These Strategies Can Help You Use Your 401 To Grow Your Wealth

A 401 makes investing for retirement easy with pre-tax contributions withdrawn directly from your paycheck. However, once you’ve made your contribution, you need to choose the right investments to maximize returns while limiting risk. Most 401 plans usually provide a small selection of funds in which to invest, and you’ll want to pick an appropriate mix of assets for your age and risk tolerance.

This guide will help you develop a strategy to invest in your 401 to make the most of this tax-advantaged retirement account.

Potentially Gain More Investing Options

While leaving money behind in a former employers 401 might be the easiest thing to do, its not always the best option. One of the main benefits of a 401 plan is an employer match if the company offers one.

Once you leave a job where you have a 401, you no longer receive the companys contribution or match. 401 plans tend to have high fees, limited investment options, and strict withdrawal rules. If the old 401 was rolled over to a different vehicle like a traditional or Roth IRA, you may have more control over the investment strategy.

Investing In Your 401

The variety of investments available in your 401 will depend on who your plan provider is and the choices your plan sponsor makes. Getting to know the different types of investments will help you create a portfolio that best suits your long-term financial needs.

Among the most importantand perhaps intimidatingdecisions you must make when you participate in a 401 plan is how to invest the money you’re contributing to your account. The investment portfolio you choose determines the rate at which your account has the potential to grow, and the income that you’ll be able to withdraw after you retire.

Don’t Miss: What Is The Difference Between Roth 401k And Roth Ira

Can Your View On Risk Change Over Time

A typical 401 plan will have eight to 12 options but some may have more or less than that. You can rebalance your 401 assets to ensure they reflect the asset allocation and risk tolerance, you want. You can also make changes to your 401 investments to reflect your evolving risk tolerance. Check with your employer or HR department to see how often you can make changes to your 401 investments.

Complete Your Plan Enrollment Form

This is the form youve been waiting for! Its the one youll use to officially commit a percentage of your paycheck for retirement. But there are a couple of other things about this form you dont want to miss:

- Pre-tax or Roth: Whats the difference between a traditional pre-tax 401 and a Roth 401? A pre-tax 401 allows you to make contributions from your pay before taxes are taken out. But when you contribute to a Roth 401, your contributions are made after taxes are taken out. We always recommend the Roth option since you wont have to pay taxes on the money you withdraw from your Roth 401 in retirement. Pre-tax contributions will lower your taxable income now, but youll pay taxes on withdrawals in retirement.

Your Action Step: Contact your 401 plan manager to find out if you have the option to choose pre-tax or after-tax contributions. If you can, take advantage of the Roth option with your next paycheck!

Your Action Step: Again, your 401 plan manager can tell you if your plan offers an automatic rebalancing feature for your investment selections. Tip: call the plan manager and speak with an actual person.

Read Also: Does Fidelity Offer Self Directed 401k

What To Look For

Among your choices, avoid funds that charge the biggest management fees and sales charges. Actively managed funds are those that hire analysts to conduct securities research. This research is expensive and drives up management fees.

Index funds generally have the lowest fees because they require little or no hands-on management by a professional. These funds are automatically invested in shares of the companies that make up a stock index, like the S& P 500 or the Russell 2000, and change only when those indexes change. If you opt for well-run index funds, you should look to pay no more than 0.25% in annual fees. By comparison, a relatively frugal actively-managed fund could charge you 1% a year.

Types Of 401 Investments

The most common type of investment choice offered by a 401 plan is the mutual fund. Mutual funds can offer built-in diversification and professional management, and can be designed to meet a wide variety of investment objectives. Be mindful that investing in a mutual fund involves certain risks, including the possibility that you may lose money.

Your 401 plan may offer other types of investments. Some of the more common ones include:

Also Check: Which 401k Plan Is Best For Me

Basics Of 401 Allocation

When you allocate your 401, you can decide where the money you contribute to the account will go by directing it into investments of your choice.

At a minimum, consider investments for your 401 that contain the mix of assets you want to hold in your portfolio in the percentages that meet your retirement goals and suit your tolerance for risk.

Diversify Your 401 Portfolio

Your portfolio is the collection of assets you have. You have nine investments in your portfolio if you have three mutual funds, three stocks, and three bonds. This mix is also diversified. It’s made up of different assets, which reduces the risk.

You have many options for planning your diversification. One is the “100 minus age” rule. The percentage of stocks in your portfolio should be the number you arrive at when you subtract your age from 100. The rest should be made up of mutual funds, bonds, or other investments. Your portfolio should be 60% stocks, with the remaining 40% in mutual funds and bonds, if you’re 40 years old and setting up your 401.

Don’t Miss: How Do Employers Match 401k

Investment Options: The Diy Approach

Target-date funds arent for everyone, and some prefer to adopt more of a hands-on approach. You typically cant invest in specific stocks or bonds in your 401 account. Instead, you often can choose from a list of mutual funds and exchange-traded funds . Some of these will be actively managed, while others may be index funds.

So what kinds of funds and investments can you expect to see?

You can bet that almost every plan will have large-cap stock funds. These are funds made up entirely of large-cap stocks, of stocks with a market capitalization of over $10 million. Large-cap stocks make up the vast majority of the U.S. equity market, so your 401 will almost certainly have multiple funds to choose from that invest in them. Notable large-cap funds include the Fidelity Large-Cap Stock Fund and the Vanguard Mega Cap Value ETF .

Another type of mutual fund youll likely find in your 401s catalog of option is a bond fund. A bond fund is a mutual fund that invests solely in bonds. Within this category exists several categories like corporate bond funds, government bond funds, short-term bond funds, intermediate-term bond funds and long-term bond funds. Bond funds are popular because, as a general rule, they provide the safety of investing in bonds, but theyre much easier to buy and sell than individual bonds. Still, bonds arent risk-free: Longer term bonds can be hurt by rising interest rates, and so-called junk bonds are at risk of default.

The 401 Contribution Amount

There’s no one-size-fits-all 401 contribution amount for everyone. It’s best to save as much you can afford to without hurting your other financial goals and obligations.

You might be placing too much into your account if you don’t have enough left over to pay your rent or reduce your credit card debt. On the other hand, contributing the full $19,500 per yearâthe maximum allowed for tax year 2021 âalong with any catch-up contributions, maximizes your returns. You’ll have even more money working for you if your employer matches your contributions.

Read Also: How To Protect 401k From Identity Theft

What Is The 401

Although the 401 plan was originally designed to become the primary retirement investment vehicle for workers in the United States, the decline of pension plans since the 1980s has forced 401 plans to comply with that role. The main consequence for most new workers is that the biggest burden of saving for retirement now lies mostly in this financial tool.401s help in the process of guaranteeing you a tax benefit, as they first help you defer a pre-tax portion of your salary and, on the other hand, allow you to compound your savings tax free.

Throughout this process you will also have to pay income taxes on any distributions you take. And, if your employer allows it, the new Roth 401 flips this process on its head, removing your tax benefits up front and allowing you to take distributions tax-free later.

How To Handle 401 Investments

A 401 plan can be a great way to help save for retirement. And while it can be a relatively low-effort way to invest, there are also a lot of moving parts to consider. You may want to consider whether the plan has automatic features, your companys policies, the applicable administrative and management fees, and which allocations might be right for you. It may be wise to consult with a financial advisor to help stay on track for your financial goals.

There are several steps you can take to manage your 401 plan to help meet your retirement goals. Start by understanding your companys matching formula, if applicable, and the potential impact that could have on your savings. Also consider whether your 401 plan has a vesting schedule, which could impact your account balance if you leave your job before a certain period. Finally, consider automating your retirement savings plan and choosing asset allocations that meet your needs.

Also Check: Can I Cash Out My 401k After Leaving My Employer

Contribute Enough To Max Out Your Match

Employers often match contributions you make to your own 401 plan. For example, your employer might match 50% of your contributions up to a maximum of 4% of your salary.

This is free money, but you can claim it only if you invest at least enough to max out your company’s matching funds. This is the only investment option that gives you a guaranteed 100% return on invested funds immediately with no risk, so it’s smart to always max out your match before investing in any other retirement accounts.

Maximize And Automate Contributions

Knowing how much to contribute to your 401 in your 20s can be challenging since your salary in the early years of your career may not be that high. If you are able, it is a good idea to put away as much money as possible into your 401, up to the maximum amount allowed by the IRS. For 2021, the annual limit on your own contributions is $19,500. This amount has increased to $20,500 for 2022.

Recommended Reading: Can I Get A 401k

When Does It Make Sense To Mitigate Risk In A 401

It is natural for the value of a 401 to fluctuate during its lifecycle. As you draw closer to retirement, you can opt for less risk to maintain a more stable value. If you tend to take a more risk-averse approach to investment regardless of your retirement timeline, you have the option to select safer investments earlier on in your career.

Setting Savings And Investment Goals

Also Check: How Can You Take Out Money From Your 401k

Optimize Your 401 Allocations

A 401 is an account type, not an investment. Once you contribute money, youll need to decide how you want to invest it by choosing an investment option available in your 401 plan. Typically, 401s don’t offer individual stock investments. Instead, you’ll likely have a choice of several mutual funds, which are investments that contain a basket of stocks and bonds. Youll need to determine how you want to divide your money between the different fundsa process called asset allocation.

How Much Money Should You Invest

If youre still a long way from retirement and struggling with current issues, you might think your 401 isnt exactly a priority. However, the combination of employer match and tax benefits make the theme irresistible.

When youre starting out, your goal should be to make a minimum payment on your 401. That minimum should be the amount that qualifies for your employers full match. To get the full tax savings, you must contribute a maximum annual contribution.Lately, most employers contribute a little less than 50 cents for every dollar the employee puts in, or 6% of your salary. This is a 3% salary bonus. Plus, youre reducing your federal taxable income when you contribute to the plan.

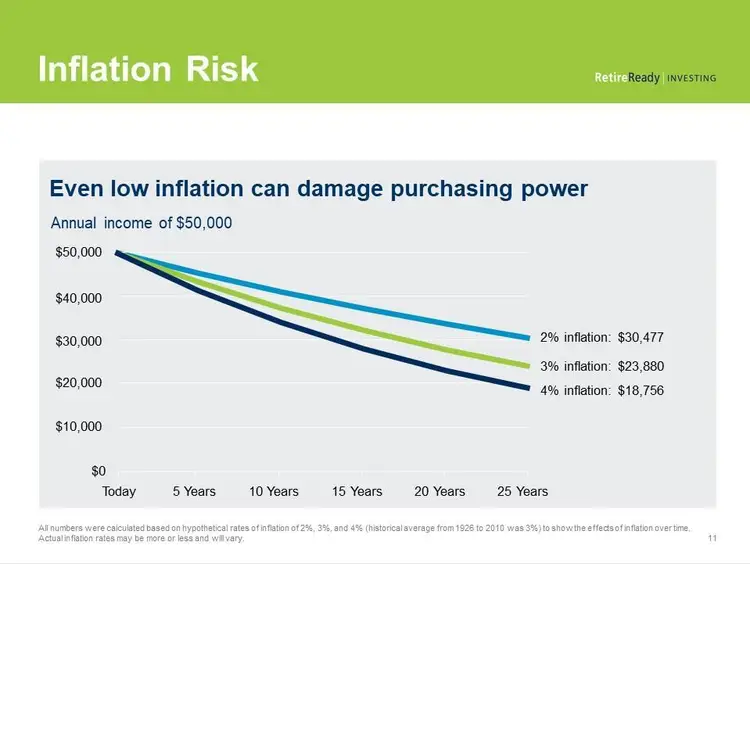

As your retirement date approaches, you may also begin to accumulate a higher percentage of your income. Considering the time horizon isnt that far off, the dollar value is probably much larger than it was in your early years, even when we factor in inflation and income growth. For the year 2022, taxpayers can contribute up to $20,500 of their pre-tax income, while people over 50 can contribute an additional $6,500.

In addition to this, as you get closer to retirement, you can start reducing your marginal taxes by contributing to your companys 401 plan. When you retire, your taxes may drop, allowing you to withdraw your funds at a lower tax assessment percentage.

Also Check: How To Sign Up For 401k At Work

Contribute To Your 401 Early

When you are a young adult, there are probably a lot of aspects regarding your career that you cant help but think about, like salary, benefits, location, and upward mobility. These are all relevant issues to weigh when considering job offers, but you should also consider a companys 401 plan.

Many employers will offer to match your 401 contributions by a certain amount, and each organization will have its own matching formula.

Set Your Contributions As A Percentage Of Your Salary

There are two general ways 401 plans allow people to manage their contributions — either as a specific dollar amount per paycheck or as a percentage of their salaries. If you have the option to enter your contribution based on a percentage of your salary, it’s a good idea to go that route.

If you choose to contribute a percentage of your salary, your contributions will increase automatically as your salary rises over time with yearly adjustments and raises. This can help to scale up your retirement savings goals over the course of your career with minimal intervention on your part.

Also Check: How To Use 401k To Buy A Home

Avoid Choosing Funds With High Fees

It costs money to run a 401 plan. The fees generally come out of your investment returns. Consider the following example posted by the Department of Labor.

Say you start with a 401 balance of $25,000 that generates a 7% average annual return over the next 35 years. If you pay 0.5% in annual fees and expenses, your account will grow to $227,000. However, increase the fees and expenses to 1.5%, and you’ll end up with only $163,000effectively handing over an additional $64,000 to pay administrators and investment companies.

It’s important to be aware that you can’t avoid all the fees and costs associated with your 401 plan. They are determined by the deal your employer made with the financial services company that manages the plan.

Getting Started With Your 401

Building a strong 401 portfolio doesnt just happen. But its worth the time and effort it takes. So whether youre making investment decisions for the first time, or youre putting your retirement savings portfolio in shape, youll want to consider four key factors:

Other retirement assets

Knowing what portion of your long-term retirement planning your 401 account represents is essential. For example, suppose its just one part of a total portfolio that includes an individual retirement account , taxable investments, and perhaps a pension or deferred annuity. In that case, you may be comfortable concentrating your 401 contributions in just a few of the best-performing alternatives your plan offers. But if your 401 is the only money youre putting away for retirement, you may want to balance your portfolio, allocating your account value across the asset classes that are available in the plan.

Read Also: Does 401k Get Split In Divorce