Can You Have A Roth Ira And A Roth 401

It is possible to have both a Roth IRA and a Roth 401 at the same time. However, keep in mind that a Roth 401 must be offered by your employer in order to participate. Meanwhile, anyone with earned income can open an IRA, given the stated income limits.

If you dont have enough money to max out contributions to both accounts, experts recommend maxing out the Roth 401 first to receive the benefit of a full employer match.

A Couple Of Added Thoughts

Like a traditional 401and unlike a Roth IRAyou do have to take a required minimum distribution from a Roth 401 unless you’re still working for that employer. The SECURE ACT of 2019 raised the age for taking an initial RMD to 72 beginning in 2020 for individuals not already 70½ .

It’s possible to eliminate that requirement by rolling over your Roth 401 into a Roth IRA. But before you make that decision, you should carefully consider others factors such as fees, legal protection, loan provisions and other particulars of each account.

If you’re thinking even farther ahead to estate planning, inheriting money in a Roth could be good news for your heirs because, provided the Roth 401 is at least 5 years old, they wouldn’t have to pay income taxes on the distributions from an inherited Roth.

It’s great that you have a choiceand the best choice of all may be to invest in both types of accounts. Whatever you decide, you’re already planning and saving for retirement. And that’s the best decision of all.

Roth 401 Meet Roth Ira’s More Versatile Big Brother

While you may have heard of the Roth IRA, thereâs a bigger and stronger retirement feature available in many 401 plans called the Roth 401. It can be a great way to protect your future savings against tax rate increases and/or climbing into a higher tax bracket in retirement.

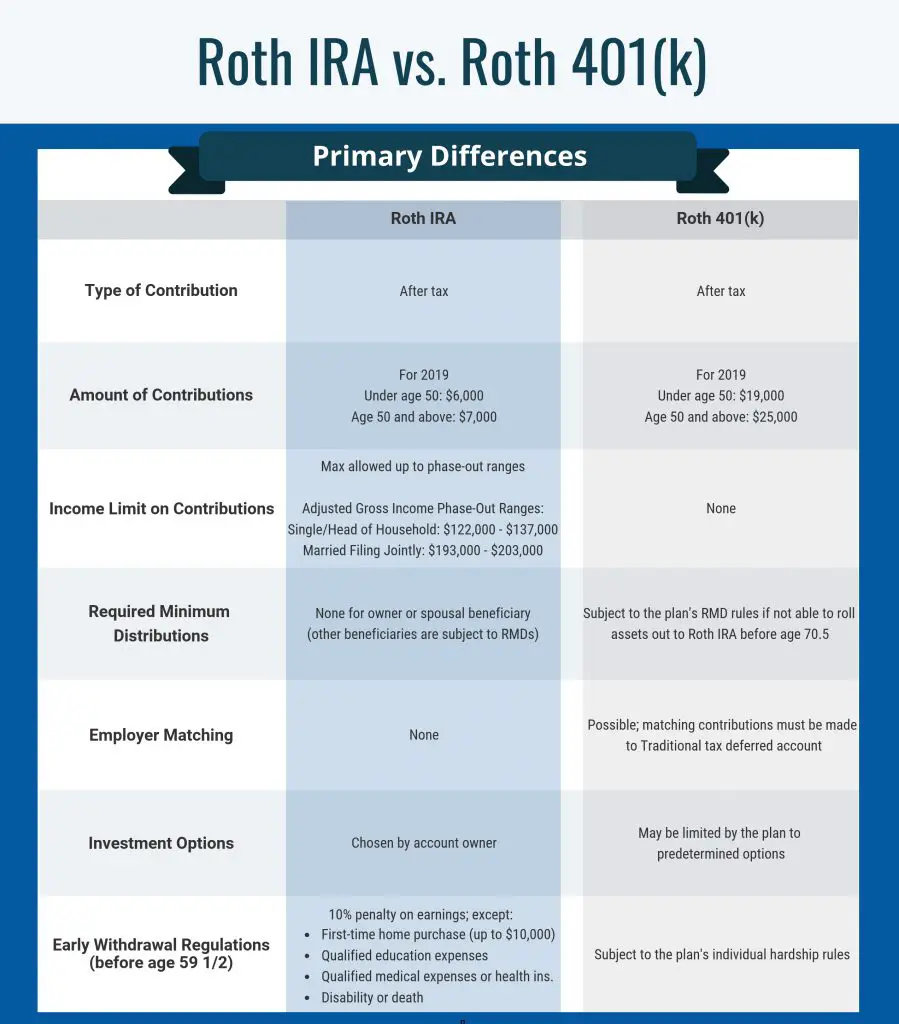

Contrary to popular belief, the Roth 401 isnât a new plan â itâs simply a feature available in a 401, and it can help you save more retirement dollars than its little brother, the Roth IRA. You can choose to put some, none or all your contributions after-tax into your Roth 401, saving up to $20,500 in 2022, or $27,000 if you are 50 years of age or older. Compare this to the Roth IRA, which only allows a maximum contribution up to $6,000 in 2022 .

Roth 401 vs. Roth IRA

| Attributes | |

|---|---|

| None | $144,000* |

Roth tax rules are the exact opposite of how traditional tax-deferred 401 contributions work. Your tax-deferred contributions will be taxed when you withdraw the money at retirement however, you receive no tax deduction on Roth contributions. The benefit is that your Roth withdrawals can be taken tax-free when you reach retirement.

Itâs important to note that any employer match or profit sharing into your 401 will always be on a tax-deferred basis as required by law.

If you donât have the Roth option in your company 401 plan, itâs a great idea to request it. This typically requires an amendment to the plan thatâs a minor cost to the business owner.

Also Check: How To Use Your 401k To Buy A Business

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

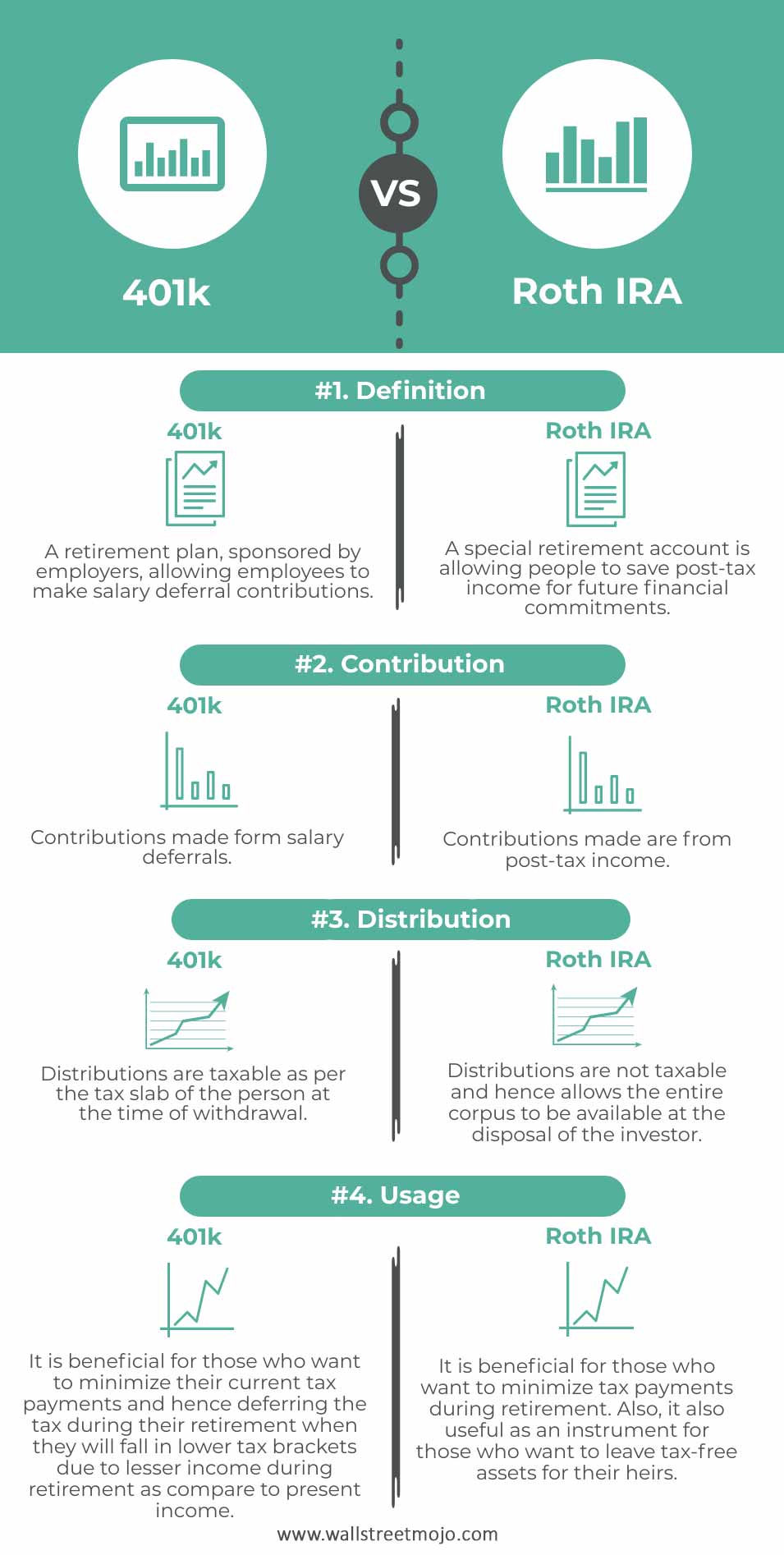

Advantages Of A Roth Ira

Here are some advantages a Roth IRA has over a 401:

- Tax-free growth. Unlike a 401, you contribute to a Roth IRA with after-tax money. Translation? Since you invest in your Roth IRA with money thats already been taxed, the money inside the account grows tax-free and you wont pay a dime in taxes when you withdraw your money at retirement. And heres the deal: Once youre ready to retire, the majority of the money in your Roth will be growth. So, no taxes on that growth means hundreds of thousands of dollars stay in your pocket. Thats worth a happy dance!

- More investing options. With a Roth IRA, youre not limited by some third-party administrator deciding which funds you can invest inyou literally have thousands of mutual funds to pick and choose from. When you have more options, you have more power to make good choices!

- Not tied to your employer. Unlike a workplace retirement plan, you can open a Roth IRA at any time. And no matter what your employment situation is, it doesnt affect your Roth IRA at all. No need to roll over anything or worry about keeping track of a pile of 401s you left behind from old jobs!

- No required minimum distributions . With a Roth IRA, you can keep your money in the account forever if youd like. That means you can let more of your money keep growing over a longer period of time!

You May Like: When Can You Use Your 401k

When A Roth Ira Is A Good Retirement Savings Option

If you are self-employed, work for a company that doesnt offer a 401 plan, or you are older, investing in a Roth IRA is a great option. You can also take out your money by the time youre 59.5 years old and leave it in the account if youre older than 70 without penalty.

Overall, however, investing in a 401 plan tends to be the better option. Many employers offer 401 planssome will even match your 401 savings each year. You may not have the biggest options for mutual funds out there, but you wont have to worry about managing your investments, as a third party will do this for you. Once you reach 50 years old, you can contribute an additional $6,000 each year. 401s also do not discriminate against income, unlike Roth IRAs, which have strict income guidelines to be eligible to contribute.

What Are The Pros And Cons Of An Ira

The IRA offers a similar variety of pros and cons. Here are the most important:

Pros of an IRA

- Available to anyone with earned income

- Non-earning spouses can contribute, too

- Wide array of investment options

- Easy to set up traditional or Roth versions

- A Roth IRA is great for estate planning

- A Roth IRA offers flexibility, including penalty-free withdrawals of contributions

Cons of an IRA

- Deductibility of contributions is limited due to income

- No investment advice

Recommended Reading: How To Roll My 401k Into An Ira

How To Decide: Pre

When a 401 or 403 retirement plan offers both pre-tax and Roth as deferral sources, employees can usually choose pre-tax, Roth, or a combination of both contribution types. These are separate sources of money to save within your retirement plan account.

Its very common to advise younger people to invest through a Roth savings option, whether thats an IRA, a 401, or a 403, because its generally assumed that they are in a lower income tax bracket than they will be later in their careers. Another benefit for younger folks is that they can take advantage of compound interest, knowing that all that growth is tax-free.

But the relationship between age and tax bracket isnt quite that simple. Wed rather talk about your tax rate now compared to your expected withdrawal tax rate. We also like to consider this question annually and think about diversification, since contributing to your retirement isnt an all-or-nothing decision, nor is it a once-and-done decision.

Its not a given that your tax rate now will be lower than what you can expect in the future. Investing in both traditional and Roth savings is a way to hedge against an inaccurate prediction of your future tax rate. Plus, since higher income earners cant participate in a Roth IRA, participating in a company-sponsored 401 or 403 offering Roth gives higher-income employees the chance to take advantage of its after-tax benefits.

Why We Recommend The Roth 401

If youre investing consistently every monthwhether its in a Roth 401, a traditional 401 or even a Roth IRAyoure already on the right track! The most important part of wealth building is consistent saving every month, no matter what the market is doing.

But if youve got a choice between a traditional 401 and a Roth 401, we’d go with the Roth every single time! Weve already talked through the differences between these two types of accounts, so youre probably already seeing the benefits. But just to be clear, here are the biggest reasons the Roth comes out on top.

Don’t Miss: Is It Too Late To Start A 401k

If Your Employer Offers A 401 Match

1. Contribute enough to earn the full match. Check your employee benefits handbook. If you see that your employer matches any portion of the money you contribute to the company 401 plan, do not bypass this opportunity to collect your free money.

A company matching program is one of the biggest benefits of a 401. It means that your employer contributes money to your account based on the amount of money you save, up to a limit. A common arrangement is for an employer to match a portion of the amount you save up to the first 6% of your earnings.

Even if a 401 has limited investment choices or higher-than-average fees, carve out enough money from your paycheck to get the full company match, as its effectively a guaranteed return on those dollars. Also note that employer contributions dont count toward the 401 annual contribution limit.

2. Next, contribute as much as youre allowed to an IRA. Depending on which type of IRA you choose Roth or traditional you can get your tax break now or down the road when you start withdrawing funds for retirement.

-

A traditional IRA is ideal for those who favor an immediate tax break. Contributions may be deductible that means your taxable income for the year will be reduced by the amount of your contribution. But, if you’re also covered by a 401, your deduction may be reduced or eliminated based on income. If you has a workplace retirement plan, check out the IRA limits.

Mr ‘big Short’ Makes A Serious Accusation

However, for a Roth 401, the five-year clock is computed on a plan-by-plan basis. In other words, the participant receiving a distribution must have started making Roth contributions to that plan at least five years ago. This means employees with Roth 401 dollars in separate plans have separate clocks.

Non-qualified distributions. When a Roth IRA distribution is not qualified, favorable ordering rules apply. The first distributions made are considered to be contributions, up to the amount of contributions made no matter where the distributions actually come from. This is good news because Roth IRA contributions always come out tax and penalty-free. The next distributions are considered to be conversions, which are always tax-free but may be subject to penalty. Only then are earnings, which are taxable and possibly subject to penalty, considered to be distributed. The result is that in many cases, even a clients non-qualified Roth IRA distribution will be tax-free.

When a Roth 401 distribution is not qualified, the less favorable pro-rata rule applies, usually resulting in a portion of the distribution becoming taxable. The taxable portion is the amount of the distribution multiplied by the taxable fraction. That fraction is the amount of earnings in the Roth 401 account divided by the total Roth account balance.

Accessibility. Roth IRAs can be withdrawn at any time. Not so with Roth 401s, which are not available for in-service withdrawal before age 59 ½ .

Also Check: How To Change 401k Contribution On Fidelity

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Set Yourself Up For Retirement

Both traditional and Roth IRAs offer tax incentives and are investment vehicles that can help you save for retirement.

Still, according to a 2017 census, nearly half of adults ages 55 to 66 had no personal retirement savings. Zero! Dont let that be you. The earlier you start saving for retirement, the more time you give compound interest to work. And the more you invest now, the less youll have to worry about it later.

If youre ready to open a retirement account, or you already have a retirement account but dont know what to do with it now, learn how to invest today and start growing your wealth!

And while youre at it, take this Retirement Quiz to see where your finances are at and determine how prepared you are for retirement.

When you know how to make smart investments with your retirement savings, you can watch your wealth grow and be confident that your retirement is secure.

Read Also: How To Withdraw 401k From Previous Employer

What Kinds Of Mutual Funds Should I Choose For My Roth 401

Diversifying your portfolio is key to maintaining a healthy amount of risk in your retirement savings. Thats why it’s important to balance your investments among four types of mutual funds: growth and income, growth, aggressive growth, and international funds.

If one type of fund isnt performing as well, the other ones can help your portfolio stay balanced. Not sure which funds to select based on your Roth 401 options? Sit down with an investment professional who can help you understand the different types of funds so you can choose the right mix.

Vs Roth : Which One Is Better

12 Min Read | Apr 25, 2022

If youve read through your companys benefit package lately, you probably noticed a new option when it comes to saving for retirement: the Roth 401.

Just over the last five years, the number of plans offering a Roth 401 has skyrocketed. About 3 out of 4 workplace retirement plans now offer a Roth optionwhich is great news for you!1

Younger savers are starting to take advantage of this new option and the tax benefits that come with it. In fact, Gen Z is now the most likely group to put money in their Roth 401 at work.2

How about you? If you have a choice between a Roth and traditional 401 at work, which one should you choose? Lets dig into some of the differences between these options so you can make the best decision.

Also Check: Can I Open A 401k On My Own

When Traditional Could Be The Way To Go

While a Roth is a good choice for many people, its not best for everyone. Here are two examples where pretax contributions, such as to a Traditional 401 or a Traditional IRA, may be a better strategy:

1. You are in your peak earning years. When you retire, you might eliminate expenses, such as mortgage payments or college costs. Additionally, withholdings for payroll taxes and retirement contributions will go away. As a result, your income from Social Security and the amount you need to draw from retirement accounts likely will be less than what you earn today. So your federal tax bracket could be lower in retirement. Your state tax rate also could decrease, for example, if you move to an income tax-free state.

In this case, taking the tax benefit now with a Traditional contribution may make more sense than the Roth contribution. Youll reduce your current taxable income while paying a higher tax rate and then make withdrawals at a potentially lower tax rate later in retirement.

2. You are struggling to save. The Traditional pretax approach may enable you to get your employers full 401 match with less impact on your take-home pay. This is because taxable income is reduced by the amount of your contribution.

Can You Invest In Both A 401 And A Roth Ira

So which is right for you: Roth IRA vs. 401? Heres the great news: you can have both. Even if your employer offers a 401, you can open a Roth IRA and contribute up to the maximum allowed for each account. If saving for retirement is a high priority for you, this can be a good way to maximize the amount you can invest.

If your employer offers matching contributions, you may want to contribute enough to get the full match, and then invest in a Roth IRA. If youre able to fully fund the Roth IRA, you can put any additional deposits into the 401, up to the annual limit.

If your employer doesnt match contributions, consider funding a Roth IRA first and then contributing to your 401 once youve reached the annual maximum.

Don’t Miss: What Is The Best Percentage To Put In 401k