What Does Rolling Over A 401 Mean

Rolling over your 401 fundamentally means moving the funds from one place to another, and it customarily happens between different places of employment.

When you leave a job for any reason, you generally have three opportunities. You can either leave your 401 with your current employer, roll over the funds to an IRA, or roll over the funds to a new employers 401 plan.

In any case, you should either be able to execute a direct or an indirect rollover. A direct rollover implies that the assets move directly from your previous 401 plan to the one at your new job. The indirect rollover transpires when you receive the funds as a distribution from your previous employer, but you have to put it into the new account within 60 days or face taxes and penalties.

Leaving your 401 with an old employer is very uncommon and has many drawbacks. If you possess less than $5,000 in savings they could force you out by presenting you a check, in which case you will have to do an indirect rollover to your next employers plan.

You also wont be able to generate contributions and take out loans, and your former employer may even add administration fees. Because of this most plan participants roll over their 401 to their new employer.

Rolling over to a different 401 plan can be done directly or indirectly and is usually the best choice.

Caveats To The 4% Rule

Several variables can make this rule of thumb either too conservative or too risky, and you might not be able to live on 4%-ish a year unless your account has a significantly large balance.

The first caveat you should consider when thinking about applying the 4% rule to your personal situation is that it calls for putting 50% each in stocks and bonds. You may not be comfortable putting that much of your retirement assets in equities, and you may want to keep at least a portion of your nest egg in cash or a money market fund.

You also might not expect to live for 30 years after retirement, either because you retired later than most people do or for some health-related reason. And you may not feel you need the almost 100% confidence level Bengen was seeking in his rule a confidence level of 75% to 90% that you won’t run out of money might be acceptable to you and may afford a more flexible withdrawal rate.

Should You Cash Out Your 401

The short response is no.

Cashing out your 401 is something that you shouldnt execute if you can help it, as its frequently a substandard financial resolution in the long run.

When you take out an early withdrawal, you have to compensate for the penalty fee on top of regular income tax and state tax. This means that you lose a lot of funds every time you seize assets from your account.

The average 401 plan account balance for consistent plan participants increased at a compound annual average growth rate of 13.9% from 2010 to 2018, rising from $63,756 to $180,251.

When you leave your funds alone you can let them increase over decades because of interests, but every time you cash out your 401, you waste funds in the future, no matter how minuscule the amount seems.

Retirement savings need to be taken very vigorously and you shouldnt plunder your future self.

The positive fact about keeping funds in your 401 is that its safety is legally guaranteed even if you file for bankruptcy and creditors cant get to it.

Of course, in some cases this will be your last resort, but in any other circumstance, do your best to circumvent it.

Don’t Miss: How Can You Check Your 401k

Is It A Good Idea To Borrow From Your 401

Using a 401 loan for elective expenses like entertainment or gifts isn’t a healthy habit. In most cases, it would be better to leave your retirement savings fully invested and find another source of cash.

On the flip side of what’s been discussed so far, borrowing from your 401 might be beneficial long-termand could even help your overall finances. For example, using a 401 loan to pay off high-interest debt, like credit cards, could reduce the amount you pay in interest to lenders. What’s more, 401 loans don’t require a credit check, and they don’t show up as debt on your credit report.

Another potentially positive way to use a 401 loan is to fund major home improvement projects that raise the value of your property enough to offset the fact that you are paying the loan back with after-tax money, as well as any foregone retirement savings.

If you decide a 401 loan is right for you, here are some helpful tips:

- Pay it off on time and in full

- Avoid borrowing more than you need or too many times

- Continue saving for retirement

It might be tempting to reduce or pause your contributions while you’re paying off your loan, but keeping up with your regular contributions is essential to keeping your retirement strategy on track.

Long-term impact of taking $15,000 from a $38,000 account balance

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Also Check: What Is 401a Vs 401k

What Happens To My 401 Savings If I Leave One Job For Another

Typically, you have several options. You may be able to leave your savings where they are . You may be able to bring your 401 savings from your old job to your new one . You could move your workplace savings into a rollover IRA, a personal IRA created to house workplace retirement plan savings. One last option is to cash out your plan but this isn’t usually recommended. You’ll pay taxes and perhaps a penalty if you’re less than age 591/2. Plus, your money will no longer be working for you.

Can I Roll Funds From A Traditional 401 Into A Roth Ira

Yes, you can. However, you’ll owe taxes on the 401 savings for the year in which you roll them into the Roth. That’s because you got the upfront tax deduction on your contributions with the proviso that you’d pay taxes on withdrawals. However, you’ll pay no taxes on your future withdrawals from the Roth IRA. It’s a good idea to inform yourself completely of the rules concerning such a rollover so you can be sure to protect your savings.

Also Check: What Is A Roth 401k Vs 401k

Series Of Substantially Equal Payments

If none of the above exceptions fit your individual circumstances, you can begin taking distributions from your IRA or 401k without penalty at any age before 59 ½ by taking a 72t early distribution. This allows you to take a series of specified payments every year. The amount of these payments is based on a calculation involving your current age and the size of your retirement account.

The catch is that once you start, you have to continue taking the periodic payments for five years, or until you reach age 59 ½, whichever is longer. Also, you will not be allowed to take more or less than the calculated distribution, even if you no longer need the money. So be careful with this one!

When Do I Have To Start Making Withdrawals From My Ira

You cant keep your funds in a retirement account indefinitely. Generally, youre required to start taking withdrawals from your traditional IRA when you reach age 70 ½ . Roth IRAs, however, dont require withdrawals until the owner of the account dies.

The amount that youre required to withdraw is called a required minimum distribution . You can withdraw more than the RMD amount, but withdrawals from a Traditional IRA are included in your taxable income. If you fail to make withdrawals that meet the RMD standards, you may be subject to a 50% excise tax. Roth IRAs do not require RMDs. Your money grows tax-free, since contributions are made from after-tax dollars, and your withdrawals in retirement aren’t taxed.

Also Check: How Much Will I Have When I Retire 401k

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Borrow Instead Of Withdrawing From A 401

Some 401 plans allow employees to take a loan from their 401 balance before attaining retirement age. The specific terms of the loan depend on the employer and the plan administrator, and an employee may be required to meet certain criteria to qualify for a 401 loan.

The amount borrowed is not subject to ordinary income tax or early-withdrawal penalty as long as it follows the IRS guidelines. The IRS provides that 401 account holders can borrow up to 50% of their vested account balance or a maximum limit of $50,000. This limit applies to the total outstanding loan balances of all loans taken from the 401 account. The loan must be paid within five years, and the borrower must make regular and equal loan payments for the term of the loan.

Read Also: How To Increase 401k Contribution Fidelity

How To Withdraw Money From Your 401

The 401 has become a staple of retirement planning in the U.S. Millions of Americans contribute to their 401 plans with the goal of having enough money to retire comfortably when the time comes. Whether youve reached retirement age or need to tap your 401 early to pay for an unexpected expense, there are various ways to withdraw money from your employer-sponsored retirement account. A financial advisor can steer you through these decisions and help you manage your retirement savings.

Exceptions To 401 Early Withdrawal Penalty:

- You stopped working for the employer sponsoring the plan after reaching age 55

- Your former spouse is taking a portion of your 401 under a court order following a divorce

- Your beneficiary is taking a withdrawal after your death

- You are disabled

- You are removing an excess contribution from the 401

- You are taking a series of equal payments that meet certain rules under the tax laws

- You are withdrawing money to pay unreimbursed medical expenses that exceed 10% of your adjusted gross income

Ubiquity is amazing! Always ready to answer questions and never makes me feel ridiculous for asking them. Additionally, she’s wonderful at returning calls and really making her clients feel valued and listened to! I feel 100% secure in all things related to retirement because I know Meli has our back :).

Don’t Miss: What Ira Should I Rollover My 401k To

High Unreimbursed Medical Expenses

This particular exception is similar to the hardship distributions mentioned earlier, and these medical bills might qualify you under either category. You should know that a hardship withdrawal for medical bills will not entitle you to a waiver of the 10% penalty in all cases. To qualify for a penalty-free withdrawal, the amount of the bills must be greater than 7.5% of your adjusted gross income . You must also take the distribution in the same year in which the bills were incurred. You cannot take money for estimated future bills either. The bills must be currently due for services already provided.

Also note the requirement that the bills be unreimbursed. If your insurance covers part of the bills or will reimburse you for the payments, then you cannot use money from your 401 to pay them. Likewise, the bills must be for you, your spouse, or a qualified dependent. You cannot use the money to pay bills for a parent, sibling, or any other family member. The limit to the amount of money you can withdraw for medical bills was recently removed, so you are allowed to withdraw as much as is needed to cover all the expenses.

Review Options Carefully And Get Help

Facing a temporary money crunch is not uncommon. But if it happens to you, think carefully about your options before turning to your 401. And if you do decide that you must tap into this account, learn everything you can about how it will affect your retirement planning and tax situation. Talk with your financial advisor and a tax professional about it so you can be better prepared to make the right choices.

Also Check: Is It Good To Convert 401k To Roth Ira

What Type Of Situation Qualifies As A Hardship

The following limited number of situations rise to the level of hardship, as defined by Congress:

- Unreimbursed medical expenses for you, your spouse or dependents

- Payments necessary to prevent eviction from your home or foreclosure on a mortgage of principal residence.

- Funeral or burial expenses for a parent, spouse, child or other dependent

- Purchase of a principal residence or to pay for certain expenses for the repair of damage to a principal residence

- Payment of college tuition and related educational costs for the next 12 months for you, your spouse, dependents or non-dependent children

Your plan may or may not limit withdrawals to the employee contributions only. Some plans exclude income earned and or employer matching contributions from being part of a hardship withdrawal.

In addition, IRS rules state that you can only withdraw what you need to cover your hardship situation, though the total amount requested may include any amounts necessary to pay federal, state or local income taxes or penalties reasonably anticipated to result from the distribution.

A 401 plan even if it allows for hardship withdrawals can require that the employee exhaust all other financial resources, including the availability of 401 loans, before permitting a hardship withdrawal, says Paul Porretta, a compensation and benefits attorney at Troutman Pepper in New York.

Home Equity Line Of Credit

Instead of fixed-term repayment, you get a variable repayment and interest rate. You may opt for an interest-only repayment, but most often that comes loaded with a balloon payment, Poorman says, and may be tough to afford. Keep in mind that with a variable interest rate loan, you could see your rates go up over time.

Read Also: What 401k Funds Should I Invest In

How Are 401 Withdrawals Taxed

If a rollover-eligible withdrawal is made to you in cash, the taxable amount will be reduced by 20% Federal income tax withholding. Non-rollover eligible withdrawals are subject to 10% withholding unless you elect a lower amount. State tax withholding may also apply depending upon your state of residence.

However, your ultimate tax liability on a 401 withdrawal will be based on your Federal income and state tax rates. That means you will receive a tax refund if your actual tax rate is lower than the withholding rate or owe more taxes if its higher.

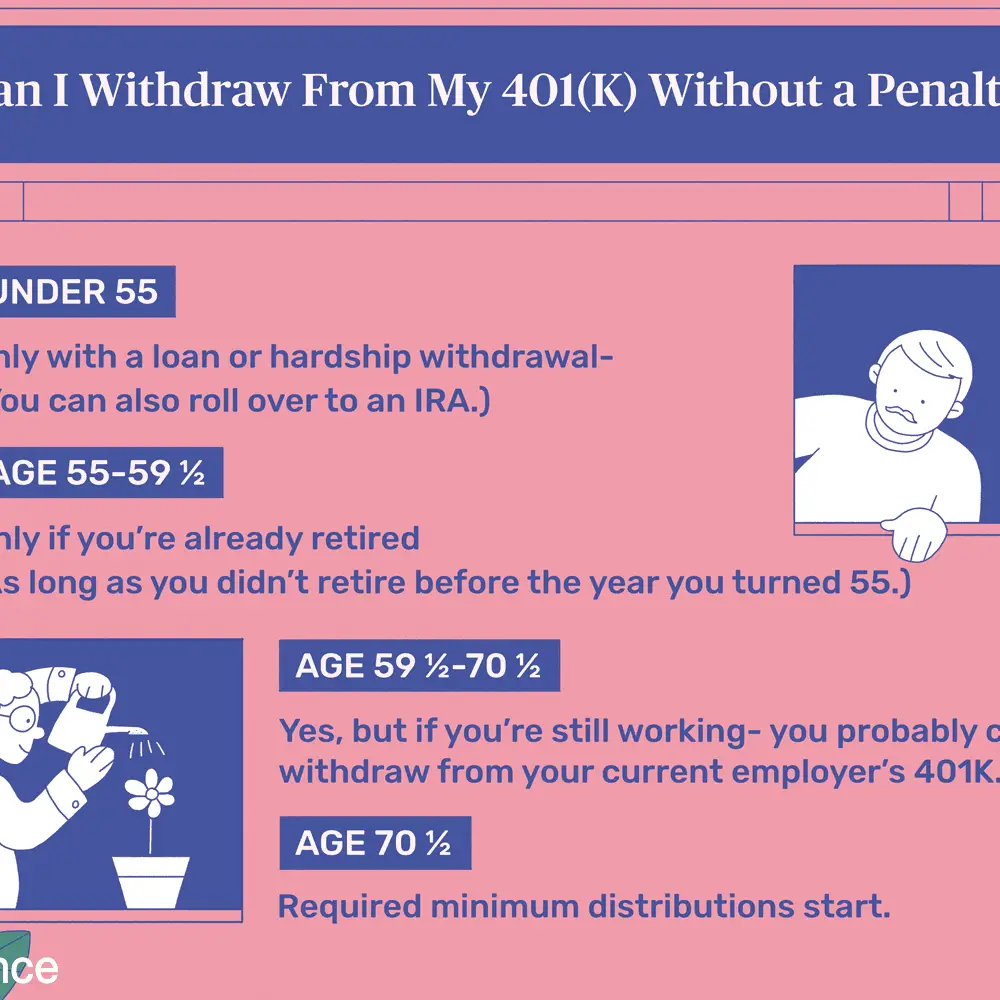

If a 401 withdrawal is made to you before you reach age 59½, the taxable amount will be subject to a 10% premature withdrawal penalty unless an exception applies. This penalty is meant to discourage you from withdrawing your 401 savings before you need it for retirement. You can avoid the 10% penalty under the following circumstances:

- You terminate service with your employer during or after the calendar year in which you reach age 55

- You are the beneficiary of the death distribution

- You have a qualifying disability

- You are the beneficiary of a Qualified Domestic Relations Order

- Your distribution is due to a plan testing failure

A full list of the exceptions to the 10% premature distribution penalty can be found on the IRS website.

What Are Alternatives

Because withdrawing or borrowing from your 401 has drawbacks, it’s a good idea to look at other options and only use your retirement savings as a last resort.

A few possible alternatives to consider include:

- Using HSA savings, if it’s a qualified medical expense

- Tapping into emergency savings

- Transferring higher interest credit card balances to a new lower interest credit card

- Using other non-retirement savings, such as checking, savings, and brokerage accounts

- Using a home equity line of credit or a personal loan3

- Withdrawing from a Roth IRAcontributions can be withdrawn any time, tax- and penalty-free

Don’t Miss: How To Find Out If You Have An Old 401k

What Are The Penalty

The IRS permits withdrawals without a penalty for certain specific uses, including to cover college tuition and to pay the down payment on a first home. It terms these “exceptions,” but they also are exemptions from the penalty it imposes on most early withdrawals.

It also allows hardship withdrawals to cover an immediate and pressing need.

There is currently one more permissible hardship withdrawal, and that is for costs directly related to the COVID-19 pandemic.

You’ll still owe regular income taxes on the money withdrawn but you won’t get slapped with the 10% early withdrawal penalty.