Contributing To A 401 Plan

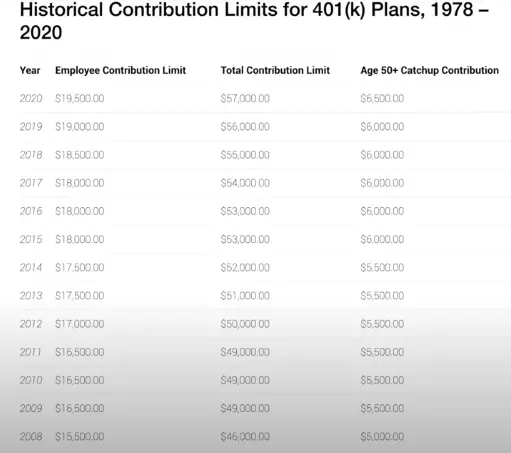

A 401 is a defined contribution plan. The employee and employer can make contributions to the account up to the dollar limits set by the Internal Revenue Service .

A defined contribution plan is an alternative to the traditional pension, known in IRS lingo as a defined-benefit plan. With a pension, the employer is committed to providing a specific amount of money to the employee for life during retirement.

In recent decades, 401 plans have become more common, and traditional pensions have become rare as employers shifted the responsibility and risk of saving for retirement to their employees.

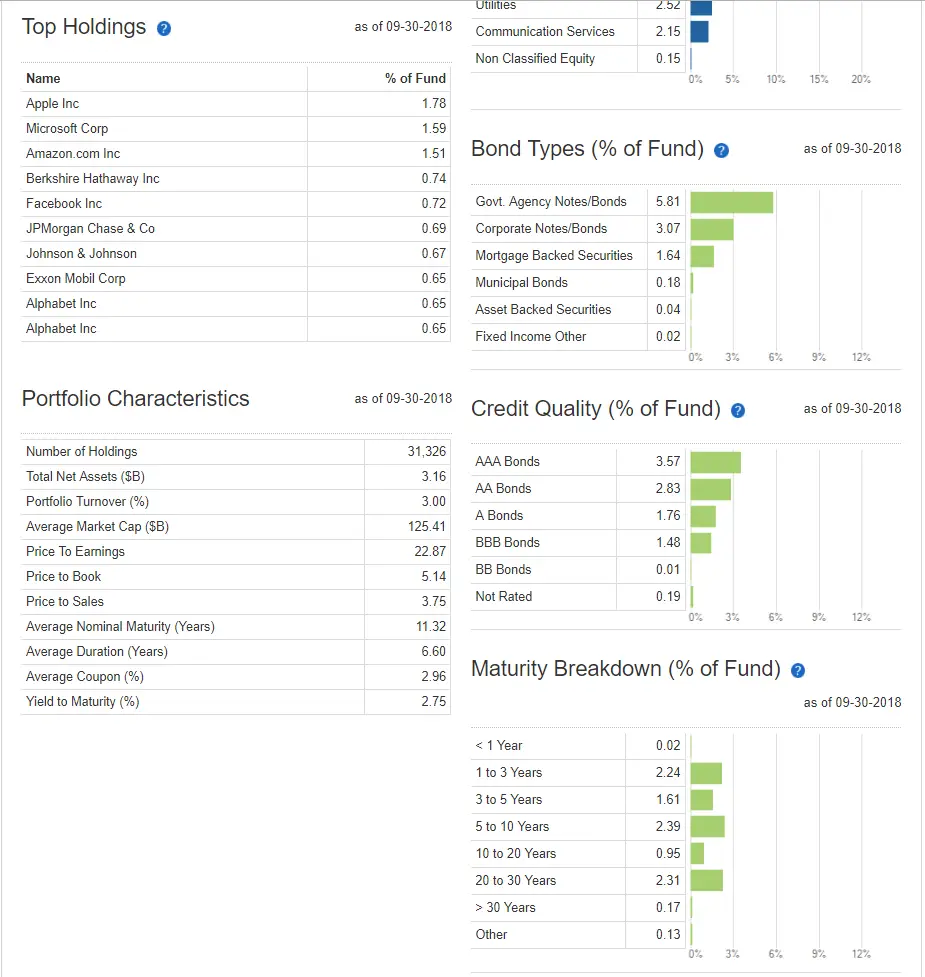

Employees also are responsible for choosing the specific investments within their 401 accounts from a selection their employer offers. Those offerings typically include an assortment of stock and bond mutual funds and target-date funds designed to reduce the risk of investment losses as the employee approaches retirement.

They may also include guaranteed investment contracts issued by insurance companies and sometimes the employers own stock.

Track Down Previous Employer Via The Department Of Labor

If you cant find an old statement, you may still be able to track down contact information for the plan administrator via the plans tax return. Many plans are required to file an annual tax return, Form 5500, with the Internal Revenue Service and the Department of Labor . You can search for these 5500s by the name of your former employer at www.efast.dol.gov. If you can find a Form 5500 for an old plan, it should have contact information on it.

Once you locate contact information for the plan administrator, call them to check on your account. Again, youll need to have your personal information available.

Check Every Corner Of Your 401

Once you gain access to your account online or review your statement, check how your money is invested.

Most 401 administrators automatically invest your money into a target-date fund. Target date funds are portfolios of various mutual funds and investments tailored to your estimated retirement date. Using your age, the percentage mix of these investments changes to match your risk tolerance as you near retirement.

If you dont want to hold your money in a target-date fund, you have the option to change investments.

However, if your plan hasnt automatically allocated your money, it may be waiting to be invested. In this case, your money will be sitting in your account, not growing in a glorified savings account.

Itâs a rare occurrence, but checking your 401 balance will help catch any funds not adequately invested.

Recommended Reading: When Can I Withdraw From 401k Without Penalty

So How Much Should You Invest In Your 401k

Okay. So, while investing is highly personal and financial goals should be personalized, you are here so we can teach you to be rich. We have some advice to get you started.

How much you should actually be investing each month depends on a system we call the Ladder of Personal Finance. It looks at three areas:

1. Your employers 401k match. Each month you should be contributing as much as you need to in order to get the most out of your companys 401k match. That means if your company offers a 5% match, you should be contributing AT LEAST 5% of your monthly income to your 401k each month.

Weve already discussed the importance of this dont throw away free money and the returns from that free money.

2. Whether youre in debt. Once youve committed yourself to contributing at least the employer match for your 401k, you need to make sure you dont have any debt. Remember, if you have employee matching, you are effectively earning a 100% return on every penny you invest in your 401k that is significantly more than the interest you would save by paying down your debt.

Donât Miss: Can I Rollover My 401k To A Roth Ira

The Takeaway On Finding Lost 401 Money

If you suspect that you’ve left a 401 behind somewhere and don’t attempt to locate it, you’re risking losing the plan — and the money — for good.

But if you don’t respond, a company holding an old 401 account has no obligation to pursue the issue further, and eventually will relinquish your old account to the state, and all of the funds held, as well.

Don’t let that happen to you. Use the tips listed above to make every effort to find your lost 401 account and get the money back for yourself, and don’t let “free” retirement slip out of your control.

Also Check: What Does It Mean To Roll Over Your 401k

What If Your Employer Goes Out Of Business

Under federal law, your employer must keep your 401 funds separate from their business assets.

This means that even if your employer abruptly shuts their doors overnight, your money is protected. It cannot be used to pay off your companys loans, cover employee payroll, or for any other purpose.

If your company shut down abruptly, it is possible that a portion of money will be at risk. If your money has been withheld, but has not yet been sent to the 401 plan to be invested, the company could in theory, access those funds.

Retirement Funds Are Different

They are not turned over to the state, which means, its possible that nothing will happen to your money until something happens with your company ).

A common scenario is when you leave a company and move, perhaps you even change your email address.

Perhaps months or even years have gone by, or youve moved to the other side of the country. Then something happens with your employer and they need to contact you for instructions of what to do with your account.

You May Like: Can I Switch My 401k To A Roth Ira

Use Resources To Discover Unclaimed Assets

Before you go any further, make sure you take the above steps to locate your funds. Once complete, you can use the following resources to gain access to your unclaimed assets:

- Unclaimed property search: To complete a search, you can use your name and location to find your assets.

- Search for Form 5500 filing: The Department of Labor makes it easy to search online for and file a Form 5500. Youll need to know your plan administrator, their EIN, the plan name or other essential information to use this tool.

- DOLs Abandoned Plan Search: Finally, you can also use the Department of Labors abandoned plan database to search for your unclaimed assets.

How To Find An Old 401 And What To Do With It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

There are billions of dollars sitting unclaimed in ghosted workplace retirement plans. And some of it might be yours if youve ever left a job and forgotten to take your vested retirement savings with you.

But no matter how long the cobwebs have been forming on your old 401, that money is still yours. All you have to do is find it.

Also Check: Can You Transfer Money From 401k To Bank Account

Leverage The National Registry

The National Registry, run by Pen Check, a retirement plan distribution firm, is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

The site offers an easy, free-of-charge way to locate lost or forgotten employee retirement accounts. You can conduct as many searches as you want, using just your Social Security number. The site is safe, encrypting any information you input on a secure server.

Determine If Your 401 Account Was Rolled Over To A Default Ira Or Missing Participant Ira

One possibility is your employer rolled the funds over into a Default IRA.

If your employer tried to contact you for instructions as to what to do with your account balance, and you fail to respond, you may be deemed a non-responsive participant.

If they are unable to locate you altogether, you may be deemed a Missing Participant.

In either scenario, if the plan is being terminated, your employer may have put the funds in a Missing Participant Auto Rollover IRA.

This is an IRA account set up on your behalf to preserve your retirement assets until they are claimed by you or your beneficiaries under Department of Labor regulations.

To qualify for a Missing Participant or Default IRA, the account balance must be greater than $100 but less than $5,000 unless the funds are coming from a terminated plan, then the $5,000 ceiling is waived.

Finding a Missing Participant IRA

If your money has been transferred to a Missing Participant IRA, you should be able to find it by searching the FreeERISA website.

This search is slightly more time consuming than the national registry. Registration is required to search the database, which contains 2.6 million ERISA form 5500s, covering 1.3 million plans and 1 million plan sponsors.

If you know your money has been transferred to one of these default accounts, you should get it out into a standard IRA account.

Typically, these accounts must be interest-bearing, bear a reasonable rate of return, and be FDIC insured.

Here’s the bad part:

Also Check: What To Do With 401k When You Switch Jobs

How To Find A Lost 401 Account

Think you may be one of the millions with forgotten 401 money floating around somewhere? Start by scouring your personal email or laptop for any old 401 plan statements that you may have saved in the past.

Your statement will provide your account number and plan administrators contact information, Corina Cavazos, managing director, advice and planning at Wells Fargo Wealth & Investment Management, tells Select. Your former coworkers may have old statements that you can reference, too.

If you dont have any luck, Cavazos says that your best bet is to contact your former employers HR or accounting department. By providing your full name, Social Security number and dates of employment with that company, you can have them check their 401 plan records to see if you were once a participant.

If youve tried contacting your 401 plan administrator or former employer to no success, you may be able to find old retirement account funds on the National Registry of Unclaimed Retirement Benefits. Upon entering your Social Security number, the secure website allows you to conduct a free database search to see if theres any unpaid retirement money in your name.

Another search database is the FreeERISA website, which indicates if your former employer rolled your 401 funds into a default participant IRA account on your behalf. FreeERISA requires you to register before performing a search, but it is free to do so.

National Registry Of Unclaimed Retirement Benefits

You may be able to locate your retirement account funds on the National Registry of Unclaimed Retirement Benefits. This registry is a secure search website designed to help both employers and former employees. Employees can perform a free database search to determine if they may be entitled to any unpaid retirement account money. Employers can register names of former employees who left money with them. Youll need to provide your Social Security number, but no additional information is required.

Read Also: How Do I Find An Old 401k

What Happens To My 401 If I Quit My Job

When you leave a job, you have several options for what to do with your 401.

You can cash it out, leave it with your old employer, or roll it into an IRA. Each option has different tax implications, so choosing the one thats best for your situation is important.

If you cash out your 401, youll have to pay taxes on the amount you withdraw. You may also be subject to a 10% early withdrawal penalty if youre younger than 59 1/2. If you decide to leave your 401 with your old employer, youll still be subject to taxes and penalties if you withdraw the money before retirement. However, leaving your money in a 401 can be a good way to keep it invested and grow over time.

Rolling over your 401 into an IRA is another option. With an IRA, youll have more control over how your money is invested. And, if you roll over your 401 into a Roth IRA, your withdrawals in retirement will be tax-free. Talk to a financial advisor to find out which option is best for you.

- You can keep your 401 with your former employer or transfer it to a new employers plan.

- You can also convert your 401 into an Individual Retirement Account via a 401 rollover.

- Another choice is to withdraw your 401, which may result in a penalty and taxes on the entire amount.

How To Find An Old : 7 Ways

People prone to leaving things behind usually don’t lose a 401 account, but it happens more often than you think – especially if you don’t have a great deal of cash stashed away in a 401.

Data from Plan Sponsor Council of America shows that 58% of 401 transfer balances are between $1,000 and $5,000 when a career professional leaves an employer. That’s not an insignificant range of money, but it’s money you could have working for you, if you could only find it.

Additionally, the U.S. Government Accountability Office states that over 25 million Americans with cash in a 401 or other employer retirement plan left that money behind when they moved on to greener career pastures.

People leave old 401 accounts behind for many reasons. The account holder may have engaged in a string of job-hopping experiences and lost an old retirement account in the shuffle. Or, the 401 account holder’s company merged with another firm, was bought out, or went bankrupt.

You might even automatically have been enrolled in an old 401 company by a firm you only spent a year or so working at, didn’t realize it, and completely missed bringing the 401 account along with you to your next job.

If that sounds vaguely familiar, how do you find the money you lost in an old 401 account and what do you do with it when you get it back?

There are plenty of ways to get the job done. Let’s take a closer look.

Also Check: What To Do With Old Employer 401k

Check On Your 401 Periodically

As mentioned, its essential to check how much is in your 401 throughout the year. Ideally, more than once, however, annual checks are enough.

The reason to monitor your retirement savings is to keep up with your retirement goals. For instance, as you near retirement, you may want to move your money to safer investments like bonds. Or, if one area has over-performed others, you might decide to reallocate your money to limit your exposure to one category.

Typically these drastic swings in your portfolio wont happen that quickly. But by scheduling an annual check of your 401 balance, youll get a good picture of your 401 portfolio.

Tags

Recommended Reading: How Much Needed In 401k To Retire

How To Check Your 401 Balance

If you already have a 401 and want to check the balance, its pretty easy. You should receive statements on your account either on paper or electronically. If not, talk to the Human Resources department at your job and ask who the provider is and how to access your account. Companies dont traditionally handle pensions and retirement accounts themselves. They are outsourced to investment managers.

Some of the largest 401 investment managers include Fidelity Investments, Bank of America Get Bank of America Corp Report, T. Rowe Price Get T. Rowe Price Group Report, Vanguard, Charles Schwab Get Charles Schwab Corporation Report, Edward Jones, and others.

Once you know who the plan sponsor or investment manager is, you can go to their website and log in, or restore your log-in, to see your account balance. Expect to go through some security measures if you do not have a user name and password for the account.

Much of this should be covered when you initiate the 401 when you are hired or when the retirement account option becomes available to you. Details like contributions, company matching, and information on how to check your balance history and current holdings should be provided.

Finding a 401 from a job you are no longer with is a little different.

Read more on TheStreet about how to find an old 401 account.

Don’t Miss: Can An Independent Contractor Participate In A 401k Plan

How Retirement Benefits Can Go Missing

Its rare for a person to stay with one company an entire career. Additionally, some companies go out of business after several years of successful operations. With both people and companies in constant transition, it is common for people to lose track of their accrued retirement benefits. Whats more, people might know they have retirement benefits available to them but not know how to find what they have.

For example, lets say a person worked for a company from ages 25 to 35, but now is 45. The company the person worked for over a decade ago has gone under. That money is still completely their own, it just might be challenging to find them.

How Do I Find Out If My Late Mother Had A 401k And Stock And Bonds

- Posted on Jun 29, 2009

Given your question, Im assuming that a probate was not conducted when your mother passed away. If the stocks and bonds earned any income , the companies should have generated 1099 forms for them. Your best way of finding this out might be to write to the IRS or the state taxing authority and see if you can obtain copies of her old tax returns . Any dividends, etc. should have been reported on the tax return.Since tax returns are only kept for a limited period of time, you need to do this ASAP. The taxing authority might want some proof that you have the right to receive the tax returns, in which case you might need to open a probate for your mothers estate. Depending on what you think the value might be, it may or may not make sense to do this .If you know who the former employers are, you might be able to get some information from the human resources dept. .

Also Check: Can My Wife Take My 401k In A Divorce

Don’t Miss: Can I Keep My 401k With My Old Employer