How Much Should I Have In My 401 By Age 60

For 55- to 64-year-olds with a 401, the average retirement savings is a little more than $408,000, according to the Federal Reserve.

One factor to consider here is how long you plan to be out of the workforce. If you plan to retire early, youâll have to factor in additional health care costs as you wonât be eligible for Medicare until age 65. Meanwhile, the minimum age to begin collecting Social Security is 62, but the longer you can wait, the higher your payment will be. Youâll also need to factor in expenses and the lifestyle you want to live in retirement.

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

Who Is Eligible For A Roth 401

If your employer offers it, youre eligible. Unlike a Roth IRA, a Roth 401 has no income limits. Thats a fantastic feature of the Roth option. No matter how much money you earn, you can contribute to a Roth 401.

If you dont have access to a Roth option at work, you can still take advantage of the Roth benefits by working with your investing pro to open a Roth IRA. Just keep in mind that income limits do apply when you contribute to a Roth IRA.

Don’t Miss: How Much Can I Convert From 401k To Roth Ira

How Much Do I Need For Retirement

There is no definite answer to this question that will work for everyone. Some people want to make enough to just pay their bills and live a quiet life. Others want to have hundreds of thousands of dollars in annual income during retirement so they can live out their golden years in style. It really comes down to how much you want in retirement, and then you can work backward to figure out how much you need to set aside.

One of the most famous financial studies of all time, the Trinity Study, set out to find a safe withdrawal rate in retirement. They wanted to see how much you could withdraw from retirement accounts and have a very high chance of never running out of money. Based on their findings, the â4% ruleâ was formed, which is a great rule of thumb to start planning out how much you need for retirement.

Under the 4% rule, you basically just need to determine how much annual income you want to have during retirement and multiply that by 25. So for example, if you want to withdraw $50,000 annually, youâd need to have $1.25 million in your accounts invested in typical investment options. That would enable you to withdraw 4% annually and have a great chance at never running out of money.

Start Living On A Budget And Tracking Your Expenses

The fact is that until you know where your money is going each month youre going to have a hard time finding money to set aside for retirement savings.

The reason its so important to discover and track where your money is going each month is so that you can identify wasteful spending and reroute it toward causes that are more important to you.

Many people find when they start tracking expenses that they are spending money in $5, $10 and $20 increments that seems like its not a lot but adds up to hundreds or thousands of dollars each month.

When my family started tracking expenses in 2013, we were able to cut them down by nearly $1,000 a month and we were making well under $100,000 per year at the time.

By trimming grocery expenses, cutting back on entertainment costs and being more mindful of each purchase, we found a lot of waste in our spending. We were able to use what we were wasting for much more important things, such as paying off our debt.

Also Check: How Can I Save For Retirement Without 401k

You May Like: How Much Do I Need In My 401k To Retire

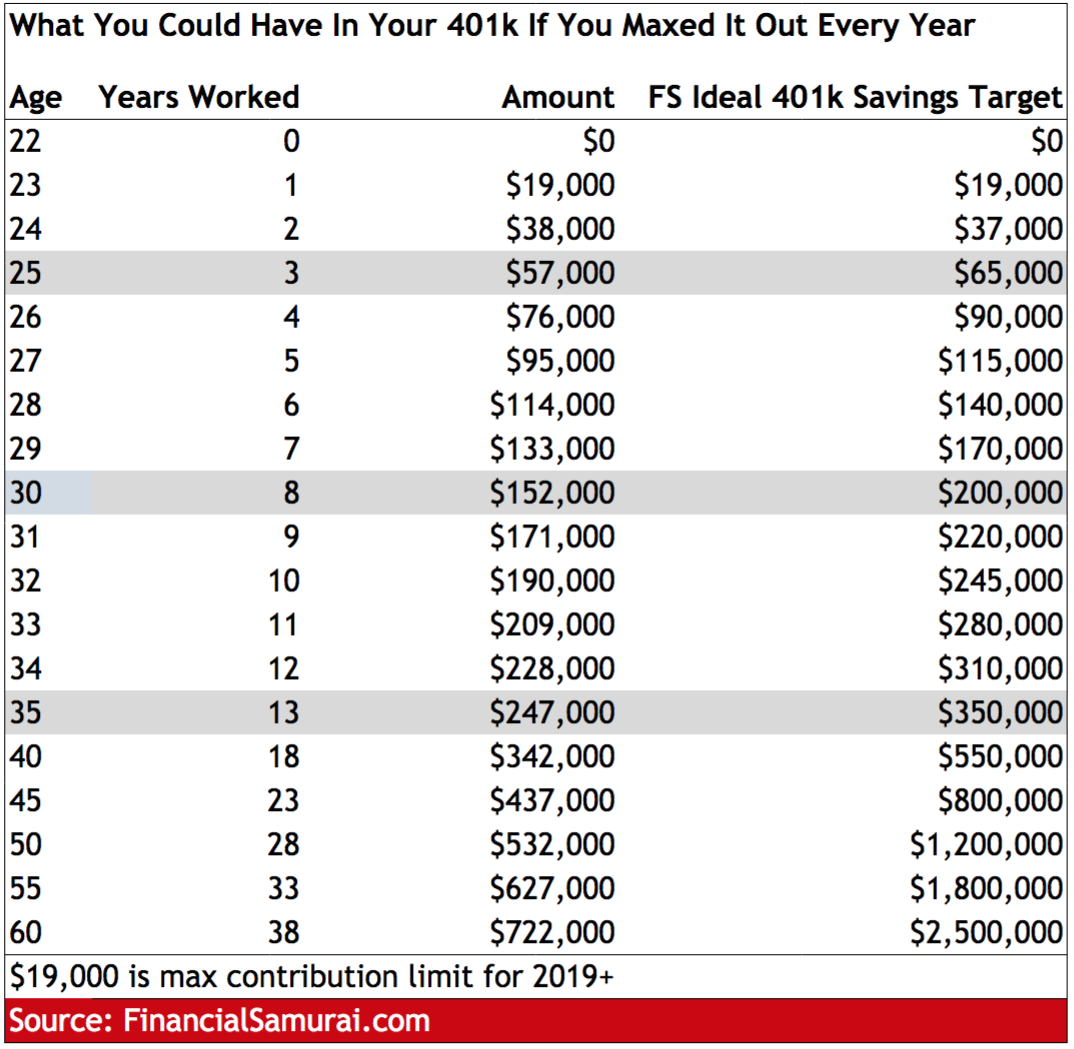

What Is The Maximum 401k Contribution Amount

Starting in 2020 , you can contribute up to $19,500 each year to your 401k if you are under 50. If you are over the age of 50, you may be able to make catch-up contributions. This provision lets you invest up to an additional $6,500 in your 401k .

PRO TIP: You need to be behind in your 401k contributions to make catchup contributions.

When compared to a Roth IRA, where you can only contribute up to $6,000/year, this is an amazing opportunity especially since your pre-tax money is being compounded over time.

Contributing To Your 401 Plan

As part of enrolling in a 401, you must decide how much you are going to contribute to the plan each year. There are some limits on the upper end, and your employer may require a minimum contribution if you want to join the plan.

But you may find that the critical question is what percentage of your earnings you are willing to commit to retirement savings. Many experts in the retirement field believe a ballpark amount is somewhere around 10 percent of your earnings. But it can be more or less, depending on your personal circumstances. If your company offers a match, you should contribute at least enough to get the full benefit of the match, otherwise you are leaving money on the table. And keep in mind that even if you are automatically enrolled at a certain level , this is often a minimum amount to save for a secure retirement. Consider increasing this amount, perhaps significantly, to give yourself a better shot at accumulating a robust retirement nest egg.

Dont Miss: How Can I Borrow Money From My Walmart 401k

Read Also: How To Rollover Old 401k To New 401k

The Two Fundamental Rules Of Retirement Savings

Here are two rules that will apply to almost everyone:

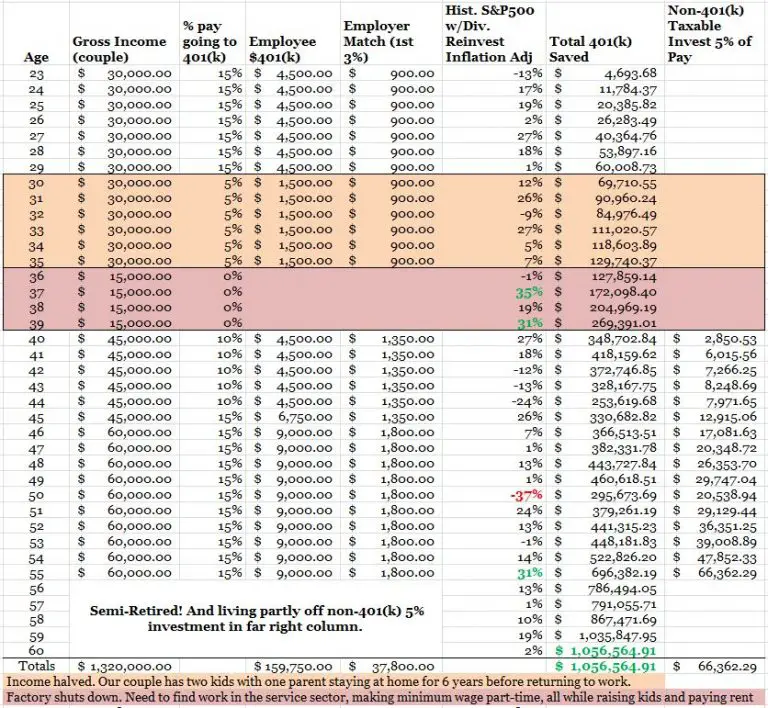

How Much Should I Have In My 401k Based On My Age

There are a few different schools of thought on how much a person should have saved in their 401k based on their age.

Every financial expert has a different opinion. When deciding what the right number is for you, I think one thing to keep in mind is that its better to have more saved than less.

Creating a potential post-retirement budget as a guideline will help you determine how much money youll spend after youre retired.

In an ideal world, you will be completely debt free by the time you retire and have minimal housing and other expenses.

Youll want to be prepare for these costs:

- Utility bills

- Travel

- Taxes

A persons income and expenses can make a difference when it comes to how much they should have saved at each interval age, but here are some general guidelines.

Use these guidelines in conjunction with your projected post-retirement budget to find out if you should have more or less saved by the time you retire than what is suggest ed here.

Do you have a 401k from an old employer that you need to rollover? Check out Capitalize which is free and will help take out the hassle of rolling over your 401k!

Don’t Miss: Is Rolling Over 401k To Ira Taxable

How Much Should You Save For Retirement

To start, invest 15% of your gross income into retirement savings accounts like a Roth 401 and Roth IRA. Spread your money evenly across four types of mutual fundsgrowth and income, growth, aggressive growth, and internationalinside of those retirement accounts.

And listen, we know youre eager to start saving money for your retirement future . . . but if youre still getting out of debt or need to get a solid emergency fund in place, now is not the time to save for retirement. Your income is your number one wealth-building tool, and you cant take full advantage of it if its tied up in credit card or student loan payments.

So lets say youre out of debt with a fully funded emergency fund and you have an annual salary of $75,000. That means your goal is to save $11,250 each year for retirement. Where do you start? Lets walk through it step-by-step.

What Is A Vested 401

WS20210609185214& bullet Last Updated 6/29/2021

This may contain information obtained from third-parties, including ratings from credit ratings agencies such as Standard & Poors. Reproduction and distribution of third-party content in any form is prohibited except with the prior written permission of the related third-party. Third-party content providers do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and are not responsible for any errors or omissions , regardless of the cause, or for the results obtained from the use of such content. THIRD-PARTY CONTENT PROVIDERS GIVE NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. THIRD-PARTY CONTENT PROVIDERS SHALL NOT BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, EXEMPLARY, COMPENSATORY, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES, COSTS, EXPENSES, LEGAL FEES OR LOSSES IN CONNECTION WITH ANY USE OF THEIR CONTENT, INCLUDING RATINGS. Credit ratings are statements of opinions and are not statements of fact or recommendations to purchase, hold or sell securities. They do not address the suitability of securities or the suitability of securities for investment purposes, and should not be relied on as investment advice. Ratings are subject to change from time to time. The ratings shown here are correct as of February 2021.

Also Check: When Can You Pull Money From 401k

Saving In A Roth Ira Without Much Money

Maxing out your annual contributions is difficult if you’re on a tight budget. So Elise suggests creating an automatic contribution of as little as $50 per month. While small, its a start and a good habit to build.

Setting up your Roth IRA and becoming familiar with how to invest is sometimes the biggest challenge, Elise said.

Look at your monthly budget, and make room for a Roth IRA contribution as a fixed cost like rent or a car insurance payment. Again, even if its only a small amount, prioritizing that contribution will pay off as compounding comes into play.

To get a general idea of how your savings can compound in a Roth IRA, check out this compound interest calculator.

The amount should be whatever can fit in the budget and can be increased over time, Mike Hunsberger, a chartered financial consultant and owner of Next Mission Financial Planning, LLC, told The Balance over email.

So your initial contributions of $50 per month can increase as your salary growsuntil your income hits the Roth contribution ceiling.

Average 401k Balance At Age 45

When you hit your 50s, you become eligible to make larger contributions towards retirement accounts. These are called catch-up contributions. Make sure that you take advantage of them! Catch-up contributions are $6,500 in 2022. So if you contribute the annual limit of $20,500 plus your catch-up contribution of $6,500, thats a total of $27,000 tax-advantaged dollars you could be saving towards your retirement.

Read Also: Can Anyone Open A 401k

An Ira Might Be A Better Option

If you are already contributing up to your employer match, another way to invest additional cash is through a traditional or Roth individual retirement account. The IRA contribution limit is much lower $6,000 in 2022 so if you max that out but want to continue saving, go back to your 401.

Some 401 plans, typically at large companies, have access to investments with very low expense ratios. That means youll pay less through your 401 than you might through an IRA for the very same investment. In other cases, the opposite is true small companies generally cant negotiate for low-fee funds the way large companies may be able to. And because 401 plans offer a small selection of investments, youre limited to what’s available.

Lets be clear: While fees are a bummer, matching dollars from your employer outweigh any fee you might be charged. But once youve contributed enough to earn the full match or if youre in a plan with no match at all the decision of whether to continue contributions to your 401 is all about those fees. If the fees are high, direct additional dollars over the match to a traditional or Roth IRA.

How Much Do You Need To Retire Comfortably

How much you need to retire comfortably isnt black-and-white because the cost of living looks different for each individual. Consider what it takes to live comfortably and maintain your lifestyle. Many experts suggest that youll need roughly 80 percent of your salary after retirement to avoid making sacrifices.

Also Check: Can Rollover 401k To Roth Ira

How Much Should You Save

Academic retirement saving studies use the term replacement rate. This is the percentage of your salary that youll receive as income during retirement. If you made $100,000 a year when you were employed and receive $38,000 a year in retirement payments, your replacement rate is 38%. The variables included in a replacement rate include savings, taxes, and spending needs.

Read Also: How To See How Much Is In My 401k

Contributions In Excess Of 2021 Limits

Evaluating your estimated contributions for the year ahead and analyzing your contributions at the end of a calendar year can be very important. If you find that you have contributions in excess of the 2021 limits, the IRS requires notification by March 1 and excess deferrals should be returned to you by April 15.

Also Check: Can I Rollover 401k To Td Ameritrade

Contribute Up To The Employer Match

You have enough saved up to cover your expenses. You emergency fund is there in case you need it. Now youre starting to think about 401 contributions. Where do you you start?

The first thing you should figure out is if you have an employer matching program with your 401. With an employer match, your employer will match your 401 contributions up to a certain percentage of your gross salary. Say your employer offers 100% match on the first 5% you contribute. That means if you contribute 5% of your gross salary to your 401, your employer will contribute an amount equal to 5% of your gross salary. The total contribution to your 401 would then equal 10% of your gross salary.

An employer match allows you to increase your contribution, and you should always take advantage of matching programs. Unfortunately, many people pass up free money by not contributing up to their employer match.

Get Help With Your 401

Already have a 401? While youre researching contributions, take a minute to analyze your current holdings toothere could be big savings to be found.

Personal Capital is a free app that creates easy-to-understand visuals of the investments you own in your 401, IRA, and other investment accounts. It then provides recommendations for how to rebalance your portfolio for maximum results and reduced expensesit can even show you how changing funds within your existing 401 might save you thousands. Try Personal Capital now or read our review.

Blooom is a new tool that can automatically manage and optimize your 401 for just $10 a month. Designed especially for 401 accounts, blooom works with your available investments to find the lowest-cost and best allocation for your goals. You can get a free 401 analysis from Blooom or learn more in our review. Plus they have a special promotion where you can get $15 off your first year of Blooom with code BLMSMART

Wealthfront is a great all-in-one financial app that allows account holders to take control over their finances, automate saving and investing, and manage their accounts all in one place. Wealthfronts Self-Driving Money tool continuously monitors your cash flows to ensure that bills are paid and savings are instantly routed into the right investment accounts. Wealthfront account holders can also take advantage of the apps automated investment services, like daily rebalancing and tax-loss harvesting.

Read Also: How Much Money Can You Put In 401k Per Year

Choosing Health Insurance Bills Or Your 401

If you cant afford to pay your monthly bills, you cant afford to make 401 contributions. If there are unexpected expenses or loss of income, you may even need to withdraw retirement money early. If possible, focus on putting in the minimum to get your employers match, then use the additional money to pay off any high-interest debt, like credit cards.

One option, if youre struggling to afford your 401 contributions, is to choose a cheaper health insurance plan. People who overpay for health insurance are 23% more likely to forgo their employers retirement match, a TIAA Institute study found.

A health savings account can help you reduce health costs and save for retirement at the same time. You can only fund one if you have a high-deductible health plan, which often leads to higher out-of-pocket costs. You fund an HSA with pre-tax money. When you spend it on Internal Revenue Service -approved qualified medical expenses, your distributions for those are also tax-free and penalty-free.

An HSA is a good supplement to your 401 contributions because if you have unused money in the account when you turn 65, you can withdraw it without penalty for any purpose, though youll owe income taxes for distributions made for non-qualified medical expenses.