I Participate In A 401k Through My Primary Employer And I Have A Part Time Business Can I Have A Solo 401k For My Part Time Business

Yes. You are eligible to establish a Solo 401k for a side business even if you participate in a 401k, 403b, 457 or Thrift Savings Plan through your primary employer. It is important to note that contributions made to the employers 401k, 403b or Thrift Savings Plan will impact the contributions for the Solo 401k. Contributions to the employers 401k, 403b or TSP count towards the Solo 401k salary deferral limit. The 2021 salary deferral limit is $19,500 and $26,000 if age 50 or older. Contributions made into a 457 plan do not count towards the salary deferral limit. In addition to a salary deferral contribution, a business owner can also make contributions to the profit sharing portion of a Solo 401k.

Example: Jennifer is age 40 and works as a W-2 employee for ABC accounting firm and contributes $10,000 to the 401k. In addition to working at the accounting firm, Jennifer is the owner of an S corporation. She is the only employee and pays herself a $100,000 W-2 salary in 2021.

Based on this information Jennifer would be eligible to make a contribution of $9,500 in salary deferrals plus make a profit sharing contribution of $25,000 for a total of $34,500 in Solo 401k contributions in 2021.

How To Do A Rollover

The mechanics of a rollover from a 401 plan are fairly straightforward.

Your first step is to contact your companys plan administrator, explain exactly what you want to do, and get the necessary forms to do it.

Then, open the new Roth IRA through a bank, a broker, or an online discount brokerage.

Finally, use those forms supplied by your plan administrator to request a direct rollover, also known as a trustee-to-trustee rollover. Your plan administrator will send the money directly to the IRA that you opened at a bank or brokerage.

Read Also: How Much Does 401k Cost Per Month

Roll Over Your 401 To A Roth Ira

If youre transitioning to a new job or heading into retirement, rolling over your 401 to a Roth IRA can help you continue to save for retirement while letting any earnings grow tax-free.2

- Cons

-

- You cant borrow against a Roth IRA as you can with a 401.

- Any Traditional 401 assets that are rolled into a Roth IRA are subject to taxes at the time of conversion.

- You may pay annual fees or other fees for maintaining your Roth IRA at some companies, or you may face higher investing fees, pricing, and expenses than you did with your 401.

- Some investments offered in a 401 plan may not be offered in a Roth IRA.

- Your IRA assets are generally protected from creditors only in the case of bankruptcy.

- Rolling over company stock may have negative tax implications.

Dont Miss: Which Fidelity 401k Fund Is The Best

Don’t Miss: How To Open A 401k Self Employed

Viability For More Employees

With the exception of a spouse who works in your business, the solo 401 will not work for a business with employees. If thats the case, then you may turn to the SEP IRA, which allows you to establish the plan for multiple employees. If youre setting up a plan for your employees, youll also want to compare the SEP IRA against the SIMPLE IRA to see which works better.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Recommended Reading: Can I Take My 401k If I Quit

What Are The Most Common Mistakes People Make With Their Self

Overcontributing, in Allecs opinion, is the largest mistake. When you discover youve put too much money into your plan, call your provider right away. They can help you withdraw the overcontributed amount so you wont have to pay taxes on it.

Another common error is breaking one of the prohibited transaction rules. For example, your plan buys a house in Florida and rents it out as an investment. If you want to take a family trip to Disney World, you cant stay in that house. Once youve invested in alternative assets and break the rules, you will be subjected to taxes and penalties. Always make sure your provider goes over the prohibited rules with you when you open your individual 401.

The last mistake many people make is not getting their solo 401 set up by the end of the year.

Additional reporting by Max Freedman

How Do You Start One Of These 401 Plans

Bergman says you first need to select a provider. One of the most common ways to establish one of these plans is to go through a bank. You usually arent charged a fee for these, but your investment options are limited to the financial products the bank or financial institution sells. You can also go through a brokerage. In addition, there are self-directed solo 401 plan document providers, which do not sell investments and will allow you to establish a self-directed solo 401 plan to make alternative asset investments, such as real estate, as well as gain access to all other available plan options, such as Roth contributions and a $50,000 loan option.

Read Also: Where To Put My 401k Rollover

Can You Contribute A Lump Sum To A Self

According to Bergman, a self-employed individual can usually make an employee deferral lump-sum contribution to a plan so long as he or she has sufficient earned income. However, in the case of a W-2 owner/employee, the employee deferral contribution should not be more than the income earned for that income period. In the case of employer profit-sharing contributions, those can be made by the employer in a lump sum.

What Is The Difference Between An Ira Vs Sep Ira

A SEP is a true profit-sharing arrangement in that the employer can contribute the lesser of 25% of business revenue, or $58,000 for 2021 to themselves and any eligible employee. To be eligible, the employee must be 21, worked for the employer 3 of the past 5 years and receive at least $650 in paid compensation. If the business has eligible employees, then they must set up accounts for each employee and contribute to their accounts every time the owner contributes to their own account.

This is usually not an issue, because the accounts are easy to set up and can be established any time before the business files their tax returns . Many business owners will work with their CPAs and wrap up the entire years taxes and determine how much the employer should contribute to each account. That flexibility and ease is one of the reasons why practice owners choose to stay with a SEP.

One thing to note is only the employer contributes money to the SEP employee contributions are not allowed.

You can still fund a Traditional or Roth IRA, in addition to the SEP. However, the Backdoor Roth IRA is not allowed, as a you cant have any pre-tax IRA money and still do the Backdoor Roth, and a SEP is considered an IRA.

Anyone can fund a Traditional IRA or Roth IRA, as long as they have earned income . These are completely separate from any employer retirement plans.

You May Like: What Is The Max You Can Put In A 401k

When Can You Not Do Both

If you use a financial institution or custodian to set up your SEP IRA, you need to be aware of what form they use. If they use the standard IRS Form 5305, then you cannot also set up a Solo 401. This form is provided by the IRS, so its unusual that you are limited in your options when you use it.

However, there is a workaround. You simply need to set up the SEP IRA not using the From 5305. You can essentially take the basics of the form and tweak it for your use. Of course, your financial institution must accept the form in order to be eligible. You can work with an attorney or financial planner to help design the form. But again, if you have zero full-time employees, its probably not worth the hassle anyway!

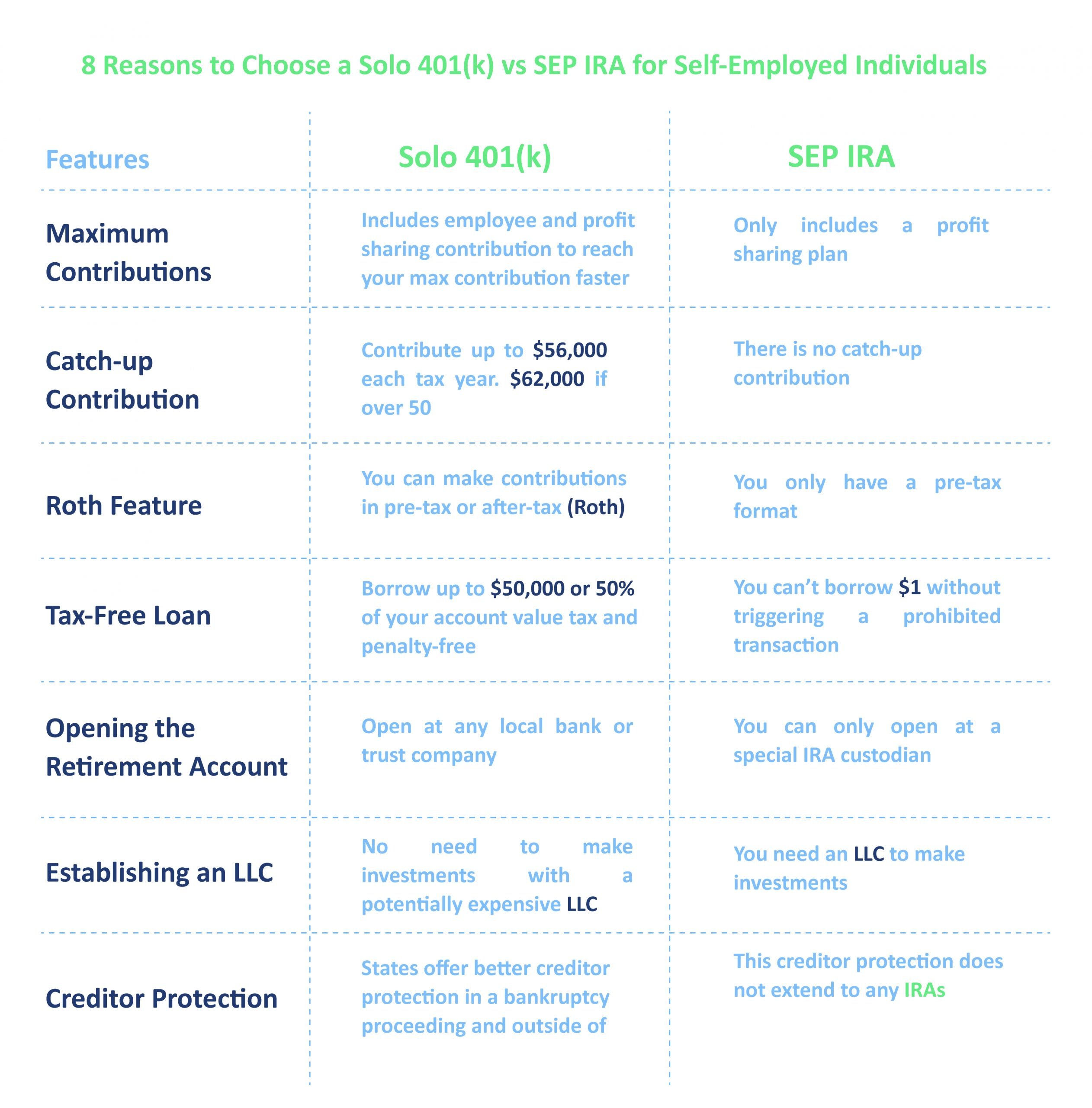

Should I Use A Sep Ira Or A Solo 401k: A Guide For Independent Contractors

For most people, the simple truth of why we work is so that one day we wont have to anymore. That is why it is so important to pick a retirement savings plan that will maximize the amount you can put away, and save you the most taxes in the long run.

One of the benefits of being an independent contractor is having more retirement plan options at your disposal. In addition to a traditional IRA and a Roth IRA, you have 2 noteworthy options: SEP IRA and a Solo 401.

SEP IRAs work essentially like a traditional IRA. That is, you are allowed to deduct any contributions you make from your gross income when calculating your adjusted gross income. As a self-employed person without any employees, there isnt a significant administration cost, but If you do have employees, they must all receive the same benefits under a SEP plan.

For 2015, if you have a SEP, you are allowed to contribute 25% of your net earnings from self-employment. However it is important to note, if you are the owner and employee of an S corporation, you are only able to contribute based on your salaried income, as any money must come from compensation as earned income, and distributions are not considered earned income by the IRS. This is the primary reason we recommend a Solo 401 for S corp owners.

Also Check: What Is A Robs 401k

Who Can Have A Solo 401 Plan

According to Allec, there are three categories of people who can have solo 401 plans:

Who Should Choose A Sep Ira Instead Of A Solo 401

When a newly minted entrepreneur or gig worker lands at Henrys door and asks whether to open an SEP IRA or a solo 401, he asks one question: Do you have any plans to hire an employee, even in the future? If the answer is maybe, he steers them toward an SEP IRA, which can be used to fund employee retirements.

Remember: Hiring just one employee for your business in the futurebeyond your spousewould eliminate the solo 401 as an option. And switching from a solo 401 to an SEP IRA at some future date can be a big hassle, Henry warns.

Entrepreneurs who go with an SEP IRA because of potential future hires have another important consideration: All employee contributions must be the same percentage of compensation. For instance, an entrepreneur who wants to put 10% of their net income into their SEP IRA must put 10% of worker pay into their SEP IRA, too.

But even in some cases where hiring employees simply isnt in the cards, Henry sometimes advises the self-employed to choose a SEP IRA. Simplified is in the plans name for a reason: They can be easier to set up than solo 401 plans, according to Henry, and theyre more widely available.

Every situation is different, and an individual should assess the option that is best for their financial goals, but there is some truth to the fact that a SEP is easier to open, says Cherill. In fact, most taxpayers can simply open a SEP account online with their brokerage firm and manage it themselves.

Read Also: How Much Can You Borrow From 401k

Round #3 When Is The Contribution Deadline For Solo 401 And Sep Ira

For 2020, the contribution deadline for the Solo 401 as well as the contribution deadline for the SEP IRA has been extended to May 17, 2021. This deadline is specifically for the employer contributions.

If youre setting up a solo 401 just now for the tax year 2020, you cannot contribute as an employee, unfortunately. But you can do so for the tax year 2021. The takeaway is you still have time to create and put in money to either a solo 401 or a SEP IRA, as the Employer. Make sure you do this before the deadline. Take a break from uploading your TikTok video for a day!

Round 3 Winner: Its a tie. The Solo 401 contribution deadline and SEP IRA contribution deadline are the same.

Can I Keep My Solo 401 If I Hire An Employee

If the business sponsoring your Solo 401 hires any full-time employees or long-term part-time employees, or if any other business you control has plan-eligible employees, then those employees are entitled by law to benefits coverage under the 401 plan.

Once a 401 has non-owner employees, its no longer the simplified Solo 401 version of the plan.

So what does that mean for your plan?

Theres no need to panic: Your plan can exclude a qualifying employee for up to one year of service, so you have time to create a proper transition strategy.

There are two directions you can take your plan:

Lets look at the pros and cons of each option below:

Read Also: How To Avoid Penalty On 401k Withdrawal

Don’t Miss: How To Recover 401k From Old Job

Rolling Over Your 401 To An Ira

You have the most control and the most choice if you own an IRA. IRAs typically offer a much wider array of investment options than 401s, unless you work for a company with a very high-quality planusually the big, Fortune 500 firms.

Some 401 plans only have a half dozen funds to choose from, and some companies strongly encourage participants to invest heavily in the companys stock. Many 401 plans are also funded with variable annuity contracts that provide a layer of insurance protection for the assets in the plan at a cost to the participants that often run as much as 3% per year. IRA fees tend to run cheaper depending on which custodian and which investments you choose.

With a small handful of exceptions, IRAs allow virtually any asset, including:

- Stocks

- Real estate investment trusts

- Annuities

If youre willing to set up a self-directed IRA, even some alternative investments like oil and gas leases, physical property, and commodities can be purchased within these accounts.

How To Set Up A Solo 401k

These days, its amazing to see how many retirement plan options there are for small businesses. Having a self-directed retirement plan for your small business can set you on the path to financial freedom. With incredible benefits like big tax deductions, every small business owner should consider a Solo 401k or SEP IRA. Ultimately, a Solo 401k offers you bigger contribution limits, Roth provisions, loan options, and catch-up contributions. This makes is a clear winner when weighing a Solo 401k vs SEP IRA. If your small business doesnt have any employees, a Solo 401k may be the right choice for you.

You May Like: How Long Will My 401k Last

Round #2 Solo 401 Vs Sep Ira: What Are The Contribution Limits

For both solo 401 and SEP IRA, as the Employer, you can contribute up to 25% of your compensation, up to a maximum of $57,000 for the 2020 tax year, $58,000 for the 2021 tax year, and $61,000 for the 2022 tax year. Based on my experience, after certain deductions and adjustments, it comes to slightly above 18% of my compensation. Work with a tax accountant to get the exact percentage right.

This is where you get to really take advantage of being a small business owner. For most people working as a regular employee, contribution limits are less than half that amount, $20,500 for 2022.

So the employer solo 401 contribution limit for 2020 and 2021 and SEP IRA contribution limit for 2020 and 2021 is the same. Now, if you have a solo 401, you can also contribute as the employee! The employee solo 401 contribution limit for 2020 and 2021 is $20,500 for employees under 50 and $27,000 for employees age 50 or older.

For example, if youre a realtor and you made $200,000 in 2020 with the help of the crazy hot real estate market, you can contribute approximately 18% of 200,000 as the employer in either a solo 401 and SEP IRA. Thats $36,000 that you get to invest and deduct from your taxes. But with a solo 401, you can contribute an additional $20,500 as an employee! Thats a total of $56,500!

Round 2 Winner: Solo 401 wins because of that additional $20,500 employee contribution allowed.

Saving For Retirement While Self

If you’re under the impression you need a workplace retirement plan to save for the future, I hope my experience makes it clear that you have options. Sure, you’ll miss out on any employer retirement benefits like an employer match if you strike out on your own, but you can open your own retirement account just the same.

Like I mentioned already, the SEP IRA is a good choice. If you think you could save more with a Solo 401 and are willing to fill out a little more paperwork, this plan can also be a smart choice.

In addition to those options, you can also contribute up to $6,000 across Roth IRA and traditional IRA accounts or $1,000 more if you’re age 50 or older.

Note that contributions to a Roth IRA are made in post-tax dollars, so there’s no tax benefit right away, and only individuals with an income of less than $122,000 a year or less than $193,000 a year married filing jointly can contribute the maximum account. However, money in a Roth IRA grows tax-free and you don’t have to pay taxes on qualified distributions.

With a traditional IRA, there are no income limits, but contributions are subject to the same limits and you may be able to deduct your contributions on your taxes if you meet certain income and employment requirements.

The bottom line: Saving for retirement is easy when you’re self-employed no matter what anyone says. All it takes is a little research, a few hours of your time, and the desire to save for the future you want.

Also Check: How To Switch 401k To Ira