Income Balanced And Growth Asset Allocation Models

We can divide asset allocation models into three broad groups:

Income Portfolio: 70% to 100% in bonds.

Balanced Portfolio: 40% to 60% in stocks.

Growth Portfolio: 70% to 100% in stocks.

For long-term retirement investors, a growth portfolio is generally recommended. Whatever asset allocation model you choose, you need to decide how to implement it. Next up, well look at three simple asset allocation portfolios that you can use to implement an income, balanced or growth portfolio.

After Establishing The Plan

Once your portfolio is in place, monitor its performance. Keep in mind that various sectors of the stock market do not always move in lockstep. For example, if your portfolio contains both large-cap and small-cap stocks, it is very likely that the small-cap portion of the portfolio will grow more quickly than the large-cap portion. If this occurs, it may be time to rebalance your portfolio by selling some of your small-cap holdings and reinvesting the proceeds in large-cap stocks.

While it may seem counter-intuitive to sell the best-performing asset in your portfolio and replace it with an asset that has not performed as well, keep in mind that your goal is to maintain your chosen asset allocation. When one portion of your portfolio grows more rapidly than another, your asset allocation is skewed toward the best-performing asset. If nothing about your financial goals has changed, rebalancing to maintain your desired asset allocation is a sound investment strategy.

Borrowing against 401 assets can be tempting if times get tight. However, doing this effectively nullifies the tax benefits of investing in a defined-benefit plan since you’ll have to repay the loan in after-tax dollars. On top of that, you will be assessed interest and possibly fees on the loan. Plus, you will often not be able to make 401 contributions until the loan has been paid off.

Trowe Price Blue Chip Growth

Expense Ratio:

Most active managers are pretty terrible, but when they are good, they are really good.

Case in point, Larry Puglia and the T. Rowe Price Blue Chip Growth . Puglia has been guiding TRBCX for twenty-five years and the results have been more than impressive.

Since the funds inception back in 1993, its managed to produce an 11.01% annual total return. This compares to just a 9.6% return for the S& P 500 over that time. The reason for those extra returns comes down to stock selection.

Puglias combs the large- and mid-cap stock universe for stocks that have plenty of competitive advantages and wide moats. He then screens for those that have faster earnings growth than the broader market as well as high measures of free cash flows. The combination creates a portfolio of stocks primed for long term capital appreciation.

And speaking of the long haul, Puglia tends to stick with his winners. For example, hes held Google shares for roughly than 15 years. Add in a relatively concentrated portfolio of holdings at just 128 different stocks and you have a recipe for one of the best mutual funds to buy.

Perhaps the only hit to TRBCX could be its expense ratio of 0.69%. However, given the continued gains and market-beating record of the fund, the higher than average expense ratio is justified. In the end, TRCBX is proof that active management can work.

Read Also: When Can I Take Out My 401k

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Set Aside One Year Of Cash

Try to set aside enough cash–minus any regular income from rental properties, annuities, pensions, Social Security, investment income etc.–to cover a year’s worth of retirement expenses. Ideally, this money would be held in a relatively safe, liquid account, such as an interest-bearing bank account, money market fund or short-term certificate of deposit .

With this cash on hand, you won’t have to worry as much about the markets or a monthly paycheck. Spend from this account and replenish it periodically with funds from your invested portfolio. Then invest the rest of your portfolio sensibly.

Recommended Reading: Can You Rollover A 401k Into A 403b

Structuring Your Retirement Portfolio

According to the Social Security Administration, the average 65-year-old retiree can expect to live roughly 1820½ years after leaving the workforce.1 However, with advances in health care leading to increasing longevity, it’s widely recommended that you plan for a retirement of 30 years or longer. Therefore, how you invest your savings in retirement is crucial.

The first aspect of our three-pronged approach to generating retirement income is creating a plan. After you’ve completed the planning stage, your next step should be to determine your portfolio allocation. Lastly, you’ll make a plan for withdrawing from your portfolio in retirement.

The portfolio allocation step is all about choosing the right mix of investments. Here’s a guide for how to approach it.

The key is staying invested–and that means having at least part of your portfolio allocated to stocks, but in the right balance with other investments.

Leave Your Retirement Savings Alone

After age 59½ you can begin to make penalty-free withdrawals from your traditional retirement plans and IRAs. With a Roth IRA, you can withdraw your contributionsbut not any earnings on thempenalty-free, at any age.

There is also an IRS exception, commonly known as the Rule of 55, that waives the early-withdrawal penalty on retirement plan distributions for workers 55 and over who lose or leave their jobs. It’s complex, so speak with a financial or tax advisor if you are considering using it.

But just because you can make withdrawals doesnt mean you shouldunless you absolutely need the cash. The longer you leave your retirement accounts untouched from some of them), the better off you are likely to be.

Don’t Miss: Can I Have A 401k Without A Job

New Life Asset Allocation Model For Stocks And Bonds

The New Life asset allocation recommendation is to subtract your age by 120 to figure out how much of your portfolio should be allocated towards stocks. Studies show we are living longer due to advancements in science and better awareness about how we should eat.

Given stocks have shown to outperform bonds over the long run, we need a greater allocation towards stocks to take care of our longer lives. Our risk tolerance still decreases as we get older, just at a later stage.

Invest Based On The Time Until You’ll Need The Money

Remember that a 401 is a retirement account, so you should plan not to withdraw money until you are at least 59 1/2. If you’re fairly young now, that means you have a long investing horizon ahead of you. If you’re nearing retirement age, however, your investing horizon is much shorter you will need to start withdrawing that money soon to fund your retirement.

Keep this timeline in mind when determining your risk tolerance. If you’re investing in your 401 throughout your career, your willingness to take risks should change over time. When you’re younger, more of your 401 funds should be invested in the stock market to maximize potential returns. You have time to wait out any downturns. However, as you age, you have less flexibility around market volatility and should shift your funds toward safer investments.

Lower-risk investments such as cash, CDs, money market funds, and bonds present far less risk of loss but also lower rates of return. If you overinvest your 401 funds in safe investments like these, you risk missing out on the wealth-building returns of the stock market.

To make sure you aren’t taking on too much — or too little — risk with your 401, consider this simple formula: Subtract your age from 110 and invest the resulting percentage of your 401 money in the market. A 20-year-old would have 90% of their money in stocks while an 80-year-old would have just 30% of their assets in the market.

Also Check: How Does 401k Work When You Quit

Is Maxing Out Your Match Enough

That depends on many factors, but maybe not. The company match limit shouldnt be taken as advice on how much to invest. What should your average 401 plan contribution be? It depends on your own unique retirement goals and other sources of savings. You might want to aim for your annual contribution from all sources your own contribution plus the employer match to be between 10% and 20% of your salary to help best prepare for retirement.

Proper Asset Allocation And Risk Tolerance

Your asset allocation between stocks and bonds first depends on your risk tolerance. Are you risk averse, moderate, or risk loving? Are young and full of energy? Or are you old and tired as hell?

Im personally extremely tired due to raising two kids during a pandemic. Therefore, Im relatively conservative. Besides, after such a huge run in the stock market, Id like to keep most of the gains during the next correction.

Your asset allocation also depends on the importance of your specific market portfolio. For example, most would probably treat their 401K or IRA as a vital part of their retirement strategy. For most, these retirement accounts will become their largest investment portfolios.

However, those who have taxable investment accounts, rental properties, and alternative assets may not find their stock and bond portfolio as important.

For example, I have roughly 40% of my net worth in real estate because I prefer owning a hard asset that is less volatile, provides shelter, and produces rental income. I then have roughly 30% of my net worth in equities. Volatility is something I do not like.

Finally, the proper asset allocation of stocks and bonds depends on your overall net worth composition. The smaller your stocks and bonds portfolio as a percentage of your overall net worth, the more aggressive your portfolio can be in stocks.

Also Check: How To Switch 401k To Ira

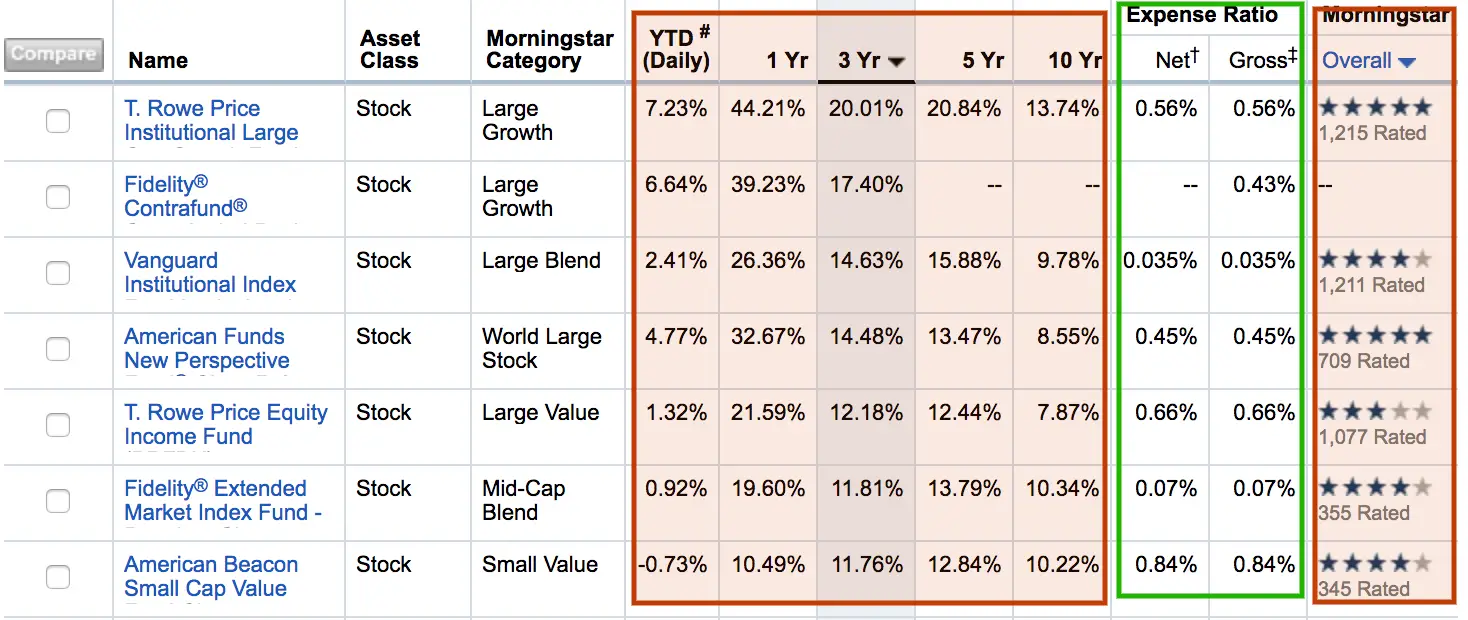

Weigh Your Investment Options

401s tend to have a small investment selection thats curated by your plan provider and your employer. Youre not selecting individual stocks and bonds , but mutual funds ideally ETFs or index funds that pool your money along with that of other investors to buy small pieces of many related securities.

Stock funds are divided into categories. Your 401 will probably offer at least one fund in each of the following categories: U.S. large cap which refers to the value of the companies within U.S. small cap, international, emerging markets and, in some plans, alternatives such as natural resources or real estate. Diversify your portfolio by spreading the portion youve allocated to equities among these funds.

You want to allocate more to the biggest asset classes, like U.S. large caps and international. U.S. small cap, natural resources and real estate are not as prevalent asset classes, so youll take smaller bits of those, Walters says.

That might mean putting 50% of your equity allocation into a U.S. large cap fund, 30% into an international fund, 10% into a U.S. small cap fund and spreading the remainder among categories such as emerging markets and natural resources.

The bond selection in 401s tends to be even more narrow, but generally youll be offered a total bond market fund. If you have access to an international bond fund, you might put a bit of your savings in there to diversify globally.

What Is A Good Asset Mix For Retirement

Saving for retirement is at the forefront of nearly every investors mind. For most, making sure that their investments can last the entirety of their retirement can feel like a daunting task. A set-it-and-forget-it strategy ends up being the default for many, even if that means running the risk of lost gains that could come through a moderately more hands-on approach.

Retirement investors stand to benefit from building a portfolio with a strong asset mix. This means going beyond retirement savings plans and pensions in order to unlock potentially greater returns. A good asset mix for retirement should include a handful of portfolio staples like stocks, bonds, and investment funds, but it should also make room for long-term alternative investments that can deliver returns that the S& P 500 cant.

If youre looking to make the most of your investing, a good asset mix for retirement is essential. Here are some top picks to consider.

Read Also: How To Check 401k Balance Fidelity

How Much Should I Invest

If you are many years from retirement and struggling with the here-and-now, you may think a 401 plan just isn’t a priority. However, the combination of an employer match and a tax benefit make it irresistible.

When starting out, the achievable goal might be a minimum contribution to your 401 plan. That minimum should be the amount that qualifies you for the full match from your employer. To get the full tax savings, you need to contribute the maximum yearly contribution.

Use Balanced Funds For A Middle

A balanced fund allocates your 401 contributions across both stocks and bonds, usually in a proportion of about 60% stocks and 40% bonds. The fund is said to be “balanced” because the more conservative bonds minimize the risk of the stocks. This means that when the stock market is quickly rising, a balanced fund usually will not rise as quickly as a fund with a higher portion of stock. When the stock market is falling, expect that a balanced fund will not fall as far as funds with a higher portion of bonds.

If you dont know when you might retire, and you want a solid approach that is not too conservative and not too aggressive, choosing a fund with balanced in its name is a good choice . This type of fund, like a target-date fund, does the work for you. You can put your entire 401 plan in a balanced fund, as it automatically maintains diversification and rebalances your money over time to maintain the original stock-bond mix.

Recommended Reading: How To Get 401k From Old Employer

What Is A Good Rate Of Return On A 401

How you define a good rate of return depends on your investment goals. Average 401 returns typically range between 5% and 10%, depending on market conditions and risk profile. If you’re playing catch-up, you may want higher returns. If you have a long way until retirement and a low tolerance for risk, you might be comfortable with a lower return.

American Funds Washington Mutual Investors

Expense Ratio:

The Bluest of the Blue Chips would be a prime way to describe American Funds Washington MutualInvestors fund. The reason for that moniker comes down to conservativism and stock picking requirements of its managers.

Founded in 1952 specifically for fiduciaries, lead manager Alan N. Berro and his team use a variety of strict eligibility screens covering everything from debt levels, quality of earnings, dividend strength and other fundamental criteria. Only about 1% of all available U.S. companies are good enough to make into AWSHXs holdings.

The end result in those strict requirements is a list of those stocks that absolutely dominate their respective fields, have been around since the beginning of time and feature strong sales/profit profiles. They churn out some hefty dividend income, too. Top holdings for the fund include Home Depot and Merck .

A despite being a gigantic fund with more than $120 billion in assets AWSHX has been pretty nimble. The focus on strong dividend-paying equities and holding them for the long-haul has resulted in some great returns. Over the last decade, the mutual fund has managed to pull in just over 12% annually. Thats not too shabby at all.

Whats also not too shabby is its expenses. As an active fund, AWSHXs expense ratio of 0.58% is actually lower than some index funds. That makes it one of the best mutual funds to own for 401k investors heading into retirement.

You May Like: How Do You Borrow From 401k

Now Is A Good Time To Check Your 401 Heres How To Get Your Stock Allocation Just Right

- Order Reprints

- Print Article

If your 401 moves too much during periods of market declines or doesnt keep up with gains, you might have an allocation problem.

With market volatility picking up in recent weeks and likely to continue through the uncertainty of the presidential transition, retirement savers may want to look away. But for investors who take a peek at their account statements and dont like what they see, it likely has to do with allocations that are out of whack.

How a retirement saver sets asset allocations is a reflection of personal risk tolerance and investing time frame, but there are a few universal truths. A portfolio with too conservative a mix wont grow fast enough to outpace inflation and taxes. A portfolio thats too aggressive is subject to significant volatility that may make it difficult to recoup losses at critical times. Either extreme puts investors at risk of not meeting their retirement goals.

So how can people saving for, and in, retirement know their mix is the right one? Here are a few tips.

Whats Too Conservative?

A moderate-risk portfolio of around 70% stocks and 30% bonds will mirror the broader trend in stocks, says Gerald Grant III, a financial advisor at Equitable Advisors. If the stock market is up on any given day, an investors portfolio should rise. If not, theres something wrong with the mix, he says.

Newsletter Sign-up

Retirement

Whats Too Aggressive?

Corrections & Amplifications

Write to us at