Magnificent Mutual Funds To Maximize Your Retirement Portfolio

Zacks Equity Research

You follow Fundamental Analysis – edit

You follow Zacks Equity Research – edit

What would you like to follow?

Zacks Equity Research

There is never a wrong time to invest in mutual funds for retirement. So, if you’re still looking for the best mutual funds, the Zacks Mutual Fund Rank can be a great guide.

How can you tell a good mutual fund from a bad one? It’s pretty basic: if the fund is diversified, has low fees, and shows strong performance, it’s a keeper. Of course, there’s a wide range, but using the Zacks Mutual Fund Rank, we’ve found three mutual funds that would be great additions to any long-term retirement investors’ portfolios.

Let’s take a look at some of our top-ranked mutual funds with the lowest fees.

Direxion Mo S& P 500 Bull 1.75X Inv : 1.32% expense ratio and 0.75% management fee. DXSLX is classified as an Allocation Balanced fund, which seeks to invest in a balance of asset types, like stocks, bonds, and cash, and including precious metals or commodities is not unusual. DXSLX has achieved five-year annual returns of an astounding 18.87%.

WCM International SmCap Growth Inst : 1.25% expense ratio and 1% management fee. WCMSX is a Non US – Equity option, focusing their investments acoss emerging and developed markets, and can often extend across cap levels too. With yearly returns of 11.07% over the last five years, WCMSX is an effectively diversified fund with a long reputation of solidly positive performance.

Crypto Price Prediction: $100000 Bitcoin Could Come Even Sooner Than You Think With Ethereum Leading The Way

We observed that many investors were able to profit from GameStop stock last year due to the meme rallies, but it appears that the fun times are over. GameStop is in a dire situation, having lost $400 million from April 2021 to April 2022, and the company needs to turn business around. With under $1 billion in cash on hand, the company needs to figure out how to stop burning cash immediately, or they risk finding themselves in serious financial trouble.

GameStop recently went through a 4-for-1 stock split and introduced an NFT marketplace, in hopes of increasing the share price. Unfortunately, both moves didnt progress the company as management hoped they would. It has been revealed that the GameStop NFT marketplace is bringing in less than $4,000 in daily revenue, clearly much lower than what the company had hoped for.

Pros Of Investing In Stocks Include:

Ability to Create a Personalized Portfolio

You can invest in any company or company you please within the limits of your available funds. This allows you to tailor your portfolio to match your specific risk tolerance and time horizon.

Higher Potential Returns

Stocks have notably offered a higher rate of return than the average mutual fund, but this may not be true in the future.

Higher Potential for Loss

Stocks are riskier investments than 401 accounts or low-risk mutual funds since they offer a higher rate of return. This also means you could potentially lose your entire investment.

Recommended Reading: How To Find A 401k From Previous Employer

First Don’t Panic Then Look For Buying Opportunities

As share prices rise in the course of a bull market, it’s easy to forget that the good times won’t last forever. Then the latest bear market arrives and suddenly your goal of a secure retirement looks a little further off with every new financial statement. What should you do when the going gets rough?

These four steps will help you bear-proof your 401 plan.

Sell Overweighted And Lower

If you need to withdraw more than your RMD, look to your taxable accounts next. Withdrawals from taxable accounts are taxed as capital gains rather than as ordinary income, with a preferential rate for gains on investments youve owned for more than a year. Of course, if youve lost confidence in any of your other investments, they are also good sell candidates.

Smart Move: Try to postpone selling appreciated investments that youve owned for less than a year. You need to have owned the security for one year and one day to get the long-term capital gains tax rate.

If you have to sell high-rated securities, you can minimize your tax bill by starting with those that will generate a loss, before you sell those that will generate a gain. Also, whenever youre considering selling an investment in a taxable account, think about matching gains to losses as a way to control your taxes. See Question 25, pages 220221, for more about this process, known as tax-loss harvesting.

Read Also: Can I Roll My Ira Into My 401k

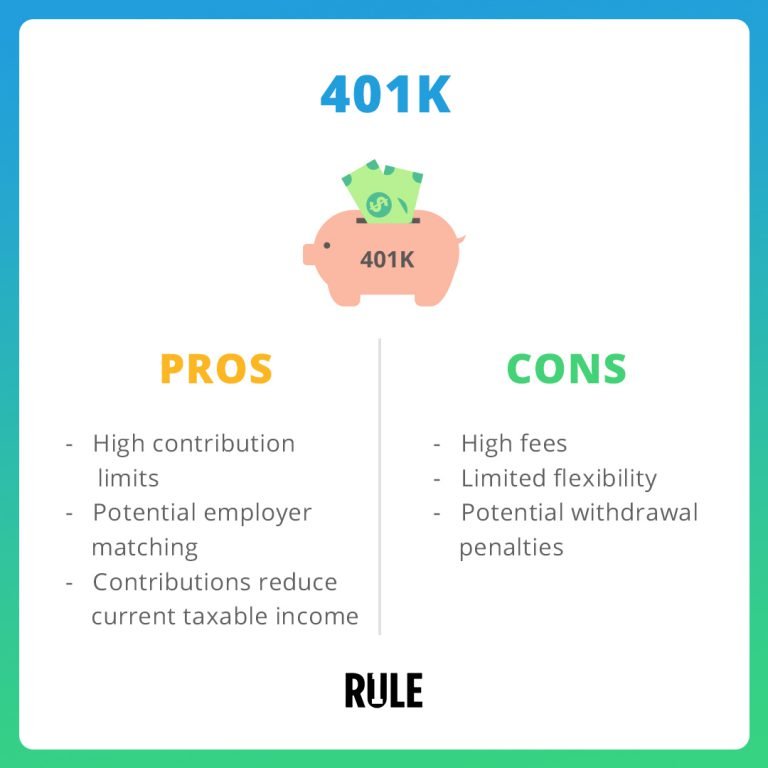

What Are The Benefits Of A 401

There are two main benefits to a 401. First, companies usually match at least a portion of the money you put into your 401. Every company’s match is different, but your $100 contribution each week to your 401 may result in your company putting an additional $100 into your 401 as well.

Second, there are tax benefits for these accounts. If your contributions to your 401 are pre-tax, you don’t have to pay taxes on the gains you earn over time when it comes time to withdraw money for retirement. If your contributions are post-tax, you get to deduct your contributions on your federal income tax return.

What Are The Right Stocks To Outperform Inside A 401k

Inside a retirement account, Im always looking to maximize dividend yields while remaining cognizant of individual equity risk.

The perfect candidate would distribute a high monthly yield but have a strong balance sheet and a conservative distribution coverage ratio .

I like to have a high monthly or quarterly yield inside my retirement account so I do not have to pay taxes on these distributions. Im also a big fan of having the cash now rather than trusting a company to return it when it benefits them.

Inside my retirement accounts Im trying to maximize monthly dividends without exposing my portfolio to unneeded risk.

When mining for these stocks or funds I use a bottom-up approach where Im selecting the 50 best candidates.

Once I have the equities selected I will monitor exclusion criteria and will quickly kick a stock out of my preferred list.

Next, I will monitor both the dividend yield, and will be looking up these candidates when their price takes a hit.

There are several stock screening tools available and the principles listed above are critical to building a strong retirement account, and a secure future.

You May Like: How Much Should Go Into 401k

Extra Benefits For Lower

The federal government offers another benefit to lower-income people. Called the Saver’s Tax Credit, it can raise your refund or reduce the taxes owed by offsetting a percentage of the first $2,000 that you contribute to your 401, IRA, or similar tax-advantaged retirement plan.

This offset is in addition to the usual tax benefits of these plans. The size of the percentage depends on the taxpayer’s adjusted gross income for the year and tax-filing status. The income limits to qualify for the minimum percentage offset under the Saver’s Tax Credit are as follows:

- For single taxpayers , the income limit is $34,000 in 2022.

- For married couples filing jointly, it’s $66,000 in 2021 and $68,000 in 2022.

- For heads of household, it maxes out at $49,500 in 2021 and $51,000 in 2022.

Do I Adjust My 401 When Markets Are Down

First know this: you havenât lost any money even though your 401 value has dropped. You only recognize a gain or loss when you take a distribution. Most folks wonât tap their 401 balances for 10, 20, 30 or even 40 years. Second, since 1926, there have been 15 recessions and 15 market recoveries.* We like that batting average for recoveries. And third, in every 20-year period researched back to 1926, the US stock market has delivered positive returns.**

While history offers no guarantees, here are some additional perspectives that can help you more confidently determine the right path for you through good times and bad.

Jumping In and Out of the Market Is Typically a Bad IdeaGiven that markets can swing quickly, it can lead to some bad outcomes if you jump in and out of the market . Some investors get so nervous during a big stock market drop that they move their 401 money out of stock funds into a money market or similar cash equivalent, essentially selling stock at a low. Then when markets rise, they feel more confident and move the money back to stock funds thereby buying at a higher point than they sold and missing the opportunity for a better return.

Stay the Course vs. Not

| 20-Year Example | |

|---|---|

| $205,338 | $112,265 |

Anne has more than double the nest egg value of Alex with $205,338 vs. Alexâs account value of $93,072. Thatâs the big deal.

The Upside of Dollar Cost Averaging

| Period | |

|---|---|

| $1,625.25 | 21.67 shares x $75 |

Read Also: How To Move Money From One 401k To Another

Things To Know Before Opening A 401 Brokerage Account

If you’re considering a 401 brokerage account, the first thing you must decide is what percentage of your retirement savings you’d like to put there. You can put all of it there if you’d like, but it may be better to leave part of it in a mutual fund chosen by your employer, just to be safe.

You should also note that some 401s only allow you to transfer funds to a brokerage account during a certain window each year. If this is the case for your plan, make a note of this time frame so you don’t miss it.

Next, look into the account maintenance fees and any other fees associated with the investment products you’re considering. Ideally, you can keep these at or below 1% of your assets. That means you’ll pay $1,000 or less per year for every $100,000 you have in the account. If you plan to employ a financial adviser to help manage or offer suggestions for your 401 brokerage account, don’t forget to factor in those fees as well.

If a 401 brokerage account isn’t a good fit for you, go with one of your employer’s investment selections instead. This is the safer bet if you don’t have the time or interest to learn more about investing. These are your retirement savings at stake, so you don’t want to take unnecessary risks.

The Motley Fool has a disclosure policy.

Know Your Investment Risk Tolerance

Whats the difference between investment types and asset classes? A lot centers around risk vs. return.

In general, the higher the potential for return the higher the potential for risk of lossand vice versa.

Risk tolerance is how much you can keep the emotion out of investing. Healthy markets typically go up and down, but those short-term market changes can stir both excitement and regret.

Some people are more comfortable knowing they could lose money in the short run if there are possible gains in the long run. Others are more conservative, preferring less risk.

To learn about coping with market volatility, watch our video.

You May Like: Should I Transfer 401k To Roth Ira

Can You Stop Your 401k From Losing Money

In a down market, you could transfer all of your holdings to cash or money market funds, that are safe but provide little to no return. This, however, is not often advised . Most retirement savers should continue to contribute to their plan and stick to their strategic asset allocation, since buying the dips should allow the portfolio to grow even larger over the long run.

What About Net Unrealized Appreciation

And one last thing to hit on net unrealized appreciation .

NUA is another benefit to investing in your company stock its a tax break.

To me, the benefit of this tax break is not worth the risk of not properly diversifying your investments.

However, if you want to learn more and form your own opinion, this post from Good Financial Cents provides a solid overview on Net Unrealized Appreciation.

You May Like: How To Get Money Out Of My 401k

Types Of 401 Investments

The most common type of investment choice offered by a 401 plan is the mutual fund. Mutual funds can offer built-in diversification and professional management, and can be designed to meet a wide variety of investment objectives. Be mindful that investing in a mutual fund involves certain risks, including the possibility that you may lose money.

Your 401 plan may offer other types of investments. Some of the more common ones include:

What Kind Of Investments Are In A 401

A 401 plan will typically offer a range of investments, but any single plan may not offer all possible types of investments. The most common investment options include:

- Stock mutual funds: These funds invest in stocks and may have specific themes, such as value stocks or dividend stocks. One popular option here is an S& P 500 index fund, which includes the largest American companies and forms the backbone of many 401 portfolios.

- Bond mutual funds: These funds invest exclusively in bonds and may feature specific kinds of bonds, such as short- or intermediate-term, as well as bonds from certain issuers such as the U.S. government or corporations.

- Target-date mutual funds: These funds will invest in stocks and bonds, and theyll shift their allocations to each based on a specific target date or when you want to retire.

- Stable value funds: These funds invest in low-yield but very safe assets, such as medium-term government bonds, and the returns and principal are insured against loss. These funds are more appropriate for investors near retirement than for younger investors.

Some 401 plans may also allow you to buy individual stocks, bonds, ETFs or other mutual funds. These plans give you the option of managing the portfolio yourself, an option that may be valuable to advanced investors who have a good understanding of the market.

Also Check: Can You Set Up Your Own 401k

The Boring Glory Of Index Funds

Your best bet is to buy something called an index fund and keep it forever. Index funds buy every stock or bond in a particular category or market. The advantage is that you know youll be capturing all of the returns available in, say, big American stocks or bonds in emerging markets.

And yes, buying index funds is boring: You usually wont see enormous day-to-day swings in prices the same way you may if you owned Apple stock. But those big swings come with powerful feelings of greed, fear and regret, and those feelings may cause you to buy or sell your investments at the worst possible time. So best to avoid the emotional tumult by touching your investments

Advantages Of A Solo 401 Llc To Purchase Real Estate

- Receive a customized IRS approved open architecture self-directed solo 401 plan

- Gain the ability to make traditional investments, such as stocks, but also all IRS approved alternative asset investments, such as real estate.

- Help build your retirement nest egg by contributing up to $61,000 per year almost 10 times the maximum contribution amount of an IRA

- Contribute to your plan using pretax or Roth funds. Below, please find a link that discussed the benefits of using Roth funds to purchase real estate

- Borrow up to $50,000 tax- and penalty-free and use those funds for any purpose, whether personal or business

- Invest in what you know and understand without tax, such as real estate, precious metals, tax liens, hard money loans, private businesses, and much more.

- As trustee of the plan, making an investment is as easy as writing a check or executing a wire transfer.

- Generate tax-deferred or tax-free income or gains on your plan investments

- Open your Self-Directed Solo 401 plan at Capital One Bank no need for a special custodian

- Asset & creditor protection

- Purchase real estate with leverage without triggering tax

- Receive an IRS opinion letter confirming the legality of the plan

Donât Miss: How To Close Out Your 401k

Read Also: Can You Transfer An Ira Into A 401k

Tip #: Dont Bet Too Much On Your Employer

To reduce the chances of getting in the unfortunate situation where your company stock has a severe drop or actually becomes worthless, do your homework and learn some things about your companys financial condition before you buy company stock in your 401.

Even if you conclude that the company you work for is in good financial shape, its still a good practice to not put more than 5% or 10% of your 401 funds into your company stock. Just ask the employees of Enron who did this and saw their company stock become worthless.Nothing in life is ever 100% certain, and that certainly includes investing in a 401 plan, but if you follow these time-tested principles of investing, the odds are you will be prepared for a comfortable retirement.

Don’t Try To Time The Market

There’s a reason why you may have heard this many times: Investment professionals show that timing the market or trying to guess when stocks are at their top or bottom is nearly impossible. Research has shown that people who dump stocks during a market downturn are likely to miss the days when the market rises sharply, and that can make a dent in long-term returns.

For instance, one study published by the investment organization CAIA found that a buy-and-hold investor would have an annual return of almost 10% from 1961 to 2015. But an investor who tried to time the market and missed the 25 best days during that period would have an annual return of less than 6%.

To be sure, if an investor managed to avoid the worst 25 days during that period, their annualized return would have been more than 15%. But predicting both the worst and best days of the market is notoriously difficult, which is why investment pros recommend sticking with the “buy and hold” strategy.

Don’t Miss: How To Rollover 401k To Ira Td Ameritrade