Withdrawing Funds From A 401 At 55

The rule of 55 allows 401 participants to withdraw money from the retirement plan penalty-free at age 55. The IRS requires that an employee must have left their employer, either by being laid off, fired, or simply quitting, in the calendar year they turn 55 to get a penalty-free distribution. If you lost your job at 54, you do not qualify to withdraw money tax-free from the 401 when you attain age 55.

The Rule of 55 does not apply to the old 401s left with former employers it only applies to the current 401 with your current employer. If you still have money in the old 401s of a former employer, and you were not yet 55 when you left, the rule of 55 does not apply. You will have to wait until you are 59 ½ to start taking withdrawals from the old 401s without paying a penalty tax. Still, you can roll over the old 401s into your current 401 before you are 55 so that you can take a distribution penalty-free.

Understanding The Rules For 401 Withdrawal After 59 1/2

LAST REVIEWED Apr 15 20219 MIN READ

A 401 is a type of investment account thats sponsored by employers. It lets employees contribute a portion of their salary before the IRS withholds funds for taxes, which allows interest to accumulate faster to increase the employees retirement funds. Now, if you have a 401, you could pay a penalty if you cash out your investment account before you turn 59 ½.

Heres some more information about the rules you need to follow to maximize your 401 benefits after you turn 59 ½.

Can You Be Denied A Hardship Withdrawal

Most 401 plans provide loans to participants who are experiencing financial difficulties or who have an immediate need, such as medical expenses or a college education. If a 401 loan is due to a luxury expense that does not meet the criteria for financial difficulty, the loan application may be rejected.

You May Like: What Happens To 401k When You Change Jobs

Avoid The 401 Early Withdrawal Penalty

While the age for avoiding the penalty is normally 59 1/2, there is an exception to the age rule. If you leave a job or are terminated at age 55 or later, then you can make withdrawals from your account with that employer without paying the penalty. Make sure that you do not make withdrawals from any other plans you might have as those will still be subject to the penalty.

Likewise, remember that there are even heavier penalties for missing required minimum distributions . Upon reaching age 72, you are required to withdraw certain amounts from your account. If you fail to make the withdrawal, then you will receive a penalty of 50% of the amount of the required distribution. Suppose you were required to withdraw $8,000 from your 401. If you miss that distribution, then you will owe $4,000 in the penalty alone!

The 401 Withdrawal Rules For People Between 55 And 59

Most of the time, anyone who withdraws from their 401 before they reach 59 ½ will have to pay a 10% penalty as well as their regular income tax. However, you can withdraw your savings without a penalty at age 55 in some circumstances. You cannot be a current employee of the company that runs the 401, and you must have left that employer during or after the calendar year in which you turned 55. Many people call this the Rule of 55.

If youre between 55 and 59 ½ years old and you are considering a 401k withdrawal from an old employer, you should keep a few things in mind. For starters, doesnt matter why your employment stopped. Whether you quit, you were fired, or you were laid off, you can qualify for a penalty-free withdrawal. However, you need to meet the age requirement and your employment must end in the calendar year you turn 55 or later.

These rules for early 401 withdrawal only apply to assets in 401 plans maintained by former employers. The rules dont apply if youre still working for your employer. For example, an employee of Washington and Sons usually wont be able to make a penalty-free withdrawal before they turn 59 ½. However, the same employee can make a withdrawal from a former employers 401 account and avoid the penalty when he or she turns 55.

Also Check: How To Pull Money Out Of Your 401k

Is It A Good Idea To Use The Rule Of 55

Just because you can take distributions from your 401 or 403 early doesn’t mean you should. Depending on your financial situation, it might be better to let your money continue to grow. Holding off withdrawals could help you better position yourself for a financially sound future. If you’re tempted to withdraw retirement funds before you’re eligible, instead consider finding another job, drawing from your savings or using other sources of income until you need to tap into your retirement savings.

If you decide to begin withdrawing funds from your 401 early, the long-term value of your portfolio will likely decrease. It’s essential that you time your withdrawals carefully and take into account how much they would cost you in taxes. To create a strategy that makes sense in your situation, consider working with a financial advisor or a retirement planner.

The Cares Act And 401k Withdrawal

The CARES Act was signed into law in 2020 to help provide financial stability and relief for individuals and businesses affected by COVID-19. As a result, it has implications on making 401 withdrawals. Under the CARES Act, early 401 withdrawal penalties are eliminated for qualified individuals making withdrawals up to $100,000 for coronavirus related distributions.

While the CARES Act eliminates early 401 withdrawal penalties, income tax on the distributions of pre-tax assets would still be owed but could be paid over a three-year period. Individuals could “recontribute” the funds to a retirement account within three years without regard to contribution limits.

You May Like: How To Transfer 401k From Old Job

Circumstances Where Both Iras And 401s Permit Penalty

- If a military reservist is called to active duty. Both IRA and 401 account owners can take certain qualified distributions from their retirement accounts if they are a military reservist who is called to active duty for 180 days or more.

- To cover qualified medical expenses. If unreimbursed medical expenses total more than 10% of the account ownerâs adjusted gross income for that year, early distributions are allowed from both a 401 or IRA without penalty.

- Disability. Early withdrawals can be taken without penalty in the case of a total and permanent disability of the participant/account owner. This applies to both IRAs and 401 plans.

- Adoption or birth of a child. Under the SECURE Act, up to $5,000 in qualified distributions can be taken from an IRA if the account owner adopts or gives birth to a child. â

- Inherited accounts. If an IRA or 401 account owner dies and passes the plan to a beneficiary, that beneficiary can withdraw funds from the account without penalty. As of 2020, inherited IRA distributions must be taken entirely by the end of the tenth year following the original account ownerâs death.

Recommended Reading: Does Maximum 401k Include Employer Match

Is Social Security Based On The Last 5 Years Of Work

Social Security benefits are based on your lifetime earnings. Your actual earnings are adjusted or indexed to account for changes in average wages since the year the earnings were received. Then Social Security calculates your average indexed monthly earnings during the 35 years in which you earned the most.

Read Also: How Do I Get My Money Out Of My 401k

Tapping Your 401 Early

If you need money but are trying to avoid high-interest credit cards or loans, an early withdrawal from your 401 plan is a possibility. However, before you consider this option, be forewarned that there are often tax consequences for doing so.

If you understand the impact it will have on your finances and would like to continue with an early withdrawal, there are two ways to go about it cashing out or taking a loan. But how do you know which is right for you? And what are the tax consequences you should be expecting?

Dont Miss: What Is The Minimum 401k Distribution

Will My Credit Score Be Impacted If I Withdraw Early

Withdrawing funds from your 401 early won’t impact your credit directly since the credit bureaus don’t track activity on your retirement accounts.

Making an early withdrawal can indirectly affect your credit when you use the money to pay down outstanding debt. It may seem like an easy way to ease a debt burden or boost your credit, but in most cases, this shouldn’t be the only reason to withdraw funds from your 401. Such a move should only be considered in a financial emergency when you have exhausted all other options.

Also Check: Can You Transfer 401k To Another Company

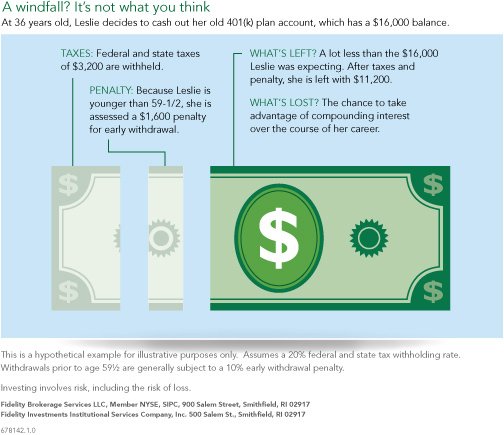

Three Consequences Of A 401 Early Withdrawal Or Cashing Out A 401

Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw $10,000 from your 401 at age 40, you may get only about $8,000. Keep in mind that you might get some of this back in the form of a tax refund at tax time if your withholding exceeds your actual tax liability.

The IRS will penalize you. If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 or 10% of that $10,000 withdrawal in addition to paying ordinary income tax on that money. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

It may mean less money for your future. That may be especially true if the market is down when you make the early withdrawal. If you’re pulling funds out, it can severely impact your ability to participate in a rebound, and then your entire retirement plan is offset, says Adam Harding, a certified financial planner in Scottsdale, Arizona.

Can You Withdraw Money From A 401 Early

Yes, if your employer allows it.

However, there are financial consequences for doing so.

You also will owe a 10% tax penalty on the amount you withdraw, except in special cases:

- If it qualifies as a hardship withdrawal under IRS rules

- If it qualifies as an exception to the penalty under IRS rules

- If you need it for COVID-19-related costs

In any case, the person making the early withdrawal will owe regular income taxes year on the money withdrawn. If it’s a traditional IRA, the entire balance is taxable. If it’s a Roth IRA, any money withdrawn early that has not already been taxed will be taxed.

If the money does not qualify for any of these exceptions, the taxpayer will owe an additional 10% penalty on the money withdrawn.

Recommended Reading: How To Cash Out My 401k Early

Who Owns Mcclain Lodge

girls prom dresses

how to remove carburetor bowl from briggs and stratton

Age Thresholds For Making A TSP Withdrawal. By Admin. Many federal employees wonder what the TSP withdrawal age is and, as a result, may miss out on certain opportunities available to them. You may be aware that making a TSP withdrawal before age 59½ can result in getting hit with a 10% early withdrawal penalty in addition to the income taxes.

2022. 7. 30. ·Search: Ups 401k Withdrawal. Sunwest Pensions is a Metropolitan Phoenix based third party administrator and recordkeeping firm specializing in the consulting, administration and recordkeeping of retirement plans You might find yourself in a situation where you need the money in your 401 before you reach 59 1/2 years of age You can stay invested.

Participants should use the online tool on the TSP website to initiate an age-based in-service withdrawal request. To access the tool, participants must log into My Account and click on “Withdrawals and Changes to Installment Payments,” then click on “Age-Based In-Service ’59½’Withdrawal.”.

age 55 can begin withdrawalswithoutpenalty. But those who separate before the year in which they reach age 55 and who wish to withdraw funds from. their accounts before age 59½ are subject to the IRS’ 10 percent early withdrawalpenalty unless they. qualify for one of the exceptions described in IRS Publication 590, “Individual.

spyderco paramilitary 2 carbon fiber

How Much Tax Do You Pay On Retirement Withdrawals

There is a mandatory withholding of 20% of a 401 withdrawal to cover federal income tax, whether you will ultimately owe 20% of your income or not. Rolling over the portion of your 401 that you would like to withdraw into an IRA is a way to access the funds without being subject to that 20% mandatory withdrawal.

Don’t Miss: What Age Can You Take Out 401k

Requirements For Hardship Withdrawals

The IRS also allows for penalty-free distributions before the age of 59 1/2 in hardship-related circumstances. To qualify for a hardship withdrawal, you, your spouse, or a dependent must experience “an immediate and heavy financial need” and the amount you are withdrawing must be “necessary to satisfy the financial need.”

These are the scenarios the IRS provides that might constitute an immediate and heavy need:

- Certain medical expenses

- Costs associated with purchasing a primary home

- Tuition and educational fees and expenses

- Expenses associated with the repair of damage to a primary home under certain circumstances

- Money necessary to prevent eviction or foreclosure from a primary home

However, your plan administrator may not permit hardship withdrawals regardless of the circumstances. And, the IRS requirements specify that you must not have any other source of funds to cover the “immediate and heavy” expenses.

How Long Does It Take To Cash Out A 401

While the amount of time it takes to receive money differs by plan, administrator and employer, you can often expect to wait several weeks minimum to receive your funds. Some plans may also be bound by rules that prohibit them from distributing these funds more than once a quarter or year, extending this time horizon to 30 90 days or more.

As 401 plans are highly regulated, and subject to strict governance, it can often take a considerable amount of time to ensure that proper guidelines are followed. Complete paperwork must also be in hand in order for requests to process. Noting that any funds withdrawn are unlikely to become immediately available, be sure to consult your summary plan description document to learn more about the rules of your plan, and how long it can take to receive disbursements.

Also Check: How To Find Where Your 401k Is

What Are The Pros And Cons Of Withdrawal Vs A 401 Loan

A withdrawal is a permanent hit to your retirement savings. By pulling out money early, youll miss out on the long-term growth that a larger sum of money in your 401 would have yielded.

Though you wont have to pay the money back, you will have to pay the income taxes due, along with a 10% penalty if the money does not meet the IRS rules for a hardship or an exception.

A loan against your 401 has to be paid back. If it is paid back in a timely manner, you at least wont lose much of that long-term growth in your retirement account.

See If You Qualify For A Hardship Withdrawal

A hardship withdrawal is a withdrawal of funds from a retirement plan due to an immediate and heavy financial need. A hardship withdrawal usually isn’t subject to penalty.

Generally, these things qualify for a hardship withdrawal:

-

Medical bills for you, your spouse or dependents.

-

Money to buy a house .

-

College tuition, fees, and room and board for you, your spouse or your dependents.

-

Money to avoid foreclosure or eviction.

-

Funeral expenses.

-

Certain costs to repair damage to your home.

How to make a hardship withdrawal

Your employers plan administrator usually decides if you qualify for a hardship withdrawal. You may need to explain why you cant get the money elsewhere. You usually can withdraw your 401 contributions and maybe any matching contributions your employer has made, but not normally the gains on the contributions . You may have to pay income taxes on a hardship distribution, and you may be subject to the 10% penalty mentioned earlier.

Recommended Reading: How To Find Out If Deceased Had 401k

Take A Home Equity Loan

If you own a home, you can consider going with a home equity loan instead. Youll need at least 20% equity to secure the loan. The average interest rate on these loans is around 5.33%, which is much better than the rates on other forms of financing . You should also note that there are no tax deductions unless youre reinvesting the loan into your home.

Read Also: What Is A 401k Vs Roth Ira

Withdrawing Funds Between Ages 55 And 59 1/2

Most 401 plans allow for penalty-free withdrawals starting at age 55. You must have left your job no earlier than the year in which you turn age 55 to use this option. You must leave your funds in the 401 plan to access them penalty-free, but there are a few exceptions to this rule. This option makes funds accessible as early as age 50 for many police officers, firefighters, and EMTs.

Make sure to understand the rules around the age requirement for penalty-free withdrawals. For example, the age 55 rule won’t apply if you retire in the year before you reach age 55, and your withdrawal would be subject to a 10% early withdrawal penalty tax in that case.

The age-55-and-up retirement rule won’t apply if you roll your 401 plan over to an IRA. The earliest age to withdraw funds from a traditional IRA account without a penalty tax is 59 1/2.

You might retire at age 54, thinking that you can access funds penalty-free in one year, but doesn’t work that way. You must wait one more year to retire for this age rule to take effect.

Also Check: What Does 401k Benefits Mean