Leave Your 401 With Your Old Employer

Some 401 plans let you leave your money right where it is after you leave the company. However, as you move through your career, this means you will need to keep track of multiple 401 accounts. Some employers require you to withdraw or rollover your 401 within a set period of time after youve left your job.

Transfer The Money Yourself Through An Indirect Rollover

You can opt to transfer your 401 to your own IRA, which is an indirect rollover. As long as you complete the process within 60 days, it still counts as a rollover for the purposes of administering the new plan. You can use this money for a 60-day period between withdrawing it and completing the rollover.

This means that your 401 plan must withhold 20% of the total for federal taxation, credited on your income tax return for the year. The amount withheld serves as a taxable distribution unless you have the funds to make up the additional 20% when depositing the funds.

There may also be a 10% premature distribution penalty, and if you don’t deposit within 60 days, then taxation may apply to the entire sum. It’s usually best to only use an indirect rollover if you plan to transfer the funds to an IRA immediately.

Related: Base Salary and Your Benefits Package

What Is The Purpose Of Tax Deferral

Tax deferral, simply put, postpones the payment of taxes on asset growth until a later date meaning 100% of the growth is compounded and wont be taxed until you withdraw the money, usually at age 59½ or later, depending on the type of account or contract.

Recommended Reading: How To Transfer 401k From Old Employer

Saving For Retirement Terms: A Glossary

Here are some terms youll see throughout the guide and a brief working definition of each:

401k: an employer-sponsored retirement account that allows your money to grow over time. Your company has to offer it, and it chooses the rules.

Traditional 401k: this is the most common 401k account. You contribute money before it is taxed. Then, you pay taxes on your money when you withdraw after age 59 1/2 .

Roth 401k: this is a newer 401k account where you contribute money thats already been taxed. You dont have to pay taxes later when you withdraw.

IRA: this stands for Individual Retirement Account. An IRA doesnt have to be employer-sponsored. You can transfer your 401k money into an IRA in the event you lose your job or your company goes under.

Brokerage account: another option for investing your money independently. A brokerage account doesnt offer the same tax benefits as a 401k or IRA, but your stock options are unlimited.

Employer matching: many employers will match all or some of your yearly contributions to your 401k. Free money!

While Roth 401ks are gaining in popularity, most of us will still be offered a traditional 401k through our company. Therefore, we’ll start by going more into detail about traditional accounts to answer our million dollar question: what is a 401k plan?

Employer matching is the best. With both you and your company contributing to your nest egg, it can grow quite large over time.

You Can Take It With You

If you leave your job someday for another, you can take your 401 with you. This won’t go into a box with your other belongings rather, you’ll need to roll over that account into a new one and for many people, converting that 401 to an IRA is a great idea. You’ll want to consult our guide for 401 rollovers when that time comes.

About the author:Dayana Yochim is a former NerdWallet authority on retirement and investing. Her work has been featured by Forbes, Real Simple, USA Today, Woman’s Day and The Associated Press.Read more

Read Also: How Can I Find Old 401k Accounts

Withdraw The Money From Your 401

You may choose to withdraw the funds from your 401 in a lump sum. You can ask the plan’s administrator to provide you with a check in your name. If you withdraw the money from your 401, you pay federal and usually state income taxes on the money. For larger sums, this could put you into a higher tax bracket for the year in which you withdraw the money.

If you withdraw money before you reach the age of 59 1/2, you may have to pay a 10% penalty tax for premature withdrawal in addition to income tax, although there are exceptions for those aged 55 and over.

Your employer also has to keep back 20% of the total to pay federal taxes, bringing the total amount down significantly. This is often not a professionals first choice due to the cost of taxes and penalties, but it may benefit you if you want access to your funds more quickly.

Related:

How Does A 401k Work

A 401k plan technically a 401 is a benefit commonly offered by employers to ensure employees have dedicated retirement funds. A set percentage the employee chooses is automatically taken out of each paycheck and invested in a 401k account.

The account is managed by an investment company of the employer’s choosing. The 401k contributions are invested in stocks, bonds, and mutual funds, which the employee can select themselves.

Depending on the details of the plan, the money invested may be tax-free and matching contributions may be made by the employer. If either of those benefits are included in your 401k plan, financial experts recommend contributing the maximum amount each year, or as close to it as you can manage.

Read Also: Can I Have A Sep Ira And A Solo 401k

How Do 401 Required Minimum Distributions Work

Holders of both traditional 401s and Roth 401s are required to take RMDs. The amount of your RMDs is based on your age and the balance in your account. As the name suggests, an RMD is a minimumyou can withdraw as much as you wish from the account each year, either in one lump sum or in a series of staggered withdrawals. As noted above, RMDs from a traditional 401 are included in your taxable income, while RMDs from Roth 401s are not.

What Is A Roth Ira

A Roth IRA is a type of individual retirement account similar to traditional IRAs in many ways, but with some significant differences. One of the main differences is in the tax breaks. With a traditional IRA, the money you put in isn’t taxed with a Roth IRA, the money you take out isn’t taxed. Roth IRAs also have no requirements on when the money must be taken out, so they can be a good tool to pass along wealth to your beneficiaries if you find you don’t need the money in retirement.

Also Check: What Happens To Your 401k If You Quit Your Job

Is A 401 Plan Right For Your Business

You may think your business is too small for a 401 plan, but these plans arent only for big companies. Meadows noted that this is a common misconception, saying small business owners have a few main reasons for being hesitant about implementing a 401:

- Paying for a 401 plan would affect the success of the business if it already doesnt have enough money to run.

- The plans are complicated and usually involve a lot of jargon.

- It is expensive. There are fees involved, such as managing fees and investment fees, that arent usually presented at first.

While the IRS website tells you exactly what you need to know about the plans, your employees might not have any idea what it actually means. Meadows advised employers to use plain language when explaining the plan to their employees.

Dont understand the plan yourself? Do you have questions about your contributions as an employer? Consider hiring a financial advisor with plenty of experience in the industry, Meadows said.

The best financial advisors are the people who have already done it, he added.

Your business offering a 401 can mean a lot for the talent you have and the talent you want.

Key takeaway: Companies of any size can offer a 401 plan. If youre new to the process, connect with a financial advisor who can help you find the best option for your company.

How A 401 Works

A 401 works by contributing a part of your salary or wages to a dedicated account. You can contribute up to a certain amount per year to your 401, with an additional contribution known as a catch-up contribution available for those over 50.

Employers usually work with a dedicated financial professional to invest your funds in the market and offer matching up to a certain percentage or gross amount. That way, your funds continue to grow based on the investment plan. Your employer may give you different investment options that include varying stock and bond mixes.

A 401 provides taxation benefits, either when contributing or withdrawing. In a traditional 401, your contributions are tax-free, while your withdrawals include taxes. An employer may instead offer a Roth 401 plan in which contributions to a retirement plan occur after taxation, allowing for tax-free withdrawal in the future. This may make a Roth 401 preferable early in your career when youre likely to be in a lower tax bracket than you may be in retirement.

Related: Salary vs. Hourly Earnings: What Are the Differences?

Read Also: How To Find Missing 401k Accounts

How Does A 401 Earn Money

Your contributions to your 401 account are invested according to the choices you make from the selection your employer offers. As noted above, these options typically include an assortment of stock and bond mutual funds and target-date funds designed to reduce the risk of investment losses as you get closer to retirement.

How much money you contribute each year, whether or not your company matches your contribution, how your contributions are invested and the annual rate of return on those investments, and the number of years you have until retirement all contribute to how quickly and how much your money will grow. And provided you don’t remove funds from your account, you don’t have to pay taxes on investment gains, interest, or dividends until you withdraw money from the account after retirement , in which case, you don’t have to pay taxes on qualified withdrawals when you retire).

What’s more, if you open a 401 when you are young, it has the potential to earn more money for you, thanks to the power of compounding. The benefit of compounding is that returns generated by savings can be reinvested back into the account and begin generating returns of their own. Over a period of many years, the compounded earnings on your 401 account can actually be larger than the contributions you have made to the account. In this way, as you keep contributing to your 401, it has the potential to grow into a sizable chunk of money over time.

At What Age Can You Withdraw From A 401

You can withdraw from a 401 plan without paying the IRS-mandated 10% “early withdrawal” penalty at age 59 1/2. Before that age, you can still make withdrawals under certain circumstances but the 10% penalty, plus any applicable taxes, must be paid.

Tip: 401 plans generally allow hardship withdrawals while you are still employed. The reasons allowed by the IRS for hardship distributions include certain medical expenses, purchase of a primary residence, tuition and related education expenses, and prevention of foreclosure on your home.

Don’t Miss: Should I Roll Over My 401k To A Roth Ira

How Does A 401 Match Work

Many employers make 401 matching contributions for employees. As the term suggests, you don’t get a 401 match from your employer unless you make your own contributions first. The amount of the match is typically determined by a formula.

For example, a typical matching formula is 50 cents for every dollar you contribute, up to 6% of your compensation. This means that if you contribute at least 6% or more of your gross pay, your employer will match 50% of that amount, which would equal 3% of your gross pay.

Leave Your 401 With The Old Employer

In many cases, employers will permit a departing employee to keep a 401 account in their old plan indefinitely, although the employee can’t make any further contributions to it. This generally applies to accounts worth at least $5,000. In the case of smaller accounts, the employer may give the employee no choice but to move the money elsewhere.

Leaving 401 money where it is can make sense if the old employer’s plan is well managed and you are satisfied with the investment choices it offers. The danger is that employees who change jobs over the course of their careers can leave a trail of old 401 plans and may forget about one or more of them. Their heirs might also be unaware of the existence of the accounts.

You May Like: How Do I Take Money Out Of My Fidelity 401k

Withdrawing Funds From Your Ira

The good news about withdrawing funds from an IRA is that the process is simple, as you just need to contact your brokerage firm and fill out the corresponding paperwork. The bad news is that, if you are withdrawing before you reach the minimum age of 59½, there are penalties in the form of additional fees. Withdrawing prior to the age of 59½ will cost you an additional 10% on the funds that you are taking out. Keep in mind that, with an IRA, you will also have to claim the withdrawal as taxable income. For traditional IRAs, you must also start taking minimum deductions once you reach 72 or 70½ if you turned 70½ before Jan. 1, 2020.

What Is A 401 And Why Is It Called A 401

A 401 is an employer-sponsored, defined-contribution, retirement savings plan. In translation, a 401 is a benefit, defined by payroll contributions, that employees can make toward their own retirement. The plan gets its name from Internal Revenue Code, section 401, which made it possible for employers to sponsor a retirement savings plan for employees.

You May Like: Can You Borrow Money Against Your 401k

Withdrawing Funds From Your 401

Funds saved in a 401 are intended to provide you with income in retirement. IRS rules prevent you from withdrawing funds from a 401 without penalty until you reach age 59 ½. With a few exceptions , early withdrawals before this age are subject to a tax penalty of 10% of the amount withdrawn, plus a 20% mandatory income tax withholding of the amount withdrawn from a traditional 401.

After you turn 59 ½, you can choose to begin taking distributions from your account. You must begin withdrawing funds from your 401 at age 72 , as required minimum distributions .

Contributing To Both A Traditional And A Roth 401

If their employer offers both types of 401 plans, employees can split their contributions, putting some money into a traditional 401 and some into a Roth 401.

However, their total contribution to the two types of accounts can’t exceed the limit for one account .

Employer contributions can only go into a traditional 401 account where they will be subject to tax upon withdrawal, not into a Roth.

Recommended Reading: How To Convert 401k To Silver

Sign Up For Automatic 401 Contributions

Enroll in automatic payroll deductions, so contributions are deposited in your 401 each pay period without any further action by you.

âOne of the advantages of these plans is the power of payroll deduction,â said Young. âYou pay yourself first, automatically, every paycheck, making retirement savings easy.â

Use Vanguardâs plan savings calculator to find out how a given level of contributions will impact your paycheck, and how much you could be earning for your retirement with an employerâs match.

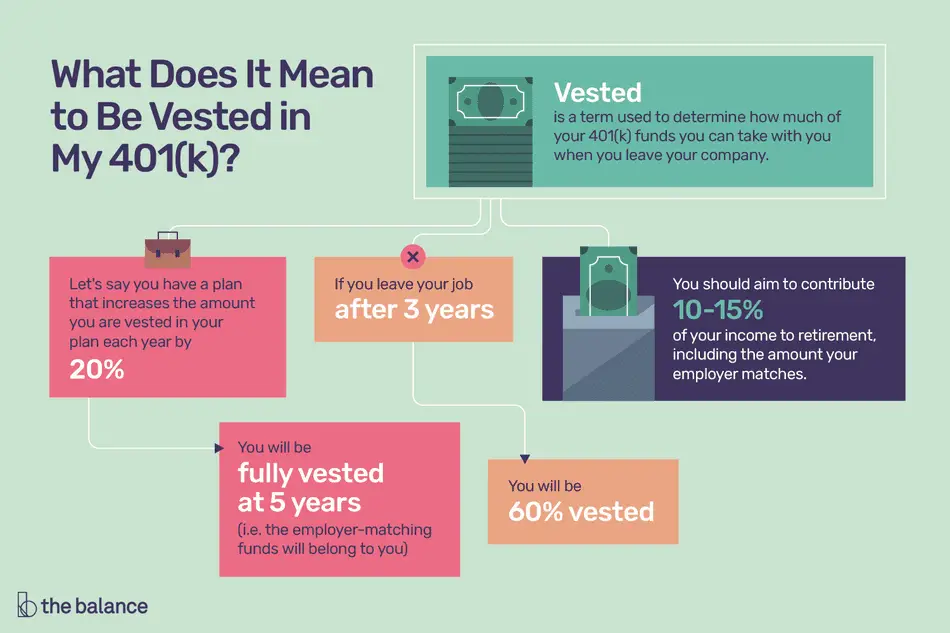

What Does It Mean To Be Vested In A 401

To be vested in a 401 means that you own the balance. In different words, the term vesting refers to ownership of the money in your 401. For example, you are always 100% owner, or 100% vested, in your own contributions but you may have to be employed for a certain number of years to be 100% vested in employer contributions, such as the match.

For example, if your employer’s 401 vesting schedule for the match is 25% per year, and you terminate employment after two years, you have a legal right to take with you 50% of the employer matching contributions made during that time, plus 100% of your own contributions, plus any growth on those contributions.

Also Check: How Is A 401k Divided In A Divorce

What Should You Consider When Choosing A Plan And When Should You Get One

Meadows said that small businesses should want to provide the most robust 401 plan that the business can afford.

Today, there are more and more providers helping small businesses avoid high-cost funds and access manageable monthly administration fees, he continued. This may vary from business to business, but the sooner you can set up a 401 plan, the better.

Even though having a 401 plan makes the most sense for small businesses, there are many things to consider as a business owner when considering offering your employees a retirement plan such as a 401. Here are a few that Smith laid out:

- Income and age of owner

- Income and age of the employees

- The time frame for which business will offer the plan

- The budget and resources that are available to manage the retirement plan

Generally speaking, any business that seeks to provide a relatively simple and low-cost plan may consider a 401, Smith said.

Key takeaway: Consider the size of your company and what you can afford in terms of contributions and management fees when exploring the types of 401 accounts.