Take A Cash Withdrawal

Partial, total, and systematic cash withdrawals allow you to receive income only as you need it and provide a high degree of flexibility. Your remaining accumulations continue to be tax-deferred until you take a distribution, and will continue to experience the investment performance of your chosen funds. See Cash Withdrawals and Loans for details. Keep in mind the following:

-

Income tax is due on cash withdrawals.

-

Your contributions and earnings are available for cash withdrawal at any age once you have terminated employment with the University.

-

University contributions and earnings are available for cash withdrawal at age 55 or older once you have terminated employment, or at any age as an official University of Michigan retiree .

Debt Relief Without Closing My 401k

Before borrowing money from your retirement account, consider other options like nonprofit credit counseling or a home equity loan. You may be able to access a nonprofit debt management plan where your payments are consolidated, without having to take out a new loan. A credit counselor can review your income and expenses and see if you qualify for debt consolidation without taking out a new loan.

8 MINUTE READ

What’s The Maximum I Can Request To Withdraw From My Account

The maximum you can request to withdraw from your account online or by telephone is $100,000 per account. To request a withdrawal greater than $100,000, you must complete a paper form. You can obtain a copy of that form by going to Customer Service > Find a Form, or by contacting a Fidelity representative at 800-544-6666. If you’ve changed your mailing address within the past 15 days, the most you can request to withdraw by check online or by telephone is $10,000.

Read Also: How Many Loans Can I Take From My 401k

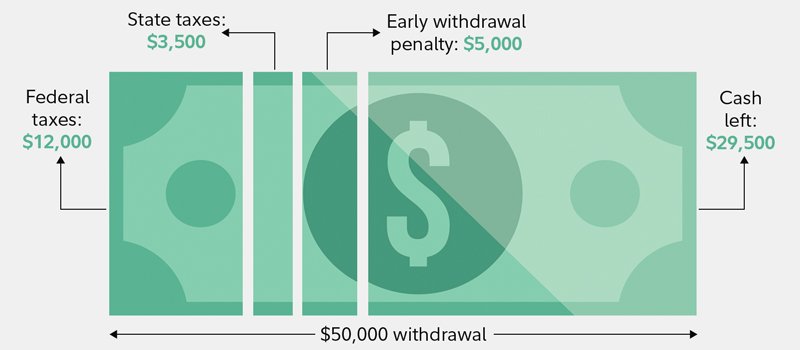

Three Consequences Of A 401 Early Withdrawal Or Cashing Out A 401

Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw $10,000 from your 401 at age 40, you may get only about $8,000. Keep in mind that you might get some of this back in the form of a tax refund at tax time if your withholding exceeds your actual tax liability.

The IRS will penalize you. If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 of that $10,000 withdrawal. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

It may mean less money for your future. That may be especially true if the market is down when you make the early withdrawal. If youre pulling funds out, it can severely impact your ability to participate in a rebound, and then your entire retirement plan is offset, says Adam Harding, a certified financial planner in Scottsdale, Arizona.

For 401 or employer sponsored account participants 1-800-835-5097 to speak with a representative on your organizations plan.

Additionally, what are Fidelity customer service hours? These departments have specific phone numbers

| Existing policies Mon.Wed., 8 a.m. to 8 p.m. ET ThF, 8 a.m. to 5 p.m. ET | 888-343-8376, enter 3 |

|---|---|

| New policies Mon.Fri., 8 a.m. to 8 p.m. ET | 800-642-6904 |

Subsequently, one may also ask, what is Fidelity NetBenefits?

Does Fidelity have online chat?

Early Money: Take Advantage Of The Age 55 Rule

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer you just left. Money that is still in an earlier employers plan is not eligible for this exceptionnor is money in an individual retirement account .

If your account is between $1,000 and $5,000, your company is required to roll the funds into an IRA if it forces you out of the plan.

Recommended Reading: How Do I Sign Up For 401k

Read Also: Is Rolling Over 401k To Ira Taxable

How Long Do I Have To Deposit The Check

You should deposit the check you get right away. Even if the check is made out to your IRA provider , you should try to do it within 60 days of receiving it.

Get a prepaid envelope sent directly to your door with a tracking number! Start a rollover with Capitalize and well send you a prepaid priority mail envelope with detailed instructions to make sure your rollover is transferred successfully. Get started

Option : Leave Your 401 Where It Is

Even if you are returning to your home country, you can choose to leave your 401 with your employer in the US until you reach the age of 59 ½. This will help you defer taxes until withdrawal or accumulate tax-free growth if you selected a Roth 401. Some employers wont allow you to leave your 401 behind especially if your balance is less than $1,000. From the day you leave your job, you have 60 days to decide if you want to roll over your 401 to IRA.

Related Article: Whats The Difference Between A 401 and an IRA?

Leaving your 401 as is can have some downsides. Within a 401 plan, your investment options may be limited. In addition, if your employer decides to terminate the plan, youll have either withdraw the funds or rollover the funds to an individual retirement account . Make sure that your 401 plan can communicate with you by email or mail once you have returned to your home country so that you get adequate notice of any changes. And keep track of your 401s over your lifetime, as you may have several employers and it can be hard to keep track of all the plan sponsors and logins.

Related Article: The Tax Trick That Will Get An Extra $37,000 Into Your Roth IRA Every Year

You May Like: How To Fund A Solo 401k

What You Can Do To Maximize Your Earning Potential

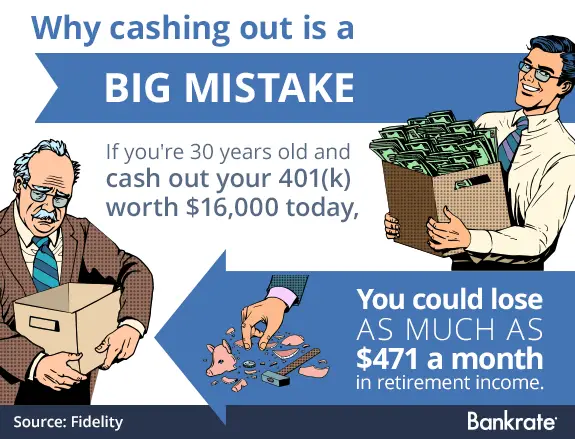

Resist the temptation to cash out. Instead, roll over your account balance into your current retirement plan. Consolidating your retirement plan assets may make account management easier and keeps your money working for you until retirement.

Please note that there may be some reasons why you would not want to consolidate accounts, including that you are comfortable with the existing plan and think it is a good one and your new plan offers fewer investment options or investment options that dont meet your needs.

Keep your retirement savings working for you. Take advantage of account consolidation.

1 Eliminating Friction and Leaks in Americas Defined Contribution System, Boston Research Group, April 2013.

2 Income taxes are due on contributions and earnings from pre-tax accounts. Income taxes are not due on earnings from after-tax Roth accounts, provided the account has met the following conditions: 1) five-year holding period, and 2) one of these qualifying events: age 59½, disability, or death. For more information, consult a qualified tax advisor.

3 If your current plan does not allow rollovers in, you also have the option to roll over the money into an IRA, which will preserve the power of tax-deferred potential growth for you.

Variable products are co-distributed by affiliates Equitable Advisors, LLC and Equitable Distributors, LLC. Equitable, Equitable Advisors, and Equitable Distributors do not provide tax or legal advice.

Report The Rollover On Your Taxes

In a direct rollover, you shouldnt owe any additional taxes, but you need to report the transaction on your taxes. If you roll over a 401k to an IRA, you should expect a 1099-R form from your 401k plan provider. This is the form youll use to report a direct rollover to the IRS. Fidelity will also send you a 5498 form if your rollover was a direct one. Simply add that information to your tax return at the end of the year.

More on 401k Investments:

You May Like: How Do You Roll Over Your 401k

Read Also: What Happens To My 401k If I Switch Jobs

What Proof Do You Need For A Hardship Withdrawal

Documentation of the hardship application or request including your review and/or approval of the request.Financial information or documentation that substantiates the employees immediate and heavy financial need. This may include insurance bills, escrow paperwork, funeral expenses, bank statements, etc.

How To Designate A Charity As The Beneficiary Of An Ira Or 401

When youre ready, making a charity the beneficiary of your IRA or other retirement assets is typically straightforward: Fill out a designated beneficiary form through your employer or your plan administrator. Most banks and financial services firms also have beneficiary forms, or they can provide you with suggested language for naming beneficiaries to these accounts. Once the designated beneficiary forms are in place, the retirement assets will generally pass directly to your beneficiaries without going through probate.

If you are married, ask the plan administrator whether your spouse is required to consent. If required but not done, this could result in a disqualification of the charity as your beneficiary.

Be clear about your wishes with your spouse, lawyer and any financial advisors, giving a copy of the completed beneficiary forms as necessary.

TIP: If your goal is to support charity as part of your legacy while also leaving assets to family members, it may be more tax efficient to leave cash and appreciated assets to heirs, while making charities the beneficiaries of retirement assets upon your death.

Recommended Reading: How To Set Up A 401k Plan

Expecting Relatively Large Long

Spreading traditional IRA withdrawals out over the course of retirement lifetime may make sense for many people. However, if an investor anticipates having a relatively large amount of long-term capital gains from their investmentsenough to reach the 15% long-term capital gain bracket thresholdthere may be a more beneficial strategy: First, use up taxable accounts, then take the remaining withdrawals proportionally.

The purpose of this strategy is to take advantage of zero or low long-term capital gains rates, if available based on ordinary income tax brackets. Tax rates on long-term capital gains are 0%, 15% or 20% depending on taxable income and filing status. Assuming no income besides capital gains, and filing single, the total capital gains would need to exceed $40,400 after deductions, before taxes would be owed.

Tax rates: Singles

| 20% |

One strategy for retirees to help reduce taxes is to take capital gains when they are in the lower tax brackets. For example, single filers with taxable income less than $40,400 are in the 2 lower tax brackets. That equates to a 0% tax on capital gains. If taxable income is between $40,401 and $445,850, long-term capital gains rate is 15%. Remember, the amount of ordinary income impacts long-term capital gain tax rates.

The big difference: Jamie pays zero on her long-term capital gains because her income is below that key threshold of $40,400, but David pays 15% on his $5,000 because of his higher earnings.

| $995 | $5,414 |

Withdrawing From A Roth 401k

Most 401k plans involve pre-tax contributions, but some allow for Roth contributions, meaning those made after taxes already have been paid.

The benefit of making a Roth contribution to your 401k plan is that you already have paid the taxes and, when you withdraw the money, there is no tax on the amount gained as long as you meet these two provisions:

- You withdraw the money at least five years after your first contribution to the Roth account

- You are older than 59 ½ or you became disabled or the money goes to someone who is the beneficiary after your death

Read Also: What Is Max Amount To Contribute To 401k

Don’t Miss: How To Find Out Whats In Your 401k

How To Roll Over Your Fidelity 401k

Rolling over your Fidelity 401k is simpler than you might think. You and Your 401K

Leaving a job or getting laid off usually prompts a period fraught with tough choices and big changes. In the midst of everything else, managing your old 401k might be the last task you want to deal with.

The good news is, if your 401k is with Fidelity, the process for completing your rollover is actually simple and quite painless. You can convert your employer-sponsored 401k to an IRA or even move it into the 401k account of your new employer rather seamlessly if you know the correct steps to take.

You May Like: How To Avoid Taxes On 401k

Withdrawing Money From A 401 After Retirement

Once you have retired, you will no longer contribute to the 401 plan, and the plan administrator is required to maintain the account if it has more than a $5000 balance. If the account has less than $5000, it will trigger a lump-sum distribution, and the plan administrator will mail you a check with your full 401 balance minus 20% withholding tax.

Before you can start taking distributions, you should contact the plan administrator about the specific rules of the 401 plan. The plan sponsor must get your consent before initiating the distribution of your retirement savings. In some 401 plans, the plan administrator may require the consent of your spouse before sending a distribution. You can choose to receive non-periodic or periodic distributions from the 401 plan.

For required minimum distributions, the plan administrator calculates the amount of distribution for the qualified plans in each calendar year. The 401 may provide that you either receive the entire benefits in the 401 by the required beginning date or receive periodic distributions from the required date in amounts calculated to distribute the entire benefits over your life expectancy.

Recommended Reading: Can You Take Money Out Of 401k

Early Withdrawals From Roth Retirement Accounts

You may be able to withdraw funds from Roth retirement accounts early without penalties, too.

In general, you can withdraw only the money you contributed without paying taxes or penalties. This is because you already paid income taxes on this money.

Things get more complicated if you withdraw earnings early. In some cases, you can withdraw earnings penalty and income tax free, too.

To withdraw earnings from a Roth IRA without paying penalties or income tax, you must take the withdrawal:

- at least five years or more after you open the account, and

- be withdrawing money because you suffered a disability, or

- youre using up to $10,000 for a first home purchase within 120 days of withdrawal.

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Read Also: How Much Can I Put In 401k

How The Rollover Is Done Is Important Too

Whether you pick an IRA for your rollover or choose to go with your new employer’s plan, consider a direct rolloverthats when one financial institution sends a check directly to the other financial institution. The check would be made out to the bank or brokerage firm with instructions to roll the money into your IRA or 401.

The alternative, having a check made payable to you, is not a good option in this case. If the check is made payable directly to you, your employer is required by the IRS to withhold 20% for taxes. As if that wouldn’t be bad enoughyou only have 60 days from the time of a withdrawal to put the money back into a tax-advantaged account like a 401 or IRA. That means if you want the full value of your former account to stay in the tax-advantaged confines of a retirement account, you’d have to come up with the 20% that was withheld and put it into your new account.

If you’re not able to make up the 20%, not only will you lose the potential tax-free or tax-deferred growth on that money but you may also owe a 10% penalty if you’re under age 59½ because the IRS would consider the tax withholding an early withdrawal from your account. So, to make a long story short, do pay attention to the details when rolling over your 401.

Common 401 Loan Questions

Can I borrow against my 401? Check with your plan administrator to find out if 401 loans are allowed under your employers plan rules. Keep in mind that even though youre borrowing your own retirement money, there are certain rules you must follow to avoid penalties and taxes.

How much can I borrow against my 401? You can borrow up to 50% of the vested value of your account, up to a maximum of $50,000 for individuals with $100,000 or more vested. If your account balance is less than $10,000, you will only be allowed to borrow up to $10,000.

How often can I borrow from my 401? Most employer 401 plans will only allow one loan at a time, and you must repay that loan before you can take out another one. Even if your 401 plan does allow multiple loans, the maximum loan allowances, noted above, still apply.

What are the rules for repaying my 401 loan? In order to be compliant with the 401 loan repayment rules, youll need to make regularly scheduled payments that include both principal and interest, and you must repay the loan within five years. If youre using your 401 loanto buy a primary residence for yourself, you may be able to extend the repayment period. What if I lose my job before I finish repaying the loan? If you leave or are terminated from your job before youve finished repaying the loan, you typically have 60 days to repay the outstanding loan amount.

Summary of loan allowances

Recommended Reading: How Old To Start A 401k