long Will $1000000 Last How Long Will $500000 Last

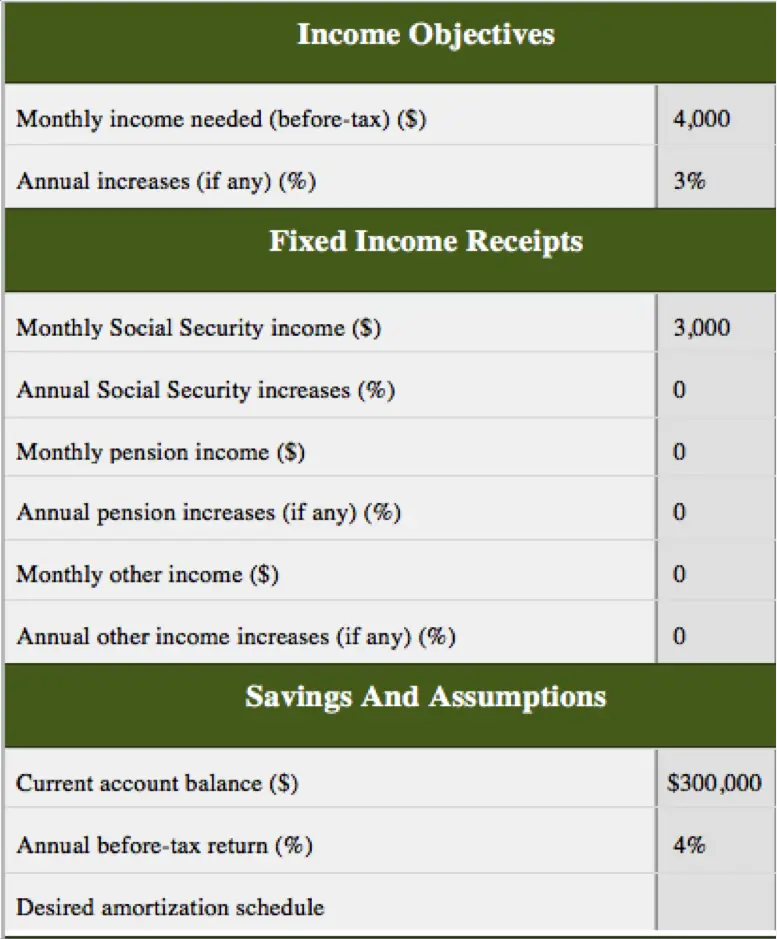

The answer to these questions are all interlinked. The calculator above can help you figure what any sum might do for you over a number of years if we fix the expectations for the interest rate, taxes, and how much you will withdraw each month. This can be a really useful rule of thumb to guide you.

If youre really unsure about how to proceed, it may be best to find a financial professional.

For example, withdrawing $100,000 each year when the market return for your money is 5.5% will drain $1,000,000 fund in about 11 years. The same market return and withdrawal pattern will burn through $500,000 in just five years.

Its impossible to know how long a fund will last unless you know how much you plan to withdraw and spend each year. The 4% safe withdrawal rate is a calculation from a lot of historical data that shows you can typically maintain a 4% income from a portfolio over most retirement windows. 4% is 0.04. 0.04 times $1,000,000 is $40,000. So, the safe withdrawal income is about $40,000. For $500,000 it moves down to $20,000.

Also Check: What To Do With 401k At Retirement

Retirement Withdrawal Strategies: How To Withdraw Money From A Retirement Account

Since Social Security benefits are not always sufficient to keep up the living standard you are used to during your post-income-earning stage of life, you may decide to obtain a retirement account to provide additional income supplements. If you happen to put aside such savings or consider opening an investment account devoted to your retirement, it is essential to ensure that your money will last long enough. A smartly chosen early retirement withdrawal strategy can support you in such a situation. Let’s explore what are the retirement plan withdrawal possibilities.

- The 4 percent rule

The 4 percent rule withdrawal strategy suggests that you should withdraw 4 percent of your investment account balance in your first year of retirement. And from then on you should increase the amount to keep pace withinflation.

For example, if you have 300,000 dollars in your account, you would withdraw 12,000 dollars in your first year of retirement. If there is 2 percent of inflation , you will withdraw 12,240 dollars in the following year.

The advantage of the 4 percent rule is that it’s a simple approach, and your buying power keeps up with inflation.

- Fixed-dollar withdrawals

Fixed-dollar withdrawals involve taking the same amount of money out of your retirement account every year for a set period. For example, you may decide to withdraw 1,000 dollars every month for the first five years of retirement and then re-evaluating.

- Fixed-percentage withdrawals

- Systematic withdrawals

- Buckets

Amount You Want To Spend Annually In Retirement

How much money you want to spend annually in retirement including payment of taxes. Use todays dollars. Subtract from this number annual Social Security, pension, or other lifetime income sources. Be careful not to underestimate living expenses and taxes. Doing so could cause serious cash-flow shortages later on.

You May Like: How Do I Take Money Out Of My Voya 401k

Should I Invest A Windfall Into An Annuity With An Insurance Company

Many a retiree faces this question. It is not a simple answer. The most common general advice from folks not selling annuities is that annuities are bad for most people. At the very least, you should probably only consider a fixed annuity. The primary benefit of an annuity is to provide guaranteed income which is good as long as the insurance company that sells it is stable. This can create a higher income floor than you might have with your social security benefit.

Annuities come in many shapes and sizes. For certain people with specific circumstances they can be a really positive place to put money and generate retirement income. You no longer have to think about the serious effort of managing your own nest egg or following complicated investment advice. For more information on a scenario where you might want to consider a fixed annuity we suggest this discussion on reddit.

We are not financial professionals and are not offering legal or financial advice. We suggest you seek the advice of a professional if you are uncertain.

Impact Of Inflation On Retirement Savings

Inflation is the general increase in prices and a fall in the purchasing power of money over time. The average inflation rate in the United States for the past 30 years has been around 2.6% per year, which means that the purchasing power of one dollar now is not only less than one dollar 30 years ago but less than 50 cents! Inflation is one of the reasons why people tend to underestimate how much they need to save for retirement.

Although inflation does have an impact on retirement savings, it is unpredictable and mostly out of a person’s control. As a result, people generally do not center their retirement planning or investments around inflation and instead focus mainly on achieving as large and steady a total return on investment as possible. For people interested in mitigating inflation, there are investments in the U.S. that are specifically designed to counter inflation called Treasury Inflation-Protected Securities and similar investments in other countries that go by different names. Also, gold and other commodities are traditionally favored as protection against inflation, as are dividend-paying stocks as opposed to short-term bonds.

Our Retirement Calculator can help by considering inflation in several calculations. Please visit the Inflation Calculator for more information about inflation or to do calculations involving inflation.

Also Check: How To Find Old Employer 401k

What Are Dynamic Withdrawals

The dynamic withdrawal retirement strategy helps give you more flexibility than the 4 percent rule. It suggests you change your withdrawal amount each year, depending on the performance of your investment returns and your actual expenses. When your investment dividends are higher, you have the freedom to withdraw more. You also may need to reduce your annual spending when your investment returns are less than you expected them to be.

We Hope To See You Again Soon

Youre about to leave Regions to use an external site.

Regions provides links to other websites merely and strictly for your convenience. The site that you are entering is operated or controlled by a third party that is unaffiliated with Regions. Regions does not monitor the linked website and has no responsibility whatsoever for or control over the content, services or products provided on the linked website. The privacy policies and security at the linked website may differ from Regions privacy and security policies and procedures. You should consult privacy disclosures at the linked website for further information.

Don’t Miss: What Are The Best Investments For My 401k

Estimating Your Own Retirement Income Needs

Its difficult to calculate exactly how long your money will last in retirement. However, you can estimate using these steps:

Remember, this estimate doesnt consider someone living off dividends or a similar constant income stream.

Your Retirement Lifestyle And Budget

Once youve decided on your retirement lifestyle, youll likely want to create a retirement spending plan that reflects your lifestyle choices.

This table shows a sample budget for an average retirement lifestyle1. For a simpler or more elaborate retirement lifestyle, your budget figures would be less or more.

| Basic expenses | |

|---|---|

| Personal insurance and financial services | $1,561 |

The above example is for illustrative purposes only. Situations will vary according to specific circumstances.

- Footnote 1

- 1 Average spending by senior couples. Source: Statistics Canada, Survey of Household Spending in 2019

- Footnote 2

- 2 Includes property taxes, utilities, maintenance, property insurance, rent, mortgage payments

- Footnote 3

- 3 Includes gas, maintenance, insurance, lease and financing costs. Statscan figures include purchase costs of owned vehicles.

- Footnote 4

- 4 Includes cleaning supplies, furnishings, appliances, garden supplies and services.

- Footnote 5

- 5 Includes computer equipment and supplies, recreation vehicles, games of chance, educational costs.

Recommended Reading: How To Cash Out 401k From Fidelity

Does My Asset Allocation Matter For Safe Withdrawal Rates

Safe withdrawal rates are generally set with respect to as much market history as possible, but you may want to consider if you should invest outside equities as well as if it would adjust your safe withdrawal either up or down depending on your investments.

Most portfolios built for things like the 4% rule will expect at least 50% of your portfolio is in equities. Often, a portfolio of 80/20 or 70/30 is typical but you would trend towards less overall in stocks as your time horizon shortens.

The primary impact of additional asset classes is to reduce your exposure to volatility that is typical in equities. On a short time horizon, mixing asset classes makes more and more sense.

It is, however, possible that moving too far away from a portfolio with a majority stake in equities could shift you into risk for safe withdrawal rates no longer being a safe assumption. You might consider using a withdrawal rate below 4% or considering rebalancing your portfolio.

Dont Forget About Inflation

If youre planning to have certain amounts of money many years in the future you absolutely must think about inflation. The value of money in modern economies degrades over time. The central banks in Western countries typically target 2% inflation each year. That means your whole dollar loses two cents of value each year.

This can have a dramatic impact over years. You should be sure to set your target income and savings goals with inflation in mind. Its also important to consider when you look at subjects below like income floors, withdrawal strategies, and asset allocation. Assets you can invest in like real estate or stocks typically dont fall in value as would cash.

Also Check: How Does Taking A Loan From Your 401k Work

How To Boost Your Retirement Savings

DON’T know where to start? Here are some tips on how to get going.

- Understand where you start: Before you consider your plans for tomorrow, you’ll need to understand where you stand today. Look into your current pension savings and research when youll be eligible for social security benefits, if at all.

- Take advantage of a 401k: The 401k plans are tax-effective accounts that put you in a better place financially for your retirement. If you save, your employer may too.

- Take advantage of online planning tools: Financial provider Western & Southern Financial Group and comparison site Bankrate have tools that give you an idea of what your retirement income will be based on how much you’re saving.

- Find out if your workplace offers advice: Some employers offer sessions with financial advisers to help you plan for your future retirement.

With a Roth, employees make contributions with post-tax income but can make withdrawals tax-free.

Most employees can currently put in $19,500 a year of their own money in a 401k account, excluding employer contributions.

However, workers who are older than 50-years-old are eligible for an extra catch-up contribution of $6,500 in 2020 and 2021.