How Much You Need

As a general rule of thumb, many financial advisors recommend having enough saved in retirement funds plus other sources of income, such as social security or a pension, to replace 80% of your income before retirement. If you have determined how much you will receive from other sources of income, you can use a conservative estimate of roughly 56% in annual returns from your 401 to figure out what sort of balance you will need to generate the additional income to achieve 80%.

Another quick and simple way to estimate the amount you will need to have saved is to take your pre-retirement income and multiply it by 12. So, for example, if you were making $50,000 a year and were considering retirement, you should have about $600,000 saved in your 401.

A more comprehensive approach would be to use a “retirement calculator.” Many financial institutions that manage 401 plans offer online, interactive retirement calculator tools that will allow you to use different assumptions and automatically calculate the required savings amount needed to achieve your goals. They typically also have knowledgeable representatives that will walk you through the process. You should take advantage of these resources if they are available, assuming you don’t already have a financial advisor.

Keep Your Money Where It Is

Keep your savings invested in your former employer’s retirement plan.

- Your savings stay invested, with the same tax advantages

- You continue with the plan’s investment options

- You can’t make additional contributions

- Your past employer may decide to make changes to the plan that impact your account

- Loans aren’t allowed, but you may be able to withdraw money before you retire under certain circumstances

The Boring Glory Of Index Funds

Your best bet is to buy something called an index fund and keep it forever. Index funds buy every stock or bond in a particular category or market. The advantage is that you know youll be capturing all of the returns available in, say, big American stocks or bonds in emerging markets.

And yes, buying index funds is boring: You usually wont see enormous day-to-day swings in prices the same way you may if you owned Apple stock. But those big swings come with powerful feelings of greed, fear and regret, and those feelings may cause you to buy or sell your investments at the worst possible time. So best to avoid the emotional tumult by touching your investments

You May Like: Can A Company Hold Your 401k After You Quit

Know The Different Types Of Funds Offered In 401s

Most 401 plans offer investments in mutual funds. But some offer other types of investments as well.

The Employee Retirement Income Security Act of 1974 requires 401 plan sponsors to offer participants multiple investment options. But the number and types of funds offered by 401 plans varies widely.

Some plans offer just a few choices, such as one or two stock mutual funds, a bond fund, and a money market fund. Others offer anywhere from 10 to 75 fund choices in a variety of asset and sub-asset classes. Some common mutual fund options include:

- Large-cap U.S. stocks

- Money market funds

The plan may include funds that invest in large-, mid- and small-cap funds with a growth or value focus. Some even offer a blend of both focuses. Additionally, many plans offer both actively managed and index mutual funds. Some index funds track the S& P 500 index or another market index. Others track the total U.S. stock market.

You Have More Choices And Potential But Greater Risks Of Messing Up

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Participants in 401 plans might feel restricted by the narrow slate of mutual fund offerings available to them. And within individual funds, investors have zero control to choose the underlying stocks, which are selected by the mutual fund managers, who regularly underperform the market.

Fortunately, many company’s offer self-directed or brokerage window functions that give investors the option to seize the reigns over their own financial destinies by managing their 401 plans for themselves. But there are both pros and cons to taking the do-it-yourself route.

Read Also: How To Find Out If I Have 401k

How To Select Funds In Your 401 Plan

Many employees are new to investing or just have never had time to truly get educated on investing. So, while you may be excited about saving in a 401 plan, it can be tough to know what investments in your 401 to select that fits you and your goals.

We wish investing was super simple, but there is some knowledge that can help you do whatâs right for you. If you donât have the time or prefer your investments to be managed professionally, you can choose a model portfolio which best fits your time to retirement and ârisk toleranceâ. Generally, more aggressive model portfolios will be more volatile but can provide more gains over time than less volatile, more conservative model portfolios. Picking a model portfolio can be a smart way to go, and something to consider whether you are new to investing or a sophisticated investor. FYI, some providers may offer target date funds which make it simpler to select an investment but doesnât make it simple to understand the risk you are taking.

Diversification is the process of balancing these asset classes , so they may offset one another amid ever-changing market conditions.

When you diversify your investments among basic asset classes you may lower your investment risk and help increase the chances of meeting your retirement goals.

| Stock Funds |

|---|

| Inflation-Protected â Vanguardâs VTIP | 5% |

Contribute Enough To Max Out Your Match

Employers often match contributions you make to your own 401 plan. For example, your employer might match 50% of your contributions up to a maximum of 4% of your salary.

This is free money, but you can claim it only if you invest at least enough to max out your company’s matching funds. This is the only investment option that gives you a guaranteed 100% return on invested funds immediately with no risk, so it’s smart to always max out your match before investing in any other retirement accounts.

You May Like: How Do I Move My 401k

How I Pick My 401k Funds In Just 15 Minutes

A few weeks back, I talked about why we should invest. Today I want to talk about company-sponsored retirement plans, which is how most people dip their toes into investing. Specifically, how Id go about choosing the investment funds that go into them.

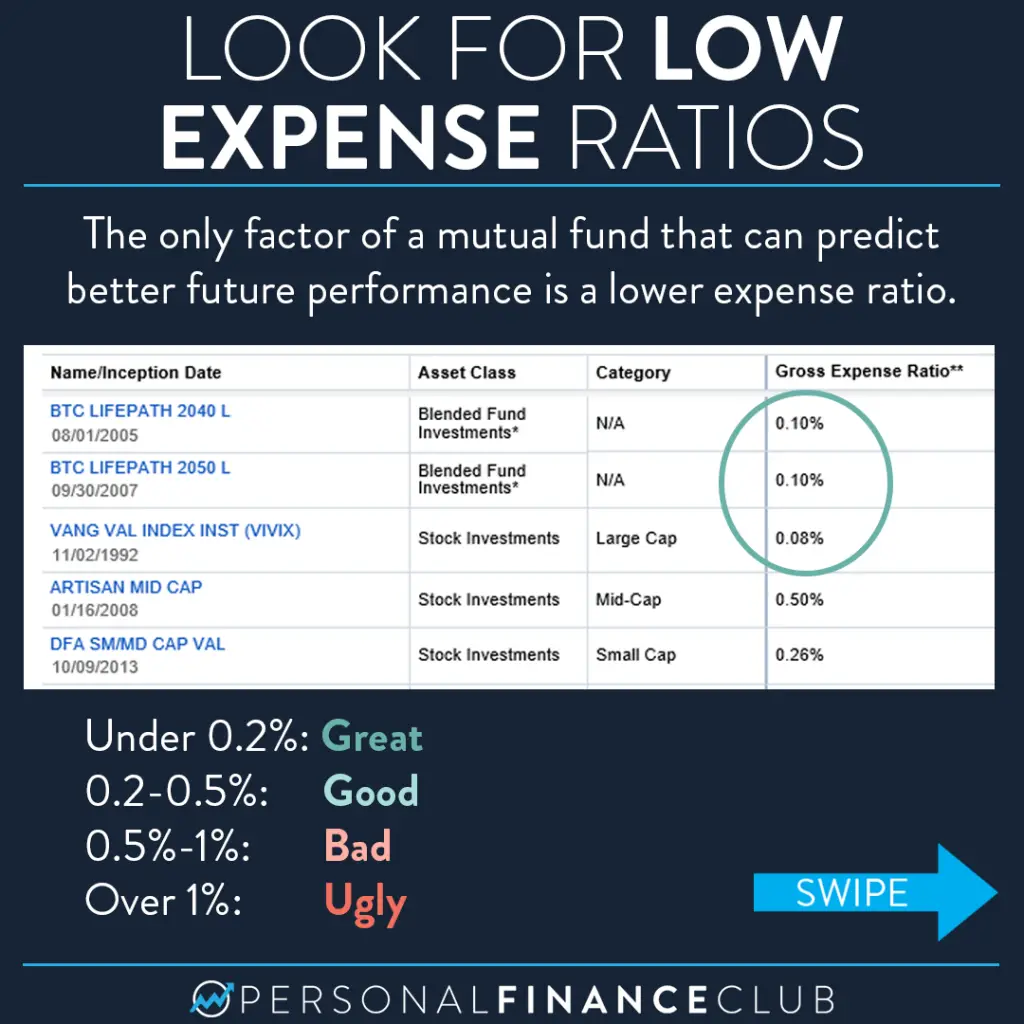

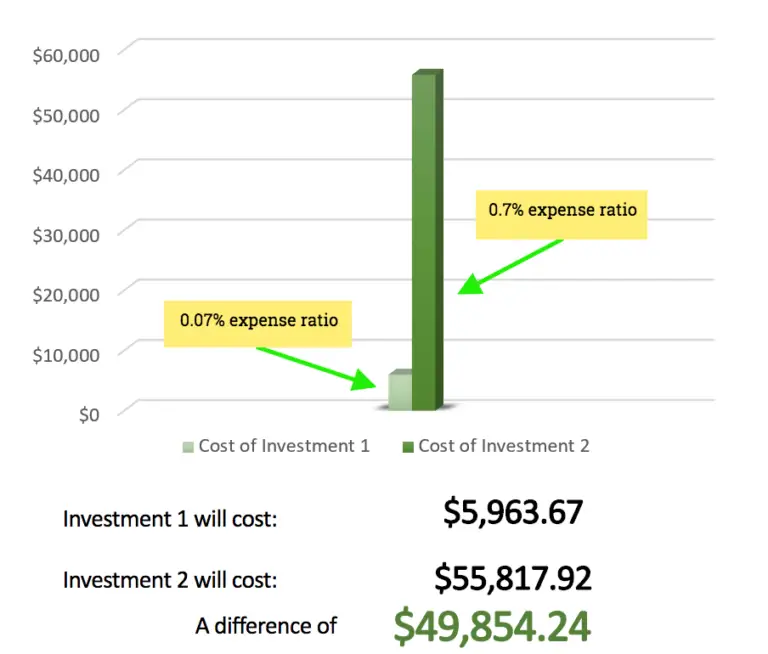

Investing in your first 401k can be overwhelming. Everyone tells you you need to do it, but no one tells you how to actually do it. Maybe youve read all about asset allocation and how index funds are the bees knees. Doing research is a great first step, but for many of us, things are different when you actually have to apply information in a real-life situation. Because once you log into your 401k account for the first time to set it up, youre met with alphabet soup like this:

With often dozens of 401k fund options to choose from, how do you know which ones to pick? And if you cant interpret all the gobbledygook in the chart, how do you know which numbers to pay attention to, and which are just a smoke screen?

Youre in the right place.

Once upon a time, I was in the same boat as you. I was super excited to participate in my first 401k. Calculating how much I could contribute to it was easy. But then I had to figure out which investments to choose. Armed with something called a prospectus, a PDF that detailed every single option available to me, I spent hours Googling every single one to try to figure out which one would make me the most money.

So, lets 80/20 this.

You May Like: How Much Can You Borrow From 401k

What Happens If You Put Too Much In 401k

Avoid the Tax on Excess 401 Contributions

As of 2019, that maximum is $19,000 each year. If you exceed this limit, you are guilty of making what is known as an excess contribution. Excess contributions are subject to an additional penalty in the form of an excise tax. The penalty for excess contributions is 6%.

You May Like: Can I Invest My 401k In Stocks

Benefits Of Setting Up A Retirement Account

Retirement accounts, such as IRAs, 401s and SEPs, allow you to set aside money and have it grow tax-free. If you are younger than 59.5, you can contribute up to $6,000 to a traditional IRA or Roth IRA or $19,000 if you’re over 50 years old. Self-employed people can contribute even more to a SEP IRA, which allows you to save up to $56,000 annually.

Setting aside money for retirement in a tax-advantaged account has key benefits. First, the money you set aside will have more time to grow. Second, your contributions to a retirement account are tax-deferred, which means you will not have to pay taxes on the money you contribute to your account until you withdraw it at retirement.

Third, some retirement accounts, such as a 401, allow you to receive matching funds from your employer. These matching funds can come in a simple dollar-for-dollar or percentage match.

Finally, your retirement contributions can be used to calculate a tax deduction. This is important because it allows you to lower your taxable income, reducing the amount of taxes you owe. If you do not have enough money to pay your taxes but enough to set aside for retirement, consider taking advantage of these benefits.

Choosing Your 401 Investing Goals

In this article

Heres one tip that will instantly make you a more sophisticated investor than almost everyone else you know: Instead of looking at your 401 as its own, isolated account, look at it as just one part of your overall investment plan which includes all of your investment accounts.

That means you dont have to perfectly or entirely match your target investment plan within your 401. Your real goal is to match your target investment plan once all your investments are summed up across all accounts.

Which is good news! Because your 401 investment options are probably limited. There are likely some good options and some not-so-good ones, and its unlikely that theres a good one for each type of thing you want to invest in. For example, there may be a great U.S. stock market fund, but not a great international stock market fund.

And by viewing all your retirement accounts as one big pot, and including your spouse or partners retirement accounts as well, you can pick and choose the best investment options in each one so that the total across all accounts lines up with your overall plan.

Heres how to do just that.

Read Also: How Much Tax Should I Withhold From My 401k Withdrawal

What Is Your Risk Appetite

Let me provide some context to risk appetite with this question:

If the value of your 401 dropped 30 percent in one year, what would you do?

Its important to know that a 30% drop in the stock market will affect some 401 investments more severely than others.

Take the 2008 Financial Crisis as an example. During this period, the stock market dropped around 30-40% in 2008 alone. From January to March 2009, it lost another 20% or so. Thats roughly 50-60% of its value!

I remember that time very well. I was in the first year of business school. I cant tell you how many classmates and professors were FREAKING OUT while the stock market dropped significantly, day after day. However, the bond market actually gained a few percentage points over this same period from 2008 to March 2009.

My MBA peers response suggests they may have taken on more risk than they were willing to handle. Market ups and downs can be terrifying and more economic recessions are expected to occur. If you cannot stomach significant short-term losses, you may be better off choosing at least some 401 investments with less risk, such as bonds, in order to help level out the ups and downs.

Investing In Gold Ira

A gold IRA allows individuals to invest in physical gold, silver, platinum and palladium rather than traditional assets like stocks, bonds and mutual funds. The gold and other precious metals held in a gold IRA are held in an IRS-approved depository and can be used to diversify and grow an individual’s retirement portfolio.

Gold IRAs are similar to traditional IRAs because they offer tax-advantaged savings and investors can contribute pre-tax dollars to their accounts. However, gold IRAs have some unique features and benefits that traditional IRAs do not offer.

One of the primary benefits of a gold IRA is that it provides investors with a way to protect their wealth from inflation, market volatility and currency devaluation. Historically, gold has been a reliable value store protected against economic uncertainty.

Gold typically maintains its purchasing power better than other investments, such as stocks and bonds, which can be affected by market fluctuations. Additionally, gold is a physical asset, so it cannot be printed or devalued like paper currency.

Another advantage of a gold IRA is that it can provide investors with a greater level of diversification than traditional IRAs. Investors can add an asset class to their retirement portfolios by investing in gold, which can help reduce overall risk and increase returns.

Don’t Miss: How Many 401k Rollovers Can I Do In A Year

Types Of 401 Investments

The most common type of investment choice offered by a 401 plan is the mutual fund. Mutual funds can offer built-in diversification and professional management, and can be designed to meet a wide variety of investment objectives. Be mindful that investing in a mutual fund involves certain risks, including the possibility that you may lose money.

Your 401 plan may offer other types of investments. Some of the more common ones include:

How Should You Alter Your Investment Strategy As You Get Closer To Retirement

As someone nears retirement, its common for them to shift their investment strategy toward safer, income-focused assets. Riskier assets like stocks tend to perform better over time, but those who are close to retirement may not have the time to recover from a crash. As their timeline shrinks, people often move money out of stocks and into safer assets that produce steady income.

You May Like: How Do You Roll A 401k Into An Ira

How To Make The Most Of Your Account From Start To Finish

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

If you are among the millions of Americans who contribute to a 401 plan, you receive a quarterly account statement composed of dull, incomprehensible financial prose. However, you want to maximize your contributionsso you’ll need to understand the types of investments offered in these investments.

Learn more about 401s, which are best suited for you, and how to manage the account going forward to maximize your returns.

How Do I Start A 401

If you work for a company that offers a 401 plan, contact the human resources or payroll specialist responsible for employee benefits. You’ll likely be asked to create a brokerage account through the brokerage firm your employee has selected to manage your funds. During the setup process, you’ll get to choose how much you want to invest and which types of investments you want your 401 funds invested in.

Also Check: How Many Percent Should I Put In 401k

Anything Else I Should Know

Yep. A few things, actually.

Once you contribute to a 401, you should consider that money locked up for retirement. In general, distributions prior to age 59½ will be hit with a 10% penalty and income taxes.

If you leave a job, you can roll your 401 into a new 401 or an IRA at an online brokerage or robo-advisor. The IRA can give you more control over your account and allow you to access a larger investment selection.

401s typically force you to begin taking distributions called required minimum distributions, or RMDs at age 72 or when you retire, whichever is later. You may be able to roll a Roth 401 into a Roth IRA to avoid RMDs.

How Do I Invest In Stocks

In general, there are four ways to invest your money in stocks: investing in the 401k plan or, if you work for a nonprofit, in the 403b plan. Invest with a Traditional IRA, Roth IRA, Simple IRA or SEPIRA. Invest through a brokerage account. Invest through a direct stock purchase plan or a dividend reinvestment plan .

You May Like: How Do You Get Your 401k When You Retire

Understanding Your Investment Account Options

Now that youve made the right choice in deciding to save for retirement, make sure you are investing that money wisely.

The lineup of retirement accounts is a giant bowl of alphabet soup: 401s, 403s, 457s, I.R.A.s, Roth I.R.A.s, Solo 401s and all the rest. They came into existence over the decades for specific reasons, designed to help people who couldnt get all the benefits of the other accounts. But the result is a system that leaves many confused.

The first thing you need to know is that your account options will depend in large part on where and how you work.