You Could Roll It Over Into A New Retirement Account

There are a couple of reasons why you might not want to leave your old 401 where it is. The first is for your own sanity. The more investment accounts you have, the more logins you have to remember, tax documents you have to wait for, and addresses and beneficiaries and email addresses you have to update when those things change.

The second reason is that when you have all your investments in one place, together, its a lot easier for your advisor to help you make sure that your investment portfolio is properly diversified and forecast whether youre on track to hit your goals, like we do for you at Ellevest.

If youre starting up with a new employer that offers a 401 and their plan allows it, then you might be able to combine them by rolling your old 401 over. A rollover might be a good choice if your new 401 has particularly low fees or unique investment options. But if you dont have access to a new 401, or if you want more choices about what kinds of things you invest in or the fees youll have to pay, then you could roll your 401 over into an IRA instead. Heres an article that lists out the pros and cons of those two options.

There arent really any wrong answers no matter what you do with your old 401, the fact that youre thinking about the options and making a decision means youre looking out for Future You. And thats really what this is all about.

Cashing Out A 401 Is Popular But Not So Smart

Intellectually, consumers know that cashing out retirement accounts isnt a smart move. But plenty of people do it anyway. As discussed, you may be forced out of your former plan based on your account balance, but that doesnt mean you should cash the check and use it for non-retirement-related purposes. In the long run, your financial future will be better served by rolling the money over into an IRA or, if applicable, your new employers 401 plan.

A 2020 survey by Alight, a leading provider of human capital and business solutions, found that 4 out of 10 people cashed out their balances after termination between 2008 and 2017. About 80 percent of those who had an account balance of less than $1,000 cashed out, while 62 percent who had balances between $1,000 and $5,000 did the same.

Based on historical rates of return, a $3,000 cash-out at age 24 leads to $23,000 less in your projected account balance at age 67 a total of 5 percent. Even a small amount of money invested into a retirement vehicle today can make a big difference in the long run.

What Determines How Long A Company Can Hold Your 401 After Leaving A Job

The retirement money you have accumulated in your 401 is your money. This gives you the freedom to change jobs without worrying that your savings may get lost in the process. The money can stay in your employerâs retirement plan for as long as you want, but there are certain cases when an employer may force a cash out or rollover the funds into another retirement account.

These factors may determine how long an employer can hold your 401 money after you leave the company:

Also Check: How To Calculate 401k Match

Investing With A 401 K

With a 401 k, you have plenty of investment options. If you plan your investments wisely, you may avoid paying excessive tax on your investments, too. One way of doing this is spreading out your distributions. If you take all of the funds from your 401 k at once, you might be subject to hefty penalties. Just because you have access to the money doesn’t mean you should use it immediately.

Instead, we recommend that you take the money from your 401 k gradually and use it for investing conservatively. This is a great way for you to build up a passive income for your retirement. You don’t have to plan this much in advance, either. If you don’t have much experience in investing, you can even work with a broker. A broker or trader can help you come up with plans for your trading and how they can help you retire more comfortably. Plan to have a source of passive income in your retirement, and you’re unlikely to regret it. It can totally transform your retirement and doesn’t require much effort on your part. What’s more, you can continue investing once you’ve retired. Plan out a strong portfolio now, and the rewards can speak for themselves later.

Leave The Money In Your Former Employers 401

Many companies will let former employees stay invested in their 401 plan indefinitely if there is at least $5,000 in the account. However, if there is less than $5,000 in your account, your old company can cash you out of the account .

In any case, unless your former employers plan has outstanding investment options or unique benefits, leaving your 401 behind rarely makes sense. According to the Bureau of Labor Statistics, the average U.S. worker changes jobs 12 times throughout a career.

If you leave a 401 plan behind at each job, you will have to sort through a trail of plans to figure out what you have at retirement. Additionally, you risk overpaying for too many unnecessary investments.

To be sure, if you have been through a layoff and are not sure of your next move, keeping your 401 funds with a former employer may make sense in the short-term.

You May Like: Can I Borrow Against 401k

Here’s What To Do When Your 401 Is Losing Money

Generally, the best move to make when you see your 401 balance go down is to do nothing at all.

This advice generally echoes investment experts’ guidance when any of your investments are affected by market downturns. Investing is a long-term game you take the short-term dips in exchange for the potential long-term growth, which, history has shown us, is what happens. Though past performance does not predict future performance, historically, any short-term losses have typically been outweighed by larger long-term gains.

“In the long run, stock prices are the world’s way of appraising the value of the underlying companies,” Winsett explains. “In the short term, prices can be chaotically random but over time, prices are firmly rooted in the real value of real companies whose products and services we use regularly, if not daily.”

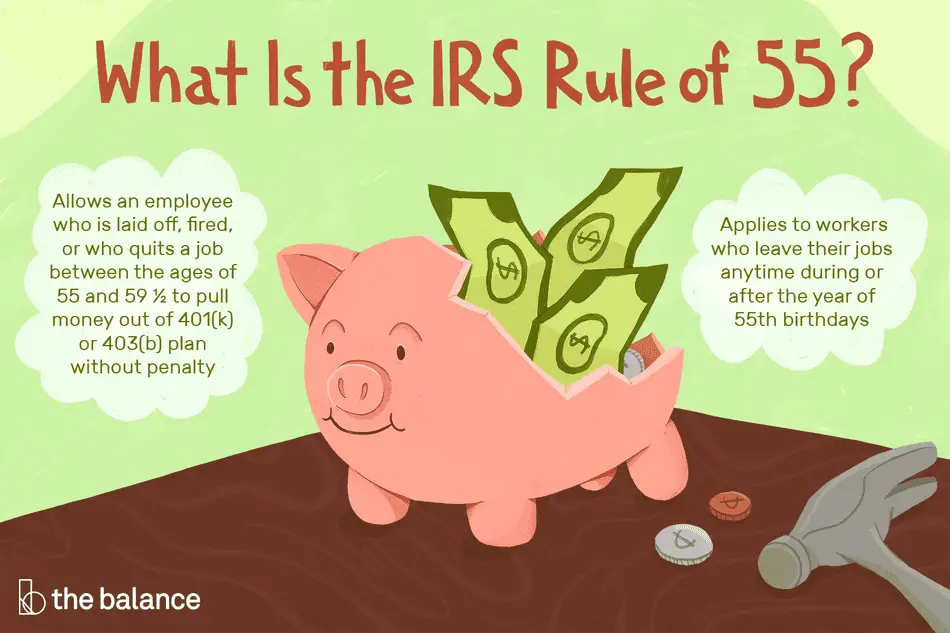

Making an impulsive move like panic selling your 401 investments or withdrawing early from your 401 would have serious consequences. If you sell only to later jump back in the market, you may time it incorrectly and miss out on an upswing, or big recovery gains. Staying invested means as the market recovers, so, too, does your account balance. Dipping into your 401 funds before reaching the age of 59½, meanwhile, entails a 10% early withdrawal penalty on top of it being taxed.

Roll It Over Into A New Retirement Account

You should not leave the old 401 account the way it is with the old employer. Basically, if you have too many investment accounts, you will have more responsibilities.

There will be a lot of tax documents to wait for, as well as email addresses, beneficiaries, and addresses to update when they change. Also, its easier to manage investments when you have all of them in a single place rather than spread across different places.

If you get a new job that also offers you a 401 account option, you can roll over the old 401. This is a great thing to do, especially if the new plan has some unique investment options and lower fees. If there isnt any 401 plan available, you can consider rolling it over into an IRA.

Ramit Sethi, financial expert and author of New York Times bestseller I Will Teach You To Be Richrecommends doing just this:

The majority of people will choose to roll over the 401 funds into an IRA, or individual retirement account. From a tax benefit standpoint, the IRA works in a similar manner to the 401, minus the contribution from your employer, of course. And since its a personal IRA, you have full control of the account and investments.

Recommended Reading: How Long Do I Have To Rollover A 401k

If You’re Younger In Your Career

Your best bet is to leave your 401 account alone and continue making contributions as normal. This guidance is even more important for younger 401 savers who still have a long way to go before retirement and therefore have time to wait out any market dips their accounts can recover and bounce back long before they enter their nonworking years.

“For investors who have long runways ahead of them, market declines can provide great opportunities,” Winsett points out, suggesting that there are a couple of items younger investors should consider. If you have excess fixed income or cash holdings, it can provide a great opportunity to rebalance capital into equities at discounted prices. Or, if you’re contributing to your 401 on a regular basis through your paycheck, you may want to consider increasing your contribution rate so more money can be deployed during a market decline.

If you’re young and still worried, make sure you know where your 401 money is being invested to make sure the risk is something you can afford taking on, as employers will usually automatically assign a 401 portfolio based on your age and target retirement date. Remember that you can always consult your 401 plan provider for help.

What To Know About 401 Vesting When Changing Jobs

Reading time: 3 minutes

Vesting refers to the ownership of the contributions made into a 401 by employees and their employers. Vested funds are any funds you, the employee, own. The contributions you make are always 100% vested, but the vested percentage of your employer’s contributions depends on the amount of time you were employed by the company. When you are fully vested, you have the right to keep the employer’s contributions whether you willfully leave or your employer terminates you.

If your retirement strategy includes a 401 and you plan to leave your job in the near future, you need to understand the plan’s vesting schedule. If you leave your current job to pursue new career opportunities, you’ll generally still have access to your former employer’s 401. However, the vesting schedule may influence when you decide to leave. If you’re not yet fully vested, it may be in your best interest to postpone your departure until you are. That way, you can walk away with 100% of the employer’s contributions. In other words, if you leave too soon, you may have to forfeit a portion of your 401 balance that was contributed by your employer.

Also Check: Can I Use My 401k To Pay Off Irs Debt

Leave It With Your Former Employer

If you have more than $5,000 invested in your 401, most plans allow you to leave it where it is after you separate from your employer. If you have a substantial amount saved and like your plan portfolio, then leaving your 401 with a previous employer may be a good idea. If you are likely to forget about the account or are not particularly impressed with the plans investment options or fees, consider some of the other options.

If you leave your 401 with your old employer, you will no longer be allowed to make contributions to the plan.

Your 401 K And Income Tax

You may be wondering if your 401 k is subject to income tax. Once you’ve withdrawn the money from the 401 k, you need to pay tax on it. It is considered part of your taxable estate. This is why you must check the terms of your 401 k before you get any money from it. Terms like these should be clearly outlined in the plan. Withdrawing funds without understanding the implications of doing so is one common mistake that people make when changing employers in the USA. It’s important to consider the other options you have.

If you’re changing employers, you still have plenty of time to build up passive capital via investment and your 401 k. You’re unlikely to get much out of rushing into a decision that you aren’t completely ready for. Roll all of the funds out of your 401 k at once, and you might end up drowning in taxes.

Don’t Miss: What Happens With My 401k When I Quit

Generally The Best Move You Can Make When Your 401 Balance Drops Is To Leave Your Account Alone

Selects editorial team works independently to review financial products and write articles we think our readers will find useful. We earn a commission from affiliate partners on many offers, but not all offers on Select are from affiliate partners.

While contributing a portion of every paycheck toward your employer-sponsored 401 plan is undoubtedly a smart way to save for retirement, it can be quite concerning when you see your balance drop.

First, know that this situation is completely normal. The money in your 401 is invested in the market, meaning it’s exposed to everyday fluctuations and can both gain and lose value in accordance with stock market performance.

“As investors in mainstream publicly traded equities, you are likely gaining broad exposure through your 401 and there will be periods of time where you go through declines, as we have since markets started correcting in late 2021,”Austin Winsett, certified public accountant and financial advisor at Exencial Wealth Advisors, tells Select.

Although 401 balances can experience drops, the good news is most plans are designed to protect your funds against any large losses. They’re also naturally diversified, meaning your 401 money is invested in things like mutual funds, index funds, target-date funds and exchange-traded funds versus individual stocks, so your risk is more spread out.

Our best selections in your inbox. Shopping recommendations that help upgrade your life, delivered weekly. Sign-up here.

Take Distributions From The Old 401

After youve reached 59½, you may withdraw funds from your 401 without paying a 10% penalty.

You may have decided to retire and are considering withdrawing funds from your account. If youre retiring, it may be a good time to start drawing on your savings for income. Youll have to pay tax at your regular rate on any distributions you take out of a traditional 401. Annuities are a reliable tool for spending your 401 without running out of money.

If you have a designated Roth 401, any payments you take after 59 1/2 are tax-free if youve held the account for at least five years. Only the earnings portion of your distributions is taxed if you do not fulfill the five-year requirement.

When you reach age 72, you must begin taking RMDs from your 401 if you leave your employment. The amount of your RMD is determined by your expected life span and 401 account balance.

Read Also: What’s A Good Percentage For 401k

Move The Money To A New Employers 401

If you are starting a new job that offers a 401 plan, you may have the option to bring your old plan over and consolidate it with the new one without taking a tax hit. If the new plan has great investment options, this might be a great move.

You also keep your retirement funds growing in one place, which makes it easier to manage over time.

Plus, if your new employer offers 401 plan loans, there is a more substantial balance to borrow against.

What Happens To Your 401 When You Quit

Look whats that? Oh hey, its the bright future ahead of you now that youve left that old job behind. Time to move on to new opportunities whether theyre waiting for you right now, or youre about to take some time to discover your next step.

But theres one slice of your old job hanging out in your periphery that employers 401, and all your money invested in it. So whats going to happen to that account, and what do you need to do next?

Read Also: What Is The Max Percentage For 401k

Roll It Over To Your New Employer

If youve switched jobs, see if your new employer offers a 401, when you are eligible to participate, and if it allows rollovers. Many employers require new employees to put in a certain number of days of service before they can enroll in a retirement savings plan. Make sure that your new 401 account is active and ready to receive contributions before you roll over your old account.

Once you are enrolled in a plan with your new employer, its simple to roll over your old 401. You can elect to have the administrator of the old plan deposit the balance of your account directly into the new plan by simply filling out some paperwork. This is called a direct transfer, made from custodian to custodian, and it saves you any risk of owing taxes or missing a deadline.

Alternatively, you can elect to have the balance of your old account distributed to you in the form of a check, which is called an indirect rollover. You must deposit the funds into your new 401 within 60 days to avoid paying income tax on the entire balance and an additional 10% penalty for early withdrawal if youre younger than age 59½. A major drawback of an indirect rollover is that your old employer is required to withhold 20% of it for federal income tax purposesand possibly state taxes as well.