How Does A 401 Rollover Work

You will need to take a few steps to complete a 401 rollover.

First, you will need to contact your old 401 plan administrator and let them know that you want to do a rollover. They will likely have some paperwork for you to fill out.

Next, you will need to open a new 401 account with the investment company of your choice.

Once your new account is set up, you will instruct your old 401 plan administrator to send your money directly to your new account. This is called a direct rollover.

If you choose to do an indirect rollover, you will withdraw the money from your old 401 and then deposit it into your new 401 or annuity within 60 days. Again, you will need to contact your old 401 plan administrator and let them know that you want to do a rollover. They will provide you with the necessary paperwork.

Once you have withdrawn the money from your old 401, you must deposit it into your new 401 within 60 days. You can do this by writing a check or by transferring the money electronically.

Its important to note that if you do an indirect rollover, you will be taxed on the withdrawal. However, as long as you deposit the money into your new 401 within the 60-day window, there are no penalties.

Third Question: Why Should I Rollover My 401k Into An Ira

- If you have more than 5k you can leave the money in that account even if you change jobs, but you wouldnt be able to contribute to it anymore

- Access to better investment options

- Possibility to lower your Fees

- With a 401k is difficult to track investments, IRA investments are easy to track

- Estate Planning. With an IRA is easier to choose beneficiaries than with a 401k

- RMDs Flexibility

Should You Invest In A 401 Or An Annuity

Your specific circumstances will determine which investment options are best for you.

Speak with a qualified financial advisor before making decisions about investments and retirement. They can provide you with information and options that you might not otherwise be able to find.

Its important to know that you can invest in both an annuity and a 401. For many people, a combination of these products might be the best way to ensure the standard of living you want. With an annuity that is designed to provide you with specific benefits like paying for long-term care, you can ensure that your 401 is available to pay other costs or to pass it on to your beneficiaries.

Having both an annuity and a 401 also gives you more control over your tax liability each year.

Read Also: Can You Open A Personal 401k

What Can I Roll My Ira Into Without Penalty

With a SIMPLE-IRA, you can transfer the assets to a standard IRA or another employer-sponsored retirement plan without paying taxes or penalties. Roth IRAs are also available, however the rollover amount must be taxed. If you want to roll over a SIMPLE-IRA to another SIMPLE-IRA, you must wait two years after you started participating before you may do so. It is possible to convert your SIMPLE-IRA into a standard IRA, a Roth IRA, or any other employer-sponsored retirement plan. The only way to transfer your Roth IRA assets is to do so into another Roth IRA. All tax-deferred retirement plans, including Roth 401, 457, and 403, are not allowed to be rolled into a Roth IRA .

Dont Miss: Should I Rollover My Old 401k To An Ira

My Financial Adviser Wants To Roll My 401 Into An Annuity Do You Think This Makes Sense

Iâm not saying that someone canât come up with a scenario where such a move might make sense. I suppose, for example, that putting your entire 401 balance into an annuity could be reasonable if your 401 balance represented only a relatively small portion of your retirement savings and the annuity achieves something that no other investment or strategy can.

But barring some pretty unusual circumstances, I would have a hard time coming up with a compelling reason to invest all or even most of your 401 in an annuity. So I canât help but wonder who benefits more if you make this move â you or the adviser?

What makes me, shall we say, suspicious about this recommendation is that annuities are a classic âsold not boughtâ investment, which is to say that in many cases they are foisted on investors who may not fully understand what theyâre getting into or realize what alternatives may be available. One reason for this is that certain annuitieshere, Iâm thinking mostly of fixed index annuities and variable annuities with income ridersâ can often pay very generous commissions that, consciously or not, may make some advisers more likely to suggest them.

Don’t Miss: Can I Cash Out My 401k From Previous Employer

How To Bring Up The Subject Of Money With Clients

If youve read any of my stuff before, Ill bet you money you can guess how Im going to approach this subject with my clients.

Im going to lean on my Client Needs Assessment. I start the conversation by asking the question Are you satisfied with the current rate of return on your investments?

Regardless of their answer, Im asking the follow-up question Are you dealing with the stock market or are you dealing with the banks?

And finally, Im covering all my bases by asking a final question: Do you have a 401?

I have seen agents fill out their Client Needs Assessment and then stop when it comes to the money questions. I completely understand were often taught that talking about money is a no-go subject, but when you have conviction that you can really help the client, you have to push yourself to get over that discomfort.

It pains me to see so many lost opportunities because the agent is afraid to talk about money.

How Does The Required Minimum Distribution Work

You generally have to start taking withdrawals from your IRA, SIMPLE IRA, SEP IRA, or retirement plan account when you reach age 70½. Due to changes made by the SECURE Act, if your 70th birthday is July 1, 2019 or later, you do not have to take withdrawals until you reach age 72.

So, once the individuals turns the appropriate age, those withdrawals must begin no later than April 1 of the following year.

Now, one important thing to note here is that your client only has to take out the Required Minimum Distribution on pre-taxed money. Thats the whole purpose of the RMD existing.

So, if theyre starting up an annuity with money that has already been taxed , they dont need to pay attention to the RMD.

Dont Miss: When I Withdraw From My 401k

You May Like: How Do I Check My 401k For Walmart

Is An Annuity Better Than A 401k

Another big difference is that an annuity often offers guaranteed payment obligations for as long as you live. This means, at least because of the annuities, that you cant miss out on much of the money. On the other hand, a 401 can only show you the amount of money you have deposited into the account, as well as the return on investment for that money.

Transfer A Defined Contribution Annuity To A Solo 401k

QUESTION: Dear Sir or Ms. Thank you for your informative article. My question to you is can I roll a defined contribution annuity into the self-directed solo 401k? Now is the window for me because I havent contributed to it for 3 yrs. and this allows me to do a rollover. My goal is to invest it into a foreclosed home. Thanks for your help!

ANSWER: Resulting from EGTRRA regulation effective 2001, yes defined contribution annuities may be transferred to a solo 401k. Once in the self-directed solo 401k, the funds can then be invested in alternative investments including foreclosed homes. to review procedure for investing in real estate with solo 401k funds.

Don’t Miss: What Can I Invest My 401k In

Rolling Annuities Into A 401 Plan

If your plan allows, you can roll an annuity into your 401 plan, but only if you held your annuity in an individual retirement arrangement or another 401 plan to begin with. This is because 401 plan contributions are tax deductible, while annuity contributions outside of a retirement account are not tax deductible. You cannot mix tax deductible with non tax deductible investments in the same account.

Reasons To Rollover A 401 To An Annuity

Annuity vs. 401k? Often debated among financial experts is whether an annuity should ever be used in a tax-qualified 401. Like a 401k, annuities provide income tax deferral. Therefore, placing an annuity inside a qualified retirement plan may initially seem redundant.

That might be true if an annuitys only benefit is tax deferral. But, the fact is, annuities offer many advantages, whether held inside or outside a 401.

Annuities are flexible investment products that can help you achieve your long-term financial goals and provide a source of retirement income. Tax deferral alone is not a sufficient reason to use an annuity in a tax-qualified plan. But income options, death benefit protection, investment selections and services, and flexibility are benefits an annuity can bring to any 401.

Read Also: What’s The Most I Can Contribute To My 401k

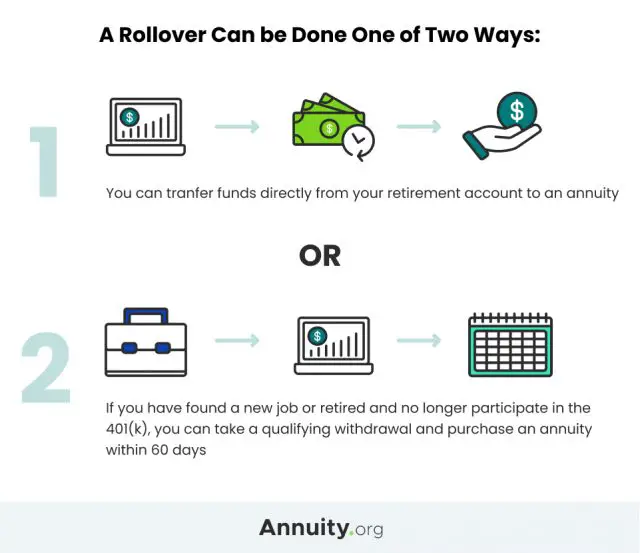

Direct And Indirect Rollovers

Annuity rollover rules are also affected based on whether you do a direct rollover or an indirect rollover.

Direct rollovers occur when you transfer your retirement account funds within annuity rollover rules directly into an annuity. Under these circumstances, direct transfers are tax free. Direct transfers are commonly done by mailing or wiring funds directly to the new plan provider, but on some occasions, the old plan provider may mail the check directly to you, payable to the new plan provider. This still counts as a tax-free direct transfer.

Indirect rollovers, however, are more complicated and have significant tax consequences if not executed correctly. Indirect rollovers involve withdrawing your funds from a retirement account typically when you change jobs or other reason allowed under the tax laws prior to retirement. To remain tax-free, the funds must be rolled over within 60 days of distribution. Otherwise, the distribution is income taxable and may also be subject to the penalty for withdrawing funds prior to age 59 and a half.

Indirect rollovers have other consequences as well. Distributions made from qualified retirement plans, such as 403 annuities and 457 plans, are subject to automatic withholding tax in the amount of 20%. Internal Revenue Code considers the withholding of a distribution unless it is added to the 80% received and reallocated during the 60-day limit.

The advice here is simple: whenever possible use direct transfers.

Should You Choose A 401 Or An Annuity

Choosing an annuity or a 401 is rarely an either-or situation. That said, there are some general rules of thumb to consider.

If youre already maxing out your 401 and IRA for the year and you still want to save more for retirement in a tax-advantaged account, you could put any additional savings into an annuity. You should always max out your 401 first and then spill over into an annuity, though, says Renee Pastor of Pastor Financial Group.

If youre worried about outliving your savings, an annuity with a living benefit rider might be an option worth considering, says Charnet. Living benefit riders can help you guarantee certain amounts of payment, which are particularly useful for variable annuities that otherwise would have no assured rate of return.

Outside of those situations, though, opting for a combination of both a 401 and an annuity might be the right choice if you want to shore up a guaranteed income stream while also leaving room for upside potential through the stock market.

Many people want to have some portion of their money where they can be certain theyre going to get their retirement paycheck regardless of whats happening in the market, says Pastor. They might, for instance, want to have all of their basic needs covered by Social Security income and guaranteed annuity payments. To achieve that, well roll over some, or all, of a 401 into either a variable annuity with a living benefit or an indexed annuity with a living benefit.

Read Also: How Do You Max Out Your 401k

Only Contributed By The Employee

The 401k is different from the 401a. In 401a plans, the employer and employee make monthly contributions. But in the 401k, only employees make monthly contributions.

The employer doesnt need to contribute to that plan.

The employer can offer different investments to the employee. For example, the employer might have up to 25 options.

Disadvantages

A 401k is a type of investment that can be hard to understand. You will pay taxes when you withdraw the money from the account in the future, when taxes may be higher than today.

You May Like: How To Check Your 401k Balance Online

How To Report The Rollover On Your Tax Return

- You must report any transaction when you submit your annual tax return for both direct and indirect rollovers.

- Your IRA brokerage will send you a Form 1099-R that will show how much money you took out of your IRA.

- On your 1040 tax return, report the amount on the line labeled IRA Distributions. The Taxable Amount you record should be $0. Select rollover.

Read Also: What Is My Fidelity 401k Account Number

Why Would You Want An Annuity In Your 401

One of the biggest concerns for workers and retirees is running out of money in retirement. In a 2021 survey by Aegon, 39% of American respondents said they held this fear. Annuities are an appealing solution to this problem because they can provide a lifetime of guaranteed income, depending on what kind of annuity you buy. In an era when defined-benefit pensions have largely been replaced by defined-contribution plans, such as 401s, the opportunity to create a self-funded pension with an annuity may be reassuring to many retirees.

While 401 plan providers have found ways to make it easy for workers to save for retirement through automatic plan enrollment, matching contributions, and default investments, they have not made it easy for workers to turn their savings into a steady, enduring stream of retirement income. It is up to retirees to decide how to both draw down their assets and change their asset allocation throughout retirement. Many plans offer target-date funds that can simplify the process.

Perbedaan Antara 401 Dan Anuitas

Char YadavFakta Diperiksa

Investasi adalah bagian penting dari kehidupan. Kita harus menabung di satu sisi dan menginvestasikan tabungan di sisi lain. Ini membantu menjalani kehidupan pensiun yang lebih baik tanpa ketegangan.

Daftar Isi

Sekarang, dalam hal investasi, orang-orang saat ini berinvestasi dalam 401 dan anuitas, alih-alih menyimpan uangnya di bank.

Keduanya memberikan pengembalian yang lebih baik daripada bank dan juga aman jika diinvestasikan pada waktu dan tempat yang tepat.

Dont Miss: Who Is Walmarts 401k Through

Don’t Miss: How To Contact Fidelity 401k

Tips For Choosing The Right Investment Plan

Choosing the right investment plan for your 401 rollover is essential! Here are a few tips to help you choose the best plan for you:

- Consider your investment goals. What are you hoping to achieve with your retirement savings?

- Think about your risk tolerance. How much risk are you willing to take on?

- Research different investment options. There are many different types of investments available, so its essential to do your research and choose the option that is right for you.

- Consider fees and expenses. Some investment plans have higher fees than others. Its essential to consider these when choosing a plan so that you dont end up paying more in fees than you need to.

When Shouldn’t I Buy An Annuity With My 401

There may be benefits to leaving your 401 balance in your employer plan if allowed:

- You will continue to benefit from tax deferral.

- There may be investment options unique to your plan.

- Fees and expenses may be lower.

- There is a possibility for loans.

- Distributions are 10% federal tax penalty-free if you terminate service after you turn 55.

Also, if you intend to spend a substantial amount of your savings early, an annuity might not be a good fit. The surrender periods and long-term nature of annuity strategies are best suited for those who leave the majority of their money in an annuity for an extended period. So, if you’re planning for immediate major expenses, research your options carefully.

Recommended Reading: How Much Can A Business Owner Contribute To A 401k

When Should I Buy An Annuity With My 401 Balance

In some cases, moving your retirement savings from a 401 plan to an annuity is an excellent idea, particularly if you’re concerned about running out of money in retirement. As noted, an annuity’s regular income stream can help you have money coming into your household for as long as you’re alive.

Annuities can provide features, such as death benefits, or several types of annuity income streams.

Major Differences Between Annuities And 401s

While anybody can buy an annuity, only people whose employers have 401 plans can contribute to one. If your employer doesnt have a 401 program, you cannot contribute to one. Anyone whos self-employed can set up his or her own 401, though.

Fees are another major differentiator. Its typically quite easy to check the fees youre paying for your 401. To do this, simply ask your plan administrator for an explanation of any fees charged to your account. Annuity fees are much harder to figure out and are often significantly higher. In particular, you may pay steep sales commission fees for an annuity, benefit rider fees and more.

If you withdraw funds from your 401 before age 59.5, you may have to pay a 10% early withdrawal penalty in addition to the income tax due on the amount you withdrew. Annuities have their own early withdrawal fees, as well as annuity surrender fees. Annuity surrender fees are reduced as time goes by, meaning theyll usually disappear after five years.

Another way annuities and 401 accounts differ is that you can borrow from your 401, while you cant from an annuity. Plus, most annuities provide unchanging regular payments, which means you wont have inflation protection.

Recommended Reading: What Happens To My 401k If I Retire Early