What Else Do I Need To Know

- If your employer makes contributions to your 401 plan you may be able to withdraw those dollars once you become vested . Check with your plan administrator for your plan’s withdrawal rules.

- If you are a reservist called to active duty after September 11, 2001, special rules may apply to you.

Important Note: Equitable believes that education is a key step toward addressing your financial goals, and this discussion serves simply as an informational and educational resource. It does not constitute investment advice, nor does it make a direct or indirect recommendation of any particular product or of the appropriateness of any particular investment-related option. Your unique needs, goals and circumstances require the individualized attention of your financial professional.

Equitable Financial Life Insurance Company issues life insurance and annuity products. Securities offered through Equitable Advisors, LLC, member FINRA, SIPC. Equitable Financial Life Insurance Company and Equitable Advisors are affiliated and do not provide tax or legal advice, and are not affiliated with Broadridge Investor Communication Solutions, Inc.

Take the next step

Requesting A Hardship Withdrawal

In order to request a hardship withdrawal, theparticipant must complete the Hardship Withdrawal Form. The participant mayalso complete Form W-4P to request no withholding. The participant then gives the signed Hardship WithdrawalForm to you.

How to complete the Hardship Withdrawal Form

How to complete the Hardship Withdrawal Form

Assess Your Credit Score

A credit score is a three-digit number that most lenders use to measure your financial responsibility.

You calculate credit scores based on the information in your credit report.

It is important to check your credit score before applying for a loan. This is because it will give you an idea of what kind of loans you are eligible for and how much you can borrow.

#CaminoTip Ask the lender if they will report the payments to the major credit bureaus if so, this can help you to improve your credit score or affect it if you dont make payments on time

Also Check: How To Find Your 401k Account Number

What Happens To My Credit Report

When you are behind in repayments, your credit report may be affected. There are two ways your credit report might be affected:

- A default being recorded

- Repayment history information being recorded

A default can only be listed on your credit report if:

- You are in default

- A default notice has been sent to you giving you at least 30 days to pay the default

- A notice of intention to list the default on your credit file has been sent to you.

The creditor cannot list a default when you have asked for a repayment arrangement. The creditor can only list a default 14 days after it has rejected your request for an arrangement.

You are not in default if you are in an agreed repayment arrangement. So, the quicker you make an agreed repayment arrangement , the less likely that a default will be listed on your credit report.

Repayment history information is information about whether you make your loan repayments each month. If you are up to date the payment is listed as 0. Once you miss a loan repayment you have 14 days to catch up. After 14 days your credit report will note that you have missed one repayment. If you keep missing repayments, your credit report keeps recording the number of monthly missed repayments.

There is no requirement to give you notice that repayment history information will be listed on your credit report.

How To Apply For A Hardship Loan

When youre ready to apply for a hardship loan, heres what you need to do:

Credible makes it easy to see your prequalified personal loan rates without affecting your credit.

Recommended Reading: Can I Combine 401k Accounts

What Is The Maximum Amount Of Elective Contributions That Can Be Distributed As A Hardship Distribution From A 401 Plan

Hardship distributions from a 401 plan were previously limited to the amount of the employees elective deferrals and generally did not include any income earned on the deferred amounts. The proposed regulations permit, but do not require, 401 plans to allow hardship distributions of elective contributions, QNECS, QMACS, and safe harbor contributions and earnings on these amounts regardless when contributed or earned. The change can be made as of January 1, 2019. and Reg. Section 1.401-1)

If your 401 plan made hardship distributions more than your plan allowed, find out how you can correct this mistake.

Other Options For Getting 401 Money

If you’re at least 59½, you’re permitted to withdraw funds from your 401 without penalty, whether you’re suffering from hardship or not. And account-holders of any age may, if their employer permits it, have the ability to loan money from a 401.

Most advisors do not recommend borrowing from your 401 either, in large part because such loans also threaten the nest egg you’ve accumulated for your retirement. But a loan might be worth considering in lieu of a withdrawal if you believe there’s a chance you’ll be able to repay the loan in a timely way s, that means within five years).

401 loans must be repaid with interest in order to avoid penalties.

Loans are generally permitted for the lesser of half your 401 balance or $50,000 and must be repaid with interest, although both the principal and interest payments are made to your own retirement account. It is also worth noting that the CARES Act raises the borrowing limit from $50,000 to $100,000. If you should default on the payments, the loan converts to a withdrawal, with most of the same consequences as if it had originated as one.

Read Also: How To Borrow Money From My 401k

How Long Does It Take To Get My 401k Money After I Quit My Job

When you leave a job, you can decide to cash out your 401 money. Generally, when you request a payout, it can take a few days to two weeks to get your funds from your 401 plan. However, depending on the employer and the amount of funds in your account, the waiting period can be longer than two weeks.

Getting Started With 401 Loans

If you plan to borrow from your 401 plan, start by contacting your benefits manager to verify that you can borrow from your plan, and know the planâs 401 loan rules. If the plan allows 401 loans, and you have an adequate balance, complete the loan application online or pick a loan application form from the benefits manager.

Usually, the plan administrator will review the loan application to decide if you have sufficient balance to cover the loan you want to borrow. If you meet the requirements, your request will be approved, and the funds disbursed to your account. You should then start making periodic loan payments over the agreed loan repayment period.

Also Check: What Are The Advantages Of A 401k

Can You Withdraw Money From A 401 Early

Yes, if your employer allows it.

However, there are financial consequences for doing so.

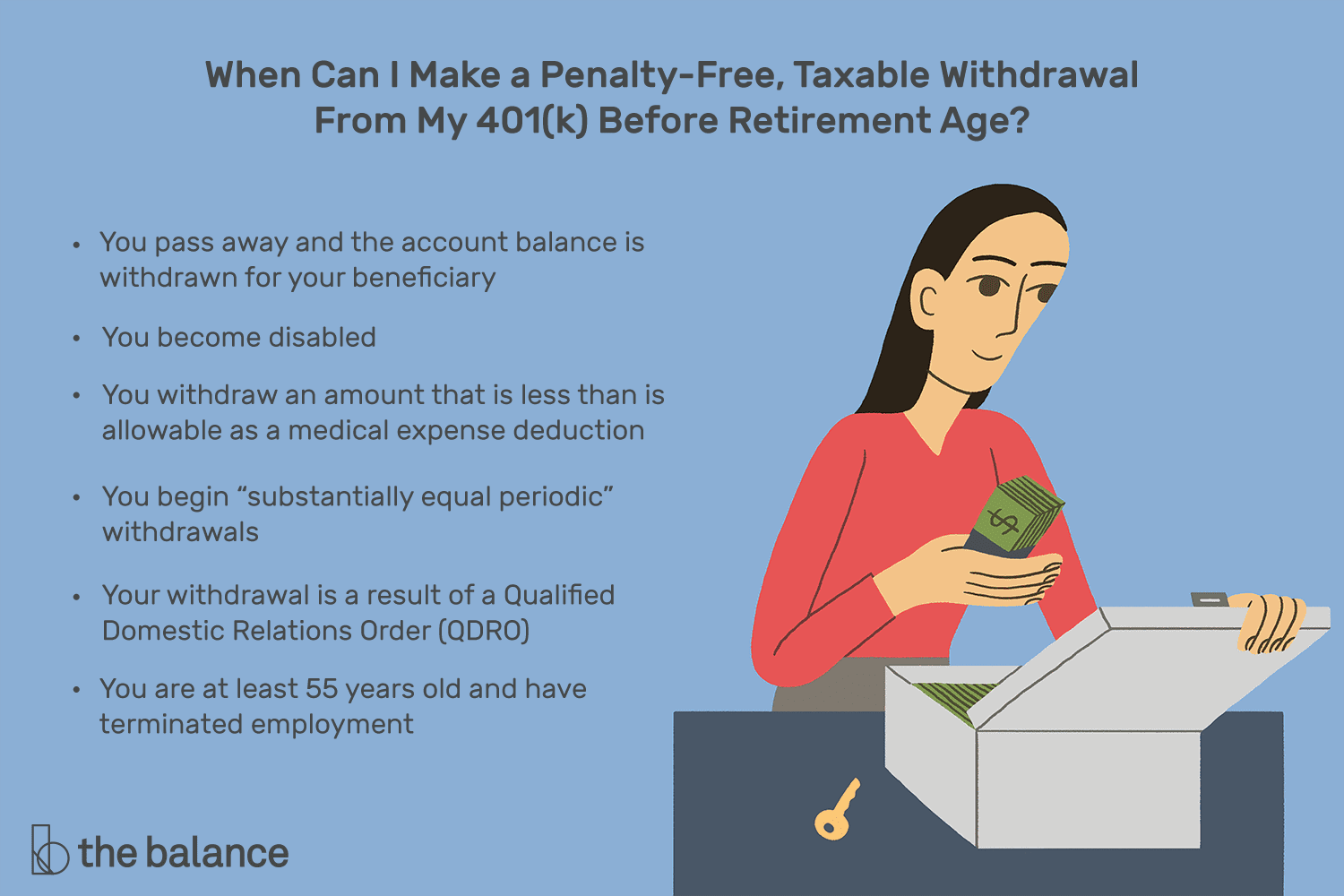

You also will owe a 10% tax penalty on the amount you withdraw, except in special cases:

- If it qualifies as a hardship withdrawal under IRS rules

- If it qualifies as an exception to the penalty under IRS rules

- If you need it for COVID-19-related costs

In any case, the person making the early withdrawal will owe regular income taxes year on the money withdrawn. If its a traditional IRA, the entire balance is taxable. If its a Roth IRA, any money withdrawn early that has not already been taxed will be taxed.

If the money does not qualify for any of these exceptions, the taxpayer will owe an additional 10% penalty on the money withdrawn.

Also Check: How To Get Old 401k Money

Withdrawal Penalty Before Age 59

If youre under age 59½, you may have to pay an additional 10% when you file your tax return. If you are still working when you are 59 ½, you can take money out of your 401.

You can take money from your 401 account if you are age 59½ or older. You will not have a penalty. Twenty percent is withheld for federal income taxes. You can also roll money from your 401 to IRA or other qualified plan. Funds that are rolled over are not subject to tax at that time.

You May Like: Do I Have Unclaimed 401k

How You Can Use Hardship Loans

People use hardship loans in a variety of different ways.

They can cover emergency expenses. They can also pay for medical bills, mortgage payments, and other necessary expenses.

This is where hardship loans come in handy.

The interest rates on these loans are usually much lower than traditional bank rates.

This makes them an attractive alternative for people who need a little help getting back on their feet financially.

A Bank Or Credit Union Loan

With a decent credit score you may be able to snag a favorable interest rate, Poorman says. But favorable is relative: If the loan is unsecured, that could still mean 8%12%. If possible, secure the loan with some type of asset to lock in a lower rate.

Interest is the price of borrowing money. Learn how interest rates work.

Recommended Reading: How Do I Get Into My 401k

Changes Coming For 2019

The Bipartisan Budget Act of 2018 enacted three changes to these rules, specifically:

- repealing the previously-required 6-month suspension of elective deferrals after a participant received a hardship distribution

- permitting amounts previously contributed as qualified non-elective or qualified matching contributions to be available as a hardship distribution.

- removing the requirement to take available plan loans prior to requesting a hardship.

- Regulations are also proposed which would further:

- revise the applicable standards governing when a distribution can be made on account of hardship

- permit hardship distributions to participants seeking to repair a primary residence, even if that repair would not otherwise qualify for a casualty loss deduction

- apply most of these rules to participants in 403 arrangements

Although the Act is effective for hardship distributions made in 2019, taxpayers can rely on these rules for purposes of hardship distributions made in 2018 as well.

Additional resources

Take A Home Equity Loan

If you own a home, you can consider going with a home equity loan instead. Youll need at least 20% equity to secure the loan. The average interest rate on these loans is around 5.33%, which is much better than the rates on other forms of financing . You should also note that there are no tax deductions unless youre reinvesting the loan into your home.

Don’t Miss: How Do You Find Lost 401k Accounts

How To Qualify For A Hardship Loan

Each lender you look at will have a different set of qualification requirements. That said, the most common include:

- A decent credit score

Some lenders may require additional documentation about the hardship you are facing.

Others only want the information in the application. This is why its important to review the application procedures before applying.

Determination Of Existence Of Need

Whether an employee has an immediate and heavy financial need depends on all relevant facts and circumstances. A financial need may be immediate and heavy even if it was reasonably foreseeable or voluntarily incurred by the employee. See Reg. Section 1.401-1.

A distribution is deemed to be on account of an immediate and heavy financial need of the employee if the distribution is for:

See Reg. Section 1.401-1.

A primary beneficiary under the plan is an individual who is named as a beneficiary under the plan and has an unconditional right, upon the death of the employee, to all or a portion of the employee’s account balance under the plan. See Reg. Section 1.401-1.

Also Check: How Do I Move My 401k To An Ira

Eligibility For A Hardshipwithdrawal

To request a hardship withdrawal, theparticipant must:

- Be 100% vested in the employersource contributions if a non-401 hardship withdrawal is requested

- Have taken all other availablewithdrawals from any and all plans in which the participant has anaccount, including this one, if a 401 hardship withdrawal is requested

- If a non-401 hardshipwithdrawal is requested, have taken all available after-tax withdrawals ifthere are after-tax contributions in the account.

Based on the criteria listed above, if theparticipant is eligible for a withdrawal, give him or her a Hardship WithdrawalForm along with a Special Tax Notice Regarding Plan Payments and a Notice ofBenefits and Benefit Payment Form .If the participant is requesting no withholding, Form W-4P should also besubmitted to the Program. Form W-4P can be obtained through the IRS website at www.irs.gov.

What Is A Hardship Loan

A hardship loan is a type of installment loan designed for borrowers who need cash to overcome a financial hardship such as job loss. Hardship loans have increased in popularity due to the coronavirus. Many banks, credit unions, and online lenders offer these short-term loans to help people from all walks of life get through the financial challenges they may be facing.

Unlike a credit card that acts as a revolving line of credit, a hardship loan offers a lump sum of money upfront. It usually comes with noteworthy features, such as low interest rates and deferred payments. If you take out a hardship loan, youll need to repay it according to its terms.

In the event you continue to experience financial hardship and are unable to back a hardship loan, its your responsibility to discuss loan modification options with the financial institution.

Don’t Miss: Can I Take 401k Money To Buy A House

Employers Have Options Under Latest Law

Although the Consolidated Appropriations Act temporarily relaxes rules for eligible individuals to access their retirement funds, businesses dont necessarily have to include these provisions in their plan provisions. Businesses that had to layoff workers due to business slowdowns also have more time to restore their workforce to at least 80 percent to avoid partial plan termination rules relating to their retirement plan. The partial retirement plan termination rule would be relaxed during a plan year that includes the period between March 13, 2020, and March 31, 2021, deferring assessments until March 2021.

Many workers count on their 401s for the lions share of their retirement savings. Thats why these employer-sponsored plans shouldnt be the first place you go if you need to make a major expenditure or are having trouble keeping up with your bills.

But if better options are exhaustedfor example, an emergency fund or outside investmentstapping your 401 early may be worth considering.

You May Like: Can I Set Up My Own 401k Plan

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

Also Check: Can Self Employed Contribute To 401k

Withdrawing Money From A : Taking Cash Out Early Can Be Costly

An unexpected job loss, illness or other emergencies can wreak havoc on family finances, so its understandable that people may immediately think about taking a withdrawal from their 401. Tread carefully as the decision may have long-range ramifications impacting your dreams of a comfortable retirement.

Taking a withdrawal from your traditional 401 should be your very last resort as any distributions prior to age 59 ½ will be taxed as income by the IRS, plus a 10 percent early withdrawal penalty to the IRS. This penalty was put into place to discourage people from dipping into their retirement accounts early.

Roth contribution withdrawals are generally tax- and penalty-free contribution and youre 59 ½ or older). This is because the dollars you contribute are after tax. Be careful here because the five-year rule supersedes the age 59 ½ rule that applies to traditional 401 distributions. If you didnt start contributing to a Roth until age 60, you would not be able to withdraw funds tax-free for five years, even though you are older than 59 ½.

Dont Miss: What To Do With 401k When You Retire