Withdrawals After Age 59

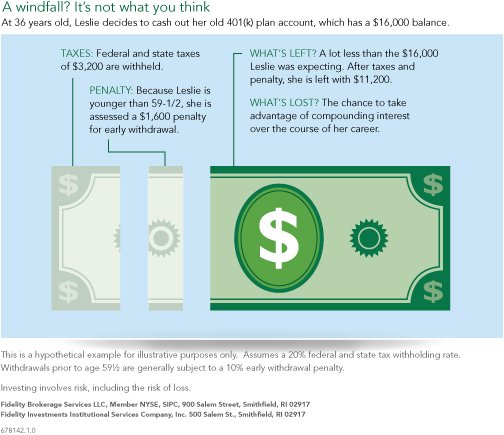

Tax-advantaged retirement accounts, such as 401s, exist to ensure that you have enough income when you get old, finish working, and no longer receive a regular salary. From time to time, you may be eager to tap into your funds before you retire. However, if you succumb to those temptations, you will likely have to pay a hefty priceincluding early withdrawal penalties and taxes such as federal income tax, a 10% penalty on the amount that you withdraw, and relevant state income tax.

Most Americans retire in their mid-60s. Theres a little more flexibility offered with retirement savings plans, though, including the company-sponsored 401. The Internal Revenue Service allows you to begin taking distributions from your 401 without a 10% early withdrawal penalty as soon as you are 59½ years old.

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer that you just left. Money that is still in an earlier employers plan is not eligible for this exceptionnor is money in an IRA.

Can You Lose Your 401 If You Get Fired

There are two types of 401 contributions: Employers and employees contributions. You acquire full ownership of your employers contributions to your 401 after a certain period of time. This is called Vesting. If you are fired, you lose your right to any remaining unvested funds in your 401. You are always completely vested in your contributions and can not lose this portion of your 401.

Eligibility For Cashing Out A 401 Plan

No advice you receive on how to cash out 401 accounts will matter if your plan doesnt allow it. Yes, some employers wont let you take the money out. Even if your employer does, there could be restrictions on how the money can be withdrawn. You probably have some type of documentation with your 401 that you can check. If not, ask your HR department to provide your policy documents. You can always take money out of plans youre not participating in anymore e.g. a plan at an old employer.

If youre 59 and ½ years old, though, none of that matters. You can take money from your 401 starting at age 59 and ½ without paying a penalty. If you havent yet celebrated your 59th birthday, you may prefer instead to take a loan against your 401 if your employer allows it. This will help get you through your financial situation while still ensuring the money is there when its time to retire.

It’s important to note that the tax man may still come calling, even if you dont pay a penalty. Traditional 401 plans are taxed when you take the money out, while Roth 401 accounts hold funds that youve already paid taxes on. If you have a Traditional 401, youll need to prepare to pay taxes on the money, whether you withdraw it at age 24 or 84. If you have a Roth 401, you can take your contributions out at any time since youve already paid taxes on them, but youll pay taxes on any earnings you withdraw early if youre under 59 and ½.

Read Also: Can I Transfer My 401k To My Child

Because You Asked: How Long Does It Take To Cash Out 401k After Leaving Job

Not every job works out the way you might have hoped. Whatever your reason is for looking for a new employer, youre probably wondering about cashing out your 401 k from your old job if youre quitting before you reach retirement age. Depending on your individual retirement account, this may involve penalties.

This article discusses how long it might take for you to cash out your 401 k once youve left your job. It also goes over your possibilities for doing so and the different types of 401 k account you can have. If you dont want to cash out the old account, you can generally transfer the money to a new 401 k plan or IRA account. It would help if you decided this based on any potential penalties and your investment options.

Dont Miss: How Do You Transfer Your 401k

When You Leave A Job

When you leave a job, you generally have the option to:

- Leave your 401 with your current employer

- Roll over the funds to an IRA

- Roll over the funds to your new employer’s 401.

If you choose any of those options, you will not owe taxes or a 10% penalty. You can also take this money as a distribution, but this will trigger early withdrawal penalties if you are under 59 1/2 .

Don’t Miss: How To Check My 401k Balance

Withdrawing From Your 401 Before Age 55

You have two options if you’re younger than age 55 and if you still work for the company that manages your 401 plan. This assumes that these options are made available by your employer.

You can take a 401 loan if you need access to the money, or you can take a hardship withdrawal, but you can only do this from a current 401 account that’s held by your employer. You can’t take loans out on older 401 accounts.

You can roll the funds over to an IRA or another employer’s 401 plan if you’re no longer employed by the company, but these plans must accept these types of rollovers.

If You Need Money: The 401 Loan Option

If you urgently need money and youve exhausted other options, you may be able to take a loan from a 401, provided the sponsoring employer permits loans. The IRS has some rules for how 401 loans can work.

- You can borrow up to 50% of your vested balance up to a maximum of $50,000.

- You have to repay the loan within five years, unless you used the money to buy your main home.

- You must make regular, substantially equal payments, at least quarterly, over the repayment period.

If your loan meets all the above criteria, you wont have to pay tax on the amount you borrowed.

Also Check: Can You Rollover A 401k From One Company To Another

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

When To Roll Over Your 401 To An Ira

Rolling over your 401 to an IRA is possible only if youre leaving your current employer or your employer is discontinuing your 401 plan. It is an alternative to:

- Leave your money invested in your existing 401

- Rollover to your new employers 401

- Withdrawal from your 401, which would trigger a 10% penalty if you arent 59 1/2 or older

A rollover or IRA) does not have tax consequences. This would not be the case if you do a rollover to a Roth IRA.

Rolling over a 401 to an IRA provides you with the opportunity to choose which brokerage you want to hold your retirement funds. It may be the right choice if:

- Your new employer doesnt offer a 401 plan

- You cannot keep your money invested in your current workplace plan because your plan is being discontinued or your 401 administration wont allow you to stay invested for some other reason

- Your new employers 401 plan charges high fees, offers limited investments, or has other drawbacks

- Youd prefer a wider choice of investment options

However, there are some downsides to consider:

- While 401 loans allow you to borrow against your retirement funds, no such option exists with an IRA.

- Transferring company stock can be complicated account, read up on an NUA strategy that could save you a lot of money.)

If these downsides arent deal breakers for you, the next step is figuring out how to roll over your 401 to an IRA.

You May Like: How Much Is Taxed On 401k Early Withdrawal

Making The Numbers Add Up

Put simply, to cash out all or part of a 401 retirement fund without being subject to penalties, you must reach the age of 59½, pass away, become disabled, or undergo some sort of financial hardship . Whatever the circumstance though, if you choose to withdraw funds early, you should prepare yourself for the possibility of funds becoming subject to income tax, and early distributions being subjected to additional fees or penalties. Be aware as well: Any funds in a 401 plan are protected in the event of bankruptcy, and creditors cannot seize them. Once removed, your money will no longer receive these protections, which may expose you to hidden expenses at a later date.

When Does A 401k Early Withdrawal Make Sense

In certain cases, it actually might be strategic to move forward with 401k early withdrawal. For example, it could be smart to cash out some of your 401k to pay off a loan with a high-interest rate, like 1820 percent. You might be better off using alternative methods to pay off debt such as acquiring a 401k loan rather than actually withdrawing the money.

Always weigh the cost of interest against tax penalties before making your decision. Some 401k plans do allow for penalty-free early withdrawals due to a layoff, major medical expenses, home-related costs, college tuition, and more. Regardless of your strategy to withdraw with the least penalties, your retirement savings are still taking a significant hit.

Recommended Reading: Where Can I Start A 401k

Substantially Equal Periodic Payments

Substantially equal periodic payments are another option for withdrawing funds without paying the early distribution penalty if the funds are in an IRA rather than a company-sponsored 401 account.

SEPP withdrawals are not permitted under a qualified retirement plan if you are still working for your employer. However, if the funds are coming from an IRA, you may start SEPP withdrawals at any time.

SEPP withdrawals are not the best idea if your financial need is short term. When starting SEPP payments, you must continue for a minimum of five years or until you reach age 59½, whichever comes later. Otherwise, the 10% early penalty still applies, and you will owe interest on the deferred penalties from prior tax years.

There is an exception to this rule for taxpayers who die or become permanently disabled.

SEPP must be calculated using one of three methods approved by the IRS: fixed amortization, fixed annuitization, or required minimum distribution . Each method will calculate different withdrawal amounts, so choose the one that is best for your financial needs.

Borrowing Or Withdrawing Money From Your 401 Plan Before You Retire

Borrowing or withdrawing money from your 401 before you retire is a big decision. After all, youve worked hard and saved hard to build up your retirement fund. While taking money out of your 401 plan is possible, it can impact your savings progress and long-term retirement goals so its important to carefully weigh the risks, costs and benefits.

Read Also: How To Apply For Hardship Loan From 401k

Exceptions To The Penalty: Hardship Withdrawal

The IRS permits withdrawals without a penalty for immediate and heavy financial needs. Dont guess. Check the current IRS rules to see whether your reason for withdrawing money is likely to be deemed a hardship withdrawal.

The IRS permits withdrawals without a penalty for certain specific uses. These include a down payment on a first home, qualified educational expenses, and medical bills, among other costs.

You may also withdraw up to $5,000 without penalty to pay expenses related to the birth or adoption of a child under the terms of the Setting Every Community Up for Retirement Enhancement Act of 2019. Keep in mind that youll still owe income taxes on that money. If it is a traditional individual retirement account , youll owe taxes on the entire withdrawal. If it is a Roth IRA, youll owe taxes only on the profits that accumulate in the account because youve paid in after-tax money.

With a hardship withdrawal, you will still owe the income taxes on that money, but you wont owe a penalty.

There is currently one more permissible hardship withdrawal, and that is for costs directly related to the COVID-19 pandemic.

Rollover To A Traditional Ira

If you are simply withdrawing funds from a 401 and transferring them to another retirement account, you can opt for a direct rollover. A direct rollover moves retirement money directly from one retirement account to another, and it does not have a tax implication. You can also choose an indirect rollover, where the plan sponsor sends you a check with your 401 balance. You must then deposit the funds to a 401 or IRA within 60 days, failure to which the amount will be considered a distribution for tax purposes.

Read Also: How To Transfer 401k From One Job To Another

Can You Roll An Ira Into A 401

posted on

If you have multiple retirement accounts, you can often move money between them without tax consequences, and you might want to combine accounts for several reasons. The most common move is to roll from your 401 to an IRA, but its also possible to do the opposite: You can roll a pretax IRA into a 401.

There are pros and cons to everything, and that includes moving an IRA into your 401 or 403b. You might like the investment choices better, or your employers retirement plan might have less expensive investments. Simplifying is another reason to transfer IRAs to a 401: Clean up those old accounts instead of spending mental energy and time to keep track of multiple accounts.

You May Like: Can 401k Be Transferred To Roth Ira

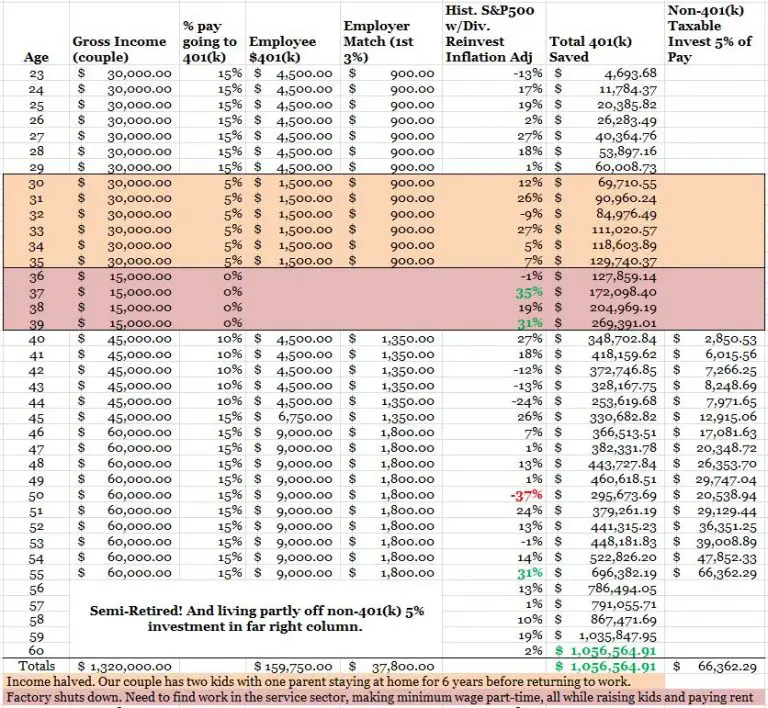

How Much Do You Need To Save To Have $1 Million By Age 50

The amount you need to save to have $1 million by age 50 depends on a few factors. The most important one is your age. When you start investing sooner, your money has more time to grow through compound interest. Compound interest is when you earn interest on top of the interest you’ve already earned.

Your annual return also makes a big difference. Earning 10% per year through the stock market is going to get you a lot farther than earning 2% or 3% through a bank account. And 10% per year is the average stock market return over the last 50 years.

Let’s say you invest in stocks and average a 10% annual return. Starting from zero, here’s how much you’d need to save per month depending on how old you are:

- 20 years old: $507 per month

- 25 years old: $847 per month

- 30 years old: $1,455 per month

- 35 years old: $2,623 per month

- 40 years old: $5,229 per month

As you can see, you don’t need to invest nearly as much when you start at a young age. That’s the power of compound interest.

These are all still lofty targets. Most 20-year-olds, for example, probably aren’t going to be able to spare $507 per month. What’s important is to invest as much as you can, as early as you can, so your money has more time to grow. Next, let’s look at some strategies to maximize the growth of your money.

Read Also: What To Do With A 401k After Leaving A Job

Can You Make An Early Withdrawal From Your 401 Plan

Yes, you can make an early withdrawal but just because you can, it doesnt mean that you should. Cashing out from your 401 plan early can come with several financial consequences such as loss of interest growth or penalties. This is why its not recommended to cash out the 401 until you are at least 59 years old.

Here’s What To Do When Your 401 Is Losing Money

Generally, the best move to make when you see your 401 balance go down is to do nothing at all.

This advice generally echoes investment experts’ guidance when any of your investments are affected by market downturns. Investing is a long-term game you take the short-term dips in exchange for the potential long-term growth, which, history has shown us, is what happens. Though past performance does not predict future performance, historically, any short-term losses have typically been outweighed by larger long-term gains.

“In the long run, stock prices are the world’s way of appraising the value of the underlying companies,” Winsett explains. “In the short term, prices can be chaotically random but over time, prices are firmly rooted in the real value of real companies whose products and services we use regularly, if not daily.”

Making an impulsive move like panic selling your 401 investments or withdrawing early from your 401 would have serious consequences. If you sell only to later jump back in the market, you may time it incorrectly and miss out on an upswing, or big recovery gains. Staying invested means as the market recovers, so, too, does your account balance. Dipping into your 401 funds before reaching the age of 59½, meanwhile, entails a 10% early withdrawal penalty on top of it being taxed.

You May Like: How To Rollover 401k To Td Ameritrade