Who Does A Solo 401 Make Sense For

A Solo 401 is well suited for those with self-employment income, stable cash flow, no employees , and no plans to hire any in the foreseeable future. While having self-employment income and no employees are requirements, ensuring that there is sufficient cash flow to make contributions is also important.

The plan can also be a fit for those who are self-employed, but only on a part-time basis, and still earn W-2 income from a corporate employer. As a result, contributions can be made to both a Solo 401 and company 401 plan as long as each employer is substantially unrelated. There are also contribution limits that apply.

Can I Have A Solo 401k And A Regular 401k

Another frequently asked question that comes up a lot is whether its possible to have a Solo 401k and also have a group 401k plan with your employer. It is possible to have both. Let me tell you how. As long as your employer is offering a 401k plan, you can participate by making employee salary deferrals. This is generally limited to $19,500 or $26,000 if you are age 50 or older.

Now, lets imagine a scenario where you also have a side business or side hustle. You are earning 1099 income driving for Uber on the weekends. You set up a Solo 401k to make additional contributions from your 1099 income to save more for retirement. Keep in mind, the salary deferrals you made at your W2 job follow you. They are aggregated across all 401k plans where you are a participant. So if you maxed out your salary deferral at your job, you cannot put anymore salary deferrals into the Solo 401k.

You can, however, contribute as the employer in the form of a profit sharing contribution which is 20% of your net income from those 1099s. You can also make after-tax contributions, which can be converted into Roth

Contribution Limits For Self

You must make a special computation to figure the maximum amount of elective deferrals and nonelective contributions you can make for yourself. When figuring the contribution, compensation is your earned income, which is defined as net earnings from self-employment after deducting both:

- one-half of your self-employment tax, and

- contributions for yourself.

Use the rate table or worksheets in Chapter 5 of IRS Publication 560, Retirement Plans for Small Business, for figuring your allowable contribution rate and tax deduction for your 401 plan contributions. See also Calculating Your Own Retirement Plan Contribution.

Recommended Reading: Can I Roll Over My 401k To An Ira

Establishing A Solo 401 Under The New Rules

My client is a sole proprietor and would like to set up a solo 401 plan for 2021. Are there any special considerations of which he needs to be aware?

ERISA consultants at the Retirement Learning Center Resource Desk regularly receive calls from financial advisors on a broad array of technical topics related to IRAs, qualified retirement plans and other types of retirement savings and income plans, including nonqualified plans, stock options, and Social Security and Medicare. We bring Case of the Week to you to highlight the most relevant topics affecting your business. A recent call with a financial advisor from Connecticut is representative of a common inquiry related to establishing a Solo 401 plan.

Highlights of the Discussion Yes, there are special considerations with respect to establishing and contributing to a solo 401 plan. For that reason, your client should work with his CPA, tax advisor and/or legal counsel to address all the issues.

Three of the key consideration would include the following items, the

Deadline for establishing the solo 401 plan, Deadline for making a salary deferral election, and Owners compensation for contribution purposes.

In order to be able to make employee salary deferrals to the solo 401 for 2021, a sole proprietor would have to establish the solo 401 and execute a salary deferral election by December 31, 2021. Heres why.

How To Set Up A Solo 401

There are specific steps that must be taken to properly open a solo 401 plan, according to the Internal Revenue Service .

First, you have to adopt a plan in writing, making a written declaration of the type of plan you intend to fund. The choices are the same as are given to an employee opening a 401 plan: you can choose a traditional 401 or a Roth 401. Each has distinct tax benefits.

A solo 401 must be set up by Dec. 31 in the tax year for which you are making contributions.

You can open a solo 401 at most online brokers and traditional brokers or directly through a financial services company. You’ll want to do some research ahead of time to identify the best solo 401 company for you.

You’ll need an employer identification number to get started with the enrollment process. If you don’t have one already, you can apply online directly to the IRS.The rest of the documentation will be provided by the broker or financial services company you choose for the account.

Also Check: How To Rollover 401k To New Employer

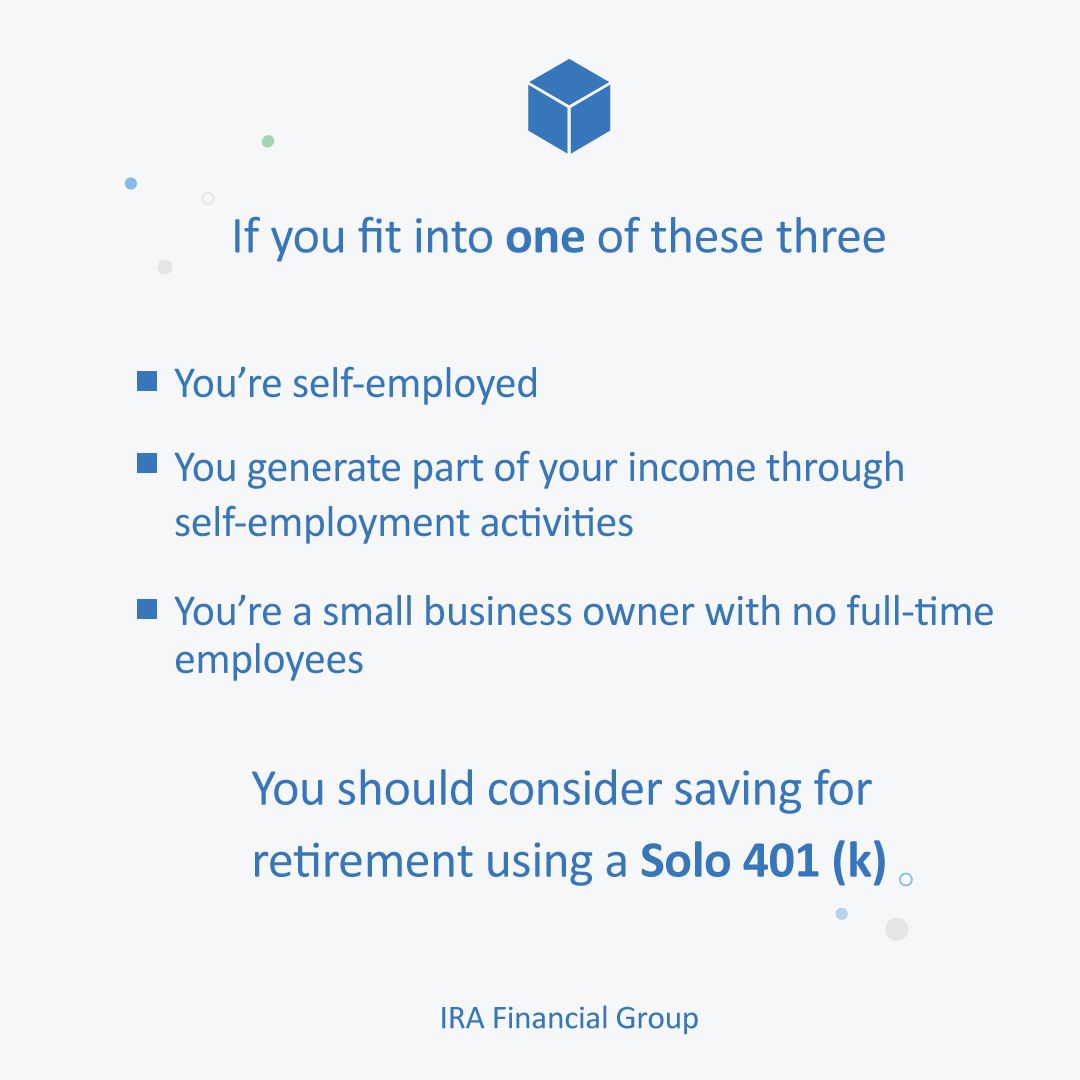

Who Can Have A Solo 401 Plan

According to Allec, there are three categories of people who can have solo 401 plans:

Why Does A Sole Proprietor Need To Get An Ein

In most cases, a sole proprietor does not need to get an EIN. Usually, it is totally acceptable for a sole proprietor to use his or her social security number in the place of any other tax identification number.

However, there are some times when a separate number is necessary. In fact, in some instances, having a separate EIN for ones business may even be preferable. Read on to get a rundown of when having a separate EIN is required and makes sense for your sole proprietorship.

When It Is Required

A sole proprietor must get a separate EIN for a business if any one of these things are true:

- That individual wants to hire employees, wants to open a Keogh or solo 401, or chooses to file for bankruptcy protection.

- When that individual plans to purchase an existing business and operate it as a sole proprietorship

- When a partnership or limited liability corporation is formed, or incorporated.

Finally, while not required by the federal government, some banks will not allow you to open a bank account in your business name if you do not have a separate EIN.

When It May Be Preferable

No matter where your sole proprietorship falls on this scale, you can find everything you need to get your status set at www.irs-ein-tax-id.com.

Member of NSTP

Also Check: Can I Manage My Own 401k

Recommended Reading: Can I Invest My 401k

Sole Proprietorship Solo 401k Contributions

A sole proprietorship is the most common business structure. Thats probably because its the easiest structure to use! A sole proprietorship means a single owner. As a sole proprietor, you might do business under your own name, or you could have a DBA fictitious business name. You might have an employer identification number for your business, or you might use your social security number.

Once your business is generating revenue, you can start contributing to a retirement plan. The easiest way to do this is to setup a Self-directed Solo 401k plan.

How To Setup A Solo 401 Plan

For small business owners who meet certain requirements, most financial institutions that offer retirement plan products have developed truncated versions of the regular 401 plan for use by business owners who want to adopt the solo 401.

As a result, less-complex documentation is needed to establish the plan. Fees may also be relatively low. Make sure to receive the proper documentation from your financial services provider.

As noted above, the solo 401 plan may be adopted only by businesses in which the only employees eligible to participate in the plan are the business owners and eligible spouses. For eligibility purposes, a spouse is considered an owner of the business, so if a spouse is employed by the business, you are still eligible to adopt the solo 401.

If your business has non-owner employees who are eligible to participate in the plan, your business may not adopt the solo 401 plan. Therefore, if you have non-owner employees, they must not meet the eligibility requirements you select for the plan, which must remain within the following limitations.

You may exclude nonresident aliens from a solo 401 who receive no U.S. income and those who receive benefits under a collective-bargaining agreement.

Don’t Miss: How To Find Out If I Have Old 401k

Withdrawing Funds From A Self

As with traditional 401 plans, the self-employed 401 is intended to help you save money for retirement, and there are regulations in place to encourage you to do so. For example:

- Withdrawals prior to age 59½ may be subject to a 10% early withdrawal penalty, along with any applicable income taxes1

- You must take required minimum distributions from self-employed 401s beginning at age 722

- Plans can be structured to allow loans or hardship distributions3

- Plans can be structured to accept rollovers from other retirement accounts, including SEP IRAs and traditional 401s, into your self-employed 401

- You can roll your self-employed 401 assets into another 401 or an IRA

Because of its high contribution levels, flexible investment options, and relatively easy administration, the self-employed 401 is an attractive option for small-business owners or sole proprietors who want to be able to save aggressively for the future.

If there is the potential that your business might add employees at a later date, however, know that you will either have to convert your self-employed 401 plan to a traditional 401, or else terminate it. But if you’re confident that you will remain a one-person operation, and you want the high savings options that these plans offer, this type of account may be a good fit.

Roth 401k And Voluntary After

- Voluntary after-tax solo 401k contributions fall under the employee contribution umbrella.

- This type of contribution is not considered employer contributions, so the contribution is not tax deductible because it is considered made with post-tax dollars.

- When voluntary after-tax solo 401k contributions are converted to a Roth IRA or the Roth Solo 401k, the conversion has to be documented in writing by completing a conversion Form , and a Form 1099-R has to be issued to report the conversion whether taxable or not. This reporting is covered by our annual service and fee.

- Voluntary after-tax solo 401k contributions can be distributed and thus converted at any time. This is why the conversion of voluntary after-tax solo 401k contributions has been dubbed the mega-backdoor Roth solo 401k.

- There is a lesser known rule called the overall 415 limits. The overall 415 limit for 401 plans including solo 401k plans. For 2020, the overall limit is $57,000. The overall limit increased to $58,000 for 2021. The overall limit looks at the total annual additions to all of a participants accounts in plans maintained by one employer and includes not just their salary deferrals, but also matching contributions, allocations of forfeitures and other amounts. Voluntary after-tax solo 401k contributions are subject to the overall annual limit $57,000 for 2020, and $58,000 for 2021.

I have provided the following links for more information and examples: https: 401k-contributions/

You May Like: How To Invest In A 401k For Dummies

Rules Change Regarding Offering Solo 401k Plan To Par

QUESTION 5: Have the rules changed for 2020 regarding whether I can still fund my solo 401k if I have two part-time employees that work less than 1000 hrs/year, but more than 500 hrs/year? Would I have to open up retirement accounts for them?

ANSWER: In short yes resulting from the SECURE Act, but it would be for those part-time employees who satisfy the new rule by 2024. Effective for tax year 2021 , solo 401k plans will need to be offered to part-time employees who have three consecutive 12-month periods of 500 hours of service and who satisfy the plans minimum age requirement. Hours of service during 12-month periods beginning before January 1, 2021, are not taken into account for this rule. See Section 112 of the ACT for more information.

Last Weeks Most Popular Solo 401k FAQs

No Employees In Other Businesses

If you have a business that fits the qualification guidelines for Solo 401, you may not be eligible, however, if you or certain family members have ownership in other businesses that do have employees. The IRS defines a Controlled or Affiliated Service Group. If the same 5 or fewer owners have either 80% ownership or more than 50% effective control of one or more businesses, then those businesses are looked at as being one for purposes of plan qualification. If any business within such a group has employees, then all businesses within the group are treated as if they have employees.

You May Like: What To Look For In A 401k

Is The Roth Solo 401 Plan Right For You

We cant speak for all small business owners/self-employed individuals, but the Roth Solo 401 might be the best plan out there.

High Contribution Limits? Check.

Alternate asset investing? Check.

Diversity? Check.

The Roth Solo 401 retirement plan certainly seems to check all the appropriate boxes. When combined, you certainly grow your retirement faster.

Did You Know?

You can use Roth Solo 401k or Roth 401k retirement plans for a tax-free source of income upon retirement, because the investment is funded with post-tax funds. Investors can use funds to invest in Bitcoin, other cryptocurrencies, and much more, including real estate and foreign investments.

What Fees Are Associated With A Solo 401

Annual or maintenance fees for these plans, according to Allec, usually run between $20 and $200. Youâll pay the least if your needs are simple you donât have any employees besides yourself, thereâs no rollover and youâre OK with investing in a budget brokerage firmâs products. If you have more interesting investment appetites, another provider can accommodate those. These providers usually charge higher fees to maintain your plan, but you also have more flexibility with your investment and plan options.

Donât Miss: Is Roth Better Than 401k

Don’t Miss: How Much Can Be Put Into A 401k Per Year

Solo 401 Eligibility And Contribution Limits

The solo 401 annual contribution maximum in 2021 is $58,000 and $61,000 in 2022. Unlike SEP IRAs, people age 50 and older can make additional catch-up contributions of $6,500 a year to a solo 401, bringing the potential total to $64,500 in 2021 .

Heres the tricky part: Since the solo 401 owner acts as both employer and employee, both types of contributions can be madeand that means most workers can contribute more and receive a higher tax break. Thats because as employee they can contribute up to $19,500 in 2021 , but as employer they can add onto that up to 25% of their adjusted income for a maximum total contribution of $58,000 in 2021 .

In the $100,000 example above, our hypothetical under-50 worker with $100,000 in annual net profit could make a total contribution of up to $38,087. Of that total contribution, in 2021, $19,500 would be the salary deferral as an employee while $18,587 would be a profit sharing contribution as an employer. If the same worker were 50 or older, they could add $6,500 on to that total. Thats more than double what the same worker could contribute to a SEP IRA.

Eligibility requirements are fairly straightforward: Anyone who generates net profits from a sole proprietorship, LLC or other business organization can open a solo 401 as long as they have no employees aside from their spouse.

Can You Have Multiple 401ks

Heres the deal. Many physicians work for multiple employers or work as an employee and either an independent contractor or a consultant. Many others have a side job of another type. Their incomes are far higher than they require for their current spending needs, but theyre behind on their savings or otherwise have a desire to maximize the amount of money they can put into retirement accounts, especially tax-deferred retirement accounts.

Obviously, these types of accounts minimize tax, maximize returns, increase asset protection, and facilitate estate planning. Who wouldnt want to get more money into them? However, most of these doctors are surprised to learn that they can have more than one 401. Thats right,

Also Check: When Leaving A Company What To Do With 401k

Also Check: How To Access My Walmart 401k

Whats So Great About Being A Plan Administrator

The key feature of the solo 401 that makes it better than the other plans available to self-employed people is: you can contribute up to 100% of the first $17,000 your business makes.

This comes in handy in a couple of common situations and one uncommon one:

1. Your spouse works full time and contributes to a retirement plan at work. You work part-time for yourself and would like to save as much of your income as possible.

With other retirement accounts like a SEP-IRA or Roth IRA, youll quickly hit the maximum contribution and miss out on the bigger tax break youd get from a 401.

2. You generally live off your self-employment income, but you receive an inheritance or other windfall. Now, all of a sudden, you have more money youd like to saveand shelter from taxes.

An individual 401 can help: you can save $17,000 plus 20%-25% of your businesss profit , up to a maximum of $50,000 .

3. Youre just super-frugal. A Spartan sole proprietor who makes $40,000 can save $8,000 in a SEP-IRA, $5000 in a Roth IRA, but over $21,000 in a solo 401.

Yes, these numbers are simplified the actual IRS formulas are more complicated. Does this surprise anyone? And yes, I know people this frugal.

Last year I found myself in the first category, so I opened an individual 401. Incidentally, despite the name, an individual 401 can have two participants: you and your spouse, as long as your spouse works for your business and is paid a reasonable salary.