What Do I Do With My 401 If I Leave My Job

If you’re older than 55 and are no longer employed, you can start withdrawals from your 401 without penalties. If you’re under age 55, you may be able to keep the 401 with your previous employer or move it to a new employer’s plan when you start working again. Talk to the plan administrator about your options. No matter what, don’t abandon your 401 when you change employers.

The Cares Act And 401k Withdrawal

The CARES Act was signed into law in 2020 to help provide financial stability and relief for individuals and businesses affected by COVID-19. As a result, it has implications on making 401 withdrawals. Under the CARES Act, early 401 withdrawal penalties are eliminated for qualified individuals making withdrawals up to $100,000 for coronavirus related distributions.

While the CARES Act eliminates early 401 withdrawal penalties, income tax on the distributions of pre-tax assets would still be owed but could be paid over a three-year period. Individuals could “recontribute” the funds to a retirement account within three years without regard to contribution limits.

Your Retirement Money Is Safe From Creditors

Did you know that money saved in a retirement account is safe from creditors? If you are sued by debt collectors or declare bankruptcy, your 401k and IRAs cannot be liquidated by creditors to satisfy bills you owe. If youre having problems managing your debt, its better to seek alternatives other than an early withdrawal, which will also come with a high penalty.

Recommended Reading: How To Take Your 401k With You

Generally The Best Move You Can Make When Your 401 Balance Drops Is To Leave Your Account Alone

Selects editorial team works independently to review financial products and write articles we think our readers will find useful. We earn a commission from affiliate partners on many offers, but not all offers on Select are from affiliate partners.

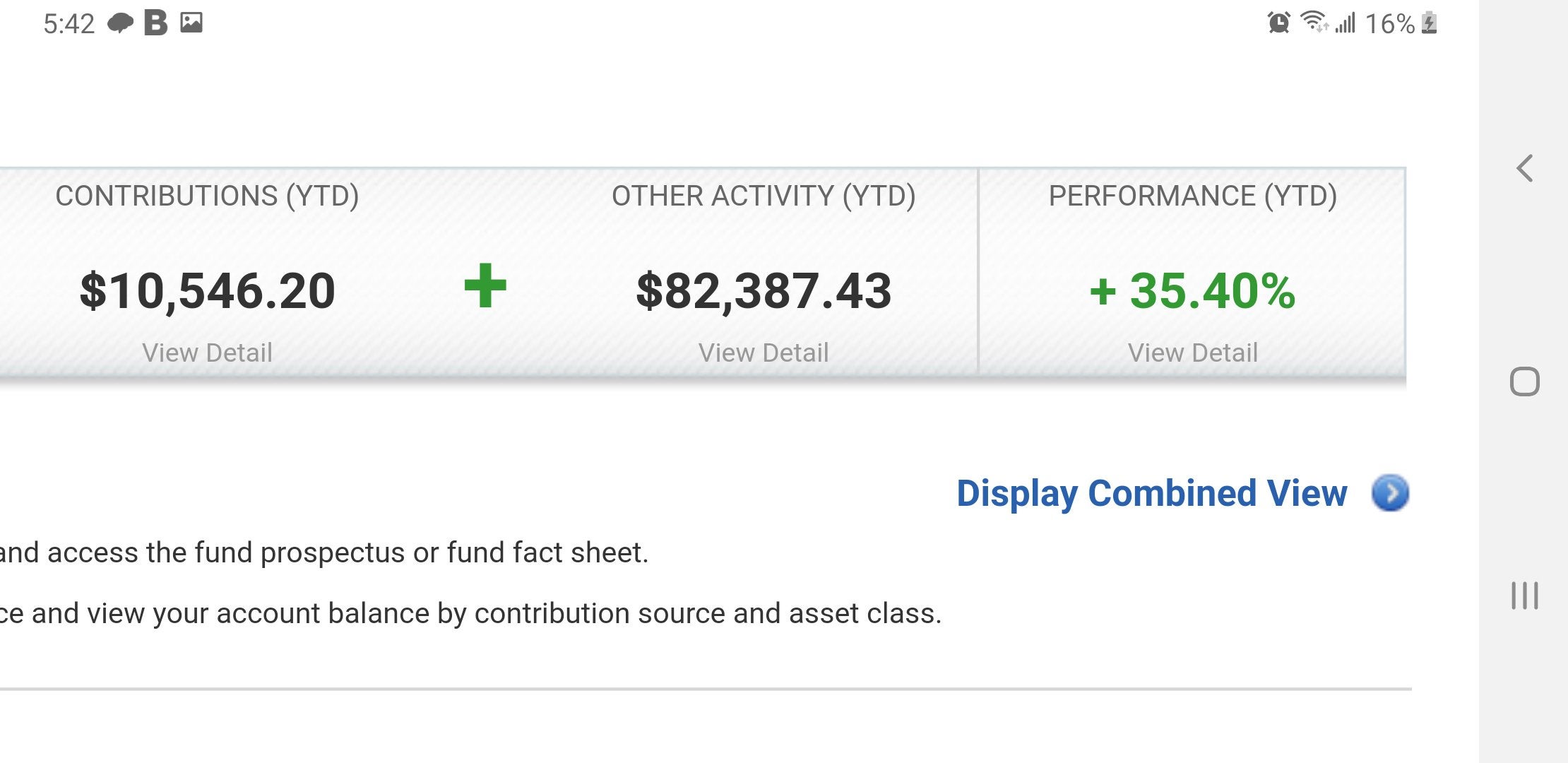

While contributing a portion of every paycheck toward your employer-sponsored 401 plan is undoubtedly a smart way to save for retirement, it can be quite concerning when you see your balance drop.

First, know that this situation is completely normal. The money in your 401 is invested in the market, meaning it’s exposed to everyday fluctuations and can both gain and lose value in accordance with stock market performance.

“As investors in mainstream publicly traded equities, you are likely gaining broad exposure through your 401 and there will be periods of time where you go through declines, as we have since markets started correcting in late 2021,”Austin Winsett, certified public accountant and financial advisor at Exencial Wealth Advisors, tells Select.

Although 401 balances can experience drops, the good news is most plans are designed to protect your funds against any large losses. They’re also naturally diversified, meaning your 401 money is invested in things like mutual funds, index funds, target-date funds and exchange-traded funds versus individual stocks, so your risk is more spread out.

Our best selections in your inbox. Shopping recommendations that help upgrade your life, delivered weekly. Sign-up here.

Common 401 Loan Questions

Can I borrow against my 401? Check with your plan administrator to find out if 401 loans are allowed under your employers plan rules. Keep in mind that even though youre borrowing your own retirement money, there are certain rules you must follow to avoid penalties and taxes.

How much can I borrow against my 401? You can borrow up to 50% of the vested value of your account, up to a maximum of $50,000 for individuals with $100,000 or more vested. If your account balance is less than $10,000, you will only be allowed to borrow up to $10,000.

How often can I borrow from my 401? Most employer 401 plans will only allow one loan at a time, and you must repay that loan before you can take out another one. Even if your 401 plan does allow multiple loans, the maximum loan allowances, noted above, still apply.

What are the rules for repaying my 401 loan? In order to be compliant with the 401 loan repayment rules, youll need to make regularly scheduled payments that include both principal and interest, and you must repay the loan within five years. If youre using your 401 loanto buy a primary residence for yourself, you may be able to extend the repayment period. What if I lose my job before I finish repaying the loan? If you leave or are terminated from your job before youve finished repaying the loan, you typically have 60 days to repay the outstanding loan amount.

Summary of loan allowances

Also Check: Should I Roll My 401k Into An Ira

Can You Lose Your 401 If You Get Fired

There are two types of 401 contributions: Employers and employees contributions. You acquire full ownership of your employers contributions to your 401 after a certain period of time. This is called Vesting. If you are fired, you lose your right to any remaining unvested funds in your 401. You are always completely vested in your contributions and can not lose this portion of your 401.

Do You Get Your 401 If You Quit

Be aware of the following rules regarding your old 401 account:

-

If your 401 has a total investment of more than $5,000, your employer may allow you to leave the account with them even after you quit the job.

-

If your account has a balance of less than $1,000, your employer may force you out and pay the amount left in your account with a check.

-

If the total investment amount in your old 401 is between $1,000 and $5,000 and your employer wants to force you out, they must transfer the amount to your IRA.

You May Like: Can I Roll My 401k Into A Roth Ira

Requesting A Loan From Your 401

If you do not meet the criteria for a hardship distribution, you may still be able to borrow from your 401 before retirement, if your employer allows it. The specific terms of these loans vary among plans. However, the IRS provides some basic guidelines for loans that won’t trigger the additional 10% tax on early distributions.

Whether you can take a hardship withdrawal or a loan from your 401 is not actually up to the IRS, but to your employerthe plan sponsorand the plan administrator the plan provisions they’ve established must allow these actions and set terms for them.

For example, a loan from your traditional or Roth 401 cannot exceed the lesser of 50% of your vested account balance or $50,000. Although you may take multiple loans at different times, the $50,000 limit applies to the combined total of all outstanding loan balances.

Retirement Funds Don’t Have To Be Off

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

For those who invest in their 401 plan, the traditional thinking is to wait until retirement before taking distributions or withdrawals from the account. If you take funds out too early, or before the age of 59½, the Internal Revenue Service could charge you with a 10% early withdrawal penalty plus income taxes.

However, life events can happen, which might put you in a position where you need to tap into your retirement funds earlier than expected. The good news is that there are a few ways to withdraw from your 401 early without incurring a penalty from the IRS.

You May Like: When Do You Need A 401k Audit

Special Rules If Youre At Least 55

If you terminated employment for any reason with a company and youre 55 or older, you can withdraw money from your 401 without the usual 10 percent penalty. By requesting a withdrawal of the entire balance, you can close your account. But keep in mind that youll still pay taxes on the entire withdrawal, at the regular income tax rate.

References

Reasons You Can Withdraw From 401k Without A Penalty Include

You May Like: Is Spouse Entitled To 401k In Divorce In Ny

To Meet Additional Essential Needs

Money for items such as medical expenses, prescriptions, food, or elder care add up fast. If you do decide pulling money from 401 or other retirement funds makes sense in a disaster scenario, consider taking out only what you need and set up a plan to pay back the amount no later than the three-year time frame.

Dont Miss: How Do You Get Money From 401k

Don’t Try To Time The Market

There’s a reason why you may have heard this many times: Investment professionals show that timing the market or trying to guess when stocks are at their top or bottom is nearly impossible. Research has shown that people who dump stocks during a market downturn are likely to miss the days when the market rises sharply, and that can make a dent in long-term returns.

For instance, one study published by the investment organization CAIA found that a buy-and-hold investor would have an annual return of almost 10% from 1961 to 2015. But an investor who tried to time the market and missed the 25 best days during that period would have an annual return of less than 6%.

To be sure, if an investor managed to avoid the worst 25 days during that period, their annualized return would have been more than 15%. But predicting both the worst and best days of the market is notoriously difficult, which is why investment pros recommend sticking with the “buy and hold” strategy.

Read Also: Do Banks Have 401k Plans

How To Get My Money If I Want To Cancel My 401

After 59 1/2, you can cancel your 401 whenever you want without penalty.

If you stashed money in a 401 plan but are wishing you hadn’t put it in, you might be stuck wishing you could get it back, depending on your age and financial circumstances. The Internal Revenue Service has fairly strict rules limiting when you can get the money out, and, even if you can access your money, when extra tax penalties apply.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

You May Like: Who Has The Best 401k Match

Closing A Fidelity Account By Phone

One way to close your Fidelity account is by phone. Make sure that before you start the process, you gather all the necessary paperwork so everything can proceed smoothly.

1) Find the Fidelity Customer Service Number

You should first look for the phone number provided by Fidelity for your account.

Check out your account statements. The number should be printed on these documents.

In the event that you do not have any account statements to look through, you can check out the Fidelity website. There will be some Fidelity contact phone numbers that you can use.

2) Call Fidelity Customer Service

Now, its time to give customer service a call. Use the right phone number to do this.

3) Request to Have Your Fidelity Account Closed

You are in contact with customer service now, so tell them that you wish to close your account. Also, you should let them know what type of account you want to close.

The team will ask for certain information so they can confirm your identity. This information will include your phone number, account number, address, and the last 4 digits of the Social Security number.

4) Record the Details of Your Call for Reference

Make sure to write down the exact date and time of the phone call you are having with the Fidelity customer service. Also, it is important to write down the name of the Fidelity representative you are talking to.

In the end, the representative will tell you when you will receive a payment for the amount left after the charges.

When To Consider A Retirement Early Withdrawal

You should consider making withdrawals from a retirement account only under dire circumstances. Given the financial and emotional impact that situations such as the COVID-19 pandemic as well as national disasters have had on Americans, there are situations when it could make sense to withdraw early.

You May Like: How To Take Money Out Of 401k Without Penalty

Also Check: Can I Roll My Old 401k Into My New 401k

Know Where Youd Like Your Funds To Go

Many reasons may cause you to close a Fidelity account. Maybe you need to liquidate some funds for a purchase. Perhaps youre changing your investment strategy. Or perhaps youve switched jobs and your new 401 is with a different provider. Your reasons for closing your account will determine whether they transfer your funds to another financial services company or release them to you.

Can I Convert 401 To Ira Without Leaving Job

Your 401k contains cash for your golden years, but you may end up closing your account long before you quit work. You can close your account when you retire, change jobs and, in some instances, while still employed. When you terminate a 401k plan, though, you have to contend with taxes and penalties.

Also Check: Do I Have A 401k From A Previous Employer

Request A Hardship Withdrawal

In certain circumstances you may qualify for whats known as a hardship withdrawal and avoid paying the 10% early distribution tax. While the IRS defines a hardship as an immediate and heavy financial need, your 401 plan will ultimately decide whether you are eligible for a hardship withdrawal and not all plans will offer one. According to the IRS, you may qualify for a hardship withdrawal to pay for the following:

- Medical care for yourself, your spouse, dependents or a beneficiary

- Costs directly related to the purchase of your principal residence

- Tuition, related educational fees and room and board expenses for the next 12 months of postsecondary education for you, your spouse, children, dependents or beneficiary

- Payments necessary to prevent eviction from your principal residence or foreclosure on the mortgage on that home

- Funeral expenses for you, your spouse, children or dependents

- Some expenses to repair damage to your primary residence

Although a hardship withdrawal is exempt from the 10% penalty, income tax is owed on these distributions. The amount withdrawn from a 401 is also limited to what is necessary to satisfy the need. In other words, if you have $5,000 in medical bills to pay, you may not withdraw $30,000 from your 401 and use the difference to buy a boat. You might also be required to prove that you cannot reasonably obtain the funds from another source.

It’s Sometimes Possible To Get A Tax Deduction But That May Not Be Worth It

The government allows you to claim a tax deduction if your 401 or other retirement plan has lost value, but there are rules you must follow. First, you must have basis. In this case, basis refers to nondeductible contributions you’ve made. Deductible contributions — those that reduce your taxable income for the year — do not count. You haven’t paid any taxes on that money so far, so the government is not going to give you a tax deduction on the amount you lost.

You also must close all retirement accounts of the same type in order to calculate the loss. So if you’re trying to claim a loss on your 401, you must close all of your 401s. Then you total your nondeductible contributions and the current value of the accounts, and you can write off the difference if the current value of the accounts is lower.

But this is inconvenient for two reasons. First, if you withdraw money from your 401 before age 59 1/2, you pay a 10% early withdrawal penalty. This may negate some of the benefit you get from writing off the loss. Second, if you take the money out of your 401, you’re giving up the tax advantages it offers and your money will no longer grow as quickly unless you invest it in something else.

For these reasons, it’s not wise to claim a tax deduction on a 401 loss unless you’re older than 59 1/2 and plan to use the money to cover your retirement expenses in the near future anyway. Otherwise, try one of the suggestions above.

Read Also: How To Find 401k From An Old Employer